| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

The really useful silver thread (AG)

squirrel888 - 12 Jun 2013 10:30

Saturn6 - 19 Dec 2013 11:21 - 992 of 1034

Remember Miners are below the larger 'Rectangle' shown here in blue horizontal lines, and outside the lower support of the Bullish 'Wedge' it needs to recover these areas to offset further declines...

But so far the retest of broken support now resistance is still bearishly in play esp as red volume increases - And if the reaction low at 20.57 is taaaken out on a closing basis taht would atrract more shorts...

S.

But so far the retest of broken support now resistance is still bearishly in play esp as red volume increases - And if the reaction low at 20.57 is taaaken out on a closing basis taht would atrract more shorts...

S.

Saturn6 - 19 Dec 2013 11:32 - 993 of 1034

With two trading days left in the week we may see the 'Doji Harami' plotted last week confirmed. Which would predicate a bullish reversal as shown prior by the two projections, although one of them still plots a lower low to come, but the blue projection would form a Bullish Inv 'H&S' pattern, can you see it?...

Todays and tomorrows price action will give us more of an idea as to price direction but for now GDX is under the Kosh.

S.

Todays and tomorrows price action will give us more of an idea as to price direction but for now GDX is under the Kosh.

S.

Saturn6 - 19 Dec 2013 14:26 - 994 of 1034

This chart of the Dow relative to $Gold looks interesting. Does it get repelled at the channel resistance line, or bust through?/

...

S.

...

S.

Saturn6 - 19 Dec 2013 14:55 - 995 of 1034

Comparing the Dow to $Silver ratio it seems to want to get above the lateral resistance, and if so the 'wedge' may paly out to its objective...

S.

S.

Saturn6 - 19 Dec 2013 15:19 - 996 of 1034

Gold and Silver Britts seem to be tight at CDI, Luckily I have my order filled but they have no stock now, and cannot supply me Eagles direct as they have hit their quota for export to UK due to VAT, which isn't an issue as I always had them delivered through ViaMat.

HGM are down to the bone, but Bairds have stock.

S.

HGM are down to the bone, but Bairds have stock.

S.

gazkaz - 19 Dec 2013 16:05 - 997 of 1034

Sahara

It does look from those charts that we are towards an inflection point.

The commercials having swung massively from net short to net long in under 12m is telling of something

- and I think T Fergussons metals report indicates their star player JPM has recently (I think technically called) stopped 90% plus of recent comex deliveries

- ie for - delivery TO - their own... house account

(which again seems telling....of something)

I suppose they could - take delivery....or I suppose...dump the paper back on the market...and drop the price a tadge or so (understatement)

The link I gave to an interview of the largest Swiss refiner....quoting that in the summer...there was no bullion supply to be had at all for refining and it being.. the first time in 35yrs... in the business - that it had ever happened

- seems to be telling too.

The huge volume of LBMA 400oz bars being smelted into to the more eastern acceptable 1kg bars....seems to both imply a drain from the LBMA and also

- an attitude perhaps of

- who cares about retaining/or cost incurring LBMA "good delivery" bar status....the premiums are in the east...and they & their 1Kg's bars are the future.

(& LBMA may soon just be quaint history)

It does look from those charts that we are towards an inflection point.

The commercials having swung massively from net short to net long in under 12m is telling of something

- and I think T Fergussons metals report indicates their star player JPM has recently (I think technically called) stopped 90% plus of recent comex deliveries

- ie for - delivery TO - their own... house account

(which again seems telling....of something)

I suppose they could - take delivery....or I suppose...dump the paper back on the market...and drop the price a tadge or so (understatement)

The link I gave to an interview of the largest Swiss refiner....quoting that in the summer...there was no bullion supply to be had at all for refining and it being.. the first time in 35yrs... in the business - that it had ever happened

- seems to be telling too.

The huge volume of LBMA 400oz bars being smelted into to the more eastern acceptable 1kg bars....seems to both imply a drain from the LBMA and also

- an attitude perhaps of

- who cares about retaining/or cost incurring LBMA "good delivery" bar status....the premiums are in the east...and they & their 1Kg's bars are the future.

