| Home | Log In | Register | Our Services | My Account | Contact | Help |

Eureka Mining, the prospects are good. (EKA)

PapalPower

- 05 Feb 2006 04:44

- 05 Feb 2006 04:44

Main Web Site : http://www.eurekamining.co.uk

EKA is now a Molybdenum producer in Kazahkstan, and is in the process of bringing the Chelyabinsk Copper/Gold project into production in 2008.

Latest Presentation June 2006 : Presentation Link (10MB PPT file)

Research Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

26th Jan 2006 Press Commentary : Press Link

About Eureka Mining

Key contact : Mr Kevin Foo Non-Exec Chairman

E-Mail : kevin.foo@eurekamining.co.uk

Eureka Mining Plc is a UK based mining exploration and project development company, focusing on projects in the Former Soviet Union. It is the Companys view that Kazakhstan and other central Asian FSU countries represent an area of significant opportunity. This belief is supported by the quality of the portfolio of assets which Eureka has acquired including;

the Shorskoye molybdenum deposit;

the acquisition of the Chelyabinsk Copper Project; and

the advanced exploration projects of Kentau, Mykubinsk and Central Kazakhstan projects. The Mykubinsk and Central Kazakhstan polymetallic project has assets situated in northern Kazakhstan and the Kentau exploration project has identified several gold and base metal deposits.

Shorskoye Molybdenum Project:

50/50 JV with KazAtomProm, largest Kazakhstan State Mining Company

Production projected for 1st Qtr 2006

Project Finance in place

Chelyabinsk Copper Project

Production planned for 2008

Very large resource base with with 3.57Mt Cu / 4.2Moz Au

First western group into Russian Copper Heartland and consequential opportunities in base metals

Kazakhstan Exploration Projects

At the Dostyk Copper-Gold Projects in Central Kazakhstan, we have reviewed all historical data and identified at least six drill targets, with particular focus on base metal projects. During 2004, we drilled five projects and completed significant field activity on two projects, including the high priority targets Berezky Central, Maiozek, Akkuduk (porphyry style), Ushtagan (epithermal gold), Maikain, Baygustam and Burovoy (VMS). We intend to focus on the most promising of these deposits in 2005/2006.

The Kentau Project in southern Kazakhstan has undergone an extensive data review, with a comprehensive Geographic Information Systems database being created. This has enabled us to plan a focused exploration programme on previously identified targets. Drilling is expected to commence in May 2005 at two of the best targets, using a large Reverse Circulation (RC) rig.

We entered into an option agreement to acquire the Nova Dnieprovka (Nova) Gold Mine in northern Kazakhstan. However, after a thorough assessment and reinterpretation of the project, including the completion of a drilling programme, we decided not to exercise the option and purchase agreement over the Nova project.

Our exploration and assessment teams are continuously reviewing potential projects for Eureka across the FSU and only the very best are selected for further work.

__________________________________________________________________

Some figures to think about (thanks to unionhall)

Current Market cap (@ 1.37) - 36m

Chelyabinsk NPV 508m (@ $1.60 copper and $550 Gold)

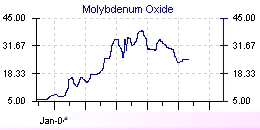

Shorskoye - 10m profit p/a @ $20 Moly

Major shareholders

Latest major holder figures are, from 26.6 million shares in issue :

Celtic Resources hold 15.02%

RAB Capital hold 6.19%

Kevin Foo holds 3.43% (Director)

David Bartley holds 3.02% (Director)

Malcom James holds 1.070% (Director)

Andrzej Sliwa holds 0.76% (Director)

JSB holds 0.177% (Director)

Latest News / Links / Research Reports

Reserach Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

25th April 2006 Moly Update :

http://www.resourceinvestor.com/pebble.asp?relid=19141

2006 Moly Report : http://www.golden-phoenix.com/documents/TheEconomicsofMolybdenum.pdf

____________________________________________________________________

The Company has used an average molybdenum price of US$19/lb throughout the first year and US$12/lb thereafter to calculate cash flows arising from the project.

