| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

SacOil - New African Oil Play (SAC)

Anders

- 09 Dec 2011 10:00

- 09 Dec 2011 10:00

Website: http://www.sacoilholdings.com/index.php

CEO Interview:

Profile:

SacOil, as a South African based, operated and controlled company has a competitive advantage at the point of entry in the highly attractive African oil and gas space.

SacOil is dual listed on the JSE (Share code: SCL) and AIM (Share code: SAC).

SacOils remit is to build a Pan-African upstream oil and gas business with a balanced portfolio of assets in Africa.

SacOil has a highly experienced board with significant oil and gas industry as well as deal making expertise.

SacOils assets are in all phases of the upstream cycle exploration, appraisal and near production and are currently in the Democratic Republic of the Congo and Nigeria.

SacOil will continue with its stated strategy of targeting the acquisition of discovered but undeveloped or previously producing but now shut, near-term producing and production upstream oil and gas assets on the African continent.

SacOil intends to initially develop all their deposits in consortiums with global major oil & gas companies with extensive experience in Africa but in time looks to establish itself as a fully-fledged exploration and production company with in house capacity.

SacOils interests are currently in Nigeria, the DRC and South Africa.

Assets:

Democratic Republic of Congo ( DRC ) - Block III ( Working Interest 12.5% )

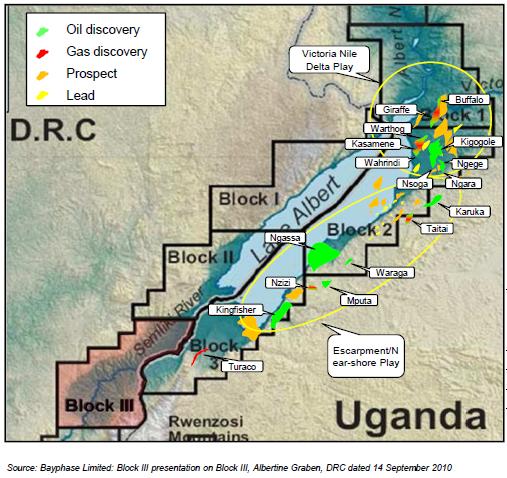

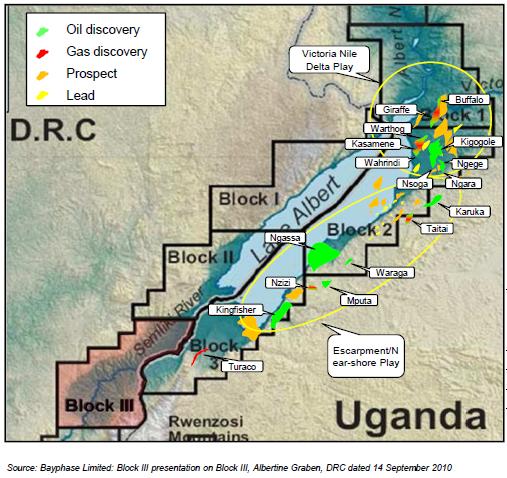

The exploration property rights are located in the DRC Lake Albert area close to the Uganda and DRC border. The area is part of the Rift Valley and is known as the Albertine Graben area which is a proven petroleum discovery region. Bituminous shales are known to be present and are generally mature. This being evidenced by numerous oil seeps and recent positive drill results in adjacent oil concessions.

DRC Block 3 Albertine Graben

The Albertine Graben is part of the East African Rift System (Western Branch) which is a relatively young exploration province with the fi rst exploration starting as recent as 1999. To date over 800 million barrels of recoverable oil resources have been discovered with two fields namely Kingfisher (200 million barrels) and Giraffe-Buffalo (300 million barrels) being the biggest discoveries. The total resource base estimated at 2 G barrels. To date the majority of the exploration has been on the Uganda side but the DRC concessions are considered to be highly prospective with Block 3 being close to recent significant discoveries.

Ownership

SacOil PTY Limited has an 85% participating interest in Block 3 with SacOil Holdings having a 50% stake which results in an overall 42.5% participating interest. The National Oil Company of the DRC holds a 15% interest.

Technical

The licence area is 3,177 square kilometres situated mostly in low land (Semliki river plain) flanked by rift margins and is on trend from recent discoveries in Uganda. The areas have been identified as Oil and Gas prone with the main source kitchen believed to be below deeper parts of Lake Albert. It is considered possible that a smaller kitchen is located in the southern part of Block 3. Kibuku oil seeps suggest that oil is likely to be found in the northern part of the block.

Work programme

The five year programme will be divided into five sub-periods and the initial work will include field studies as well as geochemical studies. Following this will be the acquisition, processing and interpretation of a minimum of 4,000 square kilometres of 2D seismic data. If the results are satisfactory then a drilling programme will follow with at least two exploration wells being drilled.

Competent Persons report

A Competent Persons Report on Block III has been prepared according to the rules of AIM, including the AIM Giuidance Note for Mining, Oil and Gas Companies, June 2009.

LATEST IN DRC:

DRC - Block III ( Working Interest 12.5% )

After the successful farm out deal to ToTal, SacOil is fully carried through to commercial development on Block III which has target prospective resources of 513 million barrels.ToTal has paid $7.5m net cash, and a $54m contingent bonus payment to the company and the project can now be fastracked ahead of earlier estimates. Analyst notes suggest the DRC assets are on trends with recent discoveries in the Lake Albert Basin.

NIGERIA:

Block OPL 281: ( Working Interest 20% )

The production mission is currently being addressed by acquisition of Nigerian near production assets acquired in Joint Venture with EER a Nigerian Oil and Investment and Consulting company. SacOil will have a 50% benefit and funding obligation in all EER joint venture acquisitions.The background and dealOPL is an ex Shell permit having been drilled between 1967 and 1970. The initial award was to a company named Binergy Limited who subsequently had their licence revoked. The block was rewarded to Transcorp in 2006 as part of a Mini Bid Round. Transcorp have paid the majority of the $30 million signing bonus and will cede a 40% equity stake to SacOil on condition the licence is reinstated to Transcorp by the Federal Government of Nigeria.Terms of the Farm-in:EER is the technical partner who will operate the asset on behalf of the JV and TranscorpJV will pay $20 million upon Minister of Petroleum consent for dealJV will pay $7.5 million upon commercial production declarationJV will pay $5 million within 90 days of first oil being producedTechnicaLDiscovery wells Obote-1 and Ekoro-1 drilled between 1967-1970. The terrain is an onshore swamp location and the entire block has been covered by Shell with 3D Seismic during 1991/2. The competent persons report indicates Contingent Resources of 250 MMBOE with further potential in two additional prospects and deeper zones. The hydrocarbons in the two wells were discovered between 2,400 and 4,000 metres with Obote-1 encountering 4 hydrocarbon levels and Ekoro-1 intersecting 8 hydrocarbon levels between 8,260ft and 10,761ft.

OPL 281 was evaluated by TRACS to contain 99.2mmboe of gross reserves with an expected initial gross production rate of 15 kbpd. Peak potential production rate could reach 30 kbpd, when it could deliver up to $200m in revenues. With relatively low running cost and a total capex need of $50m net to SacOil, the field could generate significant cash flows in excess of $40-45m pa by 2015/16.

Block OPL 233: ( Working Interest 20% )

Background: OPL 233 is an offshore oil block previously operated by Chevron. It is located in the shallow Marine central Delta region offshore Nigeria. The block encompasses an area of approximately 126 square kilometres. The water depths range from 10 to 30 feet and the block is adjacently north of the Apoi oil field. The block was awarded to NIGDEL United during the Mini-Bid Round in 2006. Current equity participation is NIGDEL 60%, EER 20% and SacOil 20%.

Olobia-1 well indicates 103ft of net oil and 54ft of gas and condensates across

five reservoir zones in the well. Based on an evaluation by TRACS it is estimated

that the 2C Best estimate on the unrisked contingent resources is 19mmbbl

(3.8mmbbl net to SacOil). Therefore if a second well, Olobia-2, is drilled and tested

the reserves can immediately be booked and classified as a producible reserve.

In OPL 233 there is only one field, the Olobia Oil and Gas field, which has been

conceptually developed and worked up to a point that can be drilled.

Exploration upside: EER/SacOil have mapped additional leads and prospects using

the existing seismic data and estimate an exploration upside, with prospective

resources in the order of 300mmboe, which will be further evaluated with an OBC

(Ocean Bottom Cable) survey.

