| Home | Log In | Register | Our Services | My Account | Contact | Help |

Eureka Mining, the prospects are good. (EKA)

PapalPower

- 05 Feb 2006 04:44

- 05 Feb 2006 04:44

Main Web Site : http://www.eurekamining.co.uk

EKA is now a Molybdenum producer in Kazahkstan, and is in the process of bringing the Chelyabinsk Copper/Gold project into production in 2008.

Latest Presentation June 2006 : Presentation Link (10MB PPT file)

Research Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

26th Jan 2006 Press Commentary : Press Link

About Eureka Mining

Key contact : Mr Kevin Foo Non-Exec Chairman

E-Mail : kevin.foo@eurekamining.co.uk

Eureka Mining Plc is a UK based mining exploration and project development company, focusing on projects in the Former Soviet Union. It is the Companys view that Kazakhstan and other central Asian FSU countries represent an area of significant opportunity. This belief is supported by the quality of the portfolio of assets which Eureka has acquired including;

the Shorskoye molybdenum deposit;

the acquisition of the Chelyabinsk Copper Project; and

the advanced exploration projects of Kentau, Mykubinsk and Central Kazakhstan projects. The Mykubinsk and Central Kazakhstan polymetallic project has assets situated in northern Kazakhstan and the Kentau exploration project has identified several gold and base metal deposits.

Shorskoye Molybdenum Project:

50/50 JV with KazAtomProm, largest Kazakhstan State Mining Company

Production projected for 1st Qtr 2006

Project Finance in place

Chelyabinsk Copper Project

Production planned for 2008

Very large resource base with with 3.57Mt Cu / 4.2Moz Au

First western group into Russian Copper Heartland and consequential opportunities in base metals

Kazakhstan Exploration Projects

At the Dostyk Copper-Gold Projects in Central Kazakhstan, we have reviewed all historical data and identified at least six drill targets, with particular focus on base metal projects. During 2004, we drilled five projects and completed significant field activity on two projects, including the high priority targets Berezky Central, Maiozek, Akkuduk (porphyry style), Ushtagan (epithermal gold), Maikain, Baygustam and Burovoy (VMS). We intend to focus on the most promising of these deposits in 2005/2006.

The Kentau Project in southern Kazakhstan has undergone an extensive data review, with a comprehensive Geographic Information Systems database being created. This has enabled us to plan a focused exploration programme on previously identified targets. Drilling is expected to commence in May 2005 at two of the best targets, using a large Reverse Circulation (RC) rig.

We entered into an option agreement to acquire the Nova Dnieprovka (Nova) Gold Mine in northern Kazakhstan. However, after a thorough assessment and reinterpretation of the project, including the completion of a drilling programme, we decided not to exercise the option and purchase agreement over the Nova project.

Our exploration and assessment teams are continuously reviewing potential projects for Eureka across the FSU and only the very best are selected for further work.

__________________________________________________________________

Some figures to think about (thanks to unionhall)

Current Market cap (@ 1.37) - 36m

Chelyabinsk NPV 508m (@ $1.60 copper and $550 Gold)

Shorskoye - 10m profit p/a @ $20 Moly

Major shareholders

Latest major holder figures are, from 26.6 million shares in issue :

Celtic Resources hold 15.02%

RAB Capital hold 6.19%

Kevin Foo holds 3.43% (Director)

David Bartley holds 3.02% (Director)

Malcom James holds 1.070% (Director)

Andrzej Sliwa holds 0.76% (Director)

JSB holds 0.177% (Director)

Latest News / Links / Research Reports

Reserach Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

25th April 2006 Moly Update :

http://www.resourceinvestor.com/pebble.asp?relid=19141

2006 Moly Report : http://www.golden-phoenix.com/documents/TheEconomicsofMolybdenum.pdf

____________________________________________________________________

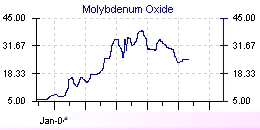

The Company has used an average molybdenum price of US$19/lb throughout the first year and US$12/lb thereafter to calculate cash flows arising from the project.

(*Note : Molybdenum does not trade on the London Metals Exchange or any other publicly traded commodity exchange. Its price is determined solely by supply/demand in the marketplace and supply contracts. In a report dated Oct. 28, 2005, RBC Capital Markets forecast that 2006 and 2007 molybdenum prices would be approximately US$25/lb and US$15/lb, respectively [source: RBC Capital Markets, Global Base Metal Equity and Commodity Report Card, company reports].*)

How will the Moly be processed ? Eureka pulled off a deal with KazAtProm.Eureka has 15-year access to state-owned KazAtomProm's processing facilities, which will allow the company to start producing molybdenum concentrate in February.The processing plant also handles other minerals.The proximity of the plant to the Chinese border, allows for quick, cheap and simple transport links to a major demand area for Moly

Implementation and schedule of Moly production

Utilising the Stepnogorsk processing facility allows Eureka to develop the Shorskoye asset and take advantage of the buoyant molybdenum market, commencing mining in Q3 05 and saleable concentrate by Q1 06. The key project milestones are:

August 2005 - award contracts

August 2005 - first blast and ore to crusher

September 2005 - first ore to Stepnogorsk

October 2005 - first equipment to Stepnogorsk

February 2006 - concentrator commissioning (Stepnogorsk)

February 2006 - Chelyabinsk 100% purchased by Eureka

May 2006 - first production from Stepnogorsk (Skorshoye)

