| Home | Log In | Register | Our Services | My Account | Contact | Help |

Victoria Oil & Gas-The Information & News Thread (VOG)

banjomick

- 07 Jan 2015 21:01

- 07 Jan 2015 21:01

Victoria Oil & Gas Plc (Victoria) has become a significant domestic energy supplier in Africa through its wholly owned subsidiary: Gaz du Cameroun S. A. (GDC).

With operations located in the industrial port-city of Douala, Cameroon, customers are converting their operations to take natural gas supplied by our production wells and pipeline infrastructure.

GDC is the sole gas supplier in the area, providing a cheaper, more efficient, reliable, and cleaner energy alternative to Heavy Fuel Oil use.

Our teams of engineering advisors are on hand to help customer’s cost and implement the change to GDC’s energy products.

Victoria Oil & Gas is traded in the NEX Exchange HERE

Link-HISTORICAL NEWS,VIDEO/AUDIO & EVENTS

Link-Dedicated Posts for:

Gaz du Cameroun S.A. (“GDC”)

Gaz Du Cameroun Matanda S.A. ("GDC Matanda")

Link-Cameroon-Industrialisation Master Plan (PDI) & Africa Energy

NEWS

21st Jan 2019 Production Update

17th Jan 2019 Q4 2018 Operations Update

02nd Jan 2019 Presidential Decree on Matanda Received

24th Dec 2018 Renewal of Long-Term Gas Supply Contract with ENEO

28th Sep 2018 INTERIM FINANCIAL REPORT FOR THE SIX MONTHS ENDED 30 JUNE 2018

17th Aug 2018 Q2 2018 Operations Update

22nd Jun 2018 Report and Accounts to 31 December 2017

14th Jun 2018 Restructure of the BGFI Debt Facility

04th Jun 2018 Notice of Annual General Meeting

04th June 2018 Logbaba Field Reserves Update

24th May 2018 Q1 2018 Operations and Outlook

16th Feb 2018 Q4 17 Operations Update & 2018 Outlook Replacement

05th Jan 2018 Gas Supply Contract with ENEO Not Extended

VIDEO/AUDIO

21st Jan 2019 Victoria Oil & Gas looks ahead to increased cash flow

24th Aug 2018 Victoria Oil & Gas confident of resolving ENEO contract 'within weeks'

22nd Apr 2018 Video from 21/04/2018 UK Investor Show

16th Feb 2018 Victoria Oil & Gas confident of positive outcome to ENEO issue

08th Nov 2017 Victoria Oil & Gas reports very pleasing initial results from La-108

31st Oct 2017 21 Oil and Gas - African Power Panel

30th Oct 2017 121 Oil & Gas Investment

26th Oct 2017 Victoria Oil & Gas raises US$23.5mln to accelerate new growth programme

26th Sep 2017 Victoria Oil & Gas to finalise long term supply contracts after first gas at LA-107

17th Aug 2017 Victoria Oil & Gas expecting La-107 to be a 'substantial' producer

16th Apr 2017 Video from 01/04/2017 UK Investor Show

13th Apr 2017 'It's been a terrific year and a great quarter', says Victoria Oil & Gas' Kevin Foo

06th Mar 2017 Farm-out deal 'a really good strategic move' for Victoria Oil & Gas, says chairman Kevin Foo

06th Feb 2017 Chairman runs Proactive through the good start to 2017

EVENTS

28th Jun 2018 Annual General Meeting ("AGM")

10th May 2018 Africa Oil & Power Investor Forum-London

21st Apr 2018 UK Investor Show

11th-12th Apr 2018 Africa Investment Exchange: Gas (AIX: Gas 2018)-London

09th-10th Nov 2017 The Cameroon Investment Forum(CIF)-Cameroon

30th-31st Oct 2017 121 Oil & Gas Investment-London

23rd-27th Oct 2017 Africa Oil Week 2017-Cape Town South Africa

07th Sep 2017 One2One Investor Forum - London

05th Sep 2017 Oil Capital Conference-London

28th Jun 2017 Annual General Meeting

01st Apr 2017 UK Investor Show

9th Feb 2017 Presentation slide show for One2One

9th Feb 2017 One2One Investor Forum - London

Social Media

banjomick

- 28 Jun 2017 08:03

- 439 of 701

- 28 Jun 2017 08:03

- 439 of 701

28 Jun 2017

La-107 and La-108, next to the existing operation on the Logbaba production site, found a combined 135 metres net gas pay, which exceeded expectations.

