| Home | Log In | Register | Our Services | My Account | Contact | Help |

Eurasia Mining (EUA)

aevansdj - 20 Jul 2005 16:35

h.hairettin - 19 Apr 2006 07:29 - 2 of 269

http://www.proactiveinvestors.com/registered/articles/article.asp?EUA

Eurasia Mining: Nearly time to come back in from the cold?

Do you remember those somewhat daft physcology tests carried out in the 80's where a doctor would hold up a picture of an object and then the patient had to say what first came to mind?

Picture: Dog

Patient: Bone

Picture: Bird

Patient: Sky

Now imagine if the doctor was testing an exploration geologist....

Picture: Platinum

Geologist: Bushveld

A slightly crude analogy, but you get the picture (hahaha)....

As wonderful as my humour is, there is a serious undertone. Platinum is synonymous with South Africa and the Bushveld which is home to the greatest and most consistent platinum group metals (PGM) mineralisation found in the world. Outside of South Africa, there are a number of other areas with PGM, but nothing on the scale of the Bushveld.

aevansdj - 17 Apr 2007 11:34 - 3 of 269

Forgive me if I sound thick as just a small private investor who enjoys trying to pick shares with potential for growth.

humpback321 - 17 Apr 2007 19:14 - 4 of 269

tescoma - 30 Jul 2009 12:06 - 6 of 269

tescoma - 30 Jul 2009 12:11 - 7 of 269

tescoma - 30 Jul 2009 12:24 - 8 of 269

tescoma - 30 Jul 2009 12:49 - 9 of 269

tescoma - 30 Jul 2009 13:02 - 10 of 269

tescoma - 30 Jul 2009 13:34 - 11 of 269

maxtor - 07 Jan 2011 08:31 - 12 of 269

gibby - 04 Jan 2012 15:07 - 13 of 269

dreamcatcher

- 04 Jan 2012 19:03

- 14 of 269

- 04 Jan 2012 19:03

- 14 of 269

Eurasia Mining PLC

04 January 2012

Eurasia Mining plc

("Eurasia" or the "Company")

Share Price Movement

The directors of the Company note the movement in the Company's share price today. The directors can confirm that they are not aware of any reason for the change.

gibby - 04 Jan 2012 20:58 - 15 of 269

http://www.miningmaven.com/rokdownloads/EUA%20VP%2020.06.11%20final.pdf

would place this in the extreme high risk category!!

banjomick

- 05 Jul 2016 09:24

- 16 of 269

- 05 Jul 2016 09:24

- 16 of 269

16:35 04 Jul 2016

An external assessment of the Semensovsky tailings project in Russia has confirmed the grades, Eurasia Mining plc's (LON:EUA) managing director told Proactive.

Independent verification was important said Christian Schaffalitsky as it moves on to the next stages of cyanide and recovery testing and a reserves report.

If they go to plan, Eurasia, and partner Metal Tiger, will devise an optimisation plan that may see construction get underway as early as next year, permits allowing, he says.

http://www.proactiveinvestors.co.uk/companies/stocktube/5225/eurasia-mining-ceo-happy-semenovsky-tailings-progress-5225.html?utm_source=dlvr.it&utm_medium=twitter

banjomick

- 27 Jul 2016 08:29

- 17 of 269

- 27 Jul 2016 08:29

- 17 of 269

Eurasia Mining plc (AIM: EUA)

West Kytlim Mining operation update - July 2016

Eurasia Mining plc, the PGM and gold mining company, is pleased to update on developments at its West Kytlim platinum and gold mine. As reported on 21 June 2016, machinery and personnel from both Eurasia and its contractor SK Region-Stroy ("SKRS") are working at the site building necessary infrastructure and preparing open pits for mining. Work remains on schedule with the first black sand platinum and gold bearing concentrates planned for shipment for refining by mid -August 2016.

Highlights:

- Machinery including two excavators, two bulldozers, three dump trucks and one loader are being operated on a shift rota;

- Water pond to manage processing water now fully excavated;

- Work is continuing on a trench to protect the open pit from water ingress;

- Southern end of tailings dump retaining wall now complete, work continues at the northern end;

- Some washplant components including conveyer belts and parts of the sluices have arrived, other components due;

- Construction has commenced on the field laboratory which will upgrade concentrates ahead of shipping for refining.

Further detail

Excellent progress has been made by the team onsite at the West Kytlim Project in the five weeks since commencing the operation. The preparatory work necessary to organise a safe, effective and environmentally sound work site to mine an alluvial orebody is now well advanced. As described previously, (see RNS's date 25 May 2016 And 21 June 1016), the current phase of operations is a start-up operation utilising diesel powered machinery to produce near and at surface ore bodies in the area known as Malaya Sosnovka. Significant capital expansion to include draglines operating on mains grid power is planned for year 2 and for the projected ten-year life of mine.

Once preparatory work has been completed the focus will immediately shift to production from the 5 defined reserve blocks in the Malaya Sosnovka area. Critical elements of the washplant have arrived to site ahead of time while other longer lead time parts are now due. The washplant when constructed will have sufficient capacity to fulfil the 2016 mining schedule. A second washplant owned by Eurasia is being refurbished and can be used to process a small volume of metal bearing gravels before the main washplant is installed.

Documentation and reporting;

The Exploration Project Report covering upgrade of Resource blocks to Reserves, on the entire 21Km2 mining licence will be submitted in the coming weeks. Under the terms of the agreement with SKRS, Eurasia are responsible for exploration on the licence which will be phased to ensure supply of sufficient reserves for the mining operation.

Christian Schaffalitzky, MD at Eurasia Mining commented'

"Our 2016 field season is off to an excellent start thanks to the experienced field personnel in both Eurasia and SKRS. As a consequence we are now a matter of weeks away from producing our first concentrates for refining with no major delays envisaged. We anticipate that the final components of the washplant will be delivered and the washplant commissioned within two to three weeks, which gives us enough time to complete the tailings dam and install the final elements of the mine design, including the facility for upgrading to a shippable black sand concentrate. We are also finalizing our plans for metal refining which will be announced shortly."

http://www.moneyam.com/action/news/showArticle?id=5386213

driver

- 27 Jul 2016 15:34

- 18 of 269

- 27 Jul 2016 15:34

- 18 of 269

driver

- 27 Jul 2016 16:59

- 19 of 269

- 27 Jul 2016 16:59

- 19 of 269

banjomick

- 27 Jul 2016 19:48

- 20 of 269

- 27 Jul 2016 19:48

- 20 of 269

banjomick

- 28 Jul 2016 09:33

- 21 of 269

- 28 Jul 2016 09:33

- 21 of 269

Eurasia Mining plc (AIM: EUA)

("Eurasia" or the "Company")

Platinum refining and sales agreements with Ekaterinburg non-ferrous metals processing plant

Eurasia Mining plc, the PGM and gold mining company, is pleased to provide an update with regard to the chosen provider of metal refining services for product from the West Kytlim Mine. Agreement has been reached with the Ekaterinburg Non-ferrous Metals Processing Plant ("EZOCM"), part of the Renova Group of companies, for processing of black sand concentrates containing a suite of precious metals from the West Kytlim Mine and a separate contract has been agreed to cover sale of the resulting metal bullion to EZOCM. EZOCM have been operating for 100 years and offer a full range of processing services and end products. Details of the agreements are presented below.

Highlights:

- EZOCM has been selected as the stand out candidate with necessary equipment and personnel to refine metals from black sand concentrates.

- Concentrates at greater than 60% platinum to be delivered in batches of not less than 500g.

- Platinum refining at a cost of 2.75%, payable by Eurasia, Gold refining costs agreed at 5.5%

- Other metals in the PGM suite, i.e. Iridium, Palladium and Rhodium will be recovered but are not expected to materially affect project economics.

- Concentrates are assayed and certified by mutual agreement within 30 days of receipt.

- Refined metals are also to be sold to EZOCM with settlement within 5 days.

Further detail

The precious metals refinery at Ekaterinburg was commissioned on 23rd October 1916 and is the oldest producer of pure platinum metal in Russia selling products to circa 1,200 customers in Russia and abroad. Their products and service are internationally recognised as being of the highest quality and are included on the London Platinum and Palladium Market (LPPM) Good Delivery List of refiners and assayers. The main products of EZOCM are precious metal bullions, precious metal anode elements, chemical compounds, catalyst gauzes, crucibles for industrial uses, products used in dentistry etc.

Eurasia has agreed, through its subsidiary Kozvinsky Kamen, contracts governing refining of precious metals from black sand concentrates, and separately, sale of the metal content to EZOCM. The concentrate is upgraded on site at the project in West Kytlim to a concentrate of not less than 60% platinum, and shipped in batches of not less than 500g contained platinum. These are received to the refinery, weighed and assayed and then certified by mutual agreement between the parties. Metals are then refined from the concentrate and are subject to a refining charge per precious metal as indicated above. The metal is then sold to the refinery at 93-95% of London Metal Exchange prices and payment settled in Roubles within 5 days. Contracts will be re-negotiated on an annual basis.

