| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

The really useful silver thread (AG)

squirrel888 - 12 Jun 2013 10:30

Saturn6 - 20 Dec 2013 08:42 - 1004 of 1034

I pointed out prior a divergence between $Gold and €Gold and here we now have $Silver failing to confirm this move lower in $Gold on a closing basis...

Now thats not to mean we turn around straight away, it may take a little while for these divergences to turn into upside moves but they are the first shoots of that up-turn.

S.

Now thats not to mean we turn around straight away, it may take a little while for these divergences to turn into upside moves but they are the first shoots of that up-turn.

S.

Saturn6 - 20 Dec 2013 09:47 - 1005 of 1034

A long tail on the daily would tag the 80/Month MA...

S.

gazkaz - 20 Dec 2013 14:33 - 1006 of 1034

Sahara

It looks like TPTB are going all in on painting the year end prices to ensure gold figures performance quoted in the news for 2013 look as painful as possible

- and in the ETF & unit trust blurb it looks as discouraging as possible to the new punters

- plus trying to shake as many leaves from the tree from existing punters

(many ordinary working folk sit down at new year and review how they have done in the year and make decisions on revisions etc)

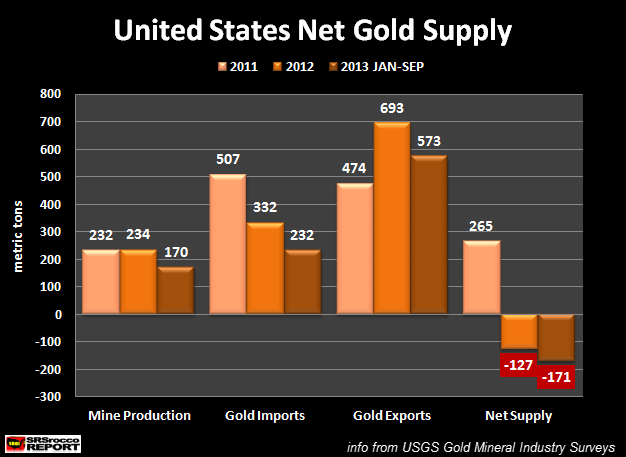

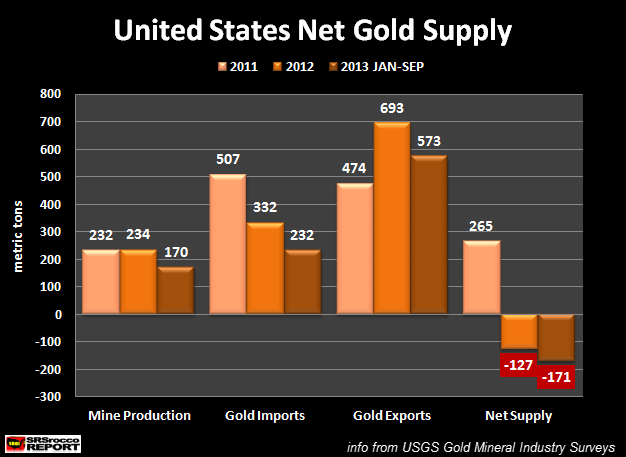

Interesting little chart

- last year and this

(& just to Sept this year ...it's already higher than the whole of last year)

The US is in net deficit on gold

- ie just to Sept 2013

- US new mine supply + imports

- minus US exports

- nets out at MINUS 171 tonnes

And from memory - doesn't US Mint supplied gold coins etc

- come from US mined gold

If "more than"....new mined supply + imports - is already going abroad in exports

- where has the US Mint - been getting it's supply

If mint supply was deducted from the supply side - and then the exports were deducted

- that net negative on the chart would be - even bigger

And again from memory - I think at one point this year - ALL US & Canadian home mined gold could be accounted for - just in US & Canadian Mint output (& that wasn't accounting for issue of proofs or sets etc)

- so that would make a "chunky" adjustment to the chart.

And I believe it was Franklin Mint who said...

