| Home | Log In | Register | Our Services | My Account | Contact | Help |

Victoria Oil & Gas-The Information & News Thread (VOG)

banjomick

- 07 Jan 2015 21:01

- 07 Jan 2015 21:01

Victoria Oil & Gas Plc (Victoria) has become a significant domestic energy supplier in Africa through its wholly owned subsidiary: Gaz du Cameroun S. A. (GDC).

With operations located in the industrial port-city of Douala, Cameroon, customers are converting their operations to take natural gas supplied by our production wells and pipeline infrastructure.

GDC is the sole gas supplier in the area, providing a cheaper, more efficient, reliable, and cleaner energy alternative to Heavy Fuel Oil use.

Our teams of engineering advisors are on hand to help customer’s cost and implement the change to GDC’s energy products.

Victoria Oil & Gas is traded in the NEX Exchange HERE

Link-HISTORICAL NEWS,VIDEO/AUDIO & EVENTS

Link-Dedicated Posts for:

Gaz du Cameroun S.A. (“GDC”)

Gaz Du Cameroun Matanda S.A. ("GDC Matanda")

Link-Cameroon-Industrialisation Master Plan (PDI) & Africa Energy

NEWS

21st Jan 2019 Production Update

17th Jan 2019 Q4 2018 Operations Update

02nd Jan 2019 Presidential Decree on Matanda Received

24th Dec 2018 Renewal of Long-Term Gas Supply Contract with ENEO

28th Sep 2018 INTERIM FINANCIAL REPORT FOR THE SIX MONTHS ENDED 30 JUNE 2018

17th Aug 2018 Q2 2018 Operations Update

22nd Jun 2018 Report and Accounts to 31 December 2017

14th Jun 2018 Restructure of the BGFI Debt Facility

04th Jun 2018 Notice of Annual General Meeting

04th June 2018 Logbaba Field Reserves Update

24th May 2018 Q1 2018 Operations and Outlook

16th Feb 2018 Q4 17 Operations Update & 2018 Outlook Replacement

05th Jan 2018 Gas Supply Contract with ENEO Not Extended

VIDEO/AUDIO

21st Jan 2019 Victoria Oil & Gas looks ahead to increased cash flow

24th Aug 2018 Victoria Oil & Gas confident of resolving ENEO contract 'within weeks'

22nd Apr 2018 Video from 21/04/2018 UK Investor Show

16th Feb 2018 Victoria Oil & Gas confident of positive outcome to ENEO issue

08th Nov 2017 Victoria Oil & Gas reports very pleasing initial results from La-108

31st Oct 2017 21 Oil and Gas - African Power Panel

30th Oct 2017 121 Oil & Gas Investment

26th Oct 2017 Victoria Oil & Gas raises US$23.5mln to accelerate new growth programme

26th Sep 2017 Victoria Oil & Gas to finalise long term supply contracts after first gas at LA-107

17th Aug 2017 Victoria Oil & Gas expecting La-107 to be a 'substantial' producer

16th Apr 2017 Video from 01/04/2017 UK Investor Show

13th Apr 2017 'It's been a terrific year and a great quarter', says Victoria Oil & Gas' Kevin Foo

06th Mar 2017 Farm-out deal 'a really good strategic move' for Victoria Oil & Gas, says chairman Kevin Foo

06th Feb 2017 Chairman runs Proactive through the good start to 2017

EVENTS

28th Jun 2018 Annual General Meeting ("AGM")

