| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

Petroneft Resources - Arctic Tiger starting to ROAR (PTR)

Mikel 4 - 23 Dec 2012 11:07

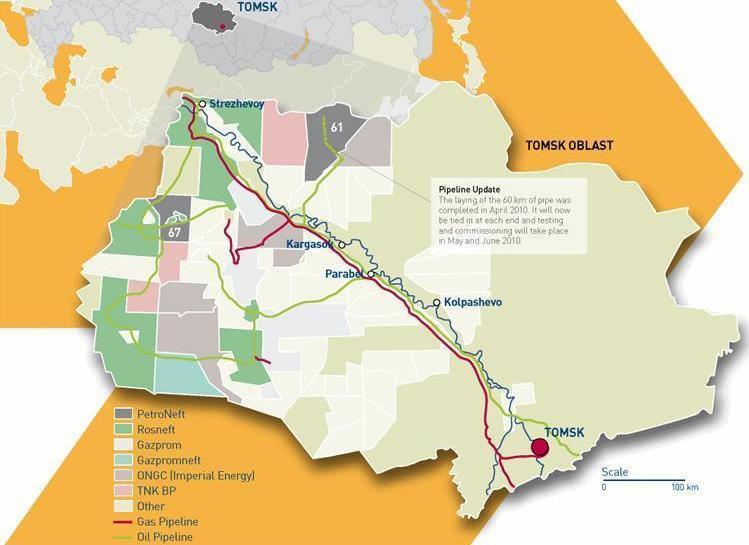

PetroNeft Resources Public Limited Company is a public company registered in Ireland (Company number 408101). Its registered office address is PetroNeft Resources plc, 20 Holles Street, Dublin 2, Ireland. The Company was established to develop oil assets in the Tomsk Oblast in Western Siberia and was admitted to the London AIM and Dublin ESM Markets on 27th September 2006.

The main assets of the Company are a 100% interest in a 4,991 km2 oil and gas licence (Licence 61) in the Tomsk Oblast in Russia, held through its wholly owned Russian subsidiary, Stimul-T and a 50% operating interest in a 2,447 km2 oil and gas licence (Licence 67) also located in the Tomsk Oblast. Both licences are located in the prolific Western Siberian Oil and Gas Basin. Licence 61 contains seven known oil fields, Lineynoye, Tungolskoye, West Lineynoye, Kondrashevskoye, Arbuzovskoye, Sibkrayevskoye and North Varyakhskoye and over 25 Prospects and Leads that are currently being explored. Licence 67 contains the Ledovoye and Cheremshanskoye oil fields and numerous prospects and leads.

News

http://petroneft.com/news/2012/

Mikel 4 - 23 Dec 2012 11:18 - 2 of 50

RNS Number : 7420T

Petroneft Resources PLC

18 December 2012

PetroNeft Resources plc (AIM: PTR) owner and operator of Licences 61 and 67, Tomsk Oblast, Russian Federation, is pleased to provide an update on its operations at Licence 61.

Highlights:

·Arbuzovskoye well 111 successfully completed and put into production

·Initial oil flow rate of 150 bopd

·No water production associated with the well

·Well 112 currently drilling ahead targeting highest flow eastern side of field

·Total production running at 2,800 bopd with 3 producing wells off line for remedial work on pumps

Licence 61 - Arbuzovskoye Pilot Development Programme

Arbuzovskoye well 111, the fourth of ten planned new production wells on the Arbuzovskoye oil field, has been successfully completed and brought into production at an initial rate of 150 bopd with no visible water cut.

Arbuzovskoye well 112, the next well in the drilling sequence, is currently drilling ahead. This well is located on the eastern side of the field where, to date, we have experienced higher flow rates. Overall, the average production rate for the first four wells in the programme continues to exceed initial targets.

Arbuzovskoye contains 2P reserves in excess of 13 million barrels of oil according to independent reserve auditors Ryder Scott and is the Company's second production development.