(& LBMA may soon just be quaint history)

Saturn6 - 19 Dec 2013 16:12 - 998 of 1034

One would hope so Gaz - But I need to roll more positions into physical Gold and Silver so would welcome one more dip in PM's and one more rally in stocks. But I think $1200 on Gold could be a key support here.

When Stocks to Miners peak I expect a severe correction...

One can clearly see 5-waves from Oct/11 lows and if you scruitnise the 5th-wave you can now see the fractal 5-waves of that wave.

S.

When Stocks to Miners peak I expect a severe correction...

One can clearly see 5-waves from Oct/11 lows and if you scruitnise the 5th-wave you can now see the fractal 5-waves of that wave.

S.

Saturn6 - 19 Dec 2013 16:22 - 999 of 1034

Gaz - There definitely seems to be a supply squeeze. CID have no Gold or Silver Britts whatsoever even for collection from Germany. They say they have Silver eagles, but she had to go and check and get back to me, so something is odd as there is no Silver coin page on their site either.

Bullion by post seem to have stock but are short of Eagles.

S.

Bullion by post seem to have stock but are short of Eagles.

S.

gazkaz - 19 Dec 2013 16:41 - 1000 of 1034

Joining some more of the dots (The way I see 'em)

More ducks being lined up.

As Aaaron Russo pinted out - in his pte conv with a Rockerchappie

- they work on a rolling multi generational plan towrds their....goal.

Colonel Wes Clarke is on record (speech on youT) that he saw a memo (I think in 2001 ish) at the Pentagoonal - outlining the plan for "the conflicts" in 7 middle east countries

- The final one being - Saudi

......................................................................................................................

So planning ahead - they need a "reason" to go after Saudi

- which as many of us know has been sat in the.... pending tray

(since 9-11)

So her's the foundational dot...that begins the longer term move towrds ...

- getting them towards the cross hairs

......................................................

911 Commission Report

A pair of lawmakers

- who recently read .......the redacted portion... say

- they are “absolutely shocked”

- at the level of.... foreign state..... involvement in the attacks.

So they’ve proposed Congress pass a resolution asking President Obama

- to declassify the entire 2002 report

President Bush...... inexplicably ....censored 28 full pages... of the 800-page report

- It was kept secret... and remains so today

http://nypost.com/2013/12/15/inside-the-saudi-911-coverup/

Wish I could place a bet on.....

"at the level of.... foreign state..... involvement in the attacks"

- being Saudi

And Sahara

the answer as to why

"President Bush...... inexplicably ....censored 28 full pages... of the 800-page report"

Was of course fully laid out .....in the report you pencilled in for "weekend reading" (& the rest :o)

....................................................................................................................

Just the dots as I see 'em tho'

And perhaps... another

- time is getting short towards "The Goal" objective date

- as multi-generational seems to be...getting crammed into a shorter and shorter timescale

(& they are already behind... on Egypt & Syria)

More ducks being lined up.

As Aaaron Russo pinted out - in his pte conv with a Rockerchappie

- they work on a rolling multi generational plan towrds their....goal.

Colonel Wes Clarke is on record (speech on youT) that he saw a memo (I think in 2001 ish) at the Pentagoonal - outlining the plan for "the conflicts" in 7 middle east countries

- The final one being - Saudi

......................................................................................................................

So planning ahead - they need a "reason" to go after Saudi

- which as many of us know has been sat in the.... pending tray

(since 9-11)

So her's the foundational dot...that begins the longer term move towrds ...

- getting them towards the cross hairs

......................................................

911 Commission Report

A pair of lawmakers

- who recently read .......the redacted portion... say

- they are “absolutely shocked”

- at the level of.... foreign state..... involvement in the attacks.

So they’ve proposed Congress pass a resolution asking President Obama

- to declassify the entire 2002 report

President Bush...... inexplicably ....censored 28 full pages... of the 800-page report

- It was kept secret... and remains so today

http://nypost.com/2013/12/15/inside-the-saudi-911-coverup/

Wish I could place a bet on.....

