| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Davai - 18 Apr 2012 11:13

Thread designed to record set-ups and targets on index and FX pairs.

'A market is only your enemy until you understand it, then it becomes your best friend.'

Any questions, please feel free to ask.

From time to time i may openly state an opinion regarding direction of a set-up and wish to add that in no way am i recommending a trade. I am sometimes only in trades for a matter of minutes and can't always update as to entry/exits taken.

As always, markets are dangerous places to be and must be respected as such. Always use stop losses and never over-leverage; 3% of your pot as a maximum per trade. As always, YOU are responsible for your own trades! Happy pip hunting!

Click HERE to visit me at FXtechnicals.net

Davai - 19 Apr 2012 15:37 - 16 of 423

£ is looking likely nearing a couple of tops (cable and vs Yen) so could start a decline soon.

Davai - 19 Apr 2012 17:19 - 17 of 423

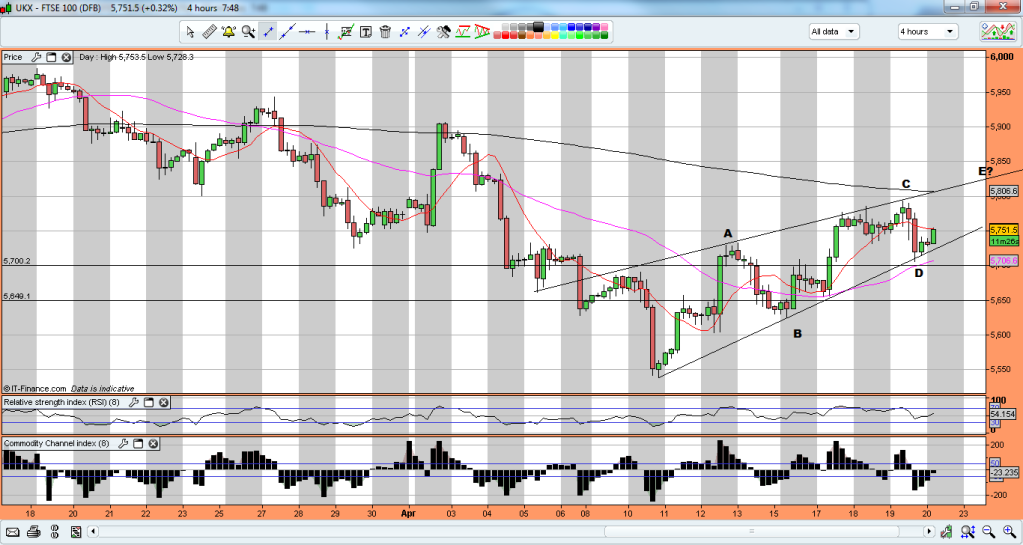

Here i have a long set-up on the FTSE, which went according to plan perfectly.

We are looking for an ABC retrace within the whole corrective move. Once the last significant LH (lower high) is breached we swing long and can look for a flag to form. If this breaks in a certain way and i get a trigger from my 'trend indicator' it is a confirmed set-up. Stop is a pip below the lowest point of the pullback and target is identical distance to the risk (ie; 1:1). Again, look how price gets there by a mere handful of points before retracing. I'm now short too.

We are looking for an ABC retrace within the whole corrective move. Once the last significant LH (lower high) is breached we swing long and can look for a flag to form. If this breaks in a certain way and i get a trigger from my 'trend indicator' it is a confirmed set-up. Stop is a pip below the lowest point of the pullback and target is identical distance to the risk (ie; 1:1). Again, look how price gets there by a mere handful of points before retracing. I'm now short too.

Davai - 19 Apr 2012 18:44 - 18 of 423

Davai - 19 Apr 2012 19:20 - 19 of 423

Chris Carson

- 19 Apr 2012 19:22

- 20 of 423

- 19 Apr 2012 19:22

- 20 of 423

Aye good call.

