| Home | Log In | Register | Our Services | My Account | Contact | Help |

Eureka Mining, the prospects are good. (EKA)

PapalPower

- 05 Feb 2006 04:44

- 05 Feb 2006 04:44

Main Web Site : http://www.eurekamining.co.uk

EKA is now a Molybdenum producer in Kazahkstan, and is in the process of bringing the Chelyabinsk Copper/Gold project into production in 2008.

Latest Presentation June 2006 : Presentation Link (10MB PPT file)

Research Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

26th Jan 2006 Press Commentary : Press Link

About Eureka Mining

Key contact : Mr Kevin Foo Non-Exec Chairman

E-Mail : kevin.foo@eurekamining.co.uk

Eureka Mining Plc is a UK based mining exploration and project development company, focusing on projects in the Former Soviet Union. It is the Companys view that Kazakhstan and other central Asian FSU countries represent an area of significant opportunity. This belief is supported by the quality of the portfolio of assets which Eureka has acquired including;

the Shorskoye molybdenum deposit;

the acquisition of the Chelyabinsk Copper Project; and

the advanced exploration projects of Kentau, Mykubinsk and Central Kazakhstan projects. The Mykubinsk and Central Kazakhstan polymetallic project has assets situated in northern Kazakhstan and the Kentau exploration project has identified several gold and base metal deposits.

Shorskoye Molybdenum Project:

50/50 JV with KazAtomProm, largest Kazakhstan State Mining Company

Production projected for 1st Qtr 2006

Project Finance in place

Chelyabinsk Copper Project

Production planned for 2008

Very large resource base with with 3.57Mt Cu / 4.2Moz Au

First western group into Russian Copper Heartland and consequential opportunities in base metals

Kazakhstan Exploration Projects

At the Dostyk Copper-Gold Projects in Central Kazakhstan, we have reviewed all historical data and identified at least six drill targets, with particular focus on base metal projects. During 2004, we drilled five projects and completed significant field activity on two projects, including the high priority targets Berezky Central, Maiozek, Akkuduk (porphyry style), Ushtagan (epithermal gold), Maikain, Baygustam and Burovoy (VMS). We intend to focus on the most promising of these deposits in 2005/2006.

The Kentau Project in southern Kazakhstan has undergone an extensive data review, with a comprehensive Geographic Information Systems database being created. This has enabled us to plan a focused exploration programme on previously identified targets. Drilling is expected to commence in May 2005 at two of the best targets, using a large Reverse Circulation (RC) rig.

We entered into an option agreement to acquire the Nova Dnieprovka (Nova) Gold Mine in northern Kazakhstan. However, after a thorough assessment and reinterpretation of the project, including the completion of a drilling programme, we decided not to exercise the option and purchase agreement over the Nova project.

Our exploration and assessment teams are continuously reviewing potential projects for Eureka across the FSU and only the very best are selected for further work.

__________________________________________________________________

Some figures to think about (thanks to unionhall)

Current Market cap (@ 1.37) - 36m

Chelyabinsk NPV 508m (@ $1.60 copper and $550 Gold)

Shorskoye - 10m profit p/a @ $20 Moly

Major shareholders

Latest major holder figures are, from 26.6 million shares in issue :

Celtic Resources hold 15.02%

RAB Capital hold 6.19%

Kevin Foo holds 3.43% (Director)

David Bartley holds 3.02% (Director)

Malcom James holds 1.070% (Director)

Andrzej Sliwa holds 0.76% (Director)

JSB holds 0.177% (Director)

Latest News / Links / Research Reports

Reserach Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

25th April 2006 Moly Update :

http://www.resourceinvestor.com/pebble.asp?relid=19141

2006 Moly Report : http://www.golden-phoenix.com/documents/TheEconomicsofMolybdenum.pdf

____________________________________________________________________

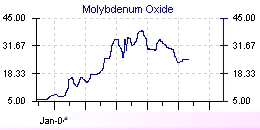

The Company has used an average molybdenum price of US$19/lb throughout the first year and US$12/lb thereafter to calculate cash flows arising from the project.

