| Home | Log In | Register | Our Services | My Account | Contact | Help |

Victoria Oil & Gas-The Information & News Thread (VOG)

banjomick

- 07 Jan 2015 21:01

- 07 Jan 2015 21:01

Victoria Oil & Gas Plc (Victoria) has become a significant domestic energy supplier in Africa through its wholly owned subsidiary: Gaz du Cameroun S. A. (GDC).

With operations located in the industrial port-city of Douala, Cameroon, customers are converting their operations to take natural gas supplied by our production wells and pipeline infrastructure.

GDC is the sole gas supplier in the area, providing a cheaper, more efficient, reliable, and cleaner energy alternative to Heavy Fuel Oil use.

Our teams of engineering advisors are on hand to help customer’s cost and implement the change to GDC’s energy products.

Victoria Oil & Gas is traded in the NEX Exchange HERE

Link-HISTORICAL NEWS,VIDEO/AUDIO & EVENTS

Link-Dedicated Posts for:

Gaz du Cameroun S.A. (“GDC”)

Gaz Du Cameroun Matanda S.A. ("GDC Matanda")

Link-Cameroon-Industrialisation Master Plan (PDI) & Africa Energy

NEWS

21st Jan 2019 Production Update

17th Jan 2019 Q4 2018 Operations Update

02nd Jan 2019 Presidential Decree on Matanda Received

24th Dec 2018 Renewal of Long-Term Gas Supply Contract with ENEO

28th Sep 2018 INTERIM FINANCIAL REPORT FOR THE SIX MONTHS ENDED 30 JUNE 2018

17th Aug 2018 Q2 2018 Operations Update

22nd Jun 2018 Report and Accounts to 31 December 2017

14th Jun 2018 Restructure of the BGFI Debt Facility

04th Jun 2018 Notice of Annual General Meeting

04th June 2018 Logbaba Field Reserves Update

24th May 2018 Q1 2018 Operations and Outlook

16th Feb 2018 Q4 17 Operations Update & 2018 Outlook Replacement

05th Jan 2018 Gas Supply Contract with ENEO Not Extended

VIDEO/AUDIO

21st Jan 2019 Victoria Oil & Gas looks ahead to increased cash flow

24th Aug 2018 Victoria Oil & Gas confident of resolving ENEO contract 'within weeks'

22nd Apr 2018 Video from 21/04/2018 UK Investor Show

16th Feb 2018 Victoria Oil & Gas confident of positive outcome to ENEO issue

08th Nov 2017 Victoria Oil & Gas reports very pleasing initial results from La-108

31st Oct 2017 21 Oil and Gas - African Power Panel

30th Oct 2017 121 Oil & Gas Investment

26th Oct 2017 Victoria Oil & Gas raises US$23.5mln to accelerate new growth programme

26th Sep 2017 Victoria Oil & Gas to finalise long term supply contracts after first gas at LA-107

17th Aug 2017 Victoria Oil & Gas expecting La-107 to be a 'substantial' producer

16th Apr 2017 Video from 01/04/2017 UK Investor Show

13th Apr 2017 'It's been a terrific year and a great quarter', says Victoria Oil & Gas' Kevin Foo

06th Mar 2017 Farm-out deal 'a really good strategic move' for Victoria Oil & Gas, says chairman Kevin Foo

06th Feb 2017 Chairman runs Proactive through the good start to 2017

EVENTS

28th Jun 2018 Annual General Meeting ("AGM")

10th May 2018 Africa Oil & Power Investor Forum-London

21st Apr 2018 UK Investor Show

11th-12th Apr 2018 Africa Investment Exchange: Gas (AIX: Gas 2018)-London

09th-10th Nov 2017 The Cameroon Investment Forum(CIF)-Cameroon

30th-31st Oct 2017 121 Oil & Gas Investment-London

23rd-27th Oct 2017 Africa Oil Week 2017-Cape Town South Africa

07th Sep 2017 One2One Investor Forum - London

05th Sep 2017 Oil Capital Conference-London

28th Jun 2017 Annual General Meeting

01st Apr 2017 UK Investor Show

9th Feb 2017 Presentation slide show for One2One

9th Feb 2017 One2One Investor Forum - London

Social Media

banjomick

- 15 Nov 2017 10:29

- 540 of 701

- 15 Nov 2017 10:29

- 540 of 701

LINK-Historic Shareholder Information

Securities in Issue

Number of shares in issue: 145,059,728

Percentage of shares not in public hands: 3.26%

Free Float: 96.74%

Holdings of Significant Shareholders

As of November 2017 the Company is aware of the following persons who hold, directly or indirectly, voting rights representing 3% or more of the issued share capital of the Company to which voting rights are attached:

