| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Argos Resources (ARG)

markymar

- 27 Jul 2010 12:41

- 27 Jul 2010 12:41

Argos Resources Ltd is an AIM quoted oil and gas exploration company based in the Falkland Islands, ideally placed to make the most of an exciting new oil province heading towards production.

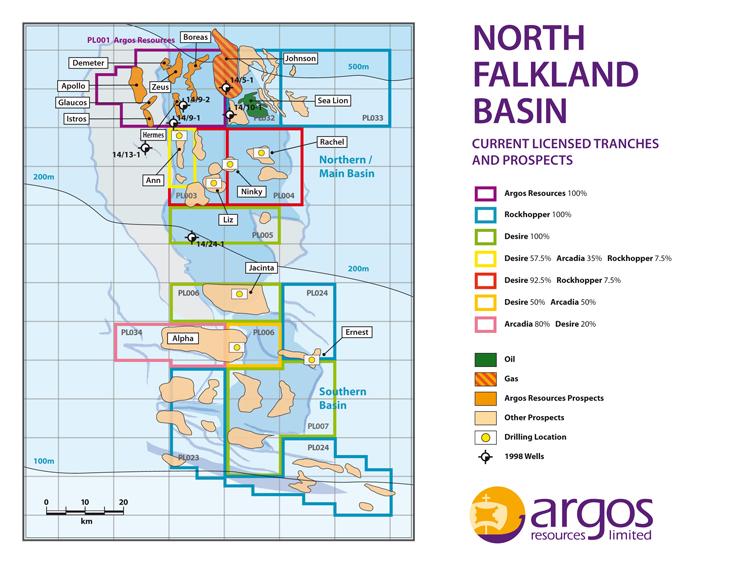

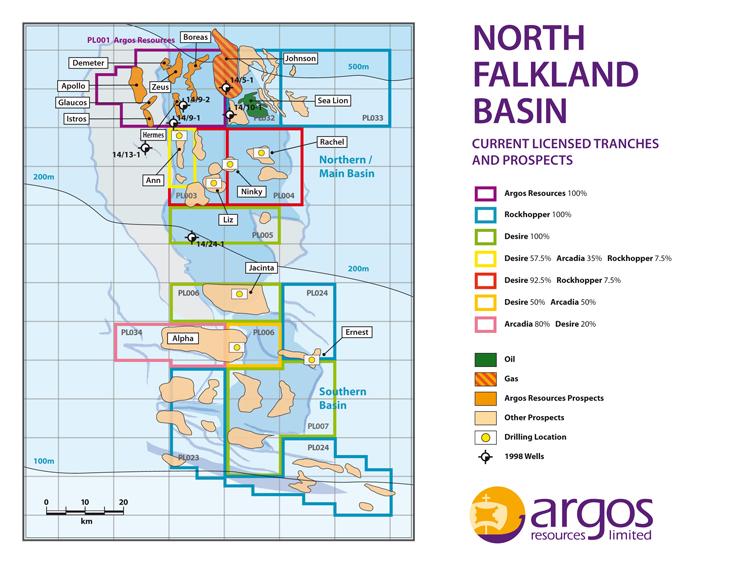

Argos holds a 100% interest in Licence PL001, which covers approximately 1,126 square kilometres in the North Falkland Basin. The licence boundary is just 3km from the Sea Lion oil field, a significant discovery on course for production start-up in 2017.

New 3D seismic data of excellent quality was acquired over the entire licence area in 2011 and has identified 52 prospects with a best estimate of 3,083 million barrels of prospective recoverable resource, and a high estimate of 10,412 million barrels. 40 additional leads have been identified which are not included in the above resource figures and which are the subject of ongoing work.

The Company is now seeking an exploration partner to drill a selection of key prospects to unlock the value of this exciting opportunity.

http://www.argosresources.com/

http://www.falklands-oil.com/

http://www.desireplc.co.uk/

http://www.rockhopperexploration.co.uk/

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

The Opportunity

The Opportunity

•Proven commercial petroleum system

•52 oil prospects, defined by excellent quality 3D seismic data

•CPR attributes 3.1 billion barrels of prospective recoverable resource to the prospects, with upside of 10.4 billion barrels

•40 additional leads identified and under review

•Several prospects similar to Sea Lion

•Prospects have been de-risked by the Sea Lion discovery

•Potential extension of Johnson gas discovery into licence

•Licence 100% owned by Argos Resources

•Benign operating environment

•Stable Government with a competitive tax regime

Argos holds a 100% interest in Licence PL001, which covers approximately 1,126 square kilometres in the North Falkland Basin. The licence boundary is just 3km from the Sea Lion oil field, a significant discovery on course for production start-up in 2017.

