| Home | Log In | Register | Our Services | My Account | Contact | Help |

Victoria Oil & Gas-The Information & News Thread (VOG)

banjomick

- 07 Jan 2015 21:01

- 07 Jan 2015 21:01

Victoria Oil & Gas Plc (Victoria) has become a significant domestic energy supplier in Africa through its wholly owned subsidiary: Gaz du Cameroun S. A. (GDC).

With operations located in the industrial port-city of Douala, Cameroon, customers are converting their operations to take natural gas supplied by our production wells and pipeline infrastructure.

GDC is the sole gas supplier in the area, providing a cheaper, more efficient, reliable, and cleaner energy alternative to Heavy Fuel Oil use.

Our teams of engineering advisors are on hand to help customer’s cost and implement the change to GDC’s energy products.

Victoria Oil & Gas is traded in the NEX Exchange HERE

Link-HISTORICAL NEWS,VIDEO/AUDIO & EVENTS

Link-Dedicated Posts for:

Gaz du Cameroun S.A. (“GDC”)

Gaz Du Cameroun Matanda S.A. ("GDC Matanda")

Link-Cameroon-Industrialisation Master Plan (PDI) & Africa Energy

NEWS

21st Jan 2019 Production Update

17th Jan 2019 Q4 2018 Operations Update

02nd Jan 2019 Presidential Decree on Matanda Received

24th Dec 2018 Renewal of Long-Term Gas Supply Contract with ENEO

28th Sep 2018 INTERIM FINANCIAL REPORT FOR THE SIX MONTHS ENDED 30 JUNE 2018

17th Aug 2018 Q2 2018 Operations Update

22nd Jun 2018 Report and Accounts to 31 December 2017

14th Jun 2018 Restructure of the BGFI Debt Facility

04th Jun 2018 Notice of Annual General Meeting

04th June 2018 Logbaba Field Reserves Update

24th May 2018 Q1 2018 Operations and Outlook

16th Feb 2018 Q4 17 Operations Update & 2018 Outlook Replacement

05th Jan 2018 Gas Supply Contract with ENEO Not Extended

VIDEO/AUDIO

21st Jan 2019 Victoria Oil & Gas looks ahead to increased cash flow

24th Aug 2018 Victoria Oil & Gas confident of resolving ENEO contract 'within weeks'

22nd Apr 2018 Video from 21/04/2018 UK Investor Show

16th Feb 2018 Victoria Oil & Gas confident of positive outcome to ENEO issue

08th Nov 2017 Victoria Oil & Gas reports very pleasing initial results from La-108

31st Oct 2017 21 Oil and Gas - African Power Panel

30th Oct 2017 121 Oil & Gas Investment

26th Oct 2017 Victoria Oil & Gas raises US$23.5mln to accelerate new growth programme

26th Sep 2017 Victoria Oil & Gas to finalise long term supply contracts after first gas at LA-107

17th Aug 2017 Victoria Oil & Gas expecting La-107 to be a 'substantial' producer

16th Apr 2017 Video from 01/04/2017 UK Investor Show

13th Apr 2017 'It's been a terrific year and a great quarter', says Victoria Oil & Gas' Kevin Foo

06th Mar 2017 Farm-out deal 'a really good strategic move' for Victoria Oil & Gas, says chairman Kevin Foo

06th Feb 2017 Chairman runs Proactive through the good start to 2017

EVENTS

28th Jun 2018 Annual General Meeting ("AGM")

10th May 2018 Africa Oil & Power Investor Forum-London

21st Apr 2018 UK Investor Show

11th-12th Apr 2018 Africa Investment Exchange: Gas (AIX: Gas 2018)-London

09th-10th Nov 2017 The Cameroon Investment Forum(CIF)-Cameroon

30th-31st Oct 2017 121 Oil & Gas Investment-London

23rd-27th Oct 2017 Africa Oil Week 2017-Cape Town South Africa

07th Sep 2017 One2One Investor Forum - London

05th Sep 2017 Oil Capital Conference-London

28th Jun 2017 Annual General Meeting

01st Apr 2017 UK Investor Show

9th Feb 2017 Presentation slide show for One2One

9th Feb 2017 One2One Investor Forum - London

Social Media

banjomick

- 08 Sep 2016 22:44

- 294 of 701

- 08 Sep 2016 22:44

- 294 of 701

Victoria Oil positions itself to meet Cameroon's need for power

10:00 08 Sep 2016

GDC is currently the only supplier of natural gas to Douala, Cameroon’s rapidly growing second city

Victoria Oil & Gas (LON:VOG) has substantial gas assets in Cameroon, a country crying out for power.

At present, Gaz du Cameroun, Victoria's local subsidiary, estimates demand for gas in Cameroon for thermal and power generation is in excess of 150mmscf (millions of standard cubic feet) per day.