Forest Nominees Limited (GC1)---------6,635,305-------4.574%

Majedie Asset Management Ltd---------6,154,761-------4.243%

http://www.victoriaoilandgas.com/investors/share-information

banjomick

- 20 Nov 2017 18:57

- 541 of 701

- 20 Nov 2017 18:57

- 541 of 701

November 20, 2017

"UBA better understands the need for an economy to have available energy needed for development and the wellbeing of people.

The Bank did not hesitate to make available US$ 12,500,000 (over 7 FCFA) to Gaz Du Cameroun to finance its 2017 capital expenditure program.

The amount which cover the sum required for the project will be used in laying more pipes, connection of customers, production enhancements, expansion of gas plant, amongst others.

Part of the production is meant for power grid to enable the plant increase Cameroon’s power generation capacity.

The other part is meant to help companies operate by replacing fuel with gas."

banjomick

- 22 Nov 2017 16:27

- 542 of 701

- 22 Nov 2017 16:27

- 542 of 701

Kribi Power Development Company reveals Eneo's payment arrears have reached a "critical threshold"

Wednesday, 22 November 2017

(Invest in Cameroon) - Kribi Power Development Company SA (Kpdc), a company controlled by Globeleq which operates the Kribi plant, confirms that it has had to reduce the production of the 100 MW plant since 1 November 2017, more " The increase in the arrears of payment of electricity supply bills to its sole customer Eneo Cameroon ".

In the words of Kpdc CEO Hans Francis Simb Nag (photo), the arrears of Eneo, a subsidiary of Britain's Actis, have reached " a critical threshold ". Mr. Simb Nag does not give a precise figure. The DG adds: " the depletion of the resources necessary for the operation of the plant, no longer allows Kpdc to finance its operations adequately ".

Kpdc said it continues to work closely with Eneo and the Cameroonian government to find a solution to the crisis affecting the entire power sector. The company is ready to restore the usual level of production of the Kribi gas plant as soon as a satisfactory solution to the problem of arrears is found.

On the side of Eneo, authorized sources explain that the financial challenges of the company are related to the fact that the State also owes him an amount of 100 billion FCFA.

http://www.investiraucameroun.com/electricite/2211-9835-kribi-power-development-company-revele-que-les-arrieres-de-paiement-deneo-ont-atteint-un-seuil-critique

banjomick

- 23 Nov 2017 13:38

- 543 of 701

- 23 Nov 2017 13:38

- 543 of 701

Eneo announces rationing of electric power throughout the north of Cameroon

Thursday, 23 November 2017

(Invest in Cameroon) - The electrician Eneo Cameroon informs that the continuous supply of the electrical service is disrupted in the North Network interconnected (RIN) of the country. Thus, all the northern part of Cameroon is experiencing load shedding: Adamawa, North and Far North.

" Due to the increased demand for electric power in recent weeks, and the lowering of the water level at the Lagdo hydroelectric dam, the current production capacity is not enough to cover the demand, " says Eneo. The concessionaire of the electricity sector adds: " Therefore, the localities of the RIN will experience temporary interruptions of supply of electric power from 2 to 3 days maximum per week, in the hourly slots going from 06h to 22h ". In order to manage this low water period, Eneo announces that it will establish a rotating energy distribution program.

To end the power cuts in the RIN, the Cameroonian government must rehabilitate the aging Lagdo hydroelectric power station (72 MW) commissioned in 1983. In May 2017, the Minister of Water and Energy, Basile Atangana Kouna had indicated that it had commissioned a complete rehabilitation study of the plant, with the option of increasing its capacity from 72 MW to 80 MW. The estimated cost of this operation is 100 billion FCFA.

http://www.investiraucameroun.com/electricite/2311-9845-eneo-annonce-le-rationnement-de-lenergie-electrique-dans-tout-le-septentrion-du-cameroun

banjomick

- 25 Nov 2017 19:10

- 544 of 701

- 25 Nov 2017 19:10

- 544 of 701

23/11/2017

The African Development Bank Group’s Board of Directors has approved a loan of €180 million to the Republic of Cameroon to finance the first phase of the government’s Competitiveness and Economic Growth Support Programme (PACCE).

