| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Avanti Communications (AVN)

hlyeo98 - 04 Aug 2010 11:22

This is a BUY tip from Tom Winnifrith...

Sorry if this is rather boring as the market cap is now c 350 million but at 470p Avanti Communications (AVN) - a stock held in the SF t1ps Growth Fund - is really very cheap whichever way you look at it. It is now funded to launch 3 satellites into space ( and fully insured if the worst happens which will only delay the programme by 6 months anyway). You value Avanti by discounting back the net cashflows these satellites will generate. That depends on how much capacity is sold and at what price. Use a model based on very conservative assumptions and this stock is worth 13 ( the lowest valuation in the market). But that model uses assumptions about sales prices which are already being beaten by forward sales Avanti is booking today. Use those prices and you head up to the 22.50 value of house broker Cenkos. My own view is that Avanti will do better still and this stock could therefore be worth 25. Exc itement will mount as the first satellite is launched later this year. Remember those valuations are the Net Present Value of future cashflows ( i.e. what they are worth today). If you can buy at under 600p ( as you can now) you should do so and sit back and wait. I suspect after HYLAS 1 is launched you will never again be able to buy at less than 600p.

Sorry if this is rather boring as the market cap is now c 350 million but at 470p Avanti Communications (AVN) - a stock held in the SF t1ps Growth Fund - is really very cheap whichever way you look at it. It is now funded to launch 3 satellites into space ( and fully insured if the worst happens which will only delay the programme by 6 months anyway). You value Avanti by discounting back the net cashflows these satellites will generate. That depends on how much capacity is sold and at what price. Use a model based on very conservative assumptions and this stock is worth 13 ( the lowest valuation in the market). But that model uses assumptions about sales prices which are already being beaten by forward sales Avanti is booking today. Use those prices and you head up to the 22.50 value of house broker Cenkos. My own view is that Avanti will do better still and this stock could therefore be worth 25. Exc itement will mount as the first satellite is launched later this year. Remember those valuations are the Net Present Value of future cashflows ( i.e. what they are worth today). If you can buy at under 600p ( as you can now) you should do so and sit back and wait. I suspect after HYLAS 1 is launched you will never again be able to buy at less than 600p.

