| Home | Log In | Register | Our Services | My Account | Contact | Help |

Victoria Oil & Gas-The Information & News Thread (VOG)

banjomick

- 07 Jan 2015 21:01

- 07 Jan 2015 21:01

Victoria Oil & Gas Plc (Victoria) has become a significant domestic energy supplier in Africa through its wholly owned subsidiary: Gaz du Cameroun S. A. (GDC).

With operations located in the industrial port-city of Douala, Cameroon, customers are converting their operations to take natural gas supplied by our production wells and pipeline infrastructure.

GDC is the sole gas supplier in the area, providing a cheaper, more efficient, reliable, and cleaner energy alternative to Heavy Fuel Oil use.

Our teams of engineering advisors are on hand to help customer’s cost and implement the change to GDC’s energy products.

Victoria Oil & Gas is traded in the NEX Exchange HERE

Link-HISTORICAL NEWS,VIDEO/AUDIO & EVENTS

Link-Dedicated Posts for:

Gaz du Cameroun S.A. (“GDC”)

Gaz Du Cameroun Matanda S.A. ("GDC Matanda")

Link-Cameroon-Industrialisation Master Plan (PDI) & Africa Energy

NEWS

21st Jan 2019 Production Update

17th Jan 2019 Q4 2018 Operations Update

02nd Jan 2019 Presidential Decree on Matanda Received

24th Dec 2018 Renewal of Long-Term Gas Supply Contract with ENEO

28th Sep 2018 INTERIM FINANCIAL REPORT FOR THE SIX MONTHS ENDED 30 JUNE 2018

17th Aug 2018 Q2 2018 Operations Update

22nd Jun 2018 Report and Accounts to 31 December 2017

14th Jun 2018 Restructure of the BGFI Debt Facility

04th Jun 2018 Notice of Annual General Meeting

04th June 2018 Logbaba Field Reserves Update

24th May 2018 Q1 2018 Operations and Outlook

16th Feb 2018 Q4 17 Operations Update & 2018 Outlook Replacement

05th Jan 2018 Gas Supply Contract with ENEO Not Extended

VIDEO/AUDIO

21st Jan 2019 Victoria Oil & Gas looks ahead to increased cash flow

24th Aug 2018 Victoria Oil & Gas confident of resolving ENEO contract 'within weeks'

22nd Apr 2018 Video from 21/04/2018 UK Investor Show

16th Feb 2018 Victoria Oil & Gas confident of positive outcome to ENEO issue

08th Nov 2017 Victoria Oil & Gas reports very pleasing initial results from La-108

31st Oct 2017 21 Oil and Gas - African Power Panel

30th Oct 2017 121 Oil & Gas Investment

26th Oct 2017 Victoria Oil & Gas raises US$23.5mln to accelerate new growth programme

26th Sep 2017 Victoria Oil & Gas to finalise long term supply contracts after first gas at LA-107

17th Aug 2017 Victoria Oil & Gas expecting La-107 to be a 'substantial' producer

16th Apr 2017 Video from 01/04/2017 UK Investor Show

13th Apr 2017 'It's been a terrific year and a great quarter', says Victoria Oil & Gas' Kevin Foo

06th Mar 2017 Farm-out deal 'a really good strategic move' for Victoria Oil & Gas, says chairman Kevin Foo

06th Feb 2017 Chairman runs Proactive through the good start to 2017

EVENTS

28th Jun 2018 Annual General Meeting ("AGM")

10th May 2018 Africa Oil & Power Investor Forum-London

21st Apr 2018 UK Investor Show

11th-12th Apr 2018 Africa Investment Exchange: Gas (AIX: Gas 2018)-London

09th-10th Nov 2017 The Cameroon Investment Forum(CIF)-Cameroon

30th-31st Oct 2017 121 Oil & Gas Investment-London

23rd-27th Oct 2017 Africa Oil Week 2017-Cape Town South Africa

07th Sep 2017 One2One Investor Forum - London

05th Sep 2017 Oil Capital Conference-London

28th Jun 2017 Annual General Meeting

01st Apr 2017 UK Investor Show

9th Feb 2017 Presentation slide show for One2One

9th Feb 2017 One2One Investor Forum - London

Social Media

banjomick

- 29 Oct 2016 14:04

- 303 of 701

- 29 Oct 2016 14:04

- 303 of 701

Africa could be significant LNG importer by 2025, Total says

By Reuters

Tue Oct 4, 2016

Africa could become a significant global market for imported liquefied natural gas (LNG) by 2025, with Egypt the main driver, as more countries eye gas-to-power projects, a senior official at Total said on Tuesday.

