| Home | Log In | Register | Our Services | My Account | Contact | Help |

Victoria Oil & Gas-The Information & News Thread (VOG)

banjomick

- 07 Jan 2015 21:01

- 07 Jan 2015 21:01

Victoria Oil & Gas Plc (Victoria) has become a significant domestic energy supplier in Africa through its wholly owned subsidiary: Gaz du Cameroun S. A. (GDC).

With operations located in the industrial port-city of Douala, Cameroon, customers are converting their operations to take natural gas supplied by our production wells and pipeline infrastructure.

GDC is the sole gas supplier in the area, providing a cheaper, more efficient, reliable, and cleaner energy alternative to Heavy Fuel Oil use.

Our teams of engineering advisors are on hand to help customer’s cost and implement the change to GDC’s energy products.

Victoria Oil & Gas is traded in the NEX Exchange HERE

Link-HISTORICAL NEWS,VIDEO/AUDIO & EVENTS

Link-Dedicated Posts for:

Gaz du Cameroun S.A. (“GDC”)

Gaz Du Cameroun Matanda S.A. ("GDC Matanda")

Link-Cameroon-Industrialisation Master Plan (PDI) & Africa Energy

NEWS

21st Jan 2019 Production Update

17th Jan 2019 Q4 2018 Operations Update

02nd Jan 2019 Presidential Decree on Matanda Received

24th Dec 2018 Renewal of Long-Term Gas Supply Contract with ENEO

28th Sep 2018 INTERIM FINANCIAL REPORT FOR THE SIX MONTHS ENDED 30 JUNE 2018

17th Aug 2018 Q2 2018 Operations Update

22nd Jun 2018 Report and Accounts to 31 December 2017

14th Jun 2018 Restructure of the BGFI Debt Facility

04th Jun 2018 Notice of Annual General Meeting

04th June 2018 Logbaba Field Reserves Update

24th May 2018 Q1 2018 Operations and Outlook

16th Feb 2018 Q4 17 Operations Update & 2018 Outlook Replacement

05th Jan 2018 Gas Supply Contract with ENEO Not Extended

VIDEO/AUDIO

21st Jan 2019 Victoria Oil & Gas looks ahead to increased cash flow

24th Aug 2018 Victoria Oil & Gas confident of resolving ENEO contract 'within weeks'

22nd Apr 2018 Video from 21/04/2018 UK Investor Show

16th Feb 2018 Victoria Oil & Gas confident of positive outcome to ENEO issue

08th Nov 2017 Victoria Oil & Gas reports very pleasing initial results from La-108

31st Oct 2017 21 Oil and Gas - African Power Panel

30th Oct 2017 121 Oil & Gas Investment

26th Oct 2017 Victoria Oil & Gas raises US$23.5mln to accelerate new growth programme

26th Sep 2017 Victoria Oil & Gas to finalise long term supply contracts after first gas at LA-107

17th Aug 2017 Victoria Oil & Gas expecting La-107 to be a 'substantial' producer

16th Apr 2017 Video from 01/04/2017 UK Investor Show

13th Apr 2017 'It's been a terrific year and a great quarter', says Victoria Oil & Gas' Kevin Foo

06th Mar 2017 Farm-out deal 'a really good strategic move' for Victoria Oil & Gas, says chairman Kevin Foo

06th Feb 2017 Chairman runs Proactive through the good start to 2017

EVENTS

28th Jun 2018 Annual General Meeting ("AGM")

10th May 2018 Africa Oil & Power Investor Forum-London

21st Apr 2018 UK Investor Show

11th-12th Apr 2018 Africa Investment Exchange: Gas (AIX: Gas 2018)-London

09th-10th Nov 2017 The Cameroon Investment Forum(CIF)-Cameroon

30th-31st Oct 2017 121 Oil & Gas Investment-London

23rd-27th Oct 2017 Africa Oil Week 2017-Cape Town South Africa

07th Sep 2017 One2One Investor Forum - London

05th Sep 2017 Oil Capital Conference-London

28th Jun 2017 Annual General Meeting

01st Apr 2017 UK Investor Show

9th Feb 2017 Presentation slide show for One2One

9th Feb 2017 One2One Investor Forum - London

Social Media

banjomick

- 26 Oct 2017 13:35

- 521 of 701

- 26 Oct 2017 13:35

- 521 of 701

Ahmet Dik, chief executive of Victoria Oil & Gas plc (LON:VOG) discusses with Proactive's Andrew Scott their US$23.5mln raise through an offering of 30,893,660 placing shares and 294,096 subscription shares at a price of 57p each.

Proceeds along with additional capital from local banks in Cameroon will be put towards a new growth programme aimed at the estimated 1,700 megawatt power deficit in the City of Douala.

They're looking to deliver gas output of 100mln cubic feet of gas per day by the end of 2021.

https://www.youtube.com/watch?v=GHmnyg_s_X4

banjomick

- 26 Oct 2017 13:52

- 522 of 701

- 26 Oct 2017 13:52

- 522 of 701

Additional 13 MW for the Oyomabang Thermal Power Plant

25/10/2017

Eneo Cameroon hereby announces the end of rehabilitation work at the Oyomabang Thermal Power Plant and its commissioning. Thanks to the renovation of this generation facility, its capacity has increased from 6 to 19 MW, with a reliability warranty of at least 15 years.

