| Home | Log In | Register | Our Services | My Account | Contact | Help |

Victoria Oil & Gas-The Information & News Thread (VOG)

banjomick

- 07 Jan 2015 21:01

- 07 Jan 2015 21:01

Victoria Oil & Gas Plc (Victoria) has become a significant domestic energy supplier in Africa through its wholly owned subsidiary: Gaz du Cameroun S. A. (GDC).

With operations located in the industrial port-city of Douala, Cameroon, customers are converting their operations to take natural gas supplied by our production wells and pipeline infrastructure.

GDC is the sole gas supplier in the area, providing a cheaper, more efficient, reliable, and cleaner energy alternative to Heavy Fuel Oil use.

Our teams of engineering advisors are on hand to help customer’s cost and implement the change to GDC’s energy products.

Victoria Oil & Gas is traded in the NEX Exchange HERE

Link-HISTORICAL NEWS,VIDEO/AUDIO & EVENTS

Link-Dedicated Posts for:

Gaz du Cameroun S.A. (“GDC”)

Gaz Du Cameroun Matanda S.A. ("GDC Matanda")

Link-Cameroon-Industrialisation Master Plan (PDI) & Africa Energy

NEWS

21st Jan 2019 Production Update

17th Jan 2019 Q4 2018 Operations Update

02nd Jan 2019 Presidential Decree on Matanda Received

24th Dec 2018 Renewal of Long-Term Gas Supply Contract with ENEO

28th Sep 2018 INTERIM FINANCIAL REPORT FOR THE SIX MONTHS ENDED 30 JUNE 2018

17th Aug 2018 Q2 2018 Operations Update

22nd Jun 2018 Report and Accounts to 31 December 2017

14th Jun 2018 Restructure of the BGFI Debt Facility

04th Jun 2018 Notice of Annual General Meeting

04th June 2018 Logbaba Field Reserves Update

24th May 2018 Q1 2018 Operations and Outlook

16th Feb 2018 Q4 17 Operations Update & 2018 Outlook Replacement

05th Jan 2018 Gas Supply Contract with ENEO Not Extended

VIDEO/AUDIO

21st Jan 2019 Victoria Oil & Gas looks ahead to increased cash flow

24th Aug 2018 Victoria Oil & Gas confident of resolving ENEO contract 'within weeks'

22nd Apr 2018 Video from 21/04/2018 UK Investor Show

16th Feb 2018 Victoria Oil & Gas confident of positive outcome to ENEO issue

08th Nov 2017 Victoria Oil & Gas reports very pleasing initial results from La-108

31st Oct 2017 21 Oil and Gas - African Power Panel

30th Oct 2017 121 Oil & Gas Investment

26th Oct 2017 Victoria Oil & Gas raises US$23.5mln to accelerate new growth programme

26th Sep 2017 Victoria Oil & Gas to finalise long term supply contracts after first gas at LA-107

17th Aug 2017 Victoria Oil & Gas expecting La-107 to be a 'substantial' producer

16th Apr 2017 Video from 01/04/2017 UK Investor Show

13th Apr 2017 'It's been a terrific year and a great quarter', says Victoria Oil & Gas' Kevin Foo

06th Mar 2017 Farm-out deal 'a really good strategic move' for Victoria Oil & Gas, says chairman Kevin Foo

06th Feb 2017 Chairman runs Proactive through the good start to 2017

EVENTS

28th Jun 2018 Annual General Meeting ("AGM")

