| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

THE TALK TO YOURSELF THREAD. (NOWT)

goldfinger

- 09 Jun 2005 12:25

- 09 Jun 2005 12:25

Thought Id start this one going because its rather dead on this board at the moment and I suppose all my usual muckers are either at the Stella tennis event watching Dim Tim (lose again) or at Henly Regatta eating cucumber sandwiches (they wish,...NOT).

Anyway please feel free to just talk to yourself blast away and let it go on any company or subject you wish. Just wish Id thought of this one before.

cheers GF.

Anyway please feel free to just talk to yourself blast away and let it go on any company or subject you wish. Just wish Id thought of this one before.

cheers GF.

Haystack

- 07 Jul 2016 12:24

- 72306 of 81564

- 07 Jul 2016 12:24

- 72306 of 81564

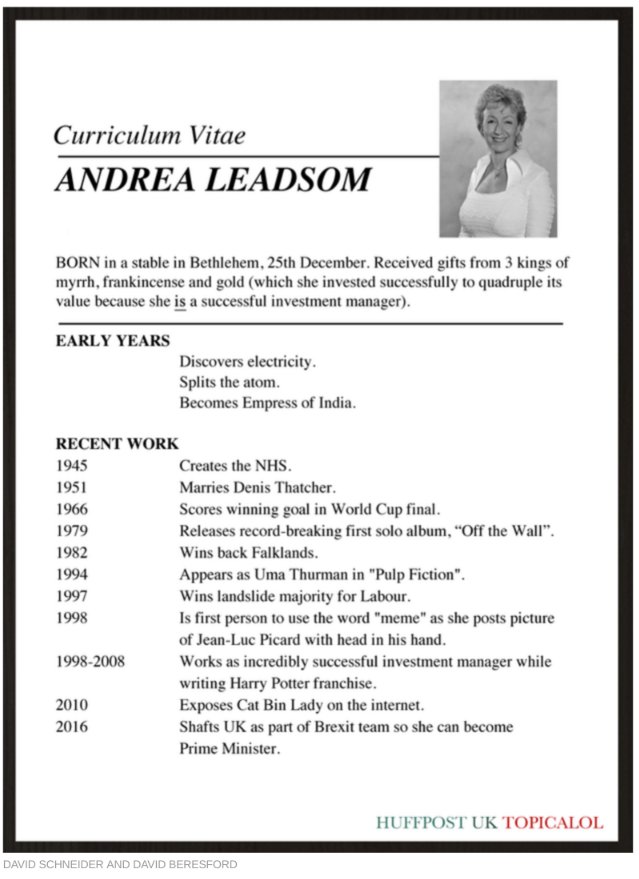

The CV is clearly not true. In fact her team have amended her CV today to correct the faults. It is the sort of CV that contains huge exaggerations in order to get a senior job. In the commercial world, it happens a lot. For the office of PM, it is unacceptable.

There are very specific types of experience that she has claimed which are totally untrue. In particular, she claims to have run teams of people numbering 30 or more. Her previous employers have said that she did not manage anyone at all.

Her finance experience if almost non existent. She had only been qualified as a finance worker three months before she left her job. She claims to have been head hunted as a finance expert when in fact she joined a relative's company as a marketing person. Almost every aspect of her CV contains false information.

There are very specific types of experience that she has claimed which are totally untrue. In particular, she claims to have run teams of people numbering 30 or more. Her previous employers have said that she did not manage anyone at all.

Her finance experience if almost non existent. She had only been qualified as a finance worker three months before she left her job. She claims to have been head hunted as a finance expert when in fact she joined a relative's company as a marketing person. Almost every aspect of her CV contains false information.

Fred1new

- 07 Jul 2016 12:31

- 72307 of 81564

- 07 Jul 2016 12:31

- 72307 of 81564

Haze,

How similar is that cv to yours/

I thought it was typical of a tory cabinet minister.

How similar is that cv to yours/

I thought it was typical of a tory cabinet minister.

grannyboy

- 07 Jul 2016 13:41

- 72308 of 81564

- 07 Jul 2016 13:41

- 72308 of 81564

Yes a bit like Mays and her associates claiming that because she's been

home secretary for six years she must have been successful...