South Africa:

Greenhills Plant - Manganese

The company manufactures manganese, sulphate powder, manganese sulphate solution and manganese oxide at its plant in Mpumalanga better known as the Greenhills plant. The main source of income from the plant is from the sale of manganese sulphate, manganese hydrate and manganese oxide. The average production of the plant is 300 tonnes per month of manganese sulphate and 360 tonnes of manganese oxides which approximately 230 tonnes are used to produce manganese sulphate powder. This business is not considered to be a core asset and will be probably disposed of in the short term future.

Latest Oil Barrel Presentation:

.

davyboy - 09 Dec 2011 10:38 - 2 of 103

anders, congrats on the new thread mate it looks great and full of info

HARRYCAT

- 09 Dec 2011 10:40

- 3 of 103

- 09 Dec 2011 10:40

- 3 of 103

No graph! ;o(

Anders

- 09 Dec 2011 11:41

- 4 of 103

- 09 Dec 2011 11:41

- 4 of 103

Harrycat, am just working on that now !

Anders

- 09 Dec 2011 12:01

- 5 of 103

- 09 Dec 2011 12:01

- 5 of 103

Harrycat, have a chart now :-)

Anders

- 09 Dec 2011 12:10

- 6 of 103

- 09 Dec 2011 12:10

- 6 of 103

davyboy, thanks i thought a good idea to have a dedicated SAC INVESTORS thread

on here.

on here.

davyboy - 09 Dec 2011 13:04 - 7 of 103

Looks good mate, is it possible to have a JSE chart on here too ??? pretty please

Anders

- 09 Dec 2011 13:45

- 8 of 103

- 09 Dec 2011 13:45

- 8 of 103

davyboy i will try and get a jse chart up but cant promise will work.

davyboy - 09 Dec 2011 14:14 - 9 of 103

Thanks much appreciated anders

Anders

- 09 Dec 2011 15:29

- 10 of 103

- 09 Dec 2011 15:29

- 10 of 103

Should be ok mate so should be up over weekend

davyboy - 09 Dec 2011 15:36 - 11 of 103

thanks again, good looking thread you have here and good to see some research on

the assets and blocks.

the assets and blocks.

Anders

- 09 Dec 2011 16:06

- 12 of 103

- 09 Dec 2011 16:06

- 12 of 103

I will be adding some more good stuff here over weekend :-)

halifax - 09 Dec 2011 16:38 - 13 of 103

rampety, rampety ramp!

Benetoni - 09 Dec 2011 18:28 - 14 of 103

Just seen your new thread anders, great stuff !

davyboy - 09 Dec 2011 23:01 - 15 of 103

Was on another forum earlier and there is quite a buzz around sacoil at the

moment,some good stuff discussed including a potential farm in on an east

african block.One also said that some survey results are due on block III in

the DRC as stated in an RNS.

moment,some good stuff discussed including a potential farm in on an east

african block.One also said that some survey results are due on block III in

the DRC as stated in an RNS.

Anders

- 10 Dec 2011 11:27

- 16 of 103

- 10 Dec 2011 11:27

- 16 of 103

davy, that is correct about the block III surveys,in the last operational update on

block III in august RNS it stated the following:

"The work planned and agreed on Block III includes an airborne gravity and magnetic survey over the licence area, the results of which are expected in Q4 of 2011. This will form the basis for the next stage of the programme which will include the acquisition of a targeted 2D seismic survey. The performance of the work programme is subject to first obtaining the relevant ministerial authorisation.

Bradley Cerff, Vice President Commercial of SacOil commented today:

"I am pleased with the progress we are making at Block III with our partners Total. Work will shortly commence on carrying out the preliminary aeromagnetic surveys which is the precursor to targeted seismic surveys. The Block III project in the DRC has an exceptional postcode in terms of recent neighbouring discoveries in Uganda. We look forward to updating shareholders on further work programmes as we move towards drilling a maiden well on Block III during the first phase of the exploration period."

block III in august RNS it stated the following:

"The work planned and agreed on Block III includes an airborne gravity and magnetic survey over the licence area, the results of which are expected in Q4 of 2011. This will form the basis for the next stage of the programme which will include the acquisition of a targeted 2D seismic survey. The performance of the work programme is subject to first obtaining the relevant ministerial authorisation.

Bradley Cerff, Vice President Commercial of SacOil commented today:

"I am pleased with the progress we are making at Block III with our partners Total. Work will shortly commence on carrying out the preliminary aeromagnetic surveys which is the precursor to targeted seismic surveys. The Block III project in the DRC has an exceptional postcode in terms of recent neighbouring discoveries in Uganda. We look forward to updating shareholders on further work programmes as we move towards drilling a maiden well on Block III during the first phase of the exploration period."

Anders

- 10 Dec 2011 12:57

- 17 of 103

- 10 Dec 2011 12:57

- 17 of 103

Location of Block III relative to nearby large discoveries.

davyboy - 10 Dec 2011 17:13 - 18 of 103

anders as you can see from that map the discoveries have been moving south

from the original buffalo and giraffe finds,total must be mighty confident of at

least moderate success to pay sacoil $63M for 60% of the block.

from the original buffalo and giraffe finds,total must be mighty confident of at

least moderate success to pay sacoil $63M for 60% of the block.

Maxo - 10 Dec 2011 19:36 - 19 of 103

hello everyone i have been looking at this site this week and found this thread

most helpful and informative.thanks

most helpful and informative.thanks

Maxo - 10 Dec 2011 21:02 - 20 of 103

Is that right you can have this stock in an ISA ?

Anders

- 10 Dec 2011 22:17

- 21 of 103

- 10 Dec 2011 22:17

- 21 of 103

welcome maxo,nice to have a new face on here on this new thread,yes you can

hold sacoil in an Isa as its dual listed on AIM / JSE.

hold sacoil in an Isa as its dual listed on AIM / JSE.

chuckles - 10 Dec 2011 23:45 - 22 of 103

On 31 March 2011, DIG settled a loan from SacOil amounting to US$1.4m (0.9m) out of its 50% share of the initial consideration. The loan advanced to DIG by SacOil was in terms of a loan agreement and related to signature bonuses paid by SacOil, on behalf of DIG, directly to the DRC Government on Block III.

Is this a bribe?

Is this a bribe?

chuckles - 10 Dec 2011 23:49 - 23 of 103

Need to look at the threats of a SW)T analysis for any company involved in the DRC:

Members of the security forces also continued to abuse and threaten journalists,

contributing to a decline in freedom of the press. Government corruption remained

pervasive (United States Department of State (11 March 2010) 2009 Country Reports

on Human Rights Practices Democratic Republic of Congo)

Members of the security forces also continued to abuse and threaten journalists,

contributing to a decline in freedom of the press. Government corruption remained

pervasive (United States Department of State (11 March 2010) 2009 Country Reports

on Human Rights Practices Democratic Republic of Congo)

Anders

- 11 Dec 2011 00:44

- 24 of 103

- 11 Dec 2011 00:44

- 24 of 103

chuckles, The DRC is no different to any number of african countries in the way

they conduct their business,in sacoil case they have a totally de-risked share

in a highly prospective acreage operated by ToTal ( 12.5% WI and $63M cash

net to sacoil ).

DRC President Joseph Kabila's re-election is actually a good development as he

has steadily turning the DRC into a place where business can be done safely.

PS - Sacoil have two blocks in nigeria which look rather tasty too :-)

Good Luck

they conduct their business,in sacoil case they have a totally de-risked share

in a highly prospective acreage operated by ToTal ( 12.5% WI and $63M cash

net to sacoil ).

DRC President Joseph Kabila's re-election is actually a good development as he

has steadily turning the DRC into a place where business can be done safely.

PS - Sacoil have two blocks in nigeria which look rather tasty too :-)

Good Luck

Maxo - 11 Dec 2011 11:01 - 25 of 103

ANDERS,

Thanks very much for the info on ISA,s

Thanks very much for the info on ISA,s

Anders

- 11 Dec 2011 12:07

- 26 of 103

- 11 Dec 2011 12:07

- 26 of 103

You are welcome Maxo, are you a new holder here ?

Maxo - 11 Dec 2011 14:03 - 27 of 103

Have been a holder for a while now first on JSE and recently on AIM,i am a south

african national living in the uk now.Still go back on a regular basis though as have

family in durban.

african national living in the uk now.Still go back on a regular basis though as have

family in durban.

Anders

- 11 Dec 2011 16:51

- 28 of 103

- 11 Dec 2011 16:51

- 28 of 103

Welcome to the forum maxo,nice to have an african point of view on here so

hope you can be a contributor to the forum.

Anders

hope you can be a contributor to the forum.