New 3D seismic data of excellent quality was acquired over the entire licence area in 2011 and has identified 52 prospects with a best estimate of 3,083 million barrels of prospective recoverable resource, and a high estimate of 10,412 million barrels. 40 additional leads have been identified which are not included in the above resource figures and which are the subject of ongoing work.

The Company is now seeking an exploration partner to drill a selection of key prospects to unlock the value of this exciting opportunity.

http://www.argosresources.com/

http://www.falklands-oil.com/

http://www.desireplc.co.uk/

http://www.rockhopperexploration.co.uk/

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

•Proven commercial petroleum system

•52 oil prospects, defined by excellent quality 3D seismic data

•CPR attributes 3.1 billion barrels of prospective recoverable resource to the prospects, with upside of 10.4 billion barrels

•40 additional leads identified and under review

•Several prospects similar to Sea Lion

•Prospects have been de-risked by the Sea Lion discovery

•Potential extension of Johnson gas discovery into licence

•Licence 100% owned by Argos Resources

•Benign operating environment

•Stable Government with a competitive tax regime

required field - 23 Oct 2011 11:23 - 127 of 185

Staying put as well......will wait for the drilling to start....sp will shoot up then....

markymar

- 03 Nov 2011 08:34

- 128 of 185

- 03 Nov 2011 08:34

- 128 of 185

After reading Desire RNS today I am wondering what part if any ARG will play, Once RKH finish with the rig there will be 2 max drill slots available now I would of thought Desire would want both of them so that leaves ARG where?

Interesting times not sure how this is going to play out.

Interesting times not sure how this is going to play out.

halifax - 29 Nov 2011 11:39 - 129 of 185

RNS no drilling in the immediate future..... sp tanked.

required field - 29 Nov 2011 16:13 - 130 of 185

Ouch !.....not having much luck with my picks as of late.....in for the long term anyway....it's all 'Arry's fault....

HARRYCAT

- 29 Nov 2011 18:14

- 131 of 185

- 29 Nov 2011 18:14

- 131 of 185

Hmmmm..... could be a longer wait than I first anticipated!

markymar

- 29 Nov 2011 23:23

- 132 of 185

- 29 Nov 2011 23:23

- 132 of 185

I was lucky i sold out the other day in to Desire still holding a few ARG.....luck full stop as i had thousands of them.

Off down the pit Chav for a long shift end of week keep an eye on them clogs.

Off down the pit Chav for a long shift end of week keep an eye on them clogs.

gibby - 18 Jan 2012 08:41 - 133 of 185

indeed it has!

markymar

- 18 Jan 2012 11:20

- 134 of 185

- 18 Jan 2012 11:20

- 134 of 185

Tuesday, January 17th, 2012 | Posted by admin

FoxDavies views from the trading floor

http://refinerynews.com/foxdavies-views-from-the-trading-floor-3/

The rush of blood continued in Argos Resources today, jumping another 28% to 17.5p as investors continued to chase the Falklands plays higher. It would not be a surprise if part of this rally is attributed to short covering here, as the market was not expecting news from Argos for some time. The last RNS said ‘it won’t proceed with a drilling campaign in the North Falkland Basin which was due to end in December, citing weak capital markets and the limited availability of the drilling rig. As the rig is leaving the region in December, Chairman Ian Thomson said the company had rejected the option of drilling only one well because it remained convinced of the value of the area and the merits of a more extensive drilling program. The firm expects to complete the work in the first half of 2012 before looking for an industry partner to help fund its drilling program.’

FoxDavies views from the trading floor

http://refinerynews.com/foxdavies-views-from-the-trading-floor-3/

The rush of blood continued in Argos Resources today, jumping another 28% to 17.5p as investors continued to chase the Falklands plays higher. It would not be a surprise if part of this rally is attributed to short covering here, as the market was not expecting news from Argos for some time. The last RNS said ‘it won’t proceed with a drilling campaign in the North Falkland Basin which was due to end in December, citing weak capital markets and the limited availability of the drilling rig. As the rig is leaving the region in December, Chairman Ian Thomson said the company had rejected the option of drilling only one well because it remained convinced of the value of the area and the merits of a more extensive drilling program. The firm expects to complete the work in the first half of 2012 before looking for an industry partner to help fund its drilling program.’

cynic

- 18 Jan 2012 11:26

- 135 of 185

- 18 Jan 2012 11:26

- 135 of 185

trouble with ARG is that is an MM-only stock so easily manipulated .... not for me this one; i'll stick with rkh

HARRYCAT

- 20 Jan 2012 10:39

- 136 of 185

- 20 Jan 2012 10:39

- 136 of 185

12p to 21p in four days! Amazing and missed opportunity on my part....damn!

markymar

- 20 Jan 2012 10:41

- 137 of 185

- 20 Jan 2012 10:41

- 137 of 185

No reason for the rise Harry apart from the Johnson prospect and maybe a partner in tow.....early days

markymar

- 20 Jan 2012 11:50

- 138 of 185

- 20 Jan 2012 11:50

- 138 of 185

Hope Desire does the same soon as i have a boat load,still at a loss why this is up so much.

