| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Argos Resources (ARG)

markymar

- 27 Jul 2010 12:41

- 27 Jul 2010 12:41

Argos Resources Ltd is an AIM quoted oil and gas exploration company based in the Falkland Islands, ideally placed to make the most of an exciting new oil province heading towards production.

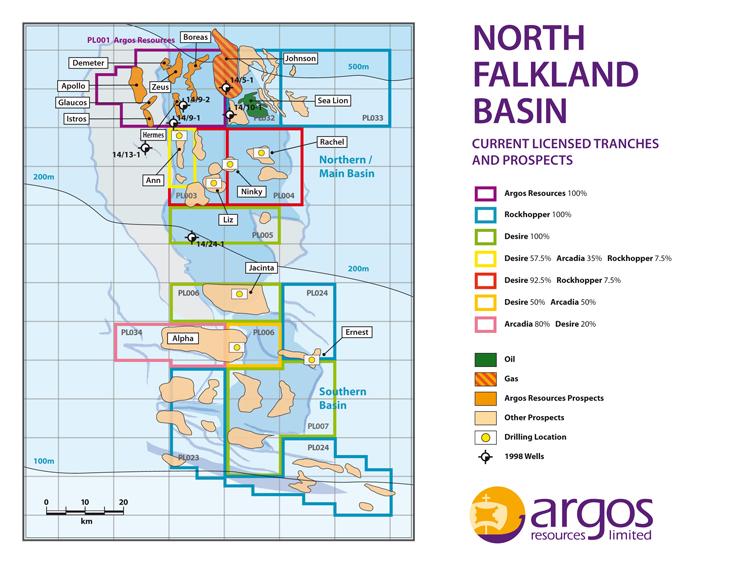

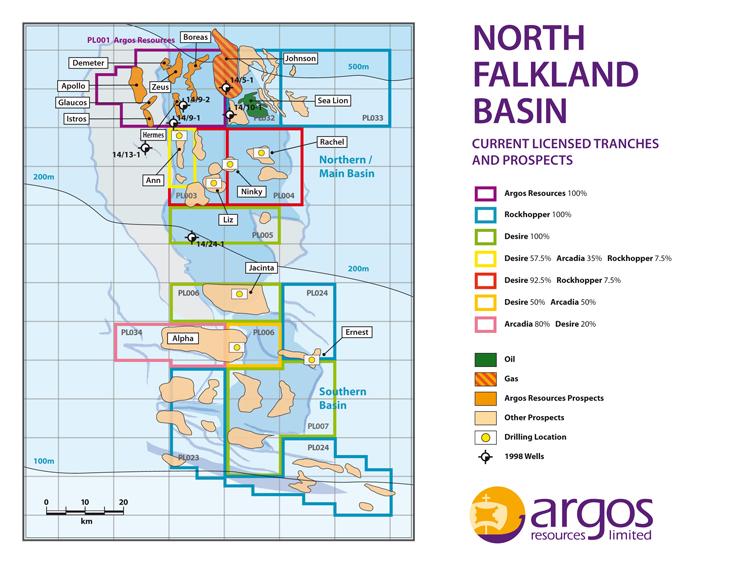

Argos holds a 100% interest in Licence PL001, which covers approximately 1,126 square kilometres in the North Falkland Basin. The licence boundary is just 3km from the Sea Lion oil field, a significant discovery on course for production start-up in 2017.

New 3D seismic data of excellent quality was acquired over the entire licence area in 2011 and has identified 52 prospects with a best estimate of 3,083 million barrels of prospective recoverable resource, and a high estimate of 10,412 million barrels. 40 additional leads have been identified which are not included in the above resource figures and which are the subject of ongoing work.