Anders

davyboy - 11 Dec 2011 20:16 - 29 of 103

evening guys,and hello maxo

Maxo - 11 Dec 2011 21:16 - 30 of 103

Thanks very much for the warm welcome fellas and by the way i want these held

in an ISA so am here for the long term.

in an ISA so am here for the long term.

ptholden

- 11 Dec 2011 23:22

- 31 of 103

- 11 Dec 2011 23:22

- 31 of 103

Really Maxo, you have these in an ISA?

So you must have forgotten you held them in an ISA when you asked this question?

Maxo - 10 Dec 2011 21:02 - 20 of 30

Is that right you can have this stock in an ISA ?

Now that's LMFAO!!

This has got to be the worst most stupid ramp I can ever remember, but it's good entertainment if nothing else. For the unwary SAC is being pumped on a number of forums, all using logons that have either recently been registered or have been pretty much dormant for quite a while.

It's a shame really because on the surface SAC seem to have something going for them.

So you must have forgotten you held them in an ISA when you asked this question?

Maxo - 10 Dec 2011 21:02 - 20 of 30

Is that right you can have this stock in an ISA ?

Now that's LMFAO!!

This has got to be the worst most stupid ramp I can ever remember, but it's good entertainment if nothing else. For the unwary SAC is being pumped on a number of forums, all using logons that have either recently been registered or have been pretty much dormant for quite a while.

It's a shame really because on the surface SAC seem to have something going for them.

Anders

- 12 Dec 2011 00:07

- 32 of 103

- 12 Dec 2011 00:07

- 32 of 103

ptholden, are you for real lol ? i have just looked back at what maxo said and

he asked if the stock can be held in an ISA ? to which the answer is yes as its

dual listed on both Aim and Jse . In his last post he stated he wants to hold

them in an Isa so here for long term. So lets put two and two together shall

we....after finding out he can ISA them he then says he intends to do just that !

Can you please get your facts straight before clogging up my thread....if you are

not a holder here holden i suggest you stick to your own stocks.

he asked if the stock can be held in an ISA ? to which the answer is yes as its

dual listed on both Aim and Jse . In his last post he stated he wants to hold

them in an Isa so here for long term. So lets put two and two together shall

we....after finding out he can ISA them he then says he intends to do just that !

Can you please get your facts straight before clogging up my thread....if you are

not a holder here holden i suggest you stick to your own stocks.

Anders

- 12 Dec 2011 00:15

- 33 of 103

- 12 Dec 2011 00:15

- 33 of 103

Maxo, i dont know if you have seen the recent report by uk analyst on sacoil

but incase you have not i post below,well worth a read through.

UK - ANALYST

SacOil Holdings - African oil play with the promise of early production - Reiterate recommendation of Speculative Buy at 4.125p with a 27p target price

Dual-listed SacOil is an independent African upstream oil and gas business. The company offers investors the promise of early production and cash flow as well as the chance to add substantial value by moving opportunities up the value chain. The recently announced interim results served to remind the market of the African oil plays impressive portfolio. The focus of attention over the past six months has been on the blue sky opportunity in Block III in the highly prospective Albertine Basin the Democratic Republic of Congo (DRC) which has been neatly de-risked following a farm-in by Total. At the same time the team has also has been fast tracking progressing the OPL 233 and OPL 281 concession blocks in Nigeria towards early production and revenues. In October, the company announced a $25 million Standby Equity Distribution Agreement with Yorkville which followed a R75 million (5.9 million) funding at R0.67 (5.28p) by Timtex Investments which should help provide the funds to accelerate these projects.

Interim results for the six months to 31st August 2011 showed that revenues from the Greenhills manganese operation increased by 17% to R19.3 million. Pre-tax profit came out at R19.15 million compared to a loss of R6.95 million at the halfway stage last year due to principally to receipts and fair value adjustments. In this period, SacOil through its 50%-owned DRC vehicle Semliki Energy SPRL (other 50% holder is DIG Oil Proprietary Limited) successfully concluded the farm-out and transfer of 60% stake in Block III to Total. In this move, SacOil gained cash of $7.5 million, a future contingent cash bonus of $54.0 million payable in two tranches, full carry on exploration costs of at least $35 million until the final investment decision and also the settlement of a $1.4 million loan provided to DIG. Importantly, SacOil has maintained representation on the management committee of Block III in which it now has a 12.5% effective stake that is fully funded.

Block III in the DRC occupies a large acreage in the Albertine Graben which forms part of the Eastern African Rift System where modern era exploration began only in 1999. Since then around 800MMbbls of recoverable oil resources have been discovered, which includes Tullows Kingfisher (200MMbbl) and the Giraffe-Buffalo (300MMbbl) discoveries, just the other side of the border in Uganda. On trend with Tullows discoveries lies Block III which represents a high risk exploration project where SacOil will be fully funded by Total until after a commercial reserve has been proved. Totals first plans have been for a gravity magnetic survey to outline the basin edges and to understand the workings of the petroleum system in that part of the prolific Albertine Graben. Next year will see the acquisition of seismic data to be followed by the drilling of two exploration wells, one either at the end of 2012 or beginning of 2013, followed by a second well in 2013. Under the term of the farm-in deal Total is required not only meet the work obligations on Block III but to reach a final investment decision by 31 March 2014.

In Nigeria, the company has been buying into projects at what would appear to be a 70% discount to open market prices. Indigenisation policies of the Nigerian Government coupled with minimum work commitments are bringing licences back onto the market that have not been looked at for the last 3-5 years. By partnering up with a local company, SacOil has been able to gain a sensible stake in the OPL 233 and OPL 281 licences. These are two blocks which both have already seen oil discoveries where there is obvious scope to add value by turning a contingent resource into reserves. The plan here is to book reserves and start production. The priority is OPL 233 where investors will not have long to wait as a seismic survey is due to be shot in Q1 2012 with an appraisal well planned for Q4 2012. There does seem scope for a substantial increase in reserves at OPL 233 with consultants TRACS identifying more than 100 feet of net oil and given that this block lies adjacent to the 600 million barrels (MMbbls) plus Apoi field. Good seismic here together with this well data could allow a significant resource to be proved up by the end of 2012. Two wells already exist on OPL 281 as well as good seismic data which points to one large field that may potentially contain close on 100 million barrels. All that could be confirmed by future appraisal drilling which looks set to begin by Q2 2013.

The prediction is that by 2020 Africa will account for 20% of world oil production. In recent years there has been a scramble for African oil and gas licences following some sensational discoveries. SacOil is led by a Board that has an enviable network in the continent and that are used to doing business in Africa coupled with a real depth of experience in the oil and gas industry. Two recent appointments have been John Bentley and Bill Guest who became Non-Executive Directors in May 2011. John was behind JSE-listed Energy Africa Limited which he turned into one of the leading independent upstream companies with operations in a dozen African countries and several big hydrocarbon resource discoveries in the late 1990s before it was acquired by Petronas. John was also the Executive Chairman of FirstOil Africa until taken over by Bowleven in 2007. Bill Guest has been a Director of a number of UK-quoted exploration and production companies which includes being President of Gulf Keystone Petroleum and a Non-Executive Director of Matra Petroleum.

The business model of this AIM and JSE-listed oil play is to provide the finance and enter joint ventures with local partners in a number of African countries with a clear focus on projects where value can rapidly be added by supplying the necessary financing. Given these sort of fundamentals it is little surprise that investors have got very excited about the potential of SacOil which caused the share price to climb above 20p in Johannesburg ahead of the AIM flotation. The dust has now settled and today the shares sit at a quarter of that price and that begs the attention of serious investors. We initiate our coverage on the stock with a Speculative Buy recommendation and with a target price of 27p.

http://uk-analyst.com/shop/page-advice/action-advertorial.show/id-130015105

but incase you have not i post below,well worth a read through.

UK - ANALYST

SacOil Holdings - African oil play with the promise of early production - Reiterate recommendation of Speculative Buy at 4.125p with a 27p target price

Dual-listed SacOil is an independent African upstream oil and gas business. The company offers investors the promise of early production and cash flow as well as the chance to add substantial value by moving opportunities up the value chain. The recently announced interim results served to remind the market of the African oil plays impressive portfolio. The focus of attention over the past six months has been on the blue sky opportunity in Block III in the highly prospective Albertine Basin the Democratic Republic of Congo (DRC) which has been neatly de-risked following a farm-in by Total. At the same time the team has also has been fast tracking progressing the OPL 233 and OPL 281 concession blocks in Nigeria towards early production and revenues. In October, the company announced a $25 million Standby Equity Distribution Agreement with Yorkville which followed a R75 million (5.9 million) funding at R0.67 (5.28p) by Timtex Investments which should help provide the funds to accelerate these projects.

