| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

AVOCET MINING PLC Charts and Discussion Thread (AVM)

Mr Ashley James

- 24 Jan 2003 09:22

- 24 Jan 2003 09:22

New Thread as requested by Wirral Owl.

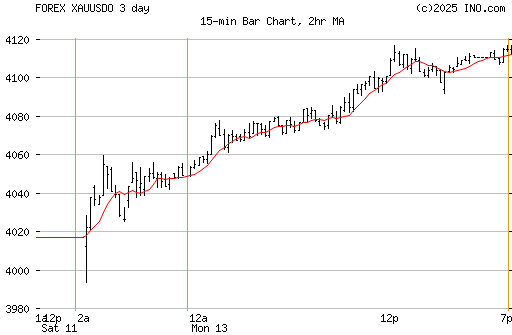

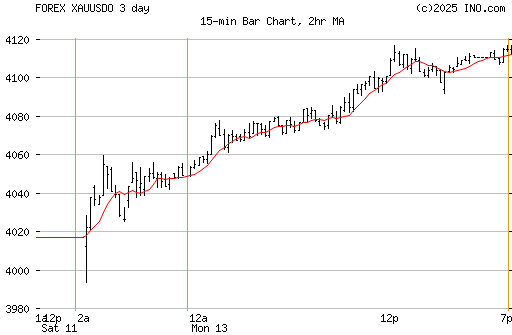

6 Months Chart:-

10 Day Chart:-

Cheers

Ash

6 Months Chart:-

10 Day Chart:-

Cheers

Ash

WirralOwl - 25 Jan 2003 12:32 - 2 of 194

Thanks Ashley.

AVM has ambitious targets to triple production over the next 3 years from cureent levels of around 120 000 ounces upto around 350,000 ounces/p.a.

Penjom in Malaysia produces 110,000 oz/p.a at current costs of around $212 an ounce - and falling.

North Lanut in Indonesia has an expected 15 year lifespan and is set to start production this year with 50,000+ oz/p.a at very low extraction costs of around $150 an ounce.

Jiiau - is expected to also produce 50,000 oz. a year, but costs are higher at $275.

With overall production costs anticipated to fall to around $208 an ounce, yet gold is continuing its rise, currently selling at $367oz, AVM is likely to be transformed from a small profit-making company, into a mid-tier gold producer, on an extremely low P.E. A re-rating may occur if the POG holds or continues to rise

A post pinched from Wallace Morris (thanks Wal, hope you don't mind!?) sums up the situation better than I could :

**********

Gold closed today at over $367oz. Using this figure as a basis, and other figures from company communications (reports, interviews, presentations), the following is a calculation of forecast earnings for Avocet:

PENJOM (110,000oz pa, forecast cash costs $150oz):

110,000 * (367-150) = $23.9 million operating profit pa.

JILAU (50,000oz pa, cash costs $275 oz):

50,000 * (367-280) = $4.5 million operating profit pa.

NORTH LANUT (forecast 50,000+ oz pa @ $150 oz):

50,000 * (367-150) = $10.9 million operating profit pa.

TOTAL FORECAST OPERATING PROFIT = $39.3 million a year.

From this operating profit, we need to subtract financing, exploration and other costs.

EXPLORATION:

Forecast @ $1 million pa.

FINANCING:

Current debt is more than covered by current assets.

Long-term credit is 6.8 million, or $11.3 million. This is repayable over the next 3 years or so, so allow payments of $5 million pa.

Capital expenditure to bring North Lanut into production is forecast at $10 million. Assume $3 million pa for the next 4 years as repayment schedule to cover financing of this.

OTHER:

At the interims they reported a hedged position of 80,000oz @ $298oz. This hedge expires in 2 years time. To liquidate it now would cost 80,000 * (367-298) = $5.5 million, or $2.8 million pa spread across 2 years.

OPERATING PROFIT $39.3 million

EXPLORATION ($1 million)

FINANCING ($8 million)

OTHER ($2.8 million)

FORECAST EARNINGS : $27.5 million per year.

This figure will increase as financing & hedging costs drop away. If gold rises further, so obviously will the earnings.

VALUATION:

A company with Avocet's growth profile should be valued at 15 to 20 times forecast earnings. However, adopting a cautious stance, we'll value them at 10 times forecast earnings.

10 * $27.5 million = $275 million = 168 million.

With 80 million shares in issue, this equates to 2.10 per share.

Wal'

*****

Assuming, as is often the case with Gold producers, we get the odd fly in the ointment - costs dont fall as much as expected, pog falls back, security issues in Tajikistan, etc. it still appears at the current price of 35.5p we have some way to go before AVM reaches fair value.

Cheers,

WirralOwl

AVM has ambitious targets to triple production over the next 3 years from cureent levels of around 120 000 ounces upto around 350,000 ounces/p.a.

Penjom in Malaysia produces 110,000 oz/p.a at current costs of around $212 an ounce - and falling.

North Lanut in Indonesia has an expected 15 year lifespan and is set to start production this year with 50,000+ oz/p.a at very low extraction costs of around $150 an ounce.

Jiiau - is expected to also produce 50,000 oz. a year, but costs are higher at $275.

With overall production costs anticipated to fall to around $208 an ounce, yet gold is continuing its rise, currently selling at $367oz, AVM is likely to be transformed from a small profit-making company, into a mid-tier gold producer, on an extremely low P.E. A re-rating may occur if the POG holds or continues to rise

A post pinched from Wallace Morris (thanks Wal, hope you don't mind!?) sums up the situation better than I could :

**********

Gold closed today at over $367oz. Using this figure as a basis, and other figures from company communications (reports, interviews, presentations), the following is a calculation of forecast earnings for Avocet:

PENJOM (110,000oz pa, forecast cash costs $150oz):

110,000 * (367-150) = $23.9 million operating profit pa.

JILAU (50,000oz pa, cash costs $275 oz):

50,000 * (367-280) = $4.5 million operating profit pa.

NORTH LANUT (forecast 50,000+ oz pa @ $150 oz):

50,000 * (367-150) = $10.9 million operating profit pa.

TOTAL FORECAST OPERATING PROFIT = $39.3 million a year.

From this operating profit, we need to subtract financing, exploration and other costs.

EXPLORATION:

Forecast @ $1 million pa.

FINANCING:

Current debt is more than covered by current assets.

Long-term credit is 6.8 million, or $11.3 million. This is repayable over the next 3 years or so, so allow payments of $5 million pa.

Capital expenditure to bring North Lanut into production is forecast at $10 million. Assume $3 million pa for the next 4 years as repayment schedule to cover financing of this.

OTHER:

At the interims they reported a hedged position of 80,000oz @ $298oz. This hedge expires in 2 years time. To liquidate it now would cost 80,000 * (367-298) = $5.5 million, or $2.8 million pa spread across 2 years.

OPERATING PROFIT $39.3 million

EXPLORATION ($1 million)

FINANCING ($8 million)

OTHER ($2.8 million)

FORECAST EARNINGS : $27.5 million per year.

This figure will increase as financing & hedging costs drop away. If gold rises further, so obviously will the earnings.

VALUATION:

A company with Avocet's growth profile should be valued at 15 to 20 times forecast earnings. However, adopting a cautious stance, we'll value them at 10 times forecast earnings.

10 * $27.5 million = $275 million = 168 million.

With 80 million shares in issue, this equates to 2.10 per share.

Wal'

*****

Assuming, as is often the case with Gold producers, we get the odd fly in the ointment - costs dont fall as much as expected, pog falls back, security issues in Tajikistan, etc. it still appears at the current price of 35.5p we have some way to go before AVM reaches fair value.

Cheers,

WirralOwl

goldfinger

- 27 Jan 2003 01:28

- 3 of 194

- 27 Jan 2003 01:28

- 3 of 194

WirralOwl, excelent posting above refering to fair value of 2.10 per share.

The number of share in issue used above. Is this figure correct?. This board on analysis seems to think there is around 65 million. Any thoughts?????

GF.

The number of share in issue used above. Is this figure correct?. This board on analysis seems to think there is around 65 million. Any thoughts?????

GF.