With hundreds of millions of people living without electricity in the world's poorest continent, African countries are increasingly turning to gas to take advantage of lower global LNG prices amid a supply glut.

"It could be collectively a 20m to 30m tonnes per year market by 2025," Tom Earl, vice president of gas and power development at the French oil major, told Reuters on the sidelines of a gas conference in Cape Town.

He said Egypt could be importing between 15m-20m tonnes annually within a decade, although actual volumes would depend on the development of its huge Zohr gas field, which had an estimated 30trn cubic feet of gas.

West Africa was seen importing 5m tonnes a year, Southern Africa 4m and Morocco 2m tonnes by 2025, Earl said.

Egypt aims to import between 110 and 120 cargos of liquefied natural gas in 2017, the state-owned Egyptian Natural Gas Holding company (EGAS) said in June.

"Africa really is going to take a central role, the projects may be typically of smaller scale, but nevertheless they will collectively be very important," said Earl.

He said Total was focusing on gas-to-power projects around the world and wanted to develop downstream markets to increase the uptake of gas, which is seen as a cleaner alternative to harmful coal-fired plants.

"Total is willing to invest further downstream and that's important for us because it is developing future demand, future markets," he said.

He said Total was considering all aspects of South Africa's plans to build two gas-to-power projects with a combined 3,126 megawatt capacity to diversify electricity production away from more environmentally damaging coal plants.

The projects, estimated to cost around 50bn rand ($3.7 bln), will initially require about 1.6m tonnes of imported gas.

jimward9

- 31 Oct 2016 15:21

- 304 of 701

- 31 Oct 2016 15:21

- 304 of 701

maestro - 31 Oct 2016 21:29 - 305 of 701

banjomick

- 31 Oct 2016 22:00

- 306 of 701

- 31 Oct 2016 22:00

- 306 of 701

From FIRST ENERGY TODAY:

A unique gas business model in Cameroon

Cash flow, growth and value

We are initiating coverage on Victoria Oil & Gas Plc (Victoria) with a BUY

recommendation and a target price of £1.00 per share.

Victoria is a £40 mm Market Cap Gas play in Cameroon, where the company

is leveraging past investments in pipeline infrastructure in Douala to directly

sell molecules to industrial consumers.

With gas demand growing very fast and a deregulated market with gas still

priced at US$9-17/mcf, the value of the company’s c. 22 mmboe (c. 132 bcf)

2P Reserves is disproportionately high. This implies very healthy economics,

even in the current environment. We expect gross production of 1.5 mboe/d

(including 8.6 mmcf/d) in 2015 to grow to 6.0 mboe/d (36 mmcf/d) by 2020.

Victoria also holds multi tcf Prospective Resources at Matanda and Logbaba,

which are relatively low risk.

Our Core NAV for Victoria stands at £0.87 per share. Our Core NAV already

represents almost 160% upside to current levels. Including the two low risk

wells the company is drilling in 2016, which are targeting less than 5% of the

company’s overall Prospective Resources at Logbaba, suggests a ReNAV of

£1.02 per share. This does not include any value for the large resources at

Matanda. The shares also trade at EV/DACF multiples of only 2.4x in 2016,

2.2x in 2017 and drop to 1.6x in 2019. We continue to see much more value

in micro caps such as Victoria, compared to most large, international E&Ps

that now trade at or above their Core NAV and often their ReNAV.

Our target price offers 200% upside

Our £1.00 target price is based on ReNAV estimate of £1.02.

banjomick

- 31 Oct 2016 22:01

- 307 of 701

- 31 Oct 2016 22:01

- 307 of 701

Shore Capital TODAY

Victoria Oil & Gas

Strong platform for bottom line growth

Victoria Oil & Gas (VOG) continues to demonstrate a strong gas sales

performance from its core Logbaba project in Cameroon and, with the

company now firmly profitable, we forecast continued earnings progression

as a result of current growth initiatives. We anticipate imminent spudding of

two appraisal/development wells at Logbaba and, with phased pipeline

extensions now commissioned, we believe that VOG is extremely well

positioned to expand its reserves and production. As an integrated gas

production business dominating its local market in Douala,

VOG is highly differentiated amongst its African E&P peers on AIM, combining a strong

geographic focus with a straightforward, highly commercial business

model and significant growth potential. Assignment of an operated interest

in the neighbouring Matanda block provides a much expanded footprint in-country

and we also note plans to supplement the portfolio with additional

complementary projects;