PACCE is the first of a three-year programmatic general budget support operations to be implemented from 2017 to 2019 in order to shore up public finances in the wake of dwindling oil prices exasperated by security and related humanitarian challenges within the country and across the CEMAC region.

“The program aims at preserving macroeconomic and budgetary stability and contributing to laying the foundations for robust, resilient and inclusive economic growth by improving the public finance management framework and strengthening the governance and competitiveness of productive sectors (transport, energy and agriculture),” Ousmane Dore, Director General of the Bank’s Central Africa Hub said while presenting the project to the Board.

The reform package of this operation is organised around two interdependent and complementary components: (i) streamlining the public finance management framework; and (ii) strengthening the governance and competitiveness of productive sectors. Both components are expected to help streamline the public the finance management framework, reinforce macroeconomic stability, create fiscal space, as well as prioritize public investment projects and stimulate growth.

Furthermore, the program’s focus on enhancement of governance and competitiveness of productive sectors is expected to reduce production costs, particularly in transport and electricity. This will help attract private investments and stimulate growth through the development of agro-industry and fiscal consolidation measures.

Leveraging funding for agriculture, electricity and transport sectors will significantly accomplish the Bank’s High 5 priorities including the improvement of the quality of life of the population. The programme is aligned with the two pillars of the 2015-2020 Country Strategy Paper with regards to strengthening infrastructure for inclusive and sustainable growth; and strengthening sector governance to ensure the efficiency and sustainability of transformative investment programs. It is aligned with the Bank’s 2013-2017 Private Sector Development Strategy, among others.

In approving the program, Board members were convinced that providing support to Cameroon, the economic giant of Central African Economic and Monetary Union (CEMAC) zone, PACCE will impact the entire sub-region, which is perfectly in line with the strategy defined in December 2016 by the Heads of State of CEMAC member countries and the managers of regional institutions. The overarching objective for the region is to achieve: (i) sustained public finance re-adjustment; (ii) restoration of sound monetary policy; and (iii) launching of major structural reforms to support economic diversification.

https://www.afdb.org/en/news-and-events/afdb-supports-cameroons-economic-reforms-with-eur180-million-loan-17589/

banjomick

- 01 Dec 2017 09:39

- 545 of 701

- 01 Dec 2017 09:39

- 545 of 701

Victoria Oil & Gas Plc

Logbaba Drilling Update - La-108 Well Completion

Victoria Oil & Gas Plc today provides an update on the Group's drilling operations, which are managed by Gaz du Cameroon S.A. ("GDC"), a wholly owned subsidiary of VOG.

· Liner has been run and cemented to case off well to depth of 2,859m

· Flow tests planned and La-108 expected to be a producing well by mid-December

As previously announced, well La-108 was successfully drilled to its planned Target Depth (TD) of the 6" hole section at 2,865m Measured Depth (MD) (2,463m TVD) on 7 November.

After reaching TD, the drilling rig experienced electrical problems that delayed progress by 14 days. The problems have been rectified and the 4½" liner has been run to TD and cemented in place. Current operations involve installation of permanent production equipment in the well.

As soon as the completion equipment is run the drilling rig will be skidded off La-108 and released. The production tree will then be installed and the well perforated and flow tested prior to connecting it to the Logbaba gas processing facilities. Preliminary analysis of the La-108 logs indicates 84.5m of net gas sand in the Logbaba Formation.

The flow testing is expected to commence during December and the well will then be put on production around mid-December.

http://www.moneyam.com/action/news/showArticle?id=5764395

banjomick

- 01 Dec 2017 22:45

- 546 of 701

- 01 Dec 2017 22:45

- 546 of 701

15:20 01 Dec 2017

The recently drilling La-108 well is expected to be in production by mid-December

Victoria Oil & Gas PLC (LON:VOG) has completed drilling operations for the La-108 well at the Logbaba gas field in Cameroon, after electrical problems were rectified.

A production tree will soon be installed prior to testing and the production well’s start-up, the company said in a statement on Friday.

READ: Victoria Oil & Gas reveals better-than-expected Logbaba-8 well result

The company expects to start flow testing during December, with production due to start by mid-December.