Andy

- 27 Jan 2003 01:36

- 4 of 194

- 27 Jan 2003 01:36

- 4 of 194

goldfinger,

your posting looks like Energyi on ADVFN!

Are you that person?

your posting looks like Energyi on ADVFN!

Are you that person?

goldfinger

- 27 Jan 2003 01:45

- 5 of 194

- 27 Jan 2003 01:45

- 5 of 194

Andy,no but tell energyi Ill flog him this name for 1,000.

GF

GF

goldfinger

- 27 Jan 2003 01:48

- 6 of 194

- 27 Jan 2003 01:48

- 6 of 194

Like I have said all along its not just down to war.

Date : January 27, 2003

The Great Bear Market In Gold Lasted So Long That Only The Old And Bold Remember The Last Bull Market.

“With age comes Wisdom”, or so one hopes. And with wisdom comes the realisation that things are never quite as they seem to be and the best way to analyse the future lies in a study of the past. This may appear as a bunch of truisms, but apply them to gold - its past and its possible future- and a few things fall into place. Why, for instance, do so many commentators glibly attribute the present revival of the gold price to the possibility of war in Iraq?

As a variant today the Financial Times Markets Report put it down to ‘speculative buying’. This was pinned on a comment from a Mr Jeffrey Christian of CPM Group suggesting that speculators were betting that people who sold the February Comex Futures contract would find it hard to buy the physical gold needed when this contract becomes deliverable on January 31st. Well it is a point, but it can hardly be held responsible for the fact that gold rose by nearly US$10/ounce last week and by US$5 the week before. It has now broken through a high point last reached in 1997. But just to show that the Pink’Un doesn’t give a toss for the gold story one way or the other, it is now going to be without a mining editor as Matthew Jones is moving to an editing job on world news there and no one is lined up to take his place.

On the same day the newspaper carried a piece saying that hedge fund managers have been switching out of falling equity markets and into commodities, particularly gold. John Reade, a precious metals analyst at UBS Warburg was quoted as saying that this switch in policy is confirmed by the fact that there are a record number of positions on the Comex gold contract in New York. He then went on to claim that there is a war premium of US$30 to US$50 in the present price of gold. It would be interesting to know his reasoning. Yes, there was a price spike at the time of the Kuwait war, but things were very different then . Equities were booming and the dollar was strong. Hardly the sort of conditions on which gold thrives.

Maybe the answer is that most of these commentators and analysts have never seen gold on a bull tack before. They have been brought up on a diet of paper currencies interspersed with assurances that gold has had its day. Looking back over the past 23 years to January 1980 when bullion topped out at US$800/oz, it has been in a basic bear market ever since with exception of a few spikes such as the one caused by the Washington Agreement on Central Bank sales. Traders and advisers in any market that maintains the same trend for such a period are bound to assume that it will last forever. Out of that grew the view that gold had had its day. When analyst Andy Smith of Mitsui Precious Metal changed to a bull last year it was easy to see that it caused him real pain as it went against the grain. Even now he finds it hard to maintain a bullish stance and has fallen back to talking in riddles.

Minews, somewhat intrusively, asked Mr Reade how old he was. The answer was 37. At the time gold entered its long bear market he was therefore still at school. How difficult must it be for him to analyse a market when things are happening that he has never experienced before. Minews can give him a good 25 years so maybe it is only those analysts and commentators now approaching their dotage who will be able to recall the times when gold and gold mining companies were an essential part of any well balanced portfolio. Ageism in reverse, perhaps. Equity analysts do not have the same problem as their bull and bear markets have a shorter time span. It is because of this that they are all starting to forecast a recovery as the market marks its entrance to a 4th year of dismal performance by falling for ten days on the trot.

To give a rational assessment of the gold market at the moment Minews has therefore asked James Picton to give us his views. James has been in the mining business as long as Mr Reade has been alive. He was first employed by Gencor in South Africa which transmogrified into Billiton and then joined the London Stock Exchange, being a partner in two leading firms as head of mining research. He then went back to South Africa where he continued to head mining research teams for several broking houses for nearly 20 years. During that time he won a number of awards – diamonds being his speciality – and spoke at conferences all around the world. Now he is back in London and readers of Minesite will get the benefit of his wisdom and age in this article on gold which will be published tomorrow. Hopefully some of the younger commentators and analysts will start to understand the real core of the argument that gold is very much here to stay. The crux of the matter is the dissolving dollar. Iraq, the equity market and technical positions on Comex are mere sideshows to the main event.

GF

Date : January 27, 2003

The Great Bear Market In Gold Lasted So Long That Only The Old And Bold Remember The Last Bull Market.

“With age comes Wisdom”, or so one hopes. And with wisdom comes the realisation that things are never quite as they seem to be and the best way to analyse the future lies in a study of the past. This may appear as a bunch of truisms, but apply them to gold - its past and its possible future- and a few things fall into place. Why, for instance, do so many commentators glibly attribute the present revival of the gold price to the possibility of war in Iraq?

As a variant today the Financial Times Markets Report put it down to ‘speculative buying’. This was pinned on a comment from a Mr Jeffrey Christian of CPM Group suggesting that speculators were betting that people who sold the February Comex Futures contract would find it hard to buy the physical gold needed when this contract becomes deliverable on January 31st. Well it is a point, but it can hardly be held responsible for the fact that gold rose by nearly US$10/ounce last week and by US$5 the week before. It has now broken through a high point last reached in 1997. But just to show that the Pink’Un doesn’t give a toss for the gold story one way or the other, it is now going to be without a mining editor as Matthew Jones is moving to an editing job on world news there and no one is lined up to take his place.

On the same day the newspaper carried a piece saying that hedge fund managers have been switching out of falling equity markets and into commodities, particularly gold. John Reade, a precious metals analyst at UBS Warburg was quoted as saying that this switch in policy is confirmed by the fact that there are a record number of positions on the Comex gold contract in New York. He then went on to claim that there is a war premium of US$30 to US$50 in the present price of gold. It would be interesting to know his reasoning. Yes, there was a price spike at the time of the Kuwait war, but things were very different then . Equities were booming and the dollar was strong. Hardly the sort of conditions on which gold thrives.

Maybe the answer is that most of these commentators and analysts have never seen gold on a bull tack before. They have been brought up on a diet of paper currencies interspersed with assurances that gold has had its day. Looking back over the past 23 years to January 1980 when bullion topped out at US$800/oz, it has been in a basic bear market ever since with exception of a few spikes such as the one caused by the Washington Agreement on Central Bank sales. Traders and advisers in any market that maintains the same trend for such a period are bound to assume that it will last forever. Out of that grew the view that gold had had its day. When analyst Andy Smith of Mitsui Precious Metal changed to a bull last year it was easy to see that it caused him real pain as it went against the grain. Even now he finds it hard to maintain a bullish stance and has fallen back to talking in riddles.

Minews, somewhat intrusively, asked Mr Reade how old he was. The answer was 37. At the time gold entered its long bear market he was therefore still at school. How difficult must it be for him to analyse a market when things are happening that he has never experienced before. Minews can give him a good 25 years so maybe it is only those analysts and commentators now approaching their dotage who will be able to recall the times when gold and gold mining companies were an essential part of any well balanced portfolio. Ageism in reverse, perhaps. Equity analysts do not have the same problem as their bull and bear markets have a shorter time span. It is because of this that they are all starting to forecast a recovery as the market marks its entrance to a 4th year of dismal performance by falling for ten days on the trot.

To give a rational assessment of the gold market at the moment Minews has therefore asked James Picton to give us his views. James has been in the mining business as long as Mr Reade has been alive. He was first employed by Gencor in South Africa which transmogrified into Billiton and then joined the London Stock Exchange, being a partner in two leading firms as head of mining research. He then went back to South Africa where he continued to head mining research teams for several broking houses for nearly 20 years. During that time he won a number of awards – diamonds being his speciality – and spoke at conferences all around the world. Now he is back in London and readers of Minesite will get the benefit of his wisdom and age in this article on gold which will be published tomorrow. Hopefully some of the younger commentators and analysts will start to understand the real core of the argument that gold is very much here to stay. The crux of the matter is the dissolving dollar. Iraq, the equity market and technical positions on Comex are mere sideshows to the main event.