The Company is now seeking an exploration partner to drill a selection of key prospects to unlock the value of this exciting opportunity.

http://www.argosresources.com/

http://www.falklands-oil.com/

http://www.desireplc.co.uk/

http://www.rockhopperexploration.co.uk/

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

The Opportunity

The Opportunity

•Proven commercial petroleum system

•52 oil prospects, defined by excellent quality 3D seismic data

•CPR attributes 3.1 billion barrels of prospective recoverable resource to the prospects, with upside of 10.4 billion barrels

•40 additional leads identified and under review

•Several prospects similar to Sea Lion

•Prospects have been de-risked by the Sea Lion discovery

•Potential extension of Johnson gas discovery into licence

•Licence 100% owned by Argos Resources

•Benign operating environment

•Stable Government with a competitive tax regime

Argos holds a 100% interest in Licence PL001, which covers approximately 1,126 square kilometres in the North Falkland Basin. The licence boundary is just 3km from the Sea Lion oil field, a significant discovery on course for production start-up in 2017.

New 3D seismic data of excellent quality was acquired over the entire licence area in 2011 and has identified 52 prospects with a best estimate of 3,083 million barrels of prospective recoverable resource, and a high estimate of 10,412 million barrels. 40 additional leads have been identified which are not included in the above resource figures and which are the subject of ongoing work.

The Company is now seeking an exploration partner to drill a selection of key prospects to unlock the value of this exciting opportunity.

http://www.argosresources.com/

http://www.falklands-oil.com/

http://www.desireplc.co.uk/

http://www.rockhopperexploration.co.uk/

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

•Proven commercial petroleum system

•52 oil prospects, defined by excellent quality 3D seismic data

•CPR attributes 3.1 billion barrels of prospective recoverable resource to the prospects, with upside of 10.4 billion barrels

•40 additional leads identified and under review

•Several prospects similar to Sea Lion

•Prospects have been de-risked by the Sea Lion discovery

•Potential extension of Johnson gas discovery into licence

•Licence 100% owned by Argos Resources

•Benign operating environment

•Stable Government with a competitive tax regime

required field - 14 Oct 2011 16:58 - 120 of 185

It will be your fault Harrycat (:))

hlyeo98 - 17 Oct 2011 11:27 - 121 of 185

This is worth 15-20p.

machoman - 17 Oct 2011 14:47 - 122 of 185

This is worth 25p ( 24.75 / 25.25p ) now after dropping to 24.25p

managed to get some at 24.75p, as MMs will not allow online at offer 24.50p

Level 2 of 4 v 1

RECA the only one at Offer since earlier, rising the price by 0.25p and yet the next MM is at 25.75p

managed to get some at 24.75p, as MMs will not allow online at offer 24.50p

Level 2 of 4 v 1

RECA the only one at Offer since earlier, rising the price by 0.25p and yet the next MM is at 25.75p

required field - 21 Oct 2011 09:58 - 123 of 185

Mistimed my buy here.....it's a 'orrible sp 'arry.....

markymar

- 21 Oct 2011 12:48

- 124 of 185

- 21 Oct 2011 12:48

- 124 of 185

Its been bouncing from 20p to 30p for ages so been buying near 20s selling near 30s so hoping for a little more drop before i buy again.

Will hold at some point just waiting for funding news then we might get an idea on how many holes they may drill.

Will hold at some point just waiting for funding news then we might get an idea on how many holes they may drill.

markymar

- 21 Oct 2011 12:49

- 125 of 185

- 21 Oct 2011 12:49

- 125 of 185

Argos Resources Hogan confident in Sea Lion lookalike prospects after pivotal report

1:00 pm by Jamie Ashcroft

http://bit.ly/plr9gL

The CPR confirms that the licence hosts prospects that are similar to Rockhoppers Sea Lion discovery

Argos Resources (LON:ARG) managing director John Hogan has declared himself "delighted" with the results of the recent independent report on its Falklands acreage which was far better than he or the team expected.

The report gave the group a major uplift in estimated resources, which rose more than 180 per cent to 2.1 billion barrels of oil, and uncovered 22 new exploration prospects. It follows a busy summer of seismic exploration for the firm.

Importantly Hogan highlights that, as expected, the CPR confirms that the licence hosts prospects that are similar to Rockhopper Explorations (LON:RKH) Sea Lion discovery, which is on the neighbouring licence.

