| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Argos Resources (ARG)

markymar

- 27 Jul 2010 12:41

- 27 Jul 2010 12:41

Argos Resources Ltd is an AIM quoted oil and gas exploration company based in the Falkland Islands, ideally placed to make the most of an exciting new oil province heading towards production.

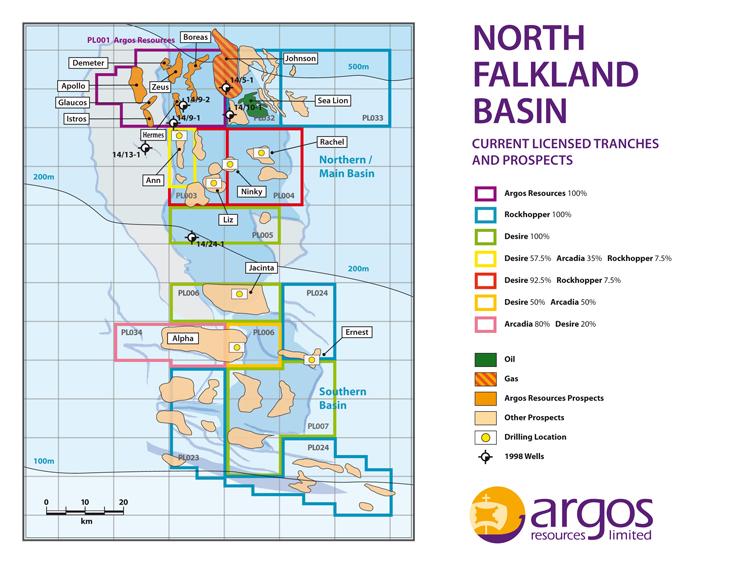

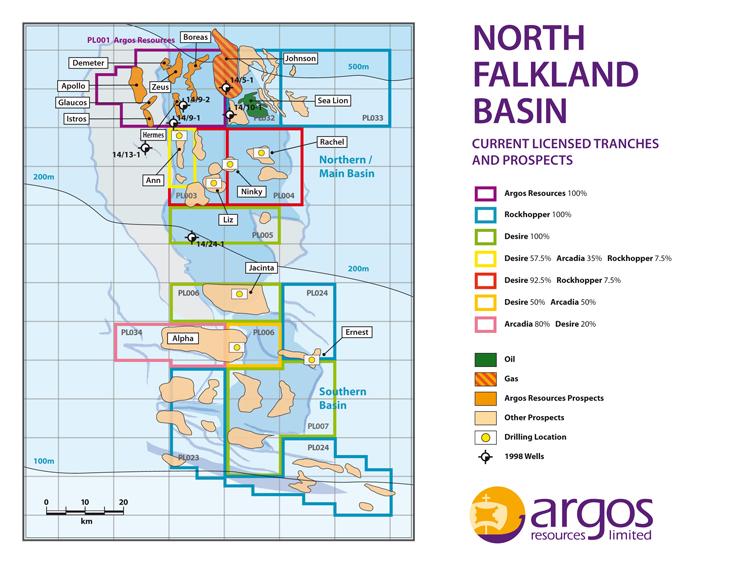

Argos holds a 100% interest in Licence PL001, which covers approximately 1,126 square kilometres in the North Falkland Basin. The licence boundary is just 3km from the Sea Lion oil field, a significant discovery on course for production start-up in 2017.

New 3D seismic data of excellent quality was acquired over the entire licence area in 2011 and has identified 52 prospects with a best estimate of 3,083 million barrels of prospective recoverable resource, and a high estimate of 10,412 million barrels. 40 additional leads have been identified which are not included in the above resource figures and which are the subject of ongoing work.

The Company is now seeking an exploration partner to drill a selection of key prospects to unlock the value of this exciting opportunity.

http://www.argosresources.com/

http://www.falklands-oil.com/

http://www.desireplc.co.uk/

http://www.rockhopperexploration.co.uk/

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

The Opportunity

The Opportunity

•Proven commercial petroleum system

•52 oil prospects, defined by excellent quality 3D seismic data

•CPR attributes 3.1 billion barrels of prospective recoverable resource to the prospects, with upside of 10.4 billion barrels

•40 additional leads identified and under review

•Several prospects similar to Sea Lion

•Prospects have been de-risked by the Sea Lion discovery

•Potential extension of Johnson gas discovery into licence

•Licence 100% owned by Argos Resources

•Benign operating environment

•Stable Government with a competitive tax regime

Argos holds a 100% interest in Licence PL001, which covers approximately 1,126 square kilometres in the North Falkland Basin. The licence boundary is just 3km from the Sea Lion oil field, a significant discovery on course for production start-up in 2017.

New 3D seismic data of excellent quality was acquired over the entire licence area in 2011 and has identified 52 prospects with a best estimate of 3,083 million barrels of prospective recoverable resource, and a high estimate of 10,412 million barrels. 40 additional leads have been identified which are not included in the above resource figures and which are the subject of ongoing work.