(*Note : Molybdenum does not trade on the London Metals Exchange or any other publicly traded commodity exchange. Its price is determined solely by supply/demand in the marketplace and supply contracts. In a report dated Oct. 28, 2005, RBC Capital Markets forecast that 2006 and 2007 molybdenum prices would be approximately US$25/lb and US$15/lb, respectively [source: RBC Capital Markets, Global Base Metal Equity and Commodity Report Card, company reports].*)

How will the Moly be processed ? Eureka pulled off a deal with KazAtProm.Eureka has 15-year access to state-owned KazAtomProm's processing facilities, which will allow the company to start producing molybdenum concentrate in February.The processing plant also handles other minerals.The proximity of the plant to the Chinese border, allows for quick, cheap and simple transport links to a major demand area for Moly

Implementation and schedule of Moly production

Utilising the Stepnogorsk processing facility allows Eureka to develop the Shorskoye asset and take advantage of the buoyant molybdenum market, commencing mining in Q3 05 and saleable concentrate by Q1 06. The key project milestones are:

August 2005 - award contracts

August 2005 - first blast and ore to crusher

September 2005 - first ore to Stepnogorsk

October 2005 - first equipment to Stepnogorsk

February 2006 - concentrator commissioning (Stepnogorsk)

February 2006 - Chelyabinsk 100% purchased by Eureka

May 2006 - first production from Stepnogorsk (Skorshoye)

____________________________________________________________________

Molybdenum Information Links

http://www.freemarketnews.com/Analysis/60/3742/2006-02-10.asp?wid=60&nid=3742

http://www.gold-eagle.com/editorials_05/reser092205.html

http://321energy.com/editorials/fross/fross120605.html

http://www.cozine.com/archive/cc2005/01370511.html

At 25$ / lb Moly prices : (Shorskoye Project)

2006 Moly production = 600,000 lbs = 14.7 million dollars sales price

2007 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2008 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2009 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2010 etc etc etc

___________________________________________________________

Recent Director Buying :

Kevin Foo BUY 5,000 on 21 June 2006 @ 81p

Kevin Foo BUY 18,000 on 21 June 2006 @ 90.3p

Kevin Foo BUY 9,000 on 22 June 2006 @ 92pb>

PapalPower

- 20 Apr 2006 07:10

- 92 of 213

- 20 Apr 2006 07:10

- 92 of 213

"Whilst molybdenum prices have fallen from their recent highs, they seem to have stabilised at around US$24/lb currently, reflecting strong demand from stainless steel producers and chemical users in Asia and the western world. The outlook for demand and prices in the medium term appears to be good."

PapalPower

- 20 Apr 2006 09:24

- 93 of 213

- 20 Apr 2006 09:24

- 93 of 213

Whatever happened to MolyMania?

Bob Moriarty

April 20, 2006

.....................I like moly, it's an interesting metal. Some 80% of moly mined, goes into stainless steel. The rest is used in industrial chemicals and in aerospace applications. China is the swing producer and their production determines the world price. Most moly is produced as a byproduct of copper production so the price doesn't have a major effect on supply. China has shut down hundreds of small moly mines in the last two years and since all their production goes straight to steel mills, the price of moly rocketed from $2 a pound to as high as $38 before stabilizing in the $24 range.

It's important for anyone considering the purchase of any primary moly stock to understand there is no shortage of moly properties. In fact, we know of enough moly in the ground to supply 200 years worth of moly. But there is a short term (at least short term) supply shortage. The first companies to actually get into production are the ones who are going to reap the benefit......................................

PapalPower

- 21 Apr 2006 03:49

- 94 of 213

- 21 Apr 2006 03:49

- 94 of 213

http://www.dailyreckoning.co.uk/article/130420062.html

Keith Cotterill - Other articles

Thu 13 Apr, 2006

Investing in copper

Five-year...ten-year...20...then 25-year...now

ALL TIME highs - copper prices are literally going

nuts.

The copper bull story is quickly told and quickly grasped when you see the performance of Phelps Dodge, (one of the world's largest producers of the metal) in the past 16 months:

- Supply is down - Chiles production has slipped and new mines arent being discovered. Prospectors havent found any easy (cheap) new fields in 100

years. In short, were running low on supplies... dangerously low.

- Demand is through the roof - Copper is needed for wiring and plumbing and there is seemingly no viable substitute.

Chinas roaring economic growth is being powered by a massive build-out of the electrical grid, and this demand alone has shaken the delicate balance that

held copper below $1 a pound for decades. And I mean shaken it to the ground: at $2.30 a pound, which it has now hit, we are in uncharted territory.