Victoria Oil & Gas plc (LON:VOG) chief executive Ahmet Dik described as “very positive” the results from two new wells it is drilling at a site outside Cameroon’s second city, Douala.

La-107 and La-108, next to the existing operation on the Logbaba production site, found a combined 135 metres net gas pay, which exceeded expectations.

To put this latest data into context, the original producing well, La-105, found 54 metres of gas-bearing sands.

READ: Our Big Picture overview of VOG

La-107 has so far tapped into a section measured at 35 metres; however work is ongoing and this is expected to expand the net pay as the drill-bit nudges into the Lower Logbaba sands.

The Upper Logbaba is described as host to high permeability, high porosity sands, which should make it reasonably straightforward to flow gas.

La-108 uncovered 100 metres of net pay. A side-track planned for the well was deferred to allow La-107 to be drilled. Once this well has been completed the rig will be ‘skidded’ back to La-108 site for the side-track.

CEO Dik was full of praise for his team: “This is a challenging drilling program, with two deep, high-pressure, high-temperature wells that have been slow and expensive to drill.

“Our drilling team have worked tirelessly to drill below 2,000 metres, a depth where only a handful of wells have been successfully drilled in the Douala Basin."

VOG said completion of both wells will take place in the third quarter. It also revealed estimates demand for gas in Douala, where it supplies local businesses who use it to generate electricity, to be 150mln standard cubic feet per day.

http://www.proactiveinvestors.co.uk/companies/news/179948

banjomick

- 28 Jun 2017 09:28

- 440 of 701

- 28 Jun 2017 09:28

- 440 of 701

4 minutes ago

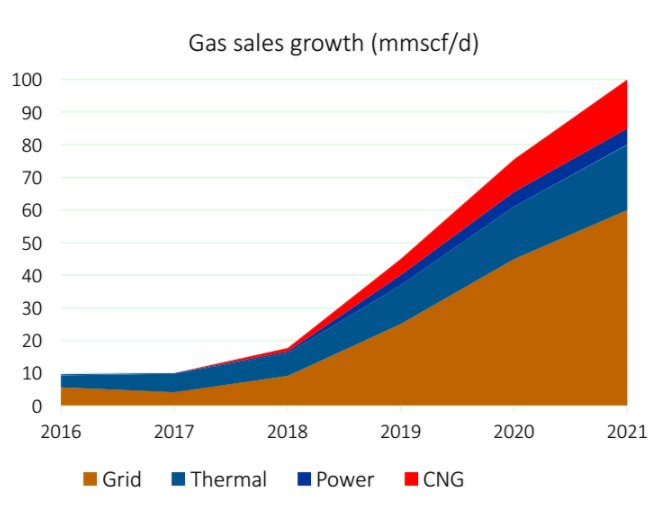

GDC aims to meet 100 mmscf/d gross

https://twitter.com/victoriaoilgas

This chart was first shown 9th Feb 2017 Presentation slide show for One2One

banjomick

- 28 Jun 2017 14:04

- 441 of 701

- 28 Jun 2017 14:04

- 441 of 701

Victoria Oil & Gas

A welcome drilling update from Logbaba which is very encouraging, drilling here is by its very nature slow and expensive but in more ways than one, groundbreaking. So far VOG has discovered net sands of 100m in La-108 and 35m in La-107 which has already ‘exceeded expectations’ with more drilling to come that should increase net pay. For La-107 a 300m high pressure flowline has been built (which was under way on my recent visit to site) and will deliver to the gas processing plant. After various consultations, La-108 is ready to side-track and after work is completed at La-107 the rig will be skidded back there and both wells are expected to complete 3Q 2017. The key now is in getting all the gas ‘behind the pipe’ and ready for production in the next quarter.