Interim results for the six months to 31st August 2011 showed that revenues from the Greenhills manganese operation increased by 17% to R19.3 million. Pre-tax profit came out at R19.15 million compared to a loss of R6.95 million at the halfway stage last year due to principally to receipts and fair value adjustments. In this period, SacOil through its 50%-owned DRC vehicle Semliki Energy SPRL (other 50% holder is DIG Oil Proprietary Limited) successfully concluded the farm-out and transfer of 60% stake in Block III to Total. In this move, SacOil gained cash of $7.5 million, a future contingent cash bonus of $54.0 million payable in two tranches, full carry on exploration costs of at least $35 million until the final investment decision and also the settlement of a $1.4 million loan provided to DIG. Importantly, SacOil has maintained representation on the management committee of Block III in which it now has a 12.5% effective stake that is fully funded.

Block III in the DRC occupies a large acreage in the Albertine Graben which forms part of the Eastern African Rift System where modern era exploration began only in 1999. Since then around 800MMbbls of recoverable oil resources have been discovered, which includes Tullows Kingfisher (200MMbbl) and the Giraffe-Buffalo (300MMbbl) discoveries, just the other side of the border in Uganda. On trend with Tullows discoveries lies Block III which represents a high risk exploration project where SacOil will be fully funded by Total until after a commercial reserve has been proved. Totals first plans have been for a gravity magnetic survey to outline the basin edges and to understand the workings of the petroleum system in that part of the prolific Albertine Graben. Next year will see the acquisition of seismic data to be followed by the drilling of two exploration wells, one either at the end of 2012 or beginning of 2013, followed by a second well in 2013. Under the term of the farm-in deal Total is required not only meet the work obligations on Block III but to reach a final investment decision by 31 March 2014.

In Nigeria, the company has been buying into projects at what would appear to be a 70% discount to open market prices. Indigenisation policies of the Nigerian Government coupled with minimum work commitments are bringing licences back onto the market that have not been looked at for the last 3-5 years. By partnering up with a local company, SacOil has been able to gain a sensible stake in the OPL 233 and OPL 281 licences. These are two blocks which both have already seen oil discoveries where there is obvious scope to add value by turning a contingent resource into reserves. The plan here is to book reserves and start production. The priority is OPL 233 where investors will not have long to wait as a seismic survey is due to be shot in Q1 2012 with an appraisal well planned for Q4 2012. There does seem scope for a substantial increase in reserves at OPL 233 with consultants TRACS identifying more than 100 feet of net oil and given that this block lies adjacent to the 600 million barrels (MMbbls) plus Apoi field. Good seismic here together with this well data could allow a significant resource to be proved up by the end of 2012. Two wells already exist on OPL 281 as well as good seismic data which points to one large field that may potentially contain close on 100 million barrels. All that could be confirmed by future appraisal drilling which looks set to begin by Q2 2013.

The prediction is that by 2020 Africa will account for 20% of world oil production. In recent years there has been a scramble for African oil and gas licences following some sensational discoveries. SacOil is led by a Board that has an enviable network in the continent and that are used to doing business in Africa coupled with a real depth of experience in the oil and gas industry. Two recent appointments have been John Bentley and Bill Guest who became Non-Executive Directors in May 2011. John was behind JSE-listed Energy Africa Limited which he turned into one of the leading independent upstream companies with operations in a dozen African countries and several big hydrocarbon resource discoveries in the late 1990s before it was acquired by Petronas. John was also the Executive Chairman of FirstOil Africa until taken over by Bowleven in 2007. Bill Guest has been a Director of a number of UK-quoted exploration and production companies which includes being President of Gulf Keystone Petroleum and a Non-Executive Director of Matra Petroleum.

The business model of this AIM and JSE-listed oil play is to provide the finance and enter joint ventures with local partners in a number of African countries with a clear focus on projects where value can rapidly be added by supplying the necessary financing. Given these sort of fundamentals it is little surprise that investors have got very excited about the potential of SacOil which caused the share price to climb above 20p in Johannesburg ahead of the AIM flotation. The dust has now settled and today the shares sit at a quarter of that price and that begs the attention of serious investors. We initiate our coverage on the stock with a Speculative Buy recommendation and with a target price of 27p.

http://uk-analyst.com/shop/page-advice/action-advertorial.show/id-130015105

davyboy - 12 Dec 2011 07:44 - 34 of 103

Morning Anders, could be the start of an exciting week here mate :-)

Anders

- 12 Dec 2011 08:22

- 35 of 103

- 12 Dec 2011 08:22

- 35 of 103

Morning mate,

Some good early trades coming through

Some good early trades coming through

davyboy - 12 Dec 2011 08:52 - 36 of 103

moved up abit mate,dont think there is much stock around

skinny

- 12 Dec 2011 08:55

- 37 of 103

- 12 Dec 2011 08:55

- 37 of 103

I don't know where you get that from - I was just offered 250,000 @4.625 - I didn't buy.

davyboy - 12 Dec 2011 09:43 - 38 of 103

skinny, and just after your quote i couldnt buy more than 50k,the market can move

very fast on this so prices and buy sizes change from minute to minute.

very fast on this so prices and buy sizes change from minute to minute.

Anders

- 12 Dec 2011 10:20

- 39 of 103

- 12 Dec 2011 10:20

- 39 of 103

Some good buys this morning including 210k @4.75p and what looks like

a delayed buy from open of 140k@4.25p

a delayed buy from open of 140k@4.25p

davyboy - 12 Dec 2011 11:09 - 40 of 103

anders there has also been some good buying over on JSE exchange too

Bob Heston - 12 Dec 2011 11:40 - 41 of 103

hi everyone i have been reading this thread with some interest..looks a great little punt to me and the deal they have with total france looks a cracker

Anders

- 12 Dec 2011 12:46

- 42 of 103

- 12 Dec 2011 12:46

- 42 of 103

welcome bob and yes the deal they done with ToTal equates to $63M net to sacoil

( $54M to come ) and sacoil retains a 12.5% WI on block III and a seat on the

management commitee.This was from a tiny initial outlay by SAC.

GOOD BUSINESS to say the least :-)

( $54M to come ) and sacoil retains a 12.5% WI on block III and a seat on the

management commitee.This was from a tiny initial outlay by SAC.

GOOD BUSINESS to say the least :-)

davyboy - 12 Dec 2011 13:52 - 43 of 103

bob you may like to take a look at this recent uk analyst coverage as it covers

very well the current position.

SacOil Holdings - African oil play with the promise of early production - Reiterate recommendation of Speculative Buy at 4.125p with a 27p target price.

http://uk-analyst.com/shop/page-advice/action-advertorial.show/id-130015105

Dual-listed SacOil is an independent African upstream oil and gas business. The company offers investors the promise of early production and cash flow as well as the chance to add substantial value by moving opportunities up the value chain. The recently announced interim results served to remind the market of the African oil plays impressive portfolio. The focus of attention over the past six months has been on the blue sky opportunity in Block III in the highly prospective Albertine Basin the Democratic Republic of Congo (DRC) which has been neatly de-risked following a farm-in by Total. At the same time the team has also has been fast tracking progressing the OPL 233 and OPL 281 concession blocks in Nigeria towards early production and revenues. In October, the company announced a $25 million Standby Equity Distribution Agreement with Yorkville which followed a R75 million (5.9 million) funding at R0.67 (5.28p) by Timtex Investments which should help provide the funds to accelerate these projects.

Interim results for the six months to 31st August 2011 showed that revenues from the Greenhills manganese operation increased by 17% to R19.3 million. Pre-tax profit came out at R19.15 million compared to a loss of R6.95 million at the halfway stage last year due to principally to receipts and fair value adjustments. In this period, SacOil through its 50%-owned DRC vehicle Semliki Energy SPRL (other 50% holder is DIG Oil Proprietary Limited) successfully concluded the farm-out and transfer of 60% stake in Block III to Total. In this move, SacOil gained cash of $7.5 million, a future contingent cash bonus of $54.0 million payable in two tranches, full carry on exploration costs of at least $35 million until the final investment decision and also the settlement of a $1.4 million loan provided to DIG. Importantly, SacOil has maintained representation on the management committee of Block III in which it now has a 12.5% effective stake that is fully funded.