This work, which falls within the framework of Eneo’s investment programme aimed at rehabilitating, reinforcing and stabilizing the generation facility has already made it possible to increase by 76 MW Eneo’s supply capacities, notably with the 55 MW extra energy generated as a result of the renovation of the Limbe Thermal Power Plant gensets, including Bafoussam’ s 9 MW.

According to Eugene Ngueha, Eneo Cameroon COO for Technical Activities, “these efforts aimed at renovating certain facilities will continue with the Bertoua power plant that will increase by 5 MW before the end of the year, thereby reducing the current energy shortfall in the East region.”

According to Joel Nana Kontchou, Eneo Cameroon General Manager, “despite the rather challenging socio-economic context, the strengthening of our generation facilities has always been our top priority. These efforts coupled with transmission and distribution networks stabilization actions have made it possible today to record an 31% improvement in service quality. The collection of debts from all our customers has become the major concern for Eneo Cameroon given the significant investment needs, which of course cannot be met only with the improvement of operational efficiency. All customers should always endeavour to pay their bills; it is a civic duty.”

Besides increasing availability of all the Thermal Power Plants nationwide, the Oyomabang Plant will help boost voltage in the city of Yaounde. By the end of 2017, Eneo Cameroon should thus increase its total generation capacity by 148 MW. These investments would go a long way in reinforcing the stability of the power system nationwide, which is characterized by a steady increase in demand.

About Eneo

Driving force in the electricity sector and a major growth catalyst in Cameroon, Eneo Cameroon has as mission to provide reliable energy and quality service while positioning itself as a model of governance in Africa. Building on the values of integrity, cohesion, respect, and commitment, since 2014, the company has safely connected 315,000 new families and industries. At the end of June 2017, unserved energy dropped by 31% compared to the same period in 2016. With an estimated workforce of 3,700 employees and a portfolio of more than one million two hundred customers, Eneo Cameroon is a public-private partnership that generates and distributes energy in Cameroon. For more information about the company, go to www.eneocameroon.cm

https://eneocameroon.cm/index.php/en/actualite-communiques-en/communiques-communiques-de-presse-en/2548-additional-13-mw-for-the-oyomabang-thermal-power-plant

banjomick

- 26 Oct 2017 22:36

- 523 of 701

- 26 Oct 2017 22:36

- 523 of 701

The Company has built a diverse customer base in Douala, supplying gas for use in thermal applications (such as cement works, breweries, foundries and food manufacturing) and for the generation of electricity. In particular, the Company currently supplies gas to generators installed at the ENEO Cameroun S.A. (“ENEO”) owned, Bassa and Logbaba power stations in Douala. The Company believes there is a circa 3,000MW power demand in Cameroon with a current supply of only c.1,300MW from existing generation sources. GDC intends to target the estimated 1,700MW power deficiency by providing gas to power stations owned by various independent power producers (“IPP’s”). The Government of Cameroon has issued IPP licences to independent parties aimed at reducing the electricity deficit, and with its gas resources and pipeline network, GDC is well placed to support such power demand with the supply of gas.

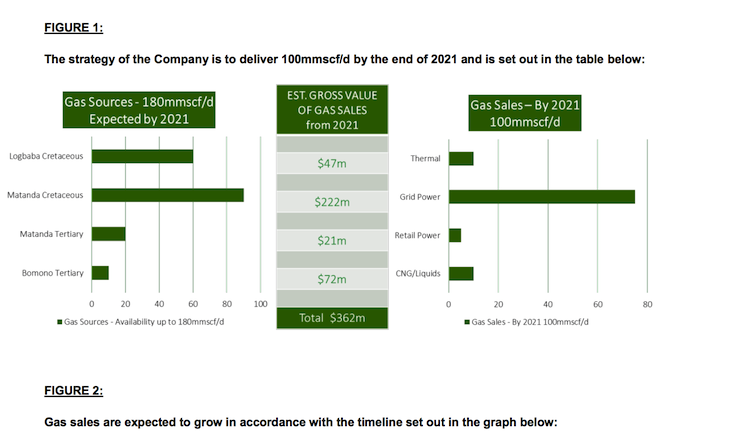

Having established a natural gas supply business in Douala, VOG believes that the net proceeds of the fundraising, together with additional capital intended to be sourced from local banks will allow the Company to accelerate growth in gas production to meet the opportunity that exists in the Cameroon power sector. In addition to the potential for growth in the power generation market, industrial growth in and around Douala provides the opportunity to expand existing thermal markets and develop new gas markets such as Compressed Natural Gas (“CNG”) and industrial power solutions. The Company’s strategy is to deliver 100mmscf/d of gas to a range of customers by 2021.