At the Logbaba gas field, where it has a 60% stake, production is currently running at 15mmscf/d and a 'primary objective' in 2016 is to exceed 3.7 Bcf of annual production, a 30% increase over 2015.

GDC is currently the only supplier of natural gas to Douala, Cameroon’s rapidly growing second city, and in its own words it manages the whole value chain from the wellhead to customer connection.

Long-term supply contracts have been established with customers at prices from $9/mmbtu (millions of British thermal unit) to $16/mmbtu and with prices not subject to regulation.

Infrastructure plans include designs for the gas treatment plant capacity to rise to 40mmscf/d, adding 13km to the pipeline network and to develop new product areas such as compressed natural gas (CNG).

Matanda can dwarf Logbaba

In addition, taking a 75% stake in the Matanda block earlier this year has given Victoria Oil control of an asset potentially 60 times larger than Logbaba.

The North Matanda field alone is estimated to hold 1.8trn cubic feet (Tcf) of gas and 136mln barrels of condensate on a p50 (50% probability) basis.

That compares with 208bcf of gas and 3.1mmbls of condensate at Logbaba.

The North Matanda Field is an extension of the Logbaba structure and wells drilled already alongside extensive 2D and 3D seismic data have shown a strong geological continuation between the two.

Next steps are a work programme to be agreed by the Cameroon government.

The work programme plan initially is to explore onshore licence areas within a few kilometres of Logbaba and send any discoveries through the pipeline network operated by Gaz Du Cameroun or GDC, Victoria’s Cameroon subsidiary.

Move into profit

Victoria posted a pre-tax profit of US$1.6mln in the seven months to December 2015, a period that reflected a change of year end.

Since then it has been tying up some of the loose ends of the ownership structure of its assets.

The latest of these was to negotiate the cancellation of its reserve bonus agreement at Logbaba.

A settlement resolved all outstanding issues relating to the reserve bonus and also ended a 1.2% royalty from a contingent payment agreement (CPA) prior to its involvement.

Ahmet Dik, VOG’s chief executive, said he was very pleased with the agreement. The termination of the CPA as part of the settlement was also a significant benefit to shareholders in terms of future profitability, he added.

-updates for September legacy settlement --

Philip Whiterow

banjomick

- 14 Sep 2016 15:09

- 295 of 701

- 14 Sep 2016 15:09

- 295 of 701

banjomick

- 17 Sep 2016 11:24

- 296 of 701

- 17 Sep 2016 11:24

- 296 of 701

VOG Social Media stopped 18th August.

HPHT Senior Drilling Supervisor in Cameroon (Expiry Date 18 Aug 2016)

SPD is a world class provider of well engineering services to the upstream sector of the Oil and Gas Industry.

An exciting and challenging opportunity has become available with one of the leading upstream Oil and Gas companies within the industry. We are currently seeking a HPHT Senior Drilling Supervisor for their operations based in Cameroon.

•Position: HPHT Senior Drilling Supervisor

•Start: September 2016

•Duration: 6 months

•Status: Contractor

•Location: Cameroon

Sorry, this job has been made inactive by SPD LLC

https://www.oilandgasjobsearch.com/Oil-and-Gas-Jobs/Drilling-Engineer-Jobs/HPHT-Senior-Drilling-Supervisor/Details/1179918

**********************************************************

Regarding the drilling operations:

RSM and VOG Arbitration

26 Aug 2016

Activity on the approved 2016 Work Program and Budget continues with spudding of the two wells imminent. GDC is well placed to continue funding these operations and the drill program with project revenue and bank debt until such time as the arbitration with RSM concludes.

Q2 2016 Operations Update

26 Jul 2016

The Logbaba drilling programme has progressed during Q2 with the completion of major site preparation work and the arrival of the drill rig in Douala, together with most of the long lead materials and equipment. The drill rig has been cleared through customs, transported to site and assembly is now underway. Drilling operations are expected to begin by end August 2016.

Drilling Rig Arrival at Douala Port, Cameroon

29 Jun 2016

VOG’s wholly-owned subsidiary Gaz du Cameroun’s (“GDC”) schedule is to commence drilling in early Q3 and complete drilling by the end of 2016.

Q1 2016 Operations Update

19 Apr 2016

SPD Petrofac is providing well design and project management services and with their assistance we are now working on the detailed design and programme preparation.

WOODIE - 26 Sep 2016 07:51 - 297 of 701

"The first half of 2016 has been a stabilising period in the Company, as we deliver on our strategy to increase production and grow our pipeline network in Douala, Cameroon," said executive chair Kevin Foo.

"Our market assessment indicates a growing demand for our gas, for both thermal and grid power markets.