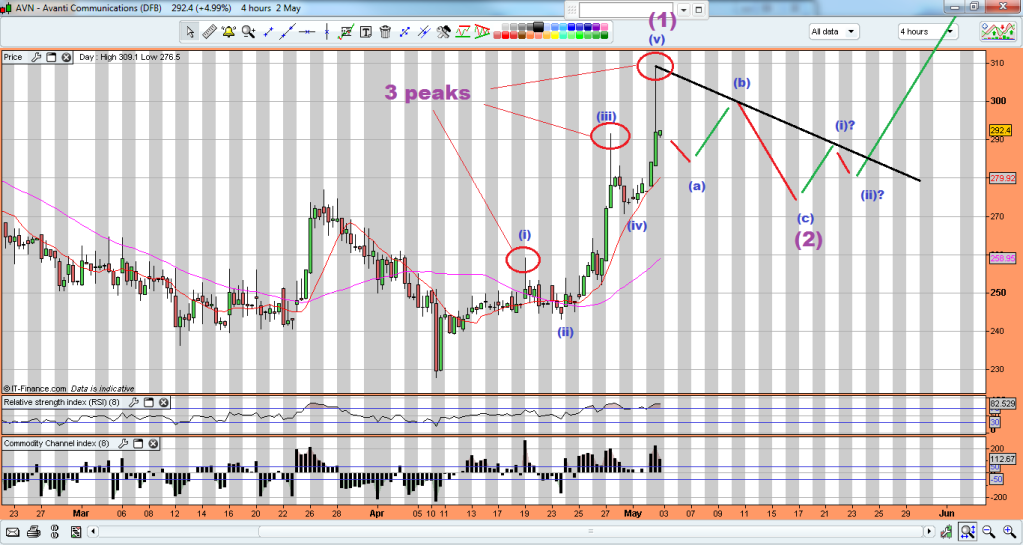

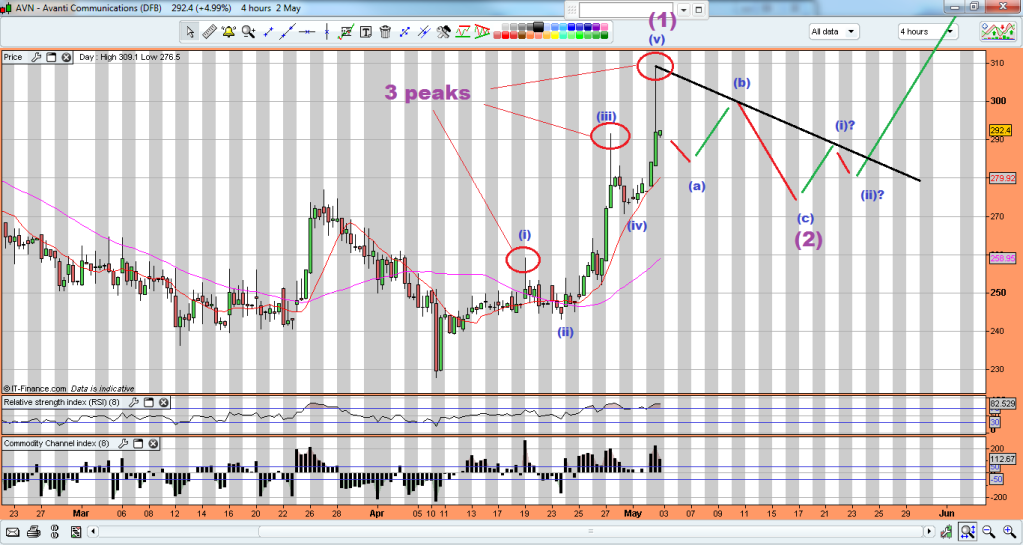

Davai - 02 May 2012 19:17 - 346 of 382

Noticed this one after GF flagged the rise on the 27th. Thought i would post my thoughts on here as its one i will now watch myself. I don't know the first thing about the company so this is purely a charting perspective, but it looks like having completed an impulsive move. I would expect a bit of chop for a few days, while it pulls back correctively in 3 waves where i hope it will form a flagline, look for a minor 'i'&'ii' to confirm the drop has finished and/or a break of the flagline for a big move up to follow.

As i said, purely speculative according to how i see the chart;

As i said, purely speculative according to how i see the chart;

Shortie - 03 May 2012 10:00 - 347 of 382

My long spread off 263 now looking rather nice. 250 support did hold as suspected. I'd add another line to the above chart, 27th March, 27th April joined and through to cross roughly in where (ii)? cross sits. I see this as being the start of the new trend line higher.

ahoj

- 03 May 2012 10:03

- 348 of 382

- 03 May 2012 10:03

- 348 of 382

Are they going to launch another satellite?

Shortie - 03 May 2012 10:08 - 349 of 382

ahoj

- 08 May 2012 10:11

- 350 of 382

- 08 May 2012 10:11

- 350 of 382

I wish I held my shares. Sold 6K at 314 last week!!!

humpback321 - 08 May 2012 10:29 - 351 of 382

Share price continues to advance ahead of second satallite launch 30th. of june.

Shortie - 08 May 2012 11:45 - 352 of 382

Sold at 346, nice profit made.

dreamcatcher

- 15 May 2012 21:35

- 353 of 382

- 15 May 2012 21:35

- 353 of 382

..Questor share tip: Avanti orbit looks inviting as satellite launch approaches

By Garry White | Telegraph – 14 hours ago

Shares in satellite group Avanti Communications have plunged over the past year and many investors are sitting on losses. What should Questor readers do next?

Avanti Communications 313¾p -14 ¼p Questor says BUY

Avanti sells satellite broadband services to telecoms providers, which then resells the service to households and businesses.

The company's first satellite, HYLAS 1, launched in November (Stuttgart: A0Z24E - news) 2010, is the first superfast broadband satellite launched in Europe (Chicago Options: ^REURUSD - news) .

Avanti's second satellite, called HYLAS 2, is fully funded and is scheduled for launch in the next few months. This satellite will extend Avanti's coverage to Africa and the Middle East.

The third satellite, HYLAS 3, is currently in the design phase, but this is also fully funded to launch.

Things have been going reasonably well at the group as a trading update released yesterday showed but the shares took a bath last year on negative sentiment.

The company was subject to what is known as a "bear raid". A high profile City player took a significant short position in the shares and then proceeded to make this fact known to the market.

Also last year, broker Numis had to issue an apology after publishing misleading statements about the group relating to contracts signed with clients.

"Numis has raised doubts about the contract Avanti Communications has signed with TigrisNet in widely distributed emails and conversations. Numis apologises if the previous communication led to a misunderstanding," the City broker said.

Unfortunately, mud sticks. This sort of thing can become a self-fulfilling prophecy and the share price has sunk. However, what is more important now is the future.

The company has undertaken a fund-raising and needs to raise no more cash to complete its launch plans. Indeed, at the interim stage Avanti had £26m of cash on its balance sheet. The launch of HYLAS 2, which will happen in a 30-day window from June 30, should be the next positive catalyst going forward. The group also plans to move from Aim to a full listing next year.

