| Home | Log In | Register | Our Services | My Account | Contact | Help |

Victoria Oil & Gas-The Information & News Thread (VOG)

banjomick

- 07 Jan 2015 21:01

- 07 Jan 2015 21:01

Victoria Oil & Gas Plc (Victoria) has become a significant domestic energy supplier in Africa through its wholly owned subsidiary: Gaz du Cameroun S. A. (GDC).

With operations located in the industrial port-city of Douala, Cameroon, customers are converting their operations to take natural gas supplied by our production wells and pipeline infrastructure.

GDC is the sole gas supplier in the area, providing a cheaper, more efficient, reliable, and cleaner energy alternative to Heavy Fuel Oil use.

Our teams of engineering advisors are on hand to help customer’s cost and implement the change to GDC’s energy products.

Victoria Oil & Gas is traded in the NEX Exchange HERE

Link-HISTORICAL NEWS,VIDEO/AUDIO & EVENTS

Link-Dedicated Posts for:

Gaz du Cameroun S.A. (“GDC”)

Gaz Du Cameroun Matanda S.A. ("GDC Matanda")

Link-Cameroon-Industrialisation Master Plan (PDI) & Africa Energy

NEWS

21st Jan 2019 Production Update

17th Jan 2019 Q4 2018 Operations Update

02nd Jan 2019 Presidential Decree on Matanda Received

24th Dec 2018 Renewal of Long-Term Gas Supply Contract with ENEO

28th Sep 2018 INTERIM FINANCIAL REPORT FOR THE SIX MONTHS ENDED 30 JUNE 2018

17th Aug 2018 Q2 2018 Operations Update

22nd Jun 2018 Report and Accounts to 31 December 2017

14th Jun 2018 Restructure of the BGFI Debt Facility

04th Jun 2018 Notice of Annual General Meeting

04th June 2018 Logbaba Field Reserves Update

24th May 2018 Q1 2018 Operations and Outlook

16th Feb 2018 Q4 17 Operations Update & 2018 Outlook Replacement

05th Jan 2018 Gas Supply Contract with ENEO Not Extended

VIDEO/AUDIO

21st Jan 2019 Victoria Oil & Gas looks ahead to increased cash flow

24th Aug 2018 Victoria Oil & Gas confident of resolving ENEO contract 'within weeks'

22nd Apr 2018 Video from 21/04/2018 UK Investor Show

16th Feb 2018 Victoria Oil & Gas confident of positive outcome to ENEO issue

08th Nov 2017 Victoria Oil & Gas reports very pleasing initial results from La-108

31st Oct 2017 21 Oil and Gas - African Power Panel

30th Oct 2017 121 Oil & Gas Investment

26th Oct 2017 Victoria Oil & Gas raises US$23.5mln to accelerate new growth programme

26th Sep 2017 Victoria Oil & Gas to finalise long term supply contracts after first gas at LA-107

17th Aug 2017 Victoria Oil & Gas expecting La-107 to be a 'substantial' producer

16th Apr 2017 Video from 01/04/2017 UK Investor Show

13th Apr 2017 'It's been a terrific year and a great quarter', says Victoria Oil & Gas' Kevin Foo

06th Mar 2017 Farm-out deal 'a really good strategic move' for Victoria Oil & Gas, says chairman Kevin Foo

06th Feb 2017 Chairman runs Proactive through the good start to 2017

EVENTS

28th Jun 2018 Annual General Meeting ("AGM")

10th May 2018 Africa Oil & Power Investor Forum-London

21st Apr 2018 UK Investor Show

11th-12th Apr 2018 Africa Investment Exchange: Gas (AIX: Gas 2018)-London

09th-10th Nov 2017 The Cameroon Investment Forum(CIF)-Cameroon

30th-31st Oct 2017 121 Oil & Gas Investment-London

23rd-27th Oct 2017 Africa Oil Week 2017-Cape Town South Africa

07th Sep 2017 One2One Investor Forum - London

05th Sep 2017 Oil Capital Conference-London

28th Jun 2017 Annual General Meeting

01st Apr 2017 UK Investor Show

9th Feb 2017 Presentation slide show for One2One

9th Feb 2017 One2One Investor Forum - London

Social Media

banjomick

- 14 Feb 2018 15:52

- 578 of 701

- 14 Feb 2018 15:52

- 578 of 701

"Mr Maestro

14 Feb '18 - 15:31 - 42474 of 42474

My broker has just phoned, said there is a highly dilutive placing coming to keep this company afloat for a short while.

Foo wants to retire with more millions in his personal account, pi's are paying for it.

