| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

CHART ATTACK 2 - Longs And Shorts, Stocks, Indicies, FX. (CHAR)

goldfinger

- 19 Mar 2013 13:57

- 19 Mar 2013 13:57

A thread created for the TA of charts on the LSE markets. (aim and plus included)

Beginners and advanced wellcome. Long or short, just post your views and lets

have some positive discussion. FIRE AWAY.

NB, UK indicies and sector charts plus FX can also to be included in posters analysis.

Money am instructions for posting a chart..http://www.moneyam.com/help/?page=charts

Kipper System 1 http://t.co/heOgs9b

nb, you may have to log in to get access to some of the links here below. Every one is free.

DAILY MORNING CHARLES STANLEY Traders Bulletin

http://www.charles-stanley.co.uk/traders-bulletin

Central Research Morning Report,

http://t.co/BTw64ZxW5e

RESOURCES

http://blog.tradersdaytrading.com/

http://stockcharts.com/school/doku.php?id=chart_school

http://www.cantos.com/masterclass

http://www.onlinetradingconcepts.com/TechnicalAnalysis/ZigZag.html

http://bigcharts.marketwatch.com/http://www.stockmarket-coach.com/index.html

http://www.trade2win.com/knowledge/equities/

http://www.babypips.com/school

CHART SCREENERS

http://www.iii.co.uk/spreadbetting/type=technical

http://www.barchart.com

http://www.autochartist.com/

http://www.britishbulls.com/

Beginners and advanced wellcome. Long or short, just post your views and lets

have some positive discussion. FIRE AWAY.

NB, UK indicies and sector charts plus FX can also to be included in posters analysis.

Money am instructions for posting a chart..http://www.moneyam.com/help/?page=charts

Kipper System 1 http://t.co/heOgs9b

nb, you may have to log in to get access to some of the links here below. Every one is free.

DAILY MORNING CHARLES STANLEY Traders Bulletin

http://www.charles-stanley.co.uk/traders-bulletin

Central Research Morning Report,

http://t.co/BTw64ZxW5e

RESOURCES

http://blog.tradersdaytrading.com/

http://stockcharts.com/school/doku.php?id=chart_school

http://www.cantos.com/masterclass

http://www.onlinetradingconcepts.com/TechnicalAnalysis/ZigZag.html

http://bigcharts.marketwatch.com/http://www.stockmarket-coach.com/index.html

http://www.trade2win.com/knowledge/equities/

http://www.babypips.com/school

CHART SCREENERS

http://www.iii.co.uk/spreadbetting/type=technical

http://www.barchart.com

http://www.autochartist.com/

http://www.britishbulls.com/

aldwickk

- 04 Sep 2014 11:52

- 2081 of 2763

- 04 Sep 2014 11:52

- 2081 of 2763

Long on ITV @219 , with stop 215

Is the hanging man a up trend or down sign today ?

Is the hanging man a up trend or down sign today ?

goldfinger

- 04 Sep 2014 13:32

- 2082 of 2763

- 04 Sep 2014 13:32

- 2082 of 2763

Alders always wait for the days after candle to CONFIRM what you see today is the 'law of the land' with candlesticks.

Great to see you getting stuck in.

Great to see you getting stuck in.

goldfinger

- 04 Sep 2014 13:34

- 2083 of 2763

- 04 Sep 2014 13:34

- 2083 of 2763

SPD, flagged this up as a WATCH candidate a week or so ago. Now broken through downtrend line and gone long. Ive marked the resistance points and gap on the chart.