Gas Markets

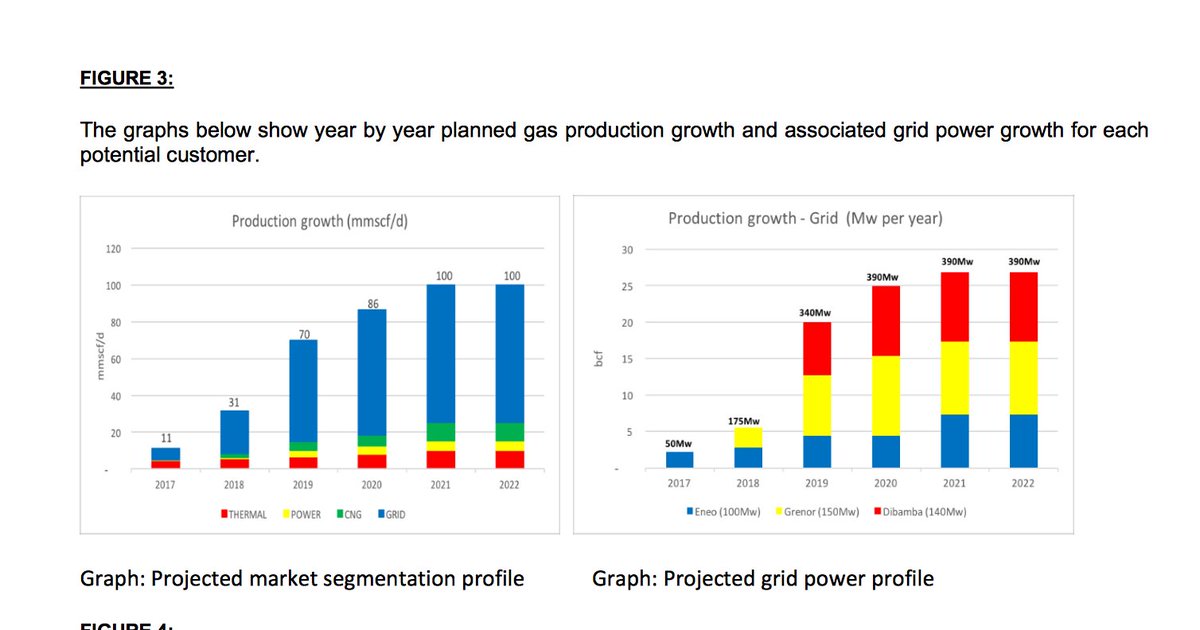

Gas MarketsThe Directors believe that the principal area of gas sales growth for the Company will be the grid power sector. The Company already supplies gas to ENEO, which is 51% owned by Actis UK, who currently generate up to 50MW of electricity using GDC gas, and are planning to increase gas-fired generation to beyond 100MW. The Dibamba Power Station, which is majority owned by Globeleq UK, is planning to install a gas-fired power generation plant by 2020 at its Dibamba Power Station. Grenor Group, owned by Entro-gruppen AS (a Norwegian power company), is the holder of an IPP licence to generate 150MW and is planning to install gas fired power generation equipment by late 2018. The Company is in discussions with all three power generation companies above and aims to secure binding contracts with them in the near future. Gas sales are expected to grow in accordance with the timeline set out in the graph below:

http://www.victoriaoilandgas.com/sites/default/files/171025%20Placing%20RNS%20final%20clean.pdf