GF

archinvest - 27 Jan 2003 10:11 - 7 of 194

smashed throuhg its 36 resistance level where it had lain in the recent past weeks. my fib calcs show the next leve of resistance to be at 42, some 17% higher followed by 49, 36% above level 36.

goldfinger

- 27 Jan 2003 11:02

- 8 of 194

- 27 Jan 2003 11:02

- 8 of 194

Latest update from the Boss of Avocet.

CEO of Avocet Mining explains company's position mining gold in Asia, an interview with The Wall Street Transcript

JOHN T. CATCHPOLE is the CEO of Avocet Mining PLC

TWST: It's often helpful to start off by giving a brief overview of the company. Could you give us a brief overview of Avocet Mining (LSE: AVM.L - news) (AVM.L)?

Mr. Catchpole: Avocet Mining is a UK company listed on AIM, the Alternative Investment Market in London. The company has been in existence since the early 1980's and was originally a Vancouver-based company before coming to the UK in 1996. Currently the company is very much focused on gold mining in Asia. It has 100% ownership over a gold mine in Malaysia, called Penjom, which has an annual gold production in excess of 100,000 ounces a year. It has been in production since 1996 and has been the company's main gold asset up to fairly recently. During this year we acquired an exploration property from Newmont Mining Corporation NEM - news) in Indonesia where we have completed a feasibility study with a view to develop a new gold mine by sometime next year. And most recently we have acquired the interests of a UK company in an operating gold mine in Tajikistan in central Asia. So altogether, on an annualized basis, our gold production will be increasing to 160-170,000 ounces with the addition of the Tajikistan mine and then a further 50-60,000 ounces from our project in Indonesia. Avocet has also historically been known as a tungsten producer but those assets were fully written off last year, and we really only have one residual operation left in the tungsten business -- a mine in Portugal under the name of Beralt. Back in September we signed a deal with a Canadian company to sell that business, which we expect to conclude in February, 2003, leaving us, as I say, exclusively in the gold business.

TWST: Turning to some of your specific mining projects such as Penjom in Malaysia and, is it the North Lanut project in Indonesia - would you walk us through some of the recent successes and problems?

Mr. Catchpole: In Penjom, one of the issues that came up over four years ago was that the mine encountered some very difficult metallurgical problems. The ore turned out to be carbonaceous and for the type of processing method that is employed this caused recoveries to drop from around normal levels of around 90% down to as low as 50%. So there was a real concern that the mine would not survive at all; in fact, at those low recovery levels, it would have been uneconomic to continue. However, we took a gamble and started developing our own process systems which, over a period of time, have greatly improved recoveries. We're now back up to recoveries that are in the range of 85% which we're quite proud of because it's all been done with our own technology -- engineered in-house and done at a reasonable capital cost. We've now had over a year's production without any of these problems so we know we have succeeded. Penjom's cash costs have been historically high over the last couple of years because we put a lot of money into pre-stripping waste rock from the open pit, which is really an investment towards lowering future mining costs. And we're now seeing the benefit. Our cash costs are reducing quite rapidly. Last year they were about $225 an ounce. This year they'll be closer to $200 and for the life of existing reserves they should be about $150 an ounce. So our view on Penjom is that it's now very much a proven and sustainable operation - technical problems have now all been resolved and it should be a very strong source of cash flow to the company. North Lanut is represented right now by one main gold deposit that was discovered by Newmont in North Sulawesi. It's a mature exploration project in that it was drilled by Newmont to the extent that there is a known resource there. We have reevaluated the deposit and done more exploration to bring it to a bankable feasibility level. On the strength of those results, we have decided to go ahead with its development. We anticipate that we can get that into production by the middle of next year, producing 50-60,000 ounces. Cash costs should be below $150 an ounce, and it will have an initial mine life of about five to six years. By gold mining standards it's quite a small project, but we have focused solely on this one deposit which is in a highly prospective, forty-square-mile, concession area. Then once we have established infrastructure on the ground we're highly confident that exploration will uncover other deposits in the region that we can bring into development as well.

TWST: Currently, what do you see as potential risks with where you are mining in Asia?

Mr. Catchpole: Well I think there's a perception of certain areas out there as being quite high risk from a political perspective, Indonesia being one case in point. We have people who are very experienced in working in that country, and I think what a lot of people don't realize is that there are areas in Indonesia that are a good deal less of a political risk than others -- North Sulawesi is a case in point. So you really have to pick your territory in that part of the world, and, just as importantly, gain a relationship with the local authorities. So I don't view the specific area of Indonesia where we're at as being high risk. Politically and economically Malaysia is a mature country and very easy to operate in as far as infrastructure and educated work force goes. It is not much different from many Western countries, in fact. Tajikistan is an unusual situation. It's the poorest of the central Asian republics, but probably the easiest to work in from a political risk perspective, particularly for us because the acquisition we made up there involves a company that has been there since the early 1990's. It has really been the country's only relatively successful foreign investor and therefore has a good relationship with the local government. Geographically, the area of Tajikistan we're in is quite isolated from many of the more troublesome regions -- Afghanistan and some of the neighboring countries. In fact the mine was developed during a local civil war which never adversely affected it.

TWST: Where do you see Avocet in five years?

Mr. Catchpole: Well, I think to survive and grow in this business you really have to be in the half-million ounce plus range. I see us growing internally to at least get to our goal of 300,000 ounces within three years. Therefore, within five years, and with only modest exploration success, we should become a middle ranked gold producer. Also, as the market realizes that this is something that we can achieve, we would be looking at merger and acquisition opportunities to accelerate our growth.

Now thats what you call a Business Plan.

GF

CEO of Avocet Mining explains company's position mining gold in Asia, an interview with The Wall Street Transcript

JOHN T. CATCHPOLE is the CEO of Avocet Mining PLC

TWST: It's often helpful to start off by giving a brief overview of the company. Could you give us a brief overview of Avocet Mining (LSE: AVM.L - news) (AVM.L)?

Mr. Catchpole: Avocet Mining is a UK company listed on AIM, the Alternative Investment Market in London. The company has been in existence since the early 1980's and was originally a Vancouver-based company before coming to the UK in 1996. Currently the company is very much focused on gold mining in Asia. It has 100% ownership over a gold mine in Malaysia, called Penjom, which has an annual gold production in excess of 100,000 ounces a year. It has been in production since 1996 and has been the company's main gold asset up to fairly recently. During this year we acquired an exploration property from Newmont Mining Corporation NEM - news) in Indonesia where we have completed a feasibility study with a view to develop a new gold mine by sometime next year. And most recently we have acquired the interests of a UK company in an operating gold mine in Tajikistan in central Asia. So altogether, on an annualized basis, our gold production will be increasing to 160-170,000 ounces with the addition of the Tajikistan mine and then a further 50-60,000 ounces from our project in Indonesia. Avocet has also historically been known as a tungsten producer but those assets were fully written off last year, and we really only have one residual operation left in the tungsten business -- a mine in Portugal under the name of Beralt. Back in September we signed a deal with a Canadian company to sell that business, which we expect to conclude in February, 2003, leaving us, as I say, exclusively in the gold business.

TWST: Turning to some of your specific mining projects such as Penjom in Malaysia and, is it the North Lanut project in Indonesia - would you walk us through some of the recent successes and problems?