The Company is now seeking an exploration partner to drill a selection of key prospects to unlock the value of this exciting opportunity.

http://www.argosresources.com/

http://www.falklands-oil.com/

http://www.desireplc.co.uk/

http://www.rockhopperexploration.co.uk/

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

•Proven commercial petroleum system

•52 oil prospects, defined by excellent quality 3D seismic data

•CPR attributes 3.1 billion barrels of prospective recoverable resource to the prospects, with upside of 10.4 billion barrels

•40 additional leads identified and under review

•Several prospects similar to Sea Lion

•Prospects have been de-risked by the Sea Lion discovery

•Potential extension of Johnson gas discovery into licence

•Licence 100% owned by Argos Resources

•Benign operating environment

•Stable Government with a competitive tax regime

HARRYCAT

- 26 Jul 2013 08:04

- 161 of 185

- 26 Jul 2013 08:04

- 161 of 185

StockMarketWire.com

North Falkland Basin-focused Argos Resources says a new competent person's report has raised the prospective resource to 3,083 million barrels of oil barrels of oil.

This is an increase from 2,107 mmbo identified in the competent person's report published by the company in 2011.

Argos says 52 prospects have been confirmed and described, an increase from 28 described in the 2011 CPR and high case prospective resource estimate now exceeds 10 billion barrels recoverable.

The CPR - which was prepared by Senergy (GB) Ltd - identifies considerable additional prospectivity resulting from further detailed interpretation of the Argos's 3D seismic data acquired in 2011 over its 100% owned licence PL001.

Based upon the CPR, the total best estimate of unrisked recoverable prospective resource on the licence area amounts to 3,083 mmbo, an uplift of 46% on the resource estimate of 2,107 mmbo included in the 2011 CPR.

Argos chairman Ian Thomson said: "The 3D seismic data we have obtained is the best quality data seen in the basin to date. This has allowed us to map with confidence numerous stratigraphic prospects associated with the early Cretaceous delta system that is a principal feature of the licence area.

"New proprietary geochemistry studies have also confirmed that two proven oil source rocks within the licence area are mature for significant volumes of oil generation, and this has added to the improved estimated chances of success for most of the prospects."

North Falkland Basin-focused Argos Resources says a new competent person's report has raised the prospective resource to 3,083 million barrels of oil barrels of oil.

This is an increase from 2,107 mmbo identified in the competent person's report published by the company in 2011.

Argos says 52 prospects have been confirmed and described, an increase from 28 described in the 2011 CPR and high case prospective resource estimate now exceeds 10 billion barrels recoverable.

The CPR - which was prepared by Senergy (GB) Ltd - identifies considerable additional prospectivity resulting from further detailed interpretation of the Argos's 3D seismic data acquired in 2011 over its 100% owned licence PL001.

Based upon the CPR, the total best estimate of unrisked recoverable prospective resource on the licence area amounts to 3,083 mmbo, an uplift of 46% on the resource estimate of 2,107 mmbo included in the 2011 CPR.

Argos chairman Ian Thomson said: "The 3D seismic data we have obtained is the best quality data seen in the basin to date. This has allowed us to map with confidence numerous stratigraphic prospects associated with the early Cretaceous delta system that is a principal feature of the licence area.

"New proprietary geochemistry studies have also confirmed that two proven oil source rocks within the licence area are mature for significant volumes of oil generation, and this has added to the improved estimated chances of success for most of the prospects."

markymar

- 27 Jul 2013 10:35

- 162 of 185

- 27 Jul 2013 10:35

- 162 of 185

But will anyone lend them some money to go drilling with Harry for next year.

markymar

- 29 Jul 2013 10:43

- 163 of 185

- 29 Jul 2013 10:43

- 163 of 185

http://oilbarrel.com/news/new-cpr-adds-another-billion-barrels-of-prospective-resources-to-argos-resources-north-falkland-basin-block

July 29, 2013

New CPR Adds Another Billion Barrels Of Prospective Resources To Argos Resources' North Falkland Basin Block

Having crunched through its 3D data set, described by managing director John Hogan as the best quality he's seen in his 35 year career, AIM-quoted Argos Resources has delivered a massive uplift in prospective resources for its acreage in the North Falkland Basin. A CPR from Senergy gives the block a new best estimate prospective resource of more than 3 billion barrels of recoverable oil, up by almost a billion on the last CPR in 2011, while the high case estimate now tops 10 billion barrels

The £38 million market cap company acquired 1,415 sq km of 3D over its PL001 licence in 2011, giving complete coverage of the 1,126 sq km block as well as a “halo” outside the licence boundaries and tie-ins to key wells (Argos participated in the first ever drilling bout in the Falklands, participating in two exploration wells in 1998 alongside Amerada Hess. Both wells, 14/09-1 and 14/09-2, found oil shows but neither were commercial.)