Christian Schaffalitzky, MD at Eurasia Mining commented'

" EZOCM was the natural candidate for metal refining, having processed similar material from the West Kytlim area and elsewhere in the Urals Platinum Belt. We are pleased to work with them now and potentially for the Life of the Project and look forward to shipment of our first concentrates in late August. In addition, we are particularly pleased to have agreed a framework for the sales of the refined metals to EZOCM, and look forward to updating shareholders on this in due course."

http://www.moneyam.com/action/news/showArticle?id=5387045

driver

- 28 Jul 2016 17:48

- 22 of 269

- 28 Jul 2016 17:48

- 22 of 269

driver

- 29 Jul 2016 20:10

- 23 of 269

- 29 Jul 2016 20:10

- 23 of 269

driver

- 29 Jul 2016 20:10

- 24 of 269

- 29 Jul 2016 20:10

- 24 of 269

driver

- 01 Aug 2016 09:21

- 25 of 269

- 01 Aug 2016 09:21

- 25 of 269

banjomick

- 01 Aug 2016 11:38

- 26 of 269

- 01 Aug 2016 11:38

- 26 of 269

Eurasia Mining looking forward to producing first platinum within weeks

16:00 28 Jul 2016

Eurasia Mining plc (LON:EUA) Managing Director Christian Schaffalitzky tells Proactive Investors that he can meet the terms of a new refining contract for its West Kytlim alluvial platinum project, producing 80 to 100 tonnes of platinum as the first phase of development. “It is not very difficult, we have been working for the last six weeks on setting up the mine and we should start production in the next few weeks, by mid-August” he says.

Schaffalitzky says that mine will eventually be a ten year project and that Eurasia is working with a local civil engineering group who will provide all the equipment and invest the development capital. “They do it at their cost, and Eurasia in return receives 30% of the revenue and the contractor receives 70%. Our job is to monitor the mining, make sure the reserves are mined correctly and to reconcile the production against the actual platinum produced” he says.

http://www.proactiveinvestors.co.uk/companies/stocktube/5337/eurasia-mining-looking-forward-to-producing-first-platinum-within-weeks-5337.html

banjomick

- 01 Aug 2016 16:10

- 27 of 269

- 01 Aug 2016 16:10

- 27 of 269

Eurasia Mining plc (AIM: EUA)

("Eurasia" or the "Company")

Loan Agreement and Issue of Equity

Eurasia confirms today that it has executed a Loan Agreement with a syndicate led by Sanderson Capital Partners Limited (the "Agreement"). Pursuant to the terms of the Agreement, Sanderson has agreed to make available £700,000 which can be drawn down any time until 31 December 2016 and must be used by Eurasia for working capital purposes, of which £100,000 has been immediately drawn down. The loan must be repaid on or before 28 January 2017.

The Facility comprises the following:

- An unsecured, interest free (save in the event of a default), fixed term loan due for repayment no later than 28 January 2017;

- The loan can be drawn down in five £100,000 tranches no less than 30 days apart and a final tranche of £200,000 on agreement with Sanderson, with tranches two, three, four and five subject to successfully achieving certain specified project deliverables;

- An arrangement fee of £145,000, to be satisfied by the issue of 26,363,636 ordinary shares in the Company at a price of 0.55p ("New Shares");

- In addition, a further drawdown fee of £10,000 payable on each £100,000 tranche of the facility as it is drawn (which shall be satisfied by the issue of 1,818,182 Ordinary Shares in the Company at each drawdown).

Issue of Equity

Following the execution of the Agreement, the Company has today issued the New Shares and, given the drawdown of the first £100,000, has further issued 1,818,182 Ordinary Shares in lieu of the drawn down fee (a total of 28,181,818 Ordinary Shares (the "Total New Shares"). Application has been made to admit the Total New Shares to trading on AIM. Admission is expected to become effective on 4 August 2016 and the Total New Shares will rank pari passu in all respects with the Company's existing Ordinary Shares in issues.

For the purposes of the Financial Conduct Authority's Disclosure and Transparency Rules ("DTRs"), the issued ordinary share capital of the Company following the allotment of the New Shares consists of 1,433,136,055 Shares with voting rights attached (one vote per Share). There are no Shares held in treasury. This total voting rights figure may be used by shareholders as the denominator for the calculations by which they will determine whether they are required to notify their interests in, or a change to their interest in, Eurasia under the DTRs.

Christian Schaffalitzky, Managing Director said: "We are pleased to have arranged this financing with Sanderson. It removes some uncertainty in the medium term as we bring West Kytlim into production with income due in the next quarter. It retains the flexibility to freely investigate additional or substitute funding alternatives and the Board considers it to be competitive vis a vis other funding options currently on offer, given the prevailing market conditions. The Company is also looking at financing options for its other projects, bearing in mind the objective of minimizing dilution for shareholders."

http://www.moneyam.com/action/news/showArticle?id=5390011

driver

- 02 Aug 2016 14:40

- 28 of 269

- 02 Aug 2016 14:40

- 28 of 269

Happy to hold.

Re: Loan Agreement

Today at 0947

Der Mr @@@ (driver)

I understand your conclusion on the share price rise but we spent the previous few weeks negotiating the loan as well as looking for alternatives. Looking at the mining sector, there was no guarantee that our share price would improve, in fact many companies have seen the opposite. It was not apparent on Friday but it took off yesterday, too late to re-price. Equity finance is very thin on the ground and available at huge discounts. Of course we wanted to avoid this but we have spent two years living on the edge financially, unable to develop our business properly. I don’t recall a time like this in my forty years at work in the minerals industry.

Other financing options means looking at funding subsidiaries, joint ventures, partial sales etc., i.e not raising equity in Eurasia.

Regards

Christian Schaffalitzky

banjomick

- 02 Aug 2016 18:55

- 29 of 269

- 02 Aug 2016 18:55

- 29 of 269

Good honest reply is my take and understand where he is coming from.

In 2-3 weeks there should be an announcement regarding production at West Kytlim.

driver

- 02 Aug 2016 22:25

- 30 of 269

- 02 Aug 2016 22:25

- 30 of 269

I agree, they have now got finaces in place and production about to start EUA are in a good place. Just have to wait till the overhang cleares witch shouldn't be long with the large volume of late.

banjomick

- 17 Aug 2016 19:36

- 31 of 269

- 17 Aug 2016 19:36

- 31 of 269

driver

- 17 Aug 2016 22:26

- 32 of 269

- 17 Aug 2016 22:26

- 32 of 269

Cheers for the link increased my holding here, on the lows.

banjomick

- 18 Aug 2016 14:33

- 33 of 269

- 18 Aug 2016 14:33

- 33 of 269

Eurasia Mining - Semenovsky Tailing Project site overview (Video)

Thu, 18 Aug 2016, 11:00am BST

https://www.brrmedia.co.uk/broadcasts-embed/5788af8ea7593e3c7bbf7af2/event/?livelink=true&popup=true

banjomick

- 31 Aug 2016 08:09

- 34 of 269

- 31 Aug 2016 08:09

- 34 of 269

Eurasia Mining plc (AIM: EUA)

Semenovsky Tailings Project - Reserves Approval and Extension of Exclusivity

Eurasia Mining plc,("Eurasia") the Russia focused PGM and gold production and development company, here working in partnership with Metal Tiger plc ("MTR"), is pleased to update progress on work on the Semenovsky Tailings Project (STP), in Bashkiria, Russia.

Highlights:

· Reserves approved totaling 2.99 million tonnes of ore grading 1.18 grams/tonne ("g/t") of gold and 16.44 g/t of silver, with contained metal calculated as 3.5 tonnes of gold and 49.3 tonnes of silver.

· An agreement to extend the exclusivity option on STP until 15 November 2016.

As reported on the 26 April 2016, a Russian Pre-Feasibility Study equivalent - the TEO of Conditions - had previously been reviewed and approved by the expert panel at the Bashkirian mines department. A Reserves Report incorporating a fresh Reserve calculation was immediately lodged for approval and has now been approved. Previous reserve calculations had not been approved at the deposit due to insufficient metallurgical work - Eurasia have integrated metallurgical work carried out on-site in 2014 which has now been considered sufficient for approval of C2 category reserves.

The entire tailings dam reserves were approved as Russian C2 standard - 2.99m tones of ore grading 1.18 g/t gold and 16.44 g/t silver - contained metal calculated as 3.53 tonnes gold and 49.28 tonnes of silver. The drill grid density and metallurgical work was sufficient for the approval of a C2 Reserve under the Russian system of Reserves assessment.