"The Matanda acquisition was a major extension of our influence in the region, whilst the drilling programme is expected to unlock new reserves for sale to customers.

"The preparation for drilling at our existing Logbaba production site is complete, and spudding is expected shortly. Expansion work on the Bonaberi pipeline is on track, and with Gas Sales Agreements in place, we expect to deliver to these new customers before the end of the year.

"As we deliver on our expansion targets, we will look to increase the process plant's capacity. The settlement of the reserve bonus and termination of the 1.2% royalty was an important matter to resolve and will mean greater revenue for the Company going forward

banjomick

- 26 Sep 2016 09:25

- 298 of 701

- 26 Sep 2016 09:25

- 298 of 701

Interim Results for six months to end June 2016

26 Sep 2016

Victoria Oil & Gas Plc, the integrated natural gas producing utility, today announces its unaudited interim results for the six months ended 30 June 2016.

In the prior year the Company changed its accounting reference date to 31 December. These interim results report on the six-month period to 30 June 2016, with the comparative period covering the six-month period ended 30 November 2015. Owing to the seasonal nature of our business, where production statistics are reported they will be compared to the equivalent six-month period to 30 June 2015, to provide a more accurate comparison.

Financial Highlights

•$23.6 million Revenue (six months to 30 November 2015 was $18.9 million)

•$14.2 million Adjusted EBITDA (six months to 30 November 2015 was $7.9 million)

•$1.9 million Net cash position (at 31 December 2015 was $6.0 million)

•$9.0 million Net cash position at 23 September 2016

•Cost recovery milestone reached on Logbaba Gas and Condensate Project on 31 May 2016 after which revenues will be shared in accordance with the participating interests

Operational Highlights

•93% average daily production rate increase to 13.1mmscf/d (six months to 30 June 2015 was 6.8mmscf/d)

•2,282mmscf of gas sold (six months to 30 June 2015 was 1,525mmscf)

•Phase II Bonaberi pipeline expansion well underway to connect new thermal customers

•Major drilling preparation work completed, drill rig arrived and is being commissioned

Corporate Highlights

•75% interest in the Matanda Production Sharing Contract assigned to the Group

•$26 million debt facility secured to support Logbaba expansion

•Group CEO appointed - Ahmet Dik; Group Finance Director appointed – Andrew Diamond

Post Balance Sheet Events

•Settlement reached over the reserve bonus dispute and termination of 1.2% royalty

•Full settlement of receivable from RSM Production Corporation

•Roger Kennedy appointed as independent Non-Executive Director

Kevin Foo, Executive Chairman said,

"The first half of 2016 has been a stabilising period in the Company, as we deliver on our strategy to increase production and grow our pipeline network in Douala, Cameroon. Our market assessment indicates a growing demand for our gas, for both thermal and grid power markets. The Matanda acquisition was a major extension of our influence in the region, whilst the drilling programme is expected to unlock new reserves for sale to customers. The preparation for drilling at our existing Logbaba production site is complete, and spudding is expected shortly. Expansion work on the Bonaberi pipeline is on track, and with Gas Sales Agreements in place, we expect to deliver to these new customers before the end of the year. As we deliver on our expansion targets, we will look to increase the process plant’s capacity. The settlement of the reserve bonus and termination of the 1.2% royalty was an important matter to resolve and will mean greater revenue for the Company going forward.”

Full Results from link below:

http://www.victoriaoilandgas.com/sites/default/files/160926%20VOG%20Interim%20Results%20to%2030%20June%202016_0.pdf

banjomick

- 26 Sep 2016 10:07

- 299 of 701

- 26 Sep 2016 10:07

- 299 of 701

07:33 26 Sep 2016

Daily gas production rose to an average 13.1 million cubic feet (mmscf) per day in the half year to June

Gas utility Victoria Oil & Gas plc (LON:VOG) has swung strongly into the black as production from its Logbaba field in Cameroon almost doubled.

Daily gas production rose to an average 13.1 million cubic feet (mmscf) per day in the half year to June from 6.8mmscf a year ago.

Revenues rose to US$23.6mln (US$18.9mln), while profits soared to US$3.86mln (US$215,000) helped by a sizeable fall in costs.

Victoria Oil, which supplies the Cameroon city of Douala, said the first half is normally stronger due to the timing of dry/wet seasons in the African country.

Exploratory drilling is set to start soon to boost the resource at Logbaba while expansion work on the Bonaberi pipeline is on track to connect customers that have signed up recently.

Victoria works on fixed price contracts, but said that prices had come under pressure even so due to the weak oil price reducing the cost of gas substitutes.

Kevin Foo, executive chairman, said: “Our market assessment indicates a growing demand for our gas, for both thermal and grid power markets.