Trust me - SELL"

https://uk.advfn.com/cmn/fbb/thread.php3?id=26413280

banjomick

- 15 Feb 2018 12:21

- 579 of 701

- 15 Feb 2018 12:21

- 579 of 701

Eneo reaches an agreement to settle its debt to KPDC, thus obtaining the capacity increase of the Kribi plant

Thursday, 15 February 2018

(Invest in Cameroon) - The Kribi gas plant, built in the Southern region of Cameroon and managed by KPDC, " is gradually increasing its energy deliveries to the profit " of Eneo, the public service concession holder of the electricity in Cameroon.

This standardization of deliveries from KPDC to the benefit of the electrician Eneo, revealed the general manager of the latter company (Joel Nana Kontchou), by inaugurating the headquarters building of his region Sanaga Ocean, on February 14, 2018 in Kribi; is the consequence of an agreement reached between the two partners, for the settlement of the debt claimed from Eneo.

As a reminder, at the end of last year, because of a debt that had reached "the critical threshold ", according to KPDC, this company had to reduce by 100 MW the production capacity of the Kribi gas station (213 MW ), depriving Eneo of the energy it needs to ensure optimal supply for its customers in the interconnected South network.

Unable to pay its bills to KPDC, because of cash flow difficulties, Eneo had in turn blacklisted a debt of about 100 billion CFA francs, claimed from the State of Cameroon, as consumption of administrations the public and the lack of tariffs.

The State's payment of part of this debt (CFAF 15 billion) had, moreover, allowed Eneo, in December 2017, to make an advance to KPDC, thereby relaxing a little bit the collaboration between the two countries. two companies controlled by the British investment fund Actis.

http://www.investiraucameroun.com/electricite/1502-10277-eneo-parvient-a-un-accord-pour-regler-sa-dette-envers-kpdc-et-obtient-ainsi-l-augmentation-des-capacites-de-la-centrale-de-kribi

banjomick

- 16 Feb 2018 09:55

- 580 of 701

- 16 Feb 2018 09:55

- 580 of 701

Victoria Oil & Gas Plc

Q4 2017 Operations Update and 2018 Outlook

Victoria Oil & Gas Plc, a Cameroon based gas and condensate producer and distributor, is pleased to provide an update on the Group's Q4 operations for the three months ended 31 December 2017 ("Q4" or "the Period").

Q4 2017 saw strong gas and condensate consumption levels from Gaz du Cameroun S. A's ("GDC")'Logbaba Project in Douala, Cameroon, especially during December, with the addition of 3 new thermal customers during the quarter. Wells La-107 and La-108 were completed during the quarter with initial flow rates ahead of expectations.

Q4 2017 Highlights - Record Gross Gas Sold

· Q4 Gross Gas Sold 726mmscf (18.56% increase on Q317, 11.04% increase on Q416)

· Average daily gas production for Q4 7.94mmscf/d (Q317: 6.96mmscf/d, Q416: 7.64mmscf/d)

· YE2017 Gross Gas Sold 3,684mmscf (3.29% increase on YE2016)

· YE2017 average daily gas production of 10.98mmscf/d was a record (YE2016: 10.23mmscf/d)

· Wells La-107 and La-108 completed and rig stacked

· Cash and cash equivalents at 31 December 2017 $10.4 million, net receivables $6.1m and net debt $14.0 million (31 December 2016: Net cash of $1.8 million)

2018 Outlook - Revised Production Targets and Alternative Gas Sales Initiatives

· Previously announced supply projections will be significantly impacted if ENEO Cameroon S.A. ("ENEO"), Cameroon's national electricity generating company, does not place its Logbaba and Bassa power stations back online during 2018.

· Revised year end production targets of 13mmscf/d set if Logbaba and Bassa back online by Q2 and 9mmscf/d if they remain offline

· GDC progressing bespoke gas to power initiative with industrial customers with third-party gas to power generation

· Negotiations continue with other grid power suppliers Dibamba and Grenor who confirm commitment to building power supply in Douala

· Fast track development of 2mmscf/d Compressed Natural Gas ("CNG") plant planned

Quarterly Production Update

The Q4 gross and net gas and condensate sales for Logbaba and GDC, are as follows; amounts in bold are gas and condensate sales attributable to GDC*:

***Via link below***

http://www.moneyam.com/action/news/showArticle?id=5858433

banjomick

- 16 Feb 2018 10:00

- 581 of 701

- 16 Feb 2018 10:00

- 581 of 701

Drilling Update

Wells La-107 and La-108 were successfully completed and the rig stacked in December.

La-107 is now a production well and a well plan is being finalised on La-108 to complete the clean-up and testing of the Lower Logbaba Sands. This includes recovery of the spent perforation gun. Once this is done, the Upper Logbaba Sands in La-108 can be tested, if required, as gas flows from the Lower Logbaba Sands were ahead of expectations. Preliminary internal reserve estimates for La-107 and La-108 based on well logs and flow tests are material and will be published in due course.

The final cost of the well programme was $87 million against an original budget of $40 million. This overrun was the result of a combination of many factors and a detailed analysis will be completed. However, the well control event during the drilling of La-108 was the main cause of the delay and cost overruns.

