| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

Argos Resources (ARG)

markymar

- 27 Jul 2010 12:41

- 27 Jul 2010 12:41

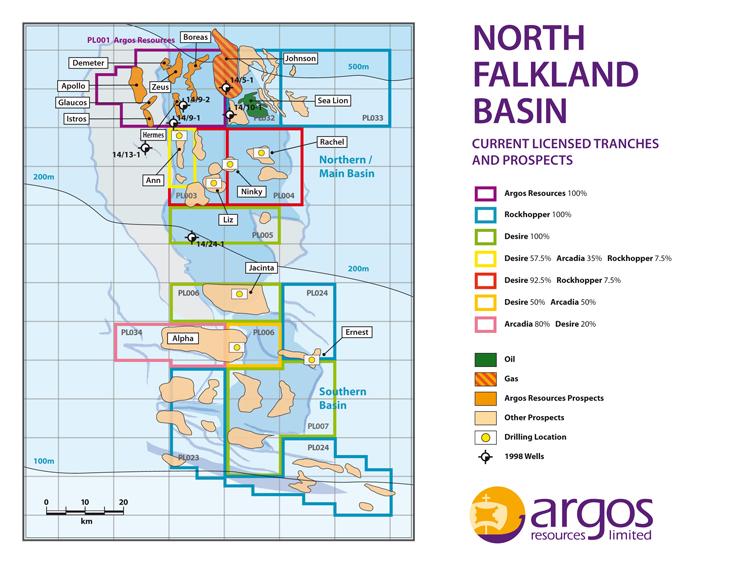

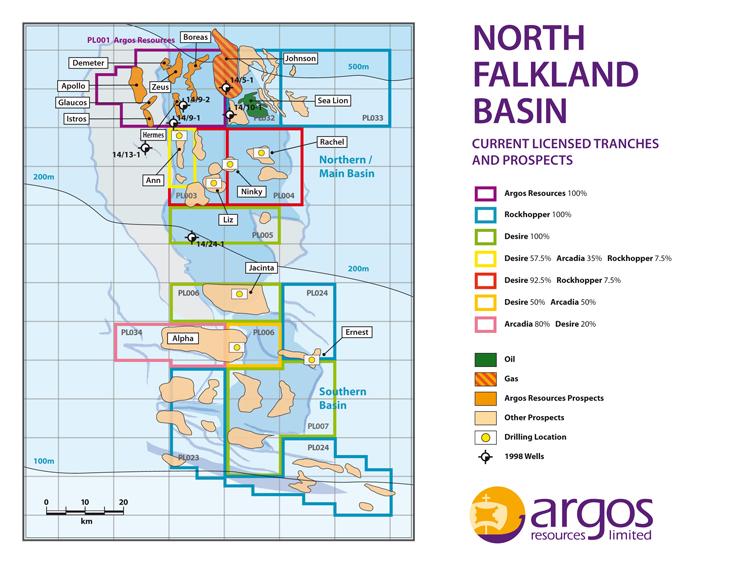

Argos Resources Ltd is an AIM quoted oil and gas exploration company based in the Falkland Islands, ideally placed to make the most of an exciting new oil province heading towards production.

Argos holds a 100% interest in Licence PL001, which covers approximately 1,126 square kilometres in the North Falkland Basin. The licence boundary is just 3km from the Sea Lion oil field, a significant discovery on course for production start-up in 2017.

New 3D seismic data of excellent quality was acquired over the entire licence area in 2011 and has identified 52 prospects with a best estimate of 3,083 million barrels of prospective recoverable resource, and a high estimate of 10,412 million barrels. 40 additional leads have been identified which are not included in the above resource figures and which are the subject of ongoing work.

The Company is now seeking an exploration partner to drill a selection of key prospects to unlock the value of this exciting opportunity.

http://www.argosresources.com/

http://www.falklands-oil.com/

http://www.desireplc.co.uk/

http://www.rockhopperexploration.co.uk/

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

The Opportunity

The Opportunity

•Proven commercial petroleum system

•52 oil prospects, defined by excellent quality 3D seismic data

•CPR attributes 3.1 billion barrels of prospective recoverable resource to the prospects, with upside of 10.4 billion barrels

•40 additional leads identified and under review

•Several prospects similar to Sea Lion

•Prospects have been de-risked by the Sea Lion discovery

•Potential extension of Johnson gas discovery into licence

•Licence 100% owned by Argos Resources

•Benign operating environment

•Stable Government with a competitive tax regime

Argos holds a 100% interest in Licence PL001, which covers approximately 1,126 square kilometres in the North Falkland Basin. The licence boundary is just 3km from the Sea Lion oil field, a significant discovery on course for production start-up in 2017.

New 3D seismic data of excellent quality was acquired over the entire licence area in 2011 and has identified 52 prospects with a best estimate of 3,083 million barrels of prospective recoverable resource, and a high estimate of 10,412 million barrels. 40 additional leads have been identified which are not included in the above resource figures and which are the subject of ongoing work.

The Company is now seeking an exploration partner to drill a selection of key prospects to unlock the value of this exciting opportunity.

http://www.argosresources.com/

http://www.falklands-oil.com/

http://www.desireplc.co.uk/

http://www.rockhopperexploration.co.uk/

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

•Proven commercial petroleum system

•52 oil prospects, defined by excellent quality 3D seismic data

•CPR attributes 3.1 billion barrels of prospective recoverable resource to the prospects, with upside of 10.4 billion barrels

•40 additional leads identified and under review

•Several prospects similar to Sea Lion

•Prospects have been de-risked by the Sea Lion discovery

•Potential extension of Johnson gas discovery into licence

•Licence 100% owned by Argos Resources

•Benign operating environment

•Stable Government with a competitive tax regime

markymar

- 27 Jul 2010 12:43

- 2 of 185

- 27 Jul 2010 12:43

- 2 of 185

markymar

- 27 Jul 2010 13:08

- 3 of 185

- 27 Jul 2010 13:08

- 3 of 185

The Company intends to carry out a 3D seismic programme in 2010/2011 over a number of the prospects identified from its earlier 2D seismic programme. These prospects have a total unrisked potential of 747 million barrels of prospective recoverable resource in the most likely case, and up to 1.75 billion barrels in the upside case. On completion of the seismic interpretation, which should be completed in the second half of 2011, the Company expects to be in a position to high-grade prospects and identify drilling locations. This process will be aided by the results of the current drilling programme being undertaken by the adjoining licencees

Indicative Timetable

Q4 2010 / 2011 Acquire up to 1,000 km2 3D seismic

Q1 2011 Process and interpret 3D seismic data

Q3 2011 Report on prospect inventory

Q4 2011 High-grade drilling targets, submit environmental impact statement

Q4 2011 / 2012 Drilling campaign

The Directors believe that the encouraging results from the adjoining licences materially de-risk the likely outcome of Argos's own programme.

Indicative Timetable

Q4 2010 / 2011 Acquire up to 1,000 km2 3D seismic

Q1 2011 Process and interpret 3D seismic data

Q3 2011 Report on prospect inventory

Q4 2011 High-grade drilling targets, submit environmental impact statement

Q4 2011 / 2012 Drilling campaign

The Directors believe that the encouraging results from the adjoining licences materially de-risk the likely outcome of Argos's own programme.

sheppo - 27 Jul 2010 16:40 - 4 of 185

MARKYMAR

Have you heard anything on the listing price wednesday

what we can expect

Have you heard anything on the listing price wednesday

what we can expect

markymar

- 27 Jul 2010 17:13

- 5 of 185

- 27 Jul 2010 17:13

- 5 of 185

Sheppo all the info you need is in front of you......31p

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

sheppo - 27 Jul 2010 17:20 - 6 of 185

Thanks for that

Are you having a punt

Are you having a punt

markymar

- 27 Jul 2010 17:37

- 7 of 185

- 27 Jul 2010 17:37

- 7 of 185

Not sure!!!! Drilling 2012 is a long way off but on the other side of the coin any sucess from RKH or DES drilling and hitting oil the share price will follow as all 3 in the NFB.

markymar

- 27 Jul 2010 22:14

- 8 of 185

- 27 Jul 2010 22:14

- 8 of 185

http://proactiveinvestors.co.uk/companies/news/19346/argos-resources-to-join-aims-falkland-oil-explorers-19346.html

Argos Resources to join AIMs Falkland oil explorers

Tuesday, July 27, 2010 by Jamie Ashcroft

Argos Resources to join AIMs Falkland oil explorers

Tuesday, July 27, 2010 by Jamie Ashcroft

markymar

- 29 Jul 2010 11:21

- 9 of 185

- 29 Jul 2010 11:21

- 9 of 185

Looks like all went well and she is up a little

halifax - 05 Aug 2010 16:51 - 10 of 185

taken a small position in ARG as marky points out their concession is in the NFB next to RKH'S sealion so even if ernest turns out to be a duster they should not be badly affected.

markymar

- 06 Aug 2010 14:01

- 11 of 185

- 06 Aug 2010 14:01

- 11 of 185

http://www.moneyweek.com/investment-advice/share-tips-argos-resources-falklands-oil-exploration-03108.aspx

Is this the next billion-barrel Falklands oil stock?

