| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Argos Resources (ARG)

markymar

- 27 Jul 2010 12:41

- 27 Jul 2010 12:41

Argos Resources Ltd is an AIM quoted oil and gas exploration company based in the Falkland Islands, ideally placed to make the most of an exciting new oil province heading towards production.

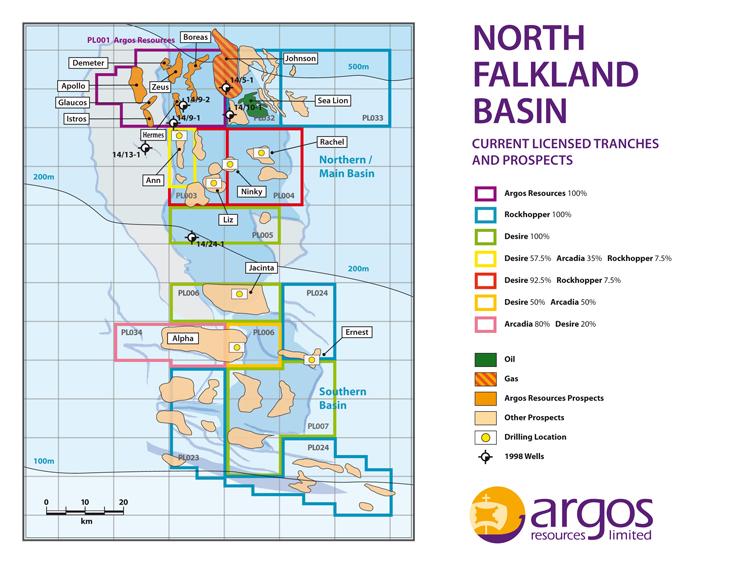

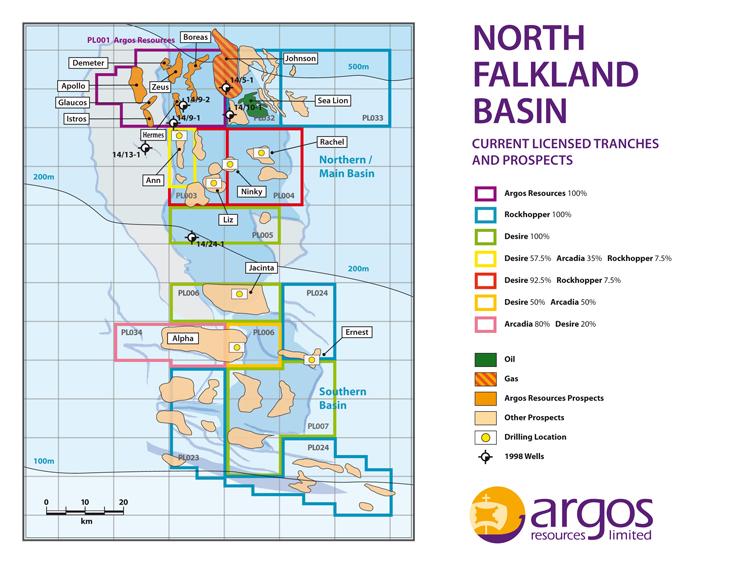

Argos holds a 100% interest in Licence PL001, which covers approximately 1,126 square kilometres in the North Falkland Basin. The licence boundary is just 3km from the Sea Lion oil field, a significant discovery on course for production start-up in 2017.

New 3D seismic data of excellent quality was acquired over the entire licence area in 2011 and has identified 52 prospects with a best estimate of 3,083 million barrels of prospective recoverable resource, and a high estimate of 10,412 million barrels. 40 additional leads have been identified which are not included in the above resource figures and which are the subject of ongoing work.

The Company is now seeking an exploration partner to drill a selection of key prospects to unlock the value of this exciting opportunity.

http://www.argosresources.com/

http://www.falklands-oil.com/

http://www.desireplc.co.uk/

http://www.rockhopperexploration.co.uk/

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

The Opportunity

The Opportunity

•Proven commercial petroleum system

•52 oil prospects, defined by excellent quality 3D seismic data

•CPR attributes 3.1 billion barrels of prospective recoverable resource to the prospects, with upside of 10.4 billion barrels

•40 additional leads identified and under review

•Several prospects similar to Sea Lion

•Prospects have been de-risked by the Sea Lion discovery

•Potential extension of Johnson gas discovery into licence

•Licence 100% owned by Argos Resources

•Benign operating environment

•Stable Government with a competitive tax regime

Argos holds a 100% interest in Licence PL001, which covers approximately 1,126 square kilometres in the North Falkland Basin. The licence boundary is just 3km from the Sea Lion oil field, a significant discovery on course for production start-up in 2017.

New 3D seismic data of excellent quality was acquired over the entire licence area in 2011 and has identified 52 prospects with a best estimate of 3,083 million barrels of prospective recoverable resource, and a high estimate of 10,412 million barrels. 40 additional leads have been identified which are not included in the above resource figures and which are the subject of ongoing work.