An insurance claim has been lodged with the Company's insurers to cover the substantial and material costs associated with this event and the consequential schedule and cost overrun. As is normal in these situations, the outcome of our claim is not certain.

The rig was stacked in December, with the intention of retaining it on site for the drilling of La-109. With the suspension of gas consumption by ENEO, as announced in our 5 January 2018 RNS, the Company decided to formally release the rig on 31 January 2018.

Matanda, Bomono and West Medvezhye Update

During the quarter the Group progressed with subsurface evaluation work for the Matanda Block, which indicates the potential for more than 1TCF of recoverable gas across onshore sections of the block. The Company continues to work with the Government of Cameroon to obtain the assignment of its participating share in this block.

On 2 January 2018, we announced a further extension of discussions with Bowleven Plc on the Bomono Project. This block is yet to receive a Provisional Exploitation Licence, in advance of any assignment of title from Bowleven Plc to the Company.

The Company is also remains engaged with potential buyers or partners for the West Medvezhye Project in Russia.

ENEO Update

The Government of Cameroon, ENEO, Altaaqa Global ("Altaaqa"), the genset providers to ENEO which consume GDC's gas, and GDC are in ongoing discussions about future power supply plans and we remain hopeful that a resolution will be found.

The Company believes that ENEO will resume gas consumption relatively shortly because there are significant shortfalls in power supply in Cameroon, with hydroelectric schemes not meeting the current demand. The Company believes that gas fired power remains an attractive solution because it is clean, cheap and readily available.

In our update on 5 January 2018, we reported gross ENEO receivables of $8.7 million. We are pleased to report that at the time of this announcement this gross receivable has reduced to $5.0 million. The Company expects the balance to be paid off in due course and at the latest by the end of Q2 2018.

Financial Update

Unaudited net revenue for Q4 was $4.4 million (Q4 2016: $4.6 million) and unaudited net revenue for 2017 was $23.9 million (2016: $32.8 million). The loss of revenue from ENEO, which accounted for approximately 53% of the Projects revenue in 2017, should a resolution with the parties involved not be found, would be significant for the Group in 2018.

Cash and cash equivalents at 31 December 2017 was $10.4 million (31 December 2016: $16.3 million), net receivables were $6.1m and net debt was $14.0 million (31 December 2016: Net cash of $1.8 million).

The Company had made application for an additional debt facility with local banking institutions in Cameroon during the second half of 2017. With ENEO suspending the consumption of gas, management decided to place these applications on hold until the matter is resolved.

In addition, the Company's previously announced capital expenditure program for 2018 will be deferred until further clarity is obtained on the ENEO situation.

http://www.moneyam.com/action/news/showArticle?id=5858433

banjomick

- 16 Feb 2018 10:06

- 582 of 701

- 16 Feb 2018 10:06

- 582 of 701

Q4 2017 Operations Update and 2018 Outlook (Continued)

Commentary and 2018 Outlook

GDC is the single onshore gas supplier in Cameroon; management estimates that with Logbaba and Matanda, GDC has potentially recoverable gas of at least 1.3 TCF and 50km of gas pipeline and support infrastructure to deliver gas to customers. GDC has a diverse customer base and whilst ENEO is our largest customer, we are connected to over 30 customer sites and believe that there is considerable expansion potential in Douala.

The Company is still in discussions with current and potential power providers Dibamba Power Development Company ("DPDC") and Grenor S.A. ("Grenor") aimed at concluding gas supply contracts with these companies for future grid power. Given the current environment, it is prudent to expect delays to the roll-out of investment into power generation, and therefore the Company has adopted a strategy of less reliance on grid power customers.

Management is expediting its support to manufacturers and producers in Douala, which are facing regular power disruptions, by providing bespoke gas fired power generation for individual customers or groups of customers. As most of these proposed power customers are already connected to the gas pipeline network, adding a gas to power generation solution will increase gas consumption with minimal additional capital costs for GDC. Furthermore, we are actively pursuing a Compressed Natural Gas (CNG) solution which will afford GDC the opportunity to reach some larger customers beyond the current pipeline infrastructure.

VOG has set an ambitious business strategy with gas sales targets building up to 100mmsc/d by 2021. The Board still believes that this target is achievable and that the demand for gas within Cameroon remains robust, however this will require positive resolution of the current problems.