The most notable of these prospects is Rhea, a 103 million barrel target that is likely the first to be drilled by Argos.

Speaking with Proactive Investors Hogan explained that the latest interpretation of 3D seismic and Rockhoppers continued appraisal success very much backs up the groups previous expectations of a Sea Lion lookalike on the Argos licence.

In fact following a data sharing exercise with its neighbour Hogan and his team are now more confident than ever about the potential Sea Lion lookalike.

"We've got all Rockhoppers seismic data, Hogan said.

"We have their information on Sea Lion and we can make our own assessments and make comparisons between the Sea Lion discovery and our new prospects. We can see what they are drilling, what looks like on the 3D seismic and use that on our respective prospects.

"Rhea has a lot of the characteristics that the Sea Lion field displays. But we've got other prospects that do that too, I'm pleased to say.

The Sea Lion Field was major a breakthrough not just for Rockhopper, but also all those companies operating in the South Atlantic. It has continued to prove up and expand is oil resources, and in just 18 months it has taken the discovery to the verge of the development phase.

Indeed last month Rockhopper unveiled a US$2 billion plans to produce the Falklands first oil by 2016. It is currently preparing to drill its eighth well on the Sea Lion field.

"We are pleased to see Rockhopper continuing the drilling programme on Sea Lion, which just keeps getting bigger and bigger, Hogan added.

For a much smaller company like Argos having such a successful peer working nearby has been a real bonus as it has helped capture the imagination of investors and has stoked up the excitement among AIMs speculators.

"Good results from Rockhopper draws industry and investor eyes onto what's going on in the Falklands and we all benefit from that attention.

Aside from the obvious Rockhoppers continued success has had another important benefit for Argos. Importantly it has meant that the Ocean Guardian rig has remained in the isolated waters of the South Atlantic.

Because of that Argos is now preparing for its own drilling programme which is expected to get underway towards the tail-end of this year or early next year. However before that Argos must first get the financial backing to support its ambitions.

Taking the temperature of investor sentiment on the ubiquitous internet bulletin boards and forums it seems that this funding issue is a lingering concern which has somewhat overshadowed the better-than expected CPR result.

A farm-out deal is one potential funding option being mooted, by some investors, as a potential means to bring in cash to cover the initial costs of drilling. It is also a theory seemingly reflected by Evolution Securities analyst Keith Morris.

The analyst, which sees Argos as a buy, has a 79p a share price target for the stock. And in a note to clients on Friday he said that his valuation assumes that Argos will farm out a 50 per cent stake in the licence and be carried for the costs of drilling the two lowest risk prospects, Rhea and the 118 million barrel Poseidon prospect.

While not ruling anything out, Hogan distanced the company from the plans that could potentially be construed from Evolutions assessment.

He explained: "(A farm-in) was merely the analysts chosen method of putting a valuation on the acreage that other analysts and the industry would recognise.

"It is not being led by any particular route that weve mentioned to him. It's not because we were telling the analyst that was what we're planning or anything like that.

"At the moment we are just keeping our options open.

While investors await some breaking news on the financing front, eyes will no doubt be fixed on the ongoing developments in the Falklands where things tend to move very quickly indeed.

"There has been a lot of good news from the Falklands of late from Rockhopper, Desire and ourselves, Hogan surmised. "There is a lot going on and I don't want to tempt fate by guessing what might happen next."

1:00 pm by Jamie Ashcroft

http://bit.ly/plr9gL

The CPR confirms that the licence hosts prospects that are similar to Rockhoppers Sea Lion discovery

Argos Resources (LON:ARG) managing director John Hogan has declared himself "delighted" with the results of the recent independent report on its Falklands acreage which was far better than he or the team expected.

The report gave the group a major uplift in estimated resources, which rose more than 180 per cent to 2.1 billion barrels of oil, and uncovered 22 new exploration prospects. It follows a busy summer of seismic exploration for the firm.

Importantly Hogan highlights that, as expected, the CPR confirms that the licence hosts prospects that are similar to Rockhopper Explorations (LON:RKH) Sea Lion discovery, which is on the neighbouring licence.