Good choice Halifax the 3 stocks in the NFB should follow each other and this should be the safer one to hold i would of thought.

Hope you have a few RKH if not a defnite dive in for Sea Lion for flow test what ever happens to Ernest.

Is this the next billion-barrel Falklands oil stock?

Good choice Halifax the 3 stocks in the NFB should follow each other and this should be the safer one to hold i would of thought.

Hope you have a few RKH if not a defnite dive in for Sea Lion for flow test what ever happens to Ernest.

halifax - 06 Aug 2010 15:18 - 12 of 185

marky waiting for ernest news before going back in.

markymar

- 06 Aug 2010 16:37

- 13 of 185

- 06 Aug 2010 16:37

- 13 of 185

Good idea Hal i am holding tight with what i have and a little left to buy in after news of Ernest.

Roll on Monday as thats a possibility in my eyes of the RNS wireline crew flew on to the OG today.

Quiet with out Cynic i bet those shaven legs of his are getting a tan.

COME ON ERNIE!!!!!

Roll on Monday as thats a possibility in my eyes of the RNS wireline crew flew on to the OG today.

Quiet with out Cynic i bet those shaven legs of his are getting a tan.

COME ON ERNIE!!!!!

mitzy - 07 Aug 2010 10:40 - 14 of 185

I'm watching this one closely.

halifax - 05 Sep 2010 13:36 - 15 of 185

ARG sp should rise as any good news from RKH's sealion discovery should be a boost.

Proselenes - 05 Sep 2010 14:06 - 16 of 185

Why ?

Sea Lion is East - Argos is far West.

So far anything remotely West (Liz from DES) has seen no commercial oil.

Argos remains high risk until they drill and find something, simple as that. With RKH holding so many Eastern prospects and with RKH having found oil, regional seal etc.... then it makes the East falklands the focus point and ignore the West.

Sea Lion is East - Argos is far West.

So far anything remotely West (Liz from DES) has seen no commercial oil.

Argos remains high risk until they drill and find something, simple as that. With RKH holding so many Eastern prospects and with RKH having found oil, regional seal etc.... then it makes the East falklands the focus point and ignore the West.

halifax - 05 Sep 2010 16:32 - 17 of 185

pp so you think geography is the answer to finding oil in the FI what a simplistic view. If sealion proves to be as good as you suggest then we can expect renewed interest in neighbouring blocks, it would appear to us drilling in the FI successfully will be like drilling in the North Sea.

Proselenes - 06 Sep 2010 05:00 - 18 of 185

Perhaps, however, the most "likely" place to find more oil is around where there is already proven oil + reservoir + seal and that is the East North Falklands, which just happens to be the RKH license area :)

Nobody will assign much value to the far west until oil is found, now when is the drilling ? In the case of Argos they only raised enough for sesimic work, they do not have funds for any drilling.

Therefore, why not buy at the next big fundraising where they will have to get money to do drilling, and perhaps it might be at a lot lower price than today as they have, as yet, no oil finds to support the price, only a license and soon, seismic BUT what has Toroa and Ernest taught everyone ? and that is that seismic and CSEM can lead to dry wells............. ;)

Nobody will assign much value to the far west until oil is found, now when is the drilling ? In the case of Argos they only raised enough for sesimic work, they do not have funds for any drilling.

Therefore, why not buy at the next big fundraising where they will have to get money to do drilling, and perhaps it might be at a lot lower price than today as they have, as yet, no oil finds to support the price, only a license and soon, seismic BUT what has Toroa and Ernest taught everyone ? and that is that seismic and CSEM can lead to dry wells............. ;)

robnickson - 06 Sep 2010 17:57 - 19 of 185

They have found gas straddling the ARG and RKH border.

markymar

- 06 Sep 2010 20:33

- 20 of 185

- 06 Sep 2010 20:33

- 20 of 185

Robnickson

RKH said that the Johnson prospect was a gas find , that prospect over laps in to Argos acreage but Argos acreage is un-drilled to date it has only ever had 2D seismic carried out over it.

Proselenes - 07 Sep 2010 03:19 - 21 of 185

And nobody wants gas at this stage, its all about oil.

markymar

- 08 Sep 2010 13:05

- 22 of 185

- 08 Sep 2010 13:05

- 22 of 185

http://www.investorschronicle.co.uk/Companies/ByEvent/Risk/Analysis/article/20100908/cf021134-bb2e-11df-81fc-00144f2af8e8/Back-to-the-Falklands.jsp

Back to the Falklands

Created:8 September 2010Written by:Martin Li

When John Hogan last drilled in the Falklands in 1998, an oil price that had crashed to $12 per barrel forced LASMO, of which he was chief operating officer, and its peers to abandon any meaningful aspirations there. They drilled the cheapest wells that satisfied their lease obligations and withdrew, despite finding a thick, rich source rock (where hydrocarbons form) and oil and gas in five of the six wells drilled. That leaves unfinished business that Mr Hogan intends to complete as managing director of Argos Resources, which became the fifth Aim-traded Falklands explorer when it floated in July, raising 22m.

First movers are generally thought to hold the advantage, but this time Mr Hogan and Argos chairman Ian Thomson espouse the benefits of coming to the Falklands party late. Argos holds a 100 per cent interest in acreage in the North Falkland basin, adjacent to licences held by Rockhopper Exploration and Desire Petroleum. Rockhopper's spectacular 242m-barrel success with its Sea Lion well provides valuable geological clues to help Argos evaluate its licence area, particularly in identifying Sea Lion lookalikes. Rockhopper and Desire will drill further exploration wells to the south and west of Argos's acreage, which should further help the company target its prospects.

Oil and gas discoveries are easier to commercialise when clustered together so as to be able to share infrastructure and facilities. The Sea Lion discovery and Rockhopper's re-interpretation of a 1998 Shell well, Johnson, also as a discovery holding several trillion cubic feet of gas (even though not commercial on its own) greatly reduce the threshold for any further discoveries to be commercial.

Another key advantage of Argos's timing may be rig availability. The inability to secure a rig to travel the long distance to the South Atlantic delayed Falklands drilling by several years until Desire finally secured the Ocean Guardian rig last September. Further exploration and testing of Sea Lion could keep the rig busy in the Falklands until mid-2011, by which time Argos hopes to be nearly ready to drill.

IC VIEW:

GoodValueAs Mr Hogan points out, "oil fields are herd animals", and Rockhopper's success in an adjacent block bodes well for Argos. Its prospects would improve significantly if successful seismic studies attract a suitable partner and allow it to tag onto the end of the current drilling campaign. Good value at 31p.

Back to the Falklands

Created:8 September 2010Written by:Martin Li

When John Hogan last drilled in the Falklands in 1998, an oil price that had crashed to $12 per barrel forced LASMO, of which he was chief operating officer, and its peers to abandon any meaningful aspirations there. They drilled the cheapest wells that satisfied their lease obligations and withdrew, despite finding a thick, rich source rock (where hydrocarbons form) and oil and gas in five of the six wells drilled. That leaves unfinished business that Mr Hogan intends to complete as managing director of Argos Resources, which became the fifth Aim-traded Falklands explorer when it floated in July, raising 22m.

First movers are generally thought to hold the advantage, but this time Mr Hogan and Argos chairman Ian Thomson espouse the benefits of coming to the Falklands party late. Argos holds a 100 per cent interest in acreage in the North Falkland basin, adjacent to licences held by Rockhopper Exploration and Desire Petroleum. Rockhopper's spectacular 242m-barrel success with its Sea Lion well provides valuable geological clues to help Argos evaluate its licence area, particularly in identifying Sea Lion lookalikes. Rockhopper and Desire will drill further exploration wells to the south and west of Argos's acreage, which should further help the company target its prospects.

Oil and gas discoveries are easier to commercialise when clustered together so as to be able to share infrastructure and facilities. The Sea Lion discovery and Rockhopper's re-interpretation of a 1998 Shell well, Johnson, also as a discovery holding several trillion cubic feet of gas (even though not commercial on its own) greatly reduce the threshold for any further discoveries to be commercial.

Another key advantage of Argos's timing may be rig availability. The inability to secure a rig to travel the long distance to the South Atlantic delayed Falklands drilling by several years until Desire finally secured the Ocean Guardian rig last September. Further exploration and testing of Sea Lion could keep the rig busy in the Falklands until mid-2011, by which time Argos hopes to be nearly ready to drill.

IC VIEW:

GoodValueAs Mr Hogan points out, "oil fields are herd animals", and Rockhopper's success in an adjacent block bodes well for Argos. Its prospects would improve significantly if successful seismic studies attract a suitable partner and allow it to tag onto the end of the current drilling campaign. Good value at 31p.

robnickson - 08 Sep 2010 17:26 - 23 of 185

"Johnson also a discovery holding several trillion cubic feet of gas greatly reduce the threshold for any further discoveries to be commercial".

