| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Argos Resources (ARG)

markymar

- 27 Jul 2010 12:41

- 27 Jul 2010 12:41

Argos Resources Ltd is an AIM quoted oil and gas exploration company based in the Falkland Islands, ideally placed to make the most of an exciting new oil province heading towards production.

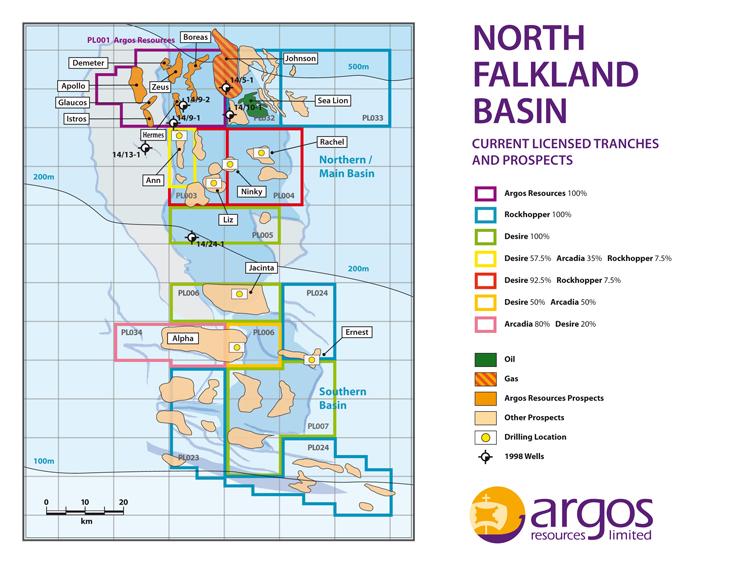

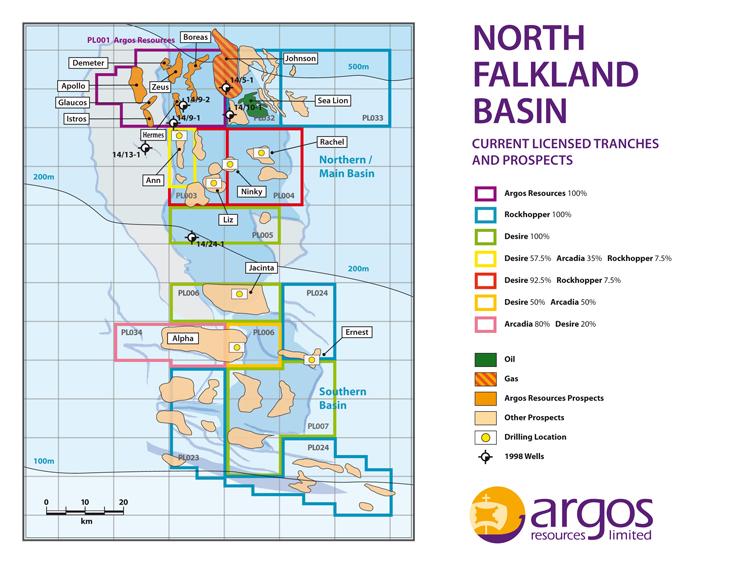

Argos holds a 100% interest in Licence PL001, which covers approximately 1,126 square kilometres in the North Falkland Basin. The licence boundary is just 3km from the Sea Lion oil field, a significant discovery on course for production start-up in 2017.

New 3D seismic data of excellent quality was acquired over the entire licence area in 2011 and has identified 52 prospects with a best estimate of 3,083 million barrels of prospective recoverable resource, and a high estimate of 10,412 million barrels. 40 additional leads have been identified which are not included in the above resource figures and which are the subject of ongoing work.

The Company is now seeking an exploration partner to drill a selection of key prospects to unlock the value of this exciting opportunity.

http://www.argosresources.com/

http://www.falklands-oil.com/

http://www.desireplc.co.uk/

http://www.rockhopperexploration.co.uk/

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

The Opportunity

The Opportunity

•Proven commercial petroleum system

•52 oil prospects, defined by excellent quality 3D seismic data

•CPR attributes 3.1 billion barrels of prospective recoverable resource to the prospects, with upside of 10.4 billion barrels

•40 additional leads identified and under review

•Several prospects similar to Sea Lion

•Prospects have been de-risked by the Sea Lion discovery

•Potential extension of Johnson gas discovery into licence

•Licence 100% owned by Argos Resources

•Benign operating environment

•Stable Government with a competitive tax regime

Argos holds a 100% interest in Licence PL001, which covers approximately 1,126 square kilometres in the North Falkland Basin. The licence boundary is just 3km from the Sea Lion oil field, a significant discovery on course for production start-up in 2017.