Licence 61 - Production

Total oil production, comprising both the Lineynoye and Arbuzovskoye oil fields is currently 2,800 bopd up from 2,500 bopd in late November. The rate is reduced due to 3 wells at the Lineynoye oil field being currently off-line while remedial work is carried out on the down-hole pumps. The Company had expected these wells to be back online before the year end however the weather conditions at the field continue to be extremely cold (as low as -47⁰C) which has slowed the workover and completion process. They are expected to be back online by mid-January 2013.

Dennis Francis, Chief Executive Officer of PetroNeft Resources plc, commented:

"We are pleased with the initial flow rate on well 111 and the fact that there is no water production associated with the well. We continue to expand our understanding of the field and are now drilling well 112 on the eastern side of the field where we have seen the highest flow rates to date. The operational challenges and variation in results are as expected. We look forward to completing further wells in Arbuzovskoye over the coming months as we continue to focus on materially increasing our production profile and cash flows."

Petroneft Resources PLC

18 December 2012

PetroNeft Resources plc (AIM: PTR) owner and operator of Licences 61 and 67, Tomsk Oblast, Russian Federation, is pleased to provide an update on its operations at Licence 61.

Highlights:

·Arbuzovskoye well 111 successfully completed and put into production

·Initial oil flow rate of 150 bopd

·No water production associated with the well

·Well 112 currently drilling ahead targeting highest flow eastern side of field

·Total production running at 2,800 bopd with 3 producing wells off line for remedial work on pumps

Licence 61 - Arbuzovskoye Pilot Development Programme

Arbuzovskoye well 111, the fourth of ten planned new production wells on the Arbuzovskoye oil field, has been successfully completed and brought into production at an initial rate of 150 bopd with no visible water cut.

Arbuzovskoye well 112, the next well in the drilling sequence, is currently drilling ahead. This well is located on the eastern side of the field where, to date, we have experienced higher flow rates. Overall, the average production rate for the first four wells in the programme continues to exceed initial targets.

Arbuzovskoye contains 2P reserves in excess of 13 million barrels of oil according to independent reserve auditors Ryder Scott and is the Company's second production development.

Licence 61 - Production

Total oil production, comprising both the Lineynoye and Arbuzovskoye oil fields is currently 2,800 bopd up from 2,500 bopd in late November. The rate is reduced due to 3 wells at the Lineynoye oil field being currently off-line while remedial work is carried out on the down-hole pumps. The Company had expected these wells to be back online before the year end however the weather conditions at the field continue to be extremely cold (as low as -47⁰C) which has slowed the workover and completion process. They are expected to be back online by mid-January 2013.

Dennis Francis, Chief Executive Officer of PetroNeft Resources plc, commented:

"We are pleased with the initial flow rate on well 111 and the fact that there is no water production associated with the well. We continue to expand our understanding of the field and are now drilling well 112 on the eastern side of the field where we have seen the highest flow rates to date. The operational challenges and variation in results are as expected. We look forward to completing further wells in Arbuzovskoye over the coming months as we continue to focus on materially increasing our production profile and cash flows."

Mikel 4 - 25 Dec 2012 12:37 - 3 of 50

HAPPY XMAS TO ALL PTR HOLDERS :-)

Newsflow expected by mid jan is result of WELL-112* situated in the high flow zones

and also the three wells taken offline to replace down hole pumps back online.

Possible that another 700-800 bopd will be added to the current 2800 bopd.

Newsflow expected by mid jan is result of WELL-112* situated in the high flow zones

and also the three wells taken offline to replace down hole pumps back online.

Possible that another 700-800 bopd will be added to the current 2800 bopd.

Jazz T - 28 Dec 2012 13:18 - 4 of 50

PTR look a very good punt for 2013

Jazz T - 24 Jan 2013 14:45 - 5 of 50

Two buys of 2m shares today for £118k each

Update is on way ?

Update is on way ?

Square Miler - 24 Jan 2013 16:41 - 6 of 50

Nearly £250k in just two trades here today,i may have to take another look at this!

Mikel 4 - 25 Jan 2013 11:40 - 7 of 50

PTR should be updating next week on well 112 and the three well repairs,i predict a very nice bounce coming here.