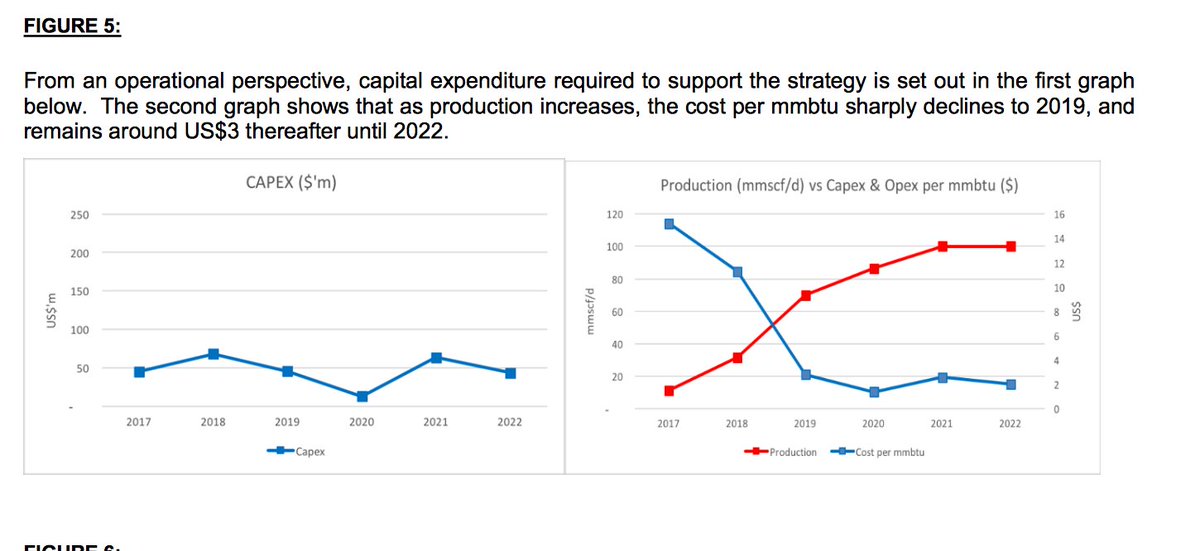

Gas pricing, which currently ranges from US$7.50 to US$16 per mmbtu, is expected to remain constant in the medium term, whilst the weighted average gas price is expected to decline slightly as greater volumes of gas are supplied to the lower margin grid power market segment. The forecast, driven by the strong growth in volumes, is expected to result in strong revenues growth to 2021 and beyond. With a relatively fixed cost based, the increased volumes are expected to result in lower production cost per mmbtu, and strong EBITDA growth. The graph below shows year by year revenue range and pricing ranges.

http://www.victoriaoilandgas.com/sites/default/files/171025%20Placing%20RNS%20final%20clean.pdf

http://www.victoriaoilandgas.com/sites/default/files/171025%20Placing%20RNS%20final%20clean.pdf

banjomick

- 26 Oct 2017 23:00

- 524 of 701

- 26 Oct 2017 23:00

- 524 of 701

Cameroon: Victoria Oil & Gas wants to raise up to $ 26 million to expand its business

(Invest in Cameroon) - On Wednesday, the British gas company Victoria Oil & Gas (VOG), said it is seeking funding between 20 and 26 million dollars to finance the expansion of its activities in Cameroon.

For this, it plans to issue new shares of at least $ 0.75 per share, representing a discount of 12% at the close of October 24. He also plans to raise $ 3 million through direct negotiations. Both plans must be given a green light at the next meeting of shareholders, which will meet at the end of October.

The NGW, the specialized daily on gas issues , says that the funds raised, as well as additional capital from local banks, will enable it to accelerate the growth of production and seize the opportunities offered by the Cameroonian electricity sector.

There is, says a statement from VOG, a persistent demand for 1.7 GW in the Douala region. The funding is expected to start the drilling of the La-109 well in its Logbada project, but above all to increase the production capacity of its eponymous treatment plant.

The statement also said that subject to government approvals, VOG hopes to expand its Matanda and Bomono projects, and expand its pipeline network around the port city of Douala to Bomono, and to other specific customers.

Olivier de Souza

banjomick

- 27 Oct 2017 13:15

- 525 of 701

- 27 Oct 2017 13:15

- 525 of 701

As of September 30, 2017, Dangote sold 938,000 tonnes of cement in Cameroon

Friday, 27th of October 2017

(Invest in Cameroon) - As of September 30, 2017, Nigerian cement manufacturer Dangote reports that, according to its " unaudited " results, it has sold 938,000 tonnes of cement in Cameroon. This represents an increase of 16.4% over the 806 000 tonnes marketed during the same period in 2016.

" Our pan-African business is performing well with excellent sales growth in Cameroon, Ethiopia and Senegal, " said the Nigerian group. It currently boasts 46% market share. The cement company says that the ton of cement is sold at $ 110 (about 60,000 FCFA). In less than two years, Dangote has delighted Lafarge-Holcim with leadership in the Cameroon cement market. The remaining shares are now shared between Cimaf and Medecm Cameroon.

Dangote Cement claims to be the largest cement producer in Africa with production of about 46 million tonnes (Mt) across Africa. Its activities are as follows: Cameroon (clinker crushing 1.5 Mt), Congo (1.5 Mt), Ghana (import 1.5 Mt), Ethiopia (2.5 Mt), Senegal (1.5 Mt), Sierra Leone (0.5Mt import), South Africa (2.8Mt), Tanzania (3Mt), Zambia (1.5Mt). Its production capacity is 29.25 Mt in the domestic market in Nigeria.

Sylvain Andzongo

banjomick

- 27 Oct 2017 14:38

- 526 of 701

- 27 Oct 2017 14:38

- 526 of 701

http://www.victoriaoilandgas.com/sites/default/files/factsheets/171026%20VOG%20Circular%20and%20Notice%20of%20General%20Meeting.pdf

banjomick

- 28 Oct 2017 13:54

- 527 of 701

- 28 Oct 2017 13:54

- 527 of 701

121 Oil & Gas Investment London provides the ideal forum for oil and gas companies to meet 1-2-1 with leading energy funds and oil & gas financiers.

Join us in London, one of the world’s key oil & gas financing hubs, to enjoy the tried and tested 121 event format.

Since 2014, 121 investment conferences have brought together over 300 natural resources companies and over 1200 investors at events in London, Hong Kong, Cape Town and New York to discuss the latest market trends and investment opportunities.

Events are built around two days of pre-arranged 1-2-1 meetings alongside a two-day conference programme packed with investor insight panels, analyst market updates and CEO spotlight presentations.