(It could have been gold sales or silver sales)

- that....private mint sales...... of coins - outstripped the Gov Mind on a ratio of

- 3 : 1

So

New mine production + imports ...- minus US Mint consumption - minus 3 x US mint consumption (via private mints)

- then minus the quoted exports

Would give - a darn sight bigger Import/Export Deficit

- which is being supplied from ?????

(answers on a postcard to...)

PS Sahara

How is your daughters health doing - it must be getting on for 6m since I last enquired. I sincerely hope improving.

It looks like TPTB are going all in on painting the year end prices to ensure gold figures performance quoted in the news for 2013 look as painful as possible

- and in the ETF & unit trust blurb it looks as discouraging as possible to the new punters

- plus trying to shake as many leaves from the tree from existing punters

(many ordinary working folk sit down at new year and review how they have done in the year and make decisions on revisions etc)

Interesting little chart

- last year and this

(& just to Sept this year ...it's already higher than the whole of last year)

The US is in net deficit on gold

- ie just to Sept 2013

- US new mine supply + imports

- minus US exports

- nets out at MINUS 171 tonnes

And from memory - doesn't US Mint supplied gold coins etc

- come from US mined gold

If "more than"....new mined supply + imports - is already going abroad in exports

- where has the US Mint - been getting it's supply

If mint supply was deducted from the supply side - and then the exports were deducted

- that net negative on the chart would be - even bigger

And again from memory - I think at one point this year - ALL US & Canadian home mined gold could be accounted for - just in US & Canadian Mint output (& that wasn't accounting for issue of proofs or sets etc)

- so that would make a "chunky" adjustment to the chart.

And I believe it was Franklin Mint who said...

(It could have been gold sales or silver sales)

- that....private mint sales...... of coins - outstripped the Gov Mind on a ratio of

- 3 : 1

So

New mine production + imports ...- minus US Mint consumption - minus 3 x US mint consumption (via private mints)

- then minus the quoted exports

Would give - a darn sight bigger Import/Export Deficit

- which is being supplied from ?????

(answers on a postcard to...)

PS Sahara

How is your daughters health doing - it must be getting on for 6m since I last enquired. I sincerely hope improving.

gazkaz - 20 Dec 2013 14:56 - 1007 of 1034

HarveyO - states 1 month out GOFO has gone negative and increasingly negative

- and the rest only marginally positive

(& increasingly less - positive)

i) One Month: -.02000000000% vs yesterday: -.005000000% (backwardation)

ii Two Months: +.001670000000%. vs yesterday: +.01000000%

iii) Three Months: +.01670000% vs yesterday: +.021670000%

iv) Six months: +.068333000000% vs yesterday: +.07333300000%

AND

The total of all issuance by all participants equates to 31 contracts of which

- 30 notices were stopped (ie received) by JPMorgan dealer ( house account )

- (or 97% of the issuance)

and 0 notices stopped by JPMorgan customer account.

It seems that... all the stopping or receiving of contracts

- is from .....the house of Morgan

...................................................................................................................

Are they "stacking their smacks" and taking in the physical delivery ?

- or ....acquiring ammo...to do a paper dump-fest ?

Here's how it looks - visually

Plus according to zh

Over the past week, JPM has been accumulating an impressive amount of gold,

- and what is more curious,

- it has been precisely in increments of 64,300 ounces of eligible gold .....on a daily basis.

So overall

- Another question with - please send answers on a postcard to.....

(As they used to say in all the old days BBC's quiz questions)

- and the rest only marginally positive

(& increasingly less - positive)

i) One Month: -.02000000000% vs yesterday: -.005000000% (backwardation)

ii Two Months: +.001670000000%. vs yesterday: +.01000000%

iii) Three Months: +.01670000% vs yesterday: +.021670000%

iv) Six months: +.068333000000% vs yesterday: +.07333300000%

AND

The total of all issuance by all participants equates to 31 contracts of which

- 30 notices were stopped (ie received) by JPMorgan dealer ( house account )

- (or 97% of the issuance)

and 0 notices stopped by JPMorgan customer account.