"at the level of.... foreign state..... involvement in the attacks"

- being Saudi

And Sahara

the answer as to why

"President Bush...... inexplicably ....censored 28 full pages... of the 800-page report"

Was of course fully laid out .....in the report you pencilled in for "weekend reading" (& the rest :o)

....................................................................................................................

Just the dots as I see 'em tho'

And perhaps... another

- time is getting short towards "The Goal" objective date

- as multi-generational seems to be...getting crammed into a shorter and shorter timescale

(& they are already behind... on Egypt & Syria)

gazkaz - 19 Dec 2013 16:49 - 1001 of 1034

Sahara - just checked & yes CID have lost the silver coins off the menu

I just looked at the page URL for gold coins

- and swapped gold for silver in the URL

All that came up is this extremely long & varied list

http://www.coininvestdirect.com/en/silver-coins/

Maple Leaf, 50 Dollar, 1oz Gold, 2013 (plus prices)

Nugget | Kangaroo, 1oz Gold, 2014Special (plus prices)

Strange indeed

I just looked at the page URL for gold coins

- and swapped gold for silver in the URL

All that came up is this extremely long & varied list

http://www.coininvestdirect.com/en/silver-coins/

Maple Leaf, 50 Dollar, 1oz Gold, 2013 (plus prices)

Nugget | Kangaroo, 1oz Gold, 2014Special (plus prices)

Strange indeed

Saturn6 - 19 Dec 2013 17:36 - 1002 of 1034

I like the way you join the dots Gaz...And it will be interesting to see it all unfold. I know they have been held back with Syria. But for how long?/...I know from scripture that Damascus will become a 'ruinous heap' or heap of ruins as stated by Isaiah 2700 years ago...a shame really considering it's the oldest continuously inhabited city in the world.

It also states in scripture that in the end times 'nation will rise against nation' I suppose you could say we have had that already with the world wars./? So we are indeed hurtling towards the tribulation and those that believe they will be whisked away in a 'rapture' will be sorely disappointed and left un-prepared.

WILL ISRAEL NUKE DAMASCUS//?

S.

It also states in scripture that in the end times 'nation will rise against nation' I suppose you could say we have had that already with the world wars./? So we are indeed hurtling towards the tribulation and those that believe they will be whisked away in a 'rapture' will be sorely disappointed and left un-prepared.

WILL ISRAEL NUKE DAMASCUS//?

S.

Saturn6 - 19 Dec 2013 17:38 - 1003 of 1034

Gaz - If we want to see the PM's turn up we first need to see miners out-perform, and where better than from here/?...

S.

S.

Saturn6 - 20 Dec 2013 08:42 - 1004 of 1034

I pointed out prior a divergence between $Gold and €Gold and here we now have $Silver failing to confirm this move lower in $Gold on a closing basis...

Now thats not to mean we turn around straight away, it may take a little while for these divergences to turn into upside moves but they are the first shoots of that up-turn.

S.

Now thats not to mean we turn around straight away, it may take a little while for these divergences to turn into upside moves but they are the first shoots of that up-turn.

S.

Saturn6 - 20 Dec 2013 09:47 - 1005 of 1034

A long tail on the daily would tag the 80/Month MA...

S.

gazkaz - 20 Dec 2013 14:33 - 1006 of 1034

Sahara

It looks like TPTB are going all in on painting the year end prices to ensure gold figures performance quoted in the news for 2013 look as painful as possible

- and in the ETF & unit trust blurb it looks as discouraging as possible to the new punters

- plus trying to shake as many leaves from the tree from existing punters

(many ordinary working folk sit down at new year and review how they have done in the year and make decisions on revisions etc)

