| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Argos Resources (ARG)

markymar

- 27 Jul 2010 12:41

- 27 Jul 2010 12:41

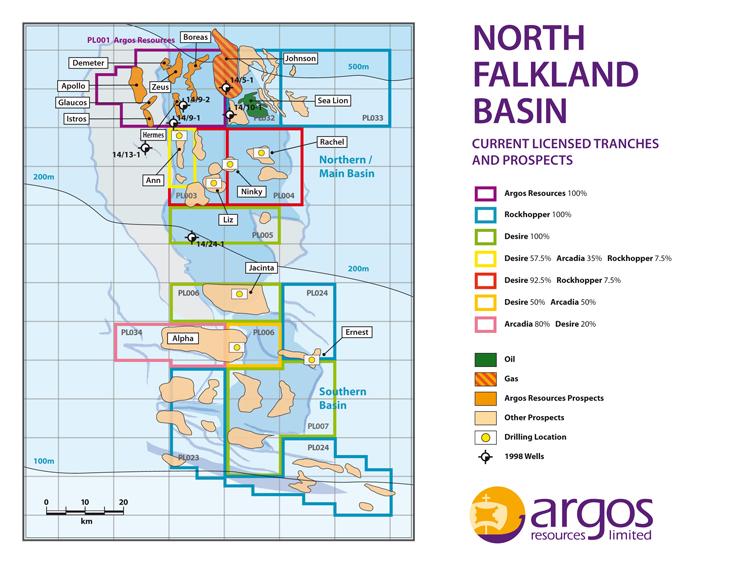

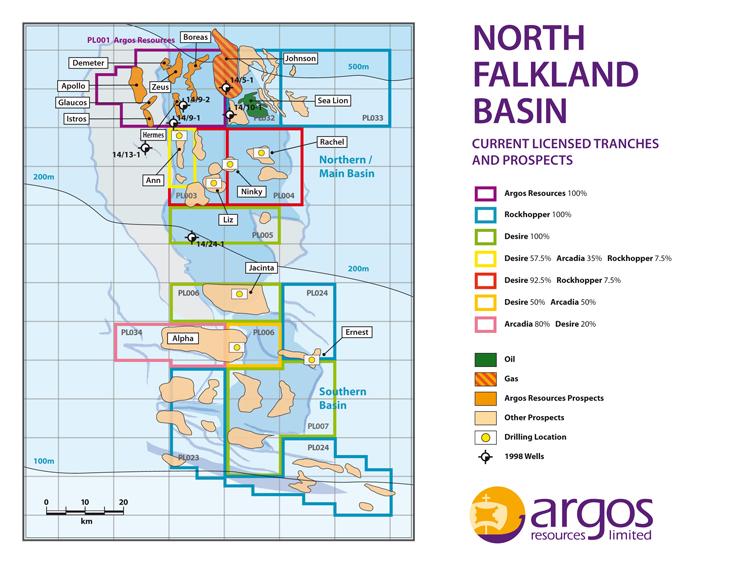

Argos Resources Ltd is an AIM quoted oil and gas exploration company based in the Falkland Islands, ideally placed to make the most of an exciting new oil province heading towards production.

Argos holds a 100% interest in Licence PL001, which covers approximately 1,126 square kilometres in the North Falkland Basin. The licence boundary is just 3km from the Sea Lion oil field, a significant discovery on course for production start-up in 2017.

New 3D seismic data of excellent quality was acquired over the entire licence area in 2011 and has identified 52 prospects with a best estimate of 3,083 million barrels of prospective recoverable resource, and a high estimate of 10,412 million barrels. 40 additional leads have been identified which are not included in the above resource figures and which are the subject of ongoing work.

The Company is now seeking an exploration partner to drill a selection of key prospects to unlock the value of this exciting opportunity.

http://www.argosresources.com/

http://www.falklands-oil.com/

http://www.desireplc.co.uk/

http://www.rockhopperexploration.co.uk/

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

The Opportunity

The Opportunity

•Proven commercial petroleum system

•52 oil prospects, defined by excellent quality 3D seismic data

•CPR attributes 3.1 billion barrels of prospective recoverable resource to the prospects, with upside of 10.4 billion barrels

•40 additional leads identified and under review

•Several prospects similar to Sea Lion

•Prospects have been de-risked by the Sea Lion discovery

•Potential extension of Johnson gas discovery into licence

•Licence 100% owned by Argos Resources

•Benign operating environment

•Stable Government with a competitive tax regime

Argos holds a 100% interest in Licence PL001, which covers approximately 1,126 square kilometres in the North Falkland Basin. The licence boundary is just 3km from the Sea Lion oil field, a significant discovery on course for production start-up in 2017.

New 3D seismic data of excellent quality was acquired over the entire licence area in 2011 and has identified 52 prospects with a best estimate of 3,083 million barrels of prospective recoverable resource, and a high estimate of 10,412 million barrels. 40 additional leads have been identified which are not included in the above resource figures and which are the subject of ongoing work.

The Company is now seeking an exploration partner to drill a selection of key prospects to unlock the value of this exciting opportunity.

http://www.argosresources.com/

http://www.falklands-oil.com/

http://www.desireplc.co.uk/

http://www.rockhopperexploration.co.uk/

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

•Proven commercial petroleum system

•52 oil prospects, defined by excellent quality 3D seismic data

•CPR attributes 3.1 billion barrels of prospective recoverable resource to the prospects, with upside of 10.4 billion barrels

•40 additional leads identified and under review

•Several prospects similar to Sea Lion

•Prospects have been de-risked by the Sea Lion discovery

•Potential extension of Johnson gas discovery into licence

•Licence 100% owned by Argos Resources

•Benign operating environment

•Stable Government with a competitive tax regime

required field - 20 Apr 2015 20:49 - 170 of 185

Little risk with some upside if a discovery is made.....hence sp rising...

HARRYCAT

- 15 May 2015 12:06

- 171 of 185

- 15 May 2015 12:06

- 171 of 185

On the move....for no immediately apparent reason.

HARRYCAT

- 15 Jun 2015 08:02

- 172 of 185

- 15 Jun 2015 08:02

- 172 of 185

StockMarketWire.com

Argos Resources, the Falkland Islands based exploration company, posts a loss of $1.3m for the year to the end of December - down from $1.8m in 2013.

The losses in both years were primarily due to administrative expenses. There were foreign exchange losses of $85,000 in 2014 and $15,000 in 2013.

Chairman Ian Thomson said: "We are delighted to have entered into a farm-out agreement with such highly-regarded and financially robust partners as Noble and Edison. "The innovative nature of the transaction means that there is no material Shareholder dilution or further Shareholder funding required by the Company for any future investments in Licence PL001. In addition, with ongoing working capital requirements catered for by the terms of this agreement and the Second Exploration Term work obligation on our Three Exploration Term licence now covered, the financial position and outlook for the Company is robust.

"We are pleased to be participating in the 2015 drilling campaign in the North Falkland Basin, which is already under way, and look forward to the drilling of the first exploration well to test the Rhea Stack. Rhea has always been our top-ranked prospect in which we estimate a resource potential of 449 million barrels of recoverable oil.

"We are especially delighted that, following their own extensive technical work, Noble and Edison have selected this as their first exploration target on the licence. We believe that success at Rhea will de-risk other prospects in the licence."

Argos Resources, the Falkland Islands based exploration company, posts a loss of $1.3m for the year to the end of December - down from $1.8m in 2013.

The losses in both years were primarily due to administrative expenses. There were foreign exchange losses of $85,000 in 2014 and $15,000 in 2013.

Chairman Ian Thomson said: "We are delighted to have entered into a farm-out agreement with such highly-regarded and financially robust partners as Noble and Edison. "The innovative nature of the transaction means that there is no material Shareholder dilution or further Shareholder funding required by the Company for any future investments in Licence PL001. In addition, with ongoing working capital requirements catered for by the terms of this agreement and the Second Exploration Term work obligation on our Three Exploration Term licence now covered, the financial position and outlook for the Company is robust.

"We are pleased to be participating in the 2015 drilling campaign in the North Falkland Basin, which is already under way, and look forward to the drilling of the first exploration well to test the Rhea Stack. Rhea has always been our top-ranked prospect in which we estimate a resource potential of 449 million barrels of recoverable oil.

"We are especially delighted that, following their own extensive technical work, Noble and Edison have selected this as their first exploration target on the licence. We believe that success at Rhea will de-risk other prospects in the licence."

HARRYCAT

- 12 Feb 2016 09:07

- 173 of 185

- 12 Feb 2016 09:07

- 173 of 185

Argos Resources Limited announces that it has today received notification from Noble Energy, the Operator of Licence PL001, in which Argos holds a 5% Overriding Royalty Interest, that it is exercising its rights under the terms of a Farmout Agreement between Noble and Argos to declare Force Majeure.

Noble had been planning to drill an exploration well on Licence PL001 which was due to commence shortly using the Eirik Raude drilling rig, which is currently operating in the North Falkland Basin. Due to operational issues with the rig, Noble has cancelled the Rig Contract, leading, in turn, to the notification to Argos of Force Majeure.

Noble intends to apply to the Falkland Islands Government for an extension to the current phase of the Licence. The licence requires the drilling of a commitment well to move to the next phase.

In addition to the continuation of the Overriding Royalty Interest in the Licence, Noble have confirmed that future cash payments to Argos will be made which will be sufficient to meet the ongoing running costs of the Company.

A new Participation Agreement between the parties to reflect the various changes created as a consequence of Force Majeure will replace the Farmout Agreement.

Ian Thomson, Chairman of Argos, commented:

"We are, of course, very disappointed to have been so close to drilling commencing on our Licence, only to suffer this delay. We respect Noble's judgement in this matter and we are working closely with them. Our Overriding Royalty Interest in the Licence will continue into any extension period agreed and our future running costs are covered, so we remain well positioned. Both Noble and the Company continue to be very positive about the exploration potential of the Licence Area".

Noble had been planning to drill an exploration well on Licence PL001 which was due to commence shortly using the Eirik Raude drilling rig, which is currently operating in the North Falkland Basin. Due to operational issues with the rig, Noble has cancelled the Rig Contract, leading, in turn, to the notification to Argos of Force Majeure.

Noble intends to apply to the Falkland Islands Government for an extension to the current phase of the Licence. The licence requires the drilling of a commitment well to move to the next phase.

In addition to the continuation of the Overriding Royalty Interest in the Licence, Noble have confirmed that future cash payments to Argos will be made which will be sufficient to meet the ongoing running costs of the Company.

A new Participation Agreement between the parties to reflect the various changes created as a consequence of Force Majeure will replace the Farmout Agreement.

Ian Thomson, Chairman of Argos, commented:

"We are, of course, very disappointed to have been so close to drilling commencing on our Licence, only to suffer this delay. We respect Noble's judgement in this matter and we are working closely with them. Our Overriding Royalty Interest in the Licence will continue into any extension period agreed and our future running costs are covered, so we remain well positioned. Both Noble and the Company continue to be very positive about the exploration potential of the Licence Area".

HARRYCAT

- 19 Sep 2016 09:34

- 174 of 185

- 19 Sep 2016 09:34

- 174 of 185

StockMarketWire.com

North Falkland Basin-focused Argos Resources posts a loss of $4000 for the six months to the end of June (2015: $0.8 million) giving a loss per share of 0.002 cents (2015: 0.35 cents).

Administrative expenses were $0.3 million compared to $0.7 million for the corresponding period in 2015.

Net assets of $29.3 million have decreased marginally by $4 thousand since December 2015 as a result of the small loss incurred.

Chairman Ian Thomson said: "It was very disappointing to have been so close to drilling commencing on our licence, only to suffer the delay which ensued from the cancellation of the rig contract.

"However, a new participation agreement was completed promptly and in a very co-operative way between the parties ensuring that our overriding royalty interest in the licence continues into the future and our ongoing running costs are covered, so we remain well positioned. Both Noble and the company continue to be very positive about the exploration potential of the licence area."

North Falkland Basin-focused Argos Resources posts a loss of $4000 for the six months to the end of June (2015: $0.8 million) giving a loss per share of 0.002 cents (2015: 0.35 cents).

Administrative expenses were $0.3 million compared to $0.7 million for the corresponding period in 2015.

Net assets of $29.3 million have decreased marginally by $4 thousand since December 2015 as a result of the small loss incurred.

Chairman Ian Thomson said: "It was very disappointing to have been so close to drilling commencing on our licence, only to suffer the delay which ensued from the cancellation of the rig contract.

"However, a new participation agreement was completed promptly and in a very co-operative way between the parties ensuring that our overriding royalty interest in the licence continues into the future and our ongoing running costs are covered, so we remain well positioned. Both Noble and the company continue to be very positive about the exploration potential of the licence area."

HARRYCAT

- 27 Mar 2017 10:31

- 175 of 185

- 27 Mar 2017 10:31

- 175 of 185

StockMarketWire.com

North Falkland Basin-focused Argos Resources' losses fell to $16,000 in the year to the end of December from $1.15m in 2015.

Chairman Ian Thomson said: "It was very disappointing to have been so close to drilling commencing on our licence, only to suffer the delay which ensued from the cancellation of the rig contract.

"However, a new participation agreement was completed promptly and in a very co-operative way between the parties ensuring that our overriding royalty interest in the licence continues into the future and our ongoing running costs are covered, so we remain well positioned.

"The company continue to be very positive about the exploration potential of the licence area."

North Falkland Basin-focused Argos Resources' losses fell to $16,000 in the year to the end of December from $1.15m in 2015.

Chairman Ian Thomson said: "It was very disappointing to have been so close to drilling commencing on our licence, only to suffer the delay which ensued from the cancellation of the rig contract.

"However, a new participation agreement was completed promptly and in a very co-operative way between the parties ensuring that our overriding royalty interest in the licence continues into the future and our ongoing running costs are covered, so we remain well positioned.

"The company continue to be very positive about the exploration potential of the licence area."

HARRYCAT

- 14 May 2018 13:09

- 176 of 185

- 14 May 2018 13:09

- 176 of 185

Up 40% this morning....for some unkown reason.

EDIT - seems it's on the back of RKH intention to drill Sealion.

EDIT - seems it's on the back of RKH intention to drill Sealion.

required field - 14 May 2018 13:55 - 177 of 185

Premier oil might be in talks with the two companies about development.....if they come to some sort of agreement...sp's will go a lot further...

markymar

- 15 May 2018 09:44

- 178 of 185

- 15 May 2018 09:44

- 178 of 185

Smoke and mirrors,but intresting shell have sold all there garages in Argentina.

markymar

- 15 May 2018 09:49

- 179 of 185

- 15 May 2018 09:49

- 179 of 185

http://en.mercopress.com/2018/04/25/brazilian-company-buys-shell-downstream-assets-in-argentina

so maybe expecting to get back in to the Falklands now garages sold they cant be held so ransom by Argentina

so maybe expecting to get back in to the Falklands now garages sold they cant be held so ransom by Argentina

required field - 15 May 2018 13:33 - 180 of 185

Crude still rising.....tensions with Iran..Palestine/Israel troubles....doubts about the USA shale production.....Opec grip on barrels per day....can't do the sp any harm.....au contraire.....makes Sealion and others much more viable....plus a mini market cap....

HARRYCAT

- 15 May 2018 13:50

- 181 of 185

- 15 May 2018 13:50

- 181 of 185

Chap on CNBC today predicting oil to reach $80-85 pb by the end of the year as he doubts Saudi will increase their production. Venezuela broke and US producers only starting to fill the gap.

All good for the RKH / ARG sp's but any kind of production way off in the future for the Falkland drillers.

All good for the RKH / ARG sp's but any kind of production way off in the future for the Falkland drillers.

markymar

- 16 May 2018 08:45

- 182 of 185

- 16 May 2018 08:45

- 182 of 185

looks like bubble has burst,no good reason for it going up as more or less a shell.

cynic

- 16 May 2018 08:57

- 183 of 185

- 16 May 2018 08:57

- 183 of 185

well there's a surprise .... rocket and stick!

HARRYCAT

- 04 Oct 2018 10:53

- 184 of 185

- 04 Oct 2018 10:53

- 184 of 185

PL001 LICENCE REASSIGNMENT

Argos Resources Limited (AIM: ARG.L), (the "Company", "Argos"), the Falkland Island based exploration company which holds a 5% Overriding Royalty Interest in Licence PL001 in the North Falkland Basin, announces that its Working Interest partners in the Licence, Noble Energy Falklands Limited ("Noble") and Edison International S.p.A ("Edison") have served notice of their intention to withdraw from the Licence.

The Company intends to take a reassignment of the Licence from Noble and Edison, as provided for under the Participation Agreement entered into between the Company, Noble and Edison in February 2016. The Company is already in contact with the Falkland Islands Government to seek the required approvals to transfer the Working Interests back to Argos.

Ian Thomson, Chairman of Argos, commented:

"The Company remains very positive about the potential of Licence PL001. We have sufficient cash reserves to meet our ongoing requirements while we progress discussions with the Government on the reassignment of the Licence and seek to secure other partners to participate in its development".

Argos Resources Limited (AIM: ARG.L), (the "Company", "Argos"), the Falkland Island based exploration company which holds a 5% Overriding Royalty Interest in Licence PL001 in the North Falkland Basin, announces that its Working Interest partners in the Licence, Noble Energy Falklands Limited ("Noble") and Edison International S.p.A ("Edison") have served notice of their intention to withdraw from the Licence.

The Company intends to take a reassignment of the Licence from Noble and Edison, as provided for under the Participation Agreement entered into between the Company, Noble and Edison in February 2016. The Company is already in contact with the Falkland Islands Government to seek the required approvals to transfer the Working Interests back to Argos.

Ian Thomson, Chairman of Argos, commented:

"The Company remains very positive about the potential of Licence PL001. We have sufficient cash reserves to meet our ongoing requirements while we progress discussions with the Government on the reassignment of the Licence and seek to secure other partners to participate in its development".

markymar

- 04 Oct 2018 16:03

- 185 of 185

- 04 Oct 2018 16:03

- 185 of 185

Makes you wonder how long they can survive without an income from Noble and Edison,they will need to get there cap out soon to stay afloat.

They have sat on there hands for years, cant see them getting a partner either as RKH and PMO been wanting a farm in and nothing as of yet come forward and its all guns blazing at moment.

They have sat on there hands for years, cant see them getting a partner either as RKH and PMO been wanting a farm in and nothing as of yet come forward and its all guns blazing at moment.