We calculate Risked NAV of 170p/share.

banjomick

- 01 Nov 2016 10:58

- 308 of 701

- 01 Nov 2016 10:58

- 308 of 701

Posted on 31 October 2016

http://www.malcysblog.com/2016/10/vox-markets-podcast-malcy-victoria-oil-gas-amerisur-resources-jersey-oil-gas/

banjomick

- 02 Nov 2016 08:31

- 309 of 701

- 02 Nov 2016 08:31

- 309 of 701

Victoria Oil & Gas Plc

("VOG" or "the Company")

Logbaba Development Wells Spudded

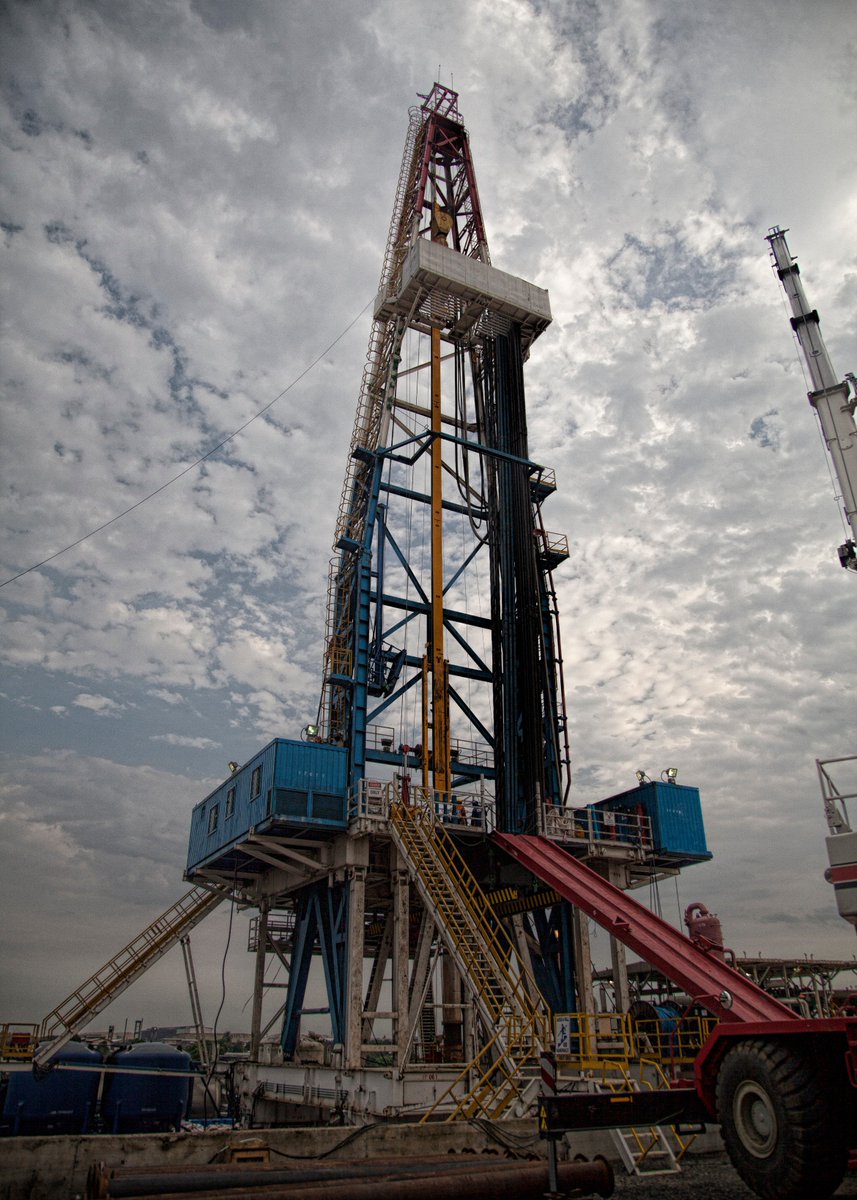

Gaz du Cameroun S.A. ("GDC"), the Company's Cameroon gas producing and distributing subsidiary, is pleased to announce the spudding of development wells La-107 and La-108 in the Logbaba Gas Field located in Douala, Cameroon. The wells are being drilled by Savannah Oil Services Cameroon S.A. ("Savannah") using the Komako 1 drilling rig.

