| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

Rockhopper - A big 2011 coming (RKH)

Proselenes - 13 Jan 2011 23:54

.

Proselenes - 13 Aug 2011 04:55 - 571 of 729

.

Proselenes - 15 Aug 2011 08:59 - 572 of 729

The new presentation (on a new link I put up that should download faster than the company website - took me ages to download it this morning).

http://www.mediafire.com/?us2dbvy3ht1syu5

.

http://www.mediafire.com/?us2dbvy3ht1syu5

.

Proselenes - 15 Aug 2011 11:06 - 573 of 729

Pretty much as I intimated earlier on the 14-10/6 results.

The loss of the lower fan (being water filled) has meant the low case has not gone over 200 MMBO.

Based on the low 608MMBO OIP with 30% recovery that comes to just over 180MMBO recoverable.

Shame really, if the lower fan was oil filled and not water filled then RKH would have been over 200MMBO recoverable low case now.

Needs more drilling and good results to get there now.

The loss of the lower fan (being water filled) has meant the low case has not gone over 200 MMBO.

Based on the low 608MMBO OIP with 30% recovery that comes to just over 180MMBO recoverable.

Shame really, if the lower fan was oil filled and not water filled then RKH would have been over 200MMBO recoverable low case now.

Needs more drilling and good results to get there now.

Proselenes - 16 Aug 2011 01:15 - 574 of 729

Post from the other side............

Pro_S2009 - 16 Aug'11 - 01:09 - 27035 of 27035

mariopeter, if you add 1 Billion pounds of development costs you will see why the market cap presently is about right.

This, and the fact they will run out of money end of Q1 2012 at present spend rate, is what is holding the share price back.

However, its not doom and gloom, you carry that Billion pounds cost over, however each successful drill from now on will boost the low case up and make the project more and more attractive, and so little by little the share price can move with the success.

I would guess they are looking to raise cash with the new CPR in Q1 2012, more than likely at around the same 315p as before, maybe a bit higher - this time with new participants (like Singapore etc..)

Some people will of course not like to hear that and start being abusive to me again, but I think I will not be far out with my estimate of around 315p to 335p for a placing for more funds along with the CPR early next year.

Not a bad way to make what should be a risk free 30% to 40% gain in 6 months.

That is the key thing here, low risk plus decent gain, it will attract more "stable players" and not attract those looking for big quick gains, the hot money if you like. This is why you are seeing the likes of the Singaporean sovereign fund buying in, they prefer low risk decent potential investments, and will likely be a major participant in the placing early next year.

mariopeter - 15 Aug'11 - 13:17 - 26990 of 27034

Our new minimum STOIIC puts an NPV of the project (dcf 10% and oil price of $70) in excess of $2500m or 1500m stg. AT todays share price you can buy the entire company for 600m. 1500m stg That was today's new MINIMUM STOIIC and ignores new exporation potential. Use median case and the project value is probably 4000m stg.

Why the huge discount?

Political risk in Falklands

General market risk

Oil price fears

Not a perfect market so this information not known

Lack of faith in management and waiting for CPR

Lack of sentiment at least until BOR get stuck in in the South.

Don't know really but I feel sentiment is the problem. The market cannot continue to ignore all of this good news forever.

Chart shows a breakout north if we close at these levels or higher for 2 days.

Pro_S2009 - 16 Aug'11 - 01:09 - 27035 of 27035

mariopeter, if you add 1 Billion pounds of development costs you will see why the market cap presently is about right.

This, and the fact they will run out of money end of Q1 2012 at present spend rate, is what is holding the share price back.

However, its not doom and gloom, you carry that Billion pounds cost over, however each successful drill from now on will boost the low case up and make the project more and more attractive, and so little by little the share price can move with the success.

I would guess they are looking to raise cash with the new CPR in Q1 2012, more than likely at around the same 315p as before, maybe a bit higher - this time with new participants (like Singapore etc..)

Some people will of course not like to hear that and start being abusive to me again, but I think I will not be far out with my estimate of around 315p to 335p for a placing for more funds along with the CPR early next year.

Not a bad way to make what should be a risk free 30% to 40% gain in 6 months.

That is the key thing here, low risk plus decent gain, it will attract more "stable players" and not attract those looking for big quick gains, the hot money if you like. This is why you are seeing the likes of the Singaporean sovereign fund buying in, they prefer low risk decent potential investments, and will likely be a major participant in the placing early next year.

mariopeter - 15 Aug'11 - 13:17 - 26990 of 27034

Our new minimum STOIIC puts an NPV of the project (dcf 10% and oil price of $70) in excess of $2500m or 1500m stg. AT todays share price you can buy the entire company for 600m. 1500m stg That was today's new MINIMUM STOIIC and ignores new exporation potential. Use median case and the project value is probably 4000m stg.