The Company has revised its Operating Plan for 2018, of which key elements are:

· Renew the gas supply contract with ENEO as soon as practicable and add further grid power, including new contracts with DPDC and Grenor, but with greater price and payment security

· Sell more thermal gas to existing and new customers by working closely with them to create cost effective energy solutions

· Work with existing and new customers to create bespoke gas to power solutions with individual generator designs, mini grids and shared power from centralised generators. These solutions will allow customers to be less dependent on grid power

· Maximise return from our high-grade gas condensate. Our condensate is very high grade (47 API) and close in composition to diesel. We currently sell condensate at near to crude oil prices, which is about half the price of diesel

· Actively develop the CNG and Natural Gas Vehicle (NGV) markets. CNG would compete with diesel as a source of energy in the more remote regions, it offers considerable uplift on current margins and can be transported 250-300km

· Sustain progress on the promising Matanda and Bomono opportunities

· Review capital projects, operational and G&A expenditure rigorously to preserve cash

A provisional production target to be achieved, should ENEO not resume gas consumption in 2018 and assuming increased thermal, gas to power and CNG project implementations, has been set at 9mmscf/d by year end 2018. Should ENEO resume full production in Q2 2018, the end of year target would be 13mmscf/d.

Ahmet Dik, CEO said, "Annual gross production figures for 2017 were a record for the Company, with 3.65 BCF of gas sold compared to 3.56 BCF in 2016. We estimate a considerable gross reserve base 200 BCF (2P) at Logbaba and over 1.3TCF of unrisked gas in place in the onshore Matanda, which the Company intends to develop following Government approval. We successfully completed two production wells and secured over $23 million of new financing via a share placing.

I believe that the ENEO issue will be solved as VOG management has prioritised this matter and is focused on achieving a result in the shortest possible timeframe. The Company now has the gas reserves in place to meet industrial and grid power demand for large quantities of gas and power from parties other than ENEO.

In parallel to efforts in resuming gas consumption by ENEO, management is actively looking to place this newly available gas with new and existing customers for power generation and new thermal customers and we have set a target, without ENEO consumption, of 9mmscf/d production to be achieved by year end.

I believe that despite the suspension of ENEO supply, the Company will actually grow stronger and create a wider and more diverse product base in 2018 and will continue to build the outstanding business we have created in Cameroon."

Sam Metcalfe, the Company's Subsurface Manager, has reviewed and approved the technical information contained in this announcement. Mr. Metcalfe is a graduate in BA Geology, BSc Civil Engineering, and MSc Petroleum Engineering.

http://www.moneyam.com/action/news/showArticle?id=5858433

Q4 17 Operations Update & 2018 Outlook Replacement

banjomick

- 16 Feb 2018 13:51

- 583 of 701

- 16 Feb 2018 13:51

- 583 of 701

Proactive Investors Stocktube

Published on Feb 16, 2018

Ahmet Dik, chief executive of Victoria Oil & Gas plc (LON:VOG), tells Proactive's Andrew Scott fourth quarter gas sales were up just short of 19% from the preceding three months.

Gross sales amounted to 726mln cubic feet in the fourth quarter, which also represents an 11% increase in the year-on-year comparative.

Dik says they're giving top priority to solving the ENEO issue and management are confident of a positive outcome in the shortest possible timeframe.

https://www.youtube.com/watch?time_continue=3&v=eO0ErzcKNHk

WOODIE - 16 Feb 2018 20:37 - 584 of 701

I would not be surprised if another Fund raising was done before year end.

banjomick

- 23 Feb 2018 14:08

- 585 of 701

- 23 Feb 2018 14:08

- 585 of 701

February 22, 2018 by Energies Media

Dibamba Power Development Company (DPDC) and the Norwegian Grenor would consider building thermal power plants to generate electricity from gas in Douala

Gas du Cameroun (GDC) could soon supply two independent power producers with natural gas, Energies Media learned via a report released last week by the company.

The subsidiary of the British firm Victoria Oil and Gas PLC (VOG) is in talks with Dibamba Power Development Company (DPDC) - a subsidiary of Britain's Globeleq - and the Norwegian group Grenor for the supply of natural gas to them.

DPDC has a thermal power station of 88 MW in Yassa (Douala), fueled by heavy fuel oil; and Grenor is working on a 150 MW thermal power station project, still in the Littoral region. This plant will be supplied with natural gas .

The potential entry of these independent power producers into GDC's customer portfolio will substantially increase the amount of natural gas distributed by this VOG subsidiary and impact its financial health.

Its largest current customer, the concessionaire of the public electricity distribution service, ENEO , has suspended the supplies of its 50 MW power plant since early January 2018 for cash tensions. ENEO supplies accounted for 53% of the sales of the Logbaba gas field - operated by GDC - for the 2017 financial year. Without the resumption of the partnership with ENEO, the company has difficulties in implementing the development plan of its subsidiaries. capabilities.