The new wells are required to meet the growing market demand for gas in Douala, to develop Logbaba reserves and to move some of the 2P (Proven plus Probable) reserves into the 1P (Proven) reserve category. One of the wells, La-107, will twin the La-104 well drilled in 1957; the other well, La-108, will be a 'step-out' well that will be drilled into a target that is intended to prove up more of our Probable reserves. Both wells will be drilled directionally from a drilling pad adjacent to the Logbaba processing plant, and will be tied into this facility once completed. The La-104 twin well is almost vertical; whereas La-108, the 'step-out' well, will be drilled to intersect a target that is about 1,100m to the south-east of the Logbaba drilling pad.

The wells are intended to be production wells completed in the Upper Cretaceous (Campanian and Santonian) Logbaba Formation, which is a thick sequence of interbedded sands and shales found at depths between 1,700m and 3,200m below the surface. In addition to developing the gas reserves in the Logbaba Formation, one of the wells, La-107, has an additional objective of an 'exploration tail.' This is to be drilled from the base of the Logbaba Formation down to 4,200m below the surface to test the hydrocarbon potential of the Lower Cretaceous Mundeck Formation which had gas shows and a significant gas kick in La-104 (which is twinned by La-107). Execution of the exploration tail is dependent on well conditions to be established during the drilling programme.

The budget total for the two well programme, without the exploration tail, is approximately $40m, which is expected to be funded by revenue and partner contributions.

The Komako 1 drilling rig is owned and operated by Savannah. It is a 1500 HP rig that is mounted on rails; the rail system allows the rig to be moved back and forth between the two wells as they are 'batch drilled'. The rig has been assembled, tested, commissioned and has passed an independent 3rd party rig inspection audit prior to spud. Drilling is scheduled to complete in Q2 of 2017.

http://www.moneyam.com/action/news/showArticle?id=5442016

banjomick

- 02 Nov 2016 09:26

- 310 of 701

- 02 Nov 2016 09:26

- 310 of 701

Bonaberi shore pipeline extension

The 3.17km pipeline laid during the quarter, part of the Bonaberi expansion, brings the total pipe laid in 2016 to 12.25km. Of this pipe laid, 7.13km was commissioned by quarter end, bringing GDC’s total commissioned pipeline network to 40.05km.

The remaining 5.12km was commissioned shortly after quarter end, bringing total pipeline laid by GDC and commissioned to 45km.

In Q4 2016 the team will focus on the branch lines to customers and installation of the PRMS units (pressure reducing/metering station) at customer sites, with the aim of bringing new customers online with gas before the end of the year.

http://www.victoriaoilandgas.com/investors/news/q3-2016-operations-update

banjomick

- 02 Nov 2016 10:06

- 311 of 701

- 02 Nov 2016 10:06

- 311 of 701

banjomick

- 02 Nov 2016 14:16

- 312 of 701

- 02 Nov 2016 14:16

- 312 of 701

12:00 02 Nov 2016

GDC is currently the only supplier of natural gas to Douala, Cameroon’s rapidly growing second city

Victoria Oil & Gas (LON:VOG) has substantial gas assets in Cameroon, a country crying out for energy.

At present, Gaz du Cameroun, Victoria's local subsidiary, estimates demand for gas in Cameroon for thermal and power generation is in excess of 150mmscf (millions of standard cubic feet) per day.

GDC is currently the only supplier of natural gas to Douala, Cameroon’s rapidly growing second city and, in its own words, it manages the whole value chain from the wellhead to customer connection.

Long-term supply contracts have been established with customers at prices from $9/mmbtu (millions of British thermal unit) to $16/mmbtu and with prices not subject to regulation.

Infrastructure plans include designs for the gas treatment plant capacity to rise to 40mmscf/d, adding 13km to the pipeline network and to develop new product areas such as compressed natural gas (CNG).

Matanda can dwarf Logbaba

In addition, taking a 75% stake in the Matanda block earlier this year has given Victoria Oil control of an asset potentially 60 times larger than Logbaba.