Investing in copper: Indispensable uses

Though copper is neither a precious metal nor a source of energy, it boasts indispensable industrial, technological and economic uses...it's one of the

most important nonferrous commodities today.

Prices have soared in the last four years with all-time highs being achieved this week. Those companies that produce and sell copper have watched their

revenues and profits skyrocket in this time, and have consequentially provided their shareholders with very handsome gains.

In the 1980s and 1990s commodities were beaten and battered. Inventories were full, mines and drills were shut down left, right and centre, and for all

consumption purposes, commodities were cheap and easy to get. Aside from the occasional bear-market rally, from an investors standpoint commodities were the dogs of the markets.

Well, how times have changed...The global economy is growing at a fast and furious pace led by the super-economies of China and India.

Investing in copper: Supply and demand

Commodities that were once undervalued are now starting to rise in price due to the simple economic imbalance of supply and demand. Industrial

development and growth in manufacturing and high technology have kicked up demand for the various natural resources used in their production causing

global inventories to sharply decline as they struggle to keep up with this new-found demand.

Copper falls comfortably into this cycle and Chinas voracious appetite for this metal has almost single-handedly emptied warehouses, drastically decreasing worldwide stock levels.

Look what happened in July of last year...copper stocks at the London Metals Exchange (LME) hit 31-year lows of 25,550 tonnes...the equivalent of less

than two days of global consumption. The hundreds of warehouses around the world, most commissioned and approved by the major metal exchanges (LME, COMEX, SHFE) have seen their inventories hit dangerously low levels.

According to Zeal.com, Chinas demand for copper has hit such extremes that in 2002 it created a large state-owned enterprise to exploit the international

development of nonferrous metals, mainly copper. The firm is called China Nonferrous Metal Mining & Construction Co., Ltd. (CNMC). Nearly four years

later CNMC has operations in over 30 different countries and is aggressively feeding its smelters back home.

Investing in copper: "...exploit overseas mineral resources"

Upon CNMCs creation, Zhang Jian, general manager of China Nonferrous Metal Industrys Foreign Engineering and Construction Group Company (CNFC) said, "It is of strategic significance to Chinas economic development to set up a long-term and stable overseas mineral resources supply base. However many domestic

small-scale nonferrous companies are incapable of solely tapping mines abroad. The only way is to jointly exploit overseas mineral resources."

With China as well as many other growing economies drawing down global inventories, it becomes clear why copper prices are on the rise and why we are

currently facing a global copper deficit.

Investing in copper: How to play the bull run

So how do you play this bull-run in copper?

First and most important, just like any other metal pulled from the ground, copper is dependent on miners to ultimately provide the supply.

To keep up with today and tomorrow's copper demand, mined output will need to increase.

Sounds simple...but as with all metals, ramping up production and opening up new mines requires significant time and capital. And I reckon it's

during that time, or cycle, that investors have the opportunity to take advantage of rising prices.

The USA's Copper Development Association (CDA)estimates that global copper resources are nearly 6 trillion pounds. The CDA also estimates that

throughout history only 700 billion pounds of copper have been mined.

These massive reserves coupled with coppers high recycle rate show we have no imminent risk of ever running out of the stuff. So for copper it is not an

issue of rarity or store of value, rather a matter of ramping up supply to meet demand. And just like all commodities, until this happens, market forces will adjust the prices accordingly in the upwards direction and give investors the opportunity to go long and profit...

And that's exactly what traders are doing today explains Keith Cotterill.......................More on the original link to the article......

....................................Investing in copper: "...the opportunity for legendary gains"

The bottom line is that the reddish metal we call copper continues to show future promise in this exciting secular bull market. Global inventories are

down and demand is up as the world economy grows.

Whereas in the 1980s and 1990s commodities producers, including copper, were the black plague of stock investing...todays commodities bull presents the

opportunity for legendary gains to investors and speculators.

PapalPower

- 21 Apr 2006 15:19

- 95 of 213

- 21 Apr 2006 15:19

- 95 of 213

PapalPower

- 22 Apr 2006 01:34

- 96 of 213

- 22 Apr 2006 01:34

- 96 of 213

So a few extra days to wait before news :)

cynic

- 23 Apr 2006 08:16

- 97 of 213

- 23 Apr 2006 08:16

- 97 of 213

My only real misgivings about CER is that they have already moved quite substantially over the last 2/3 weeks.