(*Note : Molybdenum does not trade on the London Metals Exchange or any other publicly traded commodity exchange. Its price is determined solely by supply/demand in the marketplace and supply contracts. In a report dated Oct. 28, 2005, RBC Capital Markets forecast that 2006 and 2007 molybdenum prices would be approximately US$25/lb and US$15/lb, respectively [source: RBC Capital Markets, Global Base Metal Equity and Commodity Report Card, company reports].*)

How will the Moly be processed ? Eureka pulled off a deal with KazAtProm.Eureka has 15-year access to state-owned KazAtomProm's processing facilities, which will allow the company to start producing molybdenum concentrate in February.The processing plant also handles other minerals.The proximity of the plant to the Chinese border, allows for quick, cheap and simple transport links to a major demand area for Moly

Implementation and schedule of Moly production

Utilising the Stepnogorsk processing facility allows Eureka to develop the Shorskoye asset and take advantage of the buoyant molybdenum market, commencing mining in Q3 05 and saleable concentrate by Q1 06. The key project milestones are:

August 2005 - award contracts

August 2005 - first blast and ore to crusher

September 2005 - first ore to Stepnogorsk

October 2005 - first equipment to Stepnogorsk

February 2006 - concentrator commissioning (Stepnogorsk)

February 2006 - Chelyabinsk 100% purchased by Eureka

May 2006 - first production from Stepnogorsk (Skorshoye)

____________________________________________________________________

Molybdenum Information Links

http://www.freemarketnews.com/Analysis/60/3742/2006-02-10.asp?wid=60&nid=3742

http://www.gold-eagle.com/editorials_05/reser092205.html

http://321energy.com/editorials/fross/fross120605.html

http://www.cozine.com/archive/cc2005/01370511.html

At 25$ / lb Moly prices : (Shorskoye Project)

2006 Moly production = 600,000 lbs = 14.7 million dollars sales price

2007 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2008 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2009 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2010 etc etc etc

___________________________________________________________

Recent Director Buying :

Kevin Foo BUY 5,000 on 21 June 2006 @ 81p

Kevin Foo BUY 18,000 on 21 June 2006 @ 90.3p

Kevin Foo BUY 9,000 on 22 June 2006 @ 92pb>

PapalPower

- 28 Mar 2006 01:51

- 61 of 213

- 28 Mar 2006 01:51

- 61 of 213

PapalPower

- 28 Mar 2006 09:26

- 62 of 213

- 28 Mar 2006 09:26

- 62 of 213

More background info - from this week :

Citigroup turns bullish

Earlier, Citigroup said it's abandoning a long-held bearish outlook on copper and nickel on expectations of economic growth, tight supplies, sluggish capacity additions and persistent operating outages or shortfalls.

"We continue to adhere to the Commodity Supercycle theory, believing that the combination of 15 years of underinvestment, thorough-going corporate consolidation, mounting regulatory/NGO pressure, and input cost escalation are conspiring to prevent the industry from mounting a meaningful supply response to "peak-peak" prices," said analyst John Hill.

Citigroup raised its 2006 forecast for gold to $553 an ounce from $540, and upped its copper outlook to $1.85 per pound from $1.59.

On the supply side, copper inventories were down 44 short tons at 28,104 short tons as of late Friday, according to data from Nymex.

Gold supplies were down 487 troy ounces at 7.53 million troy ounces, while silver supplies were down 119,875 troy ounces at 124.9 million troy ounces.

PapalPower

- 30 Mar 2006 04:04

- 63 of 213

- 30 Mar 2006 04:04

- 63 of 213

Lehman Bros. raised its 2006 copper price forecast to $2.05 a pound from $1.90 on the belief that increasing global supplies of copper will be much more difficult than expected.