Block III in the DRC occupies a large acreage in the Albertine Graben which forms part of the Eastern African Rift System where modern era exploration began only in 1999. Since then around 800MMbbls of recoverable oil resources have been discovered, which includes Tullows Kingfisher (200MMbbl) and the Giraffe-Buffalo (300MMbbl) discoveries, just the other side of the border in Uganda. On trend with Tullows discoveries lies Block III which represents a high risk exploration project where SacOil will be fully funded by Total until after a commercial reserve has been proved. Totals first plans have been for a gravity magnetic survey to outline the basin edges and to understand the workings of the petroleum system in that part of the prolific Albertine Graben. Next year will see the acquisition of seismic data to be followed by the drilling of two exploration wells, one either at the end of 2012 or beginning of 2013, followed by a second well in 2013. Under the term of the farm-in deal Total is required not only meet the work obligations on Block III but to reach a final investment decision by 31 March 2014.

In Nigeria, the company has been buying into projects at what would appear to be a 70% discount to open market prices. Indigenisation policies of the Nigerian Government coupled with minimum work commitments are bringing licences back onto the market that have not been looked at for the last 3-5 years. By partnering up with a local company, SacOil has been able to gain a sensible stake in the OPL 233 and OPL 281 licences. These are two blocks which both have already seen oil discoveries where there is obvious scope to add value by turning a contingent resource into reserves. The plan here is to book reserves and start production. The priority is OPL 233 where investors will not have long to wait as a seismic survey is due to be shot in Q1 2012 with an appraisal well planned for Q4 2012. There does seem scope for a substantial increase in reserves at OPL 233 with consultants TRACS identifying more than 100 feet of net oil and given that this block lies adjacent to the 600 million barrels (MMbbls) plus Apoi field. Good seismic here together with this well data could allow a significant resource to be proved up by the end of 2012. Two wells already exist on OPL 281 as well as good seismic data which points to one large field that may potentially contain close on 100 million barrels. All that could be confirmed by future appraisal drilling which looks set to begin by Q2 2013.

The prediction is that by 2020 Africa will account for 20% of world oil production. In recent years there has been a scramble for African oil and gas licences following some sensational discoveries. SacOil is led by a Board that has an enviable network in the continent and that are used to doing business in Africa coupled with a real depth of experience in the oil and gas industry. Two recent appointments have been John Bentley and Bill Guest who became Non-Executive Directors in May 2011. John was behind JSE-listed Energy Africa Limited which he turned into one of the leading independent upstream companies with operations in a dozen African countries and several big hydrocarbon resource discoveries in the late 1990s before it was acquired by Petronas. John was also the Executive Chairman of FirstOil Africa until taken over by Bowleven in 2007. Bill Guest has been a Director of a number of UK-quoted exploration and production companies which includes being President of Gulf Keystone Petroleum and a Non-Executive Director of Matra Petroleum.

The business model of this AIM and JSE-listed oil play is to provide the finance and enter joint ventures with local partners in a number of African countries with a clear focus on projects where value can rapidly be added by supplying the necessary financing. Given these sort of fundamentals it is little surprise that investors have got very excited about the potential of SacOil which caused the share price to climb above 20p in Johannesburg ahead of the AIM flotation. The dust has now settled and today the shares sit at a quarter of that price and that begs the attention of serious investors. We initiate our coverage on the stock with a Speculative Buy recommendation and with a target price of 27p.

very well the current position.

SacOil Holdings - African oil play with the promise of early production - Reiterate recommendation of Speculative Buy at 4.125p with a 27p target price.

http://uk-analyst.com/shop/page-advice/action-advertorial.show/id-130015105

Dual-listed SacOil is an independent African upstream oil and gas business. The company offers investors the promise of early production and cash flow as well as the chance to add substantial value by moving opportunities up the value chain. The recently announced interim results served to remind the market of the African oil plays impressive portfolio. The focus of attention over the past six months has been on the blue sky opportunity in Block III in the highly prospective Albertine Basin the Democratic Republic of Congo (DRC) which has been neatly de-risked following a farm-in by Total. At the same time the team has also has been fast tracking progressing the OPL 233 and OPL 281 concession blocks in Nigeria towards early production and revenues. In October, the company announced a $25 million Standby Equity Distribution Agreement with Yorkville which followed a R75 million (5.9 million) funding at R0.67 (5.28p) by Timtex Investments which should help provide the funds to accelerate these projects.

Interim results for the six months to 31st August 2011 showed that revenues from the Greenhills manganese operation increased by 17% to R19.3 million. Pre-tax profit came out at R19.15 million compared to a loss of R6.95 million at the halfway stage last year due to principally to receipts and fair value adjustments. In this period, SacOil through its 50%-owned DRC vehicle Semliki Energy SPRL (other 50% holder is DIG Oil Proprietary Limited) successfully concluded the farm-out and transfer of 60% stake in Block III to Total. In this move, SacOil gained cash of $7.5 million, a future contingent cash bonus of $54.0 million payable in two tranches, full carry on exploration costs of at least $35 million until the final investment decision and also the settlement of a $1.4 million loan provided to DIG. Importantly, SacOil has maintained representation on the management committee of Block III in which it now has a 12.5% effective stake that is fully funded.

Block III in the DRC occupies a large acreage in the Albertine Graben which forms part of the Eastern African Rift System where modern era exploration began only in 1999. Since then around 800MMbbls of recoverable oil resources have been discovered, which includes Tullows Kingfisher (200MMbbl) and the Giraffe-Buffalo (300MMbbl) discoveries, just the other side of the border in Uganda. On trend with Tullows discoveries lies Block III which represents a high risk exploration project where SacOil will be fully funded by Total until after a commercial reserve has been proved. Totals first plans have been for a gravity magnetic survey to outline the basin edges and to understand the workings of the petroleum system in that part of the prolific Albertine Graben. Next year will see the acquisition of seismic data to be followed by the drilling of two exploration wells, one either at the end of 2012 or beginning of 2013, followed by a second well in 2013. Under the term of the farm-in deal Total is required not only meet the work obligations on Block III but to reach a final investment decision by 31 March 2014.

In Nigeria, the company has been buying into projects at what would appear to be a 70% discount to open market prices. Indigenisation policies of the Nigerian Government coupled with minimum work commitments are bringing licences back onto the market that have not been looked at for the last 3-5 years. By partnering up with a local company, SacOil has been able to gain a sensible stake in the OPL 233 and OPL 281 licences. These are two blocks which both have already seen oil discoveries where there is obvious scope to add value by turning a contingent resource into reserves. The plan here is to book reserves and start production. The priority is OPL 233 where investors will not have long to wait as a seismic survey is due to be shot in Q1 2012 with an appraisal well planned for Q4 2012. There does seem scope for a substantial increase in reserves at OPL 233 with consultants TRACS identifying more than 100 feet of net oil and given that this block lies adjacent to the 600 million barrels (MMbbls) plus Apoi field. Good seismic here together with this well data could allow a significant resource to be proved up by the end of 2012. Two wells already exist on OPL 281 as well as good seismic data which points to one large field that may potentially contain close on 100 million barrels. All that could be confirmed by future appraisal drilling which looks set to begin by Q2 2013.

The prediction is that by 2020 Africa will account for 20% of world oil production. In recent years there has been a scramble for African oil and gas licences following some sensational discoveries. SacOil is led by a Board that has an enviable network in the continent and that are used to doing business in Africa coupled with a real depth of experience in the oil and gas industry. Two recent appointments have been John Bentley and Bill Guest who became Non-Executive Directors in May 2011. John was behind JSE-listed Energy Africa Limited which he turned into one of the leading independent upstream companies with operations in a dozen African countries and several big hydrocarbon resource discoveries in the late 1990s before it was acquired by Petronas. John was also the Executive Chairman of FirstOil Africa until taken over by Bowleven in 2007. Bill Guest has been a Director of a number of UK-quoted exploration and production companies which includes being President of Gulf Keystone Petroleum and a Non-Executive Director of Matra Petroleum.

The business model of this AIM and JSE-listed oil play is to provide the finance and enter joint ventures with local partners in a number of African countries with a clear focus on projects where value can rapidly be added by supplying the necessary financing. Given these sort of fundamentals it is little surprise that investors have got very excited about the potential of SacOil which caused the share price to climb above 20p in Johannesburg ahead of the AIM flotation. The dust has now settled and today the shares sit at a quarter of that price and that begs the attention of serious investors. We initiate our coverage on the stock with a Speculative Buy recommendation and with a target price of 27p.

Bob Heston - 12 Dec 2011 14:42 - 44 of 103

thankyou for that davy

Anders

- 12 Dec 2011 15:11

- 45 of 103

- 12 Dec 2011 15:11

- 45 of 103

bob, there is further info in the recent interims on block III deal and cash position

which is very healthy.