***See Link at BOP for Table***

C1 and C2 Reserves are defined by the national Russian standards on mining and minerals as published by the National Certification Body of the Russian Federation. Data included under this standard must be approved by the Russian Federal Agency for Subsoil Use ("Rosnedra")

The work at STP is being carried out under the Heads of Terms agreement ("Heads") outlined in mid November 2015 (see RNS dated 16th November 2015). The Heads allows Eurasia and Metal Tiger to acquire 67% of the Semenovsky Tailings Project ("STP") owned by OOO Metallurg Complect. These Heads, signed between Eurasia, Metal Tiger, and the Russian registered company OOO Metallurg Complect, covered an exclusive option period of 6 months to allow for due diligence by Eurasia and Metal Tiger personnel. This was extended in May 2016 to 15 August 2016. A further extension of the exclusive option has been entered into today, to extend that exclusivity period to 15 November 2016 as work continues on detailed metallurgical testwork.

Eurasia as manager aims to complete the due diligence work and if satisfactory conclude the acquisition under the terms of the Heads, although at this stage there can be no guarantee that it will do so. Subsequently a feasibility study will be completed, which is expected to include bulk sampling, flow sheet studies and mine design.

Christian Schaffalitzky, Managing Director at Eurasia Mining comments

"We are pleased to confirm what amounts to a maiden reserve calculation under Russian standards for the Semenovsky project. It is a significant milestone and shareholders can see positive results less than 12 months from announcement of the initial Heads of Terms. Our focus now turns to the ongoing SGS metallurgical work, updated on 4 July, from which we hope to see results of our optimization study on cyanide gold recovery in September."

Consent for release

EurGeol Christian Schaffalitzky, FIMMM, PGeo, MIEI, CEng, is a director of the Company. He has reviewed the update and consents to the inclusion of the exploration information in the form and context in which it appears here. He is a Competent Person for the purposes of the reporting of these results.

http://www.moneyam.com/action/news/showArticle?id=5405930

banjomick

- 01 Sep 2016 08:12

- 35 of 269

- 01 Sep 2016 08:12

- 35 of 269

Eurasia Mining plc (AIM: EUA)

West Kytlim Mining operation update - August 2016

Eurasia Mining plc ("Eurasia") the Russia focused PGM and gold production and development company is pleased to update progress on the commencement of mining at West Kytlim, Urals, Russia.

Highlights:

· Two mining blocks have been cleared of vegetation for production with a third to be finished by 1 September 2016.

· Gravels are being excavated from block 4 and hauled to the wash plant.

· The principal equipment for the on-site laboratory is in place including the concentrating table.

· One wash plant is assembled with a second main plant to be completed next week.

· First production is planned to commence next week.

Further detail

Mining has commenced at Malaya Sosnovka, with two blocks cleared of vegetation (blocks 4 and 5) and a third block (block 1) to be cleared by 1 September 2016. Gravels are being excavated from block 4 and hauled to the wash plant site. Two wash plants will be used, with the smaller wash plant ready to process metal bearing gravels. The main wash plant is installed but not yet operational - this is expected in the first week of September. The late delivery of critical parts for this wash plant have delayed start-up by 10 days but the projected production for 2016 is still expected to be met.

For the processing of the concentrates the on-site laboratory is ready, with all the main equipment in place, including a concentrating table.

A map showing the blocks at Malaya Sosnovka has been added to the company website www.eurasiamining.co.uk.

Consent for release

EurGeol Christian Schaffalitzky, FIMMM, PGeo, MIEI, CEng, is a director of the Company. He has reviewed the update and consents to the inclusion of the exploration information in the form and context in which it appears here. He is a Competent Person for the purposes of the reporting of these results.

http://www.moneyam.com/action/news/showArticle?id=5406987

driver

- 01 Sep 2016 19:50

- 36 of 269

- 01 Sep 2016 19:50

- 36 of 269

Thu, 01 Sep 2016, 04:05pm BST

https://www.brrmedia.co.uk/broadcasts-embed/57c831ec3f18d58e362bef15/event/?popup=true#

banjomick

- 01 Sep 2016 22:06

- 37 of 269

- 01 Sep 2016 22:06

- 37 of 269

banjomick

- 02 Sep 2016 15:52

- 38 of 269

- 02 Sep 2016 15:52

- 38 of 269

driver

- 02 Sep 2016 21:58

- 39 of 269

- 02 Sep 2016 21:58

- 39 of 269

We hope.

banjomick

- 06 Sep 2016 12:00

- 40 of 269

- 06 Sep 2016 12:00

- 40 of 269

banjomick

- 08 Sep 2016 14:06

- 41 of 269

- 08 Sep 2016 14:06

- 41 of 269

Q2 2016

8th September 2016

https://www.platinuminvestment.com/files/784372/WPIC_Platinum_Quarterly_Q2_2016.pdf

banjomick

- 09 Sep 2016 08:39

- 42 of 269

- 09 Sep 2016 08:39

- 42 of 269

Eurasia Mining plc (AIM: EUA)

First platinum concentrate at West Kytlim

Eurasia Mining plc ("Eurasia") the Russia focused PGM and gold production and development company is pleased to announce the production of its first platinum concentrate at West Kytlim, Urals, Russia.

A batch of raw platinum concentrate is ready for shipment to the Ekaterinburg Non-ferrous Metals Processing Plant, as per the platinum refining and sales agreement announced in RNS dated 28 July 2016. Meanwhile gravel washing at site has been adjourned while a new water supply using steel piping is installed. This will be completed early next week. Mining continues and gravels are being stockpiled adjacent to the plant ready for washing.

A video of the operation is being prepared and when completed will be uploaded on the company's website at www.eurasiamining.co.uk. Photos of the first concentrate produced will follow this press release on the company's twitter feed and website.

http://www.moneyam.com/action/news/showArticle?id=5411959

banjomick

- 09 Sep 2016 09:04

- 43 of 269

- 09 Sep 2016 09:04

- 43 of 269

driver

- 09 Sep 2016 10:16

- 44 of 269

- 09 Sep 2016 10:16

- 44 of 269

banjomick

- 09 Sep 2016 10:37

- 45 of 269

- 09 Sep 2016 10:37

- 45 of 269

banjomick

- 09 Sep 2016 16:13

- 46 of 269

- 09 Sep 2016 16:13

- 46 of 269

Eurasia Mining plc (AIM: EUA)

Acceptance report from Ekaterinburg refinery

Further to the announcement made earlier today, Eurasia Mining plc ("Eurasia") the Russia focused PGM and gold production and development company is pleased to announce the acceptance of its first batch of concentrate at the Ekaterinburg Non-ferrous Metals Processing Plant ("EZOCM" or 'The Refinery").

Eurasia had previously agreed terms with EZOCM, as announced in RNS dated 28 July 2016 and has commenced shipment of raw platinum concentrate from its mine in the Ural Mountains. The concentrate was weighed on entry to the plant as 574.18 grams of raw platinum concentrate. Under the terms of Eurasia's agreement with EZOCM, the refinery will now separate pure platinum and gold from waste (mostly iron) in the concentrate. The refined metals are then sold to the refinery.

The exact quantity of pure platinum will vary with each batch but is expected to be in line with similar products from other Uralian Mines and range between 70 and 75% pure platinum. Platinum, gold, other platinum group metals and iron form nuggets which are separated from gravel to form the company's mined concentrate product.

Christian Schaffalitzky, MD at Eurasia comments. 'This acceptance receipt represents the first step on a long road through development at the West Kytlim project. We now look forward to steady state production from the mine site once a necessary upgrade to our water supply system is completed. We appreciate our stakeholders' patience and salute the hard work and diligence of our co-workers and colleagues in Ekaterinburg and at the mine site.'

http://www.moneyam.com/action/news/showArticle?id=5412448

driver

- 09 Sep 2016 16:19

- 47 of 269

- 09 Sep 2016 16:19

- 47 of 269

I agree and the coat brought the sp back..

banjomick

- 15 Sep 2016 08:11

- 48 of 269

- 15 Sep 2016 08:11

- 48 of 269

Eurasia Mining plc

Interim Results for the six months ended 30 June 2016

Chairman's Statement

Dear Shareholder,

As I anticipated in the Annual Report, platinum and gold mining at West Kytlim has commenced, with the prospect of at least 10 years of production lying ahead. At the time of writing we have shipped and had notification of receipt of the first concentrates from the mine. A single shipment of 574.18 grams of raw platinum was received at the Ekaterinburg Non-ferrous Metals Processing Plant and will be refined and then purchased by the refinery under the terms of our refining and sales agreement.

We are very pleased that we have come to this point despite difficult market conditions. Furthermore, we believe our royalty-like structure with OOO SK Region Stroy ("SKRS") has proved to be the correct course, sparing the Company additional shareholder dilution, project finance or loans. SKRS is a reputable contractor working with major companies in Russia and has undertaken to provide all the infrastructure, equipment and supplies for mining, as well as the operating costs, in exchange for a 70% return of the gross revenue. This allows Eurasia to earn 30% of top line sales without any financing risk. Meanwhile Eurasia has committed to leverage its expertise in alluvial platinum exploration and reserves definition to upgrade known resources to reserves within the mining license.