In a note to clients today, analysts at joint house broker Shore Capital commented: “As the dominant gas producer in the Douala region, VOG is targeting delivery of 100mmcfd by the end of 2021 and, ahead of the release of flow test results from La-108, we continue to believe that VOG is superbly positioned to achieve this objective, given the strong results currently being achieved at the flagship Logbaba field.”

http://www.proactiveinvestors.co.uk/companies/news/188101/victoria-oil-gas-preparing-latest-logbaba-well-for-production-188101.html

banjomick

- 03 Dec 2017 09:38

- 547 of 701

- 03 Dec 2017 09:38

- 547 of 701

Cameroon: The La-108 gas well is expected to go into production in the next two weeks

Friday, 01 December 2017

(Invest in Cameroon) - Friday, Gaz Du Cameroun (GDC), the local subsidiary of British junior Victoria Oil & Gas (VOG), announced that it plans to launch production on its La-108 gas well, mid-December. The announcement was made in an update relayed on Energy Pedia .

This well had been the subject of a major discovery in early November 2017. The production tests should start before the end of the first week of December and be completed before the start of production, says the company that had planned, previously , that they would be cordoned off at the end of November.

In any case, the company has specified that the flow of La-108 will be greater than that of the La-107 well, which is 54 million cubic meters per day. La-107 went into production at the end of last September.

After testing, La-108 will be connected to Logbaba's gas processing facilities.

In addition, the document indicated that a 4½-inch coating was installed at the target depth of 2865 meters and that the well was cemented. Operations are underway to prepare the installation of production equipment in the well.

Once this step is completed, the drilling platform will be returned to the owner.

banjomick

- 15 Dec 2017 13:04

- 548 of 701

- 15 Dec 2017 13:04

- 548 of 701

On a total debt of about 100 billion FCfa, the Cameroonian state makes a 15 billion FCfa advance to the electrician Eneo

15th December 2017

(Invest in Cameroon) - The Ministry of Finance has recently released, in favor of Eneo, the concessionaire of the public electricity service in Cameroon, a sum of 15 billion CFA francs, as an advance on its estimated debt to about 100 billion FCFA, we learn from sources close to the case.

The electricity generation and distribution company has, according to our sources, immediately dispatched this envelope to its own suppliers, with whom it is heavily indebted.

These include the petroleum distribution company, Tradex, of the National Refining Company (Sonara) - two companies that often supply thermal power plants with fuel - and especially the company Kpdc, owner of the gas plant. Kribi whose production capacity has been reduced by 100 MW (out of 216 MW), since last November, because of the heavy debt of the main client that is Eneo.

As a reminder, the State's outstanding payments to Eneo represent both the consumption of electricity billed to the State and its dismemberments, as well as the shortfall accumulated over the last several years (since 2012, the tariffs electricity is blocked, whereas according to the concession contract, they must be readjusted each year, according to the investments made by the concessionaire).

http://www.investiraucameroun.com/electricite/1512-9974-sur-une-dette-globale-d-environ-100-milliards-fcfa-l-etat-camerounais-fait-une-avance-de-15-milliards-fcfa-a-l-electricien-eneo

banjomick

- 16 Dec 2017 13:51

- 549 of 701

- 16 Dec 2017 13:51

- 549 of 701

***Translated via google***

The State of Cameroon prepares the second phase of the extension of the National Refining Company

15 December 2017

(Invest in Cameroon) - Internal sources at the National Refinery Company (Sonara) confirm that the government is currently preparing the start of work for the second phase of the expansion of the country's only refinery.

To achieve this goal, the state needs a global amount of 397 billion FCFA. The government is still looking for a partner for financial closure. A bit like during the first phase. Sonara received financial support from Bgfi Cameroon. The bank had granted a bridge loan amounting to 143.5 billion FCFA.

For the time being, the extension work of Cameroon's only refinery has been completed with the connection of the new old-style facility. The commissioning of the new-look Sonara is now scheduled for the end of 2017.

This first phase began in mid 2009 and continued in 2017, with the construction of a wastewater treatment plant replacing the old one, the construction of ten storage bins for crude oil, oil from base and refined products. This will give the company the necessary means to ensure the country's supply of petroleum products, in sufficient quantity, and avoid the use of imports (618,833 m3 of petroleum products in 2017).

http://www.investiraucameroun.com/hydrocarbures/1512-9979-l-etat-du-cameroun-prepare-la-seconde-phase-de-l-extension-de-la-societe-nationale-de-raffinage

banjomick

- 20 Dec 2017 07:52

- 550 of 701

- 20 Dec 2017 07:52

- 550 of 701

Victoria Oil & Gas Plc

La-108 Well Test Result Ahead of Expectations

Victoria Oil & Gas Plc is pleased to provide an update on the Group's well operations, which are managed by Gaz du Cameroun S.A. ("GDC"), a wholly owned subsidiary of VOG.