Half Yearly 2011 Financial Results -14 November 2011

AIM and JSE listed - SacOil Holdings Limited, the African independent upstream oil and gas company, is pleased to announce its half yearly financial results for the six months ended 31 August 2011.

HIGHLIGHTS:

Operational / Management / Corporate

The recognition of the R238.1 (GBP20.6) million is in accordance with International Accounting Standard 37: Contingent Assets and Contingent Liabilities and is based on additional information available, at the time of this release, to the management of SacOil in relation to the probability of future economic benefits that could flow to SacOil as a result of the Disposal. The Group Interim Results for the six months ended 31 August 2011 will be released on or about Monday, 14 November 2011. The information contained in this announcement has not been reviewed or reported on by the Group`s auditors.

*Successful farmout of a 60% interest in Block III to Total E&P RDC ("Total") ("Block III Disposal") for: US$7.5m ( 4.6m) cash payment received net to SacOil

*US$54m ( 33.02m) contingent bonus paymentnet to SacOil

*Full carry on exploration costs of at least US$35m ( 21.4m) to final investment decision

*Strengthened main board, with the appointments of John Bentley and James William (Bill) Guest as Independent Non-Executive Directors.

*Strengthened management team with the appointment of Bradley Cerff as Vice-President.

*Successful admission to AIM

Financial:

**US$7.5m ( 4.6m) cash received and further potential proceeds of US$54m (33.02m) in relation to the Block III Disposal (net to SacOil)

**US$10.6m cash ( 6.5m) raised through equity

**Headline earnings up 657%

**Tangible Net Asset Value up 379%

**Greenhills plant net profit up 11%

Commenting, Robin Vela, CEO, said:

"The focus over the last six months has been on managing the Company's exposure to the high impact exploration assets in Block III in the highly prospective Albertine Basin, whilst retaining significant potential upside for shareholders. Our attention has also been on procuring funding in order to de-risk and fast track the work program obligations of our asset portfolio and progressing towards early production and revenues from our oil concession blocks, OPL 233 and OPL 281, in Nigeria. We successfully did this through the farm-out to Total and the recently announced Standby Equity Distribution Agreement. Combined, this puts us in a good position to fast track and develop our asset position and opportunities and we look forward to the next six months of the financial year with added confidence."

which is very healthy.

Half Yearly 2011 Financial Results -14 November 2011

AIM and JSE listed - SacOil Holdings Limited, the African independent upstream oil and gas company, is pleased to announce its half yearly financial results for the six months ended 31 August 2011.

HIGHLIGHTS:

Operational / Management / Corporate

The recognition of the R238.1 (GBP20.6) million is in accordance with International Accounting Standard 37: Contingent Assets and Contingent Liabilities and is based on additional information available, at the time of this release, to the management of SacOil in relation to the probability of future economic benefits that could flow to SacOil as a result of the Disposal. The Group Interim Results for the six months ended 31 August 2011 will be released on or about Monday, 14 November 2011. The information contained in this announcement has not been reviewed or reported on by the Group`s auditors.

*Successful farmout of a 60% interest in Block III to Total E&P RDC ("Total") ("Block III Disposal") for: US$7.5m ( 4.6m) cash payment received net to SacOil

*US$54m ( 33.02m) contingent bonus paymentnet to SacOil

*Full carry on exploration costs of at least US$35m ( 21.4m) to final investment decision

*Strengthened main board, with the appointments of John Bentley and James William (Bill) Guest as Independent Non-Executive Directors.

*Strengthened management team with the appointment of Bradley Cerff as Vice-President.

*Successful admission to AIM

Financial:

**US$7.5m ( 4.6m) cash received and further potential proceeds of US$54m (33.02m) in relation to the Block III Disposal (net to SacOil)

**US$10.6m cash ( 6.5m) raised through equity

**Headline earnings up 657%

**Tangible Net Asset Value up 379%

**Greenhills plant net profit up 11%

Commenting, Robin Vela, CEO, said:

"The focus over the last six months has been on managing the Company's exposure to the high impact exploration assets in Block III in the highly prospective Albertine Basin, whilst retaining significant potential upside for shareholders. Our attention has also been on procuring funding in order to de-risk and fast track the work program obligations of our asset portfolio and progressing towards early production and revenues from our oil concession blocks, OPL 233 and OPL 281, in Nigeria. We successfully did this through the farm-out to Total and the recently announced Standby Equity Distribution Agreement. Combined, this puts us in a good position to fast track and develop our asset position and opportunities and we look forward to the next six months of the financial year with added confidence."

davyboy - 12 Dec 2011 15:55 - 46 of 103

anders, the mm,s on here moved it up this morning to 4.75p-5p spread briefly on

around 700k volume,there is a clue here that their stock levels are not good IMO

around 700k volume,there is a clue here that their stock levels are not good IMO

Anders

- 12 Dec 2011 16:25

- 47 of 103

- 12 Dec 2011 16:25

- 47 of 103

davy i think you may be right on that one.

Maxo - 12 Dec 2011 17:46 - 48 of 103

anders good evening, was not able to watch the stock today much today but

looks like it spiked up early then fell back level ??

looks like it spiked up early then fell back level ??

Anders

- 12 Dec 2011 21:40

- 49 of 103

- 12 Dec 2011 21:40

- 49 of 103

Evening maxo,

Yes it moved up then moved back again today but looking at the trades they were

mostly buys again of roughly 7-1,so in my opinion this stock is still being controlled

tightly.We can only assume that something good is going to kick off here as otherwise

the mm,s would be spiking this up and selling on higher ( something corporate is going

on IMO ).

Yes it moved up then moved back again today but looking at the trades they were

mostly buys again of roughly 7-1,so in my opinion this stock is still being controlled

tightly.We can only assume that something good is going to kick off here as otherwise

the mm,s would be spiking this up and selling on higher ( something corporate is going

on IMO ).

Maxo - 12 Dec 2011 23:19 - 50 of 103

Anders the only thing i can think of is that we are in a " close period " for some

sort of deal or development going on behind the scenes.

sort of deal or development going on behind the scenes.

davyboy - 13 Dec 2011 08:14 - 51 of 103

Morning guys

Anders

- 13 Dec 2011 09:17

- 52 of 103

- 13 Dec 2011 09:17

- 52 of 103

Morning davy, hope all is well mate :-)

Will be doing another top up here today with some profits banked elsewhere!

Will be doing another top up here today with some profits banked elsewhere!

Anders

- 13 Dec 2011 10:37

- 53 of 103

- 13 Dec 2011 10:37

- 53 of 103

Some nice steady buys again this morning and looks like it could tick up

davyboy - 13 Dec 2011 11:25 - 54 of 103

Morning anders just heard some chatter on lse that directors could be buying

here,and reference made to those steady 80k buys we seen last few days at

full ask. Thoughts mate ????

here,and reference made to those steady 80k buys we seen last few days at

full ask. Thoughts mate ????

skinny

- 13 Dec 2011 11:30

- 55 of 103

- 13 Dec 2011 11:30

- 55 of 103

432k of trades today so far - @16k total.

Maxo - 13 Dec 2011 12:39 - 56 of 103

Guys just bought another batch :-)

davyboy - 13 Dec 2011 12:45 - 57 of 103

skinny, now 721k of trades and no doubt some on plus too

skinny

- 13 Dec 2011 12:47

- 58 of 103

- 13 Dec 2011 12:47

- 58 of 103

3 trades on plus - total 40k or @1600.

davyboy - 13 Dec 2011 12:55 - 59 of 103

skinny, i assume you not a holder here ? i wouldnt mind starting a sweepstake

with you on sacoil SP by end of march 2012.

with you on sacoil SP by end of march 2012.

Anders

- 13 Dec 2011 12:59

- 60 of 103

- 13 Dec 2011 12:59

- 60 of 103

davy we now have three mm,s moved on the bid price and another set to join

them,looks interesting and some fair size trades today so far.

them,looks interesting and some fair size trades today so far.

davyboy - 13 Dec 2011 13:12 - 61 of 103

anders, it is looking good for sure,some talk over on lse of director buys maybe?

Anders

- 13 Dec 2011 13:35

- 62 of 103

- 13 Dec 2011 13:35

- 62 of 103

davy, could be director buying i guess we may have to wait for next holdings rns,

but they do already have a fair whack at 18p and 19p which is of note.

but they do already have a fair whack at 18p and 19p which is of note.

