| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

AIM listed telecoms/tech company - astounding growth (GBO)

Greyhound - 14 Apr 2011 21:53

mentor - 20 Nov 2014 11:27 - 169 of 250

Figures just to good for the share price to stay on those low prices

Trading Update for nine months ended 30 September 2014

Globo Plc (LSE-AIM: GBO),

· Revenues for the first 9 months of the year grew by 46% to €73.2 million (first 9 months 2013: €50.0 million):

# GO!Enterprise revenues grew by 89% to €35.0 million (first 9 months 2013: €18.5 million), including a maiden contribution from Sourcebits of €1.2 million;

# CitronGO! Revenues grew by 13% to €29.8 (first 9 months 2013: €26.4 million).

# The Group continued to generate free cash flow1 during the third quarter. The net cash position

at 30 September 2014 was €36.3 million (30 June 2014: €46.0m) after payment of US$12.0 million and associated costs for the acquisition of Sourcebits in July 2014, and other investment and setup costs associated with US expansion.

# We expect positive free cash flow generation to continue during the last quarter of 2014 and we remain confident that our year-end results will meet market expectations.

http://stockcharts.com/h-sc/ui?s=GBO.L

Trading Update for nine months ended 30 September 2014

Globo Plc (LSE-AIM: GBO),

· Revenues for the first 9 months of the year grew by 46% to €73.2 million (first 9 months 2013: €50.0 million):

# GO!Enterprise revenues grew by 89% to €35.0 million (first 9 months 2013: €18.5 million), including a maiden contribution from Sourcebits of €1.2 million;

# CitronGO! Revenues grew by 13% to €29.8 (first 9 months 2013: €26.4 million).

# The Group continued to generate free cash flow1 during the third quarter. The net cash position

at 30 September 2014 was €36.3 million (30 June 2014: €46.0m) after payment of US$12.0 million and associated costs for the acquisition of Sourcebits in July 2014, and other investment and setup costs associated with US expansion.

# We expect positive free cash flow generation to continue during the last quarter of 2014 and we remain confident that our year-end results will meet market expectations.

http://stockcharts.com/h-sc/ui?s=GBO.L

chessplayer - 21 Nov 2014 09:36 - 170 of 250

down a touch after recent gains, but continued buying suggests more gains to come.

mentor - 09 Apr 2015 13:45 - 171 of 250

Bought some stock at 45p

Has been moving lower for some time and again today, but at this price 45p offer plenty of trades go on every time it comes to this price. Well undervalued on a historic PE of 7.2 and the latest update is everything OK for results at the end of the month, small spread

other trades at ISDX .......... GBO trades at ISDX

Has been moving lower for some time and again today, but at this price 45p offer plenty of trades go on every time it comes to this price. Well undervalued on a historic PE of 7.2 and the latest update is everything OK for results at the end of the month, small spread

other trades at ISDX .......... GBO trades at ISDX

mentor - 09 Apr 2015 14:12 - 172 of 250

CHART

&IND=&Layout=2Line;Default;Price;HisDate&XCycle=&XFormat=)

mentor - 09 Apr 2015 16:23 - 173 of 250

for the last 30 minutes the order book got stronger and a few large trades are taking the price higher from the 45p offer lasting most of the afternoon

spread 45p v 45.25p

56K at bid price 6K at offer

DEPH at 18 trades both sides

spread 45p v 45.25p

56K at bid price 6K at offer

DEPH at 18 trades both sides

mentor - 10 Apr 2015 09:30 - 174 of 250

the turning point of this cycle could have been the 45p support yesterday

spread 46 v 47 now on a complete change of order book, yesterday the DEPTH was about 4 trades down on the bid side

today is about 9 up

spread 46 v 47 now on a complete change of order book, yesterday the DEPTH was about 4 trades down on the bid side

today is about 9 up

mentor - 10 Apr 2015 09:41 - 175 of 250

Future bid prospects

Any company trading at a 75% discount to it's peers, in a rapidly consolidating market, does not stay independent for long

-------------------------

From the 2013 consolidated accounts, intangibles including goodwill were €33m. Total shareholders’ funds were €138m so even deducting the intangibles shareholders’ funds would be €105m. That compares with a market value of about €250m, i.e. net tangible assets are about 20p per share.

Within those net assets we have net cash of €43m, gross cash of €64m and a further €20 of undrawn facilities. Since Globo generated significant free cash flow from operations (about €12m) for 2014, they really don’t need anything like that amount of cash – if anything the balance sheet is too strong to the point that it is inefficient.

Of course the cash also gives them the resources to make acquisitions although to date the acquisitions they have made have been of relatively modest “infill” nature.

the amount capitalised to-date must account for most of €48.8m (= €39.8m + 9.0m) of intangible assets + goodwill (as of HY 2014). For a company on the high end of EMM technology hoping to maintain and improve on its position among the global leaders in the sector, it is essential to spend money on R&D.

One can but compared the annual spending and amounts and spending by its competitors. Then the €49m might look modest!

Any company trading at a 75% discount to it's peers, in a rapidly consolidating market, does not stay independent for long

-------------------------

From the 2013 consolidated accounts, intangibles including goodwill were €33m. Total shareholders’ funds were €138m so even deducting the intangibles shareholders’ funds would be €105m. That compares with a market value of about €250m, i.e. net tangible assets are about 20p per share.

Within those net assets we have net cash of €43m, gross cash of €64m and a further €20 of undrawn facilities. Since Globo generated significant free cash flow from operations (about €12m) for 2014, they really don’t need anything like that amount of cash – if anything the balance sheet is too strong to the point that it is inefficient.

Of course the cash also gives them the resources to make acquisitions although to date the acquisitions they have made have been of relatively modest “infill” nature.

the amount capitalised to-date must account for most of €48.8m (= €39.8m + 9.0m) of intangible assets + goodwill (as of HY 2014). For a company on the high end of EMM technology hoping to maintain and improve on its position among the global leaders in the sector, it is essential to spend money on R&D.

One can but compared the annual spending and amounts and spending by its competitors. Then the €49m might look modest!

mentor - 10 Apr 2015 11:11 - 176 of 250

BINGO

steady as she goes 48.38p +3.25p +7.20%

there was a large trade earlier 60K paying almost 49p at ISDX.............

10/04/2015 11:01 GBX/ISDX-exn 60,000 48.89p

steady as she goes 48.38p +3.25p +7.20%

there was a large trade earlier 60K paying almost 49p at ISDX.............

10/04/2015 11:01 GBX/ISDX-exn 60,000 48.89p

mentor - 10 Apr 2015 12:48 - 177 of 250

ISDX - is having a good volume and is 30 minutes delayed... 251,368K

LSE - Cum Vol ---- 324,467

LSE - Cum Vol ---- 324,467

mentor - 12 Apr 2015 23:10 - 178 of 250

RESUME of various places.............

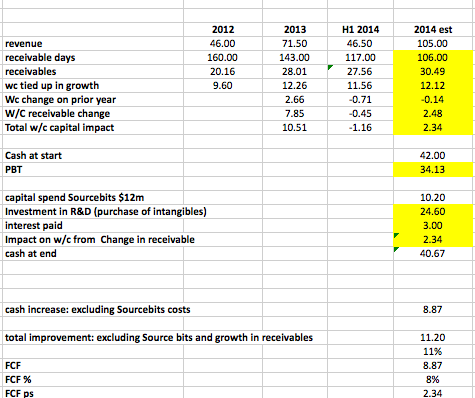

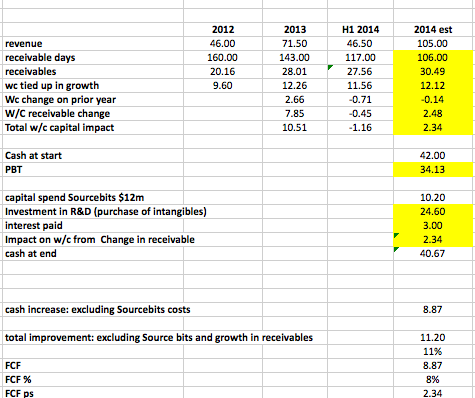

The conclusion is that GBO is investing heavily in growth. All items that diminish its cash are growth driven expenditure. ie source bits, invest in R&D and w/c impact of receivables. (the recivables are down from 160 days in 2012 to 110-117 in 2014 but notwistanding it costs cash to fund the w/c to grow.

A net Free cash flow of 10.38m (10% or revenue) is not shoddy

Strip Source bits and w/c tie up the cash would be improved to 15.13m (14%)

Now lets get real:

Globo FCF per share : 5.97% of current sp

ARM is 1.2% of current SP

RR. is 0.96% of current sp.

Admiral is 2.8%

Diagio 3.2%

------------------

Last year's increase in working capitalresulted in cash outflow of 13.5m, this year's forecast is 11.9m. EBITDA forecast is 46.8m. The Sourcebits acquisition was $12m (USD) which is 9.6m euros but there was 0.6m in H1 (deferred consideration in respect of Notify) so total acquisition costs will be 10.2m euros. Forecasting capitalised R&D of 24.6m, interest payments of 3.1m. At year end net cash was 40.3m (vs 42.7m in 2013) so free cash flow for the year will be 7.8m euros (40.3 - 42.7 +10.2 = 7.8).

EBITDA figure of 34m looks low, we're forecasting an operating profit of 35m so adding back depreciation and amortisation costs (non cash costs reported in the P+L) of 11.8m takes us to 46.8m EBITDA.

The conclusion is that GBO is investing heavily in growth. All items that diminish its cash are growth driven expenditure. ie source bits, invest in R&D and w/c impact of receivables. (the recivables are down from 160 days in 2012 to 110-117 in 2014 but notwistanding it costs cash to fund the w/c to grow.

A net Free cash flow of 10.38m (10% or revenue) is not shoddy

Strip Source bits and w/c tie up the cash would be improved to 15.13m (14%)

Now lets get real:

Globo FCF per share : 5.97% of current sp

ARM is 1.2% of current SP

RR. is 0.96% of current sp.

Admiral is 2.8%

Diagio 3.2%

------------------

Last year's increase in working capitalresulted in cash outflow of 13.5m, this year's forecast is 11.9m. EBITDA forecast is 46.8m. The Sourcebits acquisition was $12m (USD) which is 9.6m euros but there was 0.6m in H1 (deferred consideration in respect of Notify) so total acquisition costs will be 10.2m euros. Forecasting capitalised R&D of 24.6m, interest payments of 3.1m. At year end net cash was 40.3m (vs 42.7m in 2013) so free cash flow for the year will be 7.8m euros (40.3 - 42.7 +10.2 = 7.8).

EBITDA figure of 34m looks low, we're forecasting an operating profit of 35m so adding back depreciation and amortisation costs (non cash costs reported in the P+L) of 11.8m takes us to 46.8m EBITDA.

mentor - 14 Apr 2015 10:15 - 179 of 250

another steady rise, though not large it is better this way ahead of news of when the results are going to be announce, expectations going from previous years is before the end of this month

spread 47 v 48

a very strong order book 21 v 10

and bid/offer price 78K v 35K

not much volume on the LSE and not better on the ISDX

spread 47 v 48

a very strong order book 21 v 10

and bid/offer price 78K v 35K

not much volume on the LSE and not better on the ISDX

Greyhound - 16 Apr 2015 12:06 - 180 of 250

A long time treading water but I still think we will move materially higher at some point. When is the question! Canaccord buy rating maintained this month, tp 90p. RBC 120p from February.

mentor - 17 Apr 2015 16:02 - 181 of 250

Looking better this afternoon, though very volatile and the higher bid that someone is placing is being taken soon by "AT"

volume is rising also, soon should be news of when results are announce

spread 47 v 47.75p, was a bit earlier at 47.75 v 48.25p

Level2 / order book DEPTH is strong at 23 v 13

volume is rising also, soon should be news of when results are announce

spread 47 v 47.75p, was a bit earlier at 47.75 v 48.25p

Level2 / order book DEPTH is strong at 23 v 13

Greyhound - 17 Apr 2015 16:14 - 182 of 250

Let's hope the results will be the catalyst.

Greyhound - 17 Apr 2015 16:16 - 183 of 250

Results were 30th April last year.

mentor - 23 Apr 2015 11:53 - 184 of 250

finally the company has announce the date of results ............

Notice of 2014 Final Results

Globo plc (LSE-AIM: GBO), the international provider of Enterprise Mobility Management, mobile solutions and software as a service, will announce its preliminary results for the year ended 31 December 2014, on Thursday 30 April 2015.

A presentation to analysts and private client brokers will be held at 10.30 on that day at the MWB Business Exchange, 55 Old Broad Street, London, EC2M 1RX.

&MA(50)&IND=MACD(26,12,9);RSI(14);SlowSTO(14,3,3)&Layout=2Line;Default;Price;HisDate&XCycle=&XFormat=)

Notice of 2014 Final Results

Globo plc (LSE-AIM: GBO), the international provider of Enterprise Mobility Management, mobile solutions and software as a service, will announce its preliminary results for the year ended 31 December 2014, on Thursday 30 April 2015.

A presentation to analysts and private client brokers will be held at 10.30 on that day at the MWB Business Exchange, 55 Old Broad Street, London, EC2M 1RX.

Greyhound - 24 Apr 2015 09:24 - 185 of 250

Not long to wait perhaps we'll start to see a move northwards

required field - 24 Apr 2015 09:25 - 186 of 250

Isn't this based in Greece ?....

VICTIM - 24 Apr 2015 09:36 - 187 of 250

I think now it has a small percentage only in Greece now , it sold most Greek business.

mentor - 28 Apr 2015 10:40 - 188 of 250

spread 47.50 v 48p

Since yesterday there is some sense of fresh air on the trading front, and though the closing price yesterday was still @ 47p one could see plenty of trades well above that.

today has started where late yesterday finished and the fruit of it is showing on the share price and also on the trades and much the same on the order book, very strong on the bid side

Since yesterday there is some sense of fresh air on the trading front, and though the closing price yesterday was still @ 47p one could see plenty of trades well above that.

today has started where late yesterday finished and the fruit of it is showing on the share price and also on the trades and much the same on the order book, very strong on the bid side