Mr. Catchpole: In Penjom, one of the issues that came up over four years ago was that the mine encountered some very difficult metallurgical problems. The ore turned out to be carbonaceous and for the type of processing method that is employed this caused recoveries to drop from around normal levels of around 90% down to as low as 50%. So there was a real concern that the mine would not survive at all; in fact, at those low recovery levels, it would have been uneconomic to continue. However, we took a gamble and started developing our own process systems which, over a period of time, have greatly improved recoveries. We're now back up to recoveries that are in the range of 85% which we're quite proud of because it's all been done with our own technology -- engineered in-house and done at a reasonable capital cost. We've now had over a year's production without any of these problems so we know we have succeeded. Penjom's cash costs have been historically high over the last couple of years because we put a lot of money into pre-stripping waste rock from the open pit, which is really an investment towards lowering future mining costs. And we're now seeing the benefit. Our cash costs are reducing quite rapidly. Last year they were about $225 an ounce. This year they'll be closer to $200 and for the life of existing reserves they should be about $150 an ounce. So our view on Penjom is that it's now very much a proven and sustainable operation - technical problems have now all been resolved and it should be a very strong source of cash flow to the company. North Lanut is represented right now by one main gold deposit that was discovered by Newmont in North Sulawesi. It's a mature exploration project in that it was drilled by Newmont to the extent that there is a known resource there. We have reevaluated the deposit and done more exploration to bring it to a bankable feasibility level. On the strength of those results, we have decided to go ahead with its development. We anticipate that we can get that into production by the middle of next year, producing 50-60,000 ounces. Cash costs should be below $150 an ounce, and it will have an initial mine life of about five to six years. By gold mining standards it's quite a small project, but we have focused solely on this one deposit which is in a highly prospective, forty-square-mile, concession area. Then once we have established infrastructure on the ground we're highly confident that exploration will uncover other deposits in the region that we can bring into development as well.

TWST: Currently, what do you see as potential risks with where you are mining in Asia?

Mr. Catchpole: Well I think there's a perception of certain areas out there as being quite high risk from a political perspective, Indonesia being one case in point. We have people who are very experienced in working in that country, and I think what a lot of people don't realize is that there are areas in Indonesia that are a good deal less of a political risk than others -- North Sulawesi is a case in point. So you really have to pick your territory in that part of the world, and, just as importantly, gain a relationship with the local authorities. So I don't view the specific area of Indonesia where we're at as being high risk. Politically and economically Malaysia is a mature country and very easy to operate in as far as infrastructure and educated work force goes. It is not much different from many Western countries, in fact. Tajikistan is an unusual situation. It's the poorest of the central Asian republics, but probably the easiest to work in from a political risk perspective, particularly for us because the acquisition we made up there involves a company that has been there since the early 1990's. It has really been the country's only relatively successful foreign investor and therefore has a good relationship with the local government. Geographically, the area of Tajikistan we're in is quite isolated from many of the more troublesome regions -- Afghanistan and some of the neighboring countries. In fact the mine was developed during a local civil war which never adversely affected it.

TWST: Where do you see Avocet in five years?

Mr. Catchpole: Well, I think to survive and grow in this business you really have to be in the half-million ounce plus range. I see us growing internally to at least get to our goal of 300,000 ounces within three years. Therefore, within five years, and with only modest exploration success, we should become a middle ranked gold producer. Also, as the market realizes that this is something that we can achieve, we would be looking at merger and acquisition opportunities to accelerate our growth.

Now thats what you call a Business Plan.

GF

Mr Ashley James

- 27 Jan 2003 11:28

- 9 of 194

- 27 Jan 2003 11:28

- 9 of 194

GF,

Will you please answer Andy's question, are you Energyi, Goldstock, Goldstone, Natking etc from ADVFN?

Cheers

Ash

Will you please answer Andy's question, are you Energyi, Goldstock, Goldstone, Natking etc from ADVFN?

Cheers

Ash

goldfinger

- 27 Jan 2003 12:41

- 10 of 194

- 27 Jan 2003 12:41

- 10 of 194

Ash, no. I do know of energyi though. Im Oliver LWT.

Positive candidate (24 Jan 2003) [Auto] Help

Has risen 209% since the bottom on 28 Nov 2001 at 11.50. Is within a rising trend. Continued positive development within the trend channel is indicated. Positive volume balance, i.e. high volume in days of rising prices and low volume in days of falling prices, strengthens the stock further in the short term.

Support and resistance: The stock has support at 12.00 p..

GF

Positive candidate (24 Jan 2003) [Auto] Help

Has risen 209% since the bottom on 28 Nov 2001 at 11.50. Is within a rising trend. Continued positive development within the trend channel is indicated. Positive volume balance, i.e. high volume in days of rising prices and low volume in days of falling prices, strengthens the stock further in the short term.

Support and resistance: The stock has support at 12.00 p..

GF

goldfinger

- 27 Jan 2003 14:45

- 11 of 194

- 27 Jan 2003 14:45

- 11 of 194

Just seen on advfn that Evil K maybee long on AVM.

GF

GF

Andy

- 27 Jan 2003 14:55

- 12 of 194

- 27 Jan 2003 14:55

- 12 of 194

goldfinger,

Oliver, welcome!

Comdirect will not deal more than 1,000 shares online!

Oliver, welcome!

Comdirect will not deal more than 1,000 shares online!

goldfinger

- 27 Jan 2003 15:52

- 13 of 194

- 27 Jan 2003 15:52

- 13 of 194

Andy, have you tried the share centre. Iv been getting large amounts online from them but I have heard that MMs are very short of stock. Maybee why spread has come in. regs oliver.

GF.

GF.

Andy

- 27 Jan 2003 16:16

- 14 of 194

- 27 Jan 2003 16:16

- 14 of 194

Oliver,

I managed to buy via dealer on CD in the end, although he had to call the MM.

thanks,

Andy.

I managed to buy via dealer on CD in the end, although he had to call the MM.

thanks,

Andy.

archinvest - 27 Jan 2003 18:01 - 15 of 194

avm,

in the red sea of figures on my monitors today, avm has been the exception. not only it ended up the day rising 11.3%, a high percentage daily rise by any standard, but it managed it in a day as grim as this. moreover, the very few stocks that managed to raise their heads above water have managed but a fraction of this figure. other gold mining stock did not fair well either, gfm that managed gains nearing 8% intraday ended the day unchanged. oxs actually dropped by 5.1%!

technically, the stock is currently displaying near perfect configuration(super model fashion), one can't hope for better, as follows:

- all moving averages pointing up.

- the 9 day sma has just crossed over the 18 day sma.

- macd histogram has just levelled up from a down slopping direction and began to head upwards.

- rsi and slow stochs have changed direction from down turning at around mid level 50 to up turning.

- the mid january 03 reversal coincided with a dojji candlestick.

the stock remains rather top heavy. and i suggest this is showing through the high intraday volatility as follows:

- the stock opened the day with an up gap at 38.5p.

- at its highest the stock reached 42 (fib resistance), that is 9.09% above the open price of 38.5. at lowest the stock hit 37.5 which is 2.67% lower than the open level. therefore over all price movement has been 11.76%. movement intraday, between open and close prices, has been one pence only. over all price movment, between the botom and the top intraday levels, has been 4.5p.

this range was equalled by that of friday, again 4.5 between the top and bottom of the intraday price range, except on friday the candle stick was black, the net sum of price movement was negative, and amounted to three quarters of a penny. today the candle was white.

i would be happier seeing white candles with long bodies and short shadows. what we had today was a white candle with short body. but today was a better day than last friday's where the candle had been black.

now for next ports of call:

- i suggest r36 is behind us now.

- fib shows the next resistance level to be 42. this has already been confirmed as the stock touched this level intraday and then receeded from it. we need to see 42 breached.

- the next hard to crack level is 50 as both fib and the chart shows it to be a resistance level.

finally, good luck to all. something to cheer us all in these grim days.

in the red sea of figures on my monitors today, avm has been the exception. not only it ended up the day rising 11.3%, a high percentage daily rise by any standard, but it managed it in a day as grim as this. moreover, the very few stocks that managed to raise their heads above water have managed but a fraction of this figure. other gold mining stock did not fair well either, gfm that managed gains nearing 8% intraday ended the day unchanged. oxs actually dropped by 5.1%!

technically, the stock is currently displaying near perfect configuration(super model fashion), one can't hope for better, as follows:

- all moving averages pointing up.

- the 9 day sma has just crossed over the 18 day sma.

- macd histogram has just levelled up from a down slopping direction and began to head upwards.

- rsi and slow stochs have changed direction from down turning at around mid level 50 to up turning.

- the mid january 03 reversal coincided with a dojji candlestick.

the stock remains rather top heavy. and i suggest this is showing through the high intraday volatility as follows:

- the stock opened the day with an up gap at 38.5p.