The North Matanda field alone is estimated to hold 1.8trn cubic feet (Tcf) of gas and 136mln barrels of condensate on a p50 (50% probability) basis.

That compares with 208bcf of gas and 3.1mmbls of condensate at Logbaba.

The North Matanda Field is an extension of the Logbaba structure and wells drilled already alongside extensive 2D and 3D seismic data have shown a strong geological continuation between the two.

Next steps are a work programme to be agreed by the Cameroon government.

The work programme plan initially is to explore onshore licence areas within a few kilometres of Logbaba and send any discoveries through the pipeline network operated by Gaz Du Cameroun or GDC, Victoria’s Cameroon subsidiary.

Loose ends tied up

All of the loose ends of the ownership structure of its assets are also being tied off.

The latest was to negotiate the cancellation of its reserve bonus agreement at Logbaba.

A settlement resolved all outstanding issues relating to the reserve bonus and also ended a 1.2% royalty from a contingent payment agreement (CPA) prior to its involvement.

Results on the up

Victoria swung strongly into the black in the half year to June 2016 as production from Logbaba almost doubled.

Daily gas production rose to an average 13.1 million cubic feet (mmscf) per day in the half year to June from 6.8mmscf a year ago.

Revenues rose to US$23.6mln (US$18.9mln), while profits soared to US$3.86mln (US$215,000) helped by a sizeable fall in costs.

Victoria said the first half is normally stronger due to the timing of dry/wet seasons in the African country.

Development drilling under way

In November, two development wells were spudded at Logbaba

The wells, to be drilled by Savannah Oil Services, are designed to move 2P (Proven plus Probable) reserves into the more certain 1P (Proven) reserve category.

One will retrace a historic well dating back to the fifties with the other a step-out ( or new area) hole. The target is sands and shales found at depths between 1,700m and 3,200m.

One of the wells, La-107, will also have an exploration tail to test potential for gas down to 4,200m.

What the broker says

Shore Capital has a 170p/share risked net asset value estimate, which reflects material upside potential as it adds reserves, expands customer supply and delivers meaningful earnings progression this year and next.

Shares currently stand at 36p, up 13% on the drilling update, which suggests a way to go yet if Shore is right.

--update for drilling, broker comments --

Philip Whiterow

maestro - 02 Nov 2016 22:01 - 313 of 701

banjomick

- 03 Nov 2016 00:05

- 314 of 701

- 03 Nov 2016 00:05

- 314 of 701

The picture released today is very interesting firstly it shows or indicates there has been bad weather (from the mud) but also the high clouds with intermittent blue sky suggests that the wet season is ending, which by the historic rainfall charts would be correct.

Secondly and most interesting is the picture of the two figures with the LHS employed by Savannah Oil Services Cameroon S.A. and the RHS employed by VOG/GDC. They appear to be looking and taking in what they have achieved together as a team after battling the elements! Also the RHS figure of VOG/GDC with the left arm giving support to the other is very strong and quite symbolic especially with VOG's stated future plans:

26 Sep 2016

Look at new areas in Cameroon and across Africa where the GDC model can be replicated

31 May 2016

"It remains our longer term plan to replicate this model in other African locations and we continue to look for the right opportunities."

29 Feb 2016

"Kevin Foo, Executive Chairman said, “Our Company continues to deliver increased production and strong financial results. This confirms that our fully integrated gas utility business in Cameroon works well and has helped insulate us from low oil prices and extremely challenging markets. We intend to build on this foundation to increase production and cash flow in Cameroon and elsewhere in Africa.”"

28 Jan 2016-Geographic Expansion

"VOG is fully committed to expanding its business within the African continent. The success of GDC has demonstrated that monetisation can be achieved with the right model in place. The meeting of energy demands is a key building block towards successfully developing robust and stable economies. In 2016 VOG intends to implement a comprehensive strategic plan to target other jurisdictions within Africa."

http://www.victoriaoilandgas.com/investors/news/2016-outlook

banjomick

- 09 Nov 2016 12:48

- 315 of 701

- 09 Nov 2016 12:48

- 315 of 701

Victoria Oil & Gas shares can rise to 50-60p says Zak Mir

11:10 09 Nov 2016

Technical analyst Zak Mir reckons Victoria Oil & Gas plc (LON:VOG) shares can potentially rally from its current level of around 34p up to 50-60p in the coming months.