As SKRS had surplus earth-moving equipment and personnel to deploy to our West Kytlim site and Eurasia was seeking a risk-free structure, our agreement with SKRS presented a mutually beneficial agreement which is now bearing fruit. Revenue should now commence in the month of September with its distribution to the parties managed by Eurasia. The recent significant improvement in platinum and gold prices is a timely bonus for the operation. Further price growth is projected for precious metals by many analysts, in particular due to the structural deficit in notably South African platinum supply. This could further improve the economics at West Kytlim, even as Eurasia is protected from some downside risk through the royalty-like structure which awards a share of top line sales regardless of the operation's bottom line.

As I wrote earlier, we plan to increase the mining rate over the next two years and this will involve the installation of a powerline and the use of mains-powered draglines for waste stripping and ore stockpiling. These activities are to be undertaken by SKRS throughout this winter at no cost to Eurasia.

At Monchetundra, we continue to work on completing our filings for the eventual application for a discovery certificate and later a mining licence. The two target open pit resources are at West Nittis and Loipishnune. Initial positive drilling results from West Nittis, as well as the successful application of shallow soil geochemistry profiling, were announced on 22nd April 2016. This project is being reviewed by several interested parties and we are hopeful we can find a partner or a purchaser to advance it to production

At Semenovsky, our new gold in tailings project, we are continuing with detailed metallurgical testwork as the last step in our due diligence work, in advance of designing a mine. The exclusive option has been extended to November to allow more time to complete the transaction. In addition Eurasia, working in joint venture with Metal Tiger plc, has sought and been granted approval of a feasibility report (TEO in Russia) and its related reserves calculation. Both have now been approved and this, a maiden reserve for the project, has been registered on the state balance sheet as a C2 Reserve containing 3.5 tons of gold (112,000 ounces) and 49.3 tons of silver (1,578,000 ounces) (see announcement dated 31st August 2016). Results from the Eurasia drilling program carried out in April 2016 at Semenovsky also confirmed previously assessed grades in gold and silver. Average grade from the EUA drill program are 1.16 g/t gold and 17.3 g/t silver.

In conclusion, the directors of Eurasia have targeted cash-generative and 'straight-forward' mining projects to support the development of the Company. We believe this strategy has proven successful for the Company's survival in the long term. Eurasia's royalty-like financing structure for the West Kytlim mine has allowed us to advance the project to mining and we look forward to crystallizing further value from our partnership with SKRS when the project achieves steady state production in the short term, and benefits from capital expansion in the medium term.

Michael Martineau

Chairman

http://www.moneyam.com/action/news/showArticle?id=5415220

banjomick

- 15 Sep 2016 09:50

- 49 of 269

- 15 Sep 2016 09:50

- 49 of 269

07:56 15 Sep 2016

Contractor SKRS is providing all the infrastructure and supplies for mining, as well as stumping up the operating costs, in exchange for a 70% return of the gross revenue

Eurasia Mining plc (LON:EUA) should see first revenues this month (September) after mining begun at its West Kytlim platinum project in Russia, it told investors in its half year results.

As reported last Friday, the Ekaterinburg refinery had accepted the first batch of platinum concentrate, which will be refined and then purchased as per previously agreed terms.

And the West Kytlim operation will be boosted by the significant improvement in platinum and gold prices, said Eurasia, while prices are thought to go higher still by analysts.

Contractor SKRS is providing all the infrastructure and supplies for mining, as well as stumping up the operating costs, in exchange for a 70% return of the gross revenue.

Eurasia reckons this royalty structure was a good move, allowing it to spare further shareholder dilution or loans, allowing it to earn 30% of top line sales with no risk.

At the group's other projects, at Monchetundra on the Kola peninsula, it is working towards a discovery certificate and later a mining licence and there have been initial positive drilling results from one of the open pit resources at West Nittis.

The firm hopes to find a partner or buyer to advance it to production

In August, it reported a major milestone for its Semenovsky Tailings Project (STP) in Russia - namely a maiden reserve, with the entire tailings dam approved at Russian C2 standard to total 2.99mln tonnes of ore grading 1.18 g/t gold and 16.44 g/t silver.

For the six months to end June, the pre-revenue firm posted a profit of £855,000 (2015: loss of £1.68mln) and the cash at end of period was £183,591.

Giles Gwinnett

driver

- 15 Sep 2016 14:26

- 50 of 269

- 15 Sep 2016 14:26

- 50 of 269

banjomick

- 21 Sep 2016 09:20

- 51 of 269

- 21 Sep 2016 09:20

- 51 of 269

Eurasia Mining plc (AIM: EUA)

West Kytlim update/ Loan facility draw down and issue of equity

Eurasia Mining plc ("Eurasia") the Russia focused PGM and gold production and development company is pleased to confirm that mining is underway at West Kytlim and concentrate continues to be produced. An interruption necessary to refurbish the water supply was resolved within three days and production of concentrate has continued since. A more detailed announcement will follow in due course.

Separately, Eurasia confirms that it has executed a further draw down of its loan facility with Sanderson Capital Partners Limited("Sanderson") as per the agreement outlined in the announcement dated 1 August 2016. Pursuant to the terms of the Agreement, Sanderson had agreed to make available £700,000 which can be drawn down any time until 31 December 2016 and must be used by Eurasia for working capital purposes. The facility may be fulfilled in £100,000 tranches not less than 30 days apart and must be repaid on or before 28 January 2017. This is the second draw down of the facility; an initial draw down was executed when the agreement was finalized on the 1 August 2016.

Furthermore, each drawdown shall be subject to a fee of £10,000 payable as each tranche of the facility is drawn and may be met by the issue of Ordinary Shares in the company. Eurasia confirms that 1,538,462 ordinary shares ("New Shares") have been issued to Sanderson in lieu of the drawdown fee and application has been made to admit the new shares to trading on AIM.

Admission is expected to become effective on 26 September 2016 and the New Shares will rank pari passu in all respects with the Company's existing Ordinary Shares in issues.

For the purposes of the Financial Conduct Authority's Disclosure and Transparency Rules ("DTRs"), the issued ordinary share capital of the Company following the allotment of the New Shares consists of 1,434,674,517 Shares with voting rights attached (one vote per Share). There are no Shares held in treasury. The total voting rights figure may be used by shareholders as the denominator for the calculations by which they will determine whether they are required to notify their interests in, or a change to their interest in, Eurasia under the DTRs.

Christian Schaffalitzky MD at Eurasia comments ' This is a particularly busy time for Eurasia as we are active at all three of the company's projects. We continue to work to produce from this season's mining allotment at West Kytlim and have recently (see the announcement dated 9 September 2016) shipped our first batch of concentrate to the Refinery in Ekaterinburg. Our geologists and contractors are finalizing a TEO and reserves statement to be used in application for a discovery certificate before end of year at the Monchetundra hardrock PGM project, while SGS laboratories in Chita are engaged in the final round of optimized cyanide recovery tests on samples from the Semenovsky Tailings Project. The Sanderson facility provides essential working capital to drive these objectives, and we look forward to updating on developments in the near term.'

http://www.moneyam.com/action/news/showArticle?id=5418455

banjomick

- 10 Oct 2016 14:57

- 52 of 269

- 10 Oct 2016 14:57

- 52 of 269

Eurasia Mining plc (AIM: EUA)

("Eurasia" or the "Company")

Engineering Procurement, Construction and Commissioning contract

Eurasia Mining (LON:EUA), the London Stock Exchange AIM listed PGM and gold mining company, is pleased to announce that an Engineering Procurement, Construction and Commissioning ("EPC") turnkey contract has been signed in relation to its Monchetundra project in the Kola peninsula in northwest Russia bordering Finland, between Eurasia's 80% subsidiary, Closed Joint Stock Company "Terskaya Gornaya Kompaniya" ('TGK') which holds the Monchetundra licence and Sinosteel, a Chinese state owned group operating primarily in mining, trading, equipment manufacturing and engineering.

The contract is for the development of two platinum group metal ('PGM') deposits located in the Company's Monchetundra licence area, which also contain gold, copper, cobalt and nickel. Feasibility studies are currently underway on two deposits, Loipishnune and West Nittis, to be completed by year-end. Together with the EPC contract, this will be the culmination of the Company's work since the licence was acquired in 2006. The contract provides for engineering, procurement and construction of a 1.7 million tonnes per annum PGM beneficiation project at Monchetundra.

Sinosteel's engineering and construction arm is Sinosteel Equipment & Engineering Co. Ltd. Sinosteel is a major mining company and the second largest importer of iron ore in China. It is one of the largest global EPC contractors with a track record of successfully commissioning similar projects in Australia, Africa, China and Latin America.