Kevin Foo is that good he's managed to get his picture in twice on the same page! :-)

Victoria Oil & Gas – Management Interview

Conference Day 1

Corporate presentations - 10-minute oil & gas company and project updates

10:10 am Victoria Oil & Gas Kevin Foo, CEO, Victoria Oil & Gas Victoria Oil & Gas Kevin Foo, CEO, Victoria Oil & Gas

Conference Day 2

10:30 am African Power panel: Opportunities and monetisation strategies for gas-to-power across Africa

• Opportunities in African power generation

• How do you monetise your molecules?

• Overcoming operational delivery challenges

• How is upstream gas competing with the surge in renewables growth?

• Nuances investing in non-OECD jurisdictions?

• What to look for when going into a non-OECD country and what can governments do to encourage energy growth?

Moderator:

Renu Gupta, Managing Director/Oil & Gas Advisor, Gupta Energy

Panellists include:

Ignacio de Calonje, CIO, IFC

Roger Brown, CFO, Seplat Petroleum

Christopher McLean, President & CEO, Stonechair Capital Corp

Kevin Foo, Executive Chairman, Victoria Oil & Gas

Minesh Masru, Managing Partner, OM Capital Partners

https://www.weare121.com/121oilgasinvestment-london/

maestro - 30 Oct 2017 07:27 - 528 of 701

banjomick

- 06 Nov 2017 00:24

- 529 of 701

- 06 Nov 2017 00:24

- 529 of 701

What we actual see is Laurence Reed doing the 10 minute presentation and Ahmet Dik taking part in the 'African Power panel':

10:10 am Victoria Oil & Gas Laurence Reed 10 minute Presentation

Laurence Reed Interview

and

African Power Panel-Ahmet Dik

banjomick

- 06 Nov 2017 16:48

- 530 of 701

- 06 Nov 2017 16:48

- 530 of 701

Cameroon: 60,000 vehicles use the 2nd Wouri Bridge daily

November 02, 2017

The second Wouri bridge temporarily opened to traffic last October has a daily traffic of 60,000 vehicles per day, according to statistics compiled by the Urban Community of Douala (CUD) and which APA obtained a copy Thursday.

800 meters long, this bridge has five lanes, two sidewalks and a railway viaduct.

This density of traffic shows the importance of this road infrastructure not only in the Cameroonian economy, but also in that of the Economic and Monetary Community of Central Africa (CEMAC), as it is true that many goods leave the port Douala for the riparian countries, in particular the Central African Republic and Chad, which do not have a maritime facade.

Still, the figure of 60,000 vehicles contrasts sharply with that of the first bridge when it was built in 1954, and whose daily traffic was estimated at 2,000 vehicles.

And besides servicing the Bonaberi industrial zone (ZIB), and the upstream port of Douala, the second bridge over the Wouri regulates the activities in the Southwest region where is based the National Refining Company (SONARA), the regions northwestern, western and southwestern agricultural, not to mention a significant amount of goods to or from neighboring Nigeria.

With a total value of 139.5 billion FCFA, following an extension for additional facilities, this second bridge over the Wouri river, whose work was launched in November 2013, was initially financed to the tune of 120 billion FCFA, of which 86 billion francs of loans granted by the French Development Agency (AFD) and a share of 34 billion FCFA from Cameroon.

banjomick

- 07 Nov 2017 14:33

- 531 of 701

- 07 Nov 2017 14:33

- 531 of 701

02/11/2017

As the most robust economy in Central Africa, Cameroon, has in the past decade taken steps to further boost growth, making major advances in providing health, education, and clean water, and launching an ambitious infrastructure investment programme to become a middle-income country by 2035, according to the AfDB’s Cameroon Country Brief released on 2 November 2017.

The report highlights the country’s efforts towards achieving this objective, with the Bank’s support, by aligning its development actions to AfDB High 5 strategic pillars.

“Progress has been impressive, but a big leap in business competitiveness is required, to create a more diverse, inclusive, regional economy,” said Simon Mizrahi, Director of the Delivery, Performance Management and results.

Light Up and Power Cameroon: With abundant sun, rivers, and natural gas reserves, Cameroon could potentially be an electricity exporter to the Central African Economic and Monetary Community (CEMAC). But for now, the country must address domestic power shortages, strong annual demand growth of 8%, and low electricity access in rural areas. As of next year, however, 2.7 million Cameroonians will have better electricity access, due to a national plan to expand production and transmission with AfDB’s support.

https://www.afdb.org/en/news-and-events/cameroon-makes-significant-strides-in-social-services-and-infrastructure-new-afdb-report-shows-17499/

banjomick

- 07 Nov 2017 14:44

- 532 of 701

- 07 Nov 2017 14:44

- 532 of 701

Publishing Date 02/11/2017

Description

Cameroon is the economic powerhouse of the Central African Economic and Monetary Community (CEMAC), accounting for nearly 40% of the region's gross domestic product (GDP). It has abundant natural resources, a diversified economic and industrial fabric and a prominent geographical location. With these potentialities, the country meets the challenges that arise on a daily basis and aims to reach the level of emerging countries by 2035. Produce and distribute more energy, modernize agriculture, develop the industrial sector, strengthening regional integration and improving the quality of life of Cameroonians by providing them with access to basic services are at the forefront of these challenges.