Philip Whiterow

ALso:

Victoria Oil and Gas ramps up production 93% in first half

banjomick

- 15 Oct 2016 16:26

- 300 of 701

- 15 Oct 2016 16:26

- 300 of 701

10 - 11 November 2016

iPAD Cameroon Energy Infrastructure 2016 is the platform to bring investors, IPPs, large power uses and exploration companies, LPU’s, banks, donors, consultants, EPCs, technologies and alternative energy providers already in Cameroon, and others willing to invest in the region together to shape the future of the power sector within the region.

This exclusive platform is a unique chance for delegates to identify potential business opportunities to respond to an increasing power demand from the consumer and industry, in a country which enjoy rich and diversified energy resources. It will allow delegates to seek financial support, develop partnerships, analyse the impact of supply and demand on power generation, future of conventional fuels production (gas-to-power alternative), and the main issue of transmission and distribution.

************************************************************

Mark Wilson

Managing Director

Gaz du Cameroon

Cameroon

***************************************************

**************************************************

“Regardless of where a company starts in the value chain of electricity, there are opportunities in Cameroon”

iPAD_CAMEROON @ipadcameroon · Oct 14

http://www.ipad-cameroon.com/FinanciaCapital

Victoria Oil positions itself to meet Cameroon's need for power

iPAD_CAMEROON @ipadcameroon · Sep 15

http://www.ipad-cameroon.com/Victoria-positions-itself-to-meet-Cameroon-need-for-power

banjomick

- 16 Oct 2016 23:49

- 301 of 701

- 16 Oct 2016 23:49

- 301 of 701

Session 2.1: Gas to Power: Africa’s Holy Grail

09.00 Deliver a permanent supply of reliable electricity from pipeline-sourced natural gas Adolphe Moukidi, Director General, Société Nationale des Hydrocarbures, Cameroon*

09:15 Panel:

• Installing an attractive gas-to-power project environment

• Gas-fired power plant: the right boost to power up Cameroon?

• Is gas-to-power the ideal monetisation option to support increase energy demand?

• How can we accelerate the development of the energy market through efficient use of domestic gas reserves?

Presented by: • Ali Hjaiej, International Business Development Director, Clarke Energy, Cameroon • Philippe Miquel, CEO, ENGIE, Cameroon • Ralph Olaye, Director Business Development, Eranove, Ivory Cost • Mark Wilson, Managing Director, Gaz du Cameroon, Cameroon*

*Invited

Download from main website:

http://www.ipad-cameroon.com/

banjomick

- 27 Oct 2016 16:59

- 302 of 701

- 27 Oct 2016 16:59

- 302 of 701

27 Oct 2016

Victoria Oil & Gas Plc provides an update on the Group's operations for the three-month period ended 30 September 2016 (the "quarter" or “Q3”).

Highlights

•7.14mmscf/d Q3 2016 average gas production (Q3 2015: 8.19 mmscf/d)

•12% decrease in gross Logbaba gas sales of 630mmscf (Q3 2015: 718mmscf)

•Q3 unaudited financial highlights:

$4.7 million revenue (Q2 2016: $10.8 million)

$14.1 million cash position at quarter end (Q2 2016: $14.1 million)

$2.3 million net cash position at quarter end (Q2 2016: $1.9 million) *

•Logbaba drilling programme:

Rig in final stages of commissioning and testing getting ready for spudding

•7.13km pipeline commissioned during the quarter as part of the Bonaberi expansion

•Resolution of dispute over reserve bonus and extinguishing 1.2% royalty

*Net cash is defined as cash equivalents less borrowings, where cash equivalents exceed borrowings

Operational update

The quarterly gross gas and condensate consumptions for the Logbaba Project are as follows (amounts in brackets are gas and condensate sales attributable to VOG*):

***See Link at BOP***

* After reaching a cost recovery milestone on the Logbaba Gas and Condensate Project during Q2 2016, whereby revenues are shared with VOG receiving 60% in accordance with its participating interest, the sales metrics are presented on a gross basis, with attributable gas sales shown in brackets. Prior to Q2 2016 gross and attributable sales were the same. Going forward the Group will report on an attributable basis.

Thermal sales generated good growth during the quarter from our existing customer base. Progress on the pipeline extension, discussed below, is expected to generate further sales growth in the coming quarters as additional customers are added to the network.

Grid power sales for the quarter were down on Q2 2016 due to the onset of the wet season in Cameroon, at which point the ENEO consumption levels reduce as hydro power becomes more readily available. Whilst lower than Q3 2015, grid power sales are above the contracted take-or-pay levels and are therefore in line with expectations. The seasonal impact, in conjunction with the change to earning revenues in accordance with participating interests (i.e. revenues of 60% of the Logbaba Project’s gas and condensate sales to customers; previously 100%), has resulted in the decline in revenue reported in the quarter.