Balerboy

- 08 Sep 2010 20:31

- 24 of 185

- 08 Sep 2010 20:31

- 24 of 185

Steady Rob tant amount to treason that comment......With Liz only a quarter the distance from sea lion and coming up dry, compaired to ernest imo argos is 100-1 against any oil show.

markymar

- 08 Sep 2010 23:34

- 25 of 185

- 08 Sep 2010 23:34

- 25 of 185

With every prospect identified there is a risk of hitting oil or not, forget what some reporter has wrote. Use you own judgement and read up.

Thats why seismic is done 2D then 3D Argos have some canny prospects on 2D and after 3D it will slash them odds eg RKH if you read up

100 to 1 balerboy I would bet you a pile of money at them odds.

Not much down side on this stock as in NFB and oil has been found..Fact

The more success with DES or RKH the more the price will riseFact

Thats why seismic is done 2D then 3D Argos have some canny prospects on 2D and after 3D it will slash them odds eg RKH if you read up

100 to 1 balerboy I would bet you a pile of money at them odds.

Not much down side on this stock as in NFB and oil has been found..Fact

The more success with DES or RKH the more the price will riseFact

Balerboy

- 09 Sep 2010 08:06

- 26 of 185

- 09 Sep 2010 08:06

- 26 of 185

DES has yet to strike..

markymar

- 09 Sep 2010 08:15

- 27 of 185

- 09 Sep 2010 08:15

- 27 of 185

Des have only drilled one hole...............early days.....Desire found Gas in Liz.

That rig is not leaving the NFB in a hurry.....Fact!!!!!

That rig is not leaving the NFB in a hurry.....Fact!!!!!

Balerboy

- 09 Sep 2010 08:37

- 28 of 185

- 09 Sep 2010 08:37

- 28 of 185

chill marky...only putting another point of view... i want to make money as much as everyone else here.:))

robnickson - 09 Sep 2010 17:53 - 29 of 185

2 wells were drilled by Shell on the Argos acreage back in 1998, but where plugged and abandoned as uncommercial after having oil shows . So we know there is oil to be found.

cynic

- 09 Sep 2010 17:59

- 30 of 185

- 09 Sep 2010 17:59

- 30 of 185

only offered by 4 x MMs and in blocks of only 10,000

interestingly, sp is still below opening price when it came to market

interestingly, sp is still below opening price when it came to market

robnickson - 09 Sep 2010 18:04 - 31 of 185

"Shell abandoned some small finds near the Sea Lion discovery " Would be nice to know how much they found ".

robnickson - 09 Sep 2010 18:06 - 32 of 185

I bought just a top up of 3000 shares the other day no problem ( Natwest )

cynic

- 09 Sep 2010 18:08

- 33 of 185

- 09 Sep 2010 18:08

- 33 of 185

my post is accurate! .... natwest would have had to buy from MMs, so sp potentially distorted and controlled

halifax - 09 Sep 2010 19:10 - 34 of 185

no problem getting a CFD.

cynic

- 09 Sep 2010 19:41

- 35 of 185

- 09 Sep 2010 19:41

- 35 of 185

i know that, but those are still governed by 4 x MMs in tranches of +/-3,000 .... merely a caveat

Balerboy

- 10 Sep 2010 14:13

- 36 of 185

- 10 Sep 2010 14:13

- 36 of 185

From tips thread:

The Guardian

Argos barometer indicates possibility of a cold Christmas.

The Guardian

Argos barometer indicates possibility of a cold Christmas.

halifax - 10 Sep 2010 16:13 - 37 of 185

bb which Argos?

required field - 10 Sep 2010 16:16 - 38 of 185

Could not find them in the catalogue anywhere...!?...strange.....loads of kettles...electrical goods...pick up or delivery .....bizarre.....but no oil....

halifax - 10 Sep 2010 16:17 - 39 of 185

rf maybe bb is looking to become a toy boy!

required field - 10 Sep 2010 16:19 - 40 of 185

I have always wanted to become one with some beauty.......you just hang around...great job with loads of perks....

required field - 10 Sep 2010 16:21 - 42 of 185

I've learnt not to click on things...what is that link ?, skinny ?...

skinny

- 10 Sep 2010 16:22

- 43 of 185

- 10 Sep 2010 16:22

- 43 of 185

To the article in the grauniad

required field - 10 Sep 2010 16:35 - 44 of 185

pardon ?.......which newspaper....the Guardian.....?...

skinny

- 10 Sep 2010 16:48

- 45 of 185

- 10 Sep 2010 16:48

- 45 of 185

Yes :-) just hover over the link and the address will show at the bottom of your screen.

Balerboy

- 10 Sep 2010 18:34

- 46 of 185

- 10 Sep 2010 18:34

- 46 of 185

ROFLOL.....got so much oil in my head thought they meant this lot......gave you something to laugh at.....silly b*gger.,.

robnickson - 11 Sep 2010 13:01 - 47 of 185

Taken from ii . 14/9-1 Amerada 2590. 14/9-2 Amerada 2345 oil stains, in current Argos are, subsequent seismics show wells poorly positioned to hit reservoir target.

cynic

- 11 Sep 2010 13:16

- 48 of 185

- 11 Sep 2010 13:16

- 48 of 185

if i have read the RKH file correctly, the next wells/fields to be spudded (in 2011) are Jason, Fox and Stephens ..... it is worth noting that these are (just) to the EAST of the proven Sea Lion field and NOT to the north or to the west towards the Argos prospects .... to me, that indicates that RKH do not believe their holdings to N+W of Sea Lion are (particularly) strong contenders for riches

Proselenes - 11 Sep 2010 13:43 - 49 of 185

East of Sea Lion that would be cynic....... not Ernest.

cynic

- 11 Sep 2010 14:18

- 50 of 185

- 11 Sep 2010 14:18

- 50 of 185

quite right .... sorry chaps .... now corrected above

ravey davy gravy

- 15 Sep 2010 15:20

- 51 of 185

- 15 Sep 2010 15:20

- 51 of 185

Online bid price is massive compared with the monitor bid.

They are showing 33-33.75p spread but bidding 33.61p online so there has

to be a large buy order.

Think i will take a small position at 33.75p..(edit bought 10k)

They are showing 33-33.75p spread but bidding 33.61p online so there has

to be a large buy order.

Think i will take a small position at 33.75p..(edit bought 10k)

champagne ronny - 15 Sep 2010 15:27 - 52 of 185

hey ravy what's happened with that GBO you were pumping last week lad? You moved onto this sack now then?

Balerboy

- 15 Sep 2010 15:50

- 53 of 185

- 15 Sep 2010 15:50

- 53 of 185

I'll believe that when i see it.,.

ravey davy gravy

- 15 Sep 2010 17:27

- 54 of 185

- 15 Sep 2010 17:27

- 54 of 185

Fisrt warning CR.

I left advfn to get away from parasites like you so if you continue then you

know what will happen.

Quite funny how you first few posts were all denial but now you are showing

your true colours.

ps...i hold all sorts of stocks, i still hold Spmg and Dcd and Cltv but rarely post on those threads, i still hold 50% of my Gbo, it's looking solid to me

with buys to match the sellers.

I left advfn to get away from parasites like you so if you continue then you

know what will happen.

Quite funny how you first few posts were all denial but now you are showing

your true colours.

ps...i hold all sorts of stocks, i still hold Spmg and Dcd and Cltv but rarely post on those threads, i still hold 50% of my Gbo, it's looking solid to me

with buys to match the sellers.

robnickson - 15 Sep 2010 17:52 - 55 of 185

EVO target price for Argos Res 52p.

required field - 16 Sep 2010 08:47 - 56 of 185

When compared to the likes of Desire Petroleum or even FOGL and BOR : it looks undervalued as these three have not exactly set the world alight with drilling results (BOR has yet to spud a well).....in the long term, after drilling its first well not so sure but for the moment the market cap is lot,....lot less than the others....and should react like the others to excellent Rockhopper flow tests.

ravey davy gravy

- 16 Sep 2010 10:39

- 57 of 185

- 16 Sep 2010 10:39

- 57 of 185

Took a quick profit at 36p bid for 2p gain after charges.

Have to keep an eye on it though, they go nuts for these stocks when

they do find oil.

Have to keep an eye on it though, they go nuts for these stocks when

they do find oil.

cynic

- 16 Sep 2010 11:56

- 58 of 185

- 16 Sep 2010 11:56

- 58 of 185

try IF!

HARRYCAT

- 17 Sep 2010 15:38

- 59 of 185

- 17 Sep 2010 15:38

- 59 of 185

This one up 6% also!!! (Marky, any chance of a chart in the header please?)

required field - 17 Sep 2010 15:48 - 60 of 185

I have some of these...for the potential and low market cap compared to DES...

ravey davy gravy

- 17 Sep 2010 15:52

- 61 of 185

- 17 Sep 2010 15:52

- 61 of 185

They would be up more if Novum let it go.

Strange but everytime a stock hits a price where Novum are offering

it takes a huge amount of buying to shift them.