I know that I have been banging on about VOG and its potential market but this must not be underestimated, with demand in Douala alone of 150 mmscf/d the company is in a very strong position indeed. This drilling programme has indeed been long and expensive but it is incredibly rewarding. Assuming a new long term deal with ENEO, and the signing up with the plethora of industrial clients, some of which we met on the visit, the gas that will now be delivered from Logbaba will be truly value added. Combine that with potential future supplies from Bomono, which will also service the ever growing Douala and you have a true utility with a massive opportunity in Cameroon and beyond. The stock is way too cheap in my view.

banjomick

- 28 Jun 2017 14:07

- 442 of 701

- 28 Jun 2017 14:07

- 442 of 701

Victoria Oil & Gas Plc

Result of Annual General Meeting ("AGM")

Victoria Oil and Gas Plc, is pleased to announce that, at the AGM of the Company held this morning, all of the resolutions that were proposed in the Notice of Annual General Meeting which was sent to shareholders, dated 25 May 2017, were duly passed.

The presentation, given by Mr Dik, CEO, is available on the Company website www.victoriaoilandgas.com.

Direct link to presentation:

http://www.victoriaoilandgas.com/sites/default/files/presentations/170628%20VOG%20AGM%20Presentation%20FINAL.pdf

banjomick

- 03 Jul 2017 09:25

- 443 of 701

- 03 Jul 2017 09:25

- 443 of 701

The staff takes control of 5% of the capital of the Cameroonian electrician Eneo

Monday, 03 July 2017

(Investing in Cameroon) - Since June 9, 2017, Eneo, an electricity company controlled by the British investment fund Actis, has officially sold 5% of its share capital to its employees, as stipulated in the concession agreement of Electricity utility in Cameroon in 2001. The information was revealed by the company and the trade union leaders during a press conference held in Douala on 30 June.

The negotiations leading to this transaction began in May 2015, when the concession holder of the electricity utility in Cameroon had made a new proposal for a 5% retrocession scheme for the capital of the company Employees. This decision had the gift of appeasing the fears of the staff representatives, fears that had occurred days after the takeover, at the end of 2013, of 100% of the assets of the American AES by the fund Actis , Within this power company.

At the time of the announcement of the departure of AES, the trade unions of the electricity sector had invited the Cameroonian authorities to pay particular attention to the transfer of 5% of the capital of the company to the staff, before Give the right to the transaction between AES and the Actis fund.

This request was based on the fact that since the acquisition of control of the national electricity company of Cameroon by the American AES in 2001, the concessionaire never transferred to the personnel 5% of the 56% of the shares of the company, As provided for in the concession contract.

Thanks to the repair of this damage by the Eneo managers, the geography of the capital of the concessionaire of the electricity utility in Cameroon now accounts for 44% of assets for the Cameroonian state, 51% for the British investment fund Actis, and 5% for staff.

http://www.investiraucameroun.com/entreprises/0307-9088-le-personnel-prend-le-controle-de-5-du-capital-de-l-electricien-camerounais-eneo

banjomick

- 04 Jul 2017 09:55

- 444 of 701

- 04 Jul 2017 09:55

- 444 of 701

Victoria Oil & Gas Plc

("VOG" or "the Company")

Update on Logbaba Participation Agreement and Bomono Project

SNH Participation in Logbaba

Victoria Oil & Gas is pleased to announce that Societe Nationale des Hydrocarbures ("SNH"), RSM Production Company ("RSM") and Gaz du Cameroun S.A. ("GDC") have agreed and signed a Participation Agreement that will govern the relationship of the parties going forward on the Logbaba Project (the "Project").

Project participation, prior to the Participation Agreement, was split GDC 60% and RSM 40%. The Participation Agreement formalises the participation of SNH, acting on behalf of the Republic of Cameroon, alongside GDC and RSM. The Participation Agreement follows SNH exercising its right to participate in 5% of the Project and, accordingly, Project participation as a result of the execution of the Participation Agreement will be split GDC 57%, RSM 38% and SNH 5%.