New 3D seismic data of excellent quality was acquired over the entire licence area in 2011 and has identified 52 prospects with a best estimate of 3,083 million barrels of prospective recoverable resource, and a high estimate of 10,412 million barrels. 40 additional leads have been identified which are not included in the above resource figures and which are the subject of ongoing work.

The Company is now seeking an exploration partner to drill a selection of key prospects to unlock the value of this exciting opportunity.

http://www.argosresources.com/

http://www.falklands-oil.com/

http://www.desireplc.co.uk/

http://www.rockhopperexploration.co.uk/

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

•Proven commercial petroleum system

•52 oil prospects, defined by excellent quality 3D seismic data

•CPR attributes 3.1 billion barrels of prospective recoverable resource to the prospects, with upside of 10.4 billion barrels

•40 additional leads identified and under review

•Several prospects similar to Sea Lion

•Prospects have been de-risked by the Sea Lion discovery

•Potential extension of Johnson gas discovery into licence

•Licence 100% owned by Argos Resources

•Benign operating environment

•Stable Government with a competitive tax regime

markymar

- 27 Jul 2010 13:08

- 3 of 185

- 27 Jul 2010 13:08

- 3 of 185

The Company intends to carry out a 3D seismic programme in 2010/2011 over a number of the prospects identified from its earlier 2D seismic programme. These prospects have a total unrisked potential of 747 million barrels of prospective recoverable resource in the most likely case, and up to 1.75 billion barrels in the upside case. On completion of the seismic interpretation, which should be completed in the second half of 2011, the Company expects to be in a position to high-grade prospects and identify drilling locations. This process will be aided by the results of the current drilling programme being undertaken by the adjoining licencees

Indicative Timetable

Q4 2010 / 2011 Acquire up to 1,000 km2 3D seismic

Q1 2011 Process and interpret 3D seismic data

Q3 2011 Report on prospect inventory

Q4 2011 High-grade drilling targets, submit environmental impact statement

Q4 2011 / 2012 Drilling campaign

The Directors believe that the encouraging results from the adjoining licences materially de-risk the likely outcome of Argos's own programme.

Indicative Timetable

Q4 2010 / 2011 Acquire up to 1,000 km2 3D seismic

Q1 2011 Process and interpret 3D seismic data

Q3 2011 Report on prospect inventory

Q4 2011 High-grade drilling targets, submit environmental impact statement

Q4 2011 / 2012 Drilling campaign

The Directors believe that the encouraging results from the adjoining licences materially de-risk the likely outcome of Argos's own programme.

sheppo - 27 Jul 2010 16:40 - 4 of 185

MARKYMAR

Have you heard anything on the listing price wednesday

what we can expect

Have you heard anything on the listing price wednesday

what we can expect

markymar

- 27 Jul 2010 17:13

- 5 of 185

- 27 Jul 2010 17:13

- 5 of 185

Sheppo all the info you need is in front of you......31p

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

sheppo - 27 Jul 2010 17:20 - 6 of 185

Thanks for that

Are you having a punt

Are you having a punt

markymar

- 27 Jul 2010 17:37

- 7 of 185

- 27 Jul 2010 17:37

- 7 of 185

Not sure!!!! Drilling 2012 is a long way off but on the other side of the coin any sucess from RKH or DES drilling and hitting oil the share price will follow as all 3 in the NFB.

markymar

- 27 Jul 2010 22:14

- 8 of 185

- 27 Jul 2010 22:14

- 8 of 185

http://proactiveinvestors.co.uk/companies/news/19346/argos-resources-to-join-aims-falkland-oil-explorers-19346.html

Argos Resources to join AIMs Falkland oil explorers

Tuesday, July 27, 2010 by Jamie Ashcroft

Argos Resources to join AIMs Falkland oil explorers

Tuesday, July 27, 2010 by Jamie Ashcroft

markymar

- 29 Jul 2010 11:21

- 9 of 185

- 29 Jul 2010 11:21

- 9 of 185

Looks like all went well and she is up a little

halifax - 05 Aug 2010 16:51 - 10 of 185

taken a small position in ARG as marky points out their concession is in the NFB next to RKH'S sealion so even if ernest turns out to be a duster they should not be badly affected.

markymar

- 06 Aug 2010 14:01

- 11 of 185

- 06 Aug 2010 14:01

- 11 of 185

http://www.moneyweek.com/investment-advice/share-tips-argos-resources-falklands-oil-exploration-03108.aspx

Is this the next billion-barrel Falklands oil stock?