· Completion equipment and production "Christmas tree" installed and the drilling rig released from the La-108

· Initial gas flow rates up to 15mmscf/d commenced from just the Lower Logbaba sands of La-108 - ahead of expectations - La-107 flow tested at a lower rate of 4 mmscf/d from an equivalent horizon

· Operations on La-108 suspended ahead of testing the Upper Logbaba sands to allow production from La-107 during peak demand season

As previously announced, well La-108 was successfully drilled to its planned Target Depth (TD) of the 6" hole section at 2,865m Measured Depth (MD) (2,463m True Vertical Depth) on 7 November. The completion equipment has now been run, the drilling rig has been skidded off La-108 and released and the production Christmas tree has been installed.

Flow testing of the Lower Logbaba sands has now commenced, with flowrates from these sands up to 15 mmscf/d being achieved on a 40/64ths inch choke with a flowing wellhead pressure of 2006 psi. This is ahead of expectations and substantially better than the 4mmscf/d which was obtained from the Lower Logbaba sands in La-107. This is very encouraging and further evaluation will be carried out on these sands in 2018 before the well is put into full production. This work will also recover a spent perforating gun which currently remains stuck in the well.

When full production potential of the Lower Logbaba sands in La-108 has been evaluated, a decision will be taken on the timing of adding more perforations into the highly prospective Upper Logbaba sands.

As previously announced, analysis of the La-108 logs indicated 84.5m of net gas sand in the Logbaba Formation and current production results have been obtained from perforating 18.7m of sands in the Lower Logbaba only.

Commenting today Ahmet Dik, CEO, said: "It is very pleasing to have reached the end of drilling and completion operations on La-108 and the resultant release of the drilling rig. This milestone marks the end of the major capital spend on these wells as we move into the production phase. We have also achieved higher than expected flowrates from the Lower Logbaba sands in La-108. The Production Management Plan for the well is now being prepared by our team and we expect this to be completed by early 2018. Naturally, it is important to VOG that we meet short term demand, whilst aiming to maximise reserves from the field. This will help us meet the growing demand in the Douala market, which management believes will be forthcoming over the longer term."

http://www.moneyam.com/action/news/showArticle?id=5788522

banjomick

- 20 Dec 2017 09:32

- 551 of 701

- 20 Dec 2017 09:32

- 551 of 701

https://www.slb.com/~/media/Files/resources/oilfield_review/ors12/win12/3_fish_art.pdf

banjomick

- 21 Dec 2017 09:56

- 552 of 701

- 21 Dec 2017 09:56

- 552 of 701

Victoria Oil & Gas Plc

Year End Customer Supply Update 2017

Victoria Oil & Gas Plc, a Cameroon based gas producer and distributor, is pleased to provide an update on the Group's gas supply operations near to the close of 2017 and to announce Q3 production results, which are in-line with expectations.

The last few months have also been extremely active for Gaz Du Cameroun S.A ("GDC") with five customers commencing consumption of gas:

· Maya & Co Oil (Palm Oil refinery, new customer)

· SAE (Food processing, new customer)

· PROMETAL 3 (Smelter, new plant for existing customer)

· UCB (Brewery, returning customer)

· Laminoir (Foundry, returning customer)

Maya Oil and SAE are new customer connections for GDC with both operations taking gas for thermal usage. These customers are both situated on the Magzi industrial estates located on the Western Bonaberi shore, where GDC laid an extensive pipeline network during 2016.

The PROMETAL 3 connection is the latest installation at the industrial smelting complex where GDC already supplies gas to the existing operations (PROMETAL 1 & 2). UCB and Laminoir are returning customers who have opted to restart consumption of GDC gas following the rise in the heavy fuel oil price.

The impact of the new customer connections and an early uplift in ENEO consumption this year is already being reflected in current production figures with an average of 10.04 mmscf/d gas sales achieved to date in December (1-19th December), peaking at 14.94mmscf/d.

ENEO continued to consume high levels of gas at the Logbaba and Bassa power stations during the Q4 period to date and GDC will continue to provide gas to ENEO under existing contract extensions whilst negotiations on a longer-term contract continue.