- at its highest the stock reached 42 (fib resistance), that is 9.09% above the open price of 38.5. at lowest the stock hit 37.5 which is 2.67% lower than the open level. therefore over all price movement has been 11.76%. movement intraday, between open and close prices, has been one pence only. over all price movment, between the botom and the top intraday levels, has been 4.5p.

this range was equalled by that of friday, again 4.5 between the top and bottom of the intraday price range, except on friday the candle stick was black, the net sum of price movement was negative, and amounted to three quarters of a penny. today the candle was white.

i would be happier seeing white candles with long bodies and short shadows. what we had today was a white candle with short body. but today was a better day than last friday's where the candle had been black.

now for next ports of call:

- i suggest r36 is behind us now.

- fib shows the next resistance level to be 42. this has already been confirmed as the stock touched this level intraday and then receeded from it. we need to see 42 breached.

- the next hard to crack level is 50 as both fib and the chart shows it to be a resistance level.

finally, good luck to all. something to cheer us all in these grim days.

goldfinger

- 27 Jan 2003 23:57

- 16 of 194

- 27 Jan 2003 23:57

- 16 of 194

Archinvest, excelent post summary. AVM The short term chart.

Jan 2003) [Auto] Help

Has risen 243% since the bottom on 28 Nov 2001 at 11.50. Is within a rising trend and continued advance within the current trend is indicated. On reactions back, there is support against the floor of the trend channel. Positive volume balance, i.e. high volume in days of rising prices and low volume in days of falling prices, strengthens the stock further in the short term.

Support and resistance: The stock has support at 12.00

regards Oliver.

Jan 2003) [Auto] Help

Has risen 243% since the bottom on 28 Nov 2001 at 11.50. Is within a rising trend and continued advance within the current trend is indicated. On reactions back, there is support against the floor of the trend channel. Positive volume balance, i.e. high volume in days of rising prices and low volume in days of falling prices, strengthens the stock further in the short term.

Support and resistance: The stock has support at 12.00

regards Oliver.

archinvest - 28 Jan 2003 10:17 - 17 of 194

goldfinger,

investech is a nice starting place for technical analysis of stock. in particular i like the 3 time span they provide which helps the novice chartist to look at the same chart im many different ways.

the analysis of the stocks on this site are completely automated.this may bring some uniformity and objectivity to the analysis but at the same time the analysis tend to be simplistic and lacking in 'feel', in the way that a good and reliable japanese car would not have the same feel or provide the same feed back as an italian thoroughbread of equal paper specifications.

just look at the final line of their analysis, 'the stock has support at 12!!', how reassuring. what about the support levels of 16 and the other two they have themselves highlighted in green of 28.4 and 34.6! and i have not gone int o fib retracements to highlight numerous other, that may or may not be as substantial, support levels. i have actually worked out 25 support levels for this stock. I may publish them later on request.

investech is a nice starting place for technical analysis of stock. in particular i like the 3 time span they provide which helps the novice chartist to look at the same chart im many different ways.

the analysis of the stocks on this site are completely automated.this may bring some uniformity and objectivity to the analysis but at the same time the analysis tend to be simplistic and lacking in 'feel', in the way that a good and reliable japanese car would not have the same feel or provide the same feed back as an italian thoroughbread of equal paper specifications.

just look at the final line of their analysis, 'the stock has support at 12!!', how reassuring. what about the support levels of 16 and the other two they have themselves highlighted in green of 28.4 and 34.6! and i have not gone int o fib retracements to highlight numerous other, that may or may not be as substantial, support levels. i have actually worked out 25 support levels for this stock. I may publish them later on request.

goldfinger

- 29 Jan 2003 15:41

- 18 of 194

- 29 Jan 2003 15:41

- 18 of 194

Arch, yes your right about the chart. But it does give viewers a general feel for rhe stock. Would you please publish these other 25 support levels. I and I feel others would be very greatfull. Not only that I could show them to my pals on other sites who are holders of the stock.

regards GF.

regards GF.

goldfinger

- 30 Jan 2003 03:10

- 19 of 194

- 30 Jan 2003 03:10

- 19 of 194

Avocet to merge???????????. A window of opportunity opens up.

Date : January 30, 2003

Avocet Mining Presented With Window Of Opportunity Through Retirement Of Mike Diemar At Kingsgate.

It is quite good timing for AIM listed Avocet Mining to announce that it has acquired exploration rights over another 5,600 hectares in Malaysia in joint venture with a local partner virtually on the day that Canaccord Capital promoted it to its small cap UK Mining Review. The shares of Avocet have performed well since it rescheduled its debt and got rid of the remnants of its tungsten business and became gold, pure and simple, and now it has embarked on a growth strategy. In March 2002 it acquired an 80 per cent interest in the North Lanut advanced gold exploration project from Newmont and last November bought a 44 per cent stake in the Zeravshan Gold company which is exploiting the Jilau deposit in Tajikistan.

A bit more time is needed before one can assess the brilliance, or otherwise, of these acquisitions. North Lanut should be in production by the year end and quite a lot of work has to be done at Zeravshan as it produced only 10,000 ozs in the first two months since its acquisition. Just the closure of its London office, however, is said to have reduced costs significantly which is just as well as cash costs of production of US$285 are too high to be comfortable. Now Avocet has set itself a target of annual production of 300,000 ounces of gold by 2005 which would take it into the FTSE Gold Index.

The pivot of the company is the Penjom mine in Malaysia which produced 23,990 ounces of gold in the quarter to end December. This took the total for the year to 78,370 ounces so a total of 100,000 ounces is well within reach. Only now, however, with a higher gold price and its debts sorted out, is Avocet in a position to spend some real money on exploration. It is encouraging that Malaysia is its choice as the company has a history of gold mining and Avocet is the only listed company that is producing there. As a result it has excellent relationships with the relevant authorities and so should get first crack at any new exploration prospects. Nor should it be forgotten that it was Malaysia which initiated the idea of the Islamic gold dinar, so gold has a major following. A listing for Avocet on the Kuala Lumpur Stock Exchange would therefore be a PR coup of some magnitude.

The new acreage has a history of alluvial gold mining dating from 200 years ago and continuing sporadically until the 1990s. Someone must have made money out of it as Sungei Luit translates as ‘river of money’ and Avocet clearly wants to repeat the trick. It has similarities to Penjom and could be the first of a number of new properties which the company will acquire on the historic gold belts of Malaysia. In the meantime the company is also extending exploration around Penjom as the current reserves are only sufficient to support mining at the current rate for another three years. Canaccord makes an interesting point, moreover, that the treatment of mineable reserves and resources is not reported in accordance with any recognized code such as IMM or JORC. Penjom is a geologically complex and variable deposit, but now that the company is being taken seriously it should try to conform.

Avocet also has some 80,000 ounces of gold hedged at US$296 which means that it is carrying a mark-to-market loss of around US$5.6 million. Macquarie Bank, the counterparty, has agreed to defer this hedging, but it will have to be dealt with at some stage as it clicks in when Penjom is in its last year of production. The way gold is moving now it might be better to take it on the chin as investors do not like ticking clocks. One problem may be that not all the directors are confident about gold – presumably they have been indoctrinated by Kamal Naqvi at Macquarie who gave a very bearish view of gold recently - and feel that this is a wise form of risk management. Hopefully they will not accumulate any more hedging when they come to develop North Lanut later this year.

Windows of opportunity appear at the least likely times and one has just opened for Avocet with the resignation of Mike Diemar at Kingsgate Consolidated, the Australian company producing gold in Thailand. Mike was the driving force at Kingsgate and he drove the company to success when Australian investors were ignoring projects in Asia. As a result of his efforts Kingsgate became the first sizeable gold mine in Thailand and is expecting to produce 160,000 ounces this year at a cash cost of US$74/oz. This compares with Avocet’s cash costs of US$225/oz at Penjom. A merger of the two companies, as suggested in our other story today, would result in a current producer of 300,000 ounces listed on both AIM and the ASX. It might even have a listing on Bangkok and Kuala Lupur as the leading gold producer in each country. The difficulty would be to get the directors of each company to agree merger terms for what would become a very powerful entity in the Muslim world.