Gaz du Cameroun is the only natural gas distributor in Douala, the economic capital of Cameroon. GDC operates in the Logbaba gas field and has been serving a pipeline since 2012 with the industrial areas of Bassa and Bonabéri , in addition to ENEO.

https://energies-media.com/gaz-cameroun-pourparlers-dpdc-grenor-elargir-clientele/

banjomick

- 28 Feb 2018 13:26

- 586 of 701

- 28 Feb 2018 13:26

- 586 of 701

The Cameroonian government sells its Industrialization Master Plan to economic operators

Wednesday, February 28, 2018

(Invest in Cameroon) - The Cameroonian Minister of Industry, Ernest Gbwaboubou (photo), went on February 23, 2018, to meet the economic operators, in order to present them and to interest them in the National Plan of industrialization (PDI), adopted by the Cameroonian government in 2017.

This meeting took place in the framework of a workshop on "the appropriation of the master plan of industrialization by the private sector", organized in Douala, the economic capital of the country.

As a reminder, the IDP is based on the development of three priority sectors. It is agribusiness, energy and digital, as many sectors that, in terms of the impact that their development can have on the rest of the economy, have been called " sanctuaries ". »Industrial for Cameroon.

According to the public authorities, the implementation of the PDI is expected to increase by 11 points the contribution of the industrial sector to the GDP of Cameroon, from 13% currently to 24% at least, by 2035.

But, in a global way, the PDI, aims at the Cameroonian government, has for main objective to make the economic locomotive of the Cemac, the " factory of the new industrial Africa ", by 2050.

http://www.investiraucameroun.com/gestion-publique/2802-10354-le-gouvernement-camerounais-vend-son-plan-directeur-d-industrialisation-aux-operateurs-economiques

banjomick

- 12 Mar 2018 10:49

- 587 of 701

- 12 Mar 2018 10:49

- 587 of 701

banjomick

- 14 Mar 2018 19:10

- 588 of 701

- 14 Mar 2018 19:10

- 588 of 701

Basile Atangana Kouna, former Minister of Water and Energy banned from Cameroon

uesday, March 13, 2018

(Invest in Cameroon) - Basil Atangana Kouna (photo), former Minister of Water and Energy is banned from leaving Cameroon since March 8, 2018. This is indicated by a "radio message carried" signed by Divisional Commissioner Chetima Malla Abba.

According to this message, the ban on leaving Cameroon follows an instruction by the Delegate General for National Security, Martin Mbarga Nguele. It was February 7, 2018. The motive is not disclosed, but the same message indicates that the measure also relates to Louis Max Ohandja Ayina, former Secretary of State to the Minister of Public Works responsible for roads.

In the space of a few days, these two former members of the government constitute the second wave of personalities summoned not to leave Cameroon because of judicial disputes.

Last March 2, it was already David Nkotto Emane, the director general (DG) of the Cameroon Mobile Telecommunications (Camtel), incumbent public operator of the telecoms sector, to be banned from leaving Cameroon. Ditto for Richard Maga, the deputy CEO of Camtel and six employees, according to an instruction of the delegate general to the National Security.

https://www.investiraucameroun.com/justice/1303-10439-basile-atangana-kouna-ex-ministre-de-l-eau-et-de-l-energie-interdit-de-sortie-du-cameroun

banjomick

- 14 Mar 2018 21:41

- 589 of 701

- 14 Mar 2018 21:41

- 589 of 701

banjomick

- 14 Mar 2018 23:18

- 590 of 701

- 14 Mar 2018 23:18

- 590 of 701

Obviously there were distractions regarding the Minister of Energy and Water Resources at a time when VOG needed decisive action from this government body which may have had a bearing on VOG's current Grid Power situation.

Below is a list of the main bodies in the power sector with links to their websites with the main ones being the Ministry of Energy and Water, Arsel and ENEO

Ministry of Energy and Water (Ministère de l’Eau et de l’Energie, MINEE), responsible for implementing government action in the energy sector and overseeing energy sector activities.

http://www.spm.gov.cm/en.html

Rural Electrification Agency (Agence d’Electrification Rurale, AER), responsible for promoting and implementing rural electrification in Cameroon and managing the Rural Energy Fund.

http://aer.cm/menu/missions-of-aer

Electric Sector Regulation Agency (Agence de Régulation du Secteur de l’Electricité, ARSEL), responsible for regulating the electricity sector as well as setting electricity rates and determining electrical standards.

http://www.arsel-cm.org/

Electricity Development Corporation (EDC), a state company that develops the electricity sector including all hydroelectric projects in the country.

http://www.edc-cameroon.org/

ENEO Cameroun, responsible for the transmission and distribution of electricity.

https://eneocameroon.cm/index.php/en/

banjomick

- 16 Mar 2018 09:14

- 591 of 701

- 16 Mar 2018 09:14

- 591 of 701

Paul Biya prescribes a roadmap to the new government resulting from the redevelopment of March 2, 2018

Friday, 16 March 2018

(Invest in Cameroon) - For the first time since the reorganization of March 2, Paul Biya, the President of the Republic, met the entire newly formed government.