Why the huge discount?

Political risk in Falklands

General market risk

Oil price fears

Not a perfect market so this information not known

Lack of faith in management and waiting for CPR

Lack of sentiment at least until BOR get stuck in in the South.

Don't know really but I feel sentiment is the problem. The market cannot continue to ignore all of this good news forever.

Chart shows a breakout north if we close at these levels or higher for 2 days.

markymar

- 16 Aug 2011 12:17

- 575 of 729

- 16 Aug 2011 12:17

- 575 of 729

wynonie, a good question, and for the record I have in fact sold more RKH to buy more FOGL and others. So my holding is greatly reduced in RKH now from the 50% it was reduced down after flow test

Taken from motley board 6.8.11

Proselenes - 10 Aug 2011 03:24 - 564 of 574

Its hilarious, I sold out at 300p and now because the price has risen from 140p to 200p I was wrong for selling at 300p

Pro you talk utter tosh and lie through your teethyou sold half your holding at a price between 2.70 to 2.30 the rest of your holding you sold when the market collapsed I expect so under 2 so after ramping this share since New Year when you bought at 3.60 you have lost a packet.

A disgrace to the boards instead of using your name to de ramp the share your using mariopeter I hope every one who reads your thread see you as the fake and utter bull shi**er you are.

Taken from motley board 6.8.11

Proselenes - 10 Aug 2011 03:24 - 564 of 574

Its hilarious, I sold out at 300p and now because the price has risen from 140p to 200p I was wrong for selling at 300p

Pro you talk utter tosh and lie through your teethyou sold half your holding at a price between 2.70 to 2.30 the rest of your holding you sold when the market collapsed I expect so under 2 so after ramping this share since New Year when you bought at 3.60 you have lost a packet.

A disgrace to the boards instead of using your name to de ramp the share your using mariopeter I hope every one who reads your thread see you as the fake and utter bull shi**er you are.

Proselenes - 16 Aug 2011 13:03 - 576 of 729

There are a lot of people desperate to ramp RKH at the moment. Its not a rampable share now.

Slow and steady it is - the excitement is all over for now, its just like any most other stocks now, much lower risk, much less reward potential short term.

The rampers appear to be hitting their head against a brick wall and are not intelligent enough to realise whats happening.

When it was 38p when I purchased in first it was a great share with massive potential - most of that is used up for now.

Slow and steady it is - the excitement is all over for now, its just like any most other stocks now, much lower risk, much less reward potential short term.

The rampers appear to be hitting their head against a brick wall and are not intelligent enough to realise whats happening.

When it was 38p when I purchased in first it was a great share with massive potential - most of that is used up for now.

Proselenes - 16 Aug 2011 13:04 - 577 of 729

Its even got so pathetic on ADVFN that I said the share was now steady, low risk, perhaps 30% gain in the coming months before a big placing in Q1 2012 when the cash runs out.

And for saying it will rise 30% in 6 months - I got called a deramper......... LOL :)

Lots of emotional muppets in this stock now, have not got a clue but ramping it hard.........

And for saying it will rise 30% in 6 months - I got called a deramper......... LOL :)

Lots of emotional muppets in this stock now, have not got a clue but ramping it hard.........

markymar

- 16 Aug 2011 13:16

- 578 of 729

- 16 Aug 2011 13:16

- 578 of 729

36p.......rubbish 3.60 at New Year when he sold everthing to buy RKH

They have 3 more drills back to back to drill there is only one muppet not holding just deramping trying to get back in after selling at the wrong time as its doubled since he sold........muppet pro

Proselenes - 16 Aug 2011 13:56 - 579 of 729

Looking back its been a long ride since those 38p days.

Not many people were long back then in RKH, only me and a few others of the BB posters. Lots came in after the news, but there were few of us here before the big news back in May 2010.

I still remember posting the RNS of the big oil find. Those were the days, me saying not to sell and many others posting how they sold at 60p or 90p LOL :)

http://www.moneyam.com/InvestorsRoom/posts.php?tid=8509&from=597

All out of RKH at the moment - not going to buy back in either - there are much better potentials out there for big gains in the short term - RKH is now low risk with perhaps 30% gain in the coming 6 months.

Not attractive to me.