10th May 2018 Africa Oil & Power Investor Forum-London

21st Apr 2018 UK Investor Show

11th-12th Apr 2018 Africa Investment Exchange: Gas (AIX: Gas 2018)-London

09th-10th Nov 2017 The Cameroon Investment Forum(CIF)-Cameroon

30th-31st Oct 2017 121 Oil & Gas Investment-London

23rd-27th Oct 2017 Africa Oil Week 2017-Cape Town South Africa

07th Sep 2017 One2One Investor Forum - London

05th Sep 2017 Oil Capital Conference-London

28th Jun 2017 Annual General Meeting

01st Apr 2017 UK Investor Show

9th Feb 2017 Presentation slide show for One2One

9th Feb 2017 One2One Investor Forum - London

Social Media

banjomick

- 23 Mar 2018 13:46

- 594 of 701

- 23 Mar 2018 13:46

- 594 of 701

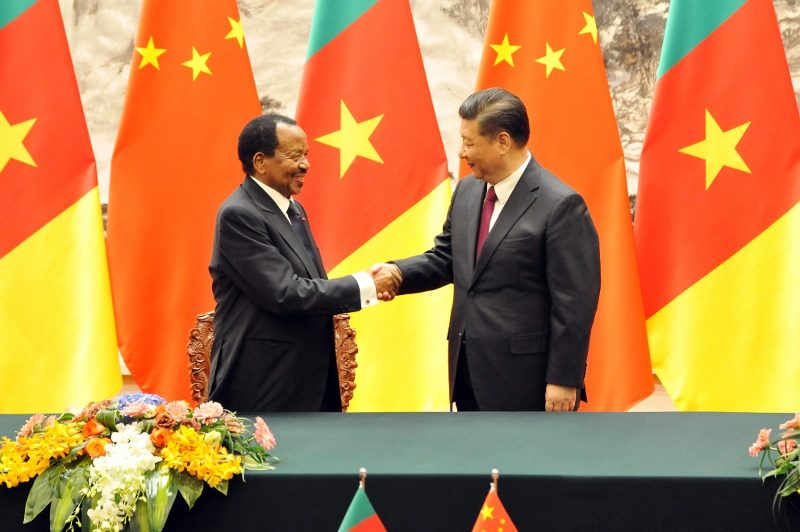

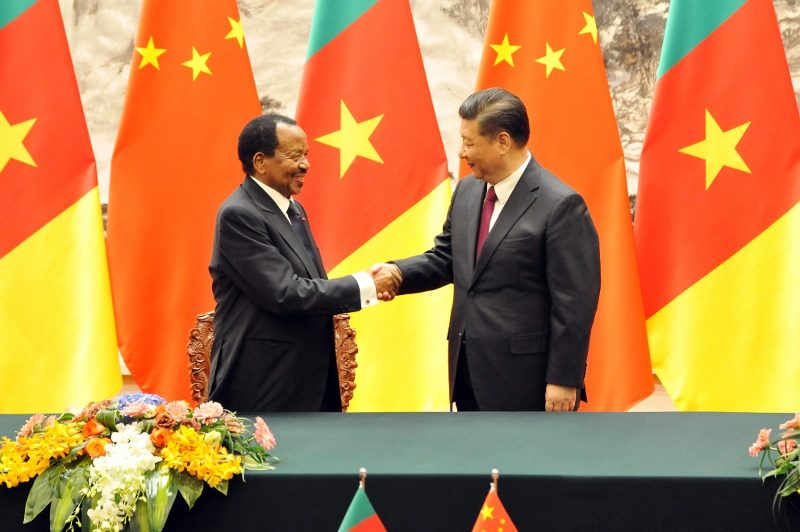

FIVE AGREEMENTS SIGNED BETWEEN CHINA AND CAMEROON

Posted by China Magazine | Mar 23, 2018

Elected president in 2013, Xi Jinping went to Africa for his first state visit, this time he received for the first visit of a head of state, the Cameroonian Paul Biya. The two men intend to elevate the Sino-Cameroonian relations.

On March 22, 2018, President Xi Jinping met with Cameroon's President Paul Biya on the possibilities of bilateral cooperation to set up new Sino-Cameroonian cooperation axes.

For Xi Jinping, Paul Biya is "an experienced leader in Africa and an old friend of the Chinese people. You are the first African Head of State to visit China in 2018 and the first foreign head of state to visit my country after the close of the first session of the 13th Chinese People's Political Consultative Conference and the first session of the 13th National People's Congress of China ".

Xi Jinping said, "We will increase trade and enhance mutually beneficial cooperation in priority sectors. China supports the acceleration of the process of industrialization of Cameroon and encourages large Chinese companies to invest in Cameroon.

For his part, President Paul Biya hailed the Chinese authorities who "gave friendly assistance to Cameroon for its socio-economic development, which brought real benefits to the Cameroonian people." He also announced his support for "The Belt and the Road", and reiterated the principle of one China.

Five cooperation agreements were signed in the presence of the two heads of state by Cameroon and China to consolidate this strategic partnership. China is currently the largest trading partner of Cameroon and the largest investor (in FDI) in Cameroon in carrying out development projects.

