| Home | Log In | Register | Our Services | My Account | Contact | Help |

Victoria Oil & Gas-The Information & News Thread (VOG)

banjomick

- 07 Jan 2015 21:01

- 07 Jan 2015 21:01

Victoria Oil & Gas Plc (Victoria) has become a significant domestic energy supplier in Africa through its wholly owned subsidiary: Gaz du Cameroun S. A. (GDC).

With operations located in the industrial port-city of Douala, Cameroon, customers are converting their operations to take natural gas supplied by our production wells and pipeline infrastructure.

GDC is the sole gas supplier in the area, providing a cheaper, more efficient, reliable, and cleaner energy alternative to Heavy Fuel Oil use.

Our teams of engineering advisors are on hand to help customer’s cost and implement the change to GDC’s energy products.

Victoria Oil & Gas is traded in the NEX Exchange HERE

Link-HISTORICAL NEWS,VIDEO/AUDIO & EVENTS

Link-Dedicated Posts for:

Gaz du Cameroun S.A. (“GDC”)

Gaz Du Cameroun Matanda S.A. ("GDC Matanda")

Link-Cameroon-Industrialisation Master Plan (PDI) & Africa Energy

NEWS

21st Jan 2019 Production Update

17th Jan 2019 Q4 2018 Operations Update

02nd Jan 2019 Presidential Decree on Matanda Received

24th Dec 2018 Renewal of Long-Term Gas Supply Contract with ENEO

28th Sep 2018 INTERIM FINANCIAL REPORT FOR THE SIX MONTHS ENDED 30 JUNE 2018

17th Aug 2018 Q2 2018 Operations Update

22nd Jun 2018 Report and Accounts to 31 December 2017

14th Jun 2018 Restructure of the BGFI Debt Facility

04th Jun 2018 Notice of Annual General Meeting

04th June 2018 Logbaba Field Reserves Update

24th May 2018 Q1 2018 Operations and Outlook

16th Feb 2018 Q4 17 Operations Update & 2018 Outlook Replacement

05th Jan 2018 Gas Supply Contract with ENEO Not Extended

VIDEO/AUDIO

21st Jan 2019 Victoria Oil & Gas looks ahead to increased cash flow

24th Aug 2018 Victoria Oil & Gas confident of resolving ENEO contract 'within weeks'

22nd Apr 2018 Video from 21/04/2018 UK Investor Show

16th Feb 2018 Victoria Oil & Gas confident of positive outcome to ENEO issue

08th Nov 2017 Victoria Oil & Gas reports very pleasing initial results from La-108

31st Oct 2017 21 Oil and Gas - African Power Panel

30th Oct 2017 121 Oil & Gas Investment

26th Oct 2017 Victoria Oil & Gas raises US$23.5mln to accelerate new growth programme

26th Sep 2017 Victoria Oil & Gas to finalise long term supply contracts after first gas at LA-107

17th Aug 2017 Victoria Oil & Gas expecting La-107 to be a 'substantial' producer

16th Apr 2017 Video from 01/04/2017 UK Investor Show

13th Apr 2017 'It's been a terrific year and a great quarter', says Victoria Oil & Gas' Kevin Foo

06th Mar 2017 Farm-out deal 'a really good strategic move' for Victoria Oil & Gas, says chairman Kevin Foo

06th Feb 2017 Chairman runs Proactive through the good start to 2017

EVENTS

28th Jun 2018 Annual General Meeting ("AGM")