SNH is entitled to a 5% share of revenues from the sale of all hydrocarbons from the Project and is also liable for 5% of exploitation costs of the Project. The parties have agreed, in accordance with the Participation Agreement, for SNH to conduct an audit of the exploitation costs for the Project to determine the Participation settlement.

Bomono

Victoria Oil & Gas Plc today announces that it has exercised its option to extend the termination date of the farm-out agreement ("Farm-out") with Bowleven Plc ("Bowleven") relating to the Bomono production sharing contract. The termination date has been extended to 28 September 2017. Bowleven and VOG wish to pursue the Farm-out and are working with the Government of Cameroon to progress the Bomono project.

Full terms of the Farm-out can be found on the RNS announcement of 6th March 2017 made by Bowleven and VOG.

Ahmet Dik, CEO, said; "I am delighted that we can now formally share our energy success story on a commercial basis with the Cameroon Government. The Cameroon Government has supported and set the conditions by which GDC has been able to operate and invest in excess of US$250m, and encouraged new investors into Douala to establish their businesses. Our team looks forward to building on the excellent working relationship we have with the SNH team and I thank and extend my gratitude to Mr Adolphe Moudiki, Executive General Manager of SNH for the contribution SNH has made to the oil and gas sector in Cameroon.

http://www.moneyam.com/action/news/showArticle?id=5579105

banjomick

- 04 Jul 2017 23:27

- 445 of 701

- 04 Jul 2017 23:27

- 445 of 701

04 Jul, 2017

(ShareCast News) - Cameroon's state hydrocarbon company decided to tap directly into Victoria Oil&Gas's Logbaba project, exercising its right to take a stake via a participation agreement.

The deal formalised SNH's involvement on behalf of the government of Cameroon alongside Gaz du Cameroun, Victoria's wholly-owned subsidiary, and RSM production company in the Logbaba on shore gas project.

Under the terms of the agreement, Victoria would have a 57% interest in the sale of all hydrocarbons from Logbaba, compared to 60% previously, with RSM entitled to 38% and SNH to 5%.

Following an audit of the exploitation costs, SNH would also have to compensate its partners for a part of the funds invested thus far.

"The Cameroon Government has supported and set the conditions by which GDC has been able to operate and invest in excess of US$250m, and encouraged new investors into Douala to establish their businesses," said Ahmet Dik, Victoria's chief executive officer.

Analysts at Shore Capital concurred, telling clients they expected commercial state participation in Logbaba to be "very supportive" of further development of the flagship project.

GDC was supplying gas from Logbaba to businesses in Douala, Cameroon's main business hub, via an integrated gas supply network.

According to Victoria, those supplies were not only cost effective, reliable, safe and cleaner than liquid fuel alternatives, they also provided the entire economy of Cameroon with stable energy.

In the same announcement, VOG confirmed it had chosen to extend the termination date of its farm-in agreement with rival Bowleven for the Bomono project to late September 2017.

ShoreCap described Bomono as "highly accretive and provides an excellent strategic fit for VOG as the company consolidates its dominant position in the Douala region".

Dik, expressed excitement about the deal reached with SNH, saying "I am delighted that we can now formally share our energy success story on a commercial basis with the Cameroon Government".

"Our team looks forward to building on the excellent working relationship we have with the SNH team and I thank and extend my gratitude to Mr Adolphe Moudiki, Executive General Manager of SNH for the contribution SNH has made to the oil and gas sector in Cameroon".

http://www.hl.co.uk/shares/aim-and-small-cap-news/aim-bulletin/cameroon-takes-stake-in-victoria-oil-and-gass-logbaba-project

banjomick

- 06 Jul 2017 08:42

- 446 of 701

- 06 Jul 2017 08:42

- 446 of 701

22 seconds ago

‘VOG share price continues to rise for the second day of sustained buying ahead of the companies gas supply expansion programme’

https://twitter.com/victoriaoilgas

banjomick

- 10 Jul 2017 09:18

- 447 of 701

- 10 Jul 2017 09:18

- 447 of 701

Victoria Oil & Gas Plc ("VOG" or "the Company")