The proposed contract would provide for Sinosteel to undertake mine and processing plant turnkey construction and commissioning on a commercial arms-length basis. The debt-based finance for the EPC turnkey contract is to be arranged by Sinosteel and is an integral part of the EPC turnkey contract. This EPC contract is being advanced as part of discussions with third parties for the sale or joint venture of the project.

Sinosteel's contract is based on a 2 year due diligence and evaluation of the Monchetundra project. The principal terms of the financing are:

· The contract value totals US$176,000,000 with the loan covering 85% of the contract value.

· Within the contract, a subcontract for $50,000,000 million is assigned to TGK to cover all preparatory engineering and pre-strip works on the two open pit deposits. TGK expects that this subcontract will be sufficient to meet the 15% equity contribution required for the project.

· Sinosteel will be responsible for the debt finance of $149,600,000 (i.e. 85% of the contract value) with the financing terms included in the EPC contract as a 10-year loan with early repayment permitted, at an indicative interest floating rate at 6 month LIBOR plus 3.5%.

· Sinosteel will carry the loan on its balance sheet with its rights and obligations under the financing and the loan will only be assigned to TGK following completion of the EPC contract, subject to key performance indicators to be achieved by the plant commissioned by Sinosteel.

· The contract is exclusive to Sinosteel for a period of ten years.

· The contract provides for a schedule of payments commencing within 36 months. This period is to allow for the obligatory steps within the Russian mine permitting system.

The contract is conditional on, amongst other things, the Company receiving all the necessary permits from the government and therefore at this stage there is no guarantee that the transaction will complete. Further updates will be provided in due course.

Christian Schaffalitzky Managing Director of Eurasia Mining said "We have always considered Monchetundra to be an attractive project and the recent expressions of interest, including the concept of an outright proposal to acquire the project, and the desire to secure an EPC contract in relation to Monchetundra, clearly demonstrates that our judgment was well founded.

This contract with one of the world largest EPC contractors provides the framework for the construction of a processing plant designed to treat ore from two open pits in the Monchetundra licence area. Meanwhile our other business continues to progress; at West Kytlim, deliveries to the refinery are continuing and payment amounts for the first batch of concentrate have been agreed, while at the Semenovsky gold project, our metallurgical testing program is nearing completion. We will provide separate updates on these projects in due course."

End

http://www.moneyam.com/action/news/showArticle?id=5429852

banjomick

- 10 Oct 2016 15:08

- 53 of 269

- 10 Oct 2016 15:08

- 53 of 269

driver

- 10 Oct 2016 17:28

- 54 of 269

- 10 Oct 2016 17:28

- 54 of 269

banjomick

- 10 Oct 2016 19:06

- 55 of 269

- 10 Oct 2016 19:06

- 55 of 269

banjomick

- 10 Oct 2016 19:12

- 56 of 269

- 10 Oct 2016 19:12

- 56 of 269

16:29 10 Oct 2016

Sinosteel is a major engineering outfit and one of the largest importers of iron ore into China.

Eurasia Mining plc (LON:EUA) shares doubled as the Russia-focused junior unveiled a massive deal with Chinese major Sinosteel to develop its Monchetundra platinum project on the Finnish border.

The contract is for the development of two platinum deposits and a 1.7mln tonnes per year beneficiation plant.

Sinosteel is a major engineering outfit and one of the largest importers of iron ore into China.

It will construct and commission the mine on a commercial arms-length basis, with the contract in total worth US$176mln.

Sinosteel will arrange US$150mln worth of finance for the development, with funding an integral part of the EPC turnkey contract said Eurasia.

Some USS$50mln of the contract will be assigned to Eurasia’s 80% subsidiary TGK for open pit preparatory work.

Sinosteel's contract is based on a two-year due diligence and evaluation of the Monchetundra project.

The plant contract is exclusive to Sinosteel for a period of ten years.

Christian Schaffalitzky, Eurasia’s managing director said: "We have always considered Monchetundra to be an attractive project and the recent expressions of interest, including the concept of an outright proposal to acquire the project, and the desire to secure an EPC contract in relation to Monchetundra, clearly demonstrates that our judgment was well founded.

“This contract with one of the world largest EPC contractors provides the framework for the construction of a processing plant designed to treat ore from two open pits in the Monchetundra licence area."

Shares jumped 100% to 1.05p.

Elsewhere, at West Kytlim, deliveries to the refinery are continuing and payment amounts for the first batch of concentrate have been agreed, while at the Semenovsky gold project, our metallurgical testing program is nearing completion, said Schaffalitzky.

Philip Whiterow

driver

- 10 Oct 2016 20:08

- 57 of 269

- 10 Oct 2016 20:08

- 57 of 269

Yes looks like we have seen the back of the overhang.

maestro - 11 Oct 2016 07:49 - 58 of 269

faceface - 11 Oct 2016 11:28 - 59 of 269

driver

- 11 Oct 2016 14:45

- 60 of 269

- 11 Oct 2016 14:45

- 60 of 269

http://www.proactiveinvestors.co.uk/companies/news/167229/big-deals-suddenly-flowing-in-junior-mining-167229.html

driver

- 11 Oct 2016 17:15

- 61 of 269

- 11 Oct 2016 17:15

- 61 of 269

Tue, 11 Oct 2016, 03:30pm BST

Christian Schaffalitzky, Managing Director of Eurasia Mining, discusses the Engineering Procurement, Construction and Commissioning turnkey contract which has been signed in relation to its Monchetundra project in the Kola peninsula in northwest Russia.

https://www.brrmedia.co.uk/broadcasts/57fce41e23b1a5e411ab8ea1/eurasia-mining-engineering-procurement-construction-and-commissioning-contract

banjomick

- 11 Oct 2016 19:19

- 62 of 269

- 11 Oct 2016 19:19

- 62 of 269

banjomick

- 12 Oct 2016 10:57

- 63 of 269

- 12 Oct 2016 10:57

- 63 of 269

China deal a 'one-step turnkey' contract to develop Russian mine, says Eurasia boss

Published on Oct 11, 2016

The Russia-focused junior miner's unveiled a massive deal with Chinese major Sinosteel to develop its Monchetundra platinum project. The contract is for the development of two platinum deposits and a beneficiation plant.

Managing director Christian Schaffalitzky tells Proactive: “Those people who follow the mining business will know we've been having a really rough time since the crash of metal prices in 2008. Normally we would do one of two things - we would raise funds to do our development work with equity capital, however the mining funds are no longer present or are much more diminished. The second way would be in joint venture with a major mining company but unfortunately they got too over-leveraged and so have been very inactive in the sector. So those of us who take risks to develop new deposits have been left on our own.”

“This new contract is basically a loan package and EPC contract, so a turnkey operation to develop the mine and plant to extract platinum group metals, precious metals and base metals from the deposits we've been exploring.

“It's basically a one-step turnkey contract with financing already conceptually in place for when we get the go-ahead from the Russian government to develop the mine,” Schaffalitzky added.

Sinosteel will construct and commission the mine with the contract in total worth US$176mln.

https://www.youtube.com/watch?v=CU6vG1qR_MM

driver

- 12 Oct 2016 17:01

- 64 of 269

- 12 Oct 2016 17:01

- 64 of 269

banjomick

- 13 Oct 2016 13:46

- 65 of 269

- 13 Oct 2016 13:46

- 65 of 269

banjomick

- 13 Oct 2016 15:51

- 66 of 269

- 13 Oct 2016 15:51

- 66 of 269

Thu, 13 Oct 2016, 02:15pm BST

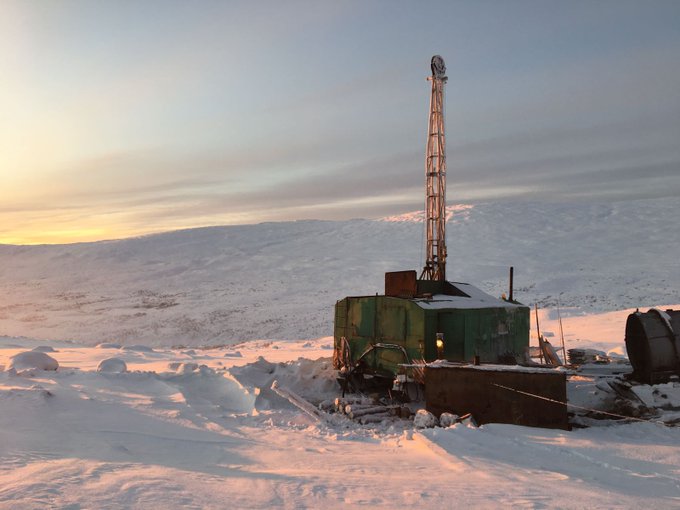

This footage, compiled in late September and early October summarises the start up operation at the West Kytlim platinum and gold mine.