Moreover, in 2016, the volume of bilateral trade reached 1 510 billion FCFA (2.3 billion euros). China is present in Cameroon in the fields of drinking water supply, medicine, road and port infrastructure, hydropower, social housing, civil aviation and telecommunications, notes the communiqué of the Presidency of the Cameroon.

https://www.chine-magazine.com/cinq-accords-signes-entre-la-chine-et-le-cameroun/

banjomick

- 26 Mar 2018 10:21

- 595 of 701

- 26 Mar 2018 10:21

- 595 of 701

Cameroon: ENEO intends to completely clear its debt to Gaz du Cameroun and KPDC "by the end of 2018"

posted the March 26, 2018 by Eugene Shema

The company has undertaken to "gradually clear" its debt since the beginning of the year, "so that the financial balance of the energy sector does not break"

The company Eneo , majority owned by the British Actis (51%), undertook to settle "progressively" its debt towards the managers of the two main gas plants: Kribi Power Development Company ( KPDC ), a subsidiary of the British Globeleq; and Gaz du Cameroun , a subsidiary of the British group Victoria Oil and Gas PLC, according to information provided to Energies Media by an official source.

This debt should be completely settled "by the end of the year" , "so that the financial equilibrium of the sector does not break , " comments our source. "It is necessary that KPDC and Gas of Cameroon can also pay their suppliers" , she completes.

Eneo finalized an "arrears settlement agreement" with KPDC in early February.

KPDC has a 211 MW gas plant in Kribi (South Cameroon), energy sold exclusively to Eneo and injected into the South interconnected grid (RIS).

Gaz du Cameroun (GDC) and its partner Altaaqa Global produce electricity from the exploitation of the Logbaba gas field (Littoral-Cameroun). Last year, Eneo consumed 50 MW of GDC, energy also intended for RIS. Between January 1 and December 31, 2017, deliveries to Eneo accounted for 53% of Logbaba's gas sales.

At the end of 2017, as Energies Media reported , KPDC decided to reduce its production by 100 MW, due to unpaid supply bills of around CFAF 46 billion (around 70 million euros).

In connection with this situation, pending the settlement of a slate valued at hundreds of billions of F CFA due to Eneo by the public administrations, the operator had decided for its part not to renew its energy supply with Gaz du Cameroun from 1 January 2018.

It should be noted, however, that in early January, Eneo was debtor of $ 8.7 million to GDC, debt that the dealer of electricity distribution began to clear. By mid-February, this debt of GDC had already been reduced to $ 5 million .

The subsidiary of Victoria Oil and Gas, which accuses the coup - because Eneo consumed more than 50% of its production before its decision to suspend - hopes that the supplies of the operator will resume once the entire debt has been settled.

On the side of Eneo, it is said that we manage however, in the current situation, to maintain "the balance of supply demand on the RIS" , partly thanks to the "erasing efforts made by our main industrial customer Alucam", can be read in the Eneo Electrical Service Information Note in February 2018

As part of the erasure , the industrial group Alucam - which consumes about 200 MW alone, according to a data communicated to Energies Media - agrees not to consume the electricity provided by Eneo at certain times of the day, during rush hours.

The concessionaire of the electricity distribution service relies heavily on the entry into production - expected - of the Memve'ele dam (211 MW), in order to reduce the production costs on the RIS and consequently the gas supplies that it receives. "Are expensive" . A hope contrary to the wishes of GDC.

https://energies-media.com/eneo-compte-apurer-dette-gaz-cameroun-kpdc-fin-annee-2018/

banjomick

- 27 Mar 2018 12:54

- 596 of 701

- 27 Mar 2018 12:54

- 596 of 701

Chinese government promised to cancel part of Cameroon's debt

Tuesday, March 27, 2018

(Invest in Cameroon) - The presidency of the Republic of Cameroon speaks about it but, discreetly. " The Chinese government promised to cancel part of Cameroon's debt ," reads the website of the presidency. This after the visit of Cameroonian President Paul Biya in China at the invitation of his Chinese counterpart Xi Jinping, from March 22 to 24.

Even if the amount of the remittance of this debt is not yet unveiled, it is noted that this announcement is a relaxation between Yaounde and Beijing. Indeed, during the visit to Cameroon of Yu Jianhu, Vice Minister of Chinese Commerce, from November 29 to December 2, 2017, the Cameroonian Ministry of Economy had revealed that the relationship with China still faces enormous difficulties which constitute bottlenecks.