The most notable of these prospects is Rhea, a 103 million barrel target that is likely the first to be drilled by Argos.

Speaking with Proactive Investors Hogan explained that the latest interpretation of 3D seismic and Rockhoppers continued appraisal success very much backs up the groups previous expectations of a Sea Lion lookalike on the Argos licence.

In fact following a data sharing exercise with its neighbour Hogan and his team are now more confident than ever about the potential Sea Lion lookalike.

"We've got all Rockhoppers seismic data, Hogan said.

"We have their information on Sea Lion and we can make our own assessments and make comparisons between the Sea Lion discovery and our new prospects. We can see what they are drilling, what looks like on the 3D seismic and use that on our respective prospects.

"Rhea has a lot of the characteristics that the Sea Lion field displays. But we've got other prospects that do that too, I'm pleased to say.

The Sea Lion Field was major a breakthrough not just for Rockhopper, but also all those companies operating in the South Atlantic. It has continued to prove up and expand is oil resources, and in just 18 months it has taken the discovery to the verge of the development phase.

Indeed last month Rockhopper unveiled a US$2 billion plans to produce the Falklands first oil by 2016. It is currently preparing to drill its eighth well on the Sea Lion field.

"We are pleased to see Rockhopper continuing the drilling programme on Sea Lion, which just keeps getting bigger and bigger, Hogan added.

For a much smaller company like Argos having such a successful peer working nearby has been a real bonus as it has helped capture the imagination of investors and has stoked up the excitement among AIMs speculators.

"Good results from Rockhopper draws industry and investor eyes onto what's going on in the Falklands and we all benefit from that attention.

Aside from the obvious Rockhoppers continued success has had another important benefit for Argos. Importantly it has meant that the Ocean Guardian rig has remained in the isolated waters of the South Atlantic.

Because of that Argos is now preparing for its own drilling programme which is expected to get underway towards the tail-end of this year or early next year. However before that Argos must first get the financial backing to support its ambitions.

Taking the temperature of investor sentiment on the ubiquitous internet bulletin boards and forums it seems that this funding issue is a lingering concern which has somewhat overshadowed the better-than expected CPR result.

A farm-out deal is one potential funding option being mooted, by some investors, as a potential means to bring in cash to cover the initial costs of drilling. It is also a theory seemingly reflected by Evolution Securities analyst Keith Morris.

The analyst, which sees Argos as a buy, has a 79p a share price target for the stock. And in a note to clients on Friday he said that his valuation assumes that Argos will farm out a 50 per cent stake in the licence and be carried for the costs of drilling the two lowest risk prospects, Rhea and the 118 million barrel Poseidon prospect.

While not ruling anything out, Hogan distanced the company from the plans that could potentially be construed from Evolutions assessment.

He explained: "(A farm-in) was merely the analysts chosen method of putting a valuation on the acreage that other analysts and the industry would recognise.

"It is not being led by any particular route that weve mentioned to him. It's not because we were telling the analyst that was what we're planning or anything like that.

"At the moment we are just keeping our options open.

While investors await some breaking news on the financing front, eyes will no doubt be fixed on the ongoing developments in the Falklands where things tend to move very quickly indeed.

"There has been a lot of good news from the Falklands of late from Rockhopper, Desire and ourselves, Hogan surmised. "There is a lot going on and I don't want to tempt fate by guessing what might happen next."

HARRYCAT

- 21 Oct 2011 13:11

- 126 of 185

- 21 Oct 2011 13:11

- 126 of 185

I have a modest holding in ARG, rf, and am happy to hold whilst they drill. I prefer to invest here & hold rather than trade them, as potential is good and I have a nasty habit of missing out by not having cash available at the right time. Will try and invest more when the rig is mobilised.

required field - 23 Oct 2011 11:23 - 127 of 185

Staying put as well......will wait for the drilling to start....sp will shoot up then....

markymar

- 03 Nov 2011 08:34

- 128 of 185

- 03 Nov 2011 08:34

- 128 of 185

After reading Desire RNS today I am wondering what part if any ARG will play, Once RKH finish with the rig there will be 2 max drill slots available now I would of thought Desire would want both of them so that leaves ARG where?