10th May 2018 Africa Oil & Power Investor Forum-London

21st Apr 2018 UK Investor Show

11th-12th Apr 2018 Africa Investment Exchange: Gas (AIX: Gas 2018)-London

09th-10th Nov 2017 The Cameroon Investment Forum(CIF)-Cameroon

30th-31st Oct 2017 121 Oil & Gas Investment-London

23rd-27th Oct 2017 Africa Oil Week 2017-Cape Town South Africa

07th Sep 2017 One2One Investor Forum - London

05th Sep 2017 Oil Capital Conference-London

28th Jun 2017 Annual General Meeting

01st Apr 2017 UK Investor Show

9th Feb 2017 Presentation slide show for One2One

9th Feb 2017 One2One Investor Forum - London

Social Media

banjomick

- 26 Sep 2017 23:21

- 491 of 701

- 26 Sep 2017 23:21

- 491 of 701

Published on Sep 26, 2017

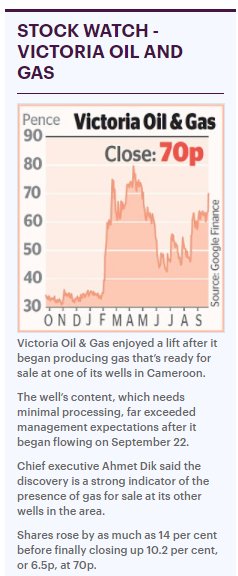

Ahmet Dik, chief executive of Victoria Oil & Gas PLC (LON:VOG) tells Proactive it's a massive day for them with the news of ‘first gas’ from their new well at the Logbaba field.

Well LA-107 has now been classified as a production well following a successful testing programme.

https://www.youtube.com/watch?v=hHiNao3ffo0

banjomick

- 27 Sep 2017 09:37

- 492 of 701

- 27 Sep 2017 09:37

- 492 of 701

Above is via VOG's twitter

banjomick

- 28 Sep 2017 07:48

- 493 of 701

- 28 Sep 2017 07:48

- 493 of 701

Victoria Oil & Gas Plc

("VOG" or "the Company")

Bomono Farm-out Extension

On 6 March 2017 Victoria Oil & Gas Plc, a Cameroon energy utility, announced that the Company and Bowleven Oil & Gas Plc ("Bowleven"), the African focused oil and gas exploration company, had signed a farm-out agreement ("the Agreement") relating to the Bomono production sharing contract.

The Company is pleased to confirm that discussions regarding the Agreement are progressing and Bowleven and VOG continue to work with the Government of Cameroon to advance the Bomono project. Consequently, VOG has elected to exercise its option to extend the termination date of the Agreement to 31 December 2017.

Further details on the Agreement are set out in the RNS made by the Company on 6 March 2017.

http://www.moneyam.com/action/news/showArticle?id=5682292

banjomick

- 28 Sep 2017 07:51

- 494 of 701

- 28 Sep 2017 07:51

- 494 of 701

Victoria Oil & Gas Plc

INTERIM FINANCIAL REPORT FOR THE SIX MONTHS ENDED 30 JUNE 2017

Victoria Oil & Gas Plc, the integrated natural gas producing utility, today announces its unaudited interim results for the six months ended 30 June 2017.

Operational Highlights

· Average daily Logbaba field gross production rate increased by 11.4% to 14.6mmscf/d (six months to 30 June 2016: 13.1mmscf/d).

· 2,345mmscf of gross gas sold from Logbaba (six months to 30 June 2016: 2,282mmscf).

· Completion of flow lines to the new wells.

Drilling Highlights

· Completion of well La-107, drilled to 3,180m Measured Depth ("MD"), has been completed for production. Preliminary analysis indicated 35m of net gas sand in the Upper Logbaba Formation, plus 23m of net gas sand in the Lower Logbaba Formation. Flow test results were very positive with 54mmscf/d flowrate through 70/64ths inch choke and 146mmscf/d Absolute Open Flow ("AOF") potential. First gas flowed to the processing plant for sale on 22 September 2017.

· Rig skidded to La-108 to resume drilling operations. Sidetrack drilling has recommenced, where approximately 100m of net gas-bearing sands were encountered. At 26 September 2017, the rig is drilling ahead at 2,085m Measured Depth ("MD")

Financial Highlights

· $15.4 million Revenue (six months to 30 June 2016: $23.6 million).

· $4.4 million EBITDA (six months to 30 June 2016: $14.2 million).

· $25.2 million Net Debt position (at 31 December 2016 Net Cash: $1.8 million).

· 5% Cameroonian State participation in Logbaba; 3% relinquished by Gaz du Cameroun S.A. ("GDC").

Corporate Highlights

· Farm-out agreement with EurOil Limited ("EurOil"), a Bowleven Plc subsidiary, under which a VOG subsidiary will acquire on completion an 80% working interest in the 2,237 km2 Bomono licence, adjacent to Gaz du Cameroun's ("GDC") Logbaba field. This transaction remains subject to Government approval.