'With mature mines throughout the world facing shortages of labor, machinery, and tires and encountering tougher mining conditions, 'unexpected' production disappointments should be expected,' said Analyst Peter Ward.

He also raised his 2007 forecast to $1.75 a pound from $1.60 and his 2008 projection to $1.50 a pound from $1.40.

PapalPower

- 30 Mar 2006 04:20

- 64 of 213

- 30 Mar 2006 04:20

- 64 of 213

China may become net moly importer in five years

Written by Platts

Sunday, 26 March 2006

China may become a net importer of molybdenum in five years from now,

George Song, president of Shangxiang Minmetals said Friday. Speaking at the

Metal Bulletin's 7th Asian ferroalloys conference in Hong Kong, Song said

China's domestic consumption on moly had been on the uptrend and the country

would continue to see steady demand growth in 2006. "China now consumes

about 50% of the country's total moly production and this will continue to

increase," he said.

Song said China's molybdenum output in 2005 stood at around 69 million lb

and the country was expected to produce 75 million lb in 2006.

......

According to Song, China imported 44.34 million lb of moly concentrate

in 2005, doubling the 2004 level. "China will import more moly concentrate in

the future due to the tolling conversion being introduced again after the ban

in 2004-2005," he said.

......

According to Song, China exported not more than 80 million lb of

molybdenum in 2005, 25% less than the 2004 level mainly due to growing

domestic demand and limited output in the country.

http://www.molyseek.com/index.php?option=com_content&task=view&id=29&Itemid=28

silvermede

- 30 Mar 2006 08:59

- 65 of 213

- 30 Mar 2006 08:59

- 65 of 213

PapalPower

- 03 Apr 2006 10:41

- 66 of 213

- 03 Apr 2006 10:41

- 66 of 213

PapalPower

- 03 Apr 2006 11:05

- 67 of 213

- 03 Apr 2006 11:05

- 67 of 213

Copper and other base metals - outlook

Sirius's core strategy is to focus upon the exploration and identification of sources of base metals. Although other junior exploration companies on AIM concentrate upon the search for high-value precious metals such as gold and silver, Sirius's regards the demand dynamics for base metals (of which copper is the most valuable) as particularly positive and a stable foundation upon which to build.

The technical and industrial advances of recent years have driven a massive expansion in the world's physical infrastructure and explain the soaring demand for commodities such as base metals (as well as precious metals, crude oil and natural gas).

Demand for base metals is being driven particularly by the growth in the so-called BRIC ( Brazil , Russia , India and China ) economies. However copper has always been fundamental to the growth of human civilization, because of specific properties that make it applicable for a wide range of domestic, industrial, and high technology applications. Copper is ductile, resists corrosion, malleable and an excellent conductor of heat and electricity. As an alloy, with other metals, such as zinc (to form brass), aluminium or tin (to form bronzes), or nickel, it acquires new characteristics for use in highly specialised applications.

The China Effect

Vast amounts have been written about China 's status as an emerging economic powerhouse. It represents a credible basis upon which to project long-term growth in demand for base metals as China has a huge and diverse manufacturing base with a large appetite for raw materials.. Previous cyclical demand peaks tracked the industrialisation of other economies such as the US , Japan and Korea , each of which experienced long periods of sustained economic growth.

China 's ongoing urbanisation is a key component of this, as it has been undergoing a huge internal migration over the last two decades, which has seen an estimated 200m people move from rural to urban settings. However the scale dwarfs the equivalent phase in the evolution of any of the other economies mentioned, has created considerable wealth and had very significant implications for base metal consumption.

Yet this process may have much further to run. In previous cycles, commodity demand has peaked when between 65% and 90% of a country's population had migrated to an urban environment. Currently, the figure for China is still estimated to be below 40%, which would suggest that at least another 300m people may migrate to urban environments. China already has over 600 cities but the infrastructure needed to fulfil that rate of growth could keep demand for raw materials under pressure for some years to come.