AfDB, one of Cameroon's first partners, has been supporting its development efforts since 1972 and has funded more than US $ 2 billion worth of projects.

The objective of this country brief on Cameroon is to present the country’s development progress over the past 10 years and AfDB’s contribution to the achievement of these results. In particular, the report focuses on the Bank’s High 5s: to light up and power Africa, feed Africa, industrialise Africa, integrate Africa, and improve the quality of life of the people of Africa. This report reviews these five priorities in the context of Cameroon using on a series of indicators from the AfDB Results Measurement Framework (RMF). Each of the first five chapters reviews one of the High 5s from the standpoint of Cameroon’s progress and more specifically in terms of AfDB support. Finally, Chapter 6 assesses how effectively the Bank manages its operations in Cameroon.

https://www.afdb.org/en/documents/document/cameroon-country-results-brief-2017-98639/

******************************************************************

"The country also has substantial solar energy potential due to abundant sunshine in the north of the country, wind energy potential (Gulf of Guinea), and abundant natural gas reserves."

"The Bank is also financing a study on the Cameroon-Chad Interconnection Line, one of the biggest electric power infrastructure projects to be implemented in the

Economic Community of Central African States (ECCAS). This study will assist the Ministries of Energy of the two countries in laying the foundations for this major regional project."

"Similarly, the extension of the Dibamba thermal plants is planned (the environmental and social analyses are ongoing"

"Under the Bank’s 2015-2020 Country Strategy Paper (CSP) for Cameroon, the aim is to help Cameroon tap its vast potential, particularly in renewable energy, to increase its generation capacity so that it can become a major regional electric power actor as part of a regional energy market."

Cameroon - Country results brief 2017 (2.2 MB)

banjomick

- 08 Nov 2017 09:37

- 533 of 701

- 08 Nov 2017 09:37

- 533 of 701

Victoria Oil & Gas Plc

Logbaba Drilling Update - La-108 Reaches Target Depth and Encounters 84.5m of Net Pay

Victoria Oil & Gas Plc today is pleased to provide an update on the Group's drilling operations, which are managed by Gaz du Cameroon S.A. ("GDC"), a wholly owned subsidiary of VOG.

· Well La-108 has successfully reached target depth of 2,865m measured depth (MD)

· Indicated 84.5m net gas sand encountered in Upper and Lower Logbaba Formations, exceeding pre-drill expectations and significantly more than La-107 net sands

· Liner to be run and cemented to case off well to depth of 2,859m

· Flow tests planned and La-108 expected to be a producing well by end November

Logbaba Drilling Update

On 7th November, well La-108 has been successfully drilled to its planned TD of the 6" hole section at 2,865m MD (2,463 m TVD). The 4½" liner will now be run and cemented to case off the Logbaba Formation. The production completion will then be installed after which the rig will be released from the well.

Preliminary analysis of the La-108 logs indicates that 84.5m net gas sands have been encountered in the Logbaba Formation, exceeding pre-drill expectations with significantly more net sands than La-107, which encountered 58m of net pay and subsequently flow tested at 54 mmscf/d maximum flowrate through a 70/64ths inch choke.

The production test through the Logbaba production facility is expected to commence during November. This will mark the end of drilling operations for the two well Logbaba drilling campaign that started in November 2016.

The additional reserves from La-107 and La-108 will allow GDC to conclude longer term contracts with Douala based high-usage gas customers.

Ahmet Dik, CEO, said: "La-108 has now successfully reached target depth, which is an excellent result for the company with over 84.5m of net gas sands encountered. This net pay exceeds those of the successful La-107 well, brought into production during September. La-107 has already delivered us a significant increase in available gas supply and we look forward to releasing flow test results from La-108 by the end of November. Our objective is to build scale from our gas production, to be in a position to deliver gas to high usage customers. We estimate that there is demand for over 150 mmscf/d of gas in the Douala Basin and GDC is presently the sole provider to the region."

http://www.moneyam.com/action/news/showArticle?id=5734604

banjomick

- 08 Nov 2017 15:54

- 534 of 701

- 08 Nov 2017 15:54

- 534 of 701

14:32 08 Nov 2017

Ahmet Dik, chief executive of Victoria Oil & Gas plc (LON:VOG), discusses with Proactive the better-than-expected initial results from the drilling of the La-108 well in Cameroon.

It was drilled down to a target depth of 2,865 metres and encountered some 84.5 metres of net gas intervals, across the upper and lower Logbaba formations – which exceeded expectations and is significantly more than the 58 metres seen in the successful recent La-7 well.

http://www.proactiveinvestors.co.uk/companies/stocktube/8341/victoria-oil-gas-reports-very-pleasing-initial-results-from-la-108-8341.html

banjomick

- 10 Nov 2017 11:20

- 535 of 701

- 10 Nov 2017 11:20

- 535 of 701

( APA 10/11/17)

Marthe Angeline Minja, General Manager of the Investment Promotion Agency (API)

APA-Douala (Cameroon) - More than 1,200 participants from local business and foreign companies from Africa, America, Asia and Europe have been participating since Thursday in Douala the second edition of the Cameroon Investment Forum (CIF), noted APA on the spot in the economic metropolis of Cameroon.