Purchase of shares by Directors and change in PDMR Shareholdings

Victoria Oil & Gas Plc announces that the following Directors of the Company have bought shares in the Company through the London Stock Exchange:

1. Kevin Foo

2. Ahmet Dik

3. Andrew Diamond

4. John Bryant

5. Iain Patrick

***See link below for full details***

http://www.moneyam.com/action/news/showArticle?id=5582441

banjomick

- 14 Jul 2017 08:58

- 448 of 701

- 14 Jul 2017 08:58

- 448 of 701

Victoria Oil & Gas Plc ("VOG" or "the Company")

Purchase of shares by Director and change in PDMR Shareholding

Victoria Oil & Gas Plc announces that Ahmet Dik, Director of the Company has bought shares in the Company through the London Stock Exchange as follows:

Bought 19,220

Total 948,749 (0.86%)

http://www.moneyam.com/action/news/showArticle?id=5585744

banjomick

- 14 Jul 2017 10:56

- 449 of 701

- 14 Jul 2017 10:56

- 449 of 701

Supporting your businesses and market entry is core to our activities. Enter Central Africa's “wild heart” and get access to the energy stakeholders!

The Regional Integration could save up to 33 billion per annum. The region posseses the highest hydro potential in Africa and 60% of the continent resources. DRC, CAR and Gabon have a large mining sector which is highly dependant on electricity.

Precarious access: 12,5kw per person versus 17,3Kw per person on the continent

Regional projects planned by the PEAC:

Inga/Cabinda/Pointe Noire interconnection project

Cross border electrification project PPET (phase 2)

Interconnection of grids between Chad and Cameroon (financed by BAD)

Hydro project in Dimoli (financed by BDEAC)

http://www.future-energy-centralafrica.com/whyinvestincentralafrica

banjomick

- 20 Jul 2017 14:20

- 450 of 701

- 20 Jul 2017 14:20

- 450 of 701

Jocelyne NDOUYOU-MOULIOM | 19-07-2017 16:45

https://www.cameroon-tribune.cm/articles/10353/fr/

banjomick

- 24 Jul 2017 19:32

- 451 of 701

- 24 Jul 2017 19:32

- 451 of 701

http://www.businessincameroon.com/pdf/BC53.pdf

maestro - 24 Jul 2017 23:48 - 452 of 701

banjomick

- 26 Jul 2017 14:32

- 453 of 701

- 26 Jul 2017 14:32

- 453 of 701

FEATURE-Cameroon's forest people pay price for country's hydropower ambitions

July 26, 2017

http://uk.reuters.com/article/cameroon-hydropower-forest-idUKL5N1KF487

banjomick

- 31 Jul 2017 10:02

- 454 of 701

- 31 Jul 2017 10:02

- 454 of 701

31 Jul 2017

Victoria Oil & Gas Plc, a Cameroon based gas producer and distributor, is pleased to provide an update on the Group's operations for the three months ended 30 June 2017.

Highlights

Production

.11.9% increase in gross average gas production from Logbaba to 14.59mmscf/d (Q2 2016: 13.04mmscf/d)

.Gross Logbaba gas sales increased to 1,192mmscf for the quarter (Q2 2016: 1,151mmscf)

Drilling new wells

.Completion, flow testing and network supply input at well La-107 is scheduled for Q3 2017

.Well La-107, as of 30 July 2017, has been drilled to 2914m Measured Depth (“MD”), and 2901m Total Vertical Depth (“TVD”) and a 7” liner has been run to 2,440m (2,426m TVD) and cemented in place

.Well La-107 has, to date, encountered a net pay of 35m of high permeability, high porosity gas bearing sands in the Upper Logbaba Formation, slightly more than was expected, based on the La-104 logs. Preliminary results indicate that a further 15m of net gas sand has been encountered in La-107 in the Lower Logbaba Formation

.Engineering design work has been completed to allow La-108 to be side-tracked, through the Logbaba Formation, to access the 100m of gas sands found in the original La-108 wellbore. Drilling will commence after the completion of La-107

Financial highlights

Q2 (unaudited) financial highlights:

$7.8 million net revenue (Q1 2017: $8.1million)

$7.6 million cash position at quarter end (Q1 2017: $10.5 million)

$20.7 million net debt position at quarter end (Q1 2017: $10.7 million)

5% Cameroonian State participation in Logbaba; 3% relinquished by Gaz du Cameroun S.A. (“GDC”)

Ahmet Dik, Chief Executive Officer of VOG, commented:

“I am pleased that in this period we delivered further positive drilling results, particularly from La-107. The detection of an additional 15m of gas-bearing reservoir sands in the Lower Logbaba and the planned production flow testing at La-107 are encouraging signs as we take the first steps towards our longer-term objective of producing 100mmscf/d.