The Company has provided separate updates on completion of wells La-107 and La-108 and further flow tests on the Lower and Upper Sands of La-108 are planned for Q1 2018. Once these tests are completed reserve calculations for both wells will be carried out by internal and external reservoir engineers. However, internal preliminary reserve estimates have given the Company sufficient confidence to enter into long term contract negotiations with current and prospective grid power suppliers.

The full quarterly gross and net gas and condensate consumptions, for Logbaba and GDC, are as follows; amounts in bold are gas and condensate sales attributable to GDC*:

***See link at BOP***

Q3 2017 Gross Gas sales from Logbaba of 612.50 mmscf are in line with the Company's expectations for the period given the early wet season from June. GDC's attributable gas sales volumes, are lower than Q3 2016 primarily due to the change in attributable revenues following the SNH participation.

Ahmet Dik, CEO, said; "I am pleased to see the increased December gas sales levels coming through from our new thermal customers. Supply to ENEO continues at strong levels and we shall update the market early 2018 on further gas to power supply. We shall also provide updates on the Matanda and Bomono projects."

http://www.moneyam.com/action/news/showArticle?id=5790434

banjomick

- 21 Dec 2017 15:02

- 553 of 701

- 21 Dec 2017 15:02

- 553 of 701

21st December 2017

(Invest in Cameroon) - The President of the Republic, Paul Biya, signed on Dec. 19, a decree establishing, organizing and operating the steering committee of the project of motorways of electricity.

The composition of this government committee includes the presence of the Norwegian Grenor and Chinese Power China International. The body's mission is to ensure the consistency of projects with public policies, validate studies related to them, formulate strategic orientations, examine funding plans, ensure compliance with commitments and obligations of the State, recruit external consultants, etc.

It must be said that the presence of Grenor and Power China in this steering committee of highways electricity is not a big surprise. For, the President of the Republic, Paul Biya, received in audience on August 11, 2017, in Yaounde, Finn Johnsen, and Song Dongsheng, respectively presidents of the Norwegian groups Green Energy Norway (Grenor) and Chinese Power China International.

The two guests of the Palace of Unity had come to present, that day, to the head of the Cameroonian state an offer of industrial development for the country. First, the construction of a thermal power plant for the production and distribution of electricity in Douala and its surroundings. It will have to produce 150 megawatts of energy. Then there is the extension of the hydroelectric dam at Memve'ele (211 MW). And finally, the construction of a thermal power plant with an estimated production capacity of 1,000 megawatts of electricity.

The chairman of the Norwegian group, Finn Johnsen, said during the meeting that this important program is a boon to young people looking for jobs. In total, 800,000 new direct and indirect jobs will, according to him, be generated by these investments.

http://www.investiraucameroun.com/grands-travaux/2112-10008-cameroun-le-norvegien-grenor-et-le-chinois-power-china-integres-dans-le-comite-gouvernemental-dedie-aux-autoroutes-de-l-electricite

banjomick

- 22 Dec 2017 11:54

- 554 of 701

- 22 Dec 2017 11:54

- 554 of 701

The IMF validates the first review of its program with Cameroon, and makes a new disbursement of 65 billion FCFA

Friday, 22 December 2017

(Invest in Cameroon) - The Board of Directors of the International Monetary Fund (IMF) validated, on December 20, 2017, the first review of its three-year economic program (2017-2019) with the Cameroonian government.

" Cameroon's performance under the Extended Credit Facility (ECF) has been broadly satisfactory. The authorities remain fully committed to fiscal consolidation, and the 2018 budget is in line with the objectives of the program. However, meeting the deficit targets can be challenging in the context of lower-than-expected revenues and spending pressures in 2018 and 2019, "said Mitsuhiro Furusawa (pictured), Deputy Managing Director of the IMF.

This validation, we learn in an official statement, gives right to a new disbursement of about 117.2 million dollars for Cameroon, more than 65 billion CFA francs. This additional disbursement brings to approximately $ 292.9 million (about CFAF 162 billion), the overall allocation made available to Cameroon by the IMF since the conclusion, in June 2017, of an Extended Credit Facility. , between Cameroon and this institution of Bretton Woods.

The program, with a total of $ 666 million (more than CFAF 370 billion), provides for disbursements over a period of three years, subject to the approval of the half-yearly reviews by the Fund's Board of Directors. .