Jazz T - 25 Jan 2013 14:35 - 8 of 50

mikel

Looking at the time schedules on the last 4 or 5 wells if it follows the same pattern they should RNS by wednesday next week.Grabbed a few more today :-)

Looking at the time schedules on the last 4 or 5 wells if it follows the same pattern they should RNS by wednesday next week.Grabbed a few more today :-)

Mikel 4 - 26 Jan 2013 13:41 - 9 of 50

jazz i think they will put an update out this week coming and should cover the

latest drill at well 112 and also the three remedial repairs on the wells taken

offline before xmas.

Around 3250 bopd would be nice!

latest drill at well 112 and also the three remedial repairs on the wells taken

offline before xmas.

Around 3250 bopd would be nice!

Jazz T - 27 Jan 2013 21:25 - 10 of 50

Article on stockopedia today mikel

Petroneft Resources Plc - Now Looking an attractive Investment ?

Sunday, Jan 27 2013

Petroneft have had mixed fortunes over the last few years but there are signs that the company are back on track and are now trading at attractive multiples to new investors.2012 proved to be a good year for the company in terms of putting the groundwork in on its key assets in Siberia and are now steadily stepping out production, which was stated in the last company update on the 18th december 2012 as being 2800 Bopd * .

Petronefts key assets are located in the Russian state of Siberia and comprise of Licence 61 and Licence 67 both of which have large booked reserves,and also hefty contingent resources which the company are starting to exploit.Internal company estimates suggest that each of their operated fields could contain many many multiples of the current booked reserves data. Petroneft also have an advantage in terms as operator and enjoy a relative low cost per well development platform.

The key factor that makes Petroneft an attractive investment right now is the company,s ability to self fund its own development plans whilst also paying down its modest debt position.Alongside an anticipated major reserves upgrade once the next few wells have been put on production.

The company are currently drilling / testing Well No 112 at its Arbuzovskoye field, following on from a solid run of successes on the acreage where production output has been steadily growing. Results are now due from Well 112 which is located on the highest flow eastern side of field alongside news of the three producing wells taken offline at the end of last year for remedial work on pumps, and are due back online before the end of january.

Well 112 is the fifth development well on the field with a further five wells planned and funded for through 2013,and the company are targetting a steady daily ouput of 5000 barrels or more during the course of the next 12 - 16 months.

RNS - 18 December 2012

Dennis Francis, Chief Executive Officer of PetroNeft Resources plc, commented:

"We are pleased with the initial flow rate on well 111 and the fact that there is no water production associated with the well. We continue to expand our understanding of the field and are now drilling well 112 on the eastern side of the field where we have seen the highest flow rates to date. The operational challenges and variation in results are as expected. We look forward to completing further wells in Arbuzovskoye over the coming months as we continue to focus on materially increasing our production profile and cash flows."

Petroneft Resources Plc - Now Looking an attractive Investment ?

Sunday, Jan 27 2013

Petroneft have had mixed fortunes over the last few years but there are signs that the company are back on track and are now trading at attractive multiples to new investors.2012 proved to be a good year for the company in terms of putting the groundwork in on its key assets in Siberia and are now steadily stepping out production, which was stated in the last company update on the 18th december 2012 as being 2800 Bopd * .

Petronefts key assets are located in the Russian state of Siberia and comprise of Licence 61 and Licence 67 both of which have large booked reserves,and also hefty contingent resources which the company are starting to exploit.Internal company estimates suggest that each of their operated fields could contain many many multiples of the current booked reserves data. Petroneft also have an advantage in terms as operator and enjoy a relative low cost per well development platform.

The key factor that makes Petroneft an attractive investment right now is the company,s ability to self fund its own development plans whilst also paying down its modest debt position.Alongside an anticipated major reserves upgrade once the next few wells have been put on production.