Once we flow test La-107, VOG plans to enter into long term gas supply agreements with large offtake customers.

The onshore field development programme at Matanda is progressing well, presenting VOG with an exciting opportunity to develop gas supply for sale from sources with low capex exposure.”

Operational update

The quarterly gross and net gas and condensate consumptions, for Logbaba and GDC, are as follows; amounts in bold are gas and condensate sales attributable to GDC*:

****See Link Below****

http://www.victoriaoilandgas.com/investors/news/q2-2017-operations-update

banjomick

- 31 Jul 2017 10:04

- 455 of 701

- 31 Jul 2017 10:04

- 455 of 701

Logbaba Drilling Programme

At the end of Q2 2017, a 7” liner was run and cemented in well La-107 at 2,440m MD (2,426m TVD). Post period end, La-107 has continued drilling in a 6” hole from the 7” liner shoe to a current depth as of 30 July 2017 of 2914m MD.

As previously announced Well La-107 has, so far, encountered a net pay of 35m of high permeability, high porosity gas bearing sands in the Upper Logbaba Formation, slightly more than was expected based on the La-104 logs.

In the La-107 6” hole section that is currently being drilled through the Lower Logbaba Formation, preliminary LWD (Logging While Drilling) data indicates that approximately 15m of net gas sand has been encountered.

The drilling programme has taken longer than expected due to the problems encountered in well La-108. First well completion, at well La-107, is targeted for Q3 2017 with flow testing and tie in to the process plant scheduled at the same time.

Following commercial completion of La-107, sidetrack drilling will recommence at La-108 where approximately 100m of net gas-bearing sands have been encountered between the top of the Logbaba Formation at 1,670m TVD and at 2,702m TVD. This programme will allow the Company to bring gas online imminently for sale from La-107 and then develop further capacity from La-108.

ENEO and Power Consumer Update

During the quarter, the Company announced that it had extended the current gas supply agreement with ENEO Cameroon S.A. (“ENEO”), the Cameroon energy joint venture between UK Group Actis and the Cameroon Government, until 31 December 2017.

The parties are currently developing the technical and financial elements of a long-term gas supply arrangement aimed at increasing the current contractual power supply of 50MW to beyond 100MW.

The take-or-pay components will remain in place and until year end; an interim gas price of US$7.50/mmbtu has been agreed. GDC estimates demand for gas in Douala at around 150mmscf/d, and supply is limited to what GDC can produce. Once the La-107 flow test is complete, the Company is confident it will execute a number of long term- high volume gas supply agreements with local companies.

Participation Agreement

As announced on 4 July 2017, the Company entered into a Participation Agreement, enabling SNH to take up a 5% participating interest in the Logbaba Project.

As a result, with effect from 12 June 2017 the Group’s participating interest has reduced from 60% to 57% to accommodate SNH’s interest.

Matanda Exploration Update (75% participating interest and operator)

Work continues on definition and evaluation of the on-block prospect inventory. The work will form the basis of a drilling campaign, with an objective to commence drilling operations during Q4 2018 / Q1 2019.

Analyses conducted during the quarter have led the Subsurface Team, in conjunction with Management, to prioritise the drilling of shallower, lower pressure targets than those in Logbaba. The ability to unlock long term gas supply from this substantial block with reduced capital and operational expenditure is significant and an exciting prospect for the Company.