HARRYCAT

- 20 Jan 2012 13:47

- 139 of 185

- 20 Jan 2012 13:47

- 139 of 185

Might just be a case of 'no real reason for the sp to drop that far and that fast' and now just recovering lost ground? No complaints from me, though holding now until drilling starts.

required field - 20 Jan 2012 14:04 - 140 of 185

More likely to do with Anadarko....(hope it's spelt like that )...and the possibility that they could be involved as well.....

markymar

- 20 Jan 2012 22:59

- 141 of 185

- 20 Jan 2012 22:59

- 141 of 185

http://www.proactiveinvestors.co.uk/columns/fox-davies-capital/8071/

Gravity defying Argos Resources (LON:ARG) continued its moon bound trip today, pushing another 20% higher to 22.75p during trading. This really is a puzzler, as the company said in a previous announcement “it won't proceed with a drilling campaign in the North Falkland Basin which was due to end in December, citing weak capital markets and the limited availability of the drilling rig. As the rig is leaving the region in December, Chairman Ian Thomson said the company had rejected the option of drilling only one well because it remained convinced of the value of the area and the merits of a more extensive drilling program. The firm expects to complete the work in the first half of 2012 before looking for an industry partner to help fund its drilling program.” This one will be a very interesting one to watch play out, as the RNS says clearly they want to look for funding partners.

Gravity defying Argos Resources (LON:ARG) continued its moon bound trip today, pushing another 20% higher to 22.75p during trading. This really is a puzzler, as the company said in a previous announcement “it won't proceed with a drilling campaign in the North Falkland Basin which was due to end in December, citing weak capital markets and the limited availability of the drilling rig. As the rig is leaving the region in December, Chairman Ian Thomson said the company had rejected the option of drilling only one well because it remained convinced of the value of the area and the merits of a more extensive drilling program. The firm expects to complete the work in the first half of 2012 before looking for an industry partner to help fund its drilling program.” This one will be a very interesting one to watch play out, as the RNS says clearly they want to look for funding partners.

cynic

- 21 Jan 2012 12:13

- 142 of 185

- 21 Jan 2012 12:13

- 142 of 185

sp is surely rising purely on the back of the possibility of an interested party looking over rkh rather than for logical and fundamental reasons

bdog - 23 Jan 2012 08:58 - 143 of 185

The sp is risig on the fact that the drilling campagn in the region (fogl/bor) has attracted worldwide interest with institutions already jumping on board. Arg remains at a reletively low price and when they get funding they and a rig on route the sp will take off to many times its current value. Even without its own sucessful drills a stike by Bor or fogl in the next 4 months will further raise the sp of arg

markymar

- 25 Jan 2012 16:17

- 144 of 185

- 25 Jan 2012 16:17

- 144 of 185

Profit taking today....stll do not understand why it went up the way it did.

markymar

- 28 Feb 2012 16:33

- 145 of 185

- 28 Feb 2012 16:33

- 145 of 185

Argos Resources: Your questions answered

By Stephen McDowell | Tue, 28/02/2012 - 11:54

Editor in Chief Stephen McDowell reports from Houston: Falklands player Argos Resources answers Interactive Investor user questions at the NAPE.

Argos Resources (ARG) is the quiet man of the Falklands Basin.

Less diluted than the others, with a different profile of shareholder, it sits aside from the seething excitement of Rockhopper (RKH) and its Sea Lion junior partner Desire (DES).

Answering one Interactive Investor user's questions, the firm’s spokesman, Peter Thomson, said: "Rockhopper’s Sea Lion is key for everyone in the Falklands basin. It’s world class as oil finds go."

Interactive Investor user question: What level of interest they are receiving with regard to ARG prospects, and as they are data sharing with RKH, whether people looking at RKH will also be able to learn more about ARG at this same expo event?

Thomson: “We have a different kind of shareholder though, quite different, ours tend to be much broader in outlook. Everyone is on a slow hold-of-breath awaiting the results of Rockhopper’s farm-out plans, it seems.