The 2011 CPR was based on fast-track processing of this data but, having spent the past two years working up a thorough interpretation and analysis of the survey, the company believed the increased prospectivity deserved a new CPR. That would appear to be vindicated by Synergy's findings, with the CPR confirming 52 prospects, up from 28 in 2011, and identifying an additional 40 leads. It's worth noting that before Argos shot the 3D in 2011, its prospect inventory tallied just seven so the US$20 million survey has delivered a real uplift in value.

The upgraded prospect inventory can be divided into two categories: fault bounded and four-way dip closed structural traps and combined structural and stratigraphic traps defined by seismic amplitude anomalies. It is the latter category that has Argos excited, with the company highlighting the similarities with the seismic anomalies of Rockhopper's 2010 Sea Lion oilfield in the neighbouring block, still the only commercial oil strike in the Falklands. A number of these prospects are vertically stacked, which means several could be tested with a single well. The Rhea stack, for example, carries a combined potential of 449 million barrels of prospective resources that could be tested by one well.

“The data shows that a big delta has migrated over time in the Lower Cretaceous from north to south across our licence area, creating Sea Lion type sandstone traps,” says Hogan, who as chief operating officer at Lasmo had a front row seat in the 1998 campaign. Argos has increased its confidence following a proprietary basin modelling study by a North American company that concluded the source rock had generated 30 billion barrels of oil on Argos' licence alone. “That should be more than enough to charge our prospects,” says Hogan.

Of course, all of this is just theory until tested by the drillbit. As oilbarrel.com regulars are only too aware, there have been plenty of AIM companies boasting multi-billion barrel prospect inventories complete with seismic anomalies, seeps and DHIs that have gone on to sink millions of pounds of shareholders' funds into expensive wildcats, only to come back empty handed.

Argos, which ended 2012 with US$5.7 million in cash, is perhaps better placed than most. Not only is the quality of the 3D exceptional - “We used a state-of-the-art vessel on only its second job and the rocks were just very conducive to good imaging so we were able to map everything in really fine detail,” says Hogan – but the company is also next door to the only commercial oilfield in the Falklands. “Oil fields are herd animals,” says Hogan, “and you never find one in isolation. We're sure that Sea Lion will be one of several in the North Falkland Basin.”

Now the company, which holds 100 per cent of the licence, needs to get other explorers to share its conviction. It has been searching for partners since last year and it is, admits Hogan, taking longer than he would have liked. “It's a new country for the vast majority of the industry and they have to go through a prolonged process of due diligence.”

News of a farm-out is going to be the next catalyst for the share price. Hogan, already in talks with interested parties, is looking for partners with industry credibility and the financial muscle to commit to a multi-well campaign. It helps that the North Falkland Basin, while remote, is actually a fairly benign place to operate. All of the Argos prospects are less than 500 metres of water and the targets are 3,000 metres down, well within the capability of conventional anchored semi-subs. It's easy drilling, with the wells reaching TD in 15 days and even the weather conditions aren't particularly challenging.

“The weather record for the Ocean Guardian campaign was less than half the waiting on weather time than the North Sea,” says Hogan. “The North Falkland Basin is actually in the lea of the South American continent so it's relatively benign.”

He puts drilling costs at around US$35 million per well and would hope to share rig time with other local operators to help shoulder the mobilisation and demobilisation costs.Because Argos holds one of the original licences here, there's no particular hurry to rush into drilling: it has until November 2015 until it needs to drill its next well. Even so, Hogan doesn't want to wait around as it is drillbit activity that is going to revive the drifting share price. The shares ticked up 1.5 per cent to close at 17.75 pence on news of the CPR. “Given that the AIM oil sector is really out of favour at the moment, no one had any expectations that it would trigger a correction in the share price,” says Hogan. “We're just pleased it didn't go down.”

July 29, 2013

New CPR Adds Another Billion Barrels Of Prospective Resources To Argos Resources' North Falkland Basin Block

Having crunched through its 3D data set, described by managing director John Hogan as the best quality he's seen in his 35 year career, AIM-quoted Argos Resources has delivered a massive uplift in prospective resources for its acreage in the North Falkland Basin. A CPR from Senergy gives the block a new best estimate prospective resource of more than 3 billion barrels of recoverable oil, up by almost a billion on the last CPR in 2011, while the high case estimate now tops 10 billion barrels

The £38 million market cap company acquired 1,415 sq km of 3D over its PL001 licence in 2011, giving complete coverage of the 1,126 sq km block as well as a “halo” outside the licence boundaries and tie-ins to key wells (Argos participated in the first ever drilling bout in the Falklands, participating in two exploration wells in 1998 alongside Amerada Hess. Both wells, 14/09-1 and 14/09-2, found oil shows but neither were commercial.)