They are the mm alone on 38p offer not budging on mostly buys.

Strange but everytime a stock hits a price where Novum are offering

it takes a huge amount of buying to shift them.

They are the mm alone on 38p offer not budging on mostly buys.

required field - 17 Sep 2010 16:25 - 62 of 185

This will play catch up because of a tiddler sp .....next week....starting now...

required field - 18 Sep 2010 08:34 - 63 of 185

I reckon that next week will see the sp here climb....just on possible potential (if that's what you can call it)....

cynic

- 18 Sep 2010 08:53

- 64 of 185

- 18 Sep 2010 08:53

- 64 of 185

their licences are a long way away from the only proven oilfield of Sealion and if the shares are marketed by just a single MM, the chances of being treated fairly at all times are pretty slim

ravey davy gravy

- 18 Sep 2010 11:01

- 65 of 185

- 18 Sep 2010 11:01

- 65 of 185

:-))

There's a lot of market makers in this stock cynic and it's extremely liquid, i was

making reference to the mm Novum who have a habit of sitting on the offer in a

lot of stocks with endless amounts of stock to sell, as it happens they did move

up a short while after my post, why sell for 38p when you can sell for higher when

the herd chase on momentum, refreshing this one is not a sets stock, thats why

i trade it, i hardly touch sets thesedays.

There's a lot of market makers in this stock cynic and it's extremely liquid, i was

making reference to the mm Novum who have a habit of sitting on the offer in a

lot of stocks with endless amounts of stock to sell, as it happens they did move

up a short while after my post, why sell for 38p when you can sell for higher when

the herd chase on momentum, refreshing this one is not a sets stock, thats why

i trade it, i hardly touch sets thesedays.

cynic

- 18 Sep 2010 11:09

- 66 of 185

- 18 Sep 2010 11:09

- 66 of 185

ah; thanks ..... it's on my watch list, but can't currently get very excited about its prospects, and i am always wary of MM only stocks as it's impossible to see any underlying orders

ravey davy gravy

- 18 Sep 2010 11:25

- 67 of 185

- 18 Sep 2010 11:25

- 67 of 185

I actually prefer mm only stocks, L2 is all false and always will be but if you

check online limits regularly you will know the real positions of the mm's, sxx

was a good example, lots of shakes all bar one mm was very short of stock.

check online limits regularly you will know the real positions of the mm's, sxx

was a good example, lots of shakes all bar one mm was very short of stock.

Proselenes - 18 Sep 2010 11:43 - 68 of 185

cynic, also they only have enough cash to do the seismic survey.

They have to come back to the market in the future to raise the big money needed to do any drilling.

Which is why I am waiting. Its only risen in the past days as Evolution and RHPS are doing a marketing job on it presently it seems to drum up buyers.

They have to come back to the market in the future to raise the big money needed to do any drilling.

Which is why I am waiting. Its only risen in the past days as Evolution and RHPS are doing a marketing job on it presently it seems to drum up buyers.

required field - 18 Sep 2010 17:26 - 69 of 185

The sp should rise on potential....why should DES rise so much with diddly squat.....and not a little bit : Argos......

cynic

- 19 Sep 2010 06:54

- 70 of 185

- 19 Sep 2010 06:54

- 70 of 185

DES is indeed rising on very little EXCEPT its fields relative proximity to the proven Sealion, and of course that it has the rig booked for the next pop at finding something

robnickson - 21 Sep 2010 17:36 - 71 of 185

ARG, doing very well on the back of RKH results, plus alot of ramping on ii. Even if ARG has no oil we can get out now for a profit that would take years to earn in a high yield bank account.

mitzy - 23 Sep 2010 08:55 - 72 of 185

What a remarkable share.

required field - 23 Sep 2010 08:57 - 73 of 185

With the others all quite high,.... this had play "catch-up"....

mitzy - 23 Sep 2010 09:05 - 74 of 185

I agree rf.. up 25% today.

cynic

- 23 Sep 2010 09:10

- 75 of 185

- 23 Sep 2010 09:10

- 75 of 185

my fear is that this whole FI scenario is becoming ridiculously frothy with the lemmings piling into everything ..... it should not be forgotten that RKH is the only one to have actually found oil so far, and though that looks to be pretty significant, even that is a good time off being extracted

required field - 23 Sep 2010 09:31 - 76 of 185

Then shorting might be the order of the day soon...bought and sold this one twice now....just taken profits at the earliest top......could go higher but not sure...by the way : everytime I see FI...the first thing I think is formula one....

markymar

- 23 Sep 2010 09:32

- 77 of 185

- 23 Sep 2010 09:32

- 77 of 185

Totaly agree with you Cynic......

cynic

- 23 Sep 2010 13:41

- 78 of 185

- 23 Sep 2010 13:41

- 78 of 185

ARG - must assuredly be too far too fast and ripe for shorting .... they're not even drilling for another 2 years!

required field - 23 Sep 2010 14:07 - 79 of 185

Check out DES...starting to drop and no short from me...

HARRYCAT

- 23 Sep 2010 14:12

- 80 of 185

- 23 Sep 2010 14:12

- 80 of 185

Barring a few exceptions, the whole market is taking a bit of a hit today, so may not be FI related. Of course, frothy stocks take a bigger hit.

cynic

- 23 Sep 2010 14:16

- 81 of 185

- 23 Sep 2010 14:16

- 81 of 185

i have shorted both ARG and FOGL, but continue to hold RKH and DES though on a much reduced level from what i had a couple of days back

markymar

- 24 Sep 2010 11:16

- 82 of 185

- 24 Sep 2010 11:16

- 82 of 185

This will come down with a bang, i have sold all my holding, it hasent even done 3D its a crazy price its not worth 132 million just on 2D.

cynic

- 24 Sep 2010 12:14

- 83 of 185

- 24 Sep 2010 12:14

- 83 of 185

just shorted some more at 60.5 ..... that's now quite sufficient, so fingers crossed that common sense takes over, which it has patently NOT done with FOGL!

halifax - 24 Sep 2010 16:27 - 84 of 185

cynic moving against you.

cynic

- 24 Sep 2010 16:37

- 85 of 185

- 24 Sep 2010 16:37

- 85 of 185

happy enough to stay put ..... indian ropes have a habit of collapsing, and even if i'm wrong this time, i can think of plenty of others where i have had a complete disaster .... shorting ARG will not be one of those

cynic

- 28 Sep 2010 15:24

- 86 of 185

- 28 Sep 2010 15:24

- 86 of 185

closed my short here with sufficient profit to pay for one dinner at the Waterside + taxi home! ...... had a staggeringly good meal there on saturday for Beloved's b'day ...... bill was truly eye-watering, but nevertheless passed the acid test of us wanting to return

HARRYCAT

- 19 Oct 2010 09:31

- 87 of 185

- 19 Oct 2010 09:31

- 87 of 185

Completely forgot about this one! There was money to be made on the bounce here, but sp now recovered.

markymar

- 19 Oct 2010 09:45

- 88 of 185

- 19 Oct 2010 09:45

- 88 of 185

What I was thinking here was that the OG will still be in the Falklands when they want to use it but will they get a borrow it is the question.

If Desire hits oil then I would think another rig will have to come to the Falklands one for RKH and one for Desire so they can both carry on drilling.

If Desire hits oil then I would think another rig will have to come to the Falklands one for RKH and one for Desire so they can both carry on drilling.

markymar

- 21 Oct 2010 11:49

- 89 of 185

- 21 Oct 2010 11:49

- 89 of 185

Good to see theym are sharing and keeping cost down.

Argos and Rockhopper sign up Polarcus to carry out Falklands survey

Falkland Islands oil explorer Argos Resources (LON:ARG) has signed a contract for marine seismic acquisition services with Polarcus.

It will carry out a substantial 3D seismic survey covering all of the Argos acreage in licence PL001, as well as adjacent areas.

The seismic vessel MV Polarcus Asima will be available by early January next year and it is estimated the survey will take 50 days.

Proactiveinvestors recommends

Petroceltic International raising 81m for appraisal work in Algeria and ItalyJupiter Energy strikes oil in primary target of J-50 wellGulfsands Petroleum - making big strides towards strategic goals Rockhopper Exploration (LON:RKH), which owns the Sea Lion field adjacent to the Argos acreage in the North Falkland Basin, has signed an identical contract with Polarcus, allowing Argos and Rockhopper to share the vessel and costs.

A separate contract to process the acquired data will will be put out to tender shortly.

However, Monarch Geophysical Services has been retained to provide specialist acquisition and processing supervision throughout the 3D seismic project.

Argos chairman Ian Thomson said: At the time of our listing in July we stated that it was our aim to secure a seismic vessel to commence shooting in the austral summer of late 2010/early 2011, allowing the possibility to commence exploration drilling as early as the fourth quarter of 2011.

Signing this contract secures the front end of this timetable. The MV Polarcus Asima is a state-of-the-art vessel which should ensure an efficient seismic acquisition programme.

We are also delighted to have been able to sign this contract in a co-operative arrangement with Rockhopper.