Mir, in a Tip TV segment for Proactive Investors, highlighted that the chart for the stock shows an extended base of support and he notes that the 200-day moving average presently sits slightly higher at 36p.

He said: “if we can close above that, it should then take the shares back towards the main resistance on the daily chart between 50 and 60 pence for early in 2017.”

banjomick

- 15 Nov 2016 10:01

- 316 of 701

- 15 Nov 2016 10:01

- 316 of 701

banjomick

- 28 Nov 2016 09:18

- 317 of 701

- 28 Nov 2016 09:18

- 317 of 701

Victoria Oil & Gas Plc

Batch Drilling of Two Wells Underway, Cameroon

Gaz du Cameroun S.A. (GDC), the Company's Cameroon gas producing and distributing subsidiary, announces that following spudding of well La-107 on November 1 2016, it has successfully drilled, cased and cemented the uppermost, 18⅝" section of the well to a depth of 400 metres. Operations on La-107 were then suspended as planned and the rig was skidded a distance of 10 metres along the rail system to the La-108 well location. The 1500 HP Komako 1 drilling rig, owned and operated by Savannah Oil Services Cameroon S.A., is a rail-mounted drilling rig and can skid between the two wells in a matter of hours.

Well La-108 was spudded on the 12th November 2016 and has been drilled and cased to a depth of 400 metres. Currently, Savannah is drilling the 17½" hole section on La-108, after which the rig will be skidded back to the La-107 well to drill its 17½" hole section.

The gas bearing target horizons, from which it is anticipated both new wells will produce, are in the Upper Cretaceous (Campanian and Santonian) Logbaba Formation, which is a thick sequence of interbedded sands and shales found at depths between 1,700m and 3,200m below the surface.

Rig Skidding and Batch Drilling

The 2016/17 drilling campaign at Logbaba is designed as a 'batch drilling' operation. As a well is drilled, the equipment, drilling fluids, drilling services and specialist personnel required vary for each hole section. In a batch drilling operation, the rig is moved back and forth between the wells, progressing through all the hole sections until the wells have reached target depth. The Komako 1 rail mounted drilling rig is designed for this type of operation.

Significant cost saving and efficiencies are realised from a batch drilling programme, as materials and services are mobilised to the site, employed on both wells for each hole section and then demobilised when no longer required. In a conventional back-to-back two well drilling campaign the equipment and materials are all mobilised as required for the first well and then all equipment remains on standby rental until it is required again on the second well, three or four months later. With batch drilling the Company avoids having significant amounts of equipment and services on standby for 3 or 4 months between wells.

http://www.moneyam.com/action/news/showArticle?id=5455435

banjomick

- 20 Dec 2016 10:16

- 318 of 701

- 20 Dec 2016 10:16

- 318 of 701

Victoria Oil & Gas Plc

Director/PDMR dealing

Victoria Oil & Gas announces that yesterday Mr Ahmet Dik elected to receive part of his compensation as Chief Executive by subscribing for 697,836 new ordinary shares of 0.5p in the Company ("Ordinary Shares").

The new Ordinary Shares have been issued at 28.66p per share, being the volume weighted average share price for the 5 trading days preceding 29 January 2016, the commencement date of his service agreement. Following this share allotment, Mr Dik will have an interest in a total of 925,787 Ordinary Shares, representing a 0.84% interest in the enlarged issued share capital of the Company.

Application has been made to the London Stock Exchange for the admission of the new Ordinary Shares to trading on AIM ("Admission"). Admission is expected to become effective and dealings in the new Ordinary Shares are expected to commence at 8.00 a.m. on 23 December 2016. Following Admission, the Company will have 110,193,098 Ordinary Shares in issue.

http://www.moneyam.com/action/news/showArticle?id=5468775

banjomick

- 21 Dec 2016 12:55

- 319 of 701

- 21 Dec 2016 12:55

- 319 of 701

Some interesting articles within the December 2016/January 2017 edition of Business in Cameroon:

Some interesting articles within the December 2016/January 2017 edition of Business in Cameroon:

Page 21

BC: Power deficit has always been presented as one of the major barriers to the development of businesses in Cameroon. However, this year, the Lom Pangar dam was filled and in June 2017, that of Memvé’élé, which has a capacity of 200 MW, should start producing.

There is also the 400 MW Natchigal dam for whose construction will begin in 2017. Could we, in sight of all these, say that Cameroon is getting out of the dark?