The 2011 CPR was based on fast-track processing of this data but, having spent the past two years working up a thorough interpretation and analysis of the survey, the company believed the increased prospectivity deserved a new CPR. That would appear to be vindicated by Synergy's findings, with the CPR confirming 52 prospects, up from 28 in 2011, and identifying an additional 40 leads. It's worth noting that before Argos shot the 3D in 2011, its prospect inventory tallied just seven so the US$20 million survey has delivered a real uplift in value.

The upgraded prospect inventory can be divided into two categories: fault bounded and four-way dip closed structural traps and combined structural and stratigraphic traps defined by seismic amplitude anomalies. It is the latter category that has Argos excited, with the company highlighting the similarities with the seismic anomalies of Rockhopper's 2010 Sea Lion oilfield in the neighbouring block, still the only commercial oil strike in the Falklands. A number of these prospects are vertically stacked, which means several could be tested with a single well. The Rhea stack, for example, carries a combined potential of 449 million barrels of prospective resources that could be tested by one well.

“The data shows that a big delta has migrated over time in the Lower Cretaceous from north to south across our licence area, creating Sea Lion type sandstone traps,” says Hogan, who as chief operating officer at Lasmo had a front row seat in the 1998 campaign. Argos has increased its confidence following a proprietary basin modelling study by a North American company that concluded the source rock had generated 30 billion barrels of oil on Argos' licence alone. “That should be more than enough to charge our prospects,” says Hogan.

Of course, all of this is just theory until tested by the drillbit. As oilbarrel.com regulars are only too aware, there have been plenty of AIM companies boasting multi-billion barrel prospect inventories complete with seismic anomalies, seeps and DHIs that have gone on to sink millions of pounds of shareholders' funds into expensive wildcats, only to come back empty handed.

Argos, which ended 2012 with US$5.7 million in cash, is perhaps better placed than most. Not only is the quality of the 3D exceptional - “We used a state-of-the-art vessel on only its second job and the rocks were just very conducive to good imaging so we were able to map everything in really fine detail,” says Hogan – but the company is also next door to the only commercial oilfield in the Falklands. “Oil fields are herd animals,” says Hogan, “and you never find one in isolation. We're sure that Sea Lion will be one of several in the North Falkland Basin.”

Now the company, which holds 100 per cent of the licence, needs to get other explorers to share its conviction. It has been searching for partners since last year and it is, admits Hogan, taking longer than he would have liked. “It's a new country for the vast majority of the industry and they have to go through a prolonged process of due diligence.”

News of a farm-out is going to be the next catalyst for the share price. Hogan, already in talks with interested parties, is looking for partners with industry credibility and the financial muscle to commit to a multi-well campaign. It helps that the North Falkland Basin, while remote, is actually a fairly benign place to operate. All of the Argos prospects are less than 500 metres of water and the targets are 3,000 metres down, well within the capability of conventional anchored semi-subs. It's easy drilling, with the wells reaching TD in 15 days and even the weather conditions aren't particularly challenging.

“The weather record for the Ocean Guardian campaign was less than half the waiting on weather time than the North Sea,” says Hogan. “The North Falkland Basin is actually in the lea of the South American continent so it's relatively benign.”

He puts drilling costs at around US$35 million per well and would hope to share rig time with other local operators to help shoulder the mobilisation and demobilisation costs.Because Argos holds one of the original licences here, there's no particular hurry to rush into drilling: it has until November 2015 until it needs to drill its next well. Even so, Hogan doesn't want to wait around as it is drillbit activity that is going to revive the drifting share price. The shares ticked up 1.5 per cent to close at 17.75 pence on news of the CPR. “Given that the AIM oil sector is really out of favour at the moment, no one had any expectations that it would trigger a correction in the share price,” says Hogan. “We're just pleased it didn't go down.”

HARRYCAT

- 21 Aug 2013 09:00

- 164 of 185

- 21 Aug 2013 09:00

- 164 of 185

StockMarketWire.com

Argos Resources managing director John Hogan will be presenting at the Proactive Investors Annual Hydrocarbons One2One Forum in London tomorrow (22 August).

Hogan's presentation will focus on the Falkland Islands-based exploration company's recently published competent person's report and will contain no new price sensitive information.

Argos Resources managing director John Hogan will be presenting at the Proactive Investors Annual Hydrocarbons One2One Forum in London tomorrow (22 August).

Hogan's presentation will focus on the Falkland Islands-based exploration company's recently published competent person's report and will contain no new price sensitive information.

markymar

- 03 Sep 2013 07:46

- 165 of 185

- 03 Sep 2013 07:46

- 165 of 185

http://en.mercopress.com/2013/09/02/falklands-argos-considering-drilling-finance-options-and-confident-about-new-exploration-round

Monday, September 2nd 2013 - 12:28 UTC

Falklands’ Argos considering drilling finance options and confident about new exploration round

Falkland Islands Argos Resources oil and exploration company have said that they are extremely well placed to participate in the next round of exploration drilling in the Falklands and they are continuing to consider various ways to finance drilling.