Maxo - 13 Dec 2011 14:00 - 63 of 103

anders....they have just moved the spread out to 4p-4.75p i think they are

short of shares,a good finish to day possible :-)

short of shares,a good finish to day possible :-)

davyboy - 13 Dec 2011 14:42 - 64 of 103

anders, :-)

Anders

- 13 Dec 2011 15:08

- 65 of 103

- 13 Dec 2011 15:08

- 65 of 103

I think there could be some delayed larger trades not showing today,very strange

they moved the ask out to 4.75p and kept the bid at 4p,it could suddenly move

again anytime.

they moved the ask out to 4.75p and kept the bid at 4p,it could suddenly move

again anytime.

davyboy - 13 Dec 2011 15:33 - 66 of 103

anders, in an RNS in august they stated that the aeromagnetic survey results on

Block III will be released during Q4 so we may get that anytime.

Block III will be released during Q4 so we may get that anytime.

robertalexander

- 13 Dec 2011 16:00

- 67 of 103

- 13 Dec 2011 16:00

- 67 of 103

i'm in albeit for a speculative gamble just the 5k[shares that is] 4.15p.

GLA

Alex

GLA

Alex

Anders

- 13 Dec 2011 16:05

- 68 of 103

- 13 Dec 2011 16:05

- 68 of 103

hey robert, nice to see a new face on here :-)

davy,just had a 450k pop up which looks like a delayed trade which i referred to

earlier mate.

davy,just had a 450k pop up which looks like a delayed trade which i referred to

earlier mate.

davyboy - 13 Dec 2011 16:56 - 69 of 103

anders.....i see these trades as significant mate, the 450.000 trade at 4.25p must

have been a buy as at time of reporting the spread was 4p - 4.50p so was bang

on the midprice and actual sell price at time was 4.075p. So this was a delayed

trade from early on today and incidently there was a 200k buy yesterday at 4.75p

right on full ask and also a number of steady mid 80k trades today and yesterday.

These are either institutional buys or director buys in my opinion and i say that

not least because three market makers have been sitting on a 4p bid price all day

and not moving even while a good steady stream of buys were going through.

Its fair to say that something is going to develop here soon of that i have no doubt.

have been a buy as at time of reporting the spread was 4p - 4.50p so was bang

on the midprice and actual sell price at time was 4.075p. So this was a delayed

trade from early on today and incidently there was a 200k buy yesterday at 4.75p

right on full ask and also a number of steady mid 80k trades today and yesterday.

These are either institutional buys or director buys in my opinion and i say that

not least because three market makers have been sitting on a 4p bid price all day

and not moving even while a good steady stream of buys were going through.

Its fair to say that something is going to develop here soon of that i have no doubt.

Anders

- 13 Dec 2011 18:41

- 70 of 103

- 13 Dec 2011 18:41

- 70 of 103

davy,

I see what you mean,for what its worth i think you are bang on there and those

trades were buys,the biggest clue these were corporate buys was the mm,s

sticking on to the 4p bid all day whilst steady buys continued. And then when

the trades were actually published still no move up or down with the bid price.

I have said quite a few times that some sort of development is going on at SAC

at the moment and i have a gut instinct that its connected with the price controls.

What could it be ? its either a new aquisition that involves equity,or ENCHA have

taken a further big stake in the company around the 4.5p level. These are my own

thoughts and opinions but based on knowledge of this company and management.

I see what you mean,for what its worth i think you are bang on there and those

trades were buys,the biggest clue these were corporate buys was the mm,s

sticking on to the 4p bid all day whilst steady buys continued. And then when

the trades were actually published still no move up or down with the bid price.

I have said quite a few times that some sort of development is going on at SAC

at the moment and i have a gut instinct that its connected with the price controls.

What could it be ? its either a new aquisition that involves equity,or ENCHA have

taken a further big stake in the company around the 4.5p level. These are my own

thoughts and opinions but based on knowledge of this company and management.

skinny

- 13 Dec 2011 19:18

- 71 of 103

- 13 Dec 2011 19:18

- 71 of 103

Today's volume (total) equates to @60k.

;MA(50)&IND=RSI(14);VOLMA(60)&Layout=2Line;Default;Price;HisDate&XCycle=&XFormat=)

Anders

- 13 Dec 2011 20:51

- 72 of 103

- 13 Dec 2011 20:51

- 72 of 103

Thankyou skinny :-) if you look at the chart you posted there are signs of a

chart reversal taking place and increasing volumes.

chart reversal taking place and increasing volumes.

Maxo - 13 Dec 2011 22:18 - 73 of 103

anders i just found an interesting post on another forum on sacoils assets and

paste here.

-------------------------------------------------------------------------

The deal with Total could ultimately be worth US$300 million to SacOil, which will receive US$61.5 million staged over the next five years, of which US$7.5 million has already been paid.

It also leaves the company with a 12.5 per cent interest ( free carry ) in the licence.

As important, the group receives a free carry on all the exploration work right up to the final investment decision phase in other words the point at which it is decided whether Block III is commercially viable and bank debt financeable.

In Nigeria sacoil has stakes in licences OPL 233 and 281, which have already seen oil discoveries and where there is obvious scope to add value by turning a contingent resource into reserves.,there does seem scope for a substantial increase in reserves at OPL 233 with consultants TRACS identifying more than 100 feet of net oil and given that this block lies adjacent to the 600 million barrels plus Apoi field, Green points out.

Good seismic here together with this well data could allow a significant resource to be proved up by the end of 2012.

Two wells already exist on OPL 281 as well as good seismic data, which points to one large field that may potentially contain close on 100 million barrels.

All that could be confirmed by future appraisal drilling which looks set to begin in April or May 2013, the GECR analyst adds.

In the DRC SacOil owns a 3,177 kilometre licence area known simply Block III.

It is in the Albetine Graben, the source of Tullow Oils (LON:TLW) Kingfisher and Giraffe-Buffalo discoveries over the border in Uganda.

To date the real excitement in this region has been on the Ugandan side of the border where discoveries have produced well flow rates anywhere from 350 to 13,000 barrels of oil a day, Green says.

In this region discoveries made to date add up to over 800 million barrels of P50 contingent Resources and these have come from two distinct types of oil plays which are either escarpment/near-shore plays such as Kingfisher or Victoria Nile Delta plays, which includes the biggest find so far at Giraffe-Buffalo.

paste here.

-------------------------------------------------------------------------

The deal with Total could ultimately be worth US$300 million to SacOil, which will receive US$61.5 million staged over the next five years, of which US$7.5 million has already been paid.

It also leaves the company with a 12.5 per cent interest ( free carry ) in the licence.

As important, the group receives a free carry on all the exploration work right up to the final investment decision phase in other words the point at which it is decided whether Block III is commercially viable and bank debt financeable.

In Nigeria sacoil has stakes in licences OPL 233 and 281, which have already seen oil discoveries and where there is obvious scope to add value by turning a contingent resource into reserves.,there does seem scope for a substantial increase in reserves at OPL 233 with consultants TRACS identifying more than 100 feet of net oil and given that this block lies adjacent to the 600 million barrels plus Apoi field, Green points out.

Good seismic here together with this well data could allow a significant resource to be proved up by the end of 2012.

Two wells already exist on OPL 281 as well as good seismic data, which points to one large field that may potentially contain close on 100 million barrels.

All that could be confirmed by future appraisal drilling which looks set to begin in April or May 2013, the GECR analyst adds.

In the DRC SacOil owns a 3,177 kilometre licence area known simply Block III.

It is in the Albetine Graben, the source of Tullow Oils (LON:TLW) Kingfisher and Giraffe-Buffalo discoveries over the border in Uganda.

To date the real excitement in this region has been on the Ugandan side of the border where discoveries have produced well flow rates anywhere from 350 to 13,000 barrels of oil a day, Green says.

In this region discoveries made to date add up to over 800 million barrels of P50 contingent Resources and these have come from two distinct types of oil plays which are either escarpment/near-shore plays such as Kingfisher or Victoria Nile Delta plays, which includes the biggest find so far at Giraffe-Buffalo.

Anders

- 14 Dec 2011 00:59

- 74 of 103

- 14 Dec 2011 00:59

- 74 of 103

Thanks for that Maxo, a very good read !

davyboy - 14 Dec 2011 08:17 - 75 of 103

maxo, i like this bit from your post

"The deal with Total could ultimately be worth US$300 million to SacOil, which will receive US$61.5 million staged over the next five years, of which US$7.5 million has already been paid.

It also leaves the company with a 12.5 per cent interest ( free carry ) in the licence".

"The deal with Total could ultimately be worth US$300 million to SacOil, which will receive US$61.5 million staged over the next five years, of which US$7.5 million has already been paid.