The company are currently drilling / testing Well No 112 at its Arbuzovskoye field, following on from a solid run of successes on the acreage where production output has been steadily growing. Results are now due from Well 112 which is located on the highest flow eastern side of field alongside news of the three producing wells taken offline at the end of last year for remedial work on pumps, and are due back online before the end of january.

Well 112 is the fifth development well on the field with a further five wells planned and funded for through 2013,and the company are targetting a steady daily ouput of 5000 barrels or more during the course of the next 12 - 16 months.

RNS - 18 December 2012

Dennis Francis, Chief Executive Officer of PetroNeft Resources plc, commented:

"We are pleased with the initial flow rate on well 111 and the fact that there is no water production associated with the well. We continue to expand our understanding of the field and are now drilling well 112 on the eastern side of the field where we have seen the highest flow rates to date. The operational challenges and variation in results are as expected. We look forward to completing further wells in Arbuzovskoye over the coming months as we continue to focus on materially increasing our production profile and cash flows."

Mikel 4 - 28 Jan 2013 07:59 - 11 of 50

jazz T,

Has been a while since ptr had any media coverage and news on well 112 is now due :-)Lots of positive stuff going on at petroneft at moment for sure.

Has been a while since ptr had any media coverage and news on well 112 is now due :-)Lots of positive stuff going on at petroneft at moment for sure.

Jazz T - 28 Jan 2013 18:42 - 12 of 50

Another day goes by and one day closer to news,i am expecting a very tidy bounce up

when they update on well 112 and the three remedial well repairs.

20p on the cards this year IMVHO

Mikel, i thought that was a great article on PTR

when they update on well 112 and the three remedial well repairs.

20p on the cards this year IMVHO

Mikel, i thought that was a great article on PTR

Mikel 4 - 29 Jan 2013 12:36 - 13 of 50

jazz T there has been a marked increase in volume here today and have a hunch an Rns is coming.Keep an eye on the newswires!

Jazz T - 29 Jan 2013 22:24 - 14 of 50

mikel,yes i just been looking through trade data and also noticed a series of

big buys again all round the same price.Been going on for a few weeks now

and im starting to think something very big is going on behind the scenes.

big buys again all round the same price.Been going on for a few weeks now

and im starting to think something very big is going on behind the scenes.

Jazz T - 30 Jan 2013 11:39 - 15 of 50

More lively volume today,must be some whiff of that news due ?

Mikel 4 - 30 Jan 2013 21:17 - 16 of 50

jazz,i have a feeling that things will be hotting up here very soon,have been reading up further today and think not only a production update is due but also some corporate news on a farm out.Will be watching the newswires for sure.

Square Miler - 31 Jan 2013 10:03 - 17 of 50

mikel / jazz

I think they may put an Rns out shortly in form of production update and could be

positive going by recent success on the field.Davy made some interesting comments

after the last one.

http://www.davy.ie/LR?id=7514

Petroneft (PTR LN)

Update reports 150 b/d from latest well on Arbuzovskoye Field

18 December 2012

FACTS: Petroneft has reported that well 111, completed on the Arbuzovskoye field in Licence 61, has flowed with an initial production rate of 150 b/d with no water production. Well 112, the fifth development well on the field, has commenced. Total production from the licence is now 2,800 b/d. The operations are located in the Tomsk region in western Siberia.

ANALYSIS: The flow rate from well 111 is comfortably within the level required to meet the production targets set by the Group. Field production rates of 2,800 b/d do not include three wells on the Linenoye Field which are currently offline. Bringing these wells back on line was planned to be achieved before the year-end, but particularly inclement weather has held back workovers and pump replacement. These three wells are likely to account for in the order of 150 b/d of production, suggesting that Licence 61 capacity is now close to 3,000 b/d. The reported level of 2,800 b/d compares to 2,500 b/d output in late November, the last update.

The next well in the programme is now underway. Well 112 is located in the productive eastern part of the field (between wells 101 and 102) and will be the fifth development well on the field.