Among these bottlenecks, there is notably, " the non-compliance with contractual clauses " by the Cameroonian side, on the one hand, and " slowness in the payment of debt service ", on the other hand. Moreover, China criticizes Cameroon for failing to honor its contractual commitments, for example in the framework of repayment mechanisms for loans earmarked for the construction of the deep-water port of Kribi ($ 243.17 billion and $ 301.57 billion). FCfa) and the acquisition of MA60 aircraft (36.43 billion FCfa) in July 2012.

And yet since 2007, China is presented as the first country providing funds in Cameroon. Its direct interventions are estimated at just over 3,000 billion FCfa. This through financial instruments such as loans and grants from the various donors such as the Chinese Government, Export-Import Bank of China, Industrial and Commercial Bank of China, Bank of China ... etc.

Sylvain Andzongo

https://www.investiraucameroun.com/finance/2703-10515-le-gouvernement-chinois-a-promis-dannuler-une-partie-de-la-dette-du-cameroun

banjomick

- 27 Mar 2018 12:58

- 597 of 701

- 27 Mar 2018 12:58

- 597 of 701

In 2018, the Cameroonian electrician wants to connect half a million additional people to the electricity grid

Tuesday, March 27, 2018

(Invest in Cameroon) - As part of its 2018 Action Plan, Eneo, the concessionaire of the public electricity service in Cameroon, aims to build 100,000 new connections, to allow half a million additional people to access electricity, announces the company in its newsletter last February.

To do this, we learn, this electricity production and distribution company, controlled by the British Investment Fund Actis, has a 2018 investment budget of 37.5 billion CFA francs. . According to the company, more than 50% of this envelope will be dedicated to the rehabilitation, modernization and extension of distribution networks.

This concentration of Eneo's investments in the distribution network is all the more understandable, explain company officials, thanks to the impoundment of the Lom-Pangar dam (6 billion cubic meters). of water supply), load shedding due to insufficient energy supply has decreased considerably, giving way to multiple incidents on the distribution network, which often deprive the population of electric power.

Brice R. Mbodiam

https://www.investiraucameroun.com/electricite/2703-10518-en-2018-l-electricien-camerounais-veut-connecter-un-demi-million-de-personnes-supplementaires-au-reseau-electrique

banjomick

- 28 Mar 2018 09:28

- 598 of 701

- 28 Mar 2018 09:28

- 598 of 701

Presentation Being Updated

27 Mar 2018

http://www.victoriaoilandgas.com/investors/presentations/presentation-being-updated

And regarding the 2018 Investor Show (21st April) which initially had VOG down as an Exhibitor only, they are actually doing a 20 minute presentation:

09.40 – 10.00 20 mins Victoria Oil and Gas

https://www.ukinvestorshow.com/schedule/

Therefore it is quite possible the presentation being updated will be released Friday 20th April.

banjomick

- 12 Apr 2018 10:05

- 599 of 701

- 12 Apr 2018 10:05

- 599 of 701

Translated via Google:

Construction of Douala Grand Mall & Business Park will provide FCFA 30 billion in revenue to local businesses

Thursday, April 12, 2018

(Invest in Cameroon) - Despite the works actually launched since January 2018, the foundation ceremony of the Douala Grand Mall & Business Park, took place on April 11, 2018 in Douala, the economic capital of Cameroon.

The first phase of this project, which involves the construction of a shopping center of 18,000 m² of leasable area, including a Carrefour supermarket, a multiplex of five cinemas operated by the Nigerian Genesis Group, and a wide range of catering, leisure and shopping; will be delivered in the second quarter of 2019, has it been officially learned. The second phase, which will be launched immediately after the first, will include the construction of a five-star hotel and an office park.

" First major investment in real estate made by Actis in Cameroon. According to David Morley, the general director of real estate investments for this British investment fund, the Douala Grand Mall & Business Park will cost 80 billion CFA francs.

According to Cameroonian Mathurin Kamdem, CEO of Craft Development, promoter of this gigantic real estate project, which managed to entice the British investor; the project will provide an overall turnover of 30 billion CFA francs to local companies, through the supply of various materials and equipment.

As a reminder, this project benefited from the tax and customs benefits provided for by the law of April 2013, encouraging private investment in the Republic of Cameroon, which provides for exemptions ranging from 5 to 10 years, both in phase installation that operating companies.