GF

Date : January 30, 2003

Avocet Mining Presented With Window Of Opportunity Through Retirement Of Mike Diemar At Kingsgate.

It is quite good timing for AIM listed Avocet Mining to announce that it has acquired exploration rights over another 5,600 hectares in Malaysia in joint venture with a local partner virtually on the day that Canaccord Capital promoted it to its small cap UK Mining Review. The shares of Avocet have performed well since it rescheduled its debt and got rid of the remnants of its tungsten business and became gold, pure and simple, and now it has embarked on a growth strategy. In March 2002 it acquired an 80 per cent interest in the North Lanut advanced gold exploration project from Newmont and last November bought a 44 per cent stake in the Zeravshan Gold company which is exploiting the Jilau deposit in Tajikistan.

A bit more time is needed before one can assess the brilliance, or otherwise, of these acquisitions. North Lanut should be in production by the year end and quite a lot of work has to be done at Zeravshan as it produced only 10,000 ozs in the first two months since its acquisition. Just the closure of its London office, however, is said to have reduced costs significantly which is just as well as cash costs of production of US$285 are too high to be comfortable. Now Avocet has set itself a target of annual production of 300,000 ounces of gold by 2005 which would take it into the FTSE Gold Index.

The pivot of the company is the Penjom mine in Malaysia which produced 23,990 ounces of gold in the quarter to end December. This took the total for the year to 78,370 ounces so a total of 100,000 ounces is well within reach. Only now, however, with a higher gold price and its debts sorted out, is Avocet in a position to spend some real money on exploration. It is encouraging that Malaysia is its choice as the company has a history of gold mining and Avocet is the only listed company that is producing there. As a result it has excellent relationships with the relevant authorities and so should get first crack at any new exploration prospects. Nor should it be forgotten that it was Malaysia which initiated the idea of the Islamic gold dinar, so gold has a major following. A listing for Avocet on the Kuala Lumpur Stock Exchange would therefore be a PR coup of some magnitude.

The new acreage has a history of alluvial gold mining dating from 200 years ago and continuing sporadically until the 1990s. Someone must have made money out of it as Sungei Luit translates as ‘river of money’ and Avocet clearly wants to repeat the trick. It has similarities to Penjom and could be the first of a number of new properties which the company will acquire on the historic gold belts of Malaysia. In the meantime the company is also extending exploration around Penjom as the current reserves are only sufficient to support mining at the current rate for another three years. Canaccord makes an interesting point, moreover, that the treatment of mineable reserves and resources is not reported in accordance with any recognized code such as IMM or JORC. Penjom is a geologically complex and variable deposit, but now that the company is being taken seriously it should try to conform.

Avocet also has some 80,000 ounces of gold hedged at US$296 which means that it is carrying a mark-to-market loss of around US$5.6 million. Macquarie Bank, the counterparty, has agreed to defer this hedging, but it will have to be dealt with at some stage as it clicks in when Penjom is in its last year of production. The way gold is moving now it might be better to take it on the chin as investors do not like ticking clocks. One problem may be that not all the directors are confident about gold – presumably they have been indoctrinated by Kamal Naqvi at Macquarie who gave a very bearish view of gold recently - and feel that this is a wise form of risk management. Hopefully they will not accumulate any more hedging when they come to develop North Lanut later this year.

Windows of opportunity appear at the least likely times and one has just opened for Avocet with the resignation of Mike Diemar at Kingsgate Consolidated, the Australian company producing gold in Thailand. Mike was the driving force at Kingsgate and he drove the company to success when Australian investors were ignoring projects in Asia. As a result of his efforts Kingsgate became the first sizeable gold mine in Thailand and is expecting to produce 160,000 ounces this year at a cash cost of US$74/oz. This compares with Avocet’s cash costs of US$225/oz at Penjom. A merger of the two companies, as suggested in our other story today, would result in a current producer of 300,000 ounces listed on both AIM and the ASX. It might even have a listing on Bangkok and Kuala Lupur as the leading gold producer in each country. The difficulty would be to get the directors of each company to agree merger terms for what would become a very powerful entity in the Muslim world.

GF

archinvest - 30 Jan 2003 18:14 - 20 of 194

goldfinger, all support levels for avm

you have asked for the king's ransome, here it is:

major levels of supports/rsistances as can be gleaned from the charts.

50, 60, 83, 110, 130, 160 & the peak of 240.

fib provides numerous levels of s/r that may or may not be visible on the chart. below is a comprehensive list

12-50 range : 36, 31, 26

12-60 range : 42, 36, 30

12-110 range : 73, 61, 49

12-130 range : 85, 71, 57

12-160 range : 104, 86, 68

12- 240 range : 153, 1265, 99

pls note that if a level appears in more than one range then this level of s/r is considered more significant.

you have asked for the king's ransome, here it is:

major levels of supports/rsistances as can be gleaned from the charts.

50, 60, 83, 110, 130, 160 & the peak of 240.

fib provides numerous levels of s/r that may or may not be visible on the chart. below is a comprehensive list

12-50 range : 36, 31, 26

12-60 range : 42, 36, 30

12-110 range : 73, 61, 49

12-130 range : 85, 71, 57

12-160 range : 104, 86, 68

12- 240 range : 153, 1265, 99

pls note that if a level appears in more than one range then this level of s/r is considered more significant.

goldfinger

- 31 Jan 2003 01:29

- 21 of 194

- 31 Jan 2003 01:29

- 21 of 194

Your a genious at TA ARCH. Bloody brilliant. Fantastic work. IM now going to as non paid PA man for AVM post these all over the internet.

GF.

GF.

archinvest - 31 Jan 2003 09:05 - 22 of 194

goldfinger, avm

first the fun bit!

-what an apt name for someone dealing with 'gold' issues!

-there was a famous latino guitarist in the 70's cald 'manitas de plata', which translated to english reads ' fingers of silver', any relation of yours goldfinger?

now for the lesser fun bit!

i am a coputer programmer self taught. i program in the language named as 'basic'. the name is an acronym. basic has often been used as the programming language for small computers,such as pocket computers, although derivatives of it is used for very advanced programming such as autocad, the engineering drafting software.

i have programmed one of my pocket computers to workout fib retracements as well as percentages. of course one can use spreadsheets to workout these, but i always find these small devises that i keep at an arm's length easier to use and instantly on tap.

charting software often include a visual fib grid that can be applied over the chart and can visually demonstrate the fib retracement as opposed to just providing the figures. with such grids you can see at an instant where the fib retracements lie. but also very importantly how they interact, co-incide or otherwise, with the support/resistance levels in the charts. like i said in my posting above, if a support/resistance level appears both on chart and fibs then the significance of the said level is corroborated. and at times the same fib derived support/resistance level may appear on different chart ranges, or may co-incide with gaps and other features of the charting landscape and by doing so their significance or otherwise further coroborated.

i am willing to post the program here should i see much demand for it from users.

first the fun bit!

-what an apt name for someone dealing with 'gold' issues!

-there was a famous latino guitarist in the 70's cald 'manitas de plata', which translated to english reads ' fingers of silver', any relation of yours goldfinger?

now for the lesser fun bit!

i am a coputer programmer self taught. i program in the language named as 'basic'. the name is an acronym. basic has often been used as the programming language for small computers,such as pocket computers, although derivatives of it is used for very advanced programming such as autocad, the engineering drafting software.

i have programmed one of my pocket computers to workout fib retracements as well as percentages. of course one can use spreadsheets to workout these, but i always find these small devises that i keep at an arm's length easier to use and instantly on tap.

charting software often include a visual fib grid that can be applied over the chart and can visually demonstrate the fib retracement as opposed to just providing the figures. with such grids you can see at an instant where the fib retracements lie. but also very importantly how they interact, co-incide or otherwise, with the support/resistance levels in the charts. like i said in my posting above, if a support/resistance level appears both on chart and fibs then the significance of the said level is corroborated. and at times the same fib derived support/resistance level may appear on different chart ranges, or may co-incide with gaps and other features of the charting landscape and by doing so their significance or otherwise further coroborated.

i am willing to post the program here should i see much demand for it from users.

goldfinger

- 02 Feb 2003 00:30

- 23 of 194

- 02 Feb 2003 00:30

- 23 of 194

New BROKER COMMENT ON AVM, from one of the BEST.