On the central theme "Linking project leaders and technical and financial partners for the promotion of local industry and investment attraction", it is a question for participants from state companies and institutions public, consular chambers, development partners, financial and banking institutions, economic operators and domestic and foreign investors, to seek ways and means to improve the business environment, with a particular focus on the new Master Plan of Industrialization (PDI).

In his speech, the Director General of the Investment Promotion Agency (API) Marthe Angélique Minja, recalled the development of an incentive framework for private investment, granting tax exemptions to companies as well during the investment phase. installation only production.

In this wake, she insisted, API has signed 134 partnership agreements with companies with investments projected at 3000 billion CFA francs for 47,000 direct jobs expected.

In any case, "Cameroon is a good risk for investors," said the IPA CEO, especially as it is a "dynamic process, a synergy that requires constructive consultation" She added.

While it is true that all sectors of the economy are concerned in this framework of incentives for private investment, in the said conventions, the focus is on the promotion of agribusiness, social housing and the chemical industry.

Opening the business forum on behalf of Cameroon's head of state Paul Biya, the Minister of Mines, Industry and Technological Development (MINMIDT) Ernest Gwaboubou, said the development of a new IDP in force since January 2017, is a framework "to promote the visibility and readability of the measures taken by the government for the promotion of business in Cameroon".

The objective being by 2025, to make Cameroon "the factory of the new Africa", "nurturer of the Economic and Monetary Community of Central Africa (CEMAC), the Economic Community of the States of the Central Africa (ECCAS), and Nigeria.

For forty-eight hours, business is about building and strengthening business partnerships through B to B and B to G meetings, thematic exchanges, panel discussions, exhibitions, and award ceremony at the investor ceremony.

banjomick

- 10 Nov 2017 16:12

- 536 of 701

- 10 Nov 2017 16:12

- 536 of 701

Friday, 10 November 2017

(Invest in Cameroon) - As every month, for the past 5 years, the new edition of the magazines Invest in Cameroon and Business in Cameroon has just been published. For this month of November 2017, this magazine in which beats the heart of the Cameroonian economy makes a big zoom on the public debt of the country, which is the subject of several debates.

What is the volume of this debt? Who are the main lenders in Cameroon? Why has the country fallen into debt with some speed in recent years? The answers to all these questions are contained in the file of the month.

Downloadable free of charge from the website www.investiraucameroun.com , the last issue of this magazine also gives an overview of local economic news with Célestin Tawamba, the new president of the Cameroonian Employers' Association (Gicam), the oldest and most important group of bosses in the country.

In this new edition, you will also find the latest national news in sectors as varied as public management; telecoms, including the Orange-Camtel dispute, and the reduction in MTN's subscriber base in the third quarter; industry; finance, with the appointment of Cameroonian Kammogne Fokam as focal point for Chinese investments in Africa; agriculture, energy, transport, infrastructure, etc.

http://www.investiraucameroun.com/media/1011-9768-le-magazine-investir-au-cameroun-revele-les-ressorts-de-la-dette-publique-du-pays-dans-son-edition-de-novembre-2017

banjomick

- 11 Nov 2017 15:23

- 537 of 701

- 11 Nov 2017 15:23

- 537 of 701

Cameroon 2017

"Leading Edge Cameroon 2017 was born out of our conviction that Cameroon holds great potential as a destination for investment capital. With the largest and most diverse economy in the Central African Economic and Monetary Community (CEMAC), the nation exhibits immense, untapped sources of wealth across multiple sectors. We have been honoured to meet first-hand with government officials and industry heavyweights in the country, a welcoming microcosm of Africa with its ethnic, linguistic and geographic diversity comparable to that of the continent at large.

This, our inaugural Cameroon guide, is the first in a planned series that will delve deep into the country’s competitive advantages for investment. In this edition, we get the ball rolling with three of the most important sectors: energy, agriculture, and water and sanitation."

Globeleq

"And the government has just confirmed that it is to go ahead with a project to extend production at Dibamba by some 200MW. We are fully on board and prepared to take these projects further, as we enter into new agreements with the government of Cameroon.

In terms of our progress so far, in both cases we have had nothing but positive feedback from all stakeholders.We have already built the new engines for Kribi Power Station, which are currently in Italy awaiting transportation to Cameroon. The final stage will be the supply of gas, which is an issue that we are still discussing with the Cameroonian national oil and gas company,Société Nationale des Hydrocarbures (SNH).