· Seismic interpretation on Matanda field (75% participating interest, subject to Government approval) shows considerable gas in place potential and several drilling targets.

Ahmet Dik, Chief Executive Officer of VOG, commented:

"The year has been very productive for the Company, with the delivery of very positive drilling results and the completion of well La-107, where we have encountered a combined 58m of net gas sands. Production flow testing has confirmed the commercial viability of the gas-bearing reservoir sands detected in the Upper and Lower Logbaba formations, and initial flows through the processing facility yielded positive results.

The developments at Logbaba are very encouraging as we take the first steps towards our longer-term ambition of producing 100mmscf/d. The Douala region alone continues to show a long-term demand for 150mmscf/d of natural gas, and we believe VOG is uniquely placed to take advantage of that market as the dominant onshore gas producer in country."

Sam Metcalfe, the Company's Subsurface Manager has reviewed and approved the technical information contained in this announcement.

http://www.moneyam.com/action/news/showArticle?id=5682364

banjomick

- 28 Sep 2017 09:24

- 495 of 701

- 28 Sep 2017 09:24

- 495 of 701

"GDC commenced two projects to upgrade its gas production facility in Douala with the objective of modernising its automation systems and increasing the amount of gas recoverable from its existing reservoirs.

The automation project, comprised the installation of hardware and software to upgrade the control system of the gas production facility to the latest Siemens automation system. One of the key benefits of this new system is the ability to expand and incorporate new facilities easily as the number of production wells and facilities of GDC expands.

The second project comprised installation of a heat exchanger and a compressor package. The equipment was installed in two stages; in the first stage, the heat exchanger has been successfully installed and commissioned. The second stage, the installation of the compressor package has been installed and is currently being commissioned. These plant improvements enable greater flexibility in gas feed conditions, such as temperature and pressure, and will allow operations to optimise production from La-105, La-107 and La-108 when it comes online."

http://www.victoriaoilandgas.com/sites/default/files/170928%20VOG%20Interims%20Results%20to%2030%20June%202017%20FINAL.pdf

banjomick

- 28 Sep 2017 09:27

- 496 of 701

- 28 Sep 2017 09:27

- 496 of 701

The ongoing drilling programme has resulted in the Group reporting a net debt position of $25.2 million.

At 30 June 2017, the headroom on existing debt facilities was $4.9 million. To supplement the remaining drilling programme costs, GDC has obtained a letter of offer from a local financial institution in Cameroon to extend our debt facilities, and we will be looking to complete on the offer in due course.

With the successful completion of well La-107, known potential of La-108, and the anticipated Government approval of the assignments for Matanda and Bomono, the Group has an exciting future and I look forward to giving you regular updates on our progress.

Kevin Foo

Executive Chairman

27 September 2017

http://www.victoriaoilandgas.com/sites/default/files/170928%20VOG%20Interims%20Results%20to%2030%20June%202017%20FINAL.pdf

banjomick

- 28 Sep 2017 10:31

- 497 of 701

- 28 Sep 2017 10:31

- 497 of 701

As we swing into the end of September and deadline dates for reporting results appear a flurry of reports arrive. As is usually the case these historic reports are important but also irrelevant, with so much news having come out since the end of June it is that investors are concentrating on.

So, especially with VOG given recent announcements I have said pretty much all I can say at the moment. Production from Logbaba is rising and post the La-107 news should rise more in coming weeks, La-108 is being sidetracked and we wait news from there with interest. CEO Ahmet Dik confirms that ‘the company’s long term ambition is to produce 100 mmscf/d and with Douala alone showing long term demand for 150 mmscf/d VOG is uniquely placed to be the dominant producer in the country’. For this reason and for the potential for Bomono (announced today that discussions are continuing and the option termination date has been extended to 31/12/17) and in Matanda, where initial seismic work is most positive I view VOG’s prospects to be up there with any company I cover and today’s share price fall can only be described as an opportunity…

banjomick

- 29 Sep 2017 10:41

- 498 of 701

- 29 Sep 2017 10:41

- 498 of 701

AOW 2017: where African oil and gas meets

Africa Oil Week is the meeting place for Africa’s upstream oil and gas market – and with 16 hours more conference content than last year, it’s bigger and better than ever before.