Wrong!...If you think that ever increasing immigration and open door

borders where immigrants can walk through a tunnel over 23 miles long

or sail across the channel, and still fail to deport them....I DON'T!!!..

SHE'S BEEN AN ABSOLUTE DISASTER.....

home secretary for six years she must have been successful...

Wrong!...If you think that ever increasing immigration and open door

borders where immigrants can walk through a tunnel over 23 miles long

or sail across the channel, and still fail to deport them....I DON'T!!!..

SHE'S BEEN AN ABSOLUTE DISASTER.....

MaxK - 07 Jul 2016 13:44 - 72309 of 81564

Yes, but she is Teflon coated. (very handy)

Haystack

- 07 Jul 2016 13:58

- 72310 of 81564

- 07 Jul 2016 13:58

- 72310 of 81564

Haystack

- 07 Jul 2016 13:59

- 72311 of 81564

- 07 Jul 2016 13:59

- 72311 of 81564

I like the 2016 item.

MaxK - 07 Jul 2016 14:31 - 72312 of 81564

That's a good one :-)

Looks like the remain pr team have been hard at work.

Looks like the remain pr team have been hard at work.

Haystack

- 07 Jul 2016 14:46

- 72313 of 81564

- 07 Jul 2016 14:46

- 72313 of 81564

Haystack

- 07 Jul 2016 14:47

- 72314 of 81564

- 07 Jul 2016 14:47

- 72314 of 81564

iturama - 07 Jul 2016 16:58 - 72315 of 81564

Mark Cavendish wins stage 6 of the Tour and the 29th of his career. 3rd win on this tour. Second in the all time list of winners and way ahead of all if time trials are excluded.

Fred1new

- 07 Jul 2016 17:19

- 72316 of 81564

- 07 Jul 2016 17:19

- 72316 of 81564

If one thinks about it, after reading Lead Some's CV, she would appear to be the most suitable leader of the Con artist's party.

Another leader you can put one's trust in!

Already, a truthful and good follow on to the barrow boy Dodgy Dave.

Another leader you can put one's trust in!

Already, a truthful and good follow on to the barrow boy Dodgy Dave.

cynic

- 07 Jul 2016 17:47

- 72317 of 81564

- 07 Jul 2016 17:47

- 72317 of 81564

as opposed to that fine leader JC!

what a sad disappointment he is ....... he should no more have been elected than michael foot was

what a sad disappointment he is ....... he should no more have been elected than michael foot was

Fred1new

- 07 Jul 2016 18:12

- 72318 of 81564

- 07 Jul 2016 18:12

- 72318 of 81564

Manuel.

While I question some of Jeremy's policies I think he seems a more honourable man than the majority who seem to be in leadership roles of the cons or UKIP parties.

I would wear a pair of gloves if forced to shake hands with the present candidates and their backers of either the latter parties.

I am not sure what Corbyn is up to, I wait to see.

My hopes are that he is working on "future" feasible policies.

But with the chaos created by the incompetent actions that Cameron's stunt of the referendum has produced, it may be sensible for the Labour and liberals to observe and comment rather than attempt to govern.

He has dealt a hand to his followers to play, which looks very dodgy!

While I question some of Jeremy's policies I think he seems a more honourable man than the majority who seem to be in leadership roles of the cons or UKIP parties.

I would wear a pair of gloves if forced to shake hands with the present candidates and their backers of either the latter parties.

I am not sure what Corbyn is up to, I wait to see.

My hopes are that he is working on "future" feasible policies.

But with the chaos created by the incompetent actions that Cameron's stunt of the referendum has produced, it may be sensible for the Labour and liberals to observe and comment rather than attempt to govern.