According to the AIM quoted Falklands based company their best estimate of un-risked potentially recoverable prospective resources on their licence area is around three billion barrels of oil, with 40 additional leads still to be evaluated. The highest estimate is 10.4 billion barrels of oil, the company said in its half-year statement.

Argos says that still to be undertaken on the 3D data includes, where appropriate, mapping potential reservoir sands within the Johnson gas discovery, which appears to extend into the licence area.

Chairman of Argos Resources Ian Thomson says that the 3D seismic data they have obtained is the best quality data seen in the basin to date. Thomson says that new studies have also confirmed that two proven oil source rocks within the licence area are mature for significant volumes of oil generation, and this has added to the improved estimated chances of success for most of the prospects.

Thomson points out that the company’s directors continue to actively consider various financing options to facilitate exploration drilling.

While financial results are not very meaningful for a company at this stage of development, the company said that they made a half-year loss of 1.1million dollars.

Argos principal asset is a 100% interest in production licence PL001 covering an area of approximately 1,126 square kilometres in the North Falkland Basin. The 3D seismic survey acquired in early 2011 covering the entire licence area identified of 52 prospects and 40 leads within the licence area.

The Argos licence area adjoins licences PL032 and PL004b. The Rockhopper/Primer Sea Lion oil discovery was made in licence PL032 in 2010 and a total of nine wells have now been drilled to complete the appraisal of this large discovery. An extension of the Sea Lion field into licence PL004b was proven by drilling in late 2011 and additional shallower stacked oil and gas accumulations above the Sea Lion field have also been proven in the Casper, Casper South and Beverley discoveries.

The presence of gas in these latest discoveries, together with gas in the Johnson discovery and gas condensate in the Liz discovery to the south points to a second deeper source rock generating commercial volumes of hydrocarbons into the basin, in addition to the Lower Cretaceous oil source rock, according to Argos half year report.

Monday, September 2nd 2013 - 12:28 UTC

Falklands’ Argos considering drilling finance options and confident about new exploration round

Falkland Islands Argos Resources oil and exploration company have said that they are extremely well placed to participate in the next round of exploration drilling in the Falklands and they are continuing to consider various ways to finance drilling.

According to the AIM quoted Falklands based company their best estimate of un-risked potentially recoverable prospective resources on their licence area is around three billion barrels of oil, with 40 additional leads still to be evaluated. The highest estimate is 10.4 billion barrels of oil, the company said in its half-year statement.

Argos says that still to be undertaken on the 3D data includes, where appropriate, mapping potential reservoir sands within the Johnson gas discovery, which appears to extend into the licence area.

Chairman of Argos Resources Ian Thomson says that the 3D seismic data they have obtained is the best quality data seen in the basin to date. Thomson says that new studies have also confirmed that two proven oil source rocks within the licence area are mature for significant volumes of oil generation, and this has added to the improved estimated chances of success for most of the prospects.

Thomson points out that the company’s directors continue to actively consider various financing options to facilitate exploration drilling.

While financial results are not very meaningful for a company at this stage of development, the company said that they made a half-year loss of 1.1million dollars.

Argos principal asset is a 100% interest in production licence PL001 covering an area of approximately 1,126 square kilometres in the North Falkland Basin. The 3D seismic survey acquired in early 2011 covering the entire licence area identified of 52 prospects and 40 leads within the licence area.

The Argos licence area adjoins licences PL032 and PL004b. The Rockhopper/Primer Sea Lion oil discovery was made in licence PL032 in 2010 and a total of nine wells have now been drilled to complete the appraisal of this large discovery. An extension of the Sea Lion field into licence PL004b was proven by drilling in late 2011 and additional shallower stacked oil and gas accumulations above the Sea Lion field have also been proven in the Casper, Casper South and Beverley discoveries.

The presence of gas in these latest discoveries, together with gas in the Johnson discovery and gas condensate in the Liz discovery to the south points to a second deeper source rock generating commercial volumes of hydrocarbons into the basin, in addition to the Lower Cretaceous oil source rock, according to Argos half year report.

HARRYCAT

- 06 Sep 2013 08:17

- 166 of 185

- 06 Sep 2013 08:17

- 166 of 185

StockMarketWire.com

Falkland Islands-based exploration company Argos Resources will hold its annual general meeting at the Falkland Islands Chamber of Commerce, West Hillside Estate, Stanley, on 10 October at 5 p.m. (local time).

Falkland Islands-based exploration company Argos Resources will hold its annual general meeting at the Falkland Islands Chamber of Commerce, West Hillside Estate, Stanley, on 10 October at 5 p.m. (local time).

HARRYCAT

- 27 May 2014 08:08

- 167 of 185

- 27 May 2014 08:08

- 167 of 185

StockMarketWire.com

North Falkland Basin-focused Argos Resources posts a loss attributable to owners of the parent of $1.8m for the year to the end of December - up from $1.6m last time.