The cash and net cash positions of the Group at the end of the quarter are more favorable than at the end of the previous quarter. This was due to outstanding receivables from the Logbaba concession partner being received, offset by payments made regarding the reserve bonus settlement agreement and the ongoing drilling programme funding requirements.

Uninterrupted supply of gas and safety

Our operations maintained a 100% safety record and ensured an uninterrupted gas supply through our integrated network to all customers across thermal, power and condensate markets.

Logbaba drilling programme

The Savannah drilling rig was delivered from Douala Port in July and rig up commenced in August. However, two lightning strikes on the derrick in August, within days of each other, caused significant damage to electrical circuits, electronic components and instrumentation and in some cases mechanical equipment. Some of this damage was not readily apparent until various components were tested individually and in-situ during commissioning. Almost all of the lightning related damage to the rig electronics and mechanical systems has now been repaired and replacement parts sourced and installed, tested, commissioned and certified.

Key structural, mechanical and electrical components such as the derrick and substructure, draw works and top drive, mud pumps, generators, blow out preventer (BOP) and other critical components have all been inspected, tested, commissioned and passed.

Savannah drilling contractor training, safety critical equipment and management systems and work control processes are all in place.

All of the well construction materials and all of the required third party contractor equipment is in- country. Third party contractor teams have been mobilised and are rigging up, and the GDC rig supervisory personnel are in-country.

A comprehensive Control of Well Review was completed by an independent engineer on behalf of the insurance underwriters and re-insurers to assess the suitability of GDC’s well design and the drilling programme and Savannah's equipment and well control policies; this review recommended the well to insurers.

In addition, a comprehensive Rig Audit and Rig Acceptance Test has been conducted by an international independent global testing, inspection and certification service provider and this process is expected to be completed within 10 days. Following completion of this test, it is expected that all equipment, procedures and personnel will be certified as fit for purpose, the rig can then be accepted by GDC to begin drilling.

The contractual arrangements on the drilling programme are such that the Company only incurs major financial commitments once drilling commences. Thus, whilst the delays in spudding have been frustrating, the Company is not expecting to suffer any significant cost increases.

Bonaberi shore pipeline extension

The 3.17km pipeline laid during the quarter, part of the Bonaberi expansion, brings the total pipe laid in 2016 to 12.25km. Of this pipe laid, 7.13km was commissioned by quarter end, bringing GDC’s total commissioned pipeline network to 40.05km. The remaining 5.12km was commissioned shortly after quarter end, bringing total pipeline laid by GDC and commissioned to 45km. In Q4 2016 the team will focus on the branch lines to customers and installation of the PRMS units (pressure reducing/metering station) at customer sites, with the aim of bringing new customers online with gas before the end of the year.

Logbaba Gas Plant Capacity Expansion

Phase one of the gas plant expansion, which aims to increase the plant’s capacity from 20mmscf/d to 25mmscf/d, is progressing with the preliminary engineering phase. Further phases of the gas plant expansion will depend on the drilling programme results.

VOG CEO Ahmet Dik said: “In this quarter we continued to deliver consistent gas sales to our customers while progressing the Bonaberi thermal expansion programme. We will be soon approaching 50km of pipeline laid by GDC, which is a major milestone for our company.

On the drill rig, all key assembly, testing and safety inspections have been completed and final independent inspections will be concluded next 10 days. Although the lightning strikes delayed us about 6 weeks, we are now on schedule to commence spudding in November 2016. We shall provide regular drilling updates over the next months.”

banjomick

- 29 Oct 2016 14:04

- 303 of 701

- 29 Oct 2016 14:04

- 303 of 701

Africa could be significant LNG importer by 2025, Total says

By Reuters

Tue Oct 4, 2016

Africa could become a significant global market for imported liquefied natural gas (LNG) by 2025, with Egypt the main driver, as more countries eye gas-to-power projects, a senior official at Total said on Tuesday.

With hundreds of millions of people living without electricity in the world's poorest continent, African countries are increasingly turning to gas to take advantage of lower global LNG prices amid a supply glut.

"It could be collectively a 20m to 30m tonnes per year market by 2025," Tom Earl, vice president of gas and power development at the French oil major, told Reuters on the sidelines of a gas conference in Cape Town.

He said Egypt could be importing between 15m-20m tonnes annually within a decade, although actual volumes would depend on the development of its huge Zohr gas field, which had an estimated 30trn cubic feet of gas.

West Africa was seen importing 5m tonnes a year, Southern Africa 4m and Morocco 2m tonnes by 2025, Earl said.

Egypt aims to import between 110 and 120 cargos of liquefied natural gas in 2017, the state-owned Egyptian Natural Gas Holding company (EGAS) said in June.