As a reminder, this three-year program aims to support the country's efforts to restore external and fiscal sustainability, and lay the foundation for sustainable, inclusive growth driven by the private sector.

Brice R. Mbodiam

http://www.investiraucameroun.com/cooperation/2212-10012-le-fmi-valide-la-1ere-revue-de-son-programme-avec-le-cameroun-et-fait-un-nouveau-decaissement-de-65-milliards-fcfa

banjomick

- 23 Dec 2017 10:50

- 555 of 701

- 23 Dec 2017 10:50

- 555 of 701

World Bank Provides $ 200 Million Budget Support to Cameroon

Friday, 22 December 2017

(Invest in Cameroon) - The Cameroonian Minister of Economy, Louis Paul Motaze, and Gina Bowen, representative of the director of operations of the World Bank, signed a credit agreement in Yaounde on 22 December. amount of 200 million dollars, or 112.83 billion FCFA.

The agreement, which is being signed, is dedicated to supporting development policies for fiscal consolidation and inclusive growth in Cameroon.

Louis Paul Motaze explained that the amount mobilized is only part of the first tranche ($ 200 million) of the global envelope of budget support expected from the World Bank totaling $ 400 million. (about 220 billion FCFA). " It will therefore remain to mobilize $ 200 million ($ 100 million in 2018 and $ 100 million in 2019) subject to the satisfactory implementation of the economic and financial program with the IMF whose success is backed by budget support. . "

To benefit from the global envelope of this financing from the World Bank, Cameroon must successfully carry out, among other things, the reduction of the tax expenditure related to direct taxation, the adoption of a new public procurement code, the deployment of the computer system for the integrated management of the State and payroll, second generation (Sigipes II) within the Cameroonian administration, the establishment of a reliable mechanism for the payment of electricity, etc. .

http://www.investiraucameroun.com/aide-au-developpement/2212-10018-la-banque-mondiale-accorde-un-appui-budgetaire-de-200-millions-de-dollars-au-cameroun

banjomick

- 02 Jan 2018 08:39

- 556 of 701

- 02 Jan 2018 08:39

- 556 of 701

Victoria Oil & Gas Plc

Bomono Farm Out Extension

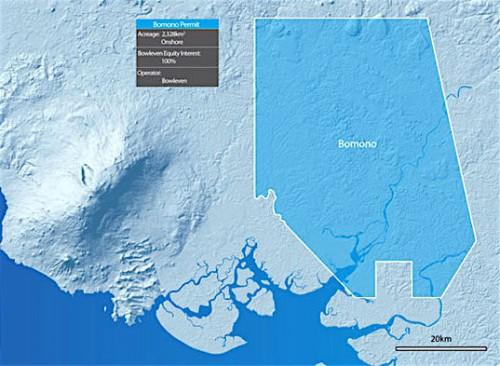

On 6 March 2017 Victoria Oil & Gas Plc, ("the Company") a Cameroon energy utility, announced that the Company and Bowleven Oil & Gas Plc ("Bowleven"), the African focused oil and gas exploration company, signed a farm-out agreement ("the Agreement") relating to the Bomono production sharing contract.

On 17 September 2017 VOG elected to exercise its option to extend the termination date of the Agreement to 31 December 2017.

The Company is pleased to confirm that a further extension has been agreed and discussions on the Agreement are continuing. Bowleven and VOG are working with the Government of Cameroon to advance the Bomono project.

http://www.moneyam.com/action/news/showArticle?id=5798937

banjomick

- 05 Jan 2018 09:42

- 557 of 701

- 05 Jan 2018 09:42

- 557 of 701

Cameroon: British petro-gas Bowleven sends sine die the conclusion of the agreement with VOG on its license Bomono

Friday, 05 January 2018

(Invest in Cameroon) - After successive referrals to September and December 2017, the deadline for the conclusion of the agreement to allow British oil and gas operator Victoria Oil & Gas (VOG) to acquire a stake in 80% on the Bomono license, so far held by his compatriot Bowleven, has just been extended again.

According to the British media, citing an official statement issued by Bowleven to this effect, no new date for the finalization of this agreement was mentioned; leaving doubt on the actual conclusion of this agreement, the principle of which has been recorded since March 2017. This is especially true, only a few days after the announcement of the agreement between the two oil operators. British gas on the Bomono permit, the National Hydrocarbons Company (SNH), the armed arm of the State of Cameroon in exploitation and oil and gas exploration, had expressed reservations.