Now in its 24th year, the event brings together governments, national oil companies, investors, corporate players, independents and financiers – giving them a place to network, discuss and share knowledge.

Africa Oil Week attracts the highest quality speakers. Sessions are headed by top figures in the sector, including ministers, heads of NOCs, leading scientists and CEOs from major and independent firms.

VOG Exhibiting on Stand 32

VOG's Ahmet Dik is part of the panel on Thursday 26th October

14:00

SESSION 11 | BUILDING AFRICA’S GAS INFRASTRUCTURE: GAS-TO-POWER DEVELOPMENT

PANEL DISCUSSION

Ahmet Dik, Group Chief Executive Officer, Victoria Oil & Gas, United Kingdom

Niall Kramer, Chief Executive Officer, South African Oil & Gas Alliance, South Africa

Jacob Modise, Chairperson, National Energy Regulator of South Africa

Rodney MacAlister, Chief Executive Officer, Monetizing Gas Africa, South Africa

Toyin Akinosho, Publisher, Africa Oil+Gas Report, Nigeria

Q&A

Chair: Mike Lakin, Managing Director, Envoi LTD, United Kingdom

http://www.africa-oilweek.com/

banjomick

- 03 Oct 2017 09:19

- 499 of 701

- 03 Oct 2017 09:19

- 499 of 701

https://www.voxmarkets.co.uk/blogs/fairfx-group-ffx-obtala-obt-great-western-mining-gwmo-malcy-on-ppe-rre-amer-vog-hur/

banjomick

- 04 Oct 2017 08:25

- 500 of 701

- 04 Oct 2017 08:25

- 500 of 701

Oil bucket list set for a rebound?

3 October 2017: Malcolm Graham-Wood, from MalcysBlog.com, discusses the progress of his bucket list of oil stocks including Hurricane, Sound, Amerisur, Victoria Oil & Gas, Jersey Oil, SDX, Pantheon and Animex.

https://www.ig.com/uk/market-insight-videos?CHID=9&SM=TW&REF=IGTV&bctid=5596537954001&bclid=3671160850001

https://twitter.com/victoriaoilgas

banjomick

- 04 Oct 2017 09:21

- 501 of 701

- 04 Oct 2017 09:21

- 501 of 701

But the bridge over the Wouri is not only a link between Douala and Bonabéri, it opens the Douala market to the production areas of the West, North West and South West Regions. 25 July 2013

As of yesterday one side of the new bridge is open.

https://twitter.com/hashtag/Bonaberi?src=hash

https://twitter.com/hashtag/Bonaberi?src=hashCameroon: What Users Will See As From January 20 July 2017

Is it really an image of the 2nd bridge over the Wouri River? 25 September 2017

Gas Distribution Network, Douala

Bonaberi Line Extension 8km two-phased extension completed into the less densely populated side of the Wouri River and the fastest growing industrial area of the city.

http://www.victoriaoilandgas.com/sites/default/files/factsheets/170401%20VOG%20Fact%20Sheet%20Flyer.pdf

banjomick

- 05 Oct 2017 11:16

- 502 of 701

- 05 Oct 2017 11:16

- 502 of 701

In anticipation, Actis obtains a 10-year extension on the concession of the electricity utility in Cameroon

(Investing in Cameroon) - It's done. After several months of negotiations with the government, the Cameroonian electrician Eneo, controlled by the British investment fund Actis, has just obtained a ten-year extension for its concession contract for the public electricity service in the country . According to Le Quotidien de l'Economie , which reveals the information, this extension was granted by the Head of State, " under certain conditions " to be settled no later than October 15, 2017.

The concession contract for the electricity utility in Cameroon was signed in 2001 for a period of 20 years between the State of Cameroon and the American company AES which, at the end of 2013, sold all its assets to British Columbia Actis.

However, as soon as it entered the electricity market in Cameroon, this investment fund had drawn up and submitted to the government, by 2015, an investment program requiring long-term borrowing, which could not be covered by the rest of the contract period (less than 10 years), sources from the company said.

