| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

THE TALK TO YOURSELF THREAD. (NOWT)

goldfinger

- 09 Jun 2005 12:25

- 09 Jun 2005 12:25

Thought Id start this one going because its rather dead on this board at the moment and I suppose all my usual muckers are either at the Stella tennis event watching Dim Tim (lose again) or at Henly Regatta eating cucumber sandwiches (they wish,...NOT).

Anyway please feel free to just talk to yourself blast away and let it go on any company or subject you wish. Just wish Id thought of this one before.

cheers GF.

Anyway please feel free to just talk to yourself blast away and let it go on any company or subject you wish. Just wish Id thought of this one before.

cheers GF.

dreamcatcher

- 22 Jun 2011 18:45

- 11240 of 81564

- 22 Jun 2011 18:45

- 11240 of 81564

These banks still think they are beyond the law, they need crippling fines. Thats all they understand.

FSA probes two banks over money laundering

tweet0Print..Topics:International.Kirstin Ridley, 18:02, Wednesday 22 June 2011

LONDON (Reuters) - Two banks in Britain are being investigated for lax money-laundering controls and others are likely to be handling the proceeds of corruption and other financial crime, the financial regulator said on Wednesday.

The Financial Services Authority (FSA) said it had referred two banks to its enforcement division for "serious weaknesses" in how they managed "high-risk" customers, including those whose public status made them vulnerable to corruption.

"We are considering whether further regulatory action is required in relation to other banks, and further cases may be referred for enforcement," the FSA added as it published a review of how banks manage money-laundering risks.

In a damning report, the FSA said some banks appeared unwilling to turn away or exit very profitable business relationships, even when there appeared to be an unacceptable risk of handling the proceeds of crime.

"Around a third of banks, including the private banking arms of some major banking groups, appeared willing to accept very high levels of money-laundering risk if the immediate reputational and regulatory risk was acceptable," it stated.

Many of the failings identified by the regulator are the same as those it spotted 10 years ago when deposed Nigerian strongman Sani Abacha, his family members and associates used 42 UK bank accounts to turn over $1.3 billion (806.2 million pounds) in four years.

More than half of banks visited by the FSA this time around failed to have meaningful due diligence measures in higher-risk situations, and failed to identify or record negative information about customers.

Around one-third also dismissed serious allegations about their customers without adequate review, and more than one-third failed to identify customers as "politically exposed persons," or PEPs, who are considered the most vulnerable to corruption because of their public prominence.

The FSA said three-quarters of banks in its sample, which included the majority of large banks, did not always manage high-risk customers and PEP relationships effectively, and needed to do more to protect themselves from money laundering.

"We will, where appropriate, use our enforcement powers to reinforce key messages in this report to encourage banks and other firms to strengthen AML (anti-money laundering) systems and controls, and deter them from making decisions which do not take adequate account of money-laundering risk," the FSA said.

Lawyers noted the FSA was not mincing its words.

"The warning is clear: do your checks properly and be prepared to turn down high-risk business, or the FSA will come knocking," noted Alison McHaffie of law firm CMS Cameron McKenna

Global Witness, a non-government organisation that runs campaigns against conflict and corruption, said the review provided long overdue recognition of the need for ongoing monitoring and punishment to force banks to comply with rules.

"For too long, Britain's banks have been happy to accept money stolen from developing countries by corrupt rulers and their families," said Anthea Lawson, head of the banks campaign at Global Witness.

"Neither dictatorship nor corruption can occur without banks willing to help."

(Editing by David Hulmes

dreamcatcher

- 22 Jun 2011 18:53

- 11241 of 81564

- 22 Jun 2011 18:53

- 11241 of 81564

The FSA do not regulate banks, they only act when its to late. Hence the mess banks are in now.

dreamcatcher

- 22 Jun 2011 19:19

- 11242 of 81564

- 22 Jun 2011 19:19

- 11242 of 81564

Does anyone remember this -

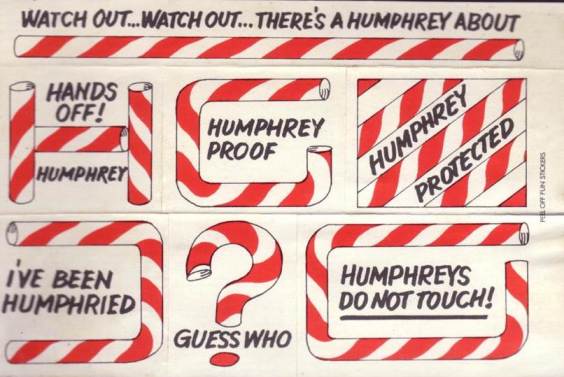

During the mid 1970's the Unigate Dairy came up with an amazing advertising campaign to promote their range of milk. It was based on an army of red and white striped straws that turned up when you weren't looking and stole your milk. An imaginative slogan "Watch out..Watch out there's a Humphrey about" became an overnight catchphrase. Several television adverts were produced, usually featuring semi-famous people of the era such as Arthur Mullard.