Chris Carson

- 04 Sep 2014 22:55

- 2084 of 2763

- 04 Sep 2014 22:55

- 2084 of 2763

Back on watch list, been in a trading range since May. Interim ex-divi date 23rd October.

jimmy b

- 05 Sep 2014 11:44

- 2085 of 2763

- 05 Sep 2014 11:44

- 2085 of 2763

Walked down again on low volume after a long struggle up.

goldfinger

- 05 Sep 2014 14:05

- 2086 of 2763

- 05 Sep 2014 14:05

- 2086 of 2763

Long on TCG...

goldfinger

- 05 Sep 2014 15:56

- 2087 of 2763

- 05 Sep 2014 15:56

- 2087 of 2763

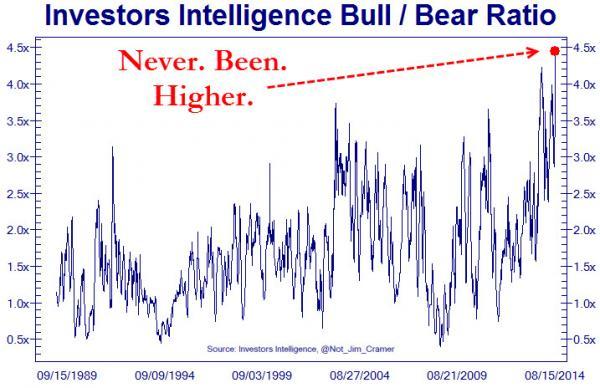

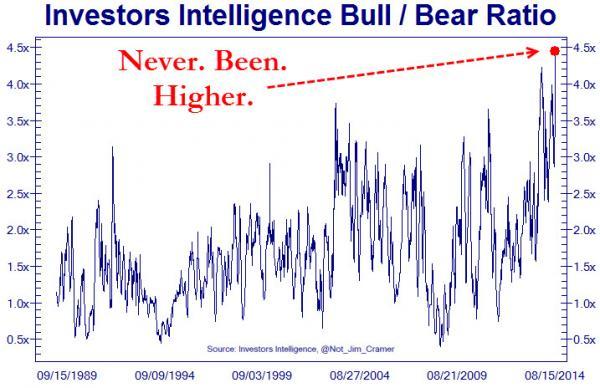

Investors Intelligence: 13% Bears, lowest since ’87 Crash -

aldwickk

- 07 Sep 2014 17:26

- 2088 of 2763

- 07 Sep 2014 17:26

- 2088 of 2763

goldfinger

just want to know if I read your advice right. , as I am only SB with a £1,000 cash pot is your 2:2 betting plan right for this small sum ?

And have i read it right that you keep risk to 2% which would mean £20 of cash pot, and do you limit your trades to 2% divided by share price = number of shares to buy, which would be 2% divided by 120p = 60 add 00 = 6,000 shares. and in my case i could bet up to £20 a point, but more likely for me £1 to £5 depending on the share

Am long on ITV @219 & 221

just want to know if I read your advice right. , as I am only SB with a £1,000 cash pot is your 2:2 betting plan right for this small sum ?

And have i read it right that you keep risk to 2% which would mean £20 of cash pot, and do you limit your trades to 2% divided by share price = number of shares to buy, which would be 2% divided by 120p = 60 add 00 = 6,000 shares. and in my case i could bet up to £20 a point, but more likely for me £1 to £5 depending on the share

Am long on ITV @219 & 221

goldfinger

- 07 Sep 2014 21:23

- 2089 of 2763

- 07 Sep 2014 21:23

- 2089 of 2763

Alders yep the golden Rule is lose no less than 2% of your Starting Capital (on anyone bet) which in your case as you say is £20 quid . This doesnt give you much room to manouvere. Hardly any if you have anything bigger than a £1 bet.

BUT as Chris said the other day because your starting up as a newbie on Spread Betting that 2% doesnt give you many alternatives and he was talking of just looking at one stock.

Hes probably half right Id say look at 2 stocks and play the market that way.

ANYWAY hopefully at the end of this week im going to come out with my NEW PLAN and it means losing less than 2% of your starting capital on anyone bet.

I tell you what if your up for it we could work through the System here on this thread and we'l start right from the beginning incorporating my system above at the top of this thread step by step until you know it inside out.