In order to make these investments estimated at around CFAF 900 billion over a 10-year period (in exchange for accompanying government measures, Editor's note), an Eneo Board of Directors held on 23 April 2015 in Yaoundé, the Cameroonian capital, recommended to the General Directorate " to finalize and sign the new amendment to the concession contract between Eneo Cameroon SA and the Republic of Cameroon ".

"The amendment shall cover the minimum duration of the extension which shall cover at least the duration of the repayment of the debt contracted by the company to the lenders. That is the purpose of this addendum. That is to say, to align the duration of the repayment of the borrowings needed by the operator, on the contract under which it operates, "a source close to this case had entrusted at that time.

Brice R. Mbodiam

http://www.investiraucameroun.com/electricite/0510-9547-par-anticipation-actis-obtient-une-prorogation-de-10-ans-sur-la-concession-du-service-public-de-l-electricite-au-cameroun

banjomick

- 05 Oct 2017 11:23

- 503 of 701

- 05 Oct 2017 11:23

- 503 of 701

An investment of FCFA 141.6 billion, the second bridge over the Wouri is now open to traffic

Thursday, 05 October 2017

(Investing in Cameroon) - Motorists in the economic capital of Cameroon have been able to travel on the second bridge built on the Wouri River in Douala for a few days. The Department of Public Works has just announced the anticipated opening of traffic on this new infrastructure in order to limit the traffic jams on the first bridge as a result of ongoing work on the western peninsula of the economic capital.

Last July 31, it was the railroad built on this bridge, which had officially been opened to traffic, pending the official commissioning of the second bridge over the Wouri, originally planned for the end of this year 2017.

With a total cost of 141.6 billion CFA francs, the second bridge over the Wouri is a strategic work long claimed by the Cameroonian economic operators. Indeed, it will streamline traffic from Bonabéri, a neighborhood that is home to an industrial zone, and downtown Douala; and even between the economic capital and the regions of Northwest, South-West and West Cameroon.

http://www.investiraucameroun.com/electricite/0510-9550-d-un-investissement-de-141-6-milliards-de-fcfa-le-2eme-pont-sur-le-wouri-est-desormais-ouvert-a-la-circulation

banjomick

- 05 Oct 2017 11:40

- 504 of 701

- 05 Oct 2017 11:40

- 504 of 701

CRTV - JOURNAL 12H00 (Ouverture du 2ème pont sur le WOURI)

Mardi 03 Octobre 2017

1,560 views

https://www.youtube.com/watch?v=CY4OPcRiAUA

banjomick

- 09 Oct 2017 13:46

- 505 of 701

- 09 Oct 2017 13:46

- 505 of 701

4 hours ago

Victoria Oil and Gas Retweeted Orbis UK

VOG and GDC proud supports of Orbis Flying Eye Hospital visit to Cameroon

https://twitter.com/victoriaoilgas

The Flying Eye Hospital lands in Cameroon for World Sight Day

http://gbr.orbis.org/en/news/2017/the-flying-eye-hospital-lands-in-cameroon-for-world-sight-day

banjomick

- 10 Oct 2017 10:13

- 506 of 701

- 10 Oct 2017 10:13

- 506 of 701

banjomick

- 12 Oct 2017 23:16

- 507 of 701

- 12 Oct 2017 23:16

- 507 of 701

banjomick

- 24 Oct 2017 10:04

- 508 of 701

- 24 Oct 2017 10:04

- 508 of 701

Thanks to the incentives of the 2013 law, Savannah Oil was able to save more than 5 billion FCfa on its investments

23rd October 2017

(Invest in Cameroon) - The Cameroonian company Savannah Oil Services is now working alongside the British oil and gas producer VOG, particularly through its subsidiary Gaz du Cameroun (GDC), for the extraction and marketing of natural gas on the gas field. Logbaba, located in the economic capital of the country.

This company launched in 2016, support its managers, is the result of the 2013 law on incentives for private investment in the Republic of Cameroon, which grants exemptions ranging from 5 to 10 years to companies in the phase of installation and production .