The rise in the urban population is also a key component of the rapid growth in China's manufacturing capability, because access to a huge supply of cheap labour enables it to transform relatively high-priced commodities into large volumes of cheap, quality manufactured goods that satisfy the world's 6.5bn global consumers. During the last commodities bull market of the 1970s the world's population was around 4bn, many located in the former communist states that did not compete as aggressively for natural resources.

Consequently supply is struggling to keep up with demand and if these dynamics are maintained, new sources of minerals, including base metals, will be needed urgently. The finite nature of that latter group of commodities has put producers under considerable pressure and although rising prices may make it more profitable to find and mine mineral resources, the time taken to identify new sources and the huge financial commitment each new project represents is a strong argument for the investment in exploration by companies such as Sirius.

Outlook

During March 2006 copper and zinc prices surged to new peaks, with some analysts expecting further rises. The projections are that demand will continue to exceed supply, and therefore drive demand for raw materials that have essential industrial and economic uses. In a recent presentation to analysts by Sirius's partner, Phelps Dodge stated that it expect copper prices to remain strong on the back of Chinese consumption, a jump in investment demand and "unprecedented" supply disruptions during 2005. Although price cycles will remain tied to the ups and downs of the economy, it commented that it expects that "demand will be quite strong over the next couple of cycles and it will be quite challenging for our industry to make sure that we find the supplies to provide for that demand growth".

Although there may be sufficient resources below ground, new sources take time to find and extract. Currently Chile produces over a third of all copper mined annually, with its two best known mines, at Escondida and Chuquicamata together producing nearly 10% of all copper mined globally. The region is however forecast to reach its peak production in 2008 and although it has plans to expand, new copper discoveries are still urgently required.

World's Top Four Copper Producers 2005e

Chile 36%

USA 8%

Indonesia 7%

Peru 7%

During 2005, the International Copper Study Group estimated suggest that global copper production was broadly in line with demand, post an estimated 4% growth in production. Its forecast for 2006 is that demand will exceed 17m metric tons and t he outlook is for market conditions to remain tight during 2006 with limited production growth and demand picking up outside of China . That environment suggests that copper prices should be supported at relatively high levels during 2006.

PapalPower

- 03 Apr 2006 13:15

- 68 of 213

- 03 Apr 2006 13:15

- 68 of 213

PapalPower

- 03 Apr 2006 15:43

- 69 of 213

- 03 Apr 2006 15:43

- 69 of 213

Something in the air ?? ;

tallsiii

- 03 Apr 2006 17:23

- 70 of 213

- 03 Apr 2006 17:23

- 70 of 213

PapalPower

- 04 Apr 2006 03:28

- 71 of 213

- 04 Apr 2006 03:28

- 71 of 213

tallsiii

- 04 Apr 2006 08:03

- 72 of 213

- 04 Apr 2006 08:03

- 72 of 213

PapalPower

- 04 Apr 2006 08:24

- 73 of 213

- 04 Apr 2006 08:24

- 73 of 213

PapalPower

- 04 Apr 2006 12:17

- 74 of 213

- 04 Apr 2006 12:17

- 74 of 213

I think that news from the production line might be leaking back, has to be something like that, that all is good and we will have first production in a couple of weeks time :)

PapalPower

- 04 Apr 2006 12:44

- 75 of 213

- 04 Apr 2006 12:44

- 75 of 213

Although the old Fox Davies report would support this view, I really want to see this new report that is due out soon, to see their summaries and milestone targets.

PapalPower

- 04 Apr 2006 15:02

- 76 of 213

- 04 Apr 2006 15:02

- 76 of 213

Looking good.

PapalPower

- 05 Apr 2006 09:18

- 77 of 213

- 05 Apr 2006 09:18

- 77 of 213

PapalPower

- 06 Apr 2006 10:07

- 78 of 213

- 06 Apr 2006 10:07

- 78 of 213

CNKS well out of the way holding at lowest and highest they are 125/135.