Good choice Halifax the 3 stocks in the NFB should follow each other and this should be the safer one to hold i would of thought.

Hope you have a few RKH if not a defnite dive in for Sea Lion for flow test what ever happens to Ernest.

Is this the next billion-barrel Falklands oil stock?

Good choice Halifax the 3 stocks in the NFB should follow each other and this should be the safer one to hold i would of thought.

Hope you have a few RKH if not a defnite dive in for Sea Lion for flow test what ever happens to Ernest.

halifax - 06 Aug 2010 15:18 - 12 of 185

marky waiting for ernest news before going back in.

markymar

- 06 Aug 2010 16:37

- 13 of 185

- 06 Aug 2010 16:37

- 13 of 185

Good idea Hal i am holding tight with what i have and a little left to buy in after news of Ernest.

Roll on Monday as thats a possibility in my eyes of the RNS wireline crew flew on to the OG today.

Quiet with out Cynic i bet those shaven legs of his are getting a tan.

COME ON ERNIE!!!!!

Roll on Monday as thats a possibility in my eyes of the RNS wireline crew flew on to the OG today.

Quiet with out Cynic i bet those shaven legs of his are getting a tan.

COME ON ERNIE!!!!!

mitzy - 07 Aug 2010 10:40 - 14 of 185

I'm watching this one closely.

halifax - 05 Sep 2010 13:36 - 15 of 185

ARG sp should rise as any good news from RKH's sealion discovery should be a boost.

Proselenes - 05 Sep 2010 14:06 - 16 of 185

Why ?

Sea Lion is East - Argos is far West.

So far anything remotely West (Liz from DES) has seen no commercial oil.

Argos remains high risk until they drill and find something, simple as that. With RKH holding so many Eastern prospects and with RKH having found oil, regional seal etc.... then it makes the East falklands the focus point and ignore the West.

Sea Lion is East - Argos is far West.

So far anything remotely West (Liz from DES) has seen no commercial oil.

Argos remains high risk until they drill and find something, simple as that. With RKH holding so many Eastern prospects and with RKH having found oil, regional seal etc.... then it makes the East falklands the focus point and ignore the West.

halifax - 05 Sep 2010 16:32 - 17 of 185

pp so you think geography is the answer to finding oil in the FI what a simplistic view. If sealion proves to be as good as you suggest then we can expect renewed interest in neighbouring blocks, it would appear to us drilling in the FI successfully will be like drilling in the North Sea.

Proselenes - 06 Sep 2010 05:00 - 18 of 185

Perhaps, however, the most "likely" place to find more oil is around where there is already proven oil + reservoir + seal and that is the East North Falklands, which just happens to be the RKH license area :)

Nobody will assign much value to the far west until oil is found, now when is the drilling ? In the case of Argos they only raised enough for sesimic work, they do not have funds for any drilling.

Therefore, why not buy at the next big fundraising where they will have to get money to do drilling, and perhaps it might be at a lot lower price than today as they have, as yet, no oil finds to support the price, only a license and soon, seismic BUT what has Toroa and Ernest taught everyone ? and that is that seismic and CSEM can lead to dry wells............. ;)

Nobody will assign much value to the far west until oil is found, now when is the drilling ? In the case of Argos they only raised enough for sesimic work, they do not have funds for any drilling.

Therefore, why not buy at the next big fundraising where they will have to get money to do drilling, and perhaps it might be at a lot lower price than today as they have, as yet, no oil finds to support the price, only a license and soon, seismic BUT what has Toroa and Ernest taught everyone ? and that is that seismic and CSEM can lead to dry wells............. ;)

robnickson - 06 Sep 2010 17:57 - 19 of 185

They have found gas straddling the ARG and RKH border.

markymar

- 06 Sep 2010 20:33

- 20 of 185

- 06 Sep 2010 20:33

- 20 of 185

Robnickson

RKH said that the Johnson prospect was a gas find , that prospect over laps in to Argos acreage but Argos acreage is un-drilled to date it has only ever had 2D seismic carried out over it.