He has dealt a hand to his followers to play, which looks very dodgy!

cynic

- 07 Jul 2016 18:17

- 72319 of 81564

- 07 Jul 2016 18:17

- 72319 of 81564

i have never questioned corbyn being a man of principle, insofar as any politician is, but by no stretch of the imagination could he be described as a leader

sorry to disillusion you, but i don't think that corbyn is up to anything ...... as a leader, he is just a limp lettuce

he showed his leadership credentials in his less than half-hearted support of the "remain" campaign, which was clearly where the rest of his party wanted to be - even he personally did not

the recent surge in labour party membership feels distinctly suspect and engineered, rather than a reflection of admiration for "the lettuce"

sorry to disillusion you, but i don't think that corbyn is up to anything ...... as a leader, he is just a limp lettuce

he showed his leadership credentials in his less than half-hearted support of the "remain" campaign, which was clearly where the rest of his party wanted to be - even he personally did not

the recent surge in labour party membership feels distinctly suspect and engineered, rather than a reflection of admiration for "the lettuce"

Fred1new

- 07 Jul 2016 18:33

- 72320 of 81564

- 07 Jul 2016 18:33

- 72320 of 81564

Atlee wasn't seen as a leader, and was quiet, sparing with his words and not brash or flash in the pan like some prefer.

However, Atlee was seen as one of the most effective and reforming leaders of the past 70 years.

However, I observed that often when somebody who had been quiet during a committee meaning spoke end of it, they often spoke more sensibly than many other more vociferous members had done.

I don't know, I am prepared to wait and see.

But there does seem an unnecessary haste by some tories to denigrate and get rid of Corbyn.

I am wondering why?

However, Atlee was seen as one of the most effective and reforming leaders of the past 70 years.

However, I observed that often when somebody who had been quiet during a committee meaning spoke end of it, they often spoke more sensibly than many other more vociferous members had done.

I don't know, I am prepared to wait and see.

But there does seem an unnecessary haste by some tories to denigrate and get rid of Corbyn.

I am wondering why?

cynic

- 07 Jul 2016 18:40

- 72321 of 81564

- 07 Jul 2016 18:40

- 72321 of 81564

because the tories and indeed the country need a credible opposition, and jc as leader is just "the lettuce"

fwiw atlee led the labour party from 1935 to 1955, and that is a lifetime ago!

indeed, politics in that long-past era was a totally different game from what we have now

fwiw atlee led the labour party from 1935 to 1955, and that is a lifetime ago!

indeed, politics in that long-past era was a totally different game from what we have now

Fred1new

- 07 Jul 2016 18:48

- 72322 of 81564

- 07 Jul 2016 18:48

- 72322 of 81564

And due to the tories a more dishonourable game.

Governing on lies comes to mind.

Governing on lies comes to mind.

cynic

- 07 Jul 2016 18:53

- 72323 of 81564

- 07 Jul 2016 18:53

- 72323 of 81564

oh do stop being so boring and repetitive and just grow up!

politics is different now as much as anything because of television and all that that has brought

and of course the world has moved on immeasurably even since 1955, never mind 1935

politics is different now as much as anything because of television and all that that has brought

and of course the world has moved on immeasurably even since 1955, never mind 1935

ExecLine

- 07 Jul 2016 19:34

- 72324 of 81564

- 07 Jul 2016 19:34

- 72324 of 81564

From the FT at:

http://www.ft.com/cms/s/0/0dda9446-4367-11e6-b22f-79eb4891c97d.html#ixzz4DkTMPYCP

Last updated: July 7, 2016 4:55 pm

Market commentators discuss what will happen to sterling

The pound has fallen more than 20 cents in the wake of Brexit. Analysts expect further declines. With sterling appearing set for one of its biggest slumps in the modern era, rivalling those of the financial crisis and the ejection from Europe’s exchange rate mechanism in 1992, the FT sought the views of market commentators on what happens next to the currency.

How low will the pound fall?

George Magnus, senior economic adviser at UBS: A 20 per cent fall from pre-referendum levels was likely, so $1.15 remains the base case. But if there is a sharper than expected economic contraction or the political impasse drains confidence, “parity is quite possible”.

Simon Derrick, head of BNY Mellon’s markets strategy team: The peak to trough decline in sterling against the dollar was 29 per cent in 1992-93 and 34 per cent in 2007-08. Similar declines would today drive sterling down to $1.22 and $1.1350.

David Blanchflower, professor of economics at Dartmouth College: Sterling could go well below $1.20, as “this is a classic response to uncertainty, to trade flows and to the fact the Brexiters had no plan”.