The head of state took the opportunity to prescribe a roadmap to his ministers led by Prime Minister Philemon Yang. " It is imperative to continue the smooth implementation of the program with the IMF. It is also urgent to finalize the implementation of major structuring projects, the Emergency Plan for accelerated growth and the Special Youth Plan. The entry into service of the deep-water port of Kribi and the second bridge over the Wouri bodes well in this regard , "said Paul Biya. He said that much remains to be done with respect to outreach services to the population. Namely, water, electricity, health, road infrastructure, etc.

The President of the Republic explained that the creation of the Ministry of Decentralization and Local Development is part of the perspective of providing a rapid response to the recurring demands of the people. " I expect, in the near future, detailed proposals and a timeline for accelerating the ongoing decentralization process. Said Biya.

https://www.investiraucameroun.com/gouvernance/1603-10457-paul-biya-prescrit-une-feuille-de-route-au-nouveau-gouvernement-issu-du-reamenagement-du-2-mars-2018

banjomick

- 16 Mar 2018 13:52

- 592 of 701

- 16 Mar 2018 13:52

- 592 of 701

EDC claims more than 24 billion FCFA to the Cameroonian electrician Eneo, under the rights of water of the dam of Lom Pangar

Friday, March 16, 2018

(Invest in Cameroon) - Electricity Development Corporation (EDC), Cameroon's state-owned power utility, has already billed Eneo, the concessionaire of the country's public electricity utility, for rights to electricity. water for an amount of more than 24 billion CFA francs, since the start of the exploitation of the Lom Pangar reservoir dam, revealed to the Government Daily , Théodore Nsangou (photo), EDC CEO.

" We are waiting for the payment of this sum. We are working on the file with the government, including the Ministries of Finance, Water and Energy. Especially as the repayment dates begin to run. It is urgent that a solution be found on water rights. He continued.

As a reminder, the Lom Pangar dam, built in the Eastern region, has a holding capacity of 6 billion cubic meters of water. This infrastructure is mainly designed to regulate flows upstream of the Sanaga River, which is home to 75% of Cameroon's hydroelectric potential.

As such, in the event of a drop in water levels in the Songloulou and Edéa dams, the two main dams operated by Eneo, the Lom Pangar waters are requested by the electricity generation and distribution company, which is then billed for the quantities required, exactly as it charges electricity consumption to users.

https://www.investiraucameroun.com/energie/1603-10464-edc-reclame-plus-de-24-milliards-fcfa-a-l-electricien-camerounais-eneo-au-titre-des-droits-d-eau-du-barrage-de-lom-pangar

banjomick

- 19 Mar 2018 14:17

- 593 of 701

- 19 Mar 2018 14:17

- 593 of 701

Victoria Oil and Gas Plc

3 hrs ·

Shore Capital update 16.3.18: “We believe that VOG has a surplus of gas available to be sold to industrial and grid power customers, and beyond its pipeline network as CNG” #VOG #Cameroon

Victoria Oil and Gas Plc

3 hrs ·

Shore Capital update 16.3.18: “VOG expects Eneo gas consumption to resume relatively shortly” and “is well placed to pursue multiple initiatives to get itself back onto a growth trajectory” #VOG #Cameroon #Douala #Eneo

Victoria Oil and Gas Plc

3 hrs ·

Shore Capital update 16.3.18: “We see a considerable market opportunity in Douala, where the company has plentiful gas, an extensive pipeline network and numerous opportunities for incremental deliveries to industrial customers”