It seems that... all the stopping or receiving of contracts

- is from .....the house of Morgan

...................................................................................................................

Are they "stacking their smacks" and taking in the physical delivery ?

- or ....acquiring ammo...to do a paper dump-fest ?

Here's how it looks - visually

Plus according to zh

Over the past week, JPM has been accumulating an impressive amount of gold,

- and what is more curious,

- it has been precisely in increments of 64,300 ounces of eligible gold .....on a daily basis.

So overall

- Another question with - please send answers on a postcard to.....

(As they used to say in all the old days BBC's quiz questions)

gazkaz - 20 Dec 2013 15:23 - 1008 of 1034

Another interesting chart

Again re JPM

Whilst JPM itself - has been - stacking the smack (Orange section)

- Registered Gold ie Customer held gold & not eligible for sale

(Blue section)

- has been pulled out by the boatload

Would that be - a sign

- of WTF - I'm getting the hell out of - Morgue paper gold IOU's

- getting the real stuff

- and - keeping it away from the morgue ??

(ooops - need another postcard :o)

Again re JPM

Whilst JPM itself - has been - stacking the smack (Orange section)

- Registered Gold ie Customer held gold & not eligible for sale

(Blue section)

- has been pulled out by the boatload

Would that be - a sign

- of WTF - I'm getting the hell out of - Morgue paper gold IOU's

- getting the real stuff

- and - keeping it away from the morgue ??

(ooops - need another postcard :o)

Saturn6 - 20 Dec 2013 15:32 - 1009 of 1034

Staggering Gaz - Great charts and the first one has 3 months more to year end, which would show further deterioration I feel.

And with the current price drop below production costs begs the question when will the first miner crimp production with a statement advising operaations will restart when Gold price is above $1500. ;-/

That statement has to come in my view if prices remain this low, as it is becoming fiancially irresponsible to carry on producing below the cost of production. That will tighten the supply side even more.

S.

And with the current price drop below production costs begs the question when will the first miner crimp production with a statement advising operaations will restart when Gold price is above $1500. ;-/

That statement has to come in my view if prices remain this low, as it is becoming fiancially irresponsible to carry on producing below the cost of production. That will tighten the supply side even more.

S.

Saturn6 - 20 Dec 2013 15:51 - 1010 of 1034

Long story with my Daughter Gaz - Her kidney function had stabilised around 14% and the gout tablets were keeping in check the Barcelos/Mediterranean disease. And she was getting back to normal and was working again full time, and then she fell pregnant.!!

And at around 13 weeks had a miscarriage which was a blessing really, as the risks were too major to contemplate. They were never advised or considered precautionary measures for becoming pregnant as she was told she would never be able to conceive again!!

She was struggling to overcome these issues while I had been screened as a donor for the last three months, and then was hit with the bombshell that her husband was secretly on cocaine for three years and it had become out of hand and had run up debts of over 40k, it turns out he ended up doing £300+ a day some days. So she is on her own with her only child and has again thrown herself back into work to recover her financial position.

The only good thing that has come out of all this is the pregnancy meant she had to stop taking the gout tablets and so far has remained off of them without any recurrence of the rigors and her kidney function increased to 19% while pregnant as they said it would, but it wouldn't last, and lo, it has remained at that, her blood pressure is under control with medication, and the only problem she has had is her legs swelling due to standing at work (She has her own hairdressing salon), which she has reduced her workload over the last week and has recovered from that complaint now. So...As you may imagine we are hoping for a better year next year.

We have given her a little financial help only because she is fiercely independent. Bless her. And that was only cos she couldn't work enough with swollen legs.

Apart from that I have high blood pressure from the screening I had and they are currently looking for an infection somewhere in my tubes. I have had scans that have confirmed it, and am awaiting a scan in early Jan to determine where exactly and what they can do for the infection that I have.

Thanks for the concern Gaz!