PapalPower

- 24 Apr 2006 09:40

- 98 of 213

- 24 Apr 2006 09:40

- 98 of 213

Results due next Tuesday after the bank holiday, where we should get the news that the Moly plant is on line and producing, along with updates on all the other stuff.

Then not long to wait (early June) for the pre BFS news, as pre BFS due to be complete by end of May.

PapalPower

- 24 Apr 2006 12:50

- 99 of 213

- 24 Apr 2006 12:50

- 99 of 213

Monday, 24 April 2006, 06:44 GMT 07:44 UK

Copper price nears $7,000 a tonne

Demand in China has boosted copper prices

The price of copper has risen to nearly $7,000 a tonne on the back of strong demand and worries over supply. Copper was up $110 on Friday's close to $6,940 a tonne in early Monday trade.

The rise in metal prices, including copper which is used in construction and electronics, has been prompted by growing demand from developing nations.

Copper prices also rose following concerns that supplies could be disrupted by strike action in mines in Mexico and Chile.

Strong demand from China, combined with a lack of investment in new mining projects, has caused surge in commodity prices.

The rise in copper follows peaks in recent weeks in silver, gold and other metals.

"The evidence is the underlying trend is very strong" said Peter Richardson, chief metals economist at Deutsche Bank. "All metals are becoming precious," he added.

The price of copper has risen by 57% this year and has increased nearly five-fold from when it was under $1,400 a tonne in November 2001.

The rise in commodities has prompted investment banks to launch many new funds that specialise exclusively in metals and oil.

Shanghai copper futures hit a record high, with May contracts hitting $7,794 a tonne.

PapalPower

- 25 Apr 2006 11:18

- 100 of 213

- 25 Apr 2006 11:18

- 100 of 213

PapalPower

- 26 Apr 2006 01:31

- 101 of 213

- 26 Apr 2006 01:31

- 101 of 213

unionhall - 25 Apr'06 - 16:49 - 396 of 399

By Nick Trevethan

LONDON (Reuters) - Copper extended its record-breaking rally on Tuesday, supported by threats to supply and strong demand, and the trend may extend into the long term, analysts said.

"I think we are still in the early stages of the bull trend in copper. We have years of strong prices ahead of us," Barclays Capital analyst Ingrid Sternby said.

"In this uncharted territory, I would look for round numbers. With inventories where they are, prices can spiral higher very quickly. The fundamentals are very compelling."

Three-month copper futures on the London Metal Exchange (LME) hit a record $7,045 a tonne on Tuesday, climbing more than three percent from Monday.

Stocks of the key industrial metal in LME-bonded warehouses were 117,450 tonnes on Tuesday, equivalent to about 2-1/2 days of global consumption. Inventories have fallen from almost 1 million tonnes in April 2002.

"Copper is going to continue up. Supporting that is the latest Ifo business survey and comments from Caterpillar who see many years of strong growth ahead," Sternby said.

Germany's Ifo April business sentiment index unexpectedly rose to a fresh 15-year high of 105.9 from 105.4 in March.

Caterpillar Inc.'s chief financial officer said on Monday he believed the machinery maker had several more years of strong growth ahead.

"This cycle has legs," he said. "We don't think people understand how strong things are...Virtually everywhere on the planet, things look good."

DEMAND STRONG

Net imports of the copper by China, which consumes a fifth of the world's production, rose to 39,760 tonnes in March from a net 32,825 tonnes in February despite increased exports attributed to the State Reserve Bureau.

As a result copper prices would remain high.

The Chilean Copper Commission on Monday raised its forecast for the average 2006 copper price to a range of $2.60-$2.64/lb from its previous forecast of $1.72-$1.76/lb.

Sentiment was also supported by industrial unrest in Mexico, Chile and Canada.

"Copper will continue to go higher. We could see $200-300 on the downside, but the trend is up and I can't see where any real weakness will come from," an LME trader said

PapalPower

- 26 Apr 2006 08:10

- 102 of 213

- 26 Apr 2006 08:10

- 102 of 213

By Jack Lifton

25 Apr 2006 at 05:08 PM EDT

.................................Molybdenum

Since I last wrote about molybdenum there has been some significant movement in the American domestic market to re-open past producers and to develop new mines, because the global market is in a basic undersupply condition.