The Douala Grand Mall & Business Park will induce, according to its promoter, the creation of 4,000 direct and indirect jobs, and will ultimately, " Actis, to plant a Garden of Eden in Cameroon, " said the Minister of Commerce, Luc Magloire Atangana.

https://www.investiraucameroun.com/immobilier/1204-10614-la-construction-du-douala-grand-mall-business-park-procurera-30-milliards-fcfa-de-chiffre-d-affaires-aux-entreprises-locales

banjomick

- 12 Apr 2018 18:58

- 600 of 701

- 12 Apr 2018 18:58

- 600 of 701

Electrician Eneo, a subsidiary of Actis, will rely on bank loans to step up investments in Cameroon

Thursday, April 12, 2018

(Invest in Cameroon) - Accompanied by the managers of Eneo, a Cameroonian subsidiary of Actis, David Grylls, Senior Partner in the British group Actis, met on 10 April in Yaoundé, the Cameroonian Minister of Finance, Louis Paul Motaze.

At the end of the interview, Joël Nana Kontchou (photo), general manager of Eneo, explained to the press that the meeting between Mr. Grylls and the member of the government aims to make the inventory of investments of Actis in Cameroon, particularly in the electricity sector. " We know that the quality of service can be improved. For this improvement, we need additional investments. We should already be looking at financing these investments with loans to the bank. So there is talk of having visibility on the Eneo concession. Said Nana Kontchou.

By committing to Cameroon in June 2014, the British Actis fund submitted to the Cameroonian government, an investment program from equity and a long-term loan of nearly 200 billion FCFA. In this vein, Eneo says it has already mobilized short-term bank facilities, up to 16 billion. Actis, the parent company, plans to inject funds amounting to 25 billion FCFA. But on one condition: the effectiveness of extending its concession in Cameroon beyond 2021.

In addition, Eneo is involved, among other things, in the interconnection studies between Chad and Cameroon, the Cholet power plant, which is expected to supply Cameroon and Congo. The subsidiary indicates that it intends to invest 900 billion FCFA in all projects in which it has interests. Half of this global envelope will be used to strengthen and expand distribution networks.

https://www.investiraucameroun.com/electricite/1204-10617-lelectricien-eneo-filiale-dactis-va-sappuyer-sur-des-prets-bancaires-pour-intensifier-ses-investissements-au-cameroun

banjomick

- 22 Apr 2018 08:39

- 601 of 701

- 22 Apr 2018 08:39

- 601 of 701

The actual video from the presentation may take a few weeks before the 'UK Investor Show' publish it on their YouTube channel.

http://www.victoriaoilandgas.com/sites/default/files/presentations/1804%20VOG%20Presentation%20Investor%20Show.pdf

Also a 'VOG Flyer' was posted:

http://www.victoriaoilandgas.com/sites/default/files/factsheets/180419%20Flyer.pdf

banjomick

- 23 Apr 2018 23:07

- 602 of 701

- 23 Apr 2018 23:07

- 602 of 701

The Africa E&P Summit organised and hosted by Frontier Communications, is being held from the 23-24 May 2018 at the world-class venue, the IET London: Savoy Place in the heart of London. We invite you to register to attend this full two-day program or join us as a Sponsor or Exhibitor for what is going to be a fabulous Showcase of Africa's Upstream, in London.

You will hear from key players and the decision-makers, from corporate players active in Africa through to fast-moving independents, finance, legal and service & supply companies and African governments and NOC's seeking investors, featuring Africa Licensing Promotion and NOC showcase with spotlight on Guinea, Cameroon & Namibia.

Event highlights

Hear from Africa's leading E&P companies

50+ world-class speakers

Two full days of High-level C-Suite networking

Africa Petroleum Club – Namibia Showcase Reception

Africa Licensing Promotion & NOC Showcase

Spotlight on Guinea, Cameroon & Namibia

Opportunities, Outlook, Risks & Challenges

Confirmed speakers include:

Jean-Jacques Koum, Head of E&P Division for Gas, Societe Nationale des Hydrocarbures (SNH), Yaounde

Ahmet Dik, Chief Executive Officer, Victoria Oil & Gas, London

https://oilvoice.com/Event/16227/Namibia-Showcase-Reception-at-the-Africa-EP-Summit-2018-and-The-Honourable-Tom-Alweendo-The-Minister-of-Mines--Energy-Namibia

Official Website

https://www.africaepsummit.com/

Wednesday, 23 May 2018 - Day 1

13:40 Session 3: Africa’s Upstream: Opportunities & Outlook

Amongst others:

Victoria Oil & Gas: Unlocking Africa’s Domestic Onshore Gas Reserve

Ahmet Dik, Chief Executive Officer, Victoria Oil & Gas, London

Thursday, 24 May 2018 - Day 2

15:05 Session 4: Africa Licensing Promotion & NOC Spotlight

Cameroon: Licensing & Promotion

Jean-Jacques Koum, Advisor Nr2 to the Executive General Manager & Gas Development Manager

banjomick

- 24 Apr 2018 08:01

- 603 of 701

- 24 Apr 2018 08:01

- 603 of 701

Victoria Oil & Gas Plc

Non-Executive Director Resignation

Victoria Oil and Gas Plc today announces that Iain Patrick has resigned as an independent non-executive director of the Company, with immediate effect.

Chairman Kevin Foo said, "We thank Iain sincerely for his contribution to the Company over the last three years and we wish him well in his future endeavours."

http://www.moneyam.com/action/news/showArticle?id=5943960

banjomick

- 26 Apr 2018 15:06

- 604 of 701

- 26 Apr 2018 15:06

- 604 of 701

Over a 10-year period (2005-2015), people's access to electricity in Cameroon grew by only 7.7%, according to the AfDB

Thursday, April 26

(Invest in Cameroon) - During the decade 2005-2015, the access rate of the Cameroonian populations to the public utility of electricity went from 46 to 53.7%, an increase of only 7.7%, reveals African Development Bank (AfDB) in its latest country report on Cameroon.

This statistic can be explained by the slowdown of investments in the electricity sector until 2012, a period which was also characterized by the inconvenience experienced by the Cameroonian population connected to the electricity grid, due to recurrent power cuts.

But starting in 2012, the country embarked on a major infrastructure construction program, which has enabled the effective start of at least three dam and other hydroelectric projects in the country.

According to the forecasts of the ADB, also contained in the aforementioned report, these new energy infrastructures will, during the year 2018, improve access to electricity for 2.7 million people.

In the meantime, Actis, the UK investment fund that controls the assets of Eneo, the concessionaire of the public electricity utility, claims since its arrival in the electricity sector in Cameroon (in 2014), the connection to the national grid of more than 2 million new consumers.

https://www.investiraucameroun.com/electricite/2604-10690-sur-une-periode-de-10-ans-2005-2015-l-acces-des-populations-a-l-electricite-au-cameroun-a-cru-de-seulement-7-7-selon-la-bad

banjomick

- 26 Apr 2018 22:48

- 605 of 701

- 26 Apr 2018 22:48

- 605 of 701

https://www.youtube.com/watch?time_continue=9&v=qrCTN1V3tBI

banjomick

- 03 May 2018 13:55

- 606 of 701

- 03 May 2018 13:55

- 606 of 701

YF Finance Limited gone over the 3% threshold 5,118,139 shares equating to 3.53%

http://www.moneyam.com/action/news/showArticle?id=5958609

banjomick

- 03 May 2018 22:13

- 607 of 701

- 03 May 2018 22:13

- 607 of 701

Cameroon potential electricity supplier of the CEMAC countries

May 03, 2018

The Cameroonian authorities said Thursday that with the establishment of the National Electricity Transmission Company (SONTREL), Cameroon is increasingly positioning itself as the potential supplier of electricity to the countries of the world. Economic and Monetary Community of Central Africa (CEMAC) and Nigeria.

With regard to the existing infrastructures and the entry into operation of the hydroelectric dams of Memv'ele and Mekin (South), Lom Pangar (East) and Warack (Adamaoua) and the others, Cameroon which currently has an installed capacity of 1,200 megawatts (MW) could save an estimated 700 MW by next year.

A "surplus" to supply the Central African Republic, Congo, Chad and Nigeria who need it.

It is therefore to this heavy mission that SONATREL, which has voted a budget of 109 billion CFA francs for the current fiscal year, will begin to fill in May 2018, when 230 agents of the company Energy of Cameroon ( ENEO) responsible for the production of electricity and who still has the responsibility of transport, have been transferred to SONATREL.

Because of the dilapidated infrastructures and their insufficiency, nearly 40% of the electricity produced is lost in transport, informs ENEO.