Unigate also saw fit to produce merchandise for the public to purchase. These ranged from clothing and bags to glasses, mugs and stickers. All of which could be bought from your milkman or via mail away promotions. Also produced was a set of three sealed Humphrey straws containing powdered milkshake which you threw in a glass and mixed with milk. My mum got me some of these and they nearly made me puke. Nice !!!! If you have any of the merchandise that is not already featured on this page, mail us an image of it and we'll feature it along with a credit to yourself.

During the mid 1970's the Unigate Dairy came up with an amazing advertising campaign to promote their range of milk. It was based on an army of red and white striped straws that turned up when you weren't looking and stole your milk. An imaginative slogan "Watch out..Watch out there's a Humphrey about" became an overnight catchphrase. Several television adverts were produced, usually featuring semi-famous people of the era such as Arthur Mullard.

Unigate also saw fit to produce merchandise for the public to purchase. These ranged from clothing and bags to glasses, mugs and stickers. All of which could be bought from your milkman or via mail away promotions. Also produced was a set of three sealed Humphrey straws containing powdered milkshake which you threw in a glass and mixed with milk. My mum got me some of these and they nearly made me puke. Nice !!!! If you have any of the merchandise that is not already featured on this page, mail us an image of it and we'll feature it along with a credit to yourself.

dreamcatcher

- 22 Jun 2011 19:21

- 11243 of 81564

- 22 Jun 2011 19:21

- 11243 of 81564

dreamcatcher

- 22 Jun 2011 19:23

- 11244 of 81564

- 22 Jun 2011 19:23

- 11244 of 81564

Fred1new

- 22 Jun 2011 23:15

- 11245 of 81564

- 22 Jun 2011 23:15

- 11245 of 81564

Good to see that Cameron is in full support of the Army, Navy and Air Force.

Oops forgot, they have dumped the Naval hardware, over stretched the Air Force.

Wonder if they have bullets for the Army.

Prisons in chaos,

Police demoralized and undermanned with the prospect of increasing crime.

Another U-turn on QE on the cards.

Cameron and Osborne looking more like Mickey Mouse and Goofy.

Hear that that UK bonds may be O graded.

Oops forgot, they have dumped the Naval hardware, over stretched the Air Force.

Wonder if they have bullets for the Army.

Prisons in chaos,

Police demoralized and undermanned with the prospect of increasing crime.

Another U-turn on QE on the cards.

Cameron and Osborne looking more like Mickey Mouse and Goofy.

Hear that that UK bonds may be O graded.

MightyMicro

- 22 Jun 2011 23:51

- 11246 of 81564

- 22 Jun 2011 23:51

- 11246 of 81564

skinny et al: I would be careful about that report on the Fukushima radiation. It's stuffed full of rather unscientific language and unattributed statements.

I found the following statement to be the most irresponsible scaremongering.

"In the US, physician Janette Sherman MD and epidemiologist Joseph Mangano published an essay shedding light on a 35 per cent spike in infant mortality in northwest cities that occurred after the Fukushima meltdown, and may well be the result of fallout from the stricken nuclear plant.

The eight cities included in the report are San Jose, Berkeley, San Francisco, Sacramento, Santa Cruz, Portland, Seattle, and Boise, and the time frame of the report included the ten weeks immediately following the disaster. "

In the words of the old Nationwide ad - it doesn't work like that.

Let me at once say that I am not a medic or a nuclear scientist. But I recognise unsupported, non-evidence based scaremongering when I see it. Read the words in the statement carefully. - "the time frame of the report included the ten weeks immediately following the disaster". How long was the time frame of the report? 1 year? 2 years? 10 years? These reports usually cover longish timescales. Longer than ten weeks, to be sure.

Now, I'm not saying there isn't a problem, or that the Japanese authorities tried to conceal or minimise the extent of the problem - what I am saying is that there are plenty of people with other agendas in play who seek to demonise nuclear power despite its essential role in power generation in a low carbon emission world.