Beeson Gregory comment:

Gold Play

Investment opportunity

• Randgold and Avocet good value exposure to strong gold price

To gain exposure to the climbing gold price from a London perspective, we

believe that Avocet Mining [AVM], and Randgold Resources [RRS] provide

the best opportunities. Ashanti the largest gold play in London having

restructured their hedge book last year will likely also benefit from the

climbing price, however they are still hedged and have therefore lost some

upside.

Avocet [AVM]: The company is a pure gold play with production from

Indonesia and Malaysia and a good looking project in Tajikistan. The

company has excellent growth prospects and output last year of 100,000

ounces will be surpassed this year with the acquisition of Nelson Resources’

interest in Zeravshan gold mine, and increased milling at Penjom. The

company is well on the road to achieving its target of 300,000 ounces per year

within the next three years.

The acquisition of Zeravashan and the addition of a second ball mill at

Penjom will see the production of gold increase in the second half-year. This

output increase will allow Avocet to exploit the higher gold price. We expect

earnings in the second half to increase by 40% at the present levels but

climbing 5% for each $5 advance in the average gold price. This would give

full year earnings of 2.9p per share and a PE multiple of 11. Thus there is

room for growth in the share price.

The strengthening Rand and Australian dollar are offsetting the climbing

gold price for South African and Australian producers. Neither Avocet nor

Randgold are exposed to these currencies and offer the best value with good

upside potential for investors in London.

Macro thoughts: Gold jumped to a near six year highs on Friday due to

increased safe haven buying on discovery of warheads in Iraq by weapons

inspectors. It will most likely ease today on the more cooperative stance by

Iraq but is unlikely to drop back far.

Gold Fields Mineral Services issued an update to their annual gold survey

last week in which they conjectured an average gold price of $330 with a

possible high of $370 if there was a lengthy war with Iraq. The continued

weakness of the US dollar is also providing support to the rising gold price.

GFMS cites significant increase in investment as one of the factors that has

driven the rise in the gold price since the beginning of last year. They

conservatively estimate that there has been a doubling of investment by

hedge funds and high net worth individuals, from 172 tonnes in 2001 to 417

tonnes in 2002.

The amount of hedging by producers declined by 352 tonnes a key factor in

sustaining the price above $300. Combining this figure with the decline in

production indicates a 10% reduction in physical supply year on year. GFMS

is forecasting further decline in hedging in the first half of 2003.

Weak global economy, continuing dehedging by producers and uncertain

political climate are all strongly supportive of an escalating gold price.ENDS.

GF.

Beeson Gregory comment:

Gold Play

Investment opportunity

• Randgold and Avocet good value exposure to strong gold price

To gain exposure to the climbing gold price from a London perspective, we

believe that Avocet Mining [AVM], and Randgold Resources [RRS] provide

the best opportunities. Ashanti the largest gold play in London having

restructured their hedge book last year will likely also benefit from the

climbing price, however they are still hedged and have therefore lost some

upside.

Avocet [AVM]: The company is a pure gold play with production from

Indonesia and Malaysia and a good looking project in Tajikistan. The

company has excellent growth prospects and output last year of 100,000

ounces will be surpassed this year with the acquisition of Nelson Resources’

interest in Zeravshan gold mine, and increased milling at Penjom. The

company is well on the road to achieving its target of 300,000 ounces per year

within the next three years.

The acquisition of Zeravashan and the addition of a second ball mill at

Penjom will see the production of gold increase in the second half-year. This

output increase will allow Avocet to exploit the higher gold price. We expect

earnings in the second half to increase by 40% at the present levels but

climbing 5% for each $5 advance in the average gold price. This would give

full year earnings of 2.9p per share and a PE multiple of 11. Thus there is

room for growth in the share price.

The strengthening Rand and Australian dollar are offsetting the climbing

gold price for South African and Australian producers. Neither Avocet nor

Randgold are exposed to these currencies and offer the best value with good

upside potential for investors in London.

Macro thoughts: Gold jumped to a near six year highs on Friday due to

increased safe haven buying on discovery of warheads in Iraq by weapons

inspectors. It will most likely ease today on the more cooperative stance by

Iraq but is unlikely to drop back far.

Gold Fields Mineral Services issued an update to their annual gold survey

last week in which they conjectured an average gold price of $330 with a

possible high of $370 if there was a lengthy war with Iraq. The continued

weakness of the US dollar is also providing support to the rising gold price.

GFMS cites significant increase in investment as one of the factors that has

driven the rise in the gold price since the beginning of last year. They

conservatively estimate that there has been a doubling of investment by

hedge funds and high net worth individuals, from 172 tonnes in 2001 to 417

tonnes in 2002.

The amount of hedging by producers declined by 352 tonnes a key factor in

sustaining the price above $300. Combining this figure with the decline in

production indicates a 10% reduction in physical supply year on year. GFMS

is forecasting further decline in hedging in the first half of 2003.

Weak global economy, continuing dehedging by producers and uncertain

political climate are all strongly supportive of an escalating gold price.ENDS.

GF.

archinvest - 02 Feb 2003 17:14 - 24 of 194

i hear nothing but good things being said about avm, be it media news or points of view expressed. yet the stock has been dropping on daily basis every day of the week last week!

what is depressing is that on many such days the stock opened the day with and up gap but ended up the day closing at a lower level than that of the closing level of the preceeding day. so if you look at a candlestick chart for last week you see a series of black candlesticks. this tells me that market makers were acting positively on the open hoping that the stock will rise only to be faced with weak demand causing them to drop the stock.

adding to this level 36 proved to have been a hard resistance to crack. it was a good day for the stock, so i thought, when it broke through this level with a gap. but the stock has now made an island reversal and closed below level 36.

none of the above would boud well for the stock. and i wounder now when it would stop falling further to find solid enough support and suggest such an act would not be an easy feat to accomplish.

what is depressing is that on many such days the stock opened the day with and up gap but ended up the day closing at a lower level than that of the closing level of the preceeding day. so if you look at a candlestick chart for last week you see a series of black candlesticks. this tells me that market makers were acting positively on the open hoping that the stock will rise only to be faced with weak demand causing them to drop the stock.

adding to this level 36 proved to have been a hard resistance to crack. it was a good day for the stock, so i thought, when it broke through this level with a gap. but the stock has now made an island reversal and closed below level 36.

none of the above would boud well for the stock. and i wounder now when it would stop falling further to find solid enough support and suggest such an act would not be an easy feat to accomplish.

Mr Ashley James

- 03 Feb 2003 02:06

- 25 of 194

- 03 Feb 2003 02:06

- 25 of 194

Wirrall,

I am afraid short term I think AVM is a sell, head and shoulders formation shows decline neckline length 43p/36.50p ie 6.50p completed by drop to 34.50p but this support seems breached.

Hourly and Daily MACD looks bearish and worried that daily 50% RSI may be breached.

I am expecting a US$20 drop in gold price over next few weeks so expect AVM to fall to 25p to 29p range.

38.20% Fibo Retracement point around 30.75p, 50% around 27.25p, 61.80% 23.75p

Slightly concerned about twin peaks at 42p

All IMHO, NAG, DYOR etc, etc

Cheers

Ash

I am afraid short term I think AVM is a sell, head and shoulders formation shows decline neckline length 43p/36.50p ie 6.50p completed by drop to 34.50p but this support seems breached.

Hourly and Daily MACD looks bearish and worried that daily 50% RSI may be breached.

I am expecting a US$20 drop in gold price over next few weeks so expect AVM to fall to 25p to 29p range.

38.20% Fibo Retracement point around 30.75p, 50% around 27.25p, 61.80% 23.75p

Slightly concerned about twin peaks at 42p

All IMHO, NAG, DYOR etc, etc

Cheers

Ash

archinvest - 03 Feb 2003 08:40 - 26 of 194

after the negative things i said yesterday, lets have a couple of good thins to say:

- the stock opened up today with a a small up gap of 1.5%. if it is to keep up its gains today, then it is possible that the stock has managed to evolve a rising trending channel the support line of which lies along the lines between the last bottom and the bottom created by last friday's closing price.