Avanti confirmed that in the four-month period to April 30 it had added £42.3m of backlog. These are contracts signed for bandwidth on both HYLAS 1 and 2. This brought the total backlog to £213m and Avanti said its pipeline of potential sales stood at £529m.

The company needs to make about £11m of sales each month to meet its target of filling capacity on HYLAS 1 by 2014 and HYLAS 2 by 2016. The figures indicate it is on track to do just that.

The company is currently loss-making, but it is expected to move into profit next year, with earnings rising quickly thereafter. The 2013 multiple is a very heady 163 times, but this falls to 9.3 in 2014 and just 4.4 in 2015.

The shares were first recommended on January 8, 2010, at 467½p and they are now down 33pc compared with a market up 1pc. The shares have drifted from a high of 735p. Questor noted that the investment could be very volatile and it was "not one on which to bet the farm" and that view still stands. The shares are now looking pretty cheap, should the group manage to fill all of its satellites. City analysts have some pretty punchy targets, with the average of the three analysts monitored by Bloomberg being £16.50, a staggering 430pc above the current levels.

Questor maintains a buy stance and looks forward to the launch of HYLAS 2 as the next major catalyst.

..

By Garry White | Telegraph – 14 hours ago

Shares in satellite group Avanti Communications have plunged over the past year and many investors are sitting on losses. What should Questor readers do next?

Avanti Communications 313¾p -14 ¼p Questor says BUY

Avanti sells satellite broadband services to telecoms providers, which then resells the service to households and businesses.

The company's first satellite, HYLAS 1, launched in November (Stuttgart: A0Z24E - news) 2010, is the first superfast broadband satellite launched in Europe (Chicago Options: ^REURUSD - news) .

Avanti's second satellite, called HYLAS 2, is fully funded and is scheduled for launch in the next few months. This satellite will extend Avanti's coverage to Africa and the Middle East.

The third satellite, HYLAS 3, is currently in the design phase, but this is also fully funded to launch.

Things have been going reasonably well at the group as a trading update released yesterday showed but the shares took a bath last year on negative sentiment.

The company was subject to what is known as a "bear raid". A high profile City player took a significant short position in the shares and then proceeded to make this fact known to the market.

Also last year, broker Numis had to issue an apology after publishing misleading statements about the group relating to contracts signed with clients.

"Numis has raised doubts about the contract Avanti Communications has signed with TigrisNet in widely distributed emails and conversations. Numis apologises if the previous communication led to a misunderstanding," the City broker said.

Unfortunately, mud sticks. This sort of thing can become a self-fulfilling prophecy and the share price has sunk. However, what is more important now is the future.

The company has undertaken a fund-raising and needs to raise no more cash to complete its launch plans. Indeed, at the interim stage Avanti had £26m of cash on its balance sheet. The launch of HYLAS 2, which will happen in a 30-day window from June 30, should be the next positive catalyst going forward. The group also plans to move from Aim to a full listing next year.

Avanti confirmed that in the four-month period to April 30 it had added £42.3m of backlog. These are contracts signed for bandwidth on both HYLAS 1 and 2. This brought the total backlog to £213m and Avanti said its pipeline of potential sales stood at £529m.

The company needs to make about £11m of sales each month to meet its target of filling capacity on HYLAS 1 by 2014 and HYLAS 2 by 2016. The figures indicate it is on track to do just that.

The company is currently loss-making, but it is expected to move into profit next year, with earnings rising quickly thereafter. The 2013 multiple is a very heady 163 times, but this falls to 9.3 in 2014 and just 4.4 in 2015.

The shares were first recommended on January 8, 2010, at 467½p and they are now down 33pc compared with a market up 1pc. The shares have drifted from a high of 735p. Questor noted that the investment could be very volatile and it was "not one on which to bet the farm" and that view still stands. The shares are now looking pretty cheap, should the group manage to fill all of its satellites. City analysts have some pretty punchy targets, with the average of the three analysts monitored by Bloomberg being £16.50, a staggering 430pc above the current levels.

Questor maintains a buy stance and looks forward to the launch of HYLAS 2 as the next major catalyst.

..

3 monkies - 15 May 2012 21:49 - 354 of 382

These have been a load of crap since BMD recommeded them or was it RHPS would not go down that road. If BT or Virgin cannot sort me out what chance has anyone else got with wratallites in the air.

humpback321 - 15 Jun 2012 11:05 - 355 of 382

Get onboard for 30th. June launch. Will go into orbit [satallite and price] unless the rocket,s a dud [insured]. watch the spreads, changes hour to hour,from 20p.+ to 1p. 5000 shares usual max. to buy.

humpback321 - 27 Jun 2012 08:00 - 356 of 382

Launch date 2nd. august.

humpback321 - 03 Jul 2012 13:01 - 357 of 382

On the move.

humpback321 - 02 Aug 2012 22:07 - 358 of 382

Liftoff. Successful launch.