"Africa really is going to take a central role, the projects may be typically of smaller scale, but nevertheless they will collectively be very important," said Earl.

He said Total was focusing on gas-to-power projects around the world and wanted to develop downstream markets to increase the uptake of gas, which is seen as a cleaner alternative to harmful coal-fired plants.

"Total is willing to invest further downstream and that's important for us because it is developing future demand, future markets," he said.

He said Total was considering all aspects of South Africa's plans to build two gas-to-power projects with a combined 3,126 megawatt capacity to diversify electricity production away from more environmentally damaging coal plants.

The projects, estimated to cost around 50bn rand ($3.7 bln), will initially require about 1.6m tonnes of imported gas.

jimward9

- 31 Oct 2016 15:21

- 304 of 701

- 31 Oct 2016 15:21

- 304 of 701

maestro - 31 Oct 2016 21:29 - 305 of 701

banjomick

- 31 Oct 2016 22:00

- 306 of 701

- 31 Oct 2016 22:00

- 306 of 701

From FIRST ENERGY TODAY:

A unique gas business model in Cameroon

Cash flow, growth and value

We are initiating coverage on Victoria Oil & Gas Plc (Victoria) with a BUY

recommendation and a target price of £1.00 per share.

Victoria is a £40 mm Market Cap Gas play in Cameroon, where the company

is leveraging past investments in pipeline infrastructure in Douala to directly

sell molecules to industrial consumers.

With gas demand growing very fast and a deregulated market with gas still

priced at US$9-17/mcf, the value of the company’s c. 22 mmboe (c. 132 bcf)

2P Reserves is disproportionately high. This implies very healthy economics,

even in the current environment. We expect gross production of 1.5 mboe/d

(including 8.6 mmcf/d) in 2015 to grow to 6.0 mboe/d (36 mmcf/d) by 2020.

Victoria also holds multi tcf Prospective Resources at Matanda and Logbaba,

which are relatively low risk.

Our Core NAV for Victoria stands at £0.87 per share. Our Core NAV already

represents almost 160% upside to current levels. Including the two low risk

wells the company is drilling in 2016, which are targeting less than 5% of the

company’s overall Prospective Resources at Logbaba, suggests a ReNAV of

£1.02 per share. This does not include any value for the large resources at

Matanda. The shares also trade at EV/DACF multiples of only 2.4x in 2016,

2.2x in 2017 and drop to 1.6x in 2019. We continue to see much more value

in micro caps such as Victoria, compared to most large, international E&Ps

that now trade at or above their Core NAV and often their ReNAV.

Our target price offers 200% upside

Our £1.00 target price is based on ReNAV estimate of £1.02.

banjomick

- 31 Oct 2016 22:01

- 307 of 701

- 31 Oct 2016 22:01

- 307 of 701

Shore Capital TODAY

Victoria Oil & Gas

Strong platform for bottom line growth

Victoria Oil & Gas (VOG) continues to demonstrate a strong gas sales

performance from its core Logbaba project in Cameroon and, with the

company now firmly profitable, we forecast continued earnings progression

as a result of current growth initiatives. We anticipate imminent spudding of

two appraisal/development wells at Logbaba and, with phased pipeline

extensions now commissioned, we believe that VOG is extremely well

positioned to expand its reserves and production. As an integrated gas

production business dominating its local market in Douala,

VOG is highly differentiated amongst its African E&P peers on AIM, combining a strong

geographic focus with a straightforward, highly commercial business

model and significant growth potential. Assignment of an operated interest

in the neighbouring Matanda block provides a much expanded footprint in-country

and we also note plans to supplement the portfolio with additional

complementary projects;

We calculate Risked NAV of 170p/share.

banjomick

- 01 Nov 2016 10:58

- 308 of 701

- 01 Nov 2016 10:58

- 308 of 701

Posted on 31 October 2016

http://www.malcysblog.com/2016/10/vox-markets-podcast-malcy-victoria-oil-gas-amerisur-resources-jersey-oil-gas/

banjomick

- 02 Nov 2016 08:31

- 309 of 701

- 02 Nov 2016 08:31

- 309 of 701

Victoria Oil & Gas Plc

("VOG" or "the Company")