“The way the oil business works is that when you get one big company the others will follow. As for us - we had a fund raising in 2010 and raised £22 million so we are continuing to be drill-ready and happy. It is a lot about financing and finding partners. The Darwin spud in the South, owned by Borders and Southern (BOR), is another story in which the islands' entire industry is keenly eying.”

“No-one knows yet just how big it could be. It's serious wild-catting. The story, as far as Argos concerned is as much about the North Falklands Basin, as the single firm.

He concluded: "We talk to each other all the time, we sit ten feet away from each other mostly. There is a great deal of interest in the whole Falklands story. People think we are competitors but we regard ourselves as colleagues in the North Falklands project."

By Stephen McDowell | Tue, 28/02/2012 - 11:54

Editor in Chief Stephen McDowell reports from Houston: Falklands player Argos Resources answers Interactive Investor user questions at the NAPE.

Argos Resources (ARG) is the quiet man of the Falklands Basin.

Less diluted than the others, with a different profile of shareholder, it sits aside from the seething excitement of Rockhopper (RKH) and its Sea Lion junior partner Desire (DES).

Answering one Interactive Investor user's questions, the firm’s spokesman, Peter Thomson, said: "Rockhopper’s Sea Lion is key for everyone in the Falklands basin. It’s world class as oil finds go."

Interactive Investor user question: What level of interest they are receiving with regard to ARG prospects, and as they are data sharing with RKH, whether people looking at RKH will also be able to learn more about ARG at this same expo event?

Thomson: “We have a different kind of shareholder though, quite different, ours tend to be much broader in outlook. Everyone is on a slow hold-of-breath awaiting the results of Rockhopper’s farm-out plans, it seems.

“The way the oil business works is that when you get one big company the others will follow. As for us - we had a fund raising in 2010 and raised £22 million so we are continuing to be drill-ready and happy. It is a lot about financing and finding partners. The Darwin spud in the South, owned by Borders and Southern (BOR), is another story in which the islands' entire industry is keenly eying.”

“No-one knows yet just how big it could be. It's serious wild-catting. The story, as far as Argos concerned is as much about the North Falklands Basin, as the single firm.

He concluded: "We talk to each other all the time, we sit ten feet away from each other mostly. There is a great deal of interest in the whole Falklands story. People think we are competitors but we regard ourselves as colleagues in the North Falklands project."

markymar

- 19 Mar 2012 08:14

- 146 of 185

- 19 Mar 2012 08:14

- 146 of 185

Argos Resources Limited (AIM: ARG.L), the Falkland Islands based explorationcompany focused on the North Falkland Basin, is pleased to announce its financial results for the year ended 31 December 2011.

Highlights

· Acquisition of 3D seismic data over the entire PL001 licence area was completed in April 2011 with further 3D data acquired in open acreage to the north of the licence through to mid-May

· Argos now has access to some 4,500 sq kms of high quality 3D seismic data covering most of the northern half of the North Falkland Basin

· The 3D data is the best quality seismic data that has been acquired in the basin to date and has transformed the Company's understanding of the prospectivity of its licence

· To date, a total of 28 stratigraphic and structural prospects have been mapped; further prospects may be added as detailed mapping continues

· Of 22 stratigraphic prospects, several bear close analogies to Sea Lion. The 6 structural prospects evident on the original 2D data have been confirmed by 3D data as robust closures

· 3D data quality over Johnson, a potential multi-TCF wet gas discovery by Shell which appears to extend into the Argos licence, is much improved. Extensive mapping and seismic modelling studies are underway

· The best estimate of unrisked prospective recoverable resource has been increased to 2.1 billion barrels, and to 7.3 billion barrels in the high case

· The Company's cash position is sufficient for its ongoing overheads

Highlights

· Acquisition of 3D seismic data over the entire PL001 licence area was completed in April 2011 with further 3D data acquired in open acreage to the north of the licence through to mid-May

· Argos now has access to some 4,500 sq kms of high quality 3D seismic data covering most of the northern half of the North Falkland Basin

· The 3D data is the best quality seismic data that has been acquired in the basin to date and has transformed the Company's understanding of the prospectivity of its licence

· To date, a total of 28 stratigraphic and structural prospects have been mapped; further prospects may be added as detailed mapping continues

· Of 22 stratigraphic prospects, several bear close analogies to Sea Lion. The 6 structural prospects evident on the original 2D data have been confirmed by 3D data as robust closures

· 3D data quality over Johnson, a potential multi-TCF wet gas discovery by Shell which appears to extend into the Argos licence, is much improved. Extensive mapping and seismic modelling studies are underway

· The best estimate of unrisked prospective recoverable resource has been increased to 2.1 billion barrels, and to 7.3 billion barrels in the high case

· The Company's cash position is sufficient for its ongoing overheads