10th May 2018 Africa Oil & Power Investor Forum-London

21st Apr 2018 UK Investor Show

11th-12th Apr 2018 Africa Investment Exchange: Gas (AIX: Gas 2018)-London

09th-10th Nov 2017 The Cameroon Investment Forum(CIF)-Cameroon

30th-31st Oct 2017 121 Oil & Gas Investment-London

23rd-27th Oct 2017 Africa Oil Week 2017-Cape Town South Africa

07th Sep 2017 One2One Investor Forum - London

05th Sep 2017 Oil Capital Conference-London

28th Jun 2017 Annual General Meeting

01st Apr 2017 UK Investor Show

9th Feb 2017 Presentation slide show for One2One

9th Feb 2017 One2One Investor Forum - London

Social Media

T110Mikey - 06 Sep 2017 08:45 - 477 of 701

The reason is because MoneyAM's Level 2 system is not correctly sensing the Auto Trades or Ordinary Trades correctly so is wrongly reporting them

banjomick

- 06 Sep 2017 13:35

- 478 of 701

- 06 Sep 2017 13:35

- 478 of 701

Chairman of VOG Kevin Foo presents well and with a style that is impossible to resist, describing it as ‘spiky’ I thought the part that I heard was a really good analysis of the company. I have described VOG as historically misunderstood but from the feedback I am getting I suspect that investors are beginning to work out just how attractive the company is, whether you describe it as a full cycle company or maybe more realistically a utility in a market with huge demand it stacks up very well.

http://www.malcysblog.com/2017/09/oil-price-sdx-energy-petrofacsundry-aex-capital-oil-conference-echo-vog-rkh-char-finally/

banjomick

- 06 Sep 2017 21:21

- 479 of 701

- 06 Sep 2017 21:21

- 479 of 701

http://www.proactiveinvestors.co.uk/register/event_details/109

banjomick

- 07 Sep 2017 09:20

- 480 of 701

- 07 Sep 2017 09:20

- 480 of 701

GDC month-long community cleanup campaign The daily objective was for each person to collect 10kg of waste.

https://twitter.com/victoriaoilgas

https://twitter.com/victoriaoilgas

banjomick

- 13 Sep 2017 22:07

- 481 of 701

- 13 Sep 2017 22:07

- 481 of 701

The Cameroonian Egin SA aims to produce at least 100,000 tons of cement per year

Wednesday, 13 September 2017

(Invest in Cameroon) - We know a little more about the Cameroonian company, Egin SA, (General industrial enterprise) which will go into production next October.

Authorized sources indicate that Egin is building a cement factory with an annual production capacity of at least 100,000 tons in the Douala Autonomous Port (PAD) industrial area.

The supplier of technical solutions of Egin SA, is the Spanish company Cemengal. The latter has been present on the international cement market for more than 25 years. Cemengal is the inventor of the latest-generation cement production solution Plug & Grind®, which is being installed in Cameroon, and supplier of plants, in the world's largest cement production companies (LafargeHolcim, Cemex, Cimport ...).

Egin aims to manufacture a cement of type "42.5R". This cement is used for seals and solid foundations. It can also be used in the manufacture of mortars and cinder blocks. It will be bagged in 50 kg bags under the brand name "Lion".

Sylvain Andzongo

http://www.investiraucameroun.com/entreprises/1309-9411-le-camerounais-egin-sa-ambitionne-de-produire-au-moins-100-000-tonnes-de-ciment-par-an

banjomick

- 13 Sep 2017 22:18

- 482 of 701

- 13 Sep 2017 22:18

- 482 of 701

Eneo Cameroon replaced more than 27,000 wooden poles between January and July 2017

Wednesday, 13 September 2017

(Investing in Cameroon) - Electrician Eneo Cameroon points a total of 27,852 wooden poles replaced on July 31, 2017, against 19,779 in the same period in 2016. This represents a positive change of + 41%.

Moreover, Eneo adds, 1,377 metal supports have been laid, against 264 in the same period in 2016, a positive variation of + 422%. " These efforts improve the quality of service indicator" Energies not supplied by the distribution network (END) ". They are down 21%, compared to the same period in 2016, "said the subsidiary of the British Actis who specifies that the energy not supplied by the transmission network, for their part, decreased by 50%. Combining the two data gives an overall reduction of 31%.