It also leaves the company with a 12.5 per cent interest ( free carry ) in the licence".

Anders

- 14 Dec 2011 08:33

- 76 of 103

- 14 Dec 2011 08:33

- 76 of 103

morning guys, interesting post from maxo there and shows some big numbers!

davyboy - 14 Dec 2011 08:46 - 77 of 103

Morning anders, level 2 is looking good today and think it could move back up on

even lowish volume,its 3 v 1 at moment with SCAP , LIBC , WINS still on the bid !

even lowish volume,its 3 v 1 at moment with SCAP , LIBC , WINS still on the bid !

Anders

- 14 Dec 2011 09:39

- 78 of 103

- 14 Dec 2011 09:39

- 78 of 103

Hi davy, yes mate and just checked and found only 20k of shares available

without negotiation at moment - something cooking ?

without negotiation at moment - something cooking ?

davyboy - 14 Dec 2011 10:02 - 79 of 103

Noticed that mate,just tried two different brokers and one had 20k available

and the other only 10k of shares.

and the other only 10k of shares.

Anders

- 14 Dec 2011 10:36

- 80 of 103

- 14 Dec 2011 10:36

- 80 of 103

davy i could get 30k on TDW just now but no more

andysmith

- 14 Dec 2011 10:41

- 81 of 103

- 14 Dec 2011 10:41

- 81 of 103

Is that 20k shares or 20k

The Other Kevin

- 14 Dec 2011 10:43

- 82 of 103

- 14 Dec 2011 10:43

- 82 of 103

There's 250,000 for sale on the book.

Maxo - 14 Dec 2011 11:38 - 83 of 103

Morning guys i found this on advfn this morning,may give us some coverage

BARCLAYS OIL AND GAS FOCUS

December 14th 2011

By Andrew Stannard

"CHRISTMAS CRACKERS"

The AIM market has suffered like its FTSE big brother an uncertain year

but there are many gems on offer for brave investors looking for

excellent returns this christmas and new year.The aim resources sector

looks seriously oversold and now looks poised for a good recovery.

I have identified four stocks that could show impressive near term

growth to help your xmas go with a bang !

Gulf Keystone Petroleum * ( GKP )

SacOil Holdings Plc * ( SAC )

Victoria Oil and Gas * ( VOG )

Desire Petroleum * ( DES )

Click for more details and Pdf *

BARCLAYS OIL AND GAS FOCUS

December 14th 2011

By Andrew Stannard

"CHRISTMAS CRACKERS"

The AIM market has suffered like its FTSE big brother an uncertain year

but there are many gems on offer for brave investors looking for

excellent returns this christmas and new year.The aim resources sector

looks seriously oversold and now looks poised for a good recovery.

I have identified four stocks that could show impressive near term

growth to help your xmas go with a bang !

Gulf Keystone Petroleum * ( GKP )

SacOil Holdings Plc * ( SAC )

Victoria Oil and Gas * ( VOG )

Desire Petroleum * ( DES )

Click for more details and Pdf *

davyboy - 14 Dec 2011 12:24 - 84 of 103

maxo good find,where did you get that from ??

Maxo - 14 Dec 2011 12:51 - 85 of 103

davyboy it was on advfn gkp board,am also a small gkp holder

Anders

- 14 Dec 2011 13:38

- 86 of 103

- 14 Dec 2011 13:38

- 86 of 103

Thanks maxo :-)

davyboy - 14 Dec 2011 14:15 - 87 of 103

Cheers for that maxo.

Maxo - 14 Dec 2011 15:09 - 88 of 103

Nice to see barclays cast an eye over sacoil guys !

davyboy - 14 Dec 2011 15:32 - 89 of 103

From a recent report :-)

The deal with Total could ultimately be worth US$300 million to SacOil, which will receive US$61.5 million staged over the next five years, of which US$7.5 million has already been paid.

It also leaves the company with a 12.5 per cent interest ( free carry ) in the licence.

As important, the group receives a free carry on all the exploration work right up to the final investment decision phase in other words the point at which it is decided whether Block III is commercially viable and bank debt financeable.

In Nigeria sacoil has stakes in licences OPL 233 and 281, which have already seen oil discoveries and where there is obvious scope to add value by turning a contingent resource into reserves.,there does seem scope for a substantial increase in reserves at OPL 233 with consultants TRACS identifying more than 100 feet of net oil and given that this block lies adjacent to the 600 million barrels plus Apoi field, Green points out.

Good seismic here together with this well data could allow a significant resource to be proved up by the end of 2012.

Two wells already exist on OPL 281 as well as good seismic data, which points to one large field that may potentially contain close on 100 million barrels.

All that could be confirmed by future appraisal drilling which looks set to begin in April or May 2013, the GECR analyst adds.

In the DRC SacOil owns a 3,177 kilometre licence area known simply Block III.

It is in the Albetine Graben, the source of Tullow Oils (LON:TLW) Kingfisher and Giraffe-Buffalo discoveries over the border in Uganda.

To date the real excitement in this region has been on the Ugandan side of the border where discoveries have produced well flow rates anywhere from 350 to 13,000 barrels of oil a day, Green says.

In this region discoveries made to date add up to over 800 million barrels of P50 contingent Resources and these have come from two distinct types of oil plays which are either escarpment/near-shore plays such as Kingfisher or Victoria Nile Delta plays, which includes the biggest find so far at Giraffe-Buffalo.

The deal with Total could ultimately be worth US$300 million to SacOil, which will receive US$61.5 million staged over the next five years, of which US$7.5 million has already been paid.

It also leaves the company with a 12.5 per cent interest ( free carry ) in the licence.

As important, the group receives a free carry on all the exploration work right up to the final investment decision phase in other words the point at which it is decided whether Block III is commercially viable and bank debt financeable.

In Nigeria sacoil has stakes in licences OPL 233 and 281, which have already seen oil discoveries and where there is obvious scope to add value by turning a contingent resource into reserves.,there does seem scope for a substantial increase in reserves at OPL 233 with consultants TRACS identifying more than 100 feet of net oil and given that this block lies adjacent to the 600 million barrels plus Apoi field, Green points out.

Good seismic here together with this well data could allow a significant resource to be proved up by the end of 2012.

Two wells already exist on OPL 281 as well as good seismic data, which points to one large field that may potentially contain close on 100 million barrels.

All that could be confirmed by future appraisal drilling which looks set to begin in April or May 2013, the GECR analyst adds.

In the DRC SacOil owns a 3,177 kilometre licence area known simply Block III.

It is in the Albetine Graben, the source of Tullow Oils (LON:TLW) Kingfisher and Giraffe-Buffalo discoveries over the border in Uganda.

To date the real excitement in this region has been on the Ugandan side of the border where discoveries have produced well flow rates anywhere from 350 to 13,000 barrels of oil a day, Green says.

In this region discoveries made to date add up to over 800 million barrels of P50 contingent Resources and these have come from two distinct types of oil plays which are either escarpment/near-shore plays such as Kingfisher or Victoria Nile Delta plays, which includes the biggest find so far at Giraffe-Buffalo.

Anders

- 14 Dec 2011 16:08

- 90 of 103

- 14 Dec 2011 16:08

- 90 of 103

davy, i think both of the nigerian blocks could net sacoil some superb returns and

they got these at a huge discount :-) the niger delta has been muted as the worlds

richest oil zones.

they got these at a huge discount :-) the niger delta has been muted as the worlds

richest oil zones.

davyboy - 14 Dec 2011 17:23 - 91 of 103

anders, sacoil already have two highly prospective blocks in nigeria and they also

have an agreement in place with EER on future projects,EER seem to be very very

well connected in a number of african countries so watch this space as the assets

grow.

have an agreement in place with EER on future projects,EER seem to be very very

well connected in a number of african countries so watch this space as the assets

grow.

Maxo - 14 Dec 2011 19:12 - 92 of 103

Nigeria Blocks Info ( OPL 281 & OPL 233 )

OPL 281 (formerly OML44) is located in the onshore swamp within the prolific area of the western Niger delta, south of OML 42, which has giant fields such as Odidi, Egwa & Jones creek. Two discovery wells have been drilled in OPL281: Ekoro- 1 in 1967 and Obote 1 in 1970. Ekoro 1 well encountered hydrocarbons in 8 intervals between 8260 ft and 10761 ft while Obote 1 well encountered 4 hydrocarbon bearing intervals between 8720 ft and 12350 ft respectively.

The block was awarded to Transcorp in 2006 as part of a Mini Bid Round. Transcorp, EER and SacOil entered into JV agreement in 2011 where EER will be Technical Operator of the asset on behalf of the JV.