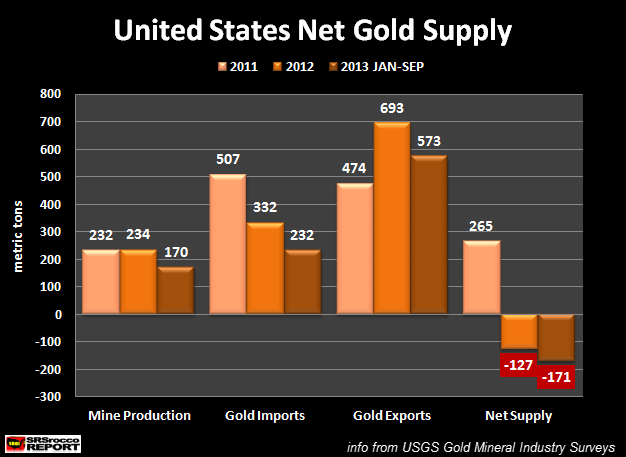

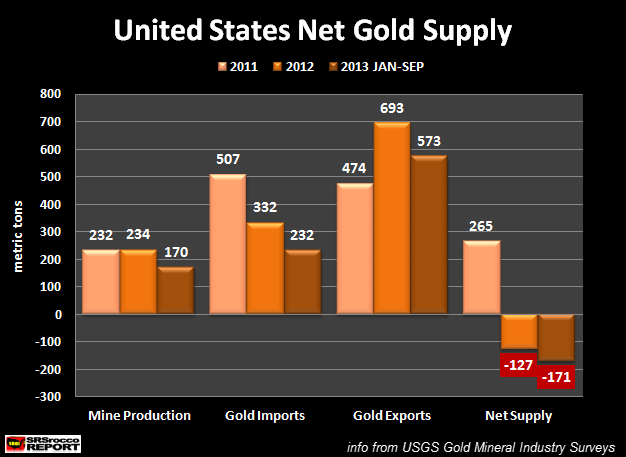

Interesting little chart

- last year and this

(& just to Sept this year ...it's already higher than the whole of last year)

The US is in net deficit on gold

- ie just to Sept 2013

- US new mine supply + imports

- minus US exports

- nets out at MINUS 171 tonnes

And from memory - doesn't US Mint supplied gold coins etc

- come from US mined gold

If "more than"....new mined supply + imports - is already going abroad in exports

- where has the US Mint - been getting it's supply

If mint supply was deducted from the supply side - and then the exports were deducted

- that net negative on the chart would be - even bigger

And again from memory - I think at one point this year - ALL US & Canadian home mined gold could be accounted for - just in US & Canadian Mint output (& that wasn't accounting for issue of proofs or sets etc)

- so that would make a "chunky" adjustment to the chart.

And I believe it was Franklin Mint who said...

(It could have been gold sales or silver sales)

- that....private mint sales...... of coins - outstripped the Gov Mind on a ratio of

- 3 : 1

So

New mine production + imports ...- minus US Mint consumption - minus 3 x US mint consumption (via private mints)

- then minus the quoted exports

Would give - a darn sight bigger Import/Export Deficit

- which is being supplied from ?????

(answers on a postcard to...)

PS Sahara

How is your daughters health doing - it must be getting on for 6m since I last enquired. I sincerely hope improving.

It looks like TPTB are going all in on painting the year end prices to ensure gold figures performance quoted in the news for 2013 look as painful as possible

- and in the ETF & unit trust blurb it looks as discouraging as possible to the new punters

- plus trying to shake as many leaves from the tree from existing punters

(many ordinary working folk sit down at new year and review how they have done in the year and make decisions on revisions etc)

Interesting little chart

- last year and this

(& just to Sept this year ...it's already higher than the whole of last year)

The US is in net deficit on gold

- ie just to Sept 2013

- US new mine supply + imports

- minus US exports

- nets out at MINUS 171 tonnes

And from memory - doesn't US Mint supplied gold coins etc

- come from US mined gold

If "more than"....new mined supply + imports - is already going abroad in exports

- where has the US Mint - been getting it's supply

If mint supply was deducted from the supply side - and then the exports were deducted

- that net negative on the chart would be - even bigger

And again from memory - I think at one point this year - ALL US & Canadian home mined gold could be accounted for - just in US & Canadian Mint output (& that wasn't accounting for issue of proofs or sets etc)

- so that would make a "chunky" adjustment to the chart.

And I believe it was Franklin Mint who said...

(It could have been gold sales or silver sales)

- that....private mint sales...... of coins - outstripped the Gov Mind on a ratio of

- 3 : 1

So

New mine production + imports ...- minus US Mint consumption - minus 3 x US mint consumption (via private mints)

- then minus the quoted exports

Would give - a darn sight bigger Import/Export Deficit

- which is being supplied from ?????