" The SNH informs the public that the State of Cameroon, the owner of the gas resources concerned, has neither been informed of this agreement in the usual forms provided for in the petroleum contracts, nor authorized such an agreement, as the texts require. . Consequently, the information published by Bowleven concerning Bomono's gas resources which, in the opinion of SNH, still requires research work to justify sustainable commercial exploitation, is erroneous and incurs only this one company " , the Cameroonian state-owned company said in an official statement.

In the wake of this exit from SNH, Bowleven's board of directors was almost dismantled, at the request of Crown Ocean Capital, the largest shareholder of the company. This further complicated the discussions not only to finalize the settlement agreement between Bowleven and VOG, but also to influence the position of the Cameroonian side on this transaction.

As a reminder, according to the aforementioned agreement, VOG will hold 80% of the assets on the Bomono license, through its subsidiary GDC Bomono, against 20% for Euroil (partner of Bowleven), which retains the status of operator. The aim of this lease-out, Bowleven emphasized, is to develop, in the short term, the potential of Bomono (which covers an area of 2328km²), by marketing more gas and by further developing downstream activities. on the perimeter.

Brice R. Mbodiam

http://www.investiraucameroun.com/hydrocarbures/0501-10037-cameroun-le-petro-gazier-britannique-bowleven-renvoie-sine-die-la-conclusion-de-l-accord-avec-vog-sur-sa-licence-bomono

WOODIE - 05 Jan 2018 17:31 - 558 of 701

banjomick

- 05 Jan 2018 20:30

- 559 of 701

- 05 Jan 2018 20:30

- 559 of 701

Victoria Oil & Gas Plc

Gas Supply Contract with ENEO Not Extended

Victoria Oil & Gas Plc ("the Company") announced on 26 June 2017 that it had extended a gas supply agreement with ENEO Cameroon S.A. ("ENEO"), the Cameroon energy joint venture between UK Group Actis and the Cameroon Government, until 31 December 2017, whilst negotiations to agree a new long-term contract continued.

ENEO has informed Gaz du Cameroun S.A. ("GDC") that it is not currently in a position to extend the gas supply agreement and has ceased taking gas from GDC. ENEO is actively discussing potential solutions to this situation with the Government of Cameroon and the Power Regulator in Cameroon. VOG believes this is a temporary issue and expects a resolution in the short to medium term.

ENEO has advised the Company that it faces considerable uncertainties in terms of generation costs that can be passed on as tariffs to end users, large payment arrears from the Cameroon Government and doubts over long term power payment security. Until such issues are resolved, the Company does not believe that ENEO will be able to underwrite the financial aspects of the extension of the contracts with GDC and Altaaqa Global Solutions ("Altaaqa"); the providers of the gas fired generators, or enter into long term financial commitments at this time. ENEO has advised that it is very pleased with the service provided by GDC and Altaaqa and that the suspension is as a result of factors beyond GDC's and Altaaqa's control.

Whilst the suspension of the ENEO supply will clearly directly affect GDC in the short term (it represents an estimated 53% of Logbaba project gas sales revenues for the year ended 31 December 2017), the Company supplies gas to a diverse customer base and will continue working with these customers and other investors in the region to place the newly available gas.

ENEO currently owes GDC approximately $8.7 million gross, which the Company expects will be paid in due course.

As a result of ENEO ceasing to take the gas from VOG, the Company will immediately undertake an assessment of the Company's capital projects and its wider budget and cash flow forecasts, in order to best position the Company to deal with this outturn. The Company intends to provide a comprehensive update of 2017 performance and outline the strategy for 2018, later this quarter.

Ahmet Dik, CEO of VOG commented, "Cameroon has a very important industrial hub in Douala that has seen significant growth and cross border investment over the last five years, both into manufacturing and the power sector.

We remain confident that ENEO and the Government will rapidly find a solution that will allow GDC to continue to supply gas to ENEO and to build on the relationships we have developed with all stakeholders over the past three years.

Cameroon is an area that is in critical need of more power, with an estimated demand in excess of 150mmscf/d of gas in the Douala basin. We remain focused on increasing thermal customer demand in Douala whilst also continuing to supply gas to our 30 other customers, building non-grid solutions for its industrial customers and advancing the compressed natural gas business whilst maintaining our strong position as the sole provider to the region."

http://www.moneyam.com/action/news/showArticle?id=5805688