S.

And at around 13 weeks had a miscarriage which was a blessing really, as the risks were too major to contemplate. They were never advised or considered precautionary measures for becoming pregnant as she was told she would never be able to conceive again!!

She was struggling to overcome these issues while I had been screened as a donor for the last three months, and then was hit with the bombshell that her husband was secretly on cocaine for three years and it had become out of hand and had run up debts of over 40k, it turns out he ended up doing £300+ a day some days. So she is on her own with her only child and has again thrown herself back into work to recover her financial position.

The only good thing that has come out of all this is the pregnancy meant she had to stop taking the gout tablets and so far has remained off of them without any recurrence of the rigors and her kidney function increased to 19% while pregnant as they said it would, but it wouldn't last, and lo, it has remained at that, her blood pressure is under control with medication, and the only problem she has had is her legs swelling due to standing at work (She has her own hairdressing salon), which she has reduced her workload over the last week and has recovered from that complaint now. So...As you may imagine we are hoping for a better year next year.

We have given her a little financial help only because she is fiercely independent. Bless her. And that was only cos she couldn't work enough with swollen legs.

Apart from that I have high blood pressure from the screening I had and they are currently looking for an infection somewhere in my tubes. I have had scans that have confirmed it, and am awaiting a scan in early Jan to determine where exactly and what they can do for the infection that I have.

Thanks for the concern Gaz!

S.

gazkaz - 20 Dec 2013 15:54 - 1011 of 1034

Sahara - true

According to Bill Kaye (Hedgie manager in the far east)

- China are still happy mining at "all in figures"

- of $2,500 !!

I like this visual - on what the announced ..taper... looks like

- on the FEDDY's .....

-( if nobody else is buying this shit....as buyers of last resort...it's down to us)

....ballooning balance sheet

(It's that ....tiny, tiny red dotted deviation line - on the increasingly exponential looking - ballooning FEDDY balance sheet)

According to Bill Kaye (Hedgie manager in the far east)

- China are still happy mining at "all in figures"

- of $2,500 !!

I like this visual - on what the announced ..taper... looks like

- on the FEDDY's .....

-( if nobody else is buying this shit....as buyers of last resort...it's down to us)

....ballooning balance sheet

(It's that ....tiny, tiny red dotted deviation line - on the increasingly exponential looking - ballooning FEDDY balance sheet)

Saturn6 - 20 Dec 2013 15:56 - 1012 of 1034

Meanwhile the miners are performing to plan and have sneaked back into the 'Rectangle' they need to get past the first barricade (the green average) now...

Watch for the Miners/Gold ratio at the top for the first confirmation.

S.

Watch for the Miners/Gold ratio at the top for the first confirmation.

S.

Saturn6 - 20 Dec 2013 16:06 - 1013 of 1034

Exactly at $2500 an oz the Chinks are not shying away from mining as much as they can get there hands on.

I would think the MSM will use the year end stats en masse in order for the banksters to call/collect and guarantee the unwinding of all remaining shorts and super-bulk there longs.... 'The worst year for Gold in 30 years and with a valuation figure of -30%? for the year'

We should be doing the same and acquiring all that we have spare funds for. The price may go lower yet but will we be able to buy it for that as I still envisage a price disconnect from physical and paper before we are all done.

S.

I would think the MSM will use the year end stats en masse in order for the banksters to call/collect and guarantee the unwinding of all remaining shorts and super-bulk there longs.... 'The worst year for Gold in 30 years and with a valuation figure of -30%? for the year'

We should be doing the same and acquiring all that we have spare funds for. The price may go lower yet but will we be able to buy it for that as I still envisage a price disconnect from physical and paper before we are all done.

S.

gazkaz - 21 Dec 2013 12:51 - 1014 of 1034

Sahara

I'm genuinely sorry to hear that your daughter has not only been thro' the mill health wise for the last two years (very much an understatement),

- then to discover her husbands habit and the financial position, would have been truly devastating in itself; but coupled with the health aspect, pregnancy and miscarriage,

- it is truly, well beyond the imagination for anyone else to understand the combined effects of all that mental anguish, and the physical effects, on top of any already, totally health blitzed position

Although I haven't met her, I certainly admire her resiliance .