Not many people were long back then in RKH, only me and a few others of the BB posters. Lots came in after the news, but there were few of us here before the big news back in May 2010.

I still remember posting the RNS of the big oil find. Those were the days, me saying not to sell and many others posting how they sold at 60p or 90p LOL :)

http://www.moneyam.com/InvestorsRoom/posts.php?tid=8509&from=597

All out of RKH at the moment - not going to buy back in either - there are much better potentials out there for big gains in the short term - RKH is now low risk with perhaps 30% gain in the coming 6 months.

Not attractive to me.

markymar

- 16 Aug 2011 15:34

- 580 of 729

- 16 Aug 2011 15:34

- 580 of 729

cynic

- 16 Aug 2011 15:53

- 581 of 729

- 16 Aug 2011 15:53

- 581 of 729

come on children - enough throwing of toys

personally, i think Pro is wrong and that there is considerably more upside potential in RKH than 30% over the next 6 months ..... even if he's right, it's better than having some blue-sky penny stock which crashes to zilch

personally, i think Pro is wrong and that there is considerably more upside potential in RKH than 30% over the next 6 months ..... even if he's right, it's better than having some blue-sky penny stock which crashes to zilch

Proselenes - 17 Aug 2011 00:53 - 582 of 729

cynic - who is throwing toys ?

I see a number of missing post numbers, which means someone on my squelched list is posting here - one of the muppets.

But which muppet is it ?

cynic - 16 Aug 2011 15:53 - 581 of 581

come on children - enough throwing of toys

I see a number of missing post numbers, which means someone on my squelched list is posting here - one of the muppets.

But which muppet is it ?

cynic - 16 Aug 2011 15:53 - 581 of 581

come on children - enough throwing of toys

Proselenes - 17 Aug 2011 05:07 - 583 of 729

ptholden

- 17 Aug 2011 07:17

- 584 of 729

- 17 Aug 2011 07:17

- 584 of 729

Ah, the great Proselenes squelch list, which I believe is at least as important as the Magna Carta or perhaps Treaty of Versailles! Not much good though when you forget who is on the list lol!

Proselenes - 17 Aug 2011 15:13 - 585 of 729

Proselenes - 18 Aug 2011 04:15 - 586 of 729

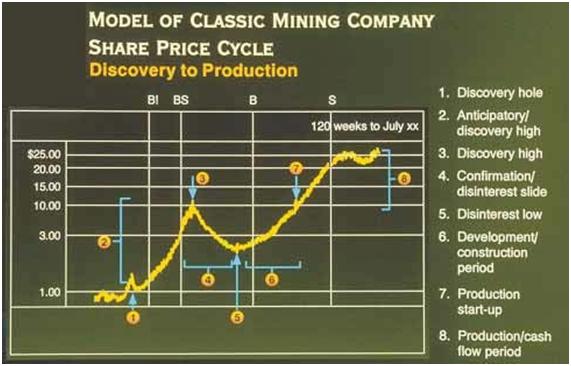

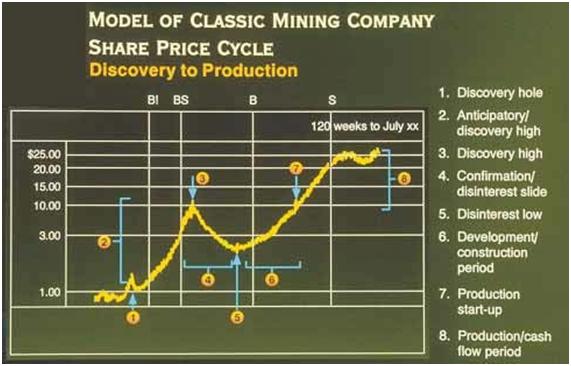

RKH for me is now in the "disinteresting" phase as they appraise more and then raise money in Q1 next year.

.

.

aldwickk

- 18 Aug 2011 08:33

- 587 of 729

- 18 Aug 2011 08:33

- 587 of 729

RKH isn't a mining company

Sequestor

- 18 Aug 2011 08:36

- 588 of 729

- 18 Aug 2011 08:36

- 588 of 729

OOPS

LOL

LOL

Proselenes - 18 Aug 2011 08:58 - 589 of 729

Mining, Oil - all the same principle.

Discovery boom, then the disinterest and the value coming out later when production nears and then starts.

Discovery boom, then the disinterest and the value coming out later when production nears and then starts.

Proselenes - 18 Aug 2011 09:00 - 590 of 729

XEL is a classic chart as above.......... RKH as well now its in the disinterest zone.......