This allows both companies to share mobilisation and demobilisation costs and to capture the technical and cost efficiencies resulting from a larger programme.

As a result of these savings, I am pleased to note that Argos should be able to acquire more 3D coverage, over the whole of PL001 and adjacent areas, than originally envisaged at the time of listing.

Argos and Rockhopper sign up Polarcus to carry out Falklands survey

Falkland Islands oil explorer Argos Resources (LON:ARG) has signed a contract for marine seismic acquisition services with Polarcus.

It will carry out a substantial 3D seismic survey covering all of the Argos acreage in licence PL001, as well as adjacent areas.

The seismic vessel MV Polarcus Asima will be available by early January next year and it is estimated the survey will take 50 days.

Proactiveinvestors recommends

Petroceltic International raising 81m for appraisal work in Algeria and ItalyJupiter Energy strikes oil in primary target of J-50 wellGulfsands Petroleum - making big strides towards strategic goals Rockhopper Exploration (LON:RKH), which owns the Sea Lion field adjacent to the Argos acreage in the North Falkland Basin, has signed an identical contract with Polarcus, allowing Argos and Rockhopper to share the vessel and costs.

A separate contract to process the acquired data will will be put out to tender shortly.

However, Monarch Geophysical Services has been retained to provide specialist acquisition and processing supervision throughout the 3D seismic project.

Argos chairman Ian Thomson said: At the time of our listing in July we stated that it was our aim to secure a seismic vessel to commence shooting in the austral summer of late 2010/early 2011, allowing the possibility to commence exploration drilling as early as the fourth quarter of 2011.

Signing this contract secures the front end of this timetable. The MV Polarcus Asima is a state-of-the-art vessel which should ensure an efficient seismic acquisition programme.

We are also delighted to have been able to sign this contract in a co-operative arrangement with Rockhopper.

This allows both companies to share mobilisation and demobilisation costs and to capture the technical and cost efficiencies resulting from a larger programme.

As a result of these savings, I am pleased to note that Argos should be able to acquire more 3D coverage, over the whole of PL001 and adjacent areas, than originally envisaged at the time of listing.

markymar

- 21 Oct 2010 14:50

- 90 of 185

- 21 Oct 2010 14:50

- 90 of 185

http://www.diamondoffshore.com/ourFleet/rigStatus.php

October update

Ocean Guardian 1,500' Falkland Is.

Current Contract AGR/Desire/ Rockhopper Eight firm wells plus two remaining optional wells mid 240's mid Feb. 2010 late Jan. 2011

October update

Ocean Guardian 1,500' Falkland Is.

Current Contract AGR/Desire/ Rockhopper Eight firm wells plus two remaining optional wells mid 240's mid Feb. 2010 late Jan. 2011

markymar

- 10 Nov 2010 16:06

- 91 of 185

- 10 Nov 2010 16:06

- 91 of 185

WTE holding Argos Resources Plc - 1,200,000

markymar

- 04 Jan 2011 14:14

- 92 of 185

- 04 Jan 2011 14:14

- 92 of 185

Argos Resources Limited, oil and gas exploration company, has announced that the MV Polarcus Asima seismic vessel is in transit to the Falkland Islands and is expected to arrive within the company's license area to commence 3D seismic acquisition in the first half of January 2011.

The Company plans to acquire 3D seismic data over the entire area of License PL001, and also intends to acquire additional 3D data in open acreage to the north of the license.

The seismic vessel has been contracted in a co-operative arrangement with Rockhopper Exploration plc, who are also participating with Argos in the 3D acquisition in the open acreage.

Commenting on this progress, Ian Thomson, Chairman of Argos, said: "Argos is on schedule to acquire 3D seismic over our license area in the austral summer weather window, allowing us the possibility to commence exploration drilling as early as the fourth quarter of 2011."

The Company plans to acquire 3D seismic data over the entire area of License PL001, and also intends to acquire additional 3D data in open acreage to the north of the license.

The seismic vessel has been contracted in a co-operative arrangement with Rockhopper Exploration plc, who are also participating with Argos in the 3D acquisition in the open acreage.

Commenting on this progress, Ian Thomson, Chairman of Argos, said: "Argos is on schedule to acquire 3D seismic over our license area in the austral summer weather window, allowing us the possibility to commence exploration drilling as early as the fourth quarter of 2011."

HARRYCAT

- 04 Jan 2011 14:18

- 93 of 185

- 04 Jan 2011 14:18

- 93 of 185

Time to start stockpiling ARG shares then?

markymar

- 04 Jan 2011 14:59

- 94 of 185

- 04 Jan 2011 14:59

- 94 of 185

I have a few at moment Harry and hope to continue topping up before result are know on the 3Dthere is lots of work to be done here but the prospects so far look quiet exciting especially with them so near to Sea Lion where RKH hit.

http://offshore.no/international/article/Falklands_seismic_to_start_

Argos has previously indicated, based on 2D seismic data, that its licence area contains seven prospects and five leads with a total unrisked potential of up to 747 million barrels of prospective recoverable resource, and up to 1.75 billion barrels in an upside case

http://offshore.no/international/article/Falklands_seismic_to_start_

Argos has previously indicated, based on 2D seismic data, that its licence area contains seven prospects and five leads with a total unrisked potential of up to 747 million barrels of prospective recoverable resource, and up to 1.75 billion barrels in an upside case

Captguns

- 17 Jan 2011 11:47

- 95 of 185

- 17 Jan 2011 11:47

- 95 of 185

Slide 11 and zoom in 3D seismic pre plot

http://www.polarcus.com/assets/0000/1209/Polarcus_Company_Presentation_SEB_12_Jan.pdf

http://www.polarcus.com/assets/0000/1209/Polarcus_Company_Presentation_SEB_12_Jan.pdf

markymar

- 17 Jan 2011 12:23

- 96 of 185

- 17 Jan 2011 12:23

- 96 of 185

cielo - 17 Jan 2011 12:30 - 97 of 185

Getting weak as the sells are taking over v buys, closing positions mos likely after the rise and MMs not letting sells on size online, Max was 3K @ 45 / 45.0p

markymar

- 17 Jan 2011 14:18

- 98 of 185

- 17 Jan 2011 14:18

- 98 of 185

Overlaid the 3D map from Polarcus with the NFB prospect/license map and you can now see where the 3D is being done in relation to the targets.

markymar

- 05 Jul 2011 09:17

- 99 of 185

- 05 Jul 2011 09:17

- 99 of 185

http://www.proactiveinvestors.co.uk/companies/news/30229/argos-resources-says-fast-tracked-3d-yields-encouraging-early-results-30229.html

Argos Resources says fast-tracked 3D yields encouraging early results

Been slowly building up a stake here when its been in its low 20s

Argos Resources says fast-tracked 3D yields encouraging early results

Been slowly building up a stake here when its been in its low 20s

markymar

- 15 Jul 2011 11:26

- 100 of 185

- 15 Jul 2011 11:26

- 100 of 185

Intresting trades going through.

markymar

- 04 Aug 2011 12:00

- 101 of 185

- 04 Aug 2011 12:00

- 101 of 185

Hoping that this might fall further been buying in at 20p mark when can through out the year.

markymar

- 05 Aug 2011 10:28

- 102 of 185

- 05 Aug 2011 10:28

- 102 of 185

Topped up in here very happy at this price to hold for 6 months expect to treble by the time they drill.

hlyeo98 - 13 Aug 2011 13:33 - 103 of 185

15p would be a good buy... not now.

This could be another Desire Petroleum.

This could be another Desire Petroleum.

markymar

- 13 Aug 2011 17:11

- 104 of 185

- 13 Aug 2011 17:11

- 104 of 185

well if it hits 1.50 like Desire did i will be a rich man again.....

HARRYCAT

- 13 Aug 2011 17:23

- 105 of 185

- 13 Aug 2011 17:23

- 105 of 185

Just bank some bl**dy profit this time!!! ;o)

markymar

- 15 Sep 2011 11:09

- 106 of 185

- 15 Sep 2011 11:09

- 106 of 185

On the march 18% up!!!!! as said been buying these when ever they were near 20p looks like the gamble paying off now,lets hope they raise some money soon so they can get the 3rd slot.

Sequestor

- 20 Sep 2011 09:34

- 107 of 185

- 20 Sep 2011 09:34

- 107 of 185

good jump

markymar

- 29 Sep 2011 09:22

- 108 of 185

- 29 Sep 2011 09:22

- 108 of 185

Wednesday, September 28th 2011 - 22:18 UTC

http://en.mercopress.com/2011/09/28/falklands-argos-needs-additional-capital-for-drilling-set-to-begin-at-end-of-year

Falklands Argos needs additional capital for drilling set to begin at end of year

Falklands based Argos Resources expects to drill its first well on license PL001 in the North Falkland basin in late-2011 or early-2012, using the semi submersible rig Ocean Guardian, currently operating in the Islands waters.

PrintShareComment

Chairman Ian Thomson, 3D data quality is excellent

However, Chairman Ian Thomson admits that the company will need additional capital to finance drilling, and the board is reviewing its options.