Its best to practicaly work through it bit by bit.

If your in favour just say yes.

I have no probs in the time it takes dont forget over 1200 people use my Kipper system as outined above at the top of the thread. Ive worked into the early hours of the morning to help people out and understand the basic principles.

We need to go into keeping your capital intact first rather than using the system to pick winners which is a discretionary system.

BUT as Chris said the other day because your starting up as a newbie on Spread Betting that 2% doesnt give you many alternatives and he was talking of just looking at one stock.

Hes probably half right Id say look at 2 stocks and play the market that way.

ANYWAY hopefully at the end of this week im going to come out with my NEW PLAN and it means losing less than 2% of your starting capital on anyone bet.

I tell you what if your up for it we could work through the System here on this thread and we'l start right from the beginning incorporating my system above at the top of this thread step by step until you know it inside out.

Its best to practicaly work through it bit by bit.

If your in favour just say yes.

I have no probs in the time it takes dont forget over 1200 people use my Kipper system as outined above at the top of the thread. Ive worked into the early hours of the morning to help people out and understand the basic principles.

We need to go into keeping your capital intact first rather than using the system to pick winners which is a discretionary system.

aldwickk

- 07 Sep 2014 22:07

- 2090 of 2763

- 07 Sep 2014 22:07

- 2090 of 2763

Goldie

Yes , am up for it.

Matter of fact i have only traded 1 or 2 stock's at a time. Was doing all right at first and was £47 up , then made the mistake of getting bored and went long on spot Gold, then had a punt on QPP and went short before the results. But now only have ITV down £3.36, My capital is now £959

Am looking to buy FAN, Monday.

Yes , am up for it.

Matter of fact i have only traded 1 or 2 stock's at a time. Was doing all right at first and was £47 up , then made the mistake of getting bored and went long on spot Gold, then had a punt on QPP and went short before the results. But now only have ITV down £3.36, My capital is now £959

Am looking to buy FAN, Monday.

Chris Carson

- 07 Sep 2014 22:41

- 2091 of 2763

- 07 Sep 2014 22:41

- 2091 of 2763

Take my advice or completely ignore it alders up to you it's your cash.

Re ITV not saying it will, but it could. Recently broken out from 210.0 which was resistance for quite a while now at all time high. It may just test 210.0 to validate support so obviously you would be stopped out if you leave your stop at 215.0

Just bear this in mind before thinking of adding again.

Re ITV not saying it will, but it could. Recently broken out from 210.0 which was resistance for quite a while now at all time high. It may just test 210.0 to validate support so obviously you would be stopped out if you leave your stop at 215.0

Just bear this in mind before thinking of adding again.

aldwickk

- 08 Sep 2014 09:03

- 2092 of 2763

- 08 Sep 2014 09:03

- 2092 of 2763

Chris

Ok , thanks for the advice

Ok , thanks for the advice

Chris Carson

- 08 Sep 2014 09:26

- 2093 of 2763

- 08 Sep 2014 09:26

- 2093 of 2763

No bother alders, as you know I have traded this stock for over two years now, in my humble opinion the time to add is on a dip. This Scottish referendum nightmare may well provide an opportunity to do so.

goldfinger

- 08 Sep 2014 11:49

- 2094 of 2763

- 08 Sep 2014 11:49

- 2094 of 2763

This Scottish Referendum is a nightmare and may tip the market into a Bear.

No probs though I normaly make more money shorting than going long and the same rules apply but in reverse.

If the YES have it I hate to think how the poor in England will survive. Just think a permanent Tory government.

No probs though I normaly make more money shorting than going long and the same rules apply but in reverse.