https://www.brrmedia.co.uk/broadcasts-embed/57ff71b74ef34929294b9119/event/?livelink=true

banjomick

- 28 Oct 2016 19:23

- 67 of 269

- 28 Oct 2016 19:23

- 67 of 269

banjomick

- 28 Oct 2016 21:11

- 68 of 269

- 28 Oct 2016 21:11

- 68 of 269

Thursday, 3 November 2016 from 18:00 to 21:00 (GMT)

City of London, United Kingdom

https://www.eventbrite.co.uk/e/miningmaven-investor-evening-with-kolar-gold-lonkgld-ortac-resources-lonotc-and-eurasia-mining-tickets-28223342778

driver

- 31 Oct 2016 14:48

- 69 of 269

- 31 Oct 2016 14:48

- 69 of 269

banjomick

- 03 Nov 2016 09:52

- 70 of 269

- 03 Nov 2016 09:52

- 70 of 269

Eurasia Mining plc (AIM: EUA)

Projects Update

The Company is pleased to update shareholders on progress on its three projects in Russia. Eurasia's West Kytlim platinum and gold project is now in production, first shipments of concentrate began in early September (see RNS dated 9 September 2016). The Monchetundra Project is in late stage development and has been bolstered by an Engineering, Procurement, Construction and Commissioning ("EPC") contract with Sinosteel Equipment and Engineering Co Ltd, while the Semenovsky Gold in Tailings Project remains under review as metallurgical test work for cyanide gold recovery nears completion.

Monchetundra, Kola Peninsula, NW Russia

As announced on Monday 10 October 2016, Eurasia has signed an EPC contract between Sinosteel (one of the largest Chinese stated-owned engineering groups), and Terskaya Gornaya Kompaniya ('TGK'), Eurasia's 80% subsidiary which holds the Monchetundra PGM licence near Monchegorsk, an industrialized area of the Kola Peninsula close to the border with Finland.

- Under the terms of the EPC contract, Sinosteel has undertaken to build a processing facility capable of treating 1.7 million tonnes per annum from two open pits within the Monchetundra licence and capable of extracting 130,000 oz of platinum equivalent per annum. The contract value totals US$176,000,000 with a US$50,000,000 subcontract assigned to TGK in respect of preparatory and pre-strip works.

- Sinosteel is to be responsible for debt finance covering 85% of the contract value with debt obligations assigned to TGK when the facility achieves production of 130,000 oz PGM equivalent per annum. The loan is assigned to TGK only on successful completion of the works such that Sinosteel are motivated to achieve design capacity on schedule. Interest is charged at a floating rate of 6 month LIBOR +3.5% per annum and the loan term set at 10 years with no penalty for early repayment.

- Following the success of the royalty-like structure signed and implemented on the West Kytlim project, Eurasia has entered into talks with an international engineering company to manage the mining operation at the Monchetundra project, and to work for the company as the owner's representative throughout the design and build phase of the Sinosteel EPC agreement and thereafter during the operation of the mine. It is envisaged that the structure used successfully at West Kytlim, where the mining operation is outsourced for a split on revenue, can be replicated at the Monchetundra project. Further updates will be made in due course.

West Kytlim, Urals

Mining and production of platinum continues at West Kytlim, with weather not stopping production and the forecast reasonable for the coming weeks. The Company will provide details of the final production figures and projected income on completion of the season's works. The trial mining operation has tested two washplants, one owned by Eurasia and refurbished on site, and another larger plant supplied by the contractor SK-Region Stroy. The information pertaining to the constitution and washability of gravels gained from these exercises will be instrumental in ensuring a smooth path to next season's production, as we approach the close of this year's mining season.

Semenovsky Tailings Project, Urals

Metallurgical testwork continues to investigate the details of the tailings composition, in view of the material being sourced historically from three mines with different mineralogy. This work will be completed shortly and then form the basis of an assessment by metallurgists for the optimal production route. Work is being carried out at SGS Chita and further announcements will be made in due course.

MD Christian Schaffalitzky commented:

"We have endeavored to replicate the structure, which has been proven to work at West Kytlim, at the Monchetundra Project with an additional contract to cover the considerable capital outlay. We believe this presents a route to project development which minimizes exposure for Eurasia, further shareholder dilution, and allows the project to be developed despite a continuing resource sector downturn.

We believe the transaction is very much on trend considering Sino-Russian relations over the past number of years. Chinese firms are increasingly active in the Russian market in rare earths, PGM, base metals and precious metals. It was our intention to capitalize on this evolving relationship and to offset some of the development risk to a suitably qualified and experienced engineering firm with considerable banking and political reach. Sinosteel is, under the terms of the contract, highly motivated to deliver the plant as stipulated in the contract, because they will be responsible for $150 million until they reach the production level of 130,000 oz of platinum equivalent per annum.

Further outsourcing the running of the mine to an international company with experience in operating mines is now a top priority for Eurasia. Engaging such a group to act as owner's representative during plant construction aims to ensure the plant is built in line with best international practice. We look forward to updating on developments in this regard in the near term."

http://www.moneyam.com/action/news/showArticle?id=5442835

driver

- 03 Nov 2016 13:01

- 71 of 269

- 03 Nov 2016 13:01

- 71 of 269

banjomick

- 07 Nov 2016 13:42

- 72 of 269

- 07 Nov 2016 13:42

- 72 of 269

http://www.eurasiamining.co.uk/~/media/Files/E/Eurasia-Mining/reports-and-presentations/Copy%20of%20eua%20mining%20maven%20nov%2016.pdf

banjomick

- 09 Nov 2016 13:24

- 73 of 269

- 09 Nov 2016 13:24

- 73 of 269

@eurasiamining

59m

Video of $EUA MD Schaffalitzky presenting @theminingmaven event last week. goo.gl/ugvM3G pic.twitter.com/qilj51yLhf

View photo ·

https://www.brrmedia.co.uk/broadcasts/582209eb9d013e187447c7c6/eurasia-mining-platinum-pgms-and-gold-in-russia

Eurasia Mining

@eurasiamining

2h

$EUA comes up Trumps with a 33g Platinum nugget. Value ranges £570 to £690, or best for a collector? pic.twitter.com/z9Vqbmzjmb

View photo

driver

- 09 Nov 2016 16:55

- 74 of 269

- 09 Nov 2016 16:55

- 74 of 269

banjomick

- 18 Nov 2016 14:45

- 75 of 269

- 18 Nov 2016 14:45

- 75 of 269

Issue of Equity

Further to the announcement of 1 August 2016, the Company confirms that it has drawn down a further £200,000 under its loan arrangement with Sanderson Capital Partners Limited ("Sanderson"), and accordingly has today issued 4,800,000 ordinary shares in the Company at a price of £0.00625 to Sanderson in satisfaction of the drawdown fee of £30,000 connected to the loan, described in that announcement. The total amount drawn down under this current loan arrangement with Sanderson is now £500,000.

Accordingly the Company has today issued a total of 4,800,000 Ordinary Shares (the "New Shares"). Application will be made for the New Shares to be admitted to trading on AIM and dealings in these shares are expected to commence on the 23 November 2016.

Following the issue of the new shares the total number of issued ordinary shares in the Company will then be 1,463,792,059 ordinary shares and consequently the total number of voting rights in the Company will be 1,463,792,059. This figure may be used by shareholders in the Company as the denominator for the calculations by which they will determine if they are required to notify their interest in the share capital of the Company under the Disclosure and Transparency Rules.

http://www.moneyam.com/action/news/showArticle?id=5451576

banjomick

- 21 Nov 2016 10:15

- 76 of 269

- 21 Nov 2016 10:15

- 76 of 269

Eurasia Mining plc (AIM: EUA)

Potential Agreement

The Company is pleased to announce that its 80% subsidiary company, Terskaya Gornaya Kompaniya ('TGK'), has granted exclusivity to Lemuria Royalties Inc. ('Lemuria') of Canada to conduct a due diligence on its Monchetundra PGM project until January 15, 2017. The purpose of the due diligence is to consider the potential financing of some of the project by Lemuria using a royalty structure.

As announced on 3 November 2016, Eurasia entered into talks with an international engineering company to manage the mining operation at the Monchetundra project, and to work for the company as the owner's representative throughout the design and build phase of the Sinosteel EPC agreement and thereafter during the operation of the mine. The directors believe a financing structure with Lemuria would put Eurasia in a safer position and would be a natural hedge for the project risks, although at this stage there can be no guarantee that any transaction will proceed.

The EPC contract was more specifically described in the announcement of 10 October 2016. This contract is on a turn-key basis, with financing and delivery of first production guaranteed. While a loan of 85% of the estimated project cost is covered by a Sinosteel loan facility that will sit on Sinosteel's balance sheet until the project is up and running, a balance of US$26 million is required for completion of the project.