Michael Metcalfe, head of macro strategy at State Street: Sterling’s fair value is $1.47, so a not-uncommon diversion of 20 per cent takes you to $1.20. “But we are most concerned about foreigners selling gilts.” A Bank of England rate cut into an inflationary environment could see foreigners dump their gilt holdings.

Who gains from sterling’s plunge?

Mohamed El-Erian, chief economic adviser at Allianz: Winners from a cheaper pound include exporters or domestic producers that compete against imports and certain service sectors, “particularly tourism”.

Supriya Menon, senior multi-asset strategist at Pictet Asset Management: The FTSE 100 index is a net beneficiary, materials and energy companies certainly benefit given a US dollar revenue stream and still stable commodities prices.

George Magnus: Exporters are the principal gainers — they are well represented in the FTSE 100. “But they have to be able to sell rising amounts of goods and services into a stagnant world trade environment. So it’s not a ‘water off a duck’s back’ issue by a long way.”

Who loses from a cheaper pound?

Mohamed El-Erian: UK tourists will find overseas holidays more expensive. Domestically oriented companies suffer twice over — from dearer imported components and decline in demand for their output “as the cheaper pound is accompanied by a slowdown in economic growth, if not a recession”.

The pound’s value prompts the question as to whether it is a blessing or omen

George Magnus: Consumers will pay more for food and raw material and other imports. If a weaker pound dampens real wages, local companies and housing markets should weaken.

Supriya Menon: “We have downgraded our growth forecast in the UK from 1.9 per cent to 1 per cent this year and believe there is a risk the UK falls into a recession in the third quarter of 2016.”

At what level does a falling pound raise capital flight concerns?

Simon Derrick: There is no level at which a falling pound raises capital flight worries. “More importantly, I’ve seen no evidence of capital flight.”

Mohamed El-Erian: Significant capital flight is a risk “if the decline is viewed as a ‘repeated game’ and with no anchor on the horizon”. Moreover, the BoE cannot raise interest rates to stabilise the foreign exchange market. “In fact, the BoE is more likely to cut rates than to hike.”

George Magnus: A disorderly fall in the pound is effectively “a pound that’s falling because of capital flight”. It is not a specific level that triggers capital flight worries, it is the manner of the decline and what it tells us about capital outflows.

Michael Metcalfe: It is not the level but the pace of move allowed. “If sterling is falling rapidly and policymakers appear to be ignoring it, there is a risk of capital flight.”

Will we look back and think the pound was absurdly cheap?

Simon Derrick: Sterling has been trending lower since the Nixon shock so all things are relative. It is certainly cheap compared with the past 30 years. But the price of the pound post-1985 also looked cheap to anybody that remembered where it had traded in the 1970s.

Mohamed El-Erian: EU negotiations will determine sterling’s fair value. A prompt comprehensive free trade agreement would make current levels look “very cheap”. Short of that would make the pound’s level look like a “new normal, if not more appreciated compared to where the currency ultimately settles”.

George Magnus: Sterling does not look cheap at the moment because “we don’t yet know what level is consistent with political and policy risk”, nor how deep/shallow or protracted the downturn will be. “Absurdly cheap will be where and when the pound overshoots on the downside. That could still be a long way off.”

David Blanchflower: The best case for the pound may ultimately be action by central banks which is likely to follow: “This will generate a response. This is literally for the Fed a culmination of the mistake it made in December [by raising rates]. The next move for the Fed is going to be a cut.”

Supriya Menon: “We don’t think we are at the point where the pound has found its floor — and uncertainty is expected to rise rather than abate in the short term. So we don’t think it is compelling value just yet.”

Michael Metcalfe: “Yes. It is already quite cheap and it could get cheaper.”

http://www.ft.com/cms/s/0/0dda9446-4367-11e6-b22f-79eb4891c97d.html#ixzz4DkTMPYCP

Last updated: July 7, 2016 4:55 pm

Market commentators discuss what will happen to sterling

The pound has fallen more than 20 cents in the wake of Brexit. Analysts expect further declines. With sterling appearing set for one of its biggest slumps in the modern era, rivalling those of the financial crisis and the ejection from Europe’s exchange rate mechanism in 1992, the FT sought the views of market commentators on what happens next to the currency.