If the YES have it I hate to think how the poor in England will survive. Just think a permanent Tory government.

goldfinger

- 09 Sep 2014 12:52

- 2095 of 2763

- 09 Sep 2014 12:52

- 2095 of 2763

One to keep a close eye on for breakout of range SMIN, see chart below.

cynic

- 09 Sep 2014 13:14

- 2096 of 2763

- 09 Sep 2014 13:14

- 2096 of 2763

cynic - 45550 of 45660

consider that within the last 4/5 months the world's shipments of chemicals has almost come to a standstill .... thus storage depots in f/e and m/e are at bursting point with shipping containers, and the indian traffic has also died a death

cynic - 45585 of 45660

some chemicals are liquids and some are powders or whatever

in simplified terms, to carry fairly small quantities of either, they are drummed and then loaded into dry freight containers (the corrugated steel things you'll often see on the back of lorries.

carrying larger quantities of liquids may make drums uneconomic, so the next step up is the tank-container, typically holding 5/6,000 gallons

after that, you get into parcel tankers and the like

world economies are effectively dependent upon chemicals for all sorts of obvious reasons

when economies are weakening, companies will reduce their deliveries (shipments) and stockpiles of chemicals

until a few months ago (3/6), everything was looking pretty chirpy, but the severe unrest in m/e, and clearly to some extent in europe, which in all honesty has not yet come out of the recession (unlike uk) and is now suffering again thanks to russia/ukraine, has brought trade to a shuddering halt

depots bulging with idle containers is the manifestation of this .... hence my original comment

consider that within the last 4/5 months the world's shipments of chemicals has almost come to a standstill .... thus storage depots in f/e and m/e are at bursting point with shipping containers, and the indian traffic has also died a death

cynic - 45585 of 45660

some chemicals are liquids and some are powders or whatever

in simplified terms, to carry fairly small quantities of either, they are drummed and then loaded into dry freight containers (the corrugated steel things you'll often see on the back of lorries.

carrying larger quantities of liquids may make drums uneconomic, so the next step up is the tank-container, typically holding 5/6,000 gallons

after that, you get into parcel tankers and the like

world economies are effectively dependent upon chemicals for all sorts of obvious reasons

when economies are weakening, companies will reduce their deliveries (shipments) and stockpiles of chemicals

until a few months ago (3/6), everything was looking pretty chirpy, but the severe unrest in m/e, and clearly to some extent in europe, which in all honesty has not yet come out of the recession (unlike uk) and is now suffering again thanks to russia/ukraine, has brought trade to a shuddering halt

depots bulging with idle containers is the manifestation of this .... hence my original comment

goldfinger

- 10 Sep 2014 08:28

- 2097 of 2763

- 10 Sep 2014 08:28

- 2097 of 2763

Fantastic results this morning and SP moving up nicely towards top of ceiling on uptrend channel. Prev top target now.

goldfinger

- 10 Sep 2014 13:19

- 2098 of 2763

- 10 Sep 2014 13:19

- 2098 of 2763

IRV Interserve PLC, very cheap,historic 2013 P/E 20.6, 2014 P/E 11.7, 2015 P/E 9.7, very low PEG. EPS inc 76% 2014.

2517GEORGE

- 11 Sep 2014 12:23

- 2099 of 2763

- 11 Sep 2014 12:23

- 2099 of 2763

I'm not au fait with charts but I notice LAD have been weak recently and go ex div later this month, is this a good bet? Sorry about that.

2517

2517

goldfinger

- 11 Sep 2014 16:30

- 2100 of 2763

- 11 Sep 2014 16:30

- 2100 of 2763

The 2 x 2 Professional Traders System A Quick Outline Of What Top Traders Use As Money Management...... Risk/Reward Trading And What It Basicaly Means.

In my opinion after 25 years on the markets (more in fact) I came to the conclusion very quickly that to succeed it wasnt just picking good stocks that counted beneficially but more being able to manage your money, your ability to manage losing and winning positions in your portfolio. How much you stand to lose and win.

Thier is an obsession with private investors that stock picking is the be all and end all of success on the markets, THEY ARE WRONG.