These replacements of electric poles are part of an investment plan announced by Eneo in 2014. The electrician at the time lamented a degraded network with overloaded transformers at 140% and falling poles. A budget of 170 billion FCFA was then voted to remedy the situation over the period 2014-2018.

http://www.investiraucameroun.com/electricite/1309-9413-eneo-cameroon-a-remplace-plus-de-27-000-poteaux-en-bois-entre-janvier-et-juillet-2017

banjomick

- 19 Sep 2017 13:31

- 483 of 701

- 19 Sep 2017 13:31

- 483 of 701

banjomick

- 20 Sep 2017 13:27

- 484 of 701

- 20 Sep 2017 13:27

- 484 of 701

Forest Nominees Limited (GC1) have increased their holding from 5,541,000 to 6,635,305 (6%)

http://www.moneyam.com/action/news/showArticle?id=5672197

banjomick

- 20 Sep 2017 13:29

- 485 of 701

- 20 Sep 2017 13:29

- 485 of 701

LINK-Historic Shareholder Information

Securities in Issue

Number of shares in issue: 110,571,762

Percentage of shares not in public hands: 4.01%

Free Float: 95.99%

Holdings of Significant Shareholders

As of September 2017 the Company is aware of the following persons who hold, directly or indirectly, voting rights representing 3% or more of the issued share capital of the Company to which voting rights are attached:

Forest Nominees Limited (GC1)---------6,635,305-------6.001%

Majedie Asset Management Ltd---------6,154,761-------5.566%

http://www.victoriaoilandgas.com/investors/share-information

banjomick

- 26 Sep 2017 08:51

- 486 of 701

- 26 Sep 2017 08:51

- 486 of 701

Victoria Oil & Gas Plc

Successful Flow Tests and First Production Gas from Logbaba Well La-107

· Well La-107 has been completed and classified as production well

· Testing of the well has been completed with a maximum flowrate of

o 54 mmscf/d maximum flowrate through a 70/64ths inch choke

o 146mmscf/d Absolute Open Flow ("AOF") potential

· Well now connected to Logbaba Gas Processing Plant and first gas flowed to the Processing Plant 22 September 2017

· Drilling rig skidded back to La-108 and operations to side track this well have commenced-completion scheduled for Q4 2017

Following the drilling update of 17 August 2017, Victoria Oil & Gas Plc is pleased to announce successful flow tests and first production gas from the Logbaba La-107 well. The well reached target depth of 3,180m, the base of the Logbaba Formation, encountering a total of 58m of net gas bearing sands in the Upper and Lower Logbaba Formations.

Following the installation of the production completion and production tree, La-107 was perforated and flow tested to a maximum rate of 54 mmscf/d on a 70/64ths inch choke, with a stabilised flowing wellhead pressure of 2,951psig. The multi-rate test results indicate that the well has an AOF potential of 146mmscf/d; this is considerably better than expected and compares very well to La-105 which had an initial AOF of 89mmscf/d.

After conducting clean up and flow testing operations the well was connected to the Logbaba Gas Processing Plant and first gas flowed to the processing plant for sales on 22 September 2017.

The drilling rig was released from La-107 on 3 September 2017 and skidded to La-108 to resume drilling operations on that well. Following procedures to re-enter the well, side-track operations commenced on La-108 on 10 September 2017. The side-track is planned to re-drill the 8½" hole section which was previously lost, where more than 100m of net gas-bearing sands were encountered at intervals between the top of the Logbaba Formation at 2,107m MD and 2,760m MD.

The combined testing and drilling operations on both La-107 and La-108 were planned and conducted under industry recognized Simultaneous Operations Procedures (SIMOPs) to ensure a safe, efficient and successful outcome of a complex operation.