Failures that SONATREL which has an investment plan of 900 billion CFA francs should rise while Cameroon plans to produce by 2025, more than 3,000 MW of electricity.

http://apanews.net/index.php/news/le-cameroun-potentiel-fournisseur-de-lelectricite-des-pays-de-la-cemac

banjomick

- 04 May 2018 09:17

- 608 of 701

- 04 May 2018 09:17

- 608 of 701

Africa Oil & Power, the continent’s leading platform for energy investment and policy innovation, is coming to Europe for the first time with the Africa Oil & Power Investor Forum. Hosted in London on May 10, the Investor Forum will bring together top government officials, executives and financiers to address critical needs and opportunities in Africa’s hydrocarbons and power space.

The rise of natural gas, a key trend in Africa’s energy sector, will feature strongly at the Investor Forum, as leaders in the industry – including Dr. Oliver Quinn, Director of Africa and Global New Ventures for Ophir Energy and Kevin Foo, Chairman, Victoria Oil and Gas – discuss the role of gas as a new solution for Africa’s power deficit. Gas-to-power and LNG-to-power are quickly becoming vital to Africa’s energy infrastructure and independents, like Ophir Energy and Victoria Oil & Gas, are blazing new trails in the development of Africa’s vast natural gas resources, bringing innovation to gas monetization. The gas-to-power panel will discuss the financing of gas-to-power and independent power projects; promoting the consumption of natural gas; and the potential of public private partnerships.

https://www.africa-news.info/travel/2018/05/03/africa-oil-power-leads-the-charge-on-energy-industry-evolution/

http://africaoilandpower.com/event/investor-forum-2018/

WOODIE - 08 May 2018 16:01 - 609 of 701

banjomick

- 09 May 2018 00:34

- 610 of 701

- 09 May 2018 00:34

- 610 of 701

banjomick

- 11 May 2018 15:11

- 611 of 701

- 11 May 2018 15:11

- 611 of 701

Cameroon: profitable again after 3 years of deficit, Sodecoton claims 15 billion FCfa to the State to boost its performances

Friday, 11 May 2018

The consolidated financial statements of the Cotton Development Company (Sodecoton), the flagship agro-industrial of the three northern regions of Cameroon, finally posted a net result of 2017 amounting to 4.3 billion CFA francs. .

These statistics revealed by the director general (Dg) of this company, Mohamadou Bayero Bounou, on the sidelines of the celebrations marking the celebration of the last International Labor Day, are well above the 800 million CFA francs advanced by internal sources at the company, in December 2017.

According to the CEO of Sodecoton, this performance is the result of the restructuring of the company, launched in 2016, with the financial support of the State, majority shareholder of this agro-industrial unit. In fact, in order to put Sodecoton back on its feet, after three successive years of deficit, which caused the company to lose a total budget officially estimated at 35.6 billion CFA francs, the state of Cameroon had promised to inject a subsidy of 30 billion FCFA.

So far, only 15 billion francs have actually been released. But thanks to this windfall and its own funds, Sodecoton, we learn, was able to upgrade its industrial equipment, which now turn to 90% of their capacity, against only 51% in 2016. At the same time , the factories were equipped with generators, in order to establish their energy autonomy in the face of recurrent power cuts.

The renewal and rehabilitation of the rolling stock of the company now allows Sodecoton to evacuate on time, the cotton field to the factories, canceling the losses often related to the wet cotton. Coupled with the improvement of the working conditions of the employees, these restructuring measures allowed the agro-industrial giant of the northern regions of Cameroon to get out of the water.

Moreover, "although society is getting better and better, I take this circumstance to once again draw the attention of the public authorities to the support expected from the State. Because, the situation of this company is not completely expurgated of the fragility that the least disruptive element, endogenous or exogenous, could put at risk, if the measures of refreshing of the technical capacities of the ginneries envisaged with these supports , have not materialized, " said the CEO of Sodecoton, evoking the 15 billion CFA francs still expected from the state, the overall envelope of 30 billion CFA francs promised in the context of the restructuring of this company, which supervises more than 250 000 producers in the northern part of Cameroon .

https://www.investiraucameroun.com/agro-industrie/1105-10752-cameroun-redevenue-rentable-apres-3-ans-de-deficit-la-sodecoton-reclame-15-milliards-fcfa-a-l-etat-pour-doper-ses-performances

banjomick

- 15 May 2018 23:22

- 612 of 701

- 15 May 2018 23:22

- 612 of 701

Brasseries of Cameroon invest 4 billion FCFA in a new bottling line in Douala

Tuesday, May 15, 2018

The Société Anonyme des breweries du Cameroun (SABC), a subsidiary of the Castel Group, has just enriched its production facilities. To this end, the governor of the Littoral region, Samuel Ivaha Diboua, inaugurated on May 9, the new PET bottling line of the SABC plant in Koumassi, Douala.