Interpretation of recently acquired 3D data is well advanced, Thomson said. The two structural prospects, Zeus and Demeter, have been confirmed and are considered to be robust closures. Mapping of other structural prospects continues and early indications are encouraging that these, too, will be confirmed.

One of the main features of the northern part of the basin, close to PL001, he added, is the presence of a major delta system.

The 3D data quality over the delta is excellent and we are now using that data to identify new stratigraphic prospects.

Several new prospects and leads which were not evident on the old 2D data [from 1996] have already been mapped from the 3D data. We are very encouraged that additional prospectivity is being identified in our license area, said Chairman Thomson.

Argos licence area adjoins licence areas being explored by Rockhopper and Desire, who between them are involved in a multi well drilling campaign in the North Falkland Basin in 2010 and 2011.

http://en.mercopress.com/2011/09/28/falklands-argos-needs-additional-capital-for-drilling-set-to-begin-at-end-of-year

Falklands Argos needs additional capital for drilling set to begin at end of year

Falklands based Argos Resources expects to drill its first well on license PL001 in the North Falkland basin in late-2011 or early-2012, using the semi submersible rig Ocean Guardian, currently operating in the Islands waters.

PrintShareComment

Chairman Ian Thomson, 3D data quality is excellent

However, Chairman Ian Thomson admits that the company will need additional capital to finance drilling, and the board is reviewing its options.

Interpretation of recently acquired 3D data is well advanced, Thomson said. The two structural prospects, Zeus and Demeter, have been confirmed and are considered to be robust closures. Mapping of other structural prospects continues and early indications are encouraging that these, too, will be confirmed.

One of the main features of the northern part of the basin, close to PL001, he added, is the presence of a major delta system.

The 3D data quality over the delta is excellent and we are now using that data to identify new stratigraphic prospects.

Several new prospects and leads which were not evident on the old 2D data [from 1996] have already been mapped from the 3D data. We are very encouraged that additional prospectivity is being identified in our license area, said Chairman Thomson.

Argos licence area adjoins licence areas being explored by Rockhopper and Desire, who between them are involved in a multi well drilling campaign in the North Falkland Basin in 2010 and 2011.

markymar

- 12 Oct 2011 18:56

- 109 of 185

- 12 Oct 2011 18:56

- 109 of 185

AGM tom so one to watch on Friday to see if the FI buy in to the story.

markymar

- 14 Oct 2011 08:21

- 110 of 185

- 14 Oct 2011 08:21

- 110 of 185

http://moneyam.uk-wire.com/cgi-bin/articles/201110140700101581Q.html

CPR out, well worth a read still no details on funding as of yet

Highlights

New prospective resource estimate of 2,107mmbo

The six structural prospects mapped from earlier 2D seismic data confirmed

22 new stratigraphic prospects identified, creating significant new opportunities

Good quality sandstones predicted, with several prospects, including Rhea, exhibiting similar seismic anomalies to those seen at Sea Lion

Progress made towards being drill ready in late 2011 / early 2012

Various financing options to fund drilling costs are being actively considered

CPR out, well worth a read still no details on funding as of yet

Highlights

New prospective resource estimate of 2,107mmbo

The six structural prospects mapped from earlier 2D seismic data confirmed

22 new stratigraphic prospects identified, creating significant new opportunities

Good quality sandstones predicted, with several prospects, including Rhea, exhibiting similar seismic anomalies to those seen at Sea Lion

Progress made towards being drill ready in late 2011 / early 2012

Various financing options to fund drilling costs are being actively considered

markymar

- 14 Oct 2011 08:31

- 111 of 185

- 14 Oct 2011 08:31

- 111 of 185

Argos Resources eyes Falklands prospects containing 2.1 billion barrels of oil

8:02 am by Jamie Ashcroft

http://bit.ly/pOp3fT

the CPR defines a new prospective resource for the companys acreage with best estimates of 2.1 billion barrels of oil.

Falklands oil explorer Argos Resources (LON:ARG) today unveiled its hotly anticipated competent persons report following the 3D seismic programme it completed earlier this year.

The CPR confirms that the 3D seismic was very successful. It confirmed six structural prospects, which were previously mapped in 2D seismic, and identified twenty two new ones. The group said that several prospects exhibit similar seismic anomalies to those seen nearby at Rockhopper Explorations Sea Lion oil discovery.

Importantly the CPR defines a new prospective resource for the companys acreage with best estimates of 2.1 billion barrels of oil. This represents a 182 per cent increase from the past estimate of 747 barrels of oil.

The high estimate sees 7.3 billion barrels of oil on the license.

At the time of planning the 3D seismic programme Senergy (the groups consultant) estimated that some 522 million barrels of new prospects might be identified, said chairman Ian Thompson.

In fact we have identified almost three times that level of prospectivity, with additional leads still being mapped. We are therefore delighted that the seismic programme has proven to be so successful.

Following the release of the CPR Argos reiterated its desire to join the current drilling campaign in the Falklands during late 2011 or early 2012. It said that various financing options are being actively considered to fund the drilling costs.

Argos also explained that preparations for drilling are continuing apace. These preparations include gaining approval for an environmental impact statement and purchasing three wellhead assembly packages which are held in storage to avoid long lead-order item delays.

The 3D seismic programme was completed in April. It covered 1,415 square kilometres, spanning the entire licence area as well as a halo outside the licence boundaries, and tie-ins to key wells.

Argos subsequently had the entire data package fast-tracked and it was very pleased with the results.

"The 3D seismic we have obtained is the best quality data seen in the (North Falkland) basin to date, Thompson said.

This has allowed us to map with confidence numerous new stratigraphic prospects associated with the early Cretaceous delta system that is a principal feature of the licence area and which is intimately associated with proven oil source rocks of the same age.

We have also confirmed as robust the six structural prospects identified from earlier 2D seismic data.

He added: Identifying new stratigraphic prospects which were not evident on the old 2D seismic was one of the key objectives in acquiring 3D seismic data.

This objective has been more than achieved, with the results reported above of 22 new stratigraphic prospects considerably exceeding expectations.

Argos explained that its prospects fall broadly into two groups. The first group is a combination of structural and stratigraphic traps, while the other group is made up of fault bounded and four-way dip closed structural traps, with closures at several horizons providing multiple reservoir targets.

In the first group 22 new prospects have been mapped, four of which are within the previously identified Boreas prospect area. The other 18 prospects were not apparent prior to the 3D data being acquired, it said.

These prospects are expected to contain good quality sandstone reservoirs with several, including Rhea, exhibiting similar seismic anomalies to those seen at the Sea Lion oil discovery, it added.

In four areas a number of prospects are vertically stacked, meaning that there is potential to drill multiple prospects within a single well. Argos explained that in these four areas there is a stacked Best Estimate potential of 216, 118, 800 and 69 million barrels of oil respectively.

In all the best estimate net un-risked potentially recoverable prospective resource totals 1.5 billion barrels for group one.

Meanwhile the second group of prospects, the structural traps, were confirmed by the 3D seismic. In the new CPR these prospects are estimated to contain 599 million barrels of oil.

Argos said that the final processed data is due to be received around year-end, and it expects to further improvements in data quality. This will help the groups prepare seismic modelling studies.

Todays resource estimates exclude the Johnson gas discovery which, according to Argos, appears to extend into the licence from Rockhoppers adjacent acreage. It said that it plans to model potential reservoir sands within the Johnson gas discovery in the future.

8:02 am by Jamie Ashcroft

http://bit.ly/pOp3fT

the CPR defines a new prospective resource for the companys acreage with best estimates of 2.1 billion barrels of oil.

Falklands oil explorer Argos Resources (LON:ARG) today unveiled its hotly anticipated competent persons report following the 3D seismic programme it completed earlier this year.

The CPR confirms that the 3D seismic was very successful. It confirmed six structural prospects, which were previously mapped in 2D seismic, and identified twenty two new ones. The group said that several prospects exhibit similar seismic anomalies to those seen nearby at Rockhopper Explorations Sea Lion oil discovery.

Importantly the CPR defines a new prospective resource for the companys acreage with best estimates of 2.1 billion barrels of oil. This represents a 182 per cent increase from the past estimate of 747 barrels of oil.

The high estimate sees 7.3 billion barrels of oil on the license.

At the time of planning the 3D seismic programme Senergy (the groups consultant) estimated that some 522 million barrels of new prospects might be identified, said chairman Ian Thompson.

In fact we have identified almost three times that level of prospectivity, with additional leads still being mapped. We are therefore delighted that the seismic programme has proven to be so successful.

Following the release of the CPR Argos reiterated its desire to join the current drilling campaign in the Falklands during late 2011 or early 2012. It said that various financing options are being actively considered to fund the drilling costs.

Argos also explained that preparations for drilling are continuing apace. These preparations include gaining approval for an environmental impact statement and purchasing three wellhead assembly packages which are held in storage to avoid long lead-order item delays.