Interesting times not sure how this is going to play out.

Interesting times not sure how this is going to play out.

halifax - 29 Nov 2011 11:39 - 129 of 185

RNS no drilling in the immediate future..... sp tanked.

required field - 29 Nov 2011 16:13 - 130 of 185

Ouch !.....not having much luck with my picks as of late.....in for the long term anyway....it's all 'Arry's fault....

HARRYCAT

- 29 Nov 2011 18:14

- 131 of 185

- 29 Nov 2011 18:14

- 131 of 185

Hmmmm..... could be a longer wait than I first anticipated!

markymar

- 29 Nov 2011 23:23

- 132 of 185

- 29 Nov 2011 23:23

- 132 of 185

I was lucky i sold out the other day in to Desire still holding a few ARG.....luck full stop as i had thousands of them.

Off down the pit Chav for a long shift end of week keep an eye on them clogs.

Off down the pit Chav for a long shift end of week keep an eye on them clogs.

gibby - 18 Jan 2012 08:41 - 133 of 185

indeed it has!

markymar

- 18 Jan 2012 11:20

- 134 of 185

- 18 Jan 2012 11:20

- 134 of 185

Tuesday, January 17th, 2012 | Posted by admin

FoxDavies views from the trading floor

http://refinerynews.com/foxdavies-views-from-the-trading-floor-3/

The rush of blood continued in Argos Resources today, jumping another 28% to 17.5p as investors continued to chase the Falklands plays higher. It would not be a surprise if part of this rally is attributed to short covering here, as the market was not expecting news from Argos for some time. The last RNS said ‘it won’t proceed with a drilling campaign in the North Falkland Basin which was due to end in December, citing weak capital markets and the limited availability of the drilling rig. As the rig is leaving the region in December, Chairman Ian Thomson said the company had rejected the option of drilling only one well because it remained convinced of the value of the area and the merits of a more extensive drilling program. The firm expects to complete the work in the first half of 2012 before looking for an industry partner to help fund its drilling program.’

FoxDavies views from the trading floor

http://refinerynews.com/foxdavies-views-from-the-trading-floor-3/

The rush of blood continued in Argos Resources today, jumping another 28% to 17.5p as investors continued to chase the Falklands plays higher. It would not be a surprise if part of this rally is attributed to short covering here, as the market was not expecting news from Argos for some time. The last RNS said ‘it won’t proceed with a drilling campaign in the North Falkland Basin which was due to end in December, citing weak capital markets and the limited availability of the drilling rig. As the rig is leaving the region in December, Chairman Ian Thomson said the company had rejected the option of drilling only one well because it remained convinced of the value of the area and the merits of a more extensive drilling program. The firm expects to complete the work in the first half of 2012 before looking for an industry partner to help fund its drilling program.’

cynic

- 18 Jan 2012 11:26

- 135 of 185

- 18 Jan 2012 11:26

- 135 of 185

trouble with ARG is that is an MM-only stock so easily manipulated .... not for me this one; i'll stick with rkh

HARRYCAT

- 20 Jan 2012 10:39

- 136 of 185

- 20 Jan 2012 10:39

- 136 of 185

12p to 21p in four days! Amazing and missed opportunity on my part....damn!

markymar

- 20 Jan 2012 10:41

- 137 of 185

- 20 Jan 2012 10:41

- 137 of 185

No reason for the rise Harry apart from the Johnson prospect and maybe a partner in tow.....early days

markymar

- 20 Jan 2012 11:50

- 138 of 185

- 20 Jan 2012 11:50

- 138 of 185

Hope Desire does the same soon as i have a boat load,still at a loss why this is up so much.

HARRYCAT

- 20 Jan 2012 13:47

- 139 of 185

- 20 Jan 2012 13:47

- 139 of 185

Might just be a case of 'no real reason for the sp to drop that far and that fast' and now just recovering lost ground? No complaints from me, though holding now until drilling starts.