Proselenes - 07 Sep 2010 03:19 - 21 of 185

And nobody wants gas at this stage, its all about oil.

markymar

- 08 Sep 2010 13:05

- 22 of 185

- 08 Sep 2010 13:05

- 22 of 185

http://www.investorschronicle.co.uk/Companies/ByEvent/Risk/Analysis/article/20100908/cf021134-bb2e-11df-81fc-00144f2af8e8/Back-to-the-Falklands.jsp

Back to the Falklands

Created:8 September 2010Written by:Martin Li

When John Hogan last drilled in the Falklands in 1998, an oil price that had crashed to $12 per barrel forced LASMO, of which he was chief operating officer, and its peers to abandon any meaningful aspirations there. They drilled the cheapest wells that satisfied their lease obligations and withdrew, despite finding a thick, rich source rock (where hydrocarbons form) and oil and gas in five of the six wells drilled. That leaves unfinished business that Mr Hogan intends to complete as managing director of Argos Resources, which became the fifth Aim-traded Falklands explorer when it floated in July, raising 22m.

First movers are generally thought to hold the advantage, but this time Mr Hogan and Argos chairman Ian Thomson espouse the benefits of coming to the Falklands party late. Argos holds a 100 per cent interest in acreage in the North Falkland basin, adjacent to licences held by Rockhopper Exploration and Desire Petroleum. Rockhopper's spectacular 242m-barrel success with its Sea Lion well provides valuable geological clues to help Argos evaluate its licence area, particularly in identifying Sea Lion lookalikes. Rockhopper and Desire will drill further exploration wells to the south and west of Argos's acreage, which should further help the company target its prospects.

Oil and gas discoveries are easier to commercialise when clustered together so as to be able to share infrastructure and facilities. The Sea Lion discovery and Rockhopper's re-interpretation of a 1998 Shell well, Johnson, also as a discovery holding several trillion cubic feet of gas (even though not commercial on its own) greatly reduce the threshold for any further discoveries to be commercial.

Another key advantage of Argos's timing may be rig availability. The inability to secure a rig to travel the long distance to the South Atlantic delayed Falklands drilling by several years until Desire finally secured the Ocean Guardian rig last September. Further exploration and testing of Sea Lion could keep the rig busy in the Falklands until mid-2011, by which time Argos hopes to be nearly ready to drill.

IC VIEW:

GoodValueAs Mr Hogan points out, "oil fields are herd animals", and Rockhopper's success in an adjacent block bodes well for Argos. Its prospects would improve significantly if successful seismic studies attract a suitable partner and allow it to tag onto the end of the current drilling campaign. Good value at 31p.

Back to the Falklands

Created:8 September 2010Written by:Martin Li

When John Hogan last drilled in the Falklands in 1998, an oil price that had crashed to $12 per barrel forced LASMO, of which he was chief operating officer, and its peers to abandon any meaningful aspirations there. They drilled the cheapest wells that satisfied their lease obligations and withdrew, despite finding a thick, rich source rock (where hydrocarbons form) and oil and gas in five of the six wells drilled. That leaves unfinished business that Mr Hogan intends to complete as managing director of Argos Resources, which became the fifth Aim-traded Falklands explorer when it floated in July, raising 22m.

First movers are generally thought to hold the advantage, but this time Mr Hogan and Argos chairman Ian Thomson espouse the benefits of coming to the Falklands party late. Argos holds a 100 per cent interest in acreage in the North Falkland basin, adjacent to licences held by Rockhopper Exploration and Desire Petroleum. Rockhopper's spectacular 242m-barrel success with its Sea Lion well provides valuable geological clues to help Argos evaluate its licence area, particularly in identifying Sea Lion lookalikes. Rockhopper and Desire will drill further exploration wells to the south and west of Argos's acreage, which should further help the company target its prospects.

Oil and gas discoveries are easier to commercialise when clustered together so as to be able to share infrastructure and facilities. The Sea Lion discovery and Rockhopper's re-interpretation of a 1998 Shell well, Johnson, also as a discovery holding several trillion cubic feet of gas (even though not commercial on its own) greatly reduce the threshold for any further discoveries to be commercial.

Another key advantage of Argos's timing may be rig availability. The inability to secure a rig to travel the long distance to the South Atlantic delayed Falklands drilling by several years until Desire finally secured the Ocean Guardian rig last September. Further exploration and testing of Sea Lion could keep the rig busy in the Falklands until mid-2011, by which time Argos hopes to be nearly ready to drill.

IC VIEW:

GoodValueAs Mr Hogan points out, "oil fields are herd animals", and Rockhopper's success in an adjacent block bodes well for Argos. Its prospects would improve significantly if successful seismic studies attract a suitable partner and allow it to tag onto the end of the current drilling campaign. Good value at 31p.