- i disagree with ashley on the macd dropping. yes the moving average lines were dropping throughout last week. but you can see the faster one is rising up to cross the slow one at high level, this bides well for the stock. remember macd is a lagging indicator. one one to get advance warning is to look at the histogram instead. the latter has been rising from negative territory throughout last week and is about to hit level zero. as histo hits level zero the moving lines cross each other and since these two lines currently lie well above the zero level, then they are bound to cross at well above zero level too. this indicates that momentum continues to exist.

- the stock opened up today with a a small up gap of 1.5%. if it is to keep up its gains today, then it is possible that the stock has managed to evolve a rising trending channel the support line of which lies along the lines between the last bottom and the bottom created by last friday's closing price.

- i disagree with ashley on the macd dropping. yes the moving average lines were dropping throughout last week. but you can see the faster one is rising up to cross the slow one at high level, this bides well for the stock. remember macd is a lagging indicator. one one to get advance warning is to look at the histogram instead. the latter has been rising from negative territory throughout last week and is about to hit level zero. as histo hits level zero the moving lines cross each other and since these two lines currently lie well above the zero level, then they are bound to cross at well above zero level too. this indicates that momentum continues to exist.

goldfinger

- 05 Feb 2003 20:59

- 27 of 194

- 05 Feb 2003 20:59

- 27 of 194

Arch, are we at a market top with AVM considering POG has closed well down on the day from its peak??????????. Your help much appreciated.

GF

GF

archinvest - 06 Feb 2003 08:15 - 28 of 194

goldfinger,

not necessarily.

i was listening to mr lock, a manager of a fund called 'oyster catcher', a bear and devoute elliot wave follower and one whose been accurately forcasting falls in this market for well over a year ago when most were expecting the market to bottom up. mr lock, who is a frequent guest on cnbc, said that gold will remain bullish above $350 pe roz. so we have long to go yet.

additionally, while the war issue remains hanging in the air it is unlikely that gold prices will undergo dramatic drops.

i therefore expect the slight drop in gold price to be a technical retracement.

however the stock appears to have got stuck at its present range. so if i am a holder sitting on over 20% profit i would be contemplating bailing out until a new phase in the development of this stock has evolved. remember a stock spends 80% of its time going nowhere and only some 20% moving up or down.

not necessarily.

i was listening to mr lock, a manager of a fund called 'oyster catcher', a bear and devoute elliot wave follower and one whose been accurately forcasting falls in this market for well over a year ago when most were expecting the market to bottom up. mr lock, who is a frequent guest on cnbc, said that gold will remain bullish above $350 pe roz. so we have long to go yet.

additionally, while the war issue remains hanging in the air it is unlikely that gold prices will undergo dramatic drops.

i therefore expect the slight drop in gold price to be a technical retracement.

however the stock appears to have got stuck at its present range. so if i am a holder sitting on over 20% profit i would be contemplating bailing out until a new phase in the development of this stock has evolved. remember a stock spends 80% of its time going nowhere and only some 20% moving up or down.

goldfinger

- 06 Feb 2003 11:33

- 29 of 194

- 06 Feb 2003 11:33

- 29 of 194

Arch, many thanks for that.

GF

GF

archinvest - 07 Feb 2003 17:43 - 30 of 194

goldfinger,

the article below regarding gold price movement published in the ft website may be of interest to you.

Overbought gold lines up for pullback

by Vince Heaney in London

Published: February 7 2003 14:54 | Last Updated: February 7 2003 14:54

After years languishing in the lower reaches of investment performance tables, gold has re-emerged into the limelight as a hot commodity.

Reflecting the precious metals resurgence, from a list of 1,862 unit trusts and OEICs the top-performing unit trust over the last one-year, three- years and five-years is the Merrill Lynch Gold and General fund. Over one-year the Merrill fund returned 40.9 per cent, more than double the next best performing fund.

Investors in both the commodity and gold stocks have enjoyed impressive returns, but following a $100 an ounce rally in just over a year, from a technical perspective golds advance is looking overstretched.

After closing at $381.50 an ounce on February 4 the spot price pushed to news highs of $388.50 the following day. However, by the close of business on February 5 the spot price had dipped to $371.75, forming a reversal day. A reversal day is a chart pattern that can indicate an imminent change in the direction of the trend. At a market peak, prices make a new high during the day but close lower. In this instance the wide daily price range on February 5 adds weight to the potential reversal.

An upward-sloping trendline can be drawn beneath the sharp advance in gold since the start of December 2002, which has taken the spot price from $315.75 to this week's high of $388.50. Support from this trendline currently lies at $365, just beneath current close of $371. A reversal pattern followed by a drop back to trendline support suggests investors should tread warily as a larger pullback may be in prospect.

Momentum indicators show that the gold market is in a very overbought condition. The Relative Strength Index (RSI) on the weekly chart currently stands at almost 91. The RSI runs from 0 to 100 and values above 80 indicate an overbought market. A value above 90 on the weekly chart has not been seen in the last five years.

If trendline support is breached at $365 investors should look for a correction of the move up from $315.75. A 38.2 per cent Fibonacci retracement would take the spot price back down to $360.70, a 50 per cent pullback would reach $352.10 and a 61.8 per cent correction would hit $343.50. Beneath the latter level the May 2002 highs offer support just above $330.

I would buy on dips as long as we hold above $330, said Chris Locke of technical consultancy Oystercatcher BV. Mr Locke also identified $330 as an important level in his longer-term view of the market.

I lean towards the long-term bull case for gold but am very wary, he added. Mr Locke follows Elliott Wave Theory, which looks for moves in the direction of the major trend to unfold in five distinct waves.

A five-wave move is nearing completion up from the lows between $270-$280, but the wave structure does not look strongly impulsive. The waves overlap at the beginning of the move which suggests the whole move could be corrective in nature, said Mr Locke.

The jury is still out on some of the more bullish arguments for gold. A monthly close above $398 is needed to confirm the long-term bull case, being the 88.6 per cent Gann retracement of the whole move down from the March 1996 highs at $417.70.

But for now the short-term reversal pattern and the overbought nature of the market suggests a correction is needed before any assault on the $398 level can be attempted.

the article below regarding gold price movement published in the ft website may be of interest to you.

Overbought gold lines up for pullback

by Vince Heaney in London

Published: February 7 2003 14:54 | Last Updated: February 7 2003 14:54

After years languishing in the lower reaches of investment performance tables, gold has re-emerged into the limelight as a hot commodity.

Reflecting the precious metals resurgence, from a list of 1,862 unit trusts and OEICs the top-performing unit trust over the last one-year, three- years and five-years is the Merrill Lynch Gold and General fund. Over one-year the Merrill fund returned 40.9 per cent, more than double the next best performing fund.

Investors in both the commodity and gold stocks have enjoyed impressive returns, but following a $100 an ounce rally in just over a year, from a technical perspective golds advance is looking overstretched.

After closing at $381.50 an ounce on February 4 the spot price pushed to news highs of $388.50 the following day. However, by the close of business on February 5 the spot price had dipped to $371.75, forming a reversal day. A reversal day is a chart pattern that can indicate an imminent change in the direction of the trend. At a market peak, prices make a new high during the day but close lower. In this instance the wide daily price range on February 5 adds weight to the potential reversal.

An upward-sloping trendline can be drawn beneath the sharp advance in gold since the start of December 2002, which has taken the spot price from $315.75 to this week's high of $388.50. Support from this trendline currently lies at $365, just beneath current close of $371. A reversal pattern followed by a drop back to trendline support suggests investors should tread warily as a larger pullback may be in prospect.

Momentum indicators show that the gold market is in a very overbought condition. The Relative Strength Index (RSI) on the weekly chart currently stands at almost 91. The RSI runs from 0 to 100 and values above 80 indicate an overbought market. A value above 90 on the weekly chart has not been seen in the last five years.