Due diligence work is commencing immediately and both Eurasia and TGK staff will assist Lemuria in their assessment of the project. Further updates will be provided in due course.

Christian Schaffalitzky, Managing Director commented: "We are excited by this opportunity to further reduce the risk on the development of the Monchetundra project. The royalty structure works by providing capital upfront to advance the development and is repaid from the mine revenue streams. This is another option being considered in seeking the best way forward for Eurasia."

http://www.moneyam.com/action/news/showArticle?id=5452103

banjomick

- 21 Nov 2016 11:15

- 77 of 269

- 21 Nov 2016 11:15

- 77 of 269

10:33 21 Nov 2016

The latter has been granted exclusive due diligence at the site until January 15 next year..

Russia-based Eurasia Mining plc (LON:EUA) will potentially have Lemuria Royalties Inc on board to provide finance at its Monchetundra platinum project.

The latter has been granted exclusive due diligence at the site until January 15 next year..

Eurasia says the idea is Lemuria will potentially fund some of the project through royalty streams.

In October, Eurasia unveiled a huge development deal with Chinese giant Sinosteel, which will build both the mine and processing plant through a contract worth US$176mln.

A loan facility from Sinosteel covers 85% of that project cost, which will sit on Sinosteel's balance sheet until the project is up and running, but a balance of balance of US$26 million is required to complete the project, Eurasia said.

Christian Schaffalitzky, Eurasia's managing director, said today: "We are excited by this opportunity to further reduce the risk on the development of the Monchetundra project.

"The royalty structure works by providing capital upfront to advance the development and is repaid from the mine revenue streams. This is another option being considered in seeking the best way forward for Eurasia."

Giles Gwinnett

driver

- 21 Nov 2016 11:47

- 78 of 269

- 21 Nov 2016 11:47

- 78 of 269

faceface - 21 Nov 2016 12:08 - 79 of 269

driver

- 21 Nov 2016 22:43

- 80 of 269

- 21 Nov 2016 22:43

- 80 of 269

More news here could come at any time, STP and this seasons production figures when this goes it will fly..

banjomick

- 28 Nov 2016 22:10

- 81 of 269

- 28 Nov 2016 22:10

- 81 of 269

Europe's largest mining investment forum

Eurasia Mining Plc

Eurasia Mining PLC is a mining and mineral exploration company focused on platinum, PGM and gold projects in Russia.

The company continues to advance two key licences at West Kytlim in the Central Urals, and Monchetundra on the Kola Peninsula, and retains an option over the Semenovsky gold tailings project in the Southern Urals.

Eurasia made the transition from explorer to miner at the West Kytlim platinum and gold mine in August this year, and plans capital expansion in 2017. The company’s strategy is to focus on near term cash generative projects such as alluvial mining and tailings reprocessing, while leveraging 20 years of Russian experience to bring larger projects to market. The Monchetundra Project was bolstered by a $176m EPC contract in early October, while metallurgical testing at Semenovsky is now in its final stages.

With mining continuing at West Kytlim and a pipeline of quality projects established, Eurasia is poised for growth through 2017.

Stand: D28

http://london.minesandmoney.com/exhibitor/eurasia-mining-plc/

banjomick

- 30 Nov 2016 09:31

- 82 of 269

- 30 Nov 2016 09:31

- 82 of 269

4:07 AM - 29 Nov 2016

https://mobile.twitter.com/eurasiamining

driver

- 30 Nov 2016 14:20

- 83 of 269

- 30 Nov 2016 14:20

- 83 of 269

Fully loaded here..

banjomick

- 09 Dec 2016 16:48

- 84 of 269

- 09 Dec 2016 16:48

- 84 of 269

faceface - 09 Dec 2016 17:51 - 85 of 269

driver

- 09 Dec 2016 23:18

- 86 of 269

- 09 Dec 2016 23:18

- 86 of 269

driver

- 12 Dec 2016 08:27

- 87 of 269

- 12 Dec 2016 08:27

- 87 of 269

driver

- 12 Dec 2016 11:40

- 88 of 269

- 12 Dec 2016 11:40

- 88 of 269

faceface - 12 Dec 2016 12:21 - 89 of 269

driver

- 12 Dec 2016 13:05

- 90 of 269

- 12 Dec 2016 13:05

- 90 of 269

1p is on the cards for the end of day IMO

driver

- 12 Dec 2016 13:09

- 91 of 269

- 12 Dec 2016 13:09

- 91 of 269

driver

- 16 Dec 2016 16:09

- 92 of 269

- 16 Dec 2016 16:09

- 92 of 269

https://www.youtube.com/watch?v=Ip0BD3Fp_fM&feature=youtu.be

banjomick

- 21 Dec 2016 09:12

- 93 of 269

- 21 Dec 2016 09:12

- 93 of 269

Loan Agreement and Issue of Equity

Eurasia is pleased to announce that it has entered into a new funding facility with a syndicate led by Sanderson Capital Partners Limited ("Sanderson"), of up £1 million (this includes the £500,000 drawn down under the previous loan arrangement with Sanderson, announced on 1 August 2016). . The directors believe this loan will provide the Company with sufficient working capital for the immediate future, with cashflow generation from West Kytlim due to begin in April when production commences.

The facility comprises the following;

- A £500,000 unsecured, interest free, fixed term loan due for repayment no later than 15 May 2017

- The loan can be drawn down in two tranches of £150,000 tranches no less than 30 days apart and two tranches of £100,000, with tranches two, three and four subject to successfully achieving certain specified project deliverables;

- The option for Sanderson to include the £500,000 drawn down from the previous arrangement with Eurasia (announced on 1 August 2016) into this facility (taking the total to £1m).

- A fee payable in 30,769,231 ordinary shares in the company shall be issued as soon as is practicable to Sanderson as an arrangement fee on signing.

- In addition, a drawdown fee of 15% will be paid by Eurasia to Sanderson for each drawdown, and a further 15% fee will be paid if Sanderson elects to include the previous £500,000 into the facility.

Issue of Equity

Following the execution of the Agreement, the Company has today issued new shares in lieu of both the arrangement fee and initial drawdown fee. The total number of shares issued amounts to 33,581,731 ordinary shares ("New Shares") (30,769,231 in respect of the arrangement fee, and a further 2,812,500 calculated as 15% of £150,000 at a share price of £0.008).

Admission is expected to become effective on 29 December 2016 and the New Shares will rank pari passu in all respects with the Company's existing Ordinary Shares in issues.

For the purposes of the Financial Conduct Authority's Disclosure and Transparency Rules ("DTRs"), the issued ordinary share capital of the Company following the allotment of the New Shares consists of 1,497,373,790 Shares with voting rights attached (one vote per Share). There are no Shares held in treasury. This total voting rights figure may be used by shareholders as the denominator for the calculations by which they will determine whether they are required to notify their interests in, or a change to their interest in, Eurasia under the DTRs.

Christian Schaffalitzky, Managing Director said: "We are pleased to have arranged our financing with Sanderson, essential in maintaining liquidity in the business without diluting our shareholders, while allowing us to further our projects in Russia through Q1 2017, as we anticipate the cash flow from our West Kytlim project. We expect to provide a further strategic project update before close of business for 2017.

http://www.moneyam.com/action/news/showArticle?id=5469314

banjomick

- 22 Dec 2016 12:00

- 94 of 269

- 22 Dec 2016 12:00

- 94 of 269

Eurasia Mining plc (AIM: EUA)

Projects Update and Semenovsky Metallurgical Study Results.

Update on West Kytlim and Monchetundra Projects

West Kytlim

Eurasia commenced mining operations at its 75% owned West Kytlim Alluvial Platinum Mine in the Ural Mountains this year (See RNS dated 1 September 2016). Shipments of raw platinum concentrate to a refinery in Ekaterinburg continued through the mining season with a final shipment in the second week of December.

A final statement on revenue from Platinum, Gold, Palladium, Iridium and Rhodium revenues is expected from the refinery in January 2017. The project is performing well, while the deferred payment basis from the refinery (which is a high credit rating company) required the use of a debt facility from Sanderson Capital Partners (See RNS dated 21 December 2016), partly as a temporary interim financing.

Monchetundra

A Feasibility Study "TEO" (Technico Economicheskiye Obosnovaniye or Technical and Economic Feasibility) was officially submitted today (22 December 2016) for approvals at the State Commission on Mineral Reserves ("GKZ"). This document, considered equivalent to a 'Western' feasibility study, documents the economic extraction of the reserves already identified at two open pit targets on Eurasia's 80% owned Monchetundra License.

The reserves, when approved, will represent the maiden reserves defined for the license. In addition, an Engineering Procurement and Construction (See RNS dated 10 October 2016) contract ("EPC Contract") is already in place with Sinosteel, a Chinese state owned group operating primarily in mining, trading, equipment manufacturing and engineering. The signed EPC Contract has an obligation for Sinosteel to provide $150m financing, subject to certain conditions, with production to commence on a turn-key basis by Sinosteel.