How low will the pound fall?

George Magnus, senior economic adviser at UBS: A 20 per cent fall from pre-referendum levels was likely, so $1.15 remains the base case. But if there is a sharper than expected economic contraction or the political impasse drains confidence, “parity is quite possible”.

Simon Derrick, head of BNY Mellon’s markets strategy team: The peak to trough decline in sterling against the dollar was 29 per cent in 1992-93 and 34 per cent in 2007-08. Similar declines would today drive sterling down to $1.22 and $1.1350.

David Blanchflower, professor of economics at Dartmouth College: Sterling could go well below $1.20, as “this is a classic response to uncertainty, to trade flows and to the fact the Brexiters had no plan”.

Michael Metcalfe, head of macro strategy at State Street: Sterling’s fair value is $1.47, so a not-uncommon diversion of 20 per cent takes you to $1.20. “But we are most concerned about foreigners selling gilts.” A Bank of England rate cut into an inflationary environment could see foreigners dump their gilt holdings.

Who gains from sterling’s plunge?

Mohamed El-Erian, chief economic adviser at Allianz: Winners from a cheaper pound include exporters or domestic producers that compete against imports and certain service sectors, “particularly tourism”.

Supriya Menon, senior multi-asset strategist at Pictet Asset Management: The FTSE 100 index is a net beneficiary, materials and energy companies certainly benefit given a US dollar revenue stream and still stable commodities prices.

George Magnus: Exporters are the principal gainers — they are well represented in the FTSE 100. “But they have to be able to sell rising amounts of goods and services into a stagnant world trade environment. So it’s not a ‘water off a duck’s back’ issue by a long way.”

Who loses from a cheaper pound?

Mohamed El-Erian: UK tourists will find overseas holidays more expensive. Domestically oriented companies suffer twice over — from dearer imported components and decline in demand for their output “as the cheaper pound is accompanied by a slowdown in economic growth, if not a recession”.

The pound’s value prompts the question as to whether it is a blessing or omen

George Magnus: Consumers will pay more for food and raw material and other imports. If a weaker pound dampens real wages, local companies and housing markets should weaken.

Supriya Menon: “We have downgraded our growth forecast in the UK from 1.9 per cent to 1 per cent this year and believe there is a risk the UK falls into a recession in the third quarter of 2016.”

At what level does a falling pound raise capital flight concerns?

Simon Derrick: There is no level at which a falling pound raises capital flight worries. “More importantly, I’ve seen no evidence of capital flight.”

Mohamed El-Erian: Significant capital flight is a risk “if the decline is viewed as a ‘repeated game’ and with no anchor on the horizon”. Moreover, the BoE cannot raise interest rates to stabilise the foreign exchange market. “In fact, the BoE is more likely to cut rates than to hike.”

George Magnus: A disorderly fall in the pound is effectively “a pound that’s falling because of capital flight”. It is not a specific level that triggers capital flight worries, it is the manner of the decline and what it tells us about capital outflows.

Michael Metcalfe: It is not the level but the pace of move allowed. “If sterling is falling rapidly and policymakers appear to be ignoring it, there is a risk of capital flight.”

Will we look back and think the pound was absurdly cheap?

Simon Derrick: Sterling has been trending lower since the Nixon shock so all things are relative. It is certainly cheap compared with the past 30 years. But the price of the pound post-1985 also looked cheap to anybody that remembered where it had traded in the 1970s.

Mohamed El-Erian: EU negotiations will determine sterling’s fair value. A prompt comprehensive free trade agreement would make current levels look “very cheap”. Short of that would make the pound’s level look like a “new normal, if not more appreciated compared to where the currency ultimately settles”.

George Magnus: Sterling does not look cheap at the moment because “we don’t yet know what level is consistent with political and policy risk”, nor how deep/shallow or protracted the downturn will be. “Absurdly cheap will be where and when the pound overshoots on the downside. That could still be a long way off.”

David Blanchflower: The best case for the pound may ultimately be action by central banks which is likely to follow: “This will generate a response. This is literally for the Fed a culmination of the mistake it made in December [by raising rates]. The next move for the Fed is going to be a cut.”