(answers on a postcard to...)

PS Sahara

How is your daughters health doing - it must be getting on for 6m since I last enquired. I sincerely hope improving.

gazkaz - 20 Dec 2013 14:56 - 1007 of 1034

HarveyO - states 1 month out GOFO has gone negative and increasingly negative

- and the rest only marginally positive

(& increasingly less - positive)

i) One Month: -.02000000000% vs yesterday: -.005000000% (backwardation)

ii Two Months: +.001670000000%. vs yesterday: +.01000000%

iii) Three Months: +.01670000% vs yesterday: +.021670000%

iv) Six months: +.068333000000% vs yesterday: +.07333300000%

AND

The total of all issuance by all participants equates to 31 contracts of which

- 30 notices were stopped (ie received) by JPMorgan dealer ( house account )

- (or 97% of the issuance)

and 0 notices stopped by JPMorgan customer account.

It seems that... all the stopping or receiving of contracts

- is from .....the house of Morgan

...................................................................................................................

Are they "stacking their smacks" and taking in the physical delivery ?

- or ....acquiring ammo...to do a paper dump-fest ?

Here's how it looks - visually

Plus according to zh

Over the past week, JPM has been accumulating an impressive amount of gold,

- and what is more curious,

- it has been precisely in increments of 64,300 ounces of eligible gold .....on a daily basis.

So overall

- Another question with - please send answers on a postcard to.....

(As they used to say in all the old days BBC's quiz questions)

- and the rest only marginally positive

(& increasingly less - positive)

i) One Month: -.02000000000% vs yesterday: -.005000000% (backwardation)

ii Two Months: +.001670000000%. vs yesterday: +.01000000%

iii) Three Months: +.01670000% vs yesterday: +.021670000%

iv) Six months: +.068333000000% vs yesterday: +.07333300000%

AND

The total of all issuance by all participants equates to 31 contracts of which

- 30 notices were stopped (ie received) by JPMorgan dealer ( house account )

- (or 97% of the issuance)

and 0 notices stopped by JPMorgan customer account.

It seems that... all the stopping or receiving of contracts

- is from .....the house of Morgan

...................................................................................................................

Are they "stacking their smacks" and taking in the physical delivery ?

- or ....acquiring ammo...to do a paper dump-fest ?

Here's how it looks - visually

Plus according to zh

Over the past week, JPM has been accumulating an impressive amount of gold,

- and what is more curious,

- it has been precisely in increments of 64,300 ounces of eligible gold .....on a daily basis.

So overall

- Another question with - please send answers on a postcard to.....

(As they used to say in all the old days BBC's quiz questions)

gazkaz - 20 Dec 2013 15:23 - 1008 of 1034

Another interesting chart

Again re JPM

Whilst JPM itself - has been - stacking the smack (Orange section)

- Registered Gold ie Customer held gold & not eligible for sale

(Blue section)

- has been pulled out by the boatload

Would that be - a sign

- of WTF - I'm getting the hell out of - Morgue paper gold IOU's

- getting the real stuff

- and - keeping it away from the morgue ??

(ooops - need another postcard :o)

Again re JPM

Whilst JPM itself - has been - stacking the smack (Orange section)

- Registered Gold ie Customer held gold & not eligible for sale

(Blue section)

- has been pulled out by the boatload

Would that be - a sign

- of WTF - I'm getting the hell out of - Morgue paper gold IOU's

- getting the real stuff

- and - keeping it away from the morgue ??

(ooops - need another postcard :o)

Saturn6 - 20 Dec 2013 15:32 - 1009 of 1034

Staggering Gaz - Great charts and the first one has 3 months more to year end, which would show further deterioration I feel.

And with the current price drop below production costs begs the question when will the first miner crimp production with a statement advising operaations will restart when Gold price is above $1500. ;-/

That statement has to come in my view if prices remain this low, as it is becoming fiancially irresponsible to carry on producing below the cost of production. That will tighten the supply side even more.

S.