Further updates on both the West Kytlim and Monchetundra Projects will be provided as and when information becomes available.

****Link below for more info on****:

Semenovsky Tailings ("STP") Metallurgical Study Update

Background to the Semenovsky project and metallurgy

Metallurgical study

Highlights of the Metallurgical study

http://www.moneyam.com/action/news/showArticle?id=5470547

banjomick

- 30 Dec 2016 11:34

- 95 of 269

- 30 Dec 2016 11:34

- 95 of 269

Eurasia Mining plc (AIM: EUA)

Issue of Equity and directors holdings

Eurasia Mining plc ("Eurasia" or "the Company"), the PGM mining and exploration company, announces that it has issued 12,413,793 ordinary shares of 0.1 pence at 0.725 pence per share (the "New Shares") in settlement of invoices for various services including accrued directors fees. The shares are issued at 0.725 pence per share, being the closing share price on 29 December 2016.

Of the New Shares, 4,827,586 ordinary shares are being issued to Managing Director Christian Schaffalitzky bringing his total holding to 49,696,674 or 3.29% of issued share capital.

A further 7,586,207 shares are issued at 0.725 pence to other suppliers in lieu of accrued fees.

Accordingly the Company has today issued a total of 12,413,793 New Shares and dealings in these shares are expected to commence on the 6 January 2017.

Following the issue of the new shares the total number of issued ordinary shares in the Company will be 1,509,787,583 ordinary shares and consequently the total number of voting rights in the Company will be 1,589,787,583. This figure may be used by shareholders in the Company as the denominator for the calculations by which they will determine if they are required to notify their interest in the share capital of the Company under the Disclosure and Transparency Rules.

http://www.moneyam.com/action/news/showArticle?id=5473039

banjomick

- 17 Jan 2017 15:33

- 96 of 269

- 17 Jan 2017 15:33

- 96 of 269

Eurasia Mining plc (AIM: EUA)

Projects Update January 2017

The Company is pleased to update shareholders on progress at its projects in early January 2017.

Monchetundra PGM Project, Kola Peninsula, NW Russia

As reported on 22 December 2016, a Feasibility Study "TEO" (Technico Economicheskiye Obosnovaniye or Technical and Economic Feasibility) was officially submitted on schedule, for approval at the State Commission on Mineral Reserves ("GKZ"). The document is now under review by a panel of experts who have responded with requests for clarifications and additional information, as per the standard process.

On 21 November 2016, it was announced that Canadian company Lemuria Royalties Corporation ('Lemuria') were engaged in considering a royalty structure for both the Monchetundra PGM mine and West Kytlim Platinum and Gold Mine ('West Kytlim'). Lemuria, preferring a focus on cash generating projects in their current portfolio, expressed an interest in West Kytlim only, however Eurasia have opted not to progress with Lemuria and to ensure the development of West Kytlim by continuing to advance the project with its existing partner.

West Kytlim Platinum and Gold Mine, Ural Mountains

A revision to the agreement (see RNS dated 25 May 2016) between Eurasia's Russian subsidiary Kosvinsky Kamen ('KK') and OOO SK Region Stroy ('SKRS') is currently being discussed to outline additional responsibilities for both parties and it is anticipated this could include further capital investment by SKRS. A meeting between KK and SKRS is expected to occur in the last week of January 2017 (in advance of the mining season), at which an international alluvial mining specialist has been engaged to bring additional expertise to the project teams. Items for discussion include production scheduling for 2017 and a detailed schedule for resource upgrade drilling. A further report will be released following these meetings.

MD Christian Schaffalitzky commented: "It is encouraging to have had an initial response from GKZ who are now actively working on approval of the Monchetundra TEO/Feasibility Study. Our experience in successfully attaining a Mining License at West Kytlim has proven that good communication and information exchange between the applicant and issuer is a good indication of a successful and timely application.

Our working relationship with SKRS at West Kytlim throughout 2016 was both amicable and mutually beneficial. It is however imperative from a KK point of view to ensure SKRS deploys the necessary capital to allow the project to expand, in this the second year of production. Whilst there can be no guarantee that this will occur, we remain confident that there is interest on both sides to reaching an agreement on this matter.

We wish a happy New Year to our shareholders and we look forward to updating on further progress in the near term."

http://www.moneyam.com/InvestorsRoom/posts.php?tid=8369#lastread

banjomick

- 03 Feb 2017 08:52

- 97 of 269

- 03 Feb 2017 08:52

- 97 of 269

Eurasia Mining plc (AIM: EUA)

Issue of Equity

Eurasia Mining plc, the PGM mining and exploration company, announces that it has issued 15,652,174 new ordinary shares of 0.1 pence (the "New Shares") both in settlement of fees relating to a drawdown on the Sanderson Capital Partners ('SCP') facility and as a fee for incorporation of a pre-existing facility with SCP into the current loan agreement which was outlined in RNS dated 21 December 2016, the details of which are as follows:

- a drawdown of £100,000 was executed on the 17 January 2017 with associated fees paid by issue of 2,608,696 ordinary shares in the company's share capital. The shares are issued at £0.00575 per share, being the closing share price on 17 January 2016; and

- SCP has elected to incorporate an amount of £500,000 outstanding from a previous facility (see RNS dated 1 August 2016)into the current facility; fees associated with this transaction (being a 15% fee) are to be settled by issue of 13,043,478 ordinary shares in the capital of the company at £0.00575, being the mid open price on 30 January 2017.

Accordingly the Company has today issued a total of 15,652,174 New Shares and dealings in these shares are expected to commence on the 8 February 2017.

Following the issue of the new shares the total number of issued ordinary shares in the Company will be 1,525,439,757 ordinary shares and consequently the total number of voting rights in the Company will be 1,525,439,757 . This figure may be used by shareholders in the Company as the denominator for the calculations by which they will determine if they are required to notify their interest in the share capital of the Company under the Disclosure and Transparency Rules.

The Company also confirms that updates regarding the West Kytlim project are expected to be released next week beginning 6 February 2017.

http://www.moneyam.com/action/news/showArticle?id=5490740

driver

- 03 Feb 2017 09:04

- 98 of 269

- 03 Feb 2017 09:04

- 98 of 269

banjomick

- 03 Feb 2017 09:39

- 99 of 269

- 03 Feb 2017 09:39

- 99 of 269

faceface - 03 Feb 2017 11:25 - 100 of 269

banjomick

- 06 Feb 2017 12:25

- 101 of 269

- 06 Feb 2017 12:25

- 101 of 269

Eurasia Mining plc (AIM: EUA)

Successful step up to Production at West Kytlim during 2016

Eurasia can now report on the final results of the initial mining season at its 75% owned West Kytlim Alluvial Platinum and Gold Mine ("West Kytlim"). Mining at West Kytlim is seasonal with gravel washing possible in a weather window between the months of April and November. The 2016 operation commenced in the later half of this season (See RNS dated 27 July 2016) as mining and other permits became available. Site facilities and infrastructure were put in place ahead of first gravel washing which commenced in the first weeks of September and continued to early November.

A total of 11.3kg raw platinum were produced through the season, with some credits from Palladium (32g), Iridium (350g), Rhodium (49g) and Gold (56g). Two washplants employing different processing schemes were tested on site to further improve knowledge of the washability of the near surface reserves at the Malaya Sosnovka Area. Sluice concentrates from these washplants were upgraded onsite to a raw platinum product which was refined by and sold to a Precious Metals Refinery in Ekaterinburg. The larger of the two washplants had downtime due to minor breakage caused by the passing of heavier gravel and cobbles through the system. Modifications to ensure continuous operation of this washplant have been discussed and will be realized ahead of the 2017 season.

The average mining grade was 449 milligrams per cubic metre. It should be noted that mining grades were notably higher than expected. Average grade of gravels mined was 120% of reserves grade.

A further update on our mining plan for 2017, an outcome of detailed discussions held in Ekaterinburg in the last week of January with our contractors operating the West Kytlim Mine, as well as updates to the agreement with the contractor will follow this announcement directly.

Christian Schaffalitzky, MD at Eurasia commented 'Having met with our contractors this past week in Ekaterinburg we are confident that the 2016 mining season was managed well by both the Eurasia and the contractor's personnel. The season was also successful in terms of becoming familiar with the operating environment, mining machinery and the nature of the ore to be worked, essential elements in an alluvial mining operation. We now look forward to a full mining season in this 2017, preparation for which is already well advanced.'

banjomick

- 06 Feb 2017 12:28

- 102 of 269

- 06 Feb 2017 12:28

- 102 of 269

Eurasia Mining plc (AIM: EUA)

West Kytlim capital expansion and exploration funding