The 3D seismic programme was completed in April. It covered 1,415 square kilometres, spanning the entire licence area as well as a halo outside the licence boundaries, and tie-ins to key wells.

Argos subsequently had the entire data package fast-tracked and it was very pleased with the results.

"The 3D seismic we have obtained is the best quality data seen in the (North Falkland) basin to date, Thompson said.

This has allowed us to map with confidence numerous new stratigraphic prospects associated with the early Cretaceous delta system that is a principal feature of the licence area and which is intimately associated with proven oil source rocks of the same age.

We have also confirmed as robust the six structural prospects identified from earlier 2D seismic data.

He added: Identifying new stratigraphic prospects which were not evident on the old 2D seismic was one of the key objectives in acquiring 3D seismic data.

This objective has been more than achieved, with the results reported above of 22 new stratigraphic prospects considerably exceeding expectations.

Argos explained that its prospects fall broadly into two groups. The first group is a combination of structural and stratigraphic traps, while the other group is made up of fault bounded and four-way dip closed structural traps, with closures at several horizons providing multiple reservoir targets.

In the first group 22 new prospects have been mapped, four of which are within the previously identified Boreas prospect area. The other 18 prospects were not apparent prior to the 3D data being acquired, it said.

These prospects are expected to contain good quality sandstone reservoirs with several, including Rhea, exhibiting similar seismic anomalies to those seen at the Sea Lion oil discovery, it added.

In four areas a number of prospects are vertically stacked, meaning that there is potential to drill multiple prospects within a single well. Argos explained that in these four areas there is a stacked Best Estimate potential of 216, 118, 800 and 69 million barrels of oil respectively.

In all the best estimate net un-risked potentially recoverable prospective resource totals 1.5 billion barrels for group one.

Meanwhile the second group of prospects, the structural traps, were confirmed by the 3D seismic. In the new CPR these prospects are estimated to contain 599 million barrels of oil.

Argos said that the final processed data is due to be received around year-end, and it expects to further improvements in data quality. This will help the groups prepare seismic modelling studies.

Todays resource estimates exclude the Johnson gas discovery which, according to Argos, appears to extend into the licence from Rockhoppers adjacent acreage. It said that it plans to model potential reservoir sands within the Johnson gas discovery in the future.

required field - 14 Oct 2011 08:33 - 112 of 185

Got a smallish punt on this one and will wait until they spud a well....

HARRYCAT

- 14 Oct 2011 08:38

- 113 of 185

- 14 Oct 2011 08:38

- 113 of 185

Smallish???????.........what are you doing rf? If these boys hit oil then we will be rich!!!! Another fledgling RKH in the making! Just your type of high risk stock I would have thought! :o)

required field - 14 Oct 2011 08:42 - 114 of 185

Well it is....I'm in but very small % when compared to my RKH %....this is a pure gamble 100%....it might turn out like DES...and then it might not.....might increase my holding...

markymar

- 14 Oct 2011 08:42

- 115 of 185

- 14 Oct 2011 08:42

- 115 of 185

Harry a lot smaller prospects than RKH but i wonder if the oil all went North....hence Argos could be a good bet or punt

required field - 14 Oct 2011 08:51 - 116 of 185

Don't forget that RKH was 35p if I remember when they struck the sealion prospect...and was dropping all the time...so this is very risky with this 100% pure explorer...the johnson gas prospect might not be commercial.....

markymar

- 14 Oct 2011 08:57

- 117 of 185

- 14 Oct 2011 08:57

- 117 of 185

They have it down as a discovery RF,30% of it is in Argos block.......its huge and i mean huge.

RKH have some big prospect in there blocks Argos a lot smaller.

RKH have some big prospect in there blocks Argos a lot smaller.

required field - 14 Oct 2011 09:06 - 118 of 185

Well.....bought some more ARG.....now no longer a punt but a serious small investment......

HARRYCAT

- 14 Oct 2011 09:15

- 119 of 185

- 14 Oct 2011 09:15

- 119 of 185

You are familiar with the ;o) icon I trust, rf? I hope you won't hold me accountable if this should end in a duster!!!

required field - 14 Oct 2011 16:58 - 120 of 185

It will be your fault Harrycat (:))

hlyeo98 - 17 Oct 2011 11:27 - 121 of 185

This is worth 15-20p.

machoman - 17 Oct 2011 14:47 - 122 of 185

This is worth 25p ( 24.75 / 25.25p ) now after dropping to 24.25p

managed to get some at 24.75p, as MMs will not allow online at offer 24.50p

Level 2 of 4 v 1

RECA the only one at Offer since earlier, rising the price by 0.25p and yet the next MM is at 25.75p

managed to get some at 24.75p, as MMs will not allow online at offer 24.50p

Level 2 of 4 v 1

RECA the only one at Offer since earlier, rising the price by 0.25p and yet the next MM is at 25.75p

required field - 21 Oct 2011 09:58 - 123 of 185

Mistimed my buy here.....it's a 'orrible sp 'arry.....

markymar

- 21 Oct 2011 12:48

- 124 of 185

- 21 Oct 2011 12:48

- 124 of 185

Its been bouncing from 20p to 30p for ages so been buying near 20s selling near 30s so hoping for a little more drop before i buy again.

Will hold at some point just waiting for funding news then we might get an idea on how many holes they may drill.

Will hold at some point just waiting for funding news then we might get an idea on how many holes they may drill.

markymar

- 21 Oct 2011 12:49

- 125 of 185

- 21 Oct 2011 12:49

- 125 of 185

Argos Resources Hogan confident in Sea Lion lookalike prospects after pivotal report

1:00 pm by Jamie Ashcroft

http://bit.ly/plr9gL

The CPR confirms that the licence hosts prospects that are similar to Rockhoppers Sea Lion discovery

Argos Resources (LON:ARG) managing director John Hogan has declared himself "delighted" with the results of the recent independent report on its Falklands acreage which was far better than he or the team expected.

The report gave the group a major uplift in estimated resources, which rose more than 180 per cent to 2.1 billion barrels of oil, and uncovered 22 new exploration prospects. It follows a busy summer of seismic exploration for the firm.

Importantly Hogan highlights that, as expected, the CPR confirms that the licence hosts prospects that are similar to Rockhopper Explorations (LON:RKH) Sea Lion discovery, which is on the neighbouring licence.

The most notable of these prospects is Rhea, a 103 million barrel target that is likely the first to be drilled by Argos.

Speaking with Proactive Investors Hogan explained that the latest interpretation of 3D seismic and Rockhoppers continued appraisal success very much backs up the groups previous expectations of a Sea Lion lookalike on the Argos licence.

In fact following a data sharing exercise with its neighbour Hogan and his team are now more confident than ever about the potential Sea Lion lookalike.

"We've got all Rockhoppers seismic data, Hogan said.

"We have their information on Sea Lion and we can make our own assessments and make comparisons between the Sea Lion discovery and our new prospects. We can see what they are drilling, what looks like on the 3D seismic and use that on our respective prospects.

"Rhea has a lot of the characteristics that the Sea Lion field displays. But we've got other prospects that do that too, I'm pleased to say.

The Sea Lion Field was major a breakthrough not just for Rockhopper, but also all those companies operating in the South Atlantic. It has continued to prove up and expand is oil resources, and in just 18 months it has taken the discovery to the verge of the development phase.

Indeed last month Rockhopper unveiled a US$2 billion plans to produce the Falklands first oil by 2016. It is currently preparing to drill its eighth well on the Sea Lion field.

"We are pleased to see Rockhopper continuing the drilling programme on Sea Lion, which just keeps getting bigger and bigger, Hogan added.

For a much smaller company like Argos having such a successful peer working nearby has been a real bonus as it has helped capture the imagination of investors and has stoked up the excitement among AIMs speculators.

"Good results from Rockhopper draws industry and investor eyes onto what's going on in the Falklands and we all benefit from that attention.

Aside from the obvious Rockhoppers continued success has had another important benefit for Argos. Importantly it has meant that the Ocean Guardian rig has remained in the isolated waters of the South Atlantic.

Because of that Argos is now preparing for its own drilling programme which is expected to get underway towards the tail-end of this year or early next year. However before that Argos must first get the financial backing to support its ambitions.

Taking the temperature of investor sentiment on the ubiquitous internet bulletin boards and forums it seems that this funding issue is a lingering concern which has somewhat overshadowed the better-than expected CPR result.

A farm-out deal is one potential funding option being mooted, by some investors, as a potential means to bring in cash to cover the initial costs of drilling. It is also a theory seemingly reflected by Evolution Securities analyst Keith Morris.

The analyst, which sees Argos as a buy, has a 79p a share price target for the stock. And in a note to clients on Friday he said that his valuation assumes that Argos will farm out a 50 per cent stake in the licence and be carried for the costs of drilling the two lowest risk prospects, Rhea and the 118 million barrel Poseidon prospect.

While not ruling anything out, Hogan distanced the company from the plans that could potentially be construed from Evolutions assessment.

He explained: "(A farm-in) was merely the analysts chosen method of putting a valuation on the acreage that other analysts and the industry would recognise.