Administrative expenses rose to $1.8m from $1.7m while fincnace income fell to $17,000 from $37,000.

Chairman Ian Thomson said: "The next key step is to secure financing for exploration drilling to test the prospect inventory. We are focussed on finding an industry partner to finance drilling operations with the capability and track record of progressing discoveries through to development. We now have a number of companies who have been through the farm-out data room and are expressing interest. Negotiations are under way at the time of writing.

"The farm-out effort has been an extended process with the main contributing factor being the timing of rig availability with every potential farminee wanting to participate in a shared drilling programme to realise the considerable cost savings. The operators in the region are making progress in arranging a shared drilling programme with a rig identified and under negotiation for a drilling programme commencing in early 2015.

"While Argos Resources cannot make a commitment to this rig contract until we have completed a farm-out, we have remained in close contact with the other operators to ensure there is an option to join this drilling programme once financing is secured."

North Falkland Basin-focused Argos Resources posts a loss attributable to owners of the parent of $1.8m for the year to the end of December - up from $1.6m last time.

Administrative expenses rose to $1.8m from $1.7m while fincnace income fell to $17,000 from $37,000.

Chairman Ian Thomson said: "The next key step is to secure financing for exploration drilling to test the prospect inventory. We are focussed on finding an industry partner to finance drilling operations with the capability and track record of progressing discoveries through to development. We now have a number of companies who have been through the farm-out data room and are expressing interest. Negotiations are under way at the time of writing.

"The farm-out effort has been an extended process with the main contributing factor being the timing of rig availability with every potential farminee wanting to participate in a shared drilling programme to realise the considerable cost savings. The operators in the region are making progress in arranging a shared drilling programme with a rig identified and under negotiation for a drilling programme commencing in early 2015.

"While Argos Resources cannot make a commitment to this rig contract until we have completed a farm-out, we have remained in close contact with the other operators to ensure there is an option to join this drilling programme once financing is secured."

HARRYCAT

- 13 Apr 2015 08:07

- 168 of 185

- 13 Apr 2015 08:07

- 168 of 185

StockMarketWire.com

Argos Resources subsidiary, Argos Exploration Limited, has entered into a farmout agreement with Noble Energy Falklands Limited and Edison International which will allow exploration drilling on its Licence PL001.

The licence covers an area of approximately 1,126 square kilometres in the North Falkland Basin and the agreement will enable drilling to proceed as part of the current 2015 drilling programme.

Chairman Ian Thomson said: "We are delighted to have entered into this agreement with such highly-regarded and financially robust partners as Noble and Edison. The innovative nature of the transaction means that there is no material Shareholder dilution or further Shareholder funding required by the Company for any future investments in Licence PL001. In addition, with ongoing working capital requirements catered for by the terms of this agreement and the Second Exploration Term work obligation on our Three Exploration Term Licence now covered, the financial position and outlook for the Company is robust.

"We are pleased to be participating in the 2015 drilling campaign in the North Falkland Basin, which is already underway, and look forward to the drilling of the first exploration well to test the Rhea Stack. Rhea has always been our top-ranked prospect in which we estimate a resource potential of 449 million barrels of recoverable oil. We are especially delighted that, following their own extensive technical work, Noble and Edison have selected this as their first exploration target on the Licence. We believe that success at Rhea will de-risk other prospects in the Licence."

Argos Resources subsidiary, Argos Exploration Limited, has entered into a farmout agreement with Noble Energy Falklands Limited and Edison International which will allow exploration drilling on its Licence PL001.

The licence covers an area of approximately 1,126 square kilometres in the North Falkland Basin and the agreement will enable drilling to proceed as part of the current 2015 drilling programme.

Chairman Ian Thomson said: "We are delighted to have entered into this agreement with such highly-regarded and financially robust partners as Noble and Edison. The innovative nature of the transaction means that there is no material Shareholder dilution or further Shareholder funding required by the Company for any future investments in Licence PL001. In addition, with ongoing working capital requirements catered for by the terms of this agreement and the Second Exploration Term work obligation on our Three Exploration Term Licence now covered, the financial position and outlook for the Company is robust.

"We are pleased to be participating in the 2015 drilling campaign in the North Falkland Basin, which is already underway, and look forward to the drilling of the first exploration well to test the Rhea Stack. Rhea has always been our top-ranked prospect in which we estimate a resource potential of 449 million barrels of recoverable oil. We are especially delighted that, following their own extensive technical work, Noble and Edison have selected this as their first exploration target on the Licence. We believe that success at Rhea will de-risk other prospects in the Licence."

required field - 13 Apr 2015 09:42 - 169 of 185

Will be keeping a keen eye on this.....I think they (Argos) have commercial hydrocarbons......

required field - 20 Apr 2015 20:49 - 170 of 185

Little risk with some upside if a discovery is made.....hence sp rising...