As part of Savannah Oil, told the government Daily its promoter, Jean Claude Tchagou Tiegue, this regulatory provision has resulted in savings of nearly $ 10 million (more than 5 billion CFA francs) on the overall volume of investments that helped launch this company.

http://www.investiraucameroun.com/entreprises/2310-9651-grace-aux-incitations-de-la-loi-de-2013-savannah-oil-a-pu-economiser-plus-de-5-milliards-de-fcfa-sur-ses-investissements

banjomick

- 24 Oct 2017 18:52

- 509 of 701

- 24 Oct 2017 18:52

- 509 of 701

https://www.youtube.com/watch?time_continue=118&v=RVrKu4AYzyk

http://www.africa-oilweek.com/

banjomick

- 25 Oct 2017 10:17

- 510 of 701

- 25 Oct 2017 10:17

- 510 of 701

Victoria Oil & Gas Plc

("VOG" or "the Company")

Proposed Placing and Subscription to raise between US$20 million to US$26 million

and Open Offer to raise up to US$3.0 million

Victoria Oil & Gas Plc, the integrated natural gas producing utility in Cameroon, has been made aware of very recent market speculation regarding the Company undertaking a potential fundraise and the Board confirms that VOG had been in advanced discussions, with a number of investors, regarding a possible placing in order to fund the Company's operational development and working capital. That fundraising structure has now been converted from a traditional placing structure to the accelerated book build process detailed in this announcement.

The Company is seeking to raise between US$20 million to US$26 million by way of the Placing and Subscription through the issue of new Ordinary Shares at a minimum price of 57 pence. The Company is also proposing to raise up to US$3.0 million by way of the Open Offer which will be available to all Qualifying Shareholders on the Record Date. The Fundraising comprises the Placing and Subscription and the Open Offer. A circular will be published setting out the full details, terms and conditions and timetable of the Open Offer.

Highlights:

· The Placing and Subscription are being conducted through an accelerated book build process which will open with immediate effect following this announcement

· The Directors intend to participate in the Fundraise by way of the Subscription

· Proceeds to be used to accelerate the Group's growth plans, as further detailed below

· The minimum Issue Price represents a discount of approximately 12 per cent to the closing mid-market price of VOG's existing ordinary shares of 64.75 pence on 24 October 2017

· Further details of the Placing are set out in the appendix to this announcement

Having established a natural gas supply business in Douala, VOG believes that the net proceeds of the fundraising, together with additional capital intended to be sourced from local banks will allow the Company to accelerate growth in gas production to meet the opportunity that exists in the Cameroon power sector.

This will enable the Company to:

· Target the c1,700MW power deficiency in Douala with gas to power solutions

· Deliver 100mmscf/d by the end of 2021

· Drill additional well La-109 at Logbaba Project

· Increase Logbaba gas processing plant capacity to 70mmscf/d

· Expedite, subject to Government approvals, development of Matanda and

Bomono Projects

· Extend pipeline reach around port city of Douala to Bomono, the Eastern Corridor and other specific customers.

Shore Capital Stockbrokers Limited ("Shore Capital") and FirstEnergy Capital LLP ("GMP FirstEnergy") have been appointed as joint bookrunners (together the "Joint Bookrunners") in respect of the Placing. Strand Hanson Limited is acting as nominated adviser to the Company.

The Placing is conditional upon the passing of Resolutions relating to the Placing and Subscription which are to be proposed at a General Meeting of the Company. A circular is expected to be posted by close of business on 26 October 2017 (the "Circular") notifying shareholders of a general meeting for the purpose of considering the relevant resolutions.

This Announcement contains inside information for the purposes of Article 7 of EU Regulation 596/2014 ("MAR"). In addition, market soundings (as defined in MAR) were taken in respect of the Placing with the result that certain persons became aware of inside information (as defined in MAR), as permitted by MAR. This inside information is set out in this Announcement. Therefore, those persons that received inside information in a market sounding are no longer in possession of such inside information relating to the Company and its securities.

Additional information on the Fundraising is included below. Attention is also drawn to the section headed 'Important Notice' and to the Appendix to this Announcement containing, inter alia, the terms and conditions of the Placing (representing important information for Placees only). The number of Placing Shares to be issued in connection with the Placing will be determined by GMP FirstEnergy and Shore Capital at the close of the Bookbuild process, and the results of the Placing will be announced as soon as practicable thereafter. The timing of the closing of the book, pricing and allocations is at the absolute discretion of GMP FirstEnergy and Shore Capital.

http://www.moneyam.com/action/news/showArticle?id=5716603