B: Cameroon’s power deficit is significant and it grows year after year. It is true that, considering the hydropower projects you mentioned, Cameroon is on the right path to reducing its deficit, but it is still far from erasing it. The government must massively invest to expand power production capacities. That should be its priority. In order to accelerate its industrialization, Cameroon immediately needs to achieve a minimal capacity of 4000 to 5000 MW, by 2020.

and the 'Energy' section starts from page 41

banjomick

- 22 Dec 2016 18:45

- 320 of 701

- 22 Dec 2016 18:45

- 320 of 701

Forest Nominees Limited (GC1) is nominee holder for GB Trustees Limited, on behalf of The Framar Trust, G.P. (Jersey) Limited have increased holding from:

4,283,595 to 4,383,595 (4.003%)

http://www.moneyam.com/action/news/showArticle?id=5470917

banjomick

- 23 Dec 2016 08:26

- 321 of 701

- 23 Dec 2016 08:26

- 321 of 701

Victoria Oil & Gas Plc

Thermal Customer Connections and Drilling Update, Cameroon

The Company is pleased to provide an update on both the gas pipeline expansion and ongoing drilling programme in Douala, Cameroon.

Pipeline Extension

Gaz du Cameroun S.A. ("GDC"), the Company's Cameroon gas producing and distribution subsidiary, has successfully completed both the Phase II & Phase III of the Bonaberi pipeline extension programme. GDC has laid a total of 15km of gas pipeline, including spur lines and metering points to seven new customers. Three of the new customers are now consuming gas for thermal applications. The remaining four thermal customers are scheduled to commission their burners during Q1 2017. The estimated consumption from the seven new customers will be 600,000 scf/d.

The Bonaberi extension of the central pipeline is part of the Company strategy to provide gas to the Western industrial area which is becoming a new hub for industrial developments utilising Douala's port, power and road networks. GDC has established itself as an important supplier of energy to industry either through thermal gas supply or via gas to power and had anticipated the Bonaberi growth and will be able to meet the growing gas demand in this area.

Customers currently online or scheduled to be online in January, all using gas for thermal use, include:

· Maya & C Palm oil refinery

· OK Foods Biscuit and sweet manufacturer

· Agrocam Specialists in poultry hatchery, egg and corrugated carton packaging.

· NAYA Food processing

· BATOULA Plastic processing

· BOCOM Car battery recycling and steel products

· Camaco Cocoa processing

Drilling Update

Drilling of wells La-107 and La-108 is continuing and GDC is working with its contractors to make up for the delayed start to drilling primarily due to lightning strikes during rig up.

The Company is pleased to announce that GDC has successfully drilled and cased the 17½" section of La-107 to 1004 m and we are preparing to drill the 12¼" section to 1600m where we will set the 9⅝" production casing prior to drilling the reservoir section in 8½" hole.

The 17½" section of La-108 has also been drilled and cased to 1173m and its 12¼" section will be drilled after the 12¼" section of La-107 is completed.

The 2016/17 drilling campaign at Logbaba is designed around a 'batch drilling' approach. As a well is drilled the equipment, drilling fluids, drilling services and specialist personnel required vary for each hole section. In a batch drilling programme the rig is moved back and forth between the wells, progressing through all the hole sections until the well is completed, which allows for a more efficient and cost effective utilisation of the various services and personnel for each hole section. The Komako 1 rail mounted drilling rig is designed for this type of operation.

The gas bearing target horizons from which it is anticipated both new wells will produce are in the Upper Cretaceous (Campanian and Santonian) Logbaba Formation, which is a thick sequence of interbedded sands and shales found at depths between 1,700m and 3,200m below the surface.

http://www.moneyam.com/action/news/showArticle?id=5470984

banjomick

- 23 Dec 2016 10:38

- 322 of 701

- 23 Dec 2016 10:38

- 322 of 701

VOG has announced that it has successfully completed phases 11 and 111 of the Banaberi pipeline extension. This is 15km of pipe and spur lines giving meters to seven new customers who will take at least 600/- scf/d. The pipeline extends VOG’s reach into the western industrial area and new industrial links. Meanwhile the batch drilling of La-107 and 108 is making up for lost time and has completed the 17 1/2″ sections and is moving to the 12 1/4″. All this is very positive news and when the story gets told early next year may show quite how cheap VOG is…