During this ceremony, Emmanuel De Tailly, CEO of Brasseries, said that this investment cost 4 billion FCFA. The work lasted 5 months. " The PET line we are inaugurating today is always the guarantee that Cameroon's industrial know-how and excellence are still at work so that this country does not become an industrial desert ," said Mr. De Tailly .

Before Koumassi, in February 2018 the SABC Group inaugurated the new box chain in Ndokoti (Douala) and the PET chain at the Bafoussam plant.

For the Brasseries of Cameroon, these major investments reflect the group's desire to maintain the rank of leader and continue to be a competitive industrial player. In this vein, SABC is pleased to have invested 45 billion FCFA in its agro-industrial ecosystem where more than 10 000 tonnes of maize and 30 000 tonnes of Cameroonian sugar have been valued.

https://www.investiraucameroun.com/agroalimentaire/1505-10768-les-brasseries-du-cameroun-investissent-4-milliards-fcfa-dans-une-nouvelle-chaine-d-embouteillage-a-douala

banjomick

- 24 May 2018 08:03

- 613 of 701

- 24 May 2018 08:03

- 613 of 701

Victoria Oil & Gas Plc

Q1 2018 Operations and Outlook

Victoria Oil & Gas Plc, the Cameroon based gas and condensate producer and distributor, is pleased to provide an update on the Group's operations for the three months ended 31 March 2018 ("Q1 18" or "the Quarter").

Q1 18 saw a decrease in gas consumption levels from Gaz du Cameroun SA's ("GDC") Logbaba Project in Douala, Cameroon, due to the non-renewal of the ENEO Cameroon SA ("ENEO") grid power gas sale agreement at the end of December 2017. ENEO has not recommenced consumption to date but management is confident of a resolution.

Q1 2018 Overview

· Q1 18 Gross Gas Sold of 330mmscf (54% decrease on Q4 17, 71% decrease on Q1 17)

· Average daily gas production for Q1 18 of 3.50mmscf/d (Q4 17: 7.94mmscf/d, Q1 17: 14.57mmscf/d)

· One more thermal customer, Panzani, came on-line post quarter end and three more, a Nestle subsidiary, Camlait and Agrocam, are commissioning their gas fired gensets

· Well La-107 flow line tie in complete and La-108 perforation gun recovery scoped

· Cash and cash equivalents at end of Q1 18 was $6.0 million (Q4 17: $11.4 million), trade receivables were $4.3 million (Q4 17: $6.2m), trade payables $9.1 million (Q4 17: $8.8 million) and borrowings were $23.4 million (Q4 17: $24.5 million). Net debt was $17.4 million (Q4 17: $13.1 million).

Outlook

· The revised year end production targets are 11.3mmscf/d if ENEO is back online by 1 July 2018 and 7.8mmscf/d if they remain offline.

· Non-grid revenue generating business such as dedicated gas to power solutions for customers and the Compressed Natural Gas (CNG) project are two initiatives that should enable increased revenue to the Company.

· Discussions with three prospective large volume grid-power customers continue for power stations to produce 150MW, 140MW and 150MW respectively with the potential to consume 78mmscf/d of gas in aggregate when operational.

Ahmet Dik, CEO said,

"Despite the suspension of the ENEO supply, I believe that the Company will actually grow stronger and create a more diverse product base in 2018 and continue to build the outstanding business we have created in Cameroon. We have developed gas reserves to meet industrial and grid power demand for large quantities of gas and power that is required by groups other than ENEO.

GDC is the only onshore gas producer in Cameroon; management estimates that with Logbaba and Matanda, GDC has recoverable gas resources of at least 1.5 TCF. Our 50km of gas pipeline and support infrastructure is delivering gas to over 30 customer sites.

We are actively working on non-grid solutions such as customer gas to power units and CNG supply for customers who are away from our pipeline but want gas. In parallel with this we are in discussions with large gas volume consumers and independent power producers who are developing large power stations with potential consumption of approximately 78mmscf/d of gas when operational in 2020."

More via link below:

http://www.moneyam.com/action/news/showArticle?id=5983559