So what are the most important investment/trading questions you have to face?

"How much money should I put on any one trade?".

Pro traders eg, Fund Managers practice and will inform you that success and money management is all about the "2 x 2 rule".

WHAT IS THE RULE?

Ensure your upside is at least twice your downside and never ever lose more than 2% of your trading pot in a single trade, ie 2 x 2.

We'l use company ABC stock as an example all figures rounded for ease of understanding.

ABC is trading at mid at £100 a share.

We start with £20,000 Capital Pot, and if we think ABC will go from £100 to a gain of £130 based on a chart resistance position (30% gain), then we should under the terms of the system not expect the stock to fall below £85 (15% loss) 2/1 ratio. And equally that the worst loss should total no more than 2% of your £20,000 capital pot, which is £400, so you should only buy £2670 of stock at £100 the present market price, (£400 is 15% of £2670). You would have a stop loss in place so that your position would be closed out if your £400 downside was touched.

The formula is P=TR/(E-X) where T is the size of the trade, P is the portfolio size (cash plus holdings) , R is 2%, E is the entry price and X is the predetermined stop-loss exit price.

Another way of looking at this is that you have £20,000 capital and you can only risk £400 loss on any one trade, that would then give you from the very start if you were spread betting 50 BETS.

ANOTHER WAY OF LOOKING AT THIS 2 x 2 RULE

You know you have at the very most £20,000 to trade with and have to keep to a strict none negotiable £400 loss ie, 2% of your capital pot. You cannot change this rule. But you can change the other side of the ratio the amount you are willing to bet on a single trade.

Some traders would be more aggresive and decide for each trade/bet they would risk at the outset £2000 per trade.

They spot a share they would like to climb on and get a " SET UP", mostly using TA and chart set ups. This time we call the stock XYZ.

XYZ as just passed through the £5.00 resistance at the end of the day in other words we have a Confirmation Set Up. The next level of resistance is £6.00 and that is our first SP target to reach so we decide to go for it, how many shares do we buy?.

Well we have a £2000 single pot to deal with and we know the stock on a S/Bet is £5 to buy therefore £5/£2000 would give us 400 shares and a profit of £400 as the SP hits our first target of £6.00.

We decide thier is far more in the stock so we place a trailing stop loss and let our bet run right up to £8.00 whare we are stopped out and return a profit of £1200. The point is we have kept to our trading rules on the downside which we always protect 100% because "without no capital we are out of the game", finito.

2 x 2 x 2 My HYBRID SYSTEM

Now onto my money management Hybrid System which I have been using for the last 12 months with great success.

Its a new entries/set up policy incorporated on the 2 x 2 system but fitted bespoke to my trading style.

The aim is to get rid of bad Set Ups far quicker than the 2 x 2 system so not incurring higher losses than neccessary.

The aim is to find stock with a spread of no more than 20 points per £1 spread bet, and then on top of this set a limit of 2.5% in good markets 3% in volatile bad markets of the total downside 2% you are prepared to lose of your total portfolio.

So eg, say we are using a £1 spread bet , the company DGF as a spread of £18 and my 2% total downside as per the 2 x 2 system is £1000, therefore £18 plus......... 3%/£1000 = £30..... total loss Im prepared to take on entering trade on first 24 hours = £48. I have tight stop loss attached and although I pick up more failures than normaly, I go onto let winners run and dogs kicked out far quicker and cheaper than previously.

Some will no doubt say Im not giving enough breathing space to the set up but dont forget on the first day or any day it is unusual for a stock SP to be down more than 3% unless we have news or MMs playing silly devils.

Right I hope that helps peeps with thier trading if you need any further info just get in touch but dont forget Id make a lousy teacher.

In my opinion after 25 years on the markets (more in fact) I came to the conclusion very quickly that to succeed it wasnt just picking good stocks that counted beneficially but more being able to manage your money, your ability to manage losing and winning positions in your portfolio. How much you stand to lose and win.