(As many say 'ere up North...you have certianly raised a "good un" & then some) .

It will undoubtedly have preyed much on you and your own life too, for the last couple of years, (which most people tend not to consider).

Hopefully you will both see a much better 2014, with what I can only describe as

"the stuff of nightmares" quickly fading away in the rear view mirror.

My best wishes to you both.

I'm genuinely sorry to hear that your daughter has not only been thro' the mill health wise for the last two years (very much an understatement),

- then to discover her husbands habit and the financial position, would have been truly devastating in itself; but coupled with the health aspect, pregnancy and miscarriage,

- it is truly, well beyond the imagination for anyone else to understand the combined effects of all that mental anguish, and the physical effects, on top of any already, totally health blitzed position

Although I haven't met her, I certainly admire her resiliance .

(As many say 'ere up North...you have certianly raised a "good un" & then some) .

It will undoubtedly have preyed much on you and your own life too, for the last couple of years, (which most people tend not to consider).

Hopefully you will both see a much better 2014, with what I can only describe as

"the stuff of nightmares" quickly fading away in the rear view mirror.

My best wishes to you both.

Saturn6 - 21 Dec 2013 14:08 - 1015 of 1034

Thank you Gaz _ That is very much appreciated.

I am wondering what she will be faced with next/?...I pray she has a massive turnaround in 2014 as heaven knows she needs it.

And you are so right she has tremendous resilience esp considering she is such a petite pretty thing. Her tenacious attitude despite the overwhleming debilitating circumstances she has faced/facing is a wonder to behold. And an inspiration to us all.

She is my firstborn and I split with her Mother when she was only 1, not for any other reason other than being totally incompatible together, and it broke my heart at the time to be out of my baby Daughters life, but I became very close with my Daughter since she was about 11. so her steely character is a testament to her Mother I have to say.

It is her 32nd Birthday Sunday, and the woman I went on to marry 30 years ago next year and have another Daughter 21 and a Son 19 by thinks of her as her own, and we are very close with her Mother; and Mothers side of the family. So between us we manage to create a sort of family circle 'support network' and it works really well, and no doubt the events that have befallen my Daughter have also made those bonds that exist between us even stronger.

We have a very close family, and just as well; as at times such as we have experienced I can assure you it is invaluable.

Thanks again Gaz for your consideration. And I hope you too have a fantastic Christmas and a bright and blessed New Year.

S.

I am wondering what she will be faced with next/?...I pray she has a massive turnaround in 2014 as heaven knows she needs it.

And you are so right she has tremendous resilience esp considering she is such a petite pretty thing. Her tenacious attitude despite the overwhleming debilitating circumstances she has faced/facing is a wonder to behold. And an inspiration to us all.

She is my firstborn and I split with her Mother when she was only 1, not for any other reason other than being totally incompatible together, and it broke my heart at the time to be out of my baby Daughters life, but I became very close with my Daughter since she was about 11. so her steely character is a testament to her Mother I have to say.

It is her 32nd Birthday Sunday, and the woman I went on to marry 30 years ago next year and have another Daughter 21 and a Son 19 by thinks of her as her own, and we are very close with her Mother; and Mothers side of the family. So between us we manage to create a sort of family circle 'support network' and it works really well, and no doubt the events that have befallen my Daughter have also made those bonds that exist between us even stronger.

We have a very close family, and just as well; as at times such as we have experienced I can assure you it is invaluable.

Thanks again Gaz for your consideration. And I hope you too have a fantastic Christmas and a bright and blessed New Year.

S.

Saturn6 - 21 Dec 2013 14:24 - 1016 of 1034

$Gold needs to bounce off the $1200 close and get above the downrend line, as a failure would argue for a sudden lurch through the $1200 support down to the $1050 line perhaps where the lower support line of a potential Bullish 'Wedge' resides...

