| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Sylvania Platinum a well undervalued stock (SLP)

mentor - 08 Aug 2017 10:41

A well run company with $16.6m cash on 31st March, half of market cap is in cash as has a strong cash flow.

latest results were an increased annual production from the 63-65K Oz expected

Fourth Quarter Report to 30 June 2017

"Another excellent quarter's production of 17,954 ounces bringing total annual production to 70,869 ounces - a new Company record."

"Sylvania is pleased to report that the rights to mine copper, gold, nickel and PGMs as well as heavy minerals, iron and vanadium were granted by the DMR on 31 March 2017."

"Sylvania Platinum is a rapidly expanding producer of the platinum group metals"

Metals produce or with rights to mine - Platinum, copper, gold, nickel rhodium, iron and vanadium

Some negative

Excess supply and inventories and demand uncertainty

SA becoming uninvestable due to poor policy

Market data

Shares in Issue 290m

Market Cap. £27m

Share price 9.25p

PE Ratio 11.28

Earnings 0.86p ( 1.28 US cents )

latest results were an increased annual production from the 63-65K Oz expected

Fourth Quarter Report to 30 June 2017

"Another excellent quarter's production of 17,954 ounces bringing total annual production to 70,869 ounces - a new Company record."

"Sylvania is pleased to report that the rights to mine copper, gold, nickel and PGMs as well as heavy minerals, iron and vanadium were granted by the DMR on 31 March 2017."

"Sylvania Platinum is a rapidly expanding producer of the platinum group metals"

Metals produce or with rights to mine - Platinum, copper, gold, nickel rhodium, iron and vanadium

Some negative

Excess supply and inventories and demand uncertainty

SA becoming uninvestable due to poor policy

Market data

Shares in Issue 290m

Market Cap. £27m

Share price 9.25p

PE Ratio 11.28

Earnings 0.86p ( 1.28 US cents )

..

mentor - 08 Aug 2017 11:00 - 2 of 10

Tramlines broken out over a couple weeks ago - 20 Jul '17

"Has been on a descending Tramlines for a while, and after holding at around 9p ( + or - ) for some time, today's rise with volume has broken out of the tramlines "

"Has been on a descending Tramlines for a while, and after holding at around 9p ( + or - ) for some time, today's rise with volume has broken out of the tramlines "

mentor - 08 Aug 2017 11:22 - 3 of 10

Has been increasing production for the last 7 years

2010 - 25K Oz

2011 - 42K Oz

2012 - 46K Oz

2013 - 44K Oz

2014 - 54K Oz

2015 - 58K Oz

2016 - 61K Oz

2017 - 71K Oz (unaudited as per last Q report)

2010 - 25K Oz

2011 - 42K Oz

2012 - 46K Oz

2013 - 44K Oz

2014 - 54K Oz

2015 - 58K Oz

2016 - 61K Oz

2017 - 71K Oz (unaudited as per last Q report)

mentor - 08 Aug 2017 14:19 - 4 of 10

Downtrend

Floor

Uptrend

Floor

Uptrend

mentor - 08 Aug 2017 15:41 - 5 of 10

Second time to 10p bid

Some large trades ( MM size is 2x30K and 5 x50K ) once again

&MA(50)&IND=MACD(26,12,9);RSI(14);SlowSTO(14,3,3)&Layout=2Line;Default;Price;HisDate&XCycle=&XFormat=)

Some large trades ( MM size is 2x30K and 5 x50K ) once again

mentor - 08 Aug 2017 23:34 - 6 of 10

As share price moved to 10p has crossed up the 50 days MA a bullish signal

&IND=;&Layout=2Line;Default;Price;HisDate&XCycle=&XFormat=)

mentor - 21 Aug 2017 09:00 - 7 of 10

SLP 10.25p +0.875p Sylvania Platinum Year results

By the profits and EPS 3.06 US cents ( 2.35p at $1.30= 1£ ), the shares are well UNDERVALUED at at historic PE of 4.4, no wonder ther is a share buy back. On a historic PE of 10 then are worth 23p and Platinium price is rising since Year end 30 June, so yet better resuls next year ............