Logbaba Development Wells Spudded

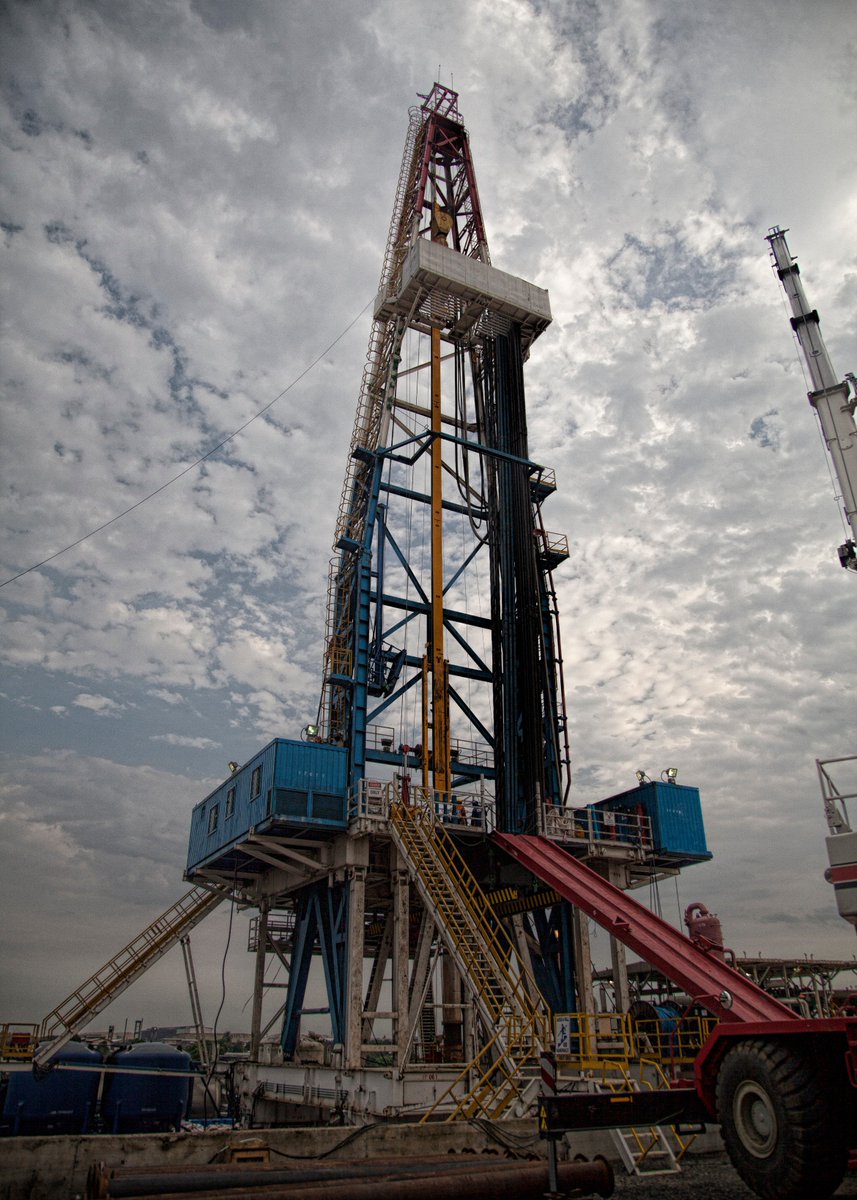

Gaz du Cameroun S.A. ("GDC"), the Company's Cameroon gas producing and distributing subsidiary, is pleased to announce the spudding of development wells La-107 and La-108 in the Logbaba Gas Field located in Douala, Cameroon. The wells are being drilled by Savannah Oil Services Cameroon S.A. ("Savannah") using the Komako 1 drilling rig.

The new wells are required to meet the growing market demand for gas in Douala, to develop Logbaba reserves and to move some of the 2P (Proven plus Probable) reserves into the 1P (Proven) reserve category. One of the wells, La-107, will twin the La-104 well drilled in 1957; the other well, La-108, will be a 'step-out' well that will be drilled into a target that is intended to prove up more of our Probable reserves. Both wells will be drilled directionally from a drilling pad adjacent to the Logbaba processing plant, and will be tied into this facility once completed. The La-104 twin well is almost vertical; whereas La-108, the 'step-out' well, will be drilled to intersect a target that is about 1,100m to the south-east of the Logbaba drilling pad.

The wells are intended to be production wells completed in the Upper Cretaceous (Campanian and Santonian) Logbaba Formation, which is a thick sequence of interbedded sands and shales found at depths between 1,700m and 3,200m below the surface. In addition to developing the gas reserves in the Logbaba Formation, one of the wells, La-107, has an additional objective of an 'exploration tail.' This is to be drilled from the base of the Logbaba Formation down to 4,200m below the surface to test the hydrocarbon potential of the Lower Cretaceous Mundeck Formation which had gas shows and a significant gas kick in La-104 (which is twinned by La-107). Execution of the exploration tail is dependent on well conditions to be established during the drilling programme.

The budget total for the two well programme, without the exploration tail, is approximately $40m, which is expected to be funded by revenue and partner contributions.