The problem is, if or when we get this downward lurch, we can expect a waterfall decline that will take your breath away, and the capitulation from the weak holders at the very time they should be backing up the truck.

S.

The problem is, if or when we get this downward lurch, we can expect a waterfall decline that will take your breath away, and the capitulation from the weak holders at the very time they should be backing up the truck.

S.

Saturn6 - 21 Dec 2013 14:32 - 1017 of 1034

S.

Saturn6 - 21 Dec 2013 14:43 - 1018 of 1034

A waterfall decline could go as low as (Drum Roll) ........$800 oz...Which eerily is where the 150/Month average resides.

S.

S.

Saturn6 - 21 Dec 2013 15:15 - 1019 of 1034

Meanwhile we got the reversal candle on the daily I alluded to earlier, and without a tail. As you may know now this candle with the days before forms an 'Harami' (I think Harami in Japanese means pregnant therefore you can maybe see why this is called so) and we need to see a close above the last candle for confirmation...

As you can see from before if we get the confirmed canlde the first resistance is the 10/DMA then the 20 Mid BB, and then the 50/DMA, and top BB

S.

As you can see from before if we get the confirmed canlde the first resistance is the 10/DMA then the 20 Mid BB, and then the 50/DMA, and top BB

S.

Saturn6 - 21 Dec 2013 15:23 - 1020 of 1034

If we do manage to get a run-up, we can see the monthly chart at month end would then form a tail and perhaps a bullish 'Hammer' candle (long tail small body at the top) which could form a bullish 'Morning Star' if we get a positive close in January. thereby plotting a 'Double Bottom' at a key price and moving average. The =ive divergences on the indicators could be discerning..

Which would then allow the line to finish back within trend on this monthly chart...

All open conjecture at present and the ensuing price action should give us the info to either remain unhedged or re-enter hedges on our long physical holdings via options.

S.

Which would then allow the line to finish back within trend on this monthly chart...

All open conjecture at present and the ensuing price action should give us the info to either remain unhedged or re-enter hedges on our long physical holdings via options.

S.

Saturn6 - 21 Dec 2013 15:32 - 1021 of 1034

$Silver may be plotting a higher low here, as it too plotted an 'Harami' on the daily, but there is a trendline that is calling to be tagged...

See if you can spot the 'Harami' also the previous bullish and bearish 'Harami's 'Hammers and 'Star' formations...

S.

See if you can spot the 'Harami' also the previous bullish and bearish 'Harami's 'Hammers and 'Star' formations...

S.

Saturn6 - 21 Dec 2013 15:40 - 1022 of 1034

S.

gazkaz - 22 Dec 2013 01:26 - 1023 of 1034

Sahara

- with you having mentioned your daughter having reached potential kidney transplant - I have on and off today spent a couple of hours trying to find a link I read a month or so ago - that could be of potential to ...both of you.

I could give the detailed gist of it - but would rather cover it

- backed up peer reviewed published info

- and doctor testimony of cases resolved by it.

My son is over tomorrow (car prob) & we have the seasonal tour - of dopping off the various xmas related etc's

- but should be able to throw some time at it again in between.

If... I can't track it down (or similar), then i will give my own (unsupported) precis and hope you can track down suitable "evidence" yourself of it's potential benefit and decide whether you/your daughter want to persue it.

........................................................................................................................

I am glad your relationship with your daughter was rekindled and has grown to what it is today. It is also great to know that your second wife accepts her as her own and that you are blessed with having a combined tight network of family support.

I was divorced in my late 30's (big knock to the finances :o) - and kept my two sons (8 & 15 at the time) - becoming a single parent full time working father

- which stopped my career in it's tracks for ten years... at what

- is traditionally prime time career time...a challenging decade financially.

(Keeping a stable environment and working within a phonecalls striking distance of home & school.

Ten yrs on ....my sons moved out, as did my long term partners children.