I refer doubters to James Lovelock, father of the Gaia theory, who simply says that it's too late to do anything other than build nuclear power plants if we are to avoid a global warming disaster.

I found the following statement to be the most irresponsible scaremongering.

"In the US, physician Janette Sherman MD and epidemiologist Joseph Mangano published an essay shedding light on a 35 per cent spike in infant mortality in northwest cities that occurred after the Fukushima meltdown, and may well be the result of fallout from the stricken nuclear plant.

The eight cities included in the report are San Jose, Berkeley, San Francisco, Sacramento, Santa Cruz, Portland, Seattle, and Boise, and the time frame of the report included the ten weeks immediately following the disaster. "

In the words of the old Nationwide ad - it doesn't work like that.

Let me at once say that I am not a medic or a nuclear scientist. But I recognise unsupported, non-evidence based scaremongering when I see it. Read the words in the statement carefully. - "the time frame of the report included the ten weeks immediately following the disaster". How long was the time frame of the report? 1 year? 2 years? 10 years? These reports usually cover longish timescales. Longer than ten weeks, to be sure.

Now, I'm not saying there isn't a problem, or that the Japanese authorities tried to conceal or minimise the extent of the problem - what I am saying is that there are plenty of people with other agendas in play who seek to demonise nuclear power despite its essential role in power generation in a low carbon emission world.

I refer doubters to James Lovelock, father of the Gaia theory, who simply says that it's too late to do anything other than build nuclear power plants if we are to avoid a global warming disaster.

skinny

- 23 Jun 2011 06:35

- 11247 of 81564

- 23 Jun 2011 06:35

- 11247 of 81564

Point taken MM.

Seymour Clearly

- 23 Jun 2011 07:55

- 11248 of 81564

- 23 Jun 2011 07:55

- 11248 of 81564

Agreed MM, looked at the home page for that website and it's one of those sensational 'I'm on a mission' types that you know is somewhat biased.

aldwickk

- 23 Jun 2011 08:41

- 11249 of 81564

- 23 Jun 2011 08:41

- 11249 of 81564

MM

One of the main contributions to global warming is deforestation and methane gas caused by cattle [ Mc Donald's ect ]

So stopping eating meat is one of the more simple solutions , also it is good for your health . there have been government warnings about red meat.

One of the main contributions to global warming is deforestation and methane gas caused by cattle [ Mc Donald's ect ]

So stopping eating meat is one of the more simple solutions , also it is good for your health . there have been government warnings about red meat.

MightyMicro

- 23 Jun 2011 15:16

- 11250 of 81564

- 23 Jun 2011 15:16

- 11250 of 81564

Further to the Fukushima discussion, the following link might be useful for those wanting to compare various doses of ionising radiation.

Radiation Dose Chart

Once it's in your browser window, you can magnify it to make it legible - I didn't embed it directly in the thread as it distorts the thread.

MM

Radiation Dose Chart

Once it's in your browser window, you can magnify it to make it legible - I didn't embed it directly in the thread as it distorts the thread.

MM

Fred1new

- 23 Jun 2011 19:36

- 11251 of 81564

- 23 Jun 2011 19:36

- 11251 of 81564

Another policy policy from Cameron and Cleggy, the conjoined twins.

Give everybody a share in a bank for Xmas.

What has happened to bank share prices on news of the brilliant idea?

Your money and economy is secure with Georgie, Davey, Cleggy and Vince.

I like the idea of giving bank shares to the public to hold for 3 years, while they devalue.

This idea should bail out the tory government, unless Murdock over hears it and grumbles.

Can't understand the market is down again today, lowest for 15years. Can't understand it with the certainty of George. (Or was QE back on this present bunch of u-turn educated mobsters'.

Mind we can sleep at night. Just seen Liam Fox on parade and told that he is looking after us.

I await to-morrow's next U-turn from our strong governors.

Give everybody a share in a bank for Xmas.

What has happened to bank share prices on news of the brilliant idea?

Your money and economy is secure with Georgie, Davey, Cleggy and Vince.

I like the idea of giving bank shares to the public to hold for 3 years, while they devalue.

This idea should bail out the tory government, unless Murdock over hears it and grumbles.

Can't understand the market is down again today, lowest for 15years. Can't understand it with the certainty of George. (Or was QE back on this present bunch of u-turn educated mobsters'.

Mind we can sleep at night. Just seen Liam Fox on parade and told that he is looking after us.