Ahmet Dik, VOG CEO said, "These flow tests exceeded our expectations and La-107 is considered a production well. We can now move to finalise long term gas supply contracts with high volume customers. Our next task is the safe and successful completion of the La-108 side track and to capture as much as the 100m of sands in that well as possible. These wells have been difficult and expensive to drill and the La-107 success is a credit to our operations and drilling teams."

The Board is pleased to confirm that the Company`s Interim Accounts will be released on, or before, 30 September 2017.

Sam Metcalfe, the Company's Subsurface Manager has reviewed and approved the technical information contained in this announcement.

http://www.moneyam.com/action/news/showArticle?id=5678732

banjomick

- 26 Sep 2017 09:42

- 487 of 701

- 26 Sep 2017 09:42

- 487 of 701

GDC team produced film of successful testing in the flare pit

https://video214.com/play/1MXHCbwddy1Zi6VlhH9DIQ/s/dark

banjomick

- 26 Sep 2017 10:46

- 488 of 701

- 26 Sep 2017 10:46

- 488 of 701

10:19 26 Sep 2017

Shore Capital analyst Craig Howie, in a note, described it as a “very impressive outcome” for Victoria Oil and Gas.

The most recent success at Victoria Oil & Gas plc’s (LON:VOG) Logbaba project, in Cameroon, positions the company extremely well to go after bigger gas sales deals, according to stock broker Shore Capital.

VOG shares advanced on Tuesday as it unveiled new test results for the LA-107 well, and that it has now been brought online for production.

Testing yielded maximum rates of 54mln cubic feet per day, and VOG told investors that the well has absolute open flow (AOF) potential of 146mln cubic feet per day.

LA-107 is now connected to the Logbaba gas processing plant, and the drilling rig is now been moved to the location of the planned LA-108 well which is scheduled for the fourth quarter of the year.

Shore Capital analyst Craig Howie, in a note, described it as a “very impressive outcome” and said: “This is considerably better than expected and, importantly, compares very favourably with the existing La-105 well, which had an initial AOF of 89mmcfd.”

Elsewhere, WH Ireland analyst Brendan Long added: “this is a very strong test result, and much better than expected.

“We look forward to the completion on the La-108 well, and progress on gas sales contracts.”

In Tuesday Morning’s statement, VOG chief executive Ahmet Dik said: “These flow tests exceeded our expectations and La-107 is considered a production well.”

“We can now move to finalise long term gas supply contracts with high volume customers.

“Our next task is the safe and successful completion of the La-108 side track and to capture as much as the 100m of sands in that well as possible.

“These wells have been difficult and expensive to drill and the La-107 success is a credit to our operations and drilling teams."

http://www.proactiveinvestors.co.uk/companies/news/184589/victoria-oil-gas-now-extremely-well-positioned-for-bigger-gas-deals-broker-184589.html

banjomick

- 26 Sep 2017 22:37

- 489 of 701

- 26 Sep 2017 22:37

- 489 of 701

Victoria Oil & Gas

I’m not sure what it is going to take for the market to get quite how good a story VOG really is, news today from La-107 adds a bit of black type into the equation, ie if it were a horse it would be winning Group 1 races and adding significantly to its valuation. La-107 has flowed on test way better than expected at 54 mmscf/d on a 70/64ths choke with a stabilised flowing wellhead pressure of 2,951 psig. Also its AOF potential of 146 mmscf/d was considerably better that expected (La-105 was only 89) and is not only flowing through the processing plant but actually being sold to clients.

The rig has now skidded over to La-108 and started to sidetrack the well aiming at the 100m of pay discovered during the long, arduous and expensive drilling process that was.

The good thing is that Ahmet Dik told me when I spoke to him this morning that ‘we have learnt our lessons’ and now know where the sands are. Expect 4-6 weeks of arriving at TD and testing, and assuming any penetration of that pay then another huge discovery will be booked.

The key to all this is how much scope it gives the GDC operatives to get to work on long term contracts with ENEO and other big local customers. There will need to be some pipeline extensions etc but VOG are in an incredibly strong position in Douala as the area is extremely power short, expect these further installations in 2018 to be followed by potentially several hundred MW of extra sales.