banjomick

- 23 Mar 2018 13:46

- 594 of 701

- 23 Mar 2018 13:46

- 594 of 701

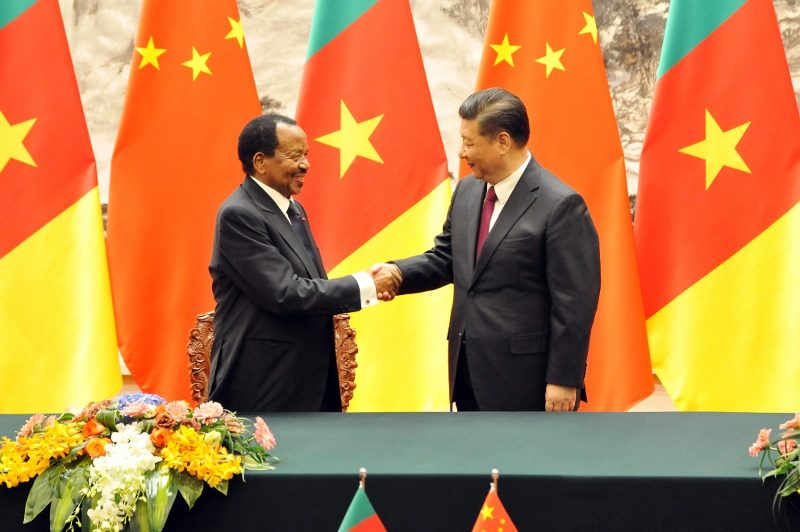

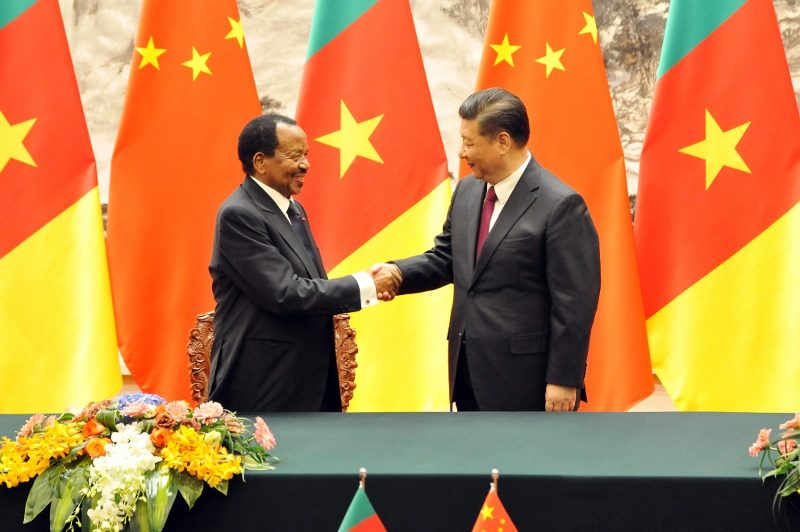

FIVE AGREEMENTS SIGNED BETWEEN CHINA AND CAMEROON

Posted by China Magazine | Mar 23, 2018

Elected president in 2013, Xi Jinping went to Africa for his first state visit, this time he received for the first visit of a head of state, the Cameroonian Paul Biya. The two men intend to elevate the Sino-Cameroonian relations.

On March 22, 2018, President Xi Jinping met with Cameroon's President Paul Biya on the possibilities of bilateral cooperation to set up new Sino-Cameroonian cooperation axes.

For Xi Jinping, Paul Biya is "an experienced leader in Africa and an old friend of the Chinese people. You are the first African Head of State to visit China in 2018 and the first foreign head of state to visit my country after the close of the first session of the 13th Chinese People's Political Consultative Conference and the first session of the 13th National People's Congress of China ".

Xi Jinping said, "We will increase trade and enhance mutually beneficial cooperation in priority sectors. China supports the acceleration of the process of industrialization of Cameroon and encourages large Chinese companies to invest in Cameroon.

For his part, President Paul Biya hailed the Chinese authorities who "gave friendly assistance to Cameroon for its socio-economic development, which brought real benefits to the Cameroonian people." He also announced his support for "The Belt and the Road", and reiterated the principle of one China.

Five cooperation agreements were signed in the presence of the two heads of state by Cameroon and China to consolidate this strategic partnership. China is currently the largest trading partner of Cameroon and the largest investor (in FDI) in Cameroon in carrying out development projects.

Moreover, in 2016, the volume of bilateral trade reached 1 510 billion FCFA (2.3 billion euros). China is present in Cameroon in the fields of drinking water supply, medicine, road and port infrastructure, hydropower, social housing, civil aviation and telecommunications, notes the communiqué of the Presidency of the Cameroon.

https://www.chine-magazine.com/cinq-accords-signes-entre-la-chine-et-le-cameroun/

banjomick

- 26 Mar 2018 10:21

- 595 of 701

- 26 Mar 2018 10:21

- 595 of 701

Cameroon: ENEO intends to completely clear its debt to Gaz du Cameroun and KPDC "by the end of 2018"

posted the March 26, 2018 by Eugene Shema

The company has undertaken to "gradually clear" its debt since the beginning of the year, "so that the financial balance of the energy sector does not break"

The company Eneo , majority owned by the British Actis (51%), undertook to settle "progressively" its debt towards the managers of the two main gas plants: Kribi Power Development Company ( KPDC ), a subsidiary of the British Globeleq; and Gaz du Cameroun , a subsidiary of the British group Victoria Oil and Gas PLC, according to information provided to Energies Media by an official source.

This debt should be completely settled "by the end of the year" , "so that the financial equilibrium of the sector does not break , " comments our source. "It is necessary that KPDC and Gas of Cameroon can also pay their suppliers" , she completes.

Eneo finalized an "arrears settlement agreement" with KPDC in early February.

KPDC has a 211 MW gas plant in Kribi (South Cameroon), energy sold exclusively to Eneo and injected into the South interconnected grid (RIS).

Gaz du Cameroun (GDC) and its partner Altaaqa Global produce electricity from the exploitation of the Logbaba gas field (Littoral-Cameroun). Last year, Eneo consumed 50 MW of GDC, energy also intended for RIS. Between January 1 and December 31, 2017, deliveries to Eneo accounted for 53% of Logbaba's gas sales.