Supriya Menon: “We don’t think we are at the point where the pound has found its floor — and uncertainty is expected to rise rather than abate in the short term. So we don’t think it is compelling value just yet.”

Michael Metcalfe: “Yes. It is already quite cheap and it could get cheaper.”

ExecLine

- 07 Jul 2016 19:46

- 72325 of 81564

- 07 Jul 2016 19:46

- 72325 of 81564

From the Guardian at: http://www.theguardian.com/politics/reality-check/2016/jul/07/reality-check-andrea-leadsom-economic-vision?CMP=twt_b-gdnnews#link_time=1467905135

Reality check: Andrea Leadsom's economic vision

Tory leadership contender needs more than a Ukip-style campaign to buy British and boost Commonwealth trade

‘Andre Leadsom’s analysis lacks credibility and her plan lacks policies.’

Phillip Inman Economics correspondent

Thursday 7 July 2016 14.19 BST

Last modified on Thursday 7 July 2016 15.05 BST

Andrea Leadsom said in her set-piece speech on the UK’s economic prospects that the financial markets were coping well and the FTSE 100 was performing better than rival stock markets. The pound was only falling because currency dealers bet the wrong way before the referendum vote, believing the UK would stay in the EU, she said. The UK’s borrowing costs remained among the lowest in the world.

Notwithstanding her previous criticism of Mark Carney for talking down the economy and being part of a conspiracy of experts campaigning to keep the UK in the EU, she said the governor of the Bank of England was right to say the country would survive the uncertainty surrounding Brexit.

As for the future, she said a lower-valued pound would be good for the country, encouraging consumers to shun imports and buy British. Exports would be the priority for her government.

As a first move, she would seek tariff-free trade with the EU and then conduct talks with countries in the Commonwealth, which represents a market of 2.3 billion consumers, many of them in fast-growing economies.

She would preside over a country with better training, “smarter working” and high standards of company behaviour. Together with higher exports, this would lead to more jobs, higher pay for workers and prosperity being taken “to every corner of the country”.

Is Leadsom right?

There was no detailed policy announcements to support her claim that a Leadsom premiership would put the UK on a path to greater prosperity.

Her main aim was to say that the current uncertainty gripping the markets was being overplayed. The FTSE 100 has gained ground to stand at 6,528 points at midday on Thursday and it is true the UK government can borrow at historically low interest rates.

But the stock market rallied only after it became clear Britain would not actually leave the EU for at least two years, probably longer. Shares also went into overdrive at the prospect of an interest rate rise in the US and cuts in the cost of borrowing by the Bank of England and the European Central Bank.

It should also be noted that the FTSE 100 is full of international companies that report most of their revenues in dollars. The falling pound has made their profits more valuable, raising their share price.

The FTSE 250, which is almost exclusively made up of smaller companies that rely more heavily on the UK for their business, is down by 8% since the referendum vote.

Leadsom said the pound had tumbled to a 31-year low against the dollar and a three-year low against the euro as investors priced in the market’s mistake of forecasting a remain win.

However, Holger Schmieding, the chief economist at Berenberg bank, said another view would be that the current uncertainty has driven away foreign investors, reducing demand for sterling. This is acute in the commercial property industry, which relies heavily on investment from overseas. The UK’s balance of payments deficit of 7%, the largest in the G7, has also played a role. It shows that the UK has been living beyond its means for some time.

Schmieding agreed with Brexiters that the pound’s fall should not be overplayed. “Despite the heightened political and economic uncertainty, the fall in sterling has been orderly so far. After an initial sharp fall of 8.4% between 24 and 29 June, sterling seems to have found a bottom in recent days. It is still trading 9% above the 2009 lows.”

The bad news, according to Schmieding, was that weaker sterling was unlikely to boost exports much, despite Leadsom’s claims.

“Although the UK’s exchange rate is currently down by 15% on a trade-weighted basis compared to last November’s peak, experience with previous sharp depreciations suggests that the boost to exports will be limited. Trade-weighted sterling fell by 30% during the financial crisis, but the trade deficit remained at 3% of GDP. Why? The fall in foreign demand matched the fall in domestic demand. The exchange rate made only a small difference.”