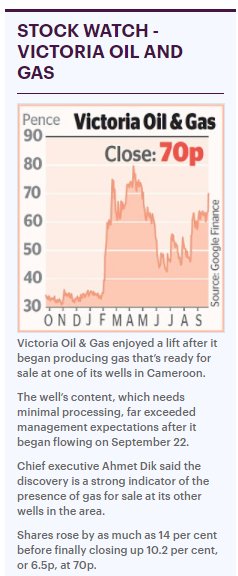

At 70p, up 9% on the day the shares are still significantly undervalued, the high earlier in the year was 80p and I said then that it should be valued ‘at a multiple of that figure’, I have not changed my position.

Also talking on VOX:

https://www.voxmarkets.co.uk/blogs/frontera-resources-frr-widecells-wdc-and-malcy-on-hur-vog-amer-trin/

banjomick

- 26 Sep 2017 22:46

- 490 of 701

- 26 Sep 2017 22:46

- 490 of 701

banjomick

- 26 Sep 2017 23:21

- 491 of 701

- 26 Sep 2017 23:21

- 491 of 701

Published on Sep 26, 2017

Ahmet Dik, chief executive of Victoria Oil & Gas PLC (LON:VOG) tells Proactive it's a massive day for them with the news of ‘first gas’ from their new well at the Logbaba field.

Well LA-107 has now been classified as a production well following a successful testing programme.

https://www.youtube.com/watch?v=hHiNao3ffo0

banjomick

- 27 Sep 2017 09:37

- 492 of 701

- 27 Sep 2017 09:37

- 492 of 701

Above is via VOG's twitter

banjomick

- 28 Sep 2017 07:48

- 493 of 701

- 28 Sep 2017 07:48

- 493 of 701

Victoria Oil & Gas Plc

("VOG" or "the Company")

Bomono Farm-out Extension

On 6 March 2017 Victoria Oil & Gas Plc, a Cameroon energy utility, announced that the Company and Bowleven Oil & Gas Plc ("Bowleven"), the African focused oil and gas exploration company, had signed a farm-out agreement ("the Agreement") relating to the Bomono production sharing contract.

The Company is pleased to confirm that discussions regarding the Agreement are progressing and Bowleven and VOG continue to work with the Government of Cameroon to advance the Bomono project. Consequently, VOG has elected to exercise its option to extend the termination date of the Agreement to 31 December 2017.

Further details on the Agreement are set out in the RNS made by the Company on 6 March 2017.

http://www.moneyam.com/action/news/showArticle?id=5682292

banjomick

- 28 Sep 2017 07:51

- 494 of 701

- 28 Sep 2017 07:51

- 494 of 701

Victoria Oil & Gas Plc

INTERIM FINANCIAL REPORT FOR THE SIX MONTHS ENDED 30 JUNE 2017

Victoria Oil & Gas Plc, the integrated natural gas producing utility, today announces its unaudited interim results for the six months ended 30 June 2017.

Operational Highlights

· Average daily Logbaba field gross production rate increased by 11.4% to 14.6mmscf/d (six months to 30 June 2016: 13.1mmscf/d).

· 2,345mmscf of gross gas sold from Logbaba (six months to 30 June 2016: 2,282mmscf).

· Completion of flow lines to the new wells.

Drilling Highlights

· Completion of well La-107, drilled to 3,180m Measured Depth ("MD"), has been completed for production. Preliminary analysis indicated 35m of net gas sand in the Upper Logbaba Formation, plus 23m of net gas sand in the Lower Logbaba Formation. Flow test results were very positive with 54mmscf/d flowrate through 70/64ths inch choke and 146mmscf/d Absolute Open Flow ("AOF") potential. First gas flowed to the processing plant for sale on 22 September 2017.