Sam Metcalfe, the Company's Subsurface Manager has reviewed and approved the technical information contained in this announcement.

http://www.victoriaoilandgas.com/investors/news/q2-2017-operations-update

banjomick

- 31 Jul 2017 12:22

- 456 of 701

- 31 Jul 2017 12:22

- 456 of 701

Victoria Oil & Gas Plc

("VOG" or "the Company")

Confirmation of Reduction of Capital

Victoria Oil & Gas Plc, a Cameroon energy utility, is pleased to announce that the Court has made an order approving the reduction of the Company's capital, under the Companies Act 2006, (the "Reduction of Capital") at a hearing on 26 July 2017.

Details of the Reduction of Capital were set out in the circular to shareholders, dated 25 May 2017, and the proposal was approved by shareholders at the Company's Annual General Meeting held on 28 June 2017.

The order of the Court and statement of capital have been delivered to and registered by the Registrar of Companies on 28 July 2017.

The Reduction of Capital is now effective, the result of which is the cancellation of all issued deferred shares in the capital of the Company and the cancellation of the Company's share premium account.

The Reduction of Capital does not change the number of issued ordinary shares of 0.5 pence each in the capital of the Company, which remains at 110,571,762.

http://www.moneyam.com/action/news/showArticle?id=5606902

banjomick

- 31 Jul 2017 13:41

- 457 of 701

- 31 Jul 2017 13:41

- 457 of 701

Quarterly update time from VOG and things continue to go well across the board, Logbaba gas production had a good quarter, up 11.9% to 14.59 mmscf/d. At La-107 net pay of 35m of high permeability, high porosity gas bearing sands in the Upper Logbaba Formation was slightly better than expected whilst a further 15m of net gas sand has been encountered in the Lower Logbaba Formation. After drilling has been completed here they are going to do the sidetrack on La-108 to access the 100m of gas sands in the original 108 wellbore.

Finances are good despite the cost overrun talked about last time, $7.8m net revenue, $7.6m of cash and $20.7m of net debt as predicted after the recent delay. After La 107 has been flow tested, VOG plans to enter into a number of long-term GSA’s with large offtake customers whilst continuing to supply ENEO under the take or pay agreement. Longer term it is envisaged that an agreement can be reached ‘increasing the current contractual power supply of 50MW to beyond 100MW’. On my recent visit to Cameroon and GDC, I was particularly impressed not just by the ENEO potential but the way that significant customers in Douala are coming to rely on gas from VOG. Finally the company report that the onshore field development work at Matanda is progressing well, saying that there is an “exciting opportunity to develop gas supply for sale from sources with low capex exposure.” I remain convinced that VOG is not yet properly judged by the market and should be back to the 80p high and then some.

http://www.malcysblog.com/2017/07/oil-price-victoria-oil-gas-premier-oil-finally/

banjomick

- 03 Aug 2017 23:23

- 458 of 701

- 03 Aug 2017 23:23

- 458 of 701

4 Jun 2017

"Looking back, our strategic decision to lay almost 1km of pipeline under the Wouri River in 2014, to be prepared for the expected industrial expansion in Bonaberi, was prescient. Many industries are now being established in this area and we are ready to supply gas to them."

http://www.victoriaoilandgas.com/sites/default/files/VOGAR16_Web.pdf

Cameroon: Railway viaduct over Wouri River commissioned

Aug 01, 2017

APA – Douala (Cameroon)

The process of commissioning a second bridge over the Wouri River in Douala has taken an important step, with the opening of a railway viaduct, APA can report from Cameroon’s commercial capital on Tuesday.

The opening of the railway track was marked by the running of a freight train, towing fuel tanks and about ten containers on its wagons which plied the state-of-the-art infrastructure.

This represents a decisive step in the execution of such a major project for a second bridge over the Wouri River.

The development of this segment of the railway is not the only visible sign of transformation on the site.

The project has witnessed important progress with a visible layer of bitumen now above the river, perched on concrete shoulders.

Apart from the rail, the completion of the viaduct and access section of the existing bridge are scheduled for 31 December 2017, while the commissioning of the roadwork on the second one is due for 31 October.

Works on the second bridge over the Wouri River are estimated to cost CFA 141.6 billion.

CFA 38 billion of this amount is for the railway viaduct.