____________________________________________________________________

Molybdenum Information Links

http://www.freemarketnews.com/Analysis/60/3742/2006-02-10.asp?wid=60&nid=3742

http://www.gold-eagle.com/editorials_05/reser092205.html

http://321energy.com/editorials/fross/fross120605.html

http://www.cozine.com/archive/cc2005/01370511.html

At 25$ / lb Moly prices : (Shorskoye Project)

2006 Moly production = 600,000 lbs = 14.7 million dollars sales price

2007 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2008 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2009 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2010 etc etc etc

___________________________________________________________

Recent Director Buying :

Kevin Foo BUY 5,000 on 21 June 2006 @ 81p

Kevin Foo BUY 18,000 on 21 June 2006 @ 90.3p

Kevin Foo BUY 9,000 on 22 June 2006 @ 92pb>

PapalPower

- 04 Apr 2006 12:17

- 74 of 213

- 04 Apr 2006 12:17

- 74 of 213

I think that news from the production line might be leaking back, has to be something like that, that all is good and we will have first production in a couple of weeks time :)

PapalPower

- 04 Apr 2006 12:44

- 75 of 213

- 04 Apr 2006 12:44

- 75 of 213

Although the old Fox Davies report would support this view, I really want to see this new report that is due out soon, to see their summaries and milestone targets.

PapalPower

- 04 Apr 2006 15:02

- 76 of 213

- 04 Apr 2006 15:02

- 76 of 213

Looking good.

PapalPower

- 05 Apr 2006 09:18

- 77 of 213

- 05 Apr 2006 09:18

- 77 of 213

PapalPower

- 06 Apr 2006 10:07

- 78 of 213

- 06 Apr 2006 10:07

- 78 of 213

CNKS well out of the way holding at lowest and highest they are 125/135.

PapalPower

- 06 Apr 2006 10:19

- 79 of 213

- 06 Apr 2006 10:19

- 79 of 213

tallsiii

- 06 Apr 2006 16:22

- 80 of 213

- 06 Apr 2006 16:22

- 80 of 213

tallsiii

- 07 Apr 2006 09:43

- 81 of 213

- 07 Apr 2006 09:43

- 81 of 213

PapalPower

- 07 Apr 2006 09:47

- 82 of 213

- 07 Apr 2006 09:47

- 82 of 213

PapalPower

- 07 Apr 2006 10:19

- 83 of 213

- 07 Apr 2006 10:19

- 83 of 213

Should be moving up next week too then :)

PapalPower

- 07 Apr 2006 12:32

- 84 of 213

- 07 Apr 2006 12:32

- 84 of 213

The expectation has to be plant commissioned and first production of Moly this month (April), then ramping up to full output in May, and along with this comes the pre-BFS for Chelyabinsk in May.

Therefore we should be hoping for news once the Moly plant is commissioned :) sometime this month :)

PapalPower

- 12 Apr 2006 00:20

- 85 of 213

- 12 Apr 2006 00:20

- 85 of 213

PapalPower

- 14 Apr 2006 01:22

- 86 of 213

- 14 Apr 2006 01:22

- 86 of 213

PapalPower

- 15 Apr 2006 10:03

- 87 of 213

- 15 Apr 2006 10:03

- 87 of 213

"Key Financials - Molybednum Poject 21st July 2005:

Payback six months

Only eight per cent. of Shorskoye reserves mined Further cash flow can be generated by increasing tonnage through plant

Molybdenum price assumed is conservative against todays price, at US$20/lb for one year and US$10/lb thereafter (current price is US$35/lb)

Further review of Copper (Cu) and Rhenium (Re) will be undertaken during production to evaluate the economic viability of their recovery "

PapalPower

- 18 Apr 2006 02:05

- 88 of 213

- 18 Apr 2006 02:05

- 88 of 213

ROBTV Mon 17th April 11:13AM:

Title: Look To Industrial Metals For Superior Returns with Otto Spork, president and CEO, Sextant Capital Management

http://www.robtv.com/shows/past_archive.tv

cynic

- 18 Apr 2006 07:55

- 89 of 213

- 18 Apr 2006 07:55

- 89 of 213

PapalPower

- 19 Apr 2006 09:55

- 90 of 213

- 19 Apr 2006 09:55

- 90 of 213

L2 now 5 v 1 so we should be moving up some more I think :)

PapalPower

- 20 Apr 2006 03:01

- 91 of 213

- 20 Apr 2006 03:01

- 91 of 213

We should be getting prelims anytime soon, and that should give us the latest updates :)

PapalPower

- 20 Apr 2006 07:10

- 92 of 213

- 20 Apr 2006 07:10

- 92 of 213

"Whilst molybdenum prices have fallen from their recent highs, they seem to have stabilised at around US$24/lb currently, reflecting strong demand from stainless steel producers and chemical users in Asia and the western world. The outlook for demand and prices in the medium term appears to be good."

PapalPower

- 20 Apr 2006 09:24

- 93 of 213

- 20 Apr 2006 09:24

- 93 of 213

Whatever happened to MolyMania?

Bob Moriarty

April 20, 2006

.....................I like moly, it's an interesting metal. Some 80% of moly mined, goes into stainless steel. The rest is used in industrial chemicals and in aerospace applications. China is the swing producer and their production determines the world price. Most moly is produced as a byproduct of copper production so the price doesn't have a major effect on supply. China has shut down hundreds of small moly mines in the last two years and since all their production goes straight to steel mills, the price of moly rocketed from $2 a pound to as high as $38 before stabilizing in the $24 range.

It's important for anyone considering the purchase of any primary moly stock to understand there is no shortage of moly properties. In fact, we know of enough moly in the ground to supply 200 years worth of moly. But there is a short term (at least short term) supply shortage. The first companies to actually get into production are the ones who are going to reap the benefit......................................