"It is not being led by any particular route that weve mentioned to him. It's not because we were telling the analyst that was what we're planning or anything like that.

"At the moment we are just keeping our options open.

While investors await some breaking news on the financing front, eyes will no doubt be fixed on the ongoing developments in the Falklands where things tend to move very quickly indeed.

"There has been a lot of good news from the Falklands of late from Rockhopper, Desire and ourselves, Hogan surmised. "There is a lot going on and I don't want to tempt fate by guessing what might happen next."

1:00 pm by Jamie Ashcroft

http://bit.ly/plr9gL

The CPR confirms that the licence hosts prospects that are similar to Rockhoppers Sea Lion discovery

Argos Resources (LON:ARG) managing director John Hogan has declared himself "delighted" with the results of the recent independent report on its Falklands acreage which was far better than he or the team expected.

The report gave the group a major uplift in estimated resources, which rose more than 180 per cent to 2.1 billion barrels of oil, and uncovered 22 new exploration prospects. It follows a busy summer of seismic exploration for the firm.

Importantly Hogan highlights that, as expected, the CPR confirms that the licence hosts prospects that are similar to Rockhopper Explorations (LON:RKH) Sea Lion discovery, which is on the neighbouring licence.

The most notable of these prospects is Rhea, a 103 million barrel target that is likely the first to be drilled by Argos.

Speaking with Proactive Investors Hogan explained that the latest interpretation of 3D seismic and Rockhoppers continued appraisal success very much backs up the groups previous expectations of a Sea Lion lookalike on the Argos licence.

In fact following a data sharing exercise with its neighbour Hogan and his team are now more confident than ever about the potential Sea Lion lookalike.

"We've got all Rockhoppers seismic data, Hogan said.

"We have their information on Sea Lion and we can make our own assessments and make comparisons between the Sea Lion discovery and our new prospects. We can see what they are drilling, what looks like on the 3D seismic and use that on our respective prospects.

"Rhea has a lot of the characteristics that the Sea Lion field displays. But we've got other prospects that do that too, I'm pleased to say.

The Sea Lion Field was major a breakthrough not just for Rockhopper, but also all those companies operating in the South Atlantic. It has continued to prove up and expand is oil resources, and in just 18 months it has taken the discovery to the verge of the development phase.

Indeed last month Rockhopper unveiled a US$2 billion plans to produce the Falklands first oil by 2016. It is currently preparing to drill its eighth well on the Sea Lion field.

"We are pleased to see Rockhopper continuing the drilling programme on Sea Lion, which just keeps getting bigger and bigger, Hogan added.

For a much smaller company like Argos having such a successful peer working nearby has been a real bonus as it has helped capture the imagination of investors and has stoked up the excitement among AIMs speculators.

"Good results from Rockhopper draws industry and investor eyes onto what's going on in the Falklands and we all benefit from that attention.

Aside from the obvious Rockhoppers continued success has had another important benefit for Argos. Importantly it has meant that the Ocean Guardian rig has remained in the isolated waters of the South Atlantic.

Because of that Argos is now preparing for its own drilling programme which is expected to get underway towards the tail-end of this year or early next year. However before that Argos must first get the financial backing to support its ambitions.

Taking the temperature of investor sentiment on the ubiquitous internet bulletin boards and forums it seems that this funding issue is a lingering concern which has somewhat overshadowed the better-than expected CPR result.

A farm-out deal is one potential funding option being mooted, by some investors, as a potential means to bring in cash to cover the initial costs of drilling. It is also a theory seemingly reflected by Evolution Securities analyst Keith Morris.

The analyst, which sees Argos as a buy, has a 79p a share price target for the stock. And in a note to clients on Friday he said that his valuation assumes that Argos will farm out a 50 per cent stake in the licence and be carried for the costs of drilling the two lowest risk prospects, Rhea and the 118 million barrel Poseidon prospect.

While not ruling anything out, Hogan distanced the company from the plans that could potentially be construed from Evolutions assessment.

He explained: "(A farm-in) was merely the analysts chosen method of putting a valuation on the acreage that other analysts and the industry would recognise.

"It is not being led by any particular route that weve mentioned to him. It's not because we were telling the analyst that was what we're planning or anything like that.

"At the moment we are just keeping our options open.

While investors await some breaking news on the financing front, eyes will no doubt be fixed on the ongoing developments in the Falklands where things tend to move very quickly indeed.

"There has been a lot of good news from the Falklands of late from Rockhopper, Desire and ourselves, Hogan surmised. "There is a lot going on and I don't want to tempt fate by guessing what might happen next."

HARRYCAT

- 21 Oct 2011 13:11

- 126 of 185

- 21 Oct 2011 13:11

- 126 of 185

I have a modest holding in ARG, rf, and am happy to hold whilst they drill. I prefer to invest here & hold rather than trade them, as potential is good and I have a nasty habit of missing out by not having cash available at the right time. Will try and invest more when the rig is mobilised.

required field - 23 Oct 2011 11:23 - 127 of 185

Staying put as well......will wait for the drilling to start....sp will shoot up then....

markymar

- 03 Nov 2011 08:34

- 128 of 185

- 03 Nov 2011 08:34

- 128 of 185

After reading Desire RNS today I am wondering what part if any ARG will play, Once RKH finish with the rig there will be 2 max drill slots available now I would of thought Desire would want both of them so that leaves ARG where?

Interesting times not sure how this is going to play out.

Interesting times not sure how this is going to play out.

halifax - 29 Nov 2011 11:39 - 129 of 185

RNS no drilling in the immediate future..... sp tanked.

required field - 29 Nov 2011 16:13 - 130 of 185

Ouch !.....not having much luck with my picks as of late.....in for the long term anyway....it's all 'Arry's fault....

HARRYCAT

- 29 Nov 2011 18:14

- 131 of 185

- 29 Nov 2011 18:14

- 131 of 185

Hmmmm..... could be a longer wait than I first anticipated!

markymar

- 29 Nov 2011 23:23

- 132 of 185

- 29 Nov 2011 23:23

- 132 of 185

I was lucky i sold out the other day in to Desire still holding a few ARG.....luck full stop as i had thousands of them.

Off down the pit Chav for a long shift end of week keep an eye on them clogs.

Off down the pit Chav for a long shift end of week keep an eye on them clogs.

gibby - 18 Jan 2012 08:41 - 133 of 185

indeed it has!

markymar

- 18 Jan 2012 11:20

- 134 of 185

- 18 Jan 2012 11:20

- 134 of 185

Tuesday, January 17th, 2012 | Posted by admin

FoxDavies views from the trading floor

http://refinerynews.com/foxdavies-views-from-the-trading-floor-3/

The rush of blood continued in Argos Resources today, jumping another 28% to 17.5p as investors continued to chase the Falklands plays higher. It would not be a surprise if part of this rally is attributed to short covering here, as the market was not expecting news from Argos for some time. The last RNS said ‘it won’t proceed with a drilling campaign in the North Falkland Basin which was due to end in December, citing weak capital markets and the limited availability of the drilling rig. As the rig is leaving the region in December, Chairman Ian Thomson said the company had rejected the option of drilling only one well because it remained convinced of the value of the area and the merits of a more extensive drilling program. The firm expects to complete the work in the first half of 2012 before looking for an industry partner to help fund its drilling program.’

FoxDavies views from the trading floor

http://refinerynews.com/foxdavies-views-from-the-trading-floor-3/

The rush of blood continued in Argos Resources today, jumping another 28% to 17.5p as investors continued to chase the Falklands plays higher. It would not be a surprise if part of this rally is attributed to short covering here, as the market was not expecting news from Argos for some time. The last RNS said ‘it won’t proceed with a drilling campaign in the North Falkland Basin which was due to end in December, citing weak capital markets and the limited availability of the drilling rig. As the rig is leaving the region in December, Chairman Ian Thomson said the company had rejected the option of drilling only one well because it remained convinced of the value of the area and the merits of a more extensive drilling program. The firm expects to complete the work in the first half of 2012 before looking for an industry partner to help fund its drilling program.’

cynic

- 18 Jan 2012 11:26

- 135 of 185

- 18 Jan 2012 11:26

- 135 of 185

trouble with ARG is that is an MM-only stock so easily manipulated .... not for me this one; i'll stick with rkh

HARRYCAT

- 20 Jan 2012 10:39

- 136 of 185

- 20 Jan 2012 10:39

- 136 of 185

12p to 21p in four days! Amazing and missed opportunity on my part....damn!

markymar

- 20 Jan 2012 10:41

- 137 of 185

- 20 Jan 2012 10:41

- 137 of 185

No reason for the rise Harry apart from the Johnson prospect and maybe a partner in tow.....early days

markymar

- 20 Jan 2012 11:50

- 138 of 185

- 20 Jan 2012 11:50

- 138 of 185

Hope Desire does the same soon as i have a boat load,still at a loss why this is up so much.

HARRYCAT

- 20 Jan 2012 13:47

- 139 of 185

- 20 Jan 2012 13:47

- 139 of 185