At the end of 2017, as Energies Media reported , KPDC decided to reduce its production by 100 MW, due to unpaid supply bills of around CFAF 46 billion (around 70 million euros).

In connection with this situation, pending the settlement of a slate valued at hundreds of billions of F CFA due to Eneo by the public administrations, the operator had decided for its part not to renew its energy supply with Gaz du Cameroun from 1 January 2018.

It should be noted, however, that in early January, Eneo was debtor of $ 8.7 million to GDC, debt that the dealer of electricity distribution began to clear. By mid-February, this debt of GDC had already been reduced to $ 5 million .

The subsidiary of Victoria Oil and Gas, which accuses the coup - because Eneo consumed more than 50% of its production before its decision to suspend - hopes that the supplies of the operator will resume once the entire debt has been settled.

On the side of Eneo, it is said that we manage however, in the current situation, to maintain "the balance of supply demand on the RIS" , partly thanks to the "erasing efforts made by our main industrial customer Alucam", can be read in the Eneo Electrical Service Information Note in February 2018

As part of the erasure , the industrial group Alucam - which consumes about 200 MW alone, according to a data communicated to Energies Media - agrees not to consume the electricity provided by Eneo at certain times of the day, during rush hours.

The concessionaire of the electricity distribution service relies heavily on the entry into production - expected - of the Memve'ele dam (211 MW), in order to reduce the production costs on the RIS and consequently the gas supplies that it receives. "Are expensive" . A hope contrary to the wishes of GDC.

https://energies-media.com/eneo-compte-apurer-dette-gaz-cameroun-kpdc-fin-annee-2018/

banjomick

- 27 Mar 2018 12:54

- 596 of 701

- 27 Mar 2018 12:54

- 596 of 701

Chinese government promised to cancel part of Cameroon's debt

Tuesday, March 27, 2018

(Invest in Cameroon) - The presidency of the Republic of Cameroon speaks about it but, discreetly. " The Chinese government promised to cancel part of Cameroon's debt ," reads the website of the presidency. This after the visit of Cameroonian President Paul Biya in China at the invitation of his Chinese counterpart Xi Jinping, from March 22 to 24.

Even if the amount of the remittance of this debt is not yet unveiled, it is noted that this announcement is a relaxation between Yaounde and Beijing. Indeed, during the visit to Cameroon of Yu Jianhu, Vice Minister of Chinese Commerce, from November 29 to December 2, 2017, the Cameroonian Ministry of Economy had revealed that the relationship with China still faces enormous difficulties which constitute bottlenecks.

Among these bottlenecks, there is notably, " the non-compliance with contractual clauses " by the Cameroonian side, on the one hand, and " slowness in the payment of debt service ", on the other hand. Moreover, China criticizes Cameroon for failing to honor its contractual commitments, for example in the framework of repayment mechanisms for loans earmarked for the construction of the deep-water port of Kribi ($ 243.17 billion and $ 301.57 billion). FCfa) and the acquisition of MA60 aircraft (36.43 billion FCfa) in July 2012.

And yet since 2007, China is presented as the first country providing funds in Cameroon. Its direct interventions are estimated at just over 3,000 billion FCfa. This through financial instruments such as loans and grants from the various donors such as the Chinese Government, Export-Import Bank of China, Industrial and Commercial Bank of China, Bank of China ... etc.

Sylvain Andzongo

https://www.investiraucameroun.com/finance/2703-10515-le-gouvernement-chinois-a-promis-dannuler-une-partie-de-la-dette-du-cameroun

banjomick

- 27 Mar 2018 12:58

- 597 of 701

- 27 Mar 2018 12:58

- 597 of 701

In 2018, the Cameroonian electrician wants to connect half a million additional people to the electricity grid

Tuesday, March 27, 2018

(Invest in Cameroon) - As part of its 2018 Action Plan, Eneo, the concessionaire of the public electricity service in Cameroon, aims to build 100,000 new connections, to allow half a million additional people to access electricity, announces the company in its newsletter last February.

To do this, we learn, this electricity production and distribution company, controlled by the British Investment Fund Actis, has a 2018 investment budget of 37.5 billion CFA francs. . According to the company, more than 50% of this envelope will be dedicated to the rehabilitation, modernization and extension of distribution networks.

This concentration of Eneo's investments in the distribution network is all the more understandable, explain company officials, thanks to the impoundment of the Lom-Pangar dam (6 billion cubic meters). of water supply), load shedding due to insufficient energy supply has decreased considerably, giving way to multiple incidents on the distribution network, which often deprive the population of electric power.

Brice R. Mbodiam

https://www.investiraucameroun.com/electricite/2703-10518-en-2018-l-electricien-camerounais-veut-connecter-un-demi-million-de-personnes-supplementaires-au-reseau-electrique