| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Argos Resources (ARG)

markymar

- 27 Jul 2010 12:41

- 27 Jul 2010 12:41

Argos Resources Ltd is an AIM quoted oil and gas exploration company based in the Falkland Islands, ideally placed to make the most of an exciting new oil province heading towards production.

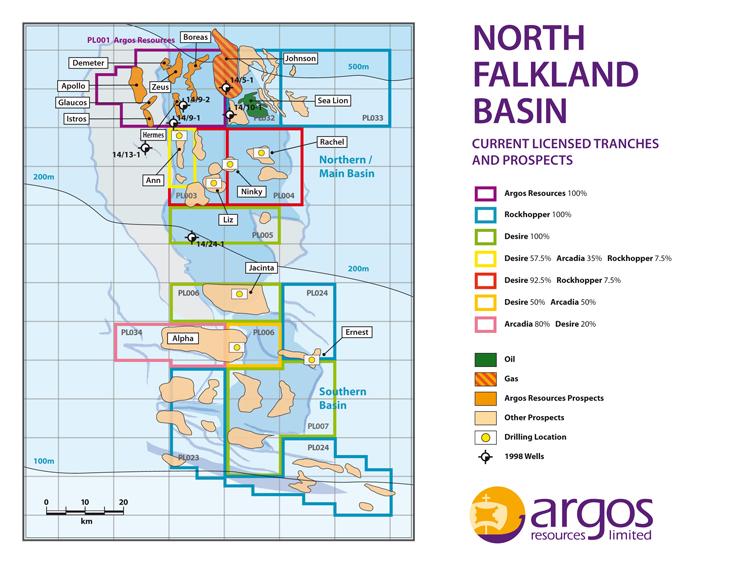

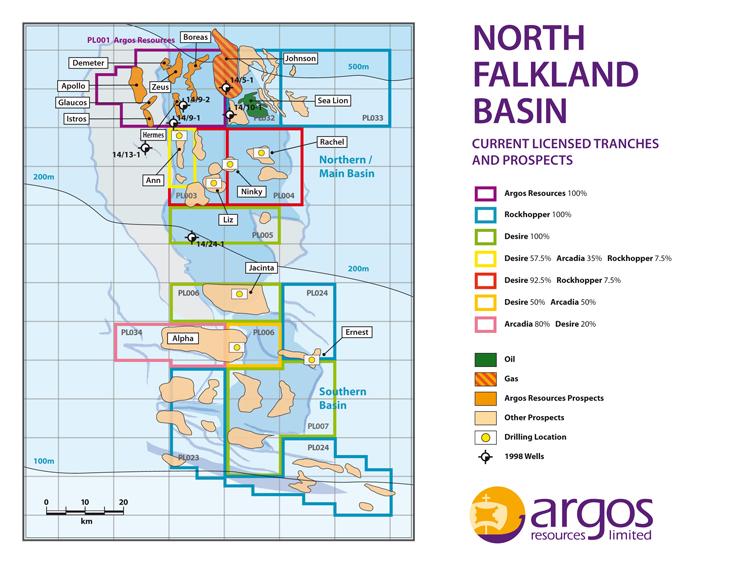

Argos holds a 100% interest in Licence PL001, which covers approximately 1,126 square kilometres in the North Falkland Basin. The licence boundary is just 3km from the Sea Lion oil field, a significant discovery on course for production start-up in 2017.

New 3D seismic data of excellent quality was acquired over the entire licence area in 2011 and has identified 52 prospects with a best estimate of 3,083 million barrels of prospective recoverable resource, and a high estimate of 10,412 million barrels. 40 additional leads have been identified which are not included in the above resource figures and which are the subject of ongoing work.

The Company is now seeking an exploration partner to drill a selection of key prospects to unlock the value of this exciting opportunity.

http://www.argosresources.com/

http://www.falklands-oil.com/

http://www.desireplc.co.uk/

http://www.rockhopperexploration.co.uk/

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

The Opportunity

The Opportunity

•Proven commercial petroleum system

•52 oil prospects, defined by excellent quality 3D seismic data

•CPR attributes 3.1 billion barrels of prospective recoverable resource to the prospects, with upside of 10.4 billion barrels

•40 additional leads identified and under review

•Several prospects similar to Sea Lion

•Prospects have been de-risked by the Sea Lion discovery

•Potential extension of Johnson gas discovery into licence

•Licence 100% owned by Argos Resources

•Benign operating environment

•Stable Government with a competitive tax regime

Argos holds a 100% interest in Licence PL001, which covers approximately 1,126 square kilometres in the North Falkland Basin. The licence boundary is just 3km from the Sea Lion oil field, a significant discovery on course for production start-up in 2017.

New 3D seismic data of excellent quality was acquired over the entire licence area in 2011 and has identified 52 prospects with a best estimate of 3,083 million barrels of prospective recoverable resource, and a high estimate of 10,412 million barrels. 40 additional leads have been identified which are not included in the above resource figures and which are the subject of ongoing work.