I await to-morrow's next U-turn from our strong governors.

Haystack

- 24 Jun 2011 15:06

- 11252 of 81564

- 24 Jun 2011 15:06

- 11252 of 81564

Italy bank shares dive on credit rating alert

Shares in leading Italian banks fell sharply after the credit ratings agency Moody's said it may downgrade their status.

Moody's report, published late on Thursday, put 16 Italian banks and two government institutions on review for a possible mark-down.

Shares in the country's biggest bank, Unicredit, lost more than 8%.

Intesa Sanpaolo, Italy's second-largest bank, and Monte Paschi also dropped. Trading was suspended in some banks.

Other factors weighing on bank shares included fears that Italian banks could be forced to raise more capital as a result of imminent stress tests.

Credit ratings help investors to determine the strength of an institution or company.

They affect the rate of interest a borrowing organisation must pay. The weaker the credit rating, the higher the cost of borrowing.

Moody's put Italy's public debt on review for possible downgrade amid concerns about low growth and high public debt, which at 120% of gross domestic product (GDP) is one of the highest in Europe.

Greece's debt is 150% of GDP.

Shares in leading Italian banks fell sharply after the credit ratings agency Moody's said it may downgrade their status.

Moody's report, published late on Thursday, put 16 Italian banks and two government institutions on review for a possible mark-down.

Shares in the country's biggest bank, Unicredit, lost more than 8%.

Intesa Sanpaolo, Italy's second-largest bank, and Monte Paschi also dropped. Trading was suspended in some banks.

Other factors weighing on bank shares included fears that Italian banks could be forced to raise more capital as a result of imminent stress tests.

Credit ratings help investors to determine the strength of an institution or company.

They affect the rate of interest a borrowing organisation must pay. The weaker the credit rating, the higher the cost of borrowing.

Moody's put Italy's public debt on review for possible downgrade amid concerns about low growth and high public debt, which at 120% of gross domestic product (GDP) is one of the highest in Europe.

Greece's debt is 150% of GDP.

dreamcatcher

- 24 Jun 2011 15:17

- 11253 of 81564

- 24 Jun 2011 15:17

- 11253 of 81564

I am sure they do not have as stringent stress tests as uk banks have had to pass. ie capital reserves.

Haystack

- 24 Jun 2011 17:19

- 11254 of 81564

- 24 Jun 2011 17:19

- 11254 of 81564

Saab on the brink of collapse

Swedish car maker Saab is desperately close to going under as it confirms it cannot pay staff wages.

It has already suspended production because it has failed to pay suppliers.

Saab's sales in 2010 were miserable - only 30,000 cars were sold worldwide. The company needed to sell 120,000 just to break even.

Swedish car maker Saab is desperately close to going under as it confirms it cannot pay staff wages.

It has already suspended production because it has failed to pay suppliers.

Saab's sales in 2010 were miserable - only 30,000 cars were sold worldwide. The company needed to sell 120,000 just to break even.

Haystack

- 24 Jun 2011 17:23

- 11255 of 81564

- 24 Jun 2011 17:23

- 11255 of 81564

The burglar stabbed to death after an attempted break-in at a house in Salford, was on police bail for another suspected burglary, it has emerged.

skinny

- 24 Jun 2011 17:29

- 11256 of 81564

- 24 Jun 2011 17:29

- 11256 of 81564

Shame about SAAB - I've driven them for 25 years. I must confess the current one - a 95 AERO is not a patch on the previous ones. The build qualitity etc etc etc. Inevitable really.

MightyMicro

- 25 Jun 2011 01:33

- 11257 of 81564

- 25 Jun 2011 01:33

- 11257 of 81564

I dunno - fouur masked men break into a family home, one already bailed on burglary charges, family defends themselves and get arrested on suspicion of murder. There's something wrong with this picture.

And it's to do with the the way the police 'grade' crimes. In any given incident, they focus on the most serious apparent offence - in this case the stabbing of the burglar - and not the whole picture or sequence of events.

I thought Cameron promised to change the law on this.

And it's to do with the the way the police 'grade' crimes. In any given incident, they focus on the most serious apparent offence - in this case the stabbing of the burglar - and not the whole picture or sequence of events.

I thought Cameron promised to change the law on this.

aldwickk

- 25 Jun 2011 09:28

- 11258 of 81564

- 25 Jun 2011 09:28

- 11258 of 81564

Greekman

What's your view on this , being in the force ?

What's your view on this , being in the force ?