Schmieding pointed out that a lower pound made UK households poorer. “Since UK households consume many foreign goods and services, the drop in sterling makes them poorer in real terms. Over time, the rise in import prices will contribute to higher inflation. Higher inflation will slow the growth of, or even lead to a reduction in real wages – real wage growth is the primary determinant of domestic demand growth.”

Leadsom said she wanted to boost growth with high-paid, export-led jobs. Schmieding said the economy “will rebalance the wrong way”.

“The trade deficit should begin to fall in the coming months. But it will happen for the wrong reason,” he said. “A healthy rebalancing would involve growth in exports. Since lower sterling will not boost exports much, the fall in the trade deficit will be driven by lower imports instead – reflecting weaker domestic demand.”

The Bank of England governor said the UK’s balance of payments deficit meant it was “relying on the kindness of strangers”. Schmieding agreed.

“This deficit is funded by foreigners who are willing to lend to the UK. Strong growth attracts investment, recessions deter it,” he said. “Until the UK economy and its financial markets stabilise, a sterling crisis remains a key tail risk. With each day that passes, the risk falls a little, the outlook becomes a little clearer and the post-vote shock fades. But political and economic risks loom large.”

Leadsom pitched for a deal with the EU that offers tariff-free trade. How she can achieve that without conceding free movement of labour is not clear.

She said the UK could expand exports to fast-growing countries in Asia, Africa and South America. There was no plan to back up this claim. It can take five years or more to secure trade deals with foreign governments.

It is possible for the UK to trade under World Trade Organisation rules, accepting existing tariffs and regulations, but that is unlikely to bring a big boost to exports and turn around a long-term decline in the manufacturing sector, which is smaller now than before the 2008 crash.

Verdict

Leadsom’s analysis lacks credibility and her plan for the future lacks policies.

As a vision, it ranks alongside that of Ukip, with her emphasis on building relations with the Commonwealth, and consumers rejecting foreign-made goods in favour of buying British.

A lower currency can bring some benefits, but not if it is a judgment on the strength of the economy. If the UK suffers a recession, that is a more important factor than a fall in the pound. Foreign investors will flee.

Some anti-EU economists say good riddance, but just like Leadsom’s “buy British” campaign to help the balance of payments and boost the economy, a shift to higher domestic investment is going to take a long time and will need to reverse more than 30 years of reliance on foreigners.

Reality check: Andrea Leadsom's economic vision

Tory leadership contender needs more than a Ukip-style campaign to buy British and boost Commonwealth trade

‘Andre Leadsom’s analysis lacks credibility and her plan lacks policies.’

Phillip Inman Economics correspondent

Thursday 7 July 2016 14.19 BST

Last modified on Thursday 7 July 2016 15.05 BST

Andrea Leadsom said in her set-piece speech on the UK’s economic prospects that the financial markets were coping well and the FTSE 100 was performing better than rival stock markets. The pound was only falling because currency dealers bet the wrong way before the referendum vote, believing the UK would stay in the EU, she said. The UK’s borrowing costs remained among the lowest in the world.

Notwithstanding her previous criticism of Mark Carney for talking down the economy and being part of a conspiracy of experts campaigning to keep the UK in the EU, she said the governor of the Bank of England was right to say the country would survive the uncertainty surrounding Brexit.

As for the future, she said a lower-valued pound would be good for the country, encouraging consumers to shun imports and buy British. Exports would be the priority for her government.

As a first move, she would seek tariff-free trade with the EU and then conduct talks with countries in the Commonwealth, which represents a market of 2.3 billion consumers, many of them in fast-growing economies.

She would preside over a country with better training, “smarter working” and high standards of company behaviour. Together with higher exports, this would lead to more jobs, higher pay for workers and prosperity being taken “to every corner of the country”.

Is Leadsom right?

There was no detailed policy announcements to support her claim that a Leadsom premiership would put the UK on a path to greater prosperity.

Her main aim was to say that the current uncertainty gripping the markets was being overplayed. The FTSE 100 has gained ground to stand at 6,528 points at midday on Thursday and it is true the UK government can borrow at historically low interest rates.