The Company is now seeking an exploration partner to drill a selection of key prospects to unlock the value of this exciting opportunity.

http://www.argosresources.com/

http://www.falklands-oil.com/

http://www.desireplc.co.uk/

http://www.rockhopperexploration.co.uk/

http://www.argosresources.com/docs/AIM-Admission-Document.pdf

•Proven commercial petroleum system

•52 oil prospects, defined by excellent quality 3D seismic data

•CPR attributes 3.1 billion barrels of prospective recoverable resource to the prospects, with upside of 10.4 billion barrels

•40 additional leads identified and under review

•Several prospects similar to Sea Lion

•Prospects have been de-risked by the Sea Lion discovery

•Potential extension of Johnson gas discovery into licence

•Licence 100% owned by Argos Resources

•Benign operating environment

•Stable Government with a competitive tax regime

Proselenes - 18 Sep 2010 11:43 - 68 of 185

cynic, also they only have enough cash to do the seismic survey.

They have to come back to the market in the future to raise the big money needed to do any drilling.

Which is why I am waiting. Its only risen in the past days as Evolution and RHPS are doing a marketing job on it presently it seems to drum up buyers.

They have to come back to the market in the future to raise the big money needed to do any drilling.

Which is why I am waiting. Its only risen in the past days as Evolution and RHPS are doing a marketing job on it presently it seems to drum up buyers.

required field - 18 Sep 2010 17:26 - 69 of 185

The sp should rise on potential....why should DES rise so much with diddly squat.....and not a little bit : Argos......

cynic

- 19 Sep 2010 06:54

- 70 of 185

- 19 Sep 2010 06:54

- 70 of 185

DES is indeed rising on very little EXCEPT its fields relative proximity to the proven Sealion, and of course that it has the rig booked for the next pop at finding something

robnickson - 21 Sep 2010 17:36 - 71 of 185

ARG, doing very well on the back of RKH results, plus alot of ramping on ii. Even if ARG has no oil we can get out now for a profit that would take years to earn in a high yield bank account.

mitzy - 23 Sep 2010 08:55 - 72 of 185

What a remarkable share.

required field - 23 Sep 2010 08:57 - 73 of 185

With the others all quite high,.... this had play "catch-up"....

mitzy - 23 Sep 2010 09:05 - 74 of 185

I agree rf.. up 25% today.

cynic

- 23 Sep 2010 09:10

- 75 of 185

- 23 Sep 2010 09:10

- 75 of 185

my fear is that this whole FI scenario is becoming ridiculously frothy with the lemmings piling into everything ..... it should not be forgotten that RKH is the only one to have actually found oil so far, and though that looks to be pretty significant, even that is a good time off being extracted

required field - 23 Sep 2010 09:31 - 76 of 185

Then shorting might be the order of the day soon...bought and sold this one twice now....just taken profits at the earliest top......could go higher but not sure...by the way : everytime I see FI...the first thing I think is formula one....

markymar

- 23 Sep 2010 09:32

- 77 of 185

- 23 Sep 2010 09:32

- 77 of 185

Totaly agree with you Cynic......

cynic

- 23 Sep 2010 13:41

- 78 of 185

- 23 Sep 2010 13:41

- 78 of 185

ARG - must assuredly be too far too fast and ripe for shorting .... they're not even drilling for another 2 years!

required field - 23 Sep 2010 14:07 - 79 of 185

Check out DES...starting to drop and no short from me...

HARRYCAT

- 23 Sep 2010 14:12

- 80 of 185

- 23 Sep 2010 14:12

- 80 of 185

Barring a few exceptions, the whole market is taking a bit of a hit today, so may not be FI related. Of course, frothy stocks take a bigger hit.

cynic

- 23 Sep 2010 14:16

- 81 of 185

- 23 Sep 2010 14:16

- 81 of 185

i have shorted both ARG and FOGL, but continue to hold RKH and DES though on a much reduced level from what i had a couple of days back

markymar

- 24 Sep 2010 11:16

- 82 of 185

- 24 Sep 2010 11:16

- 82 of 185

This will come down with a bang, i have sold all my holding, it hasent even done 3D its a crazy price its not worth 132 million just on 2D.

cynic

- 24 Sep 2010 12:14

- 83 of 185

- 24 Sep 2010 12:14

- 83 of 185

just shorted some more at 60.5 ..... that's now quite sufficient, so fingers crossed that common sense takes over, which it has patently NOT done with FOGL!

halifax - 24 Sep 2010 16:27 - 84 of 185

cynic moving against you.

cynic

- 24 Sep 2010 16:37

- 85 of 185

- 24 Sep 2010 16:37

- 85 of 185

happy enough to stay put ..... indian ropes have a habit of collapsing, and even if i'm wrong this time, i can think of plenty of others where i have had a complete disaster .... shorting ARG will not be one of those

cynic

- 28 Sep 2010 15:24

- 86 of 185

- 28 Sep 2010 15:24

- 86 of 185

closed my short here with sufficient profit to pay for one dinner at the Waterside + taxi home! ...... had a staggeringly good meal there on saturday for Beloved's b'day ...... bill was truly eye-watering, but nevertheless passed the acid test of us wanting to return

HARRYCAT

- 19 Oct 2010 09:31

- 87 of 185

- 19 Oct 2010 09:31

- 87 of 185

Completely forgot about this one! There was money to be made on the bounce here, but sp now recovered.