· Rig skidded to La-108 to resume drilling operations. Sidetrack drilling has recommenced, where approximately 100m of net gas-bearing sands were encountered. At 26 September 2017, the rig is drilling ahead at 2,085m Measured Depth ("MD")

Financial Highlights

· $15.4 million Revenue (six months to 30 June 2016: $23.6 million).

· $4.4 million EBITDA (six months to 30 June 2016: $14.2 million).

· $25.2 million Net Debt position (at 31 December 2016 Net Cash: $1.8 million).

· 5% Cameroonian State participation in Logbaba; 3% relinquished by Gaz du Cameroun S.A. ("GDC").

Corporate Highlights

· Farm-out agreement with EurOil Limited ("EurOil"), a Bowleven Plc subsidiary, under which a VOG subsidiary will acquire on completion an 80% working interest in the 2,237 km2 Bomono licence, adjacent to Gaz du Cameroun's ("GDC") Logbaba field. This transaction remains subject to Government approval.

· Seismic interpretation on Matanda field (75% participating interest, subject to Government approval) shows considerable gas in place potential and several drilling targets.

Ahmet Dik, Chief Executive Officer of VOG, commented:

"The year has been very productive for the Company, with the delivery of very positive drilling results and the completion of well La-107, where we have encountered a combined 58m of net gas sands. Production flow testing has confirmed the commercial viability of the gas-bearing reservoir sands detected in the Upper and Lower Logbaba formations, and initial flows through the processing facility yielded positive results.

The developments at Logbaba are very encouraging as we take the first steps towards our longer-term ambition of producing 100mmscf/d. The Douala region alone continues to show a long-term demand for 150mmscf/d of natural gas, and we believe VOG is uniquely placed to take advantage of that market as the dominant onshore gas producer in country."

Sam Metcalfe, the Company's Subsurface Manager has reviewed and approved the technical information contained in this announcement.

http://www.moneyam.com/action/news/showArticle?id=5682364

banjomick

- 28 Sep 2017 09:24

- 495 of 701

- 28 Sep 2017 09:24

- 495 of 701

"GDC commenced two projects to upgrade its gas production facility in Douala with the objective of modernising its automation systems and increasing the amount of gas recoverable from its existing reservoirs.

The automation project, comprised the installation of hardware and software to upgrade the control system of the gas production facility to the latest Siemens automation system. One of the key benefits of this new system is the ability to expand and incorporate new facilities easily as the number of production wells and facilities of GDC expands.

The second project comprised installation of a heat exchanger and a compressor package. The equipment was installed in two stages; in the first stage, the heat exchanger has been successfully installed and commissioned. The second stage, the installation of the compressor package has been installed and is currently being commissioned. These plant improvements enable greater flexibility in gas feed conditions, such as temperature and pressure, and will allow operations to optimise production from La-105, La-107 and La-108 when it comes online."

http://www.victoriaoilandgas.com/sites/default/files/170928%20VOG%20Interims%20Results%20to%2030%20June%202017%20FINAL.pdf

banjomick

- 28 Sep 2017 09:27

- 496 of 701

- 28 Sep 2017 09:27

- 496 of 701

The ongoing drilling programme has resulted in the Group reporting a net debt position of $25.2 million.

At 30 June 2017, the headroom on existing debt facilities was $4.9 million. To supplement the remaining drilling programme costs, GDC has obtained a letter of offer from a local financial institution in Cameroon to extend our debt facilities, and we will be looking to complete on the offer in due course.

With the successful completion of well La-107, known potential of La-108, and the anticipated Government approval of the assignments for Matanda and Bomono, the Group has an exciting future and I look forward to giving you regular updates on our progress.

Kevin Foo

Executive Chairman

27 September 2017

http://www.victoriaoilandgas.com/sites/default/files/170928%20VOG%20Interims%20Results%20to%2030%20June%202017%20FINAL.pdf