But the stock market rallied only after it became clear Britain would not actually leave the EU for at least two years, probably longer. Shares also went into overdrive at the prospect of an interest rate rise in the US and cuts in the cost of borrowing by the Bank of England and the European Central Bank.

It should also be noted that the FTSE 100 is full of international companies that report most of their revenues in dollars. The falling pound has made their profits more valuable, raising their share price.

The FTSE 250, which is almost exclusively made up of smaller companies that rely more heavily on the UK for their business, is down by 8% since the referendum vote.

Leadsom said the pound had tumbled to a 31-year low against the dollar and a three-year low against the euro as investors priced in the market’s mistake of forecasting a remain win.

However, Holger Schmieding, the chief economist at Berenberg bank, said another view would be that the current uncertainty has driven away foreign investors, reducing demand for sterling. This is acute in the commercial property industry, which relies heavily on investment from overseas. The UK’s balance of payments deficit of 7%, the largest in the G7, has also played a role. It shows that the UK has been living beyond its means for some time.

Schmieding agreed with Brexiters that the pound’s fall should not be overplayed. “Despite the heightened political and economic uncertainty, the fall in sterling has been orderly so far. After an initial sharp fall of 8.4% between 24 and 29 June, sterling seems to have found a bottom in recent days. It is still trading 9% above the 2009 lows.”

The bad news, according to Schmieding, was that weaker sterling was unlikely to boost exports much, despite Leadsom’s claims.

“Although the UK’s exchange rate is currently down by 15% on a trade-weighted basis compared to last November’s peak, experience with previous sharp depreciations suggests that the boost to exports will be limited. Trade-weighted sterling fell by 30% during the financial crisis, but the trade deficit remained at 3% of GDP. Why? The fall in foreign demand matched the fall in domestic demand. The exchange rate made only a small difference.”

Schmieding pointed out that a lower pound made UK households poorer. “Since UK households consume many foreign goods and services, the drop in sterling makes them poorer in real terms. Over time, the rise in import prices will contribute to higher inflation. Higher inflation will slow the growth of, or even lead to a reduction in real wages – real wage growth is the primary determinant of domestic demand growth.”

Leadsom said she wanted to boost growth with high-paid, export-led jobs. Schmieding said the economy “will rebalance the wrong way”.

“The trade deficit should begin to fall in the coming months. But it will happen for the wrong reason,” he said. “A healthy rebalancing would involve growth in exports. Since lower sterling will not boost exports much, the fall in the trade deficit will be driven by lower imports instead – reflecting weaker domestic demand.”

The Bank of England governor said the UK’s balance of payments deficit meant it was “relying on the kindness of strangers”. Schmieding agreed.

“This deficit is funded by foreigners who are willing to lend to the UK. Strong growth attracts investment, recessions deter it,” he said. “Until the UK economy and its financial markets stabilise, a sterling crisis remains a key tail risk. With each day that passes, the risk falls a little, the outlook becomes a little clearer and the post-vote shock fades. But political and economic risks loom large.”

Leadsom pitched for a deal with the EU that offers tariff-free trade. How she can achieve that without conceding free movement of labour is not clear.

She said the UK could expand exports to fast-growing countries in Asia, Africa and South America. There was no plan to back up this claim. It can take five years or more to secure trade deals with foreign governments.

It is possible for the UK to trade under World Trade Organisation rules, accepting existing tariffs and regulations, but that is unlikely to bring a big boost to exports and turn around a long-term decline in the manufacturing sector, which is smaller now than before the 2008 crash.

Verdict

Leadsom’s analysis lacks credibility and her plan for the future lacks policies.

As a vision, it ranks alongside that of Ukip, with her emphasis on building relations with the Commonwealth, and consumers rejecting foreign-made goods in favour of buying British.

A lower currency can bring some benefits, but not if it is a judgment on the strength of the economy. If the UK suffers a recession, that is a more important factor than a fall in the pound. Foreign investors will flee.

Some anti-EU economists say good riddance, but just like Leadsom’s “buy British” campaign to help the balance of payments and boost the economy, a shift to higher domestic investment is going to take a long time and will need to reverse more than 30 years of reliance on foreigners.