As far as Dibamba is concerned, here we see an exciting opportunity to introduce a completely new technology in Cameroon. We would like to implement the combined cycle. This technolgy is an assembly of heat engines that work in tandem from the same source of heat, converting it into mechanical energy, which in turn drives electrical generators. It would represent an innovative means of producing energy for Cameroon. We are engaged in ongoing discussions with the government in terms of these new developments and agreements. We have a clear and shared goal which is to work together in partnership to drive economic growth and help meet the objectives of the 2035 initiative — to transform Cameroon’s economy."

A simple energy equation

The Government of Cameroon’s Vision 2035 strategic development plan recognises that “the energy production situation in Cameroon is characterised by volatile and unequal supply for a growing demand”. In its plan, the government has pledged to offset the energy deficit by acting across four areas: “Improving the production of electricity by better exploiting hydroelectric and gas potential; increasing the exploration and exploitation of oil resources; exploiting alternative sources of energy; expanding and modernising transport and distribution infrastructure.” The plan also states that “the energy sector will be one of the main areas where there will be partnerships between the state and the private sector”.

Information regarding Combined Cycle Power Plants

https://www.gepower.com/resources/knowledge-base/combined-cycle-power-plant-how-it-works

https://www.energy.siemens.com/br/en/industries-utilities/power/processes/combined-cycle.htm

banjomick

- 13 Nov 2017 12:08

- 538 of 701

- 13 Nov 2017 12:08

- 538 of 701

Victoria Oil & Gas Plc

("VOG" or "the Company")

Result of General Meeting ("GM")

On 25 October 2017, Victoria Oil & Gas Plc (AIM: VOG) announced the successful completion of a proposed placing and subscription with new and existing shareholders, raising gross proceeds of US$23.5 million (£17.78 million). The Company also proposed to raise up to US$3.0 million (£2.25 million) by way of the Open Offer. The Fundraising, comprising a Placing of 30,893,660 Placing Shares, a Subscription of 294,096 Subscription Shares and an Open Offer of up to 3,948,991 Open Offer Shares, was conditional upon, inter alia, the passing of the Resolutions at the General Meeting.

Full details of the Fundraising were set out in the circular dispatched to Shareholders on 26 October (the "Circular").

General Meeting

The Company is pleased to announce that, at the General Meeting held this morning, all of the resolutions that were proposed in the Notice of General Meeting, were duly passed.

Open Offer

Under the Open Offer, Qualifying Shareholders were able to subscribe for Open Offer Shares on the basis of 1 Open Offer Share for every 28 Existing Ordinary Shares held on the Record Date (being 24 October 2017). The Open Offer closed for acceptances at 11.00 a.m. on 10 November 2017.

The Open Offer Shares were not placed subject to clawback nor were they underwritten. Qualifying Shareholders applied for, in aggregate, 2,073,700 Open Offer Shares pursuant to their Open Offer Entitlements and all Qualifying Shareholders who validly applied for Open Offer Shares pursuant to their Open Offer Entitlements will receive the full amount of Open Offer Shares for which they applied.

As a result, 1,875,291 Open Offer Shares were available under the Excess Application Facility and valid acceptances were received in respect of 1,226,510 Excess Open Offer Entitlements. Accordingly, each Qualifying Shareholder applying for Excess Open Offer Entitlements will receive 100 per cent. of their excess application pursuant to the Excess Application Facility.

Accordingly, the Company has received valid acceptances in respect of 3,300,210 Open Offer Shares from Qualifying Shareholders, which represents 83.57 per cent. of the Open Offer Shares offered.

Admission

Application has been made to the London Stock Exchange for up to 35,136,747 New Ordinary Shares to be admitted to trading on AIM pursuant to the Fundraising. It is expected that Admission will occur at 8.00 a.m. on 14 November 2017.

Following Admission, the Company's total issued share capital will comprise 145,059,728 Ordinary Shares with voting rights. This figure may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, securities of the Company under the FCA's Disclosure and Transparency Rules. The New Ordinary Shares will rank pari passu in all respects with the existing Ordinary Shares in issue, including the right to receive all dividends and other distributions declared.

Interests in Ordinary Shares

The Directors' interests following completion of the Fundraising are as follows:

***via link below***

http://www.moneyam.com/action/news/showArticle?id=5740933

banjomick

- 15 Nov 2017 09:32

- 539 of 701

- 15 Nov 2017 09:32

- 539 of 701

Victoria Oil & Gas Plc ("VOG" or "the Company")

Director Subscription and change in PDMR Shareholdings

http://www.moneyam.com/action/news/showArticle?id=5743475

banjomick

- 15 Nov 2017 10:29

- 540 of 701

- 15 Nov 2017 10:29

- 540 of 701

LINK-Historic Shareholder Information

Securities in Issue

Number of shares in issue: 145,059,728

Percentage of shares not in public hands: 3.26%

Free Float: 96.74%

Holdings of Significant Shareholders

As of November 2017 the Company is aware of the following persons who hold, directly or indirectly, voting rights representing 3% or more of the issued share capital of the Company to which voting rights are attached:

Forest Nominees Limited (GC1)---------6,635,305-------4.574%

Majedie Asset Management Ltd---------6,154,761-------4.243%

http://www.victoriaoilandgas.com/investors/share-information