The Komako 1 drilling rig is owned and operated by Savannah. It is a 1500 HP rig that is mounted on rails; the rail system allows the rig to be moved back and forth between the two wells as they are 'batch drilled'. The rig has been assembled, tested, commissioned and has passed an independent 3rd party rig inspection audit prior to spud. Drilling is scheduled to complete in Q2 of 2017.

http://www.moneyam.com/action/news/showArticle?id=5442016

banjomick

- 02 Nov 2016 09:26

- 310 of 701

- 02 Nov 2016 09:26

- 310 of 701

Bonaberi shore pipeline extension

The 3.17km pipeline laid during the quarter, part of the Bonaberi expansion, brings the total pipe laid in 2016 to 12.25km. Of this pipe laid, 7.13km was commissioned by quarter end, bringing GDC’s total commissioned pipeline network to 40.05km.

The remaining 5.12km was commissioned shortly after quarter end, bringing total pipeline laid by GDC and commissioned to 45km.

In Q4 2016 the team will focus on the branch lines to customers and installation of the PRMS units (pressure reducing/metering station) at customer sites, with the aim of bringing new customers online with gas before the end of the year.

http://www.victoriaoilandgas.com/investors/news/q3-2016-operations-update

banjomick

- 02 Nov 2016 10:06

- 311 of 701

- 02 Nov 2016 10:06

- 311 of 701

banjomick

- 02 Nov 2016 14:16

- 312 of 701

- 02 Nov 2016 14:16

- 312 of 701

12:00 02 Nov 2016

GDC is currently the only supplier of natural gas to Douala, Cameroon’s rapidly growing second city

Victoria Oil & Gas (LON:VOG) has substantial gas assets in Cameroon, a country crying out for energy.

At present, Gaz du Cameroun, Victoria's local subsidiary, estimates demand for gas in Cameroon for thermal and power generation is in excess of 150mmscf (millions of standard cubic feet) per day.

GDC is currently the only supplier of natural gas to Douala, Cameroon’s rapidly growing second city and, in its own words, it manages the whole value chain from the wellhead to customer connection.

Long-term supply contracts have been established with customers at prices from $9/mmbtu (millions of British thermal unit) to $16/mmbtu and with prices not subject to regulation.

Infrastructure plans include designs for the gas treatment plant capacity to rise to 40mmscf/d, adding 13km to the pipeline network and to develop new product areas such as compressed natural gas (CNG).

Matanda can dwarf Logbaba

In addition, taking a 75% stake in the Matanda block earlier this year has given Victoria Oil control of an asset potentially 60 times larger than Logbaba.

The North Matanda field alone is estimated to hold 1.8trn cubic feet (Tcf) of gas and 136mln barrels of condensate on a p50 (50% probability) basis.

That compares with 208bcf of gas and 3.1mmbls of condensate at Logbaba.

The North Matanda Field is an extension of the Logbaba structure and wells drilled already alongside extensive 2D and 3D seismic data have shown a strong geological continuation between the two.

Next steps are a work programme to be agreed by the Cameroon government.

The work programme plan initially is to explore onshore licence areas within a few kilometres of Logbaba and send any discoveries through the pipeline network operated by Gaz Du Cameroun or GDC, Victoria’s Cameroon subsidiary.

Loose ends tied up

All of the loose ends of the ownership structure of its assets are also being tied off.

The latest was to negotiate the cancellation of its reserve bonus agreement at Logbaba.

A settlement resolved all outstanding issues relating to the reserve bonus and also ended a 1.2% royalty from a contingent payment agreement (CPA) prior to its involvement.

Results on the up

Victoria swung strongly into the black in the half year to June 2016 as production from Logbaba almost doubled.

Daily gas production rose to an average 13.1 million cubic feet (mmscf) per day in the half year to June from 6.8mmscf a year ago.

Revenues rose to US$23.6mln (US$18.9mln), while profits soared to US$3.86mln (US$215,000) helped by a sizeable fall in costs.

Victoria said the first half is normally stronger due to the timing of dry/wet seasons in the African country.

Development drilling under way

In November, two development wells were spudded at Logbaba

The wells, to be drilled by Savannah Oil Services, are designed to move 2P (Proven plus Probable) reserves into the more certain 1P (Proven) reserve category.

One will retrace a historic well dating back to the fifties with the other a step-out ( or new area) hole. The target is sands and shales found at depths between 1,700m and 3,200m.

One of the wells, La-107, will also have an exploration tail to test potential for gas down to 4,200m.

What the broker says

Shore Capital has a 170p/share risked net asset value estimate, which reflects material upside potential as it adds reserves, expands customer supply and delivers meaningful earnings progression this year and next.

Shares currently stand at 36p, up 13% on the drilling update, which suggests a way to go yet if Shore is right.

--update for drilling, broker comments --

Philip Whiterow