Financial snapshot

· Group revenue increased 28% year-on-year to $50.5 million (FY2016: $39.5 million);

· EBITDA increased 54% to $20.0 million for the Sylvania Dump Operations ("SDO") (FY2016: $13.0 million);

· Group EBITDA improved by 65% to $18.3 million (FY2016 $11.1 million);

· General and administrative costs are down by 12% from $2.26 million in FY2016 to $2.00 million;

· Gross profit up by 84% year-on-year from $7.73 million in FY2016 to $14.26 million;

· Profit after income tax of $8.87 million achieved (FY2016: $3.73 million);

· Basic earnings per share ("EPS") improved 139% to 3.06 US cents per share from 1.28 US cents per share in FY2016;

· Group capital and exploration expenditure increased by 162% to $4.67 million (FY2016: $1.78 million);

Operations snapshot

· Fourth consecutive year of record SDO production at steady state, achieving 70,869 ounces - a 17% increase from the previous record of 60,643 ounces achieved in FY2016;

· Group cash cost $453/oz, a 4% decrease year-on-year from $470/oz in FY2016.

SYLVANIA OVERVIEW

The SDO production set an annual Company record for the fourth consecutive year at steady state by achieving 70,869 ounces. This is a 17% increase year-on-year from the previous record of 60,643 ounces achieved in FY2016.

The Group cash balance was $15.3 million at 30 June 2017, having increased by $8.6 million (128%) from $6.7 million in the previous year. The Group cash balance grew by 20% from $12.7 million reported at the end of H1 to $15.3 million in H2.

By the profits and EPS 3.06 US cents ( 2.35p at $1.30= 1£ ), the shares are well UNDERVALUED at at historic PE of 4.4, no wonder ther is a share buy back. On a historic PE of 10 then are worth 23p and Platinium price is rising since Year end 30 June, so yet better resuls next year ............

Financial snapshot

· Group revenue increased 28% year-on-year to $50.5 million (FY2016: $39.5 million);

· EBITDA increased 54% to $20.0 million for the Sylvania Dump Operations ("SDO") (FY2016: $13.0 million);

· Group EBITDA improved by 65% to $18.3 million (FY2016 $11.1 million);

· General and administrative costs are down by 12% from $2.26 million in FY2016 to $2.00 million;

· Gross profit up by 84% year-on-year from $7.73 million in FY2016 to $14.26 million;

· Profit after income tax of $8.87 million achieved (FY2016: $3.73 million);

· Basic earnings per share ("EPS") improved 139% to 3.06 US cents per share from 1.28 US cents per share in FY2016;

· Group capital and exploration expenditure increased by 162% to $4.67 million (FY2016: $1.78 million);

Operations snapshot

· Fourth consecutive year of record SDO production at steady state, achieving 70,869 ounces - a 17% increase from the previous record of 60,643 ounces achieved in FY2016;

· Group cash cost $453/oz, a 4% decrease year-on-year from $470/oz in FY2016.

SYLVANIA OVERVIEW

The SDO production set an annual Company record for the fourth consecutive year at steady state by achieving 70,869 ounces. This is a 17% increase year-on-year from the previous record of 60,643 ounces achieved in FY2016.

The Group cash balance was $15.3 million at 30 June 2017, having increased by $8.6 million (128%) from $6.7 million in the previous year. The Group cash balance grew by 20% from $12.7 million reported at the end of H1 to $15.3 million in H2.

mentor - 22 Aug 2017 15:57 - 8 of 10

Another good rise with volume 4.3M shares traded

mentor - 23 Aug 2017 08:37 - 9 of 10

11.375p +0.375p

Sylvania Platinum Limited - Share Purchase

The Company hereby announces that, on 22 August 2017, 1,498,248 ordinary shares of USD0.01 each in the Company ("Ordinary Shares") were repurchased at 10.7274 pence per Ordinary Share, and will be held in treasury to satisfy future management awards.

Following this transaction, the Company's issued share capital will be 297,981,896 Ordinary Shares, of which a total of 9,604,135 Ordinary Shares are held in treasury. Therefore the total number of Ordinary Shares with voting rights in Sylvania is 288,377,761 Ordinary Shares.

Sylvania Platinum Limited - Share Purchase

The Company hereby announces that, on 22 August 2017, 1,498,248 ordinary shares of USD0.01 each in the Company ("Ordinary Shares") were repurchased at 10.7274 pence per Ordinary Share, and will be held in treasury to satisfy future management awards.