DAVY VIEW: Today's news is positive for Petroneft. Following the recent funding, the group’s priority is now to steadily build out production. This funding allowed material inroads into group debt to be made ($7.5m was repaid) and put in a re-scheduled repayment plan. So far, the combined well results are in line with requirements and expectations to meet this programme. More generally, the build out of production indicates that the underlying business plan for Petroneft's Licence 61 is back on track. We value the group at 23p per share.

I think they may put an Rns out shortly in form of production update and could be

positive going by recent success on the field.Davy made some interesting comments

after the last one.

http://www.davy.ie/LR?id=7514

Petroneft (PTR LN)

Update reports 150 b/d from latest well on Arbuzovskoye Field

18 December 2012

FACTS: Petroneft has reported that well 111, completed on the Arbuzovskoye field in Licence 61, has flowed with an initial production rate of 150 b/d with no water production. Well 112, the fifth development well on the field, has commenced. Total production from the licence is now 2,800 b/d. The operations are located in the Tomsk region in western Siberia.

ANALYSIS: The flow rate from well 111 is comfortably within the level required to meet the production targets set by the Group. Field production rates of 2,800 b/d do not include three wells on the Linenoye Field which are currently offline. Bringing these wells back on line was planned to be achieved before the year-end, but particularly inclement weather has held back workovers and pump replacement. These three wells are likely to account for in the order of 150 b/d of production, suggesting that Licence 61 capacity is now close to 3,000 b/d. The reported level of 2,800 b/d compares to 2,500 b/d output in late November, the last update.

The next well in the programme is now underway. Well 112 is located in the productive eastern part of the field (between wells 101 and 102) and will be the fifth development well on the field.

DAVY VIEW: Today's news is positive for Petroneft. Following the recent funding, the group’s priority is now to steadily build out production. This funding allowed material inroads into group debt to be made ($7.5m was repaid) and put in a re-scheduled repayment plan. So far, the combined well results are in line with requirements and expectations to meet this programme. More generally, the build out of production indicates that the underlying business plan for Petroneft's Licence 61 is back on track. We value the group at 23p per share.

Mikel 4 - 01 Feb 2013 00:43 - 18 of 50

square miler,there is certainly a exciting period of newsflow upon us !

Jazz T - 01 Feb 2013 10:47 - 19 of 50

A mention in small cap news today

http://www.smallcapnews.co.uk/2013/02/wells-to-watch-in-february-2/

PetroNeft Resources (LON:PTR) should update shareholders on the 112 well on the Arbuzovskoe Field in Tomsk Oblast, Russian Federation. The well is located on the eastern side of the field where, to date, PetroNeft has experienced higher flow rates. Investors will also be keen to hear if three wells that have been offline for remedial works to pumps have been put back into production.

http://www.smallcapnews.co.uk/2013/02/wells-to-watch-in-february-2/

PetroNeft Resources (LON:PTR) should update shareholders on the 112 well on the Arbuzovskoe Field in Tomsk Oblast, Russian Federation. The well is located on the eastern side of the field where, to date, PetroNeft has experienced higher flow rates. Investors will also be keen to hear if three wells that have been offline for remedial works to pumps have been put back into production.

Mikel 4 - 01 Feb 2013 11:59 - 20 of 50

Thanks jazz and good find

An exciting month ahead here with multiple news due

An exciting month ahead here with multiple news due

davyboy - 02 Feb 2013 09:37 - 21 of 50

Hi guys i put a nice chunk of these in my SIPP friday :-}

Mikel 4 - 03 Feb 2013 13:11 - 22 of 50

Hello davyboy that may just be a wise move.

davyboy - 03 Feb 2013 22:03 - 23 of 50

hey mikel,i only have one other stock in my sipp among all i own and that is now

316% up since this time last year.I think this may do same if not better.

316% up since this time last year.I think this may do same if not better.

Jazz T - 04 Feb 2013 13:54 - 24 of 50

More loading up today by someone!

Mikel 4 - 04 Feb 2013 20:59 - 25 of 50

hello davyboy,i have a target price here of 20p - 25p which could come this year IMO

Jazz T - 05 Feb 2013 12:04 - 26 of 50

a couple of very chunky buys this morning!