Shortie - 04 Oct 2012 12:24 - 359 of 382

Moving back to the lower end of its range, worth another punt I reckon.

skinny

- 04 Oct 2012 12:29

- 360 of 382

- 04 Oct 2012 12:29

- 360 of 382

Cue Dil - stage left.

Shortie - 05 Oct 2012 09:24 - 361 of 382

Notice of full year results and HYLAS2 update

London - 5 October 2012. Avanti Communications Group plc (AIM: AVN, "Avanti"), the satellite operator, will announce its full year results for the year ended 30 June 2012 on Wednesday 10 October 2012.

Avanti will also update the market on the launch of service of HYLAS2.

London - 5 October 2012. Avanti Communications Group plc (AIM: AVN, "Avanti"), the satellite operator, will announce its full year results for the year ended 30 June 2012 on Wednesday 10 October 2012.

Avanti will also update the market on the launch of service of HYLAS2.

Shortie - 10 Oct 2012 10:31 - 362 of 382

Avanti Communications Group plc

Preliminary Results Announcement

London - 10 October 2012. Avanti Communications Group plc (AIM: AVN, "Avanti" or "the Company"), the satellite operator, has published today its unaudited preliminary results for the year ended 30 June 2012.

Operational Highlights

· Announcement today that HYLAS 2 has entered service, open for business on all beams

· 22% more capacity available for sale than originally expected due to technical successes (11GHz versus 9GHz)

· HYLAS 3 fully financed and under construction for launch in 2015

Financial Highlights

· Revenues and Other Operating Income increased by 246% to £15.0 million (2011: £6.1 million)

· Cash at year end of £76.7 million

· Backlog increased by 57% to £268 million

· Strong sales momentum - the average monthly target of £11m new Backlog continues to be achieved

· Although the phasing of Backlog is more back-ended than expected, existing satellites are expected to be full at current run rate in 2016

Commenting, John Brackenbury, CBE, Avanti Chairman said:

"This has been a year of very strong growth for Avanti. The momentum of launching our second satellite in as many years to expand coverage to a total of 53 countries has created very significant demand. This is now evidenced in our contract backlog which grew by 57% in the year. Within the emerging markets that Avanti serves our flexible and resilient technology is winning business from customers who urgently need reliable, high quality communications.

"The formal launch of service today on HYLAS 2 over Africa and the Middle East gives us access to markets showing high economic and structural growth in demand for telecoms services. We look forward to the continued development of Avanti with growing confidence."

Preliminary Results Announcement

London - 10 October 2012. Avanti Communications Group plc (AIM: AVN, "Avanti" or "the Company"), the satellite operator, has published today its unaudited preliminary results for the year ended 30 June 2012.

Operational Highlights

· Announcement today that HYLAS 2 has entered service, open for business on all beams

· 22% more capacity available for sale than originally expected due to technical successes (11GHz versus 9GHz)

· HYLAS 3 fully financed and under construction for launch in 2015

Financial Highlights

· Revenues and Other Operating Income increased by 246% to £15.0 million (2011: £6.1 million)

· Cash at year end of £76.7 million

· Backlog increased by 57% to £268 million

· Strong sales momentum - the average monthly target of £11m new Backlog continues to be achieved

· Although the phasing of Backlog is more back-ended than expected, existing satellites are expected to be full at current run rate in 2016

Commenting, John Brackenbury, CBE, Avanti Chairman said:

"This has been a year of very strong growth for Avanti. The momentum of launching our second satellite in as many years to expand coverage to a total of 53 countries has created very significant demand. This is now evidenced in our contract backlog which grew by 57% in the year. Within the emerging markets that Avanti serves our flexible and resilient technology is winning business from customers who urgently need reliable, high quality communications.

"The formal launch of service today on HYLAS 2 over Africa and the Middle East gives us access to markets showing high economic and structural growth in demand for telecoms services. We look forward to the continued development of Avanti with growing confidence."

ahoj

- 12 Oct 2012 13:01

- 363 of 382

- 12 Oct 2012 13:01

- 363 of 382

Why has it been falling recently?

Shortie - 12 Oct 2012 13:50 - 364 of 382

Increased backlog plus reduced cash (preliminary results show pre-tax loss growing), theres only so much premium investors will pay over net worth. Once the backlog is reduced and AVN moves to the main market it'll generate interest inline with its peers. Its a volitile waiting game though at the moment, buy on the dips and sell on the ups is what most investors including myself are currently doing 260 buy, 300 sell unless momentum is strong.

humpback321 - 12 Oct 2012 14:10 - 365 of 382

What to do? hold? and wait a year or so to even out or sell and move on?