Following this transaction, the Company's issued share capital will be 297,981,896 Ordinary Shares, of which a total of 9,604,135 Ordinary Shares are held in treasury. Therefore the total number of Ordinary Shares with voting rights in Sylvania is 288,377,761 Ordinary Shares.

mentor - 25 Aug 2017 09:56 - 10 of 10

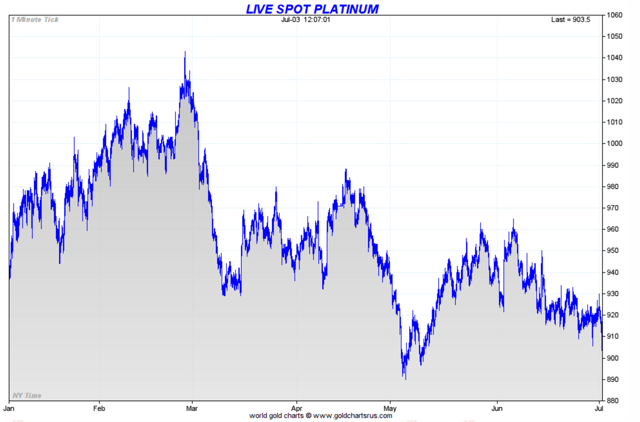

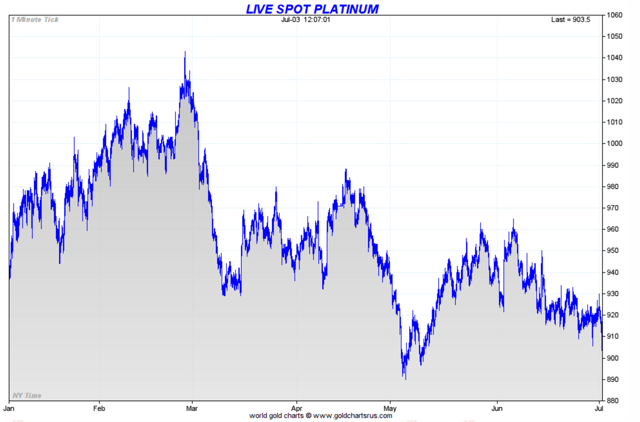

Is It Time To Buy Platinum? - Jul. 5, 2017 5:59 PM ET|

Summary

Platinum is the worst-performing precious metal in the complex and has been down four of the last five years.

At current prices, mine production is unsustainable and as we approach platinum's cash costs of production, supply will inevitably decrease.

Negativity based on its role in the auto industry is driving investor sentiment.

Implementation of tougher emissions standards in China for diesel are scheduled to go into effect in January 2018, which will use more platinum.

Speculative sentiment is the most bearish it has been since the CFTC has published records in 2006.

While we have put a heavy focus in covering gold and silver, the hammering that platinum has received has piqued our interest. We believe that in platinum investors might have the best opportunity of all precious metals. Of course, looking at the YTD chart of platinum doesn't inspire much confidence:

In fact, it's not only this year platinum has been falling. It has been the worst-performing precious metal over the last 10 years. After the drop seen on Monday, it has fallen four out of the last five years -- how is that for beaten down?

Much of this drop has been attributed to the expectations of "changing consumer interests" as they purchase more gasoline vehicles vs. diesel vehicles. Since gasoline vehicles primarily use palladium in catalytic converters (diesel vehicles use platinum), the result is that industrial demand will fall for platinum -- hence surging palladium, which has almost reached parity with platinum.

Summary

Platinum is the worst-performing precious metal in the complex and has been down four of the last five years.

At current prices, mine production is unsustainable and as we approach platinum's cash costs of production, supply will inevitably decrease.

Negativity based on its role in the auto industry is driving investor sentiment.

Implementation of tougher emissions standards in China for diesel are scheduled to go into effect in January 2018, which will use more platinum.

Speculative sentiment is the most bearish it has been since the CFTC has published records in 2006.

While we have put a heavy focus in covering gold and silver, the hammering that platinum has received has piqued our interest. We believe that in platinum investors might have the best opportunity of all precious metals. Of course, looking at the YTD chart of platinum doesn't inspire much confidence:

In fact, it's not only this year platinum has been falling. It has been the worst-performing precious metal over the last 10 years. After the drop seen on Monday, it has fallen four out of the last five years -- how is that for beaten down?

Much of this drop has been attributed to the expectations of "changing consumer interests" as they purchase more gasoline vehicles vs. diesel vehicles. Since gasoline vehicles primarily use palladium in catalytic converters (diesel vehicles use platinum), the result is that industrial demand will fall for platinum -- hence surging palladium, which has almost reached parity with platinum.

- Page:

- 1