Thier is an obsession with private investors that stock picking is the be all and end all of success on the markets, THEY ARE WRONG.

So what are the most important investment/trading questions you have to face?

"How much money should I put on any one trade?".

Pro traders eg, Fund Managers practice and will inform you that success and money management is all about the "2 x 2 rule".

WHAT IS THE RULE?

Ensure your upside is at least twice your downside and never ever lose more than 2% of your trading pot in a single trade, ie 2 x 2.

We'l use company ABC stock as an example all figures rounded for ease of understanding.

ABC is trading at mid at £100 a share.

We start with £20,000 Capital Pot, and if we think ABC will go from £100 to a gain of £130 based on a chart resistance position (30% gain), then we should under the terms of the system not expect the stock to fall below £85 (15% loss) 2/1 ratio. And equally that the worst loss should total no more than 2% of your £20,000 capital pot, which is £400, so you should only buy £2670 of stock at £100 the present market price, (£400 is 15% of £2670). You would have a stop loss in place so that your position would be closed out if your £400 downside was touched.

The formula is P=TR/(E-X) where T is the size of the trade, P is the portfolio size (cash plus holdings) , R is 2%, E is the entry price and X is the predetermined stop-loss exit price.

Another way of looking at this is that you have £20,000 capital and you can only risk £400 loss on any one trade, that would then give you from the very start if you were spread betting 50 BETS.

ANOTHER WAY OF LOOKING AT THIS 2 x 2 RULE

You know you have at the very most £20,000 to trade with and have to keep to a strict none negotiable £400 loss ie, 2% of your capital pot. You cannot change this rule. But you can change the other side of the ratio the amount you are willing to bet on a single trade.

Some traders would be more aggresive and decide for each trade/bet they would risk at the outset £2000 per trade.

They spot a share they would like to climb on and get a " SET UP", mostly using TA and chart set ups. This time we call the stock XYZ.

XYZ as just passed through the £5.00 resistance at the end of the day in other words we have a Confirmation Set Up. The next level of resistance is £6.00 and that is our first SP target to reach so we decide to go for it, how many shares do we buy?.

Well we have a £2000 single pot to deal with and we know the stock on a S/Bet is £5 to buy therefore £5/£2000 would give us 400 shares and a profit of £400 as the SP hits our first target of £6.00.

We decide thier is far more in the stock so we place a trailing stop loss and let our bet run right up to £8.00 whare we are stopped out and return a profit of £1200. The point is we have kept to our trading rules on the downside which we always protect 100% because "without no capital we are out of the game", finito.

2 x 2 x 2 My HYBRID SYSTEM

Now onto my money management Hybrid System which I have been using for the last 12 months with great success.

Its a new entries/set up policy incorporated on the 2 x 2 system but fitted bespoke to my trading style.

The aim is to get rid of bad Set Ups far quicker than the 2 x 2 system so not incurring higher losses than neccessary.

The aim is to find stock with a spread of no more than 20 points per £1 spread bet, and then on top of this set a limit of 2.5% in good markets 3% in volatile bad markets of the total downside 2% you are prepared to lose of your total portfolio.

So eg, say we are using a £1 spread bet , the company DGF as a spread of £18 and my 2% total downside as per the 2 x 2 system is £1000, therefore £18 plus......... 3%/£1000 = £30..... total loss Im prepared to take on entering trade on first 24 hours = £48. I have tight stop loss attached and although I pick up more failures than normaly, I go onto let winners run and dogs kicked out far quicker and cheaper than previously.

Some will no doubt say Im not giving enough breathing space to the set up but dont forget on the first day or any day it is unusual for a stock SP to be down more than 3% unless we have news or MMs playing silly devils.

Right I hope that helps peeps with thier trading if you need any further info just get in touch but dont forget Id make a lousy teacher.