And with the current price drop below production costs begs the question when will the first miner crimp production with a statement advising operaations will restart when Gold price is above $1500. ;-/

That statement has to come in my view if prices remain this low, as it is becoming fiancially irresponsible to carry on producing below the cost of production. That will tighten the supply side even more.

S.

Saturn6 - 20 Dec 2013 15:51 - 1010 of 1034

Long story with my Daughter Gaz - Her kidney function had stabilised around 14% and the gout tablets were keeping in check the Barcelos/Mediterranean disease. And she was getting back to normal and was working again full time, and then she fell pregnant.!!

And at around 13 weeks had a miscarriage which was a blessing really, as the risks were too major to contemplate. They were never advised or considered precautionary measures for becoming pregnant as she was told she would never be able to conceive again!!

She was struggling to overcome these issues while I had been screened as a donor for the last three months, and then was hit with the bombshell that her husband was secretly on cocaine for three years and it had become out of hand and had run up debts of over 40k, it turns out he ended up doing £300+ a day some days. So she is on her own with her only child and has again thrown herself back into work to recover her financial position.

The only good thing that has come out of all this is the pregnancy meant she had to stop taking the gout tablets and so far has remained off of them without any recurrence of the rigors and her kidney function increased to 19% while pregnant as they said it would, but it wouldn't last, and lo, it has remained at that, her blood pressure is under control with medication, and the only problem she has had is her legs swelling due to standing at work (She has her own hairdressing salon), which she has reduced her workload over the last week and has recovered from that complaint now. So...As you may imagine we are hoping for a better year next year.

We have given her a little financial help only because she is fiercely independent. Bless her. And that was only cos she couldn't work enough with swollen legs.

Apart from that I have high blood pressure from the screening I had and they are currently looking for an infection somewhere in my tubes. I have had scans that have confirmed it, and am awaiting a scan in early Jan to determine where exactly and what they can do for the infection that I have.

Thanks for the concern Gaz!

S.

And at around 13 weeks had a miscarriage which was a blessing really, as the risks were too major to contemplate. They were never advised or considered precautionary measures for becoming pregnant as she was told she would never be able to conceive again!!

She was struggling to overcome these issues while I had been screened as a donor for the last three months, and then was hit with the bombshell that her husband was secretly on cocaine for three years and it had become out of hand and had run up debts of over 40k, it turns out he ended up doing £300+ a day some days. So she is on her own with her only child and has again thrown herself back into work to recover her financial position.

The only good thing that has come out of all this is the pregnancy meant she had to stop taking the gout tablets and so far has remained off of them without any recurrence of the rigors and her kidney function increased to 19% while pregnant as they said it would, but it wouldn't last, and lo, it has remained at that, her blood pressure is under control with medication, and the only problem she has had is her legs swelling due to standing at work (She has her own hairdressing salon), which she has reduced her workload over the last week and has recovered from that complaint now. So...As you may imagine we are hoping for a better year next year.

We have given her a little financial help only because she is fiercely independent. Bless her. And that was only cos she couldn't work enough with swollen legs.

Apart from that I have high blood pressure from the screening I had and they are currently looking for an infection somewhere in my tubes. I have had scans that have confirmed it, and am awaiting a scan in early Jan to determine where exactly and what they can do for the infection that I have.

Thanks for the concern Gaz!

S.

gazkaz - 20 Dec 2013 15:54 - 1011 of 1034

Sahara - true

According to Bill Kaye (Hedgie manager in the far east)

- China are still happy mining at "all in figures"

- of $2,500 !!

I like this visual - on what the announced ..taper... looks like

- on the FEDDY's .....

-( if nobody else is buying this shit....as buyers of last resort...it's down to us)

....ballooning balance sheet

(It's that ....tiny, tiny red dotted deviation line - on the increasingly exponential looking - ballooning FEDDY balance sheet)

According to Bill Kaye (Hedgie manager in the far east)

- China are still happy mining at "all in figures"

- of $2,500 !!

I like this visual - on what the announced ..taper... looks like

- on the FEDDY's .....

-( if nobody else is buying this shit....as buyers of last resort...it's down to us)

....ballooning balance sheet

(It's that ....tiny, tiny red dotted deviation line - on the increasingly exponential looking - ballooning FEDDY balance sheet)