Davai - 19 Apr 2012 19:53 - 21 of 423

Yeh thx Chris. I closed the FTSE short ten minutes ago for +40. Its right on a flagline, which i'm watching closely. I might get a validation trigger candle tonight which, if so, means more short side will be nailed on...

Chris Carson

- 19 Apr 2012 20:04

- 22 of 423

- 19 Apr 2012 20:04

- 22 of 423

I closed @ 5710.5 + 24 cheers again.

Chris Carson

- 19 Apr 2012 21:05

- 23 of 423

- 19 Apr 2012 21:05

- 23 of 423

That was some comeback on the Dow, didn't trade it scares the shxt out of me :O)

Davai - 19 Apr 2012 21:20 - 24 of 423

Lol! Yep, that's why i closed short, still expecting much more downside but will wait to see if i get the set-up in the morning. Dow has been a bit jumpy today though!

Davai - 20 Apr 2012 07:30 - 25 of 423

Further to post 10;

Looks like a possible 1&2 with wave 3 soon;

Complete conflict to last nights thoughts, however, i don't particularly like the structure of wave 1, with the retrace roughly halfway, however, even if an 'AB' of a corrective move, we should still head higher for a 'C' wave.

Biased long, but a break of either black line will make it more obvious.

Looks like a possible 1&2 with wave 3 soon;

Complete conflict to last nights thoughts, however, i don't particularly like the structure of wave 1, with the retrace roughly halfway, however, even if an 'AB' of a corrective move, we should still head higher for a 'C' wave.

Biased long, but a break of either black line will make it more obvious.

Davai - 20 Apr 2012 07:57 - 26 of 423

Davai - 20 Apr 2012 09:34 - 27 of 423

Davai - 20 Apr 2012 10:42 - 28 of 423

Davai - 20 Apr 2012 14:48 - 29 of 423

Given up on the Euro some time ago. Not trending nicely at all and has an algo in play that gives me an entry right into a corrective move, so straight into a loss almost to stop out before turning. here is a perfect example of this, (despite it looking like a valid set-up, i can do without the stress!) The algo comes and goes, but it hasn't been flavour of the month for a while now;

Davai - 20 Apr 2012 14:49 - 30 of 423

Davai - 20 Apr 2012 21:34 - 31 of 423

Davai - 20 Apr 2012 21:45 - 32 of 423

Davai - 21 Apr 2012 13:20 - 33 of 423

Davai - 21 Apr 2012 13:22 - 34 of 423

Obviously complete contrast between the last two charts, so i need the market to show its hand. Will post an exact set-up as it happens. No trigger, no trade. Discipline and patience are equally as important as reading charts in a traders world.

Davai - 23 Apr 2012 10:21 - 35 of 423

Fridays action on the Dax (in particular) was puzzling if it was indeed to be as i had labeled it (a 'i'&'ii' leading to (sub)wave 'iii'), (bigger red circle);

Although powering up in the morning, there was simply no continuance. I was expecting something like i have shown, but instead we got the action within the blue circle, which was at least a red flag so to speak.

I closed the long and although i was tempted to re-enter as it drifted down in the evening, i thought it better to wait for more evidence.

Well, from the off this morning it looked like the alternative count was indeed the way forward, (this on the Dow, but they all make the main moves roughly in conjunction with one another);

Sure enough i got a short trigger on the FTSE at 08:01 and would consider we have quite a way to drop over the coming week. Perhaps a little too early to make that assumption, so the first requirement is a LL on the Dax (6529 req'd)

Although powering up in the morning, there was simply no continuance. I was expecting something like i have shown, but instead we got the action within the blue circle, which was at least a red flag so to speak.

I closed the long and although i was tempted to re-enter as it drifted down in the evening, i thought it better to wait for more evidence.

Well, from the off this morning it looked like the alternative count was indeed the way forward, (this on the Dow, but they all make the main moves roughly in conjunction with one another);

Sure enough i got a short trigger on the FTSE at 08:01 and would consider we have quite a way to drop over the coming week. Perhaps a little too early to make that assumption, so the first requirement is a LL on the Dax (6529 req'd)