HARRYCAT

- 15 May 2015 12:06

- 171 of 185

- 15 May 2015 12:06

- 171 of 185

On the move....for no immediately apparent reason.

HARRYCAT

- 15 Jun 2015 08:02

- 172 of 185

- 15 Jun 2015 08:02

- 172 of 185

StockMarketWire.com

Argos Resources, the Falkland Islands based exploration company, posts a loss of $1.3m for the year to the end of December - down from $1.8m in 2013.

The losses in both years were primarily due to administrative expenses. There were foreign exchange losses of $85,000 in 2014 and $15,000 in 2013.

Chairman Ian Thomson said: "We are delighted to have entered into a farm-out agreement with such highly-regarded and financially robust partners as Noble and Edison. "The innovative nature of the transaction means that there is no material Shareholder dilution or further Shareholder funding required by the Company for any future investments in Licence PL001. In addition, with ongoing working capital requirements catered for by the terms of this agreement and the Second Exploration Term work obligation on our Three Exploration Term licence now covered, the financial position and outlook for the Company is robust.

"We are pleased to be participating in the 2015 drilling campaign in the North Falkland Basin, which is already under way, and look forward to the drilling of the first exploration well to test the Rhea Stack. Rhea has always been our top-ranked prospect in which we estimate a resource potential of 449 million barrels of recoverable oil.

"We are especially delighted that, following their own extensive technical work, Noble and Edison have selected this as their first exploration target on the licence. We believe that success at Rhea will de-risk other prospects in the licence."

Argos Resources, the Falkland Islands based exploration company, posts a loss of $1.3m for the year to the end of December - down from $1.8m in 2013.

The losses in both years were primarily due to administrative expenses. There were foreign exchange losses of $85,000 in 2014 and $15,000 in 2013.

Chairman Ian Thomson said: "We are delighted to have entered into a farm-out agreement with such highly-regarded and financially robust partners as Noble and Edison. "The innovative nature of the transaction means that there is no material Shareholder dilution or further Shareholder funding required by the Company for any future investments in Licence PL001. In addition, with ongoing working capital requirements catered for by the terms of this agreement and the Second Exploration Term work obligation on our Three Exploration Term licence now covered, the financial position and outlook for the Company is robust.

"We are pleased to be participating in the 2015 drilling campaign in the North Falkland Basin, which is already under way, and look forward to the drilling of the first exploration well to test the Rhea Stack. Rhea has always been our top-ranked prospect in which we estimate a resource potential of 449 million barrels of recoverable oil.

"We are especially delighted that, following their own extensive technical work, Noble and Edison have selected this as their first exploration target on the licence. We believe that success at Rhea will de-risk other prospects in the licence."

HARRYCAT

- 12 Feb 2016 09:07

- 173 of 185

- 12 Feb 2016 09:07

- 173 of 185

Argos Resources Limited announces that it has today received notification from Noble Energy, the Operator of Licence PL001, in which Argos holds a 5% Overriding Royalty Interest, that it is exercising its rights under the terms of a Farmout Agreement between Noble and Argos to declare Force Majeure.

Noble had been planning to drill an exploration well on Licence PL001 which was due to commence shortly using the Eirik Raude drilling rig, which is currently operating in the North Falkland Basin. Due to operational issues with the rig, Noble has cancelled the Rig Contract, leading, in turn, to the notification to Argos of Force Majeure.

Noble intends to apply to the Falkland Islands Government for an extension to the current phase of the Licence. The licence requires the drilling of a commitment well to move to the next phase.

In addition to the continuation of the Overriding Royalty Interest in the Licence, Noble have confirmed that future cash payments to Argos will be made which will be sufficient to meet the ongoing running costs of the Company.

A new Participation Agreement between the parties to reflect the various changes created as a consequence of Force Majeure will replace the Farmout Agreement.

Ian Thomson, Chairman of Argos, commented:

"We are, of course, very disappointed to have been so close to drilling commencing on our Licence, only to suffer this delay. We respect Noble's judgement in this matter and we are working closely with them. Our Overriding Royalty Interest in the Licence will continue into any extension period agreed and our future running costs are covered, so we remain well positioned. Both Noble and the Company continue to be very positive about the exploration potential of the Licence Area".

Noble had been planning to drill an exploration well on Licence PL001 which was due to commence shortly using the Eirik Raude drilling rig, which is currently operating in the North Falkland Basin. Due to operational issues with the rig, Noble has cancelled the Rig Contract, leading, in turn, to the notification to Argos of Force Majeure.

Noble intends to apply to the Falkland Islands Government for an extension to the current phase of the Licence. The licence requires the drilling of a commitment well to move to the next phase.

In addition to the continuation of the Overriding Royalty Interest in the Licence, Noble have confirmed that future cash payments to Argos will be made which will be sufficient to meet the ongoing running costs of the Company.