The Company is now seeking an exploration partner to drill a selection of key prospects to unlock the value of this exciting opportunity.

http://www.argosresources.com/

http://www.falklands-oil.com/

http://www.desireplc.co.uk/

http://www.rockhopperexploration.co.uk/

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

•Proven commercial petroleum system

•52 oil prospects, defined by excellent quality 3D seismic data

•CPR attributes 3.1 billion barrels of prospective recoverable resource to the prospects, with upside of 10.4 billion barrels

•40 additional leads identified and under review

•Several prospects similar to Sea Lion

•Prospects have been de-risked by the Sea Lion discovery

•Potential extension of Johnson gas discovery into licence

•Licence 100% owned by Argos Resources

•Benign operating environment

•Stable Government with a competitive tax regime

Proselenes - 07 Sep 2010 03:19 - 21 of 185

And nobody wants gas at this stage, its all about oil.

markymar

- 08 Sep 2010 13:05

- 22 of 185

- 08 Sep 2010 13:05

- 22 of 185

http://www.investorschronicle.co.uk/Companies/ByEvent/Risk/Analysis/article/20100908/cf021134-bb2e-11df-81fc-00144f2af8e8/Back-to-the-Falklands.jsp

Back to the Falklands

Created:8 September 2010Written by:Martin Li

When John Hogan last drilled in the Falklands in 1998, an oil price that had crashed to $12 per barrel forced LASMO, of which he was chief operating officer, and its peers to abandon any meaningful aspirations there. They drilled the cheapest wells that satisfied their lease obligations and withdrew, despite finding a thick, rich source rock (where hydrocarbons form) and oil and gas in five of the six wells drilled. That leaves unfinished business that Mr Hogan intends to complete as managing director of Argos Resources, which became the fifth Aim-traded Falklands explorer when it floated in July, raising 22m.

First movers are generally thought to hold the advantage, but this time Mr Hogan and Argos chairman Ian Thomson espouse the benefits of coming to the Falklands party late. Argos holds a 100 per cent interest in acreage in the North Falkland basin, adjacent to licences held by Rockhopper Exploration and Desire Petroleum. Rockhopper's spectacular 242m-barrel success with its Sea Lion well provides valuable geological clues to help Argos evaluate its licence area, particularly in identifying Sea Lion lookalikes. Rockhopper and Desire will drill further exploration wells to the south and west of Argos's acreage, which should further help the company target its prospects.

Oil and gas discoveries are easier to commercialise when clustered together so as to be able to share infrastructure and facilities. The Sea Lion discovery and Rockhopper's re-interpretation of a 1998 Shell well, Johnson, also as a discovery holding several trillion cubic feet of gas (even though not commercial on its own) greatly reduce the threshold for any further discoveries to be commercial.

Another key advantage of Argos's timing may be rig availability. The inability to secure a rig to travel the long distance to the South Atlantic delayed Falklands drilling by several years until Desire finally secured the Ocean Guardian rig last September. Further exploration and testing of Sea Lion could keep the rig busy in the Falklands until mid-2011, by which time Argos hopes to be nearly ready to drill.

IC VIEW:

GoodValueAs Mr Hogan points out, "oil fields are herd animals", and Rockhopper's success in an adjacent block bodes well for Argos. Its prospects would improve significantly if successful seismic studies attract a suitable partner and allow it to tag onto the end of the current drilling campaign. Good value at 31p.

Back to the Falklands

Created:8 September 2010Written by:Martin Li

When John Hogan last drilled in the Falklands in 1998, an oil price that had crashed to $12 per barrel forced LASMO, of which he was chief operating officer, and its peers to abandon any meaningful aspirations there. They drilled the cheapest wells that satisfied their lease obligations and withdrew, despite finding a thick, rich source rock (where hydrocarbons form) and oil and gas in five of the six wells drilled. That leaves unfinished business that Mr Hogan intends to complete as managing director of Argos Resources, which became the fifth Aim-traded Falklands explorer when it floated in July, raising 22m.

First movers are generally thought to hold the advantage, but this time Mr Hogan and Argos chairman Ian Thomson espouse the benefits of coming to the Falklands party late. Argos holds a 100 per cent interest in acreage in the North Falkland basin, adjacent to licences held by Rockhopper Exploration and Desire Petroleum. Rockhopper's spectacular 242m-barrel success with its Sea Lion well provides valuable geological clues to help Argos evaluate its licence area, particularly in identifying Sea Lion lookalikes. Rockhopper and Desire will drill further exploration wells to the south and west of Argos's acreage, which should further help the company target its prospects.

Oil and gas discoveries are easier to commercialise when clustered together so as to be able to share infrastructure and facilities. The Sea Lion discovery and Rockhopper's re-interpretation of a 1998 Shell well, Johnson, also as a discovery holding several trillion cubic feet of gas (even though not commercial on its own) greatly reduce the threshold for any further discoveries to be commercial.