I said in my earlier article that considering all of the factors involved, the price of molybdenum would not go higher and would probably drop, as additional concentrates get refined in reopened capacity in the near term. I did not take into account the substantial increase in the demand for oil, Chinese resource shortages and the real possibility of U.S. dollar devaluation.

Phelps Dodge [NYSE:PD] has taken these factors into account and has just (April 6, 2006) announced the reopening of the old Climax Molybdenum Mine in the Leadville, Colorado, area. This is a dramatic vote by Phelps Dodge in the future value of molybdenum, because Colorado is one of the three most difficult places in the world to get an environmental permit to remove anything from the ground or process it above ground.

Phelps Dodge has committed up to $250 million to bring the Climax mine back into production beginning in late 2009 or early 2010. The mine when back to full operation is projected to produce 30 million pounds of Mo per year at an estimated cost of $4.00 (2006 U.S. dollars per pound). PD estimates that the value of this output will be, in constant 2006 dollars, $750 million per year. They are clearly putting their money where their mouths are.

The gold price rush now occurring is another factor increasing the supply of molybdenum in the U.S. Past producing gold mines are being brought into operation, as fast as environmental permitting will allow throughout the U.S. west.

Many of them produced molybdenum as a by-product that was ignored when, as recently as six years ago it was worth only $3.50 per pound. Last June, 2005, molybdenum touched $50 per pound; it has since settled at about half of that, but I think that we will not see any further decreases as long as the economies of Asia and India are growing.

Note also that Phelps Dodge has historically been a receptive toll producer for other companies, so some other gold miners with molybdenum by-products will not have to construct their own smelters. This will make permitting much easier for them.

Conclusion

Finally, since major mining companies today use juniors as their prospecting arms, keep your eyes open for reports of tungsten, molybdenum, vanadium and chromium, along with gold and platinum group metals reported and hyped by the juniors.

And if you must follow a trend let it be the trend to invest in natural resources outside of the United States other than gold and platinum. Maybe, just maybe, commodity and minor metals will be the new global currency.

PapalPower

- 26 Apr 2006 10:39

- 103 of 213

- 26 Apr 2006 10:39

- 103 of 213

Therefore, with added potential for mid May IC coverage, then June pre BFS news, plus June IC update, then December final BFS complete for Chelyabinsk, you see a lovely stream of events coming this year !! :)

PapalPower

- 26 Apr 2006 11:08

- 104 of 213

- 26 Apr 2006 11:08

- 104 of 213

PapalPower

- 26 Apr 2006 15:18

- 105 of 213

- 26 Apr 2006 15:18

- 105 of 213

PapalPower

- 27 Apr 2006 08:13

- 106 of 213

- 27 Apr 2006 08:13

- 106 of 213

PapalPower

- 27 Apr 2006 09:06

- 107 of 213

- 27 Apr 2006 09:06

- 107 of 213

PapalPower

- 28 Apr 2006 00:55

- 108 of 213

- 28 Apr 2006 00:55

- 108 of 213

PapalPower

- 01 May 2006 05:15

- 109 of 213

- 01 May 2006 05:15

- 109 of 213

Tuesday 2 May

UK RESULTS: : (final) Epic Reconstruction, Eureka Mining; (interim) Aberdeen Asset Management, CSR, Formation

Wednesday 3 May

UK RESULTS: (F) Babcock International, Matalan; (I) easyJet, Tomkins, BG Group, British Sky Broadcasting, British American Tobacco, Numis, Surfcontrol

Thursday 4 May

UK RESULTS: (F) Blacks Leisure, iTrain; (I) Imperial Chemical Industries, Lonmin, Royal Dutch Shell, Sanderson

Friday 5 May

UK RESULTS: (F) Body Shop International, NWD

PapalPower

- 02 May 2006 04:01

- 110 of 213

- 02 May 2006 04:01

- 110 of 213

Moly production on line, and Chelyabinsk 100% owned, where does that put us with the target prices...

http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

PapalPower

- 02 May 2006 11:44

- 111 of 213

- 02 May 2006 11:44

- 111 of 213

350K X trade today, looks like its time for VDM to wake up ahead of the summer start of mining :) Maybe................