Square Miler - 05 Feb 2013 20:08 - 27 of 50

More stock for me today here,something about to kick off here i feel.

DYOR

DYOR

Mikel 4 - 06 Feb 2013 14:24 - 28 of 50

There are rumours on various bb,s that ROMAN ABRAMOVICH could be taking over

petroneft,not really sure what to make of it except i remember roman was interviewed

on i think business news europe before xmas and he said he was looking for O&G assets

in siberia.Might sound wild but ptr would be a super buy for someone with cash and

connections like him.

Watch this space,if true this will go into orbit.

petroneft,not really sure what to make of it except i remember roman was interviewed

on i think business news europe before xmas and he said he was looking for O&G assets

in siberia.Might sound wild but ptr would be a super buy for someone with cash and

connections like him.

Watch this space,if true this will go into orbit.

halifax - 06 Feb 2013 14:27 - 29 of 50

Great story, keep up the great ramping, some lemmings may buy it!

Jazz T - 06 Feb 2013 15:44 - 30 of 50

oh another pearl of wisdom from the halifax kid lol

I see you ramping all sorts of no hopers on here and you call a company producing

2800 bopd fit for lemmings,where is my filter!

I see you ramping all sorts of no hopers on here and you call a company producing

2800 bopd fit for lemmings,where is my filter!

davyboy - 06 Feb 2013 19:42 - 31 of 50

jazz halifax is a well known troll on here so put firmly on IGNORE

It works a treat !

It works a treat !

Jazz T - 06 Feb 2013 21:52 - 32 of 50

davy i feel that could be sound advice,there is one born every minute it seems!

Square Miler - 07 Feb 2013 10:55 - 33 of 50

I expect the next production update during the next ten days jazz

Mikel 4 - 07 Feb 2013 22:21 - 34 of 50

WELLS TO WATCH IN FEBRUARY

http://www.smallcapnews.co.uk/2013/02/wells-to-watch-in-february-2/

PetroNeft Resources (LON:PTR) should update shareholders on the 112 well on the Arbuzovskoe Field in Tomsk Oblast, Russian Federation. The well is located on the eastern side of the field where, to date, PetroNeft has experienced higher flow rates. Investors will also be keen to hear if three wells that have been offline for remedial works to pumps have been put back into production.

http://www.smallcapnews.co.uk/2013/02/wells-to-watch-in-february-2/

PetroNeft Resources (LON:PTR) should update shareholders on the 112 well on the Arbuzovskoe Field in Tomsk Oblast, Russian Federation. The well is located on the eastern side of the field where, to date, PetroNeft has experienced higher flow rates. Investors will also be keen to hear if three wells that have been offline for remedial works to pumps have been put back into production.

halifax - 08 Feb 2013 09:15 - 35 of 50

RNS sp down 20% .......enough said?

Mikel 4 - 08 Feb 2013 13:03 - 36 of 50

halifax lol

Take a closer look,they have just had their fifth straight success on a new field and

according to company all above expectation.They have been unlucky with some very

cold weather locally lately thats all and if you check through the stats you will see

that when all the current wells offline for repair ate back online and added to the new

wells they will be at their highest ever total production level.

As the mm,s were so kind to lower the sp today i actually bought another 500k and

will take a few more later,watch this move up over next week or two.My target this

year is over 20p on this and think i will get it.

Take a closer look,they have just had their fifth straight success on a new field and

according to company all above expectation.They have been unlucky with some very

cold weather locally lately thats all and if you check through the stats you will see

that when all the current wells offline for repair ate back online and added to the new

wells they will be at their highest ever total production level.

As the mm,s were so kind to lower the sp today i actually bought another 500k and

will take a few more later,watch this move up over next week or two.My target this

year is over 20p on this and think i will get it.

halifax - 08 Feb 2013 13:10 - 37 of 50

Mikel, bon chance.

Mikel 4 - 08 Feb 2013 14:52 - 38 of 50

halifax if that was french for good chance you are astute,not many companies with

a near 1m barrel per year production level and huge reserves trading at these levels.