- She sold her house and moved into mine.

- Things were looking rosy. But.....

Two yrs on - I got hit with a long term illness and had to finish work

(It's a frustrating illness - but at least not a terminal one).

We got married earlier this year - and fortunately both treat one anothers adult offspring and grandchildren as our own.

Having had to finish work - gave me another blessing tho'

- via the opportunity to spend a great deal time with my father for a few years, getting to know...the actual man, ....that was my father.

- and since his death a couple of years ago...the actual person herself that is my mother.

So whilst my finances were/are what you might term "blitzed"... by those combined past events to date (Cue Violins - that's enough - it gets better)

- I wouldn't change any of them,

- as I consider the time it gave me with my children growing up & latterly with my parents

- plus meeting and marrying my current wife,

- truly priceless.

The other thing is, had events been otherwise,

- I would never have had the time to find out - how the world really ticks :o)

As to "The Silver Lining" oft quoted.... re every cloud

- I can now look back (over nearly 20yrs) and say (in hindsight)

- it did indeed... shine thro'.... along the way.

.......................................................................................................................

Hopefully - the silver lining will - shine brightly.... for you both in 2014

& fingers crossed on tomorrows search .

PS I seem to get regular spells of - not being able to access Mon-Am - so if I dont post an update by late on Sun/Earl, Mon - it wont probably for the want of trying (even if it's only my own precis of the info)

- with you having mentioned your daughter having reached potential kidney transplant - I have on and off today spent a couple of hours trying to find a link I read a month or so ago - that could be of potential to ...both of you.

I could give the detailed gist of it - but would rather cover it

- backed up peer reviewed published info

- and doctor testimony of cases resolved by it.

My son is over tomorrow (car prob) & we have the seasonal tour - of dopping off the various xmas related etc's

- but should be able to throw some time at it again in between.

If... I can't track it down (or similar), then i will give my own (unsupported) precis and hope you can track down suitable "evidence" yourself of it's potential benefit and decide whether you/your daughter want to persue it.

........................................................................................................................

I am glad your relationship with your daughter was rekindled and has grown to what it is today. It is also great to know that your second wife accepts her as her own and that you are blessed with having a combined tight network of family support.

I was divorced in my late 30's (big knock to the finances :o) - and kept my two sons (8 & 15 at the time) - becoming a single parent full time working father

- which stopped my career in it's tracks for ten years... at what

- is traditionally prime time career time...a challenging decade financially.

(Keeping a stable environment and working within a phonecalls striking distance of home & school.

Ten yrs on ....my sons moved out, as did my long term partners children.

- She sold her house and moved into mine.

- Things were looking rosy. But.....

Two yrs on - I got hit with a long term illness and had to finish work

(It's a frustrating illness - but at least not a terminal one).

We got married earlier this year - and fortunately both treat one anothers adult offspring and grandchildren as our own.

Having had to finish work - gave me another blessing tho'

- via the opportunity to spend a great deal time with my father for a few years, getting to know...the actual man, ....that was my father.

- and since his death a couple of years ago...the actual person herself that is my mother.

So whilst my finances were/are what you might term "blitzed"... by those combined past events to date (Cue Violins - that's enough - it gets better)

- I wouldn't change any of them,

- as I consider the time it gave me with my children growing up & latterly with my parents

- plus meeting and marrying my current wife,

- truly priceless.

The other thing is, had events been otherwise,

- I would never have had the time to find out - how the world really ticks :o)

As to "The Silver Lining" oft quoted.... re every cloud

- I can now look back (over nearly 20yrs) and say (in hindsight)

- it did indeed... shine thro'.... along the way.

.......................................................................................................................

Hopefully - the silver lining will - shine brightly.... for you both in 2014

& fingers crossed on tomorrows search .

PS I seem to get regular spells of - not being able to access Mon-Am - so if I dont post an update by late on Sun/Earl, Mon - it wont probably for the want of trying (even if it's only my own precis of the info)