A new Participation Agreement between the parties to reflect the various changes created as a consequence of Force Majeure will replace the Farmout Agreement.

Ian Thomson, Chairman of Argos, commented:

"We are, of course, very disappointed to have been so close to drilling commencing on our Licence, only to suffer this delay. We respect Noble's judgement in this matter and we are working closely with them. Our Overriding Royalty Interest in the Licence will continue into any extension period agreed and our future running costs are covered, so we remain well positioned. Both Noble and the Company continue to be very positive about the exploration potential of the Licence Area".

HARRYCAT

- 19 Sep 2016 09:34

- 174 of 185

- 19 Sep 2016 09:34

- 174 of 185

StockMarketWire.com

North Falkland Basin-focused Argos Resources posts a loss of $4000 for the six months to the end of June (2015: $0.8 million) giving a loss per share of 0.002 cents (2015: 0.35 cents).

Administrative expenses were $0.3 million compared to $0.7 million for the corresponding period in 2015.

Net assets of $29.3 million have decreased marginally by $4 thousand since December 2015 as a result of the small loss incurred.

Chairman Ian Thomson said: "It was very disappointing to have been so close to drilling commencing on our licence, only to suffer the delay which ensued from the cancellation of the rig contract.

"However, a new participation agreement was completed promptly and in a very co-operative way between the parties ensuring that our overriding royalty interest in the licence continues into the future and our ongoing running costs are covered, so we remain well positioned. Both Noble and the company continue to be very positive about the exploration potential of the licence area."

North Falkland Basin-focused Argos Resources posts a loss of $4000 for the six months to the end of June (2015: $0.8 million) giving a loss per share of 0.002 cents (2015: 0.35 cents).

Administrative expenses were $0.3 million compared to $0.7 million for the corresponding period in 2015.

Net assets of $29.3 million have decreased marginally by $4 thousand since December 2015 as a result of the small loss incurred.

Chairman Ian Thomson said: "It was very disappointing to have been so close to drilling commencing on our licence, only to suffer the delay which ensued from the cancellation of the rig contract.

"However, a new participation agreement was completed promptly and in a very co-operative way between the parties ensuring that our overriding royalty interest in the licence continues into the future and our ongoing running costs are covered, so we remain well positioned. Both Noble and the company continue to be very positive about the exploration potential of the licence area."

HARRYCAT

- 27 Mar 2017 10:31

- 175 of 185

- 27 Mar 2017 10:31

- 175 of 185

StockMarketWire.com

North Falkland Basin-focused Argos Resources' losses fell to $16,000 in the year to the end of December from $1.15m in 2015.

Chairman Ian Thomson said: "It was very disappointing to have been so close to drilling commencing on our licence, only to suffer the delay which ensued from the cancellation of the rig contract.

"However, a new participation agreement was completed promptly and in a very co-operative way between the parties ensuring that our overriding royalty interest in the licence continues into the future and our ongoing running costs are covered, so we remain well positioned.

"The company continue to be very positive about the exploration potential of the licence area."

North Falkland Basin-focused Argos Resources' losses fell to $16,000 in the year to the end of December from $1.15m in 2015.

Chairman Ian Thomson said: "It was very disappointing to have been so close to drilling commencing on our licence, only to suffer the delay which ensued from the cancellation of the rig contract.

"However, a new participation agreement was completed promptly and in a very co-operative way between the parties ensuring that our overriding royalty interest in the licence continues into the future and our ongoing running costs are covered, so we remain well positioned.

"The company continue to be very positive about the exploration potential of the licence area."

HARRYCAT

- 14 May 2018 13:09

- 176 of 185

- 14 May 2018 13:09

- 176 of 185

Up 40% this morning....for some unkown reason.

EDIT - seems it's on the back of RKH intention to drill Sealion.

EDIT - seems it's on the back of RKH intention to drill Sealion.

required field - 14 May 2018 13:55 - 177 of 185

Premier oil might be in talks with the two companies about development.....if they come to some sort of agreement...sp's will go a lot further...

markymar

- 15 May 2018 09:44

- 178 of 185

- 15 May 2018 09:44

- 178 of 185

Smoke and mirrors,but intresting shell have sold all there garages in Argentina.

markymar

- 15 May 2018 09:49

- 179 of 185

- 15 May 2018 09:49

- 179 of 185

http://en.mercopress.com/2018/04/25/brazilian-company-buys-shell-downstream-assets-in-argentina

so maybe expecting to get back in to the Falklands now garages sold they cant be held so ransom by Argentina

so maybe expecting to get back in to the Falklands now garages sold they cant be held so ransom by Argentina

required field - 15 May 2018 13:33 - 180 of 185

Crude still rising.....tensions with Iran..Palestine/Israel troubles....doubts about the USA shale production.....Opec grip on barrels per day....can't do the sp any harm.....au contraire.....makes Sealion and others much more viable....plus a mini market cap....