Bon Luck!

a near 1m barrel per year production level and huge reserves trading at these levels.

Bon Luck!

Jazz T - 09 Feb 2013 09:50 - 39 of 50

Mikel,i took another huge chunk of these yesterday and here is why!

Was just looking through the latest news item,another well success which flowed at

140 bopd so now that is five wells at Arbuzovskoye and five successes.Adding these

up it now amounts to over 1500 bopd at the half way stage and actually double the

original expectation of 150 bopd per well x 5 which would have been only 750 bopd by

now.

They have taken a few of those wells offline for maintenance and pressure testing

which i think was scheduled anyway at half way stage.But in effect they have now

increased production to 3000 bopd from 2800 bopd in last update when they put

the wells back online. And it actually could be more like 3200 bopd because there

are some wells at the other licence 67 which were taken offline for pump repairs at

end of 2012 which should be back on shortly.

I would also add when you consider they have just been working in the few coldest

months in siberia it must now give them a head start on this years program to be at

this point,and with weather now turning in their favour i would be amazed if they are

not at 3200 bopd or over in the next update.They are also drilling ahead on the next

well at Arbuzovskoye.

Was just looking through the latest news item,another well success which flowed at

140 bopd so now that is five wells at Arbuzovskoye and five successes.Adding these

up it now amounts to over 1500 bopd at the half way stage and actually double the

original expectation of 150 bopd per well x 5 which would have been only 750 bopd by

now.

They have taken a few of those wells offline for maintenance and pressure testing

which i think was scheduled anyway at half way stage.But in effect they have now

increased production to 3000 bopd from 2800 bopd in last update when they put

the wells back online. And it actually could be more like 3200 bopd because there

are some wells at the other licence 67 which were taken offline for pump repairs at

end of 2012 which should be back on shortly.

I would also add when you consider they have just been working in the few coldest

months in siberia it must now give them a head start on this years program to be at

this point,and with weather now turning in their favour i would be amazed if they are

not at 3200 bopd or over in the next update.They are also drilling ahead on the next

well at Arbuzovskoye.

Mikel 4 - 09 Feb 2013 18:46 - 40 of 50

jazz i totally agree it was a crazy reaction to what is bloody good news,and as you rightly point out they could actually be at 3200 bopd in a week or two with all the wells online.I might grab even more monday :-)

Square Miler - 10 Feb 2013 10:06 - 41 of 50

jazz & mikel, interesting posts chaps and i agree with you,there was a post over on Lse that i paste below

as its very much my angle on this too.

From Lse :

"That is exactly the point :-) not only are they producing but they have doubled their production output over the last year and all of this has come from their 100% licence 61,so this additional 1500+ bopd is effectively worth 3000 bopd if it were on their other licence where they are 50% with Arawak ( VITOL ).And as per my previous post they are only half way through the funded program at Arb but already slightly over what they were expecting over the whole ten well program. Five drills and five straight hits all flowing under natural pressure tells me they have a very healthy bearing zone at arb and dont forget this is one of their smaller fields (they have some huge fields yet to get going ).

The news they put out friday said in basic terms that they are now at 3000 bopd or over,but we wont be there for a few weeks while we carry out some repairs,and they also have a number of wells at licence 67 due back online anytime now after pump repairs that will add a further 200 bopd. The latest well is now drilling ahead at 61 so there is a good chance that by the time that reports they will be at 3200 bopd anyway PLUS whatever the new well delivers. A rare opportunity to get in on something significantly undervalued (they also have huge P2 reserves valued at just 60 cents per barrel )."

as its very much my angle on this too.

From Lse :

"That is exactly the point :-) not only are they producing but they have doubled their production output over the last year and all of this has come from their 100% licence 61,so this additional 1500+ bopd is effectively worth 3000 bopd if it were on their other licence where they are 50% with Arawak ( VITOL ).And as per my previous post they are only half way through the funded program at Arb but already slightly over what they were expecting over the whole ten well program. Five drills and five straight hits all flowing under natural pressure tells me they have a very healthy bearing zone at arb and dont forget this is one of their smaller fields (they have some huge fields yet to get going ).

The news they put out friday said in basic terms that they are now at 3000 bopd or over,but we wont be there for a few weeks while we carry out some repairs,and they also have a number of wells at licence 67 due back online anytime now after pump repairs that will add a further 200 bopd. The latest well is now drilling ahead at 61 so there is a good chance that by the time that reports they will be at 3200 bopd anyway PLUS whatever the new well delivers. A rare opportunity to get in on something significantly undervalued (they also have huge P2 reserves valued at just 60 cents per barrel )."

ontheturn - 28 Aug 2013 16:12 - 42 of 50

time to take a look at the stock,

on the move up, large volume than lately and looks ready to break the important 3p

on the move up, large volume than lately and looks ready to break the important 3p

ontheturn - 29 Aug 2013 12:50 - 43 of 50

Another rise today, but some profit taking has been taking place by the amount of volume on the trades

ontheturn - 11 Sep 2013 16:46 - 44 of 50

Retracement done today was on the move up with some larger trades

ontheturn - 12 Sep 2013 12:13 - 45 of 50

3.45p +0.20p

The bounce after retracement goes on today on higher volume once again

Looking at the chart, clearly show rising with volume and dropping with hardly any volume

The bounce after retracement goes on today on higher volume once again

Looking at the chart, clearly show rising with volume and dropping with hardly any volume

ontheturn - 12 Sep 2013 16:00 - 46 of 50

The Arctic Tiger starting to roar alright for the last couple days 3.60p at the moment, but was higher earlier

northerly1 - 12 Sep 2013 23:49 - 47 of 50

Following the bullish 11th September RNS this should see PTR recover back to previous higher levels from here if this can move above the 200ma at 4.15p

ontheturn - 13 Sep 2013 12:10 - 48 of 50

Yet another strong move up this morning now 4p with volume on hald day gone is already higher than yesterday

AliSob - 29 Sep 2013 21:04 - 49 of 50

According to the sources close to the company the undisclosed Asian oil and gas producer submitted the non-binding indicative offer to PetroNeft Resources plc (PTR:LI) regarding its willingness to acquire 50% equity shareholding in licence 61 (via a number of PetroNeft subsidiaries, Worldace Investments Ltd. and Stimul-T OOO). Licence 61 issued by the Government of Russia allows PetroNeft to explore the sub-soil area in Tomsk region of Russia. The Asian O&G company offered the full repayment of USD 14 million Macquarie loan (payable in 2014) and USD 30 million development Capex for Licence 61.

The announcement is fully in line with Dennis Francis (CEO of PetroNeft Resources plc) recent comments: "We have made good progress on the re-financing and farm-out fronts in the last month. We appreciate shareholders continued patience and support while these negotiations are completed. The successful completion of either of these objectives will enable us to recommence our drilling programme and return to building production."

Research analysts see the news as highly positive for PetroNeft as licence 61 farm-out is crucial not only for further development but also for the financial security of PetroNeft. The recent share price dynamics supports the positive shifts on PetroNeft's re-financing and licence 61 farm-out.

http://www.vedomosti.ru/companies/news/14353471/nenazvannaya-aziatskaya-neftegazovaya-kompaniya-zainteresovalas-petroneftyu..

The announcement is fully in line with Dennis Francis (CEO of PetroNeft Resources plc) recent comments: "We have made good progress on the re-financing and farm-out fronts in the last month. We appreciate shareholders continued patience and support while these negotiations are completed. The successful completion of either of these objectives will enable us to recommence our drilling programme and return to building production."

Research analysts see the news as highly positive for PetroNeft as licence 61 farm-out is crucial not only for further development but also for the financial security of PetroNeft. The recent share price dynamics supports the positive shifts on PetroNeft's re-financing and licence 61 farm-out.

http://www.vedomosti.ru/companies/news/14353471/nenazvannaya-aziatskaya-neftegazovaya-kompaniya-zainteresovalas-petroneftyu..