Another key advantage of Argos's timing may be rig availability. The inability to secure a rig to travel the long distance to the South Atlantic delayed Falklands drilling by several years until Desire finally secured the Ocean Guardian rig last September. Further exploration and testing of Sea Lion could keep the rig busy in the Falklands until mid-2011, by which time Argos hopes to be nearly ready to drill.

IC VIEW:

GoodValueAs Mr Hogan points out, "oil fields are herd animals", and Rockhopper's success in an adjacent block bodes well for Argos. Its prospects would improve significantly if successful seismic studies attract a suitable partner and allow it to tag onto the end of the current drilling campaign. Good value at 31p.

robnickson - 08 Sep 2010 17:26 - 23 of 185

"Johnson also a discovery holding several trillion cubic feet of gas greatly reduce the threshold for any further discoveries to be commercial".

Balerboy

- 08 Sep 2010 20:31

- 24 of 185

- 08 Sep 2010 20:31

- 24 of 185

Steady Rob tant amount to treason that comment......With Liz only a quarter the distance from sea lion and coming up dry, compaired to ernest imo argos is 100-1 against any oil show.

markymar

- 08 Sep 2010 23:34

- 25 of 185

- 08 Sep 2010 23:34

- 25 of 185

With every prospect identified there is a risk of hitting oil or not, forget what some reporter has wrote. Use you own judgement and read up.

Thats why seismic is done 2D then 3D Argos have some canny prospects on 2D and after 3D it will slash them odds eg RKH if you read up

100 to 1 balerboy I would bet you a pile of money at them odds.

Not much down side on this stock as in NFB and oil has been found..Fact

The more success with DES or RKH the more the price will riseFact

Thats why seismic is done 2D then 3D Argos have some canny prospects on 2D and after 3D it will slash them odds eg RKH if you read up

100 to 1 balerboy I would bet you a pile of money at them odds.

Not much down side on this stock as in NFB and oil has been found..Fact

The more success with DES or RKH the more the price will riseFact

Balerboy

- 09 Sep 2010 08:06

- 26 of 185

- 09 Sep 2010 08:06

- 26 of 185

DES has yet to strike..

markymar

- 09 Sep 2010 08:15

- 27 of 185

- 09 Sep 2010 08:15

- 27 of 185

Des have only drilled one hole...............early days.....Desire found Gas in Liz.

That rig is not leaving the NFB in a hurry.....Fact!!!!!

That rig is not leaving the NFB in a hurry.....Fact!!!!!

Balerboy

- 09 Sep 2010 08:37

- 28 of 185

- 09 Sep 2010 08:37

- 28 of 185

chill marky...only putting another point of view... i want to make money as much as everyone else here.:))

robnickson - 09 Sep 2010 17:53 - 29 of 185

2 wells were drilled by Shell on the Argos acreage back in 1998, but where plugged and abandoned as uncommercial after having oil shows . So we know there is oil to be found.

cynic

- 09 Sep 2010 17:59

- 30 of 185

- 09 Sep 2010 17:59

- 30 of 185

only offered by 4 x MMs and in blocks of only 10,000

interestingly, sp is still below opening price when it came to market

interestingly, sp is still below opening price when it came to market

robnickson - 09 Sep 2010 18:04 - 31 of 185

"Shell abandoned some small finds near the Sea Lion discovery " Would be nice to know how much they found ".

robnickson - 09 Sep 2010 18:06 - 32 of 185

I bought just a top up of 3000 shares the other day no problem ( Natwest )

cynic

- 09 Sep 2010 18:08

- 33 of 185

- 09 Sep 2010 18:08

- 33 of 185

my post is accurate! .... natwest would have had to buy from MMs, so sp potentially distorted and controlled

halifax - 09 Sep 2010 19:10 - 34 of 185

no problem getting a CFD.

cynic

- 09 Sep 2010 19:41

- 35 of 185

- 09 Sep 2010 19:41

- 35 of 185

i know that, but those are still governed by 4 x MMs in tranches of +/-3,000 .... merely a caveat

Balerboy

- 10 Sep 2010 14:13

- 36 of 185

- 10 Sep 2010 14:13

- 36 of 185

From tips thread:

The Guardian

Argos barometer indicates possibility of a cold Christmas.

The Guardian

Argos barometer indicates possibility of a cold Christmas.

halifax - 10 Sep 2010 16:13 - 37 of 185

bb which Argos?

required field - 10 Sep 2010 16:16 - 38 of 185

Could not find them in the catalogue anywhere...!?...strange.....loads of kettles...electrical goods...pick up or delivery .....bizarre.....but no oil....

halifax - 10 Sep 2010 16:17 - 39 of 185

rf maybe bb is looking to become a toy boy!

required field - 10 Sep 2010 16:19 - 40 of 185